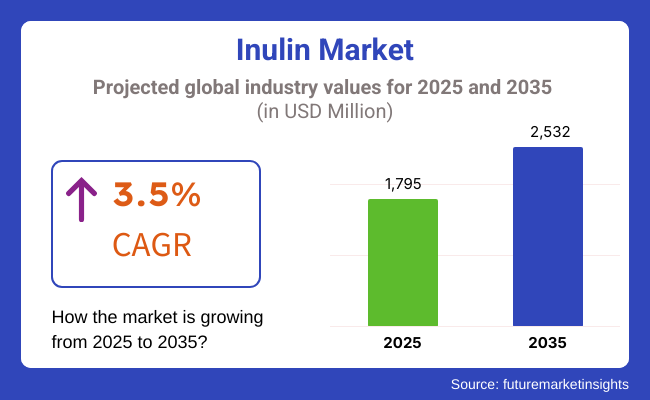

The global Inulin market is estimated to be worth USD 1,795.0 million in 2025 and is projected to reach a value of USD 2,532.0 million by 2035, expanding at a CAGR of 3.5% over the assessment period of 2025 to 2035

Inulin is recognized for its prebiotic effects, which means it serves as a food source for beneficial gut bacteria, such as bifidobacteria. By promoting the growth of these microorganisms, inulin helps enhance gut health, improve digestion, and support the immune system.

This has led to its widespread incorporation in various food and beverage products, including yogurts, smoothies, and health bars, catering to the increasing consumer demand for products that support overall wellness and digestive health.

The awareness of dietary fiber's crucial role in maintaining health has surged, with consumers increasingly seeking ways to incorporate more fiber into their diets. Inulin, as a soluble fiber, is often added to food products to boost their fiber content without altering taste or texture.

This trend aligns with health recommendations for improved digestive health, weight management, and reduced risk of chronic diseases, prompting manufacturers to innovate and create fiber-rich options that appeal to health-conscious consumers.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for global inulin market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision about the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 2.8% (2024 to 2034) |

| H2 | 3.1% (2024 to 2034) |

| H1 | 3.4% (2025 to 2035) |

| H2 | 3.9% (2025 to 2035) |

The above table presents the expected CAGR for the global inulin demand space over semi-annual period spanning from 2025 to 2035. In the first half (H1) of the year 2024, the business is predicted to surge at a CAGR of 2.8%, followed by a slightly higher growth rate of 3.1% in the second half (H2) of the same year.

Moving into year 2025, the CAGR is projected to increase slightly to 3.4% in the first half and remain relatively moderate at 3.9% in the second half. In the first half (H1 2025) the market witnessed a decrease of 16 BPS while in the second half (H2 2025), the market witnessed an increase of 34 BPS.

Plant-Based Diets

The growing popularity of plant-based diets is reshaping consumer preferences and driving demand for plant-derived ingredients. Inulin, a soluble fiber sourced from plants like chicory and Jerusalem artichokes, is increasingly favored in vegan and vegetarian products. Its ability to enhance the nutritional profile of plant-based alternatives makes it a valuable ingredient in various food and beverage applications.

As consumers seek healthier, more sustainable options, inulin serves as a functional component that not only boosts fiber content but also improves texture and taste. This trend is particularly evident in meat substitutes, dairy alternatives, and snacks, where inulin helps manufacturers meet the rising demand for nutritious, plant-based offerings that align with health-conscious lifestyles.

Personalized Nutrition

The trend towards personalized nutrition reflects a growing consumer awareness of individual health needs and dietary preferences. Inulin's versatility allows it to be customized for specific health benefits, such as promoting digestive health, aiding weight management, or supporting metabolic function. This adaptability makes inulin an attractive ingredient for brands looking to create tailored solutions that resonate with health-conscious consumers.

As people increasingly seek products that cater to their unique health goals, inulin's role in functional foods and supplements becomes more prominent. This trend not only enhances inulin's market presence but also encourages innovation in product development, as manufacturers strive to offer personalized nutrition options that address diverse consumer needs.

Functional Beverages

The rising popularity of functional beverages, including probiotic drinks, health tonics, and fortified waters, is significantly impacting the beverage industry. Inulin is increasingly being incorporated into these products to enhance fiber content and promote gut health, aligning with consumer demand for functional ingredients that offer health benefits.

As consumers become more health-conscious, they are seeking beverages that not only quench their thirst but also contribute to their overall well-being. Inulin's prebiotic properties make it an ideal addition to functional beverages, as it supports the growth of beneficial gut bacteria. This trend is driving innovation in the beverage sector, leading to new product launches that feature inulin as a key ingredient, ultimately expanding its market reach and appeal.

Global Inulin sales increased at a CAGR of 2.8% from 2020 to 2024. For the next ten years (2025 to 2035), projections are that expenditure on inulin will rise at 3.5% CAGR.

Inulin's remarkable versatility makes it a sought-after ingredient across various product categories, including food and beverages, dietary supplements, and functional foods. It serves multiple functions, such as acting as a fat replacer in low-calorie products, a sugar alternative for reduced-sugar formulations, and a texturizing agent that improves mouthfeel and consistency.

This adaptability allows manufacturers to innovate and create healthier options that cater to diverse consumer preferences, enhancing the overall appeal of their product offerings.

The functional foods and beverages market is experiencing significant growth, driven by increasing consumer demand for products that provide additional health benefits beyond basic nutrition. Inulin, with its prebiotic properties and ability to enhance fiber content, is well-positioned to meet this demand.

Manufacturers are incorporating inulin into a variety of products, such as fortified snacks, beverages, and supplements, to improve their nutritional profiles. This trend not only attracts health-conscious consumers but also encourages brands to differentiate themselves in a competitive market.

Tier 1 Companies: This tier comprises industry leaders with substantial market revenue exceeding USD 20 million, collectively holding a market share of approximately 40% to 50%. These companies are recognized for their high production capacities and extensive product portfolios, which include a diverse range of inulin-based products tailored for various applications.

Tier 1 players are distinguished by their advanced manufacturing capabilities, robust supply chains, and broad geographical reach, supported by a strong consumer base. Prominent companies in this tier include Beneo GmbH, Cargill, Tate & Lyle, and Royal DSM. Their established market presence and investment in research and development enable them to innovate continuously and respond effectively to evolving consumer demands.

Tier 2 Companies: This tier consists of mid-sized players with revenues ranging from USD 5 million to USD 20 million. These companies have a significant presence in specific regions and play a crucial role in influencing local retail markets. Tier 2 companies are characterized by their strong regional knowledge and consumer insights, which allow them to cater effectively to local preferences.

While they possess good technology and ensure regulatory compliance, they may lack the extensive global reach and advanced technological capabilities of Tier 1 companies. Notable players in this tier include Ingredion, Frutarom (now part of IFF), and Sensient Technology Corporation. Their focus on niche markets and regional specialties enables them to maintain a competitive edge.

Tier 3 Companies: The third tier encompasses a majority of small-scale companies operating primarily at the local level, with revenues below USD 5 million. These companies are often oriented towards fulfilling specific local marketplace demands and are classified within the unorganized sector.

They typically have limited geographical reach and may lack the formal structure and resources of larger competitors. Despite their smaller scale, Tier 3 companies can be agile and responsive to local trends, allowing them to serve niche markets effectively.

| Countries | Market Value (2035) |

|---|---|

| United States | USD 379.8 million |

| Germany | USD 253.2 million |

| China | USD 202.6 million |

| India | USD 126.6 million |

| Japan | USD 50.6 million |

The rise of plant-based products and increased fiber awareness are significantly driving the demand for inulin in the United States. As more consumers adopt vegan and vegetarian diets, inulin, derived from plant sources like chicory and Jerusalem artichokes, has become a favored ingredient in plant-based alternatives. It enhances fiber content and improves texture, making products more appealing to health-conscious consumers.

Simultaneously, USA dietary guidelines emphasize the importance of fiber, leading to heightened awareness about its health benefits. Inulin serves as an effective soluble fiber that can be seamlessly incorporated into various food products, including snacks, beverages, and dairy alternatives. This dual trend allows manufacturers to cater to the growing demand for nutritious, fiber-rich options without compromising on taste or quality.

In Germany, there is a notable increase in consumer awareness regarding the critical role of dietary fiber in overall health. The German Nutrition Society (DGE) actively promotes the importance of adequate fiber intake, highlighting its benefits for digestive health, weight management, and chronic disease prevention. As a result, consumers are increasingly seeking food products that can help them meet these dietary recommendations.

Inulin, recognized as an effective soluble fiber, can be seamlessly incorporated into a variety of products, including snacks, beverages, and dairy alternatives. This versatility makes inulin an appealing choice for health-conscious individuals aiming to enhance their fiber consumption.

The Chinese government has implemented various initiatives and dietary guidelines aimed at promoting healthier eating habits among its population. These efforts highlight the critical role of dietary fiber in maintaining overall health and preventing chronic diseases. By encouraging consumers to increase their fiber intake, the government is fostering a greater awareness of nutrition and wellness.

Inulin, recognized as a soluble fiber, can be seamlessly integrated into a wide range of food products, including snacks, beverages, and dairy items. This compatibility with government guidelines positions inulin as a valuable ingredient, driving its demand as consumers seek to enhance their dietary fiber consumption.

| Segment | Value Share (2025) |

|---|---|

| Liquid (Form) | 42% |

The growing popularity of liquid inulin can be attributed to its ease of incorporation and versatility in various applications. Unlike powdered forms, liquid inulin seamlessly blends into a wide range of food and beverage products, such as smoothies, juices, and functional drinks, without altering their texture or taste. This convenience appeals to manufacturers looking to enhance nutritional profiles while maintaining product integrity.

Additionally, liquid inulin's versatility extends to applications in dairy products, sauces, dressings, and baked goods, enabling brands to innovate and cater to diverse consumer preferences. As manufacturers increasingly recognize the benefits of liquid inulin, its incorporation into new and existing products is driving demand, aligning with the trend towards health-focused and convenient food options.

Key players are investing in research and development to enhance the functionality and applications of inulin, catering to health-conscious consumers. Additionally, manufacturers are expanding their product portfolios to include organic and clean-label options, while leveraging e-commerce platforms to increase market reach. Collaborations with food and beverage brands further enable companies to create tailored solutions that meet evolving consumer demands for health and wellness.

For instance

This segment is further categorized into Leeks, Asparagus, Onion, Wheat, Garlic, Chicory, Oats, Soybean, Jerusalem Artichokes, Banana, and Other Sources (Fruits, etc.).

This segment is further categorized into Food and Beverages, Dietary Supplements, Animal Feed Additives, Pet Food, Aquafeed, and Other Applications.

This segment is further categorized into Powder Form and Liquid Form.

This segment is further categorized into Bifdus Promoting Agent, Fiber Enhancer, Sugar Alternative, Fat Alternative or Replacer, and Other Functions.

This segment is further categorized into Direct Sales Channels, Indirect Sales Channels (Modern Trade Channels, Specialty Stores, Franchise or Brand Outlets, Online Retailers, and Other Indirect Sales)

Industry analysis has been carried out in key countries of North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus and the Middle East & Africa.

The global Inulin industry is estimated at a value of USD 1,795.0 million in 2025.

Sales of Inulin increased at 2.8% CAGR between 2020 and 2024.

Archer Daniels Midland Co. , Cargill Incorporated, Sudzucker Group , Ingredion Incorporated or TIC Gums,Tate & Lyle PLC, Dow DuPont are some of the leading players in this industry.

The South Asia domain is projected to hold a revenue share of 28% over the forecast period.

North America holds 34% share of the global demand space for Inulin.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Source, 2018 to 2033

Table 5: Global Market Value (US$ million) Forecast by Function, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Function, 2018 to 2033

Table 7: Global Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 9: Global Market Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 11: Global Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 12: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 13: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: North America Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 17: North America Market Value (US$ million) Forecast by Function, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Function, 2018 to 2033

Table 19: North America Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 21: North America Market Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 22: North America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 23: North America Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 24: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 25: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Latin America Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 29: Latin America Market Value (US$ million) Forecast by Function, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Function, 2018 to 2033

Table 31: Latin America Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 32: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 33: Latin America Market Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 34: Latin America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 35: Latin America Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 36: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 37: Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 38: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 39: Europe Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 40: Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 41: Europe Market Value (US$ million) Forecast by Function, 2018 to 2033

Table 42: Europe Market Volume (MT) Forecast by Function, 2018 to 2033

Table 43: Europe Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 44: Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 45: Europe Market Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 46: Europe Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 47: Europe Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 48: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 49: East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 52: East Asia Market Volume (MT) Forecast by Source, 2018 to 2033

Table 53: East Asia Market Value (US$ million) Forecast by Function, 2018 to 2033

Table 54: East Asia Market Volume (MT) Forecast by Function, 2018 to 2033

Table 55: East Asia Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 56: East Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 57: East Asia Market Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 58: East Asia Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 59: East Asia Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 60: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 61: South Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 62: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 63: South Asia Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 64: South Asia Market Volume (MT) Forecast by Source, 2018 to 2033

Table 65: South Asia Market Value (US$ million) Forecast by Function, 2018 to 2033

Table 66: South Asia Market Volume (MT) Forecast by Function, 2018 to 2033

Table 67: South Asia Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 68: South Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 69: South Asia Market Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 70: South Asia Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 71: South Asia Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 72: South Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 73: Oceania Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 74: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 75: Oceania Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 76: Oceania Market Volume (MT) Forecast by Source, 2018 to 2033

Table 77: Oceania Market Value (US$ million) Forecast by Function, 2018 to 2033

Table 78: Oceania Market Volume (MT) Forecast by Function, 2018 to 2033

Table 79: Oceania Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 80: Oceania Market Volume (MT) Forecast by Form, 2018 to 2033

Table 81: Oceania Market Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 82: Oceania Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 83: Oceania Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 84: Oceania Market Volume (MT) Forecast by Application, 2018 to 2033

Table 85: Middle East and Africa Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 86: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 87: Middle East and Africa Market Value (US$ million) Forecast by Source, 2018 to 2033

Table 88: Middle East and Africa Market Volume (MT) Forecast by Source, 2018 to 2033

Table 89: Middle East and Africa Market Value (US$ million) Forecast by Function, 2018 to 2033

Table 90: Middle East and Africa Market Volume (MT) Forecast by Function, 2018 to 2033

Table 91: Middle East and Africa Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 92: Middle East and Africa Market Volume (MT) Forecast by Form, 2018 to 2033

Table 93: Middle East and Africa Market Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 94: Middle East and Africa Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 95: Middle East and Africa Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 96: Middle East and Africa Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Function, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Source, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Form, 2023 to 2033

Figure 4: Global Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ million) by Application, 2023 to 2033

Figure 6: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ million) Analysis by Function, 2018 to 2033

Figure 12: Global Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 15: Global Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 16: Global Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 19: Global Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 20: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 23: Global Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 27: Global Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 28: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 31: Global Market Attractiveness by Function, 2023 to 2033

Figure 32: Global Market Attractiveness by Source, 2023 to 2033

Figure 33: Global Market Attractiveness by Form, 2023 to 2033

Figure 34: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 35: Global Market Attractiveness by Application, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ million) by Function, 2023 to 2033

Figure 38: North America Market Value (US$ million) by Source, 2023 to 2033

Figure 39: North America Market Value (US$ million) by Form, 2023 to 2033

Figure 40: North America Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 41: North America Market Value (US$ million) by Application, 2023 to 2033

Figure 42: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ million) Analysis by Function, 2018 to 2033

Figure 48: North America Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 51: North America Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 52: North America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 55: North America Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 56: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 59: North America Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 60: North America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 63: North America Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 64: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 67: North America Market Attractiveness by Function, 2023 to 2033

Figure 68: North America Market Attractiveness by Source, 2023 to 2033

Figure 69: North America Market Attractiveness by Form, 2023 to 2033

Figure 70: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 71: North America Market Attractiveness by Application, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ million) by Function, 2023 to 2033

Figure 74: Latin America Market Value (US$ million) by Source, 2023 to 2033

Figure 75: Latin America Market Value (US$ million) by Form, 2023 to 2033

Figure 76: Latin America Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 77: Latin America Market Value (US$ million) by Application, 2023 to 2033

Figure 78: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 79: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 80: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ million) Analysis by Function, 2018 to 2033

Figure 84: Latin America Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 87: Latin America Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 88: Latin America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 91: Latin America Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 92: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 95: Latin America Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 96: Latin America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 99: Latin America Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 100: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Function, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 106: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 107: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Europe Market Value (US$ million) by Function, 2023 to 2033

Figure 110: Europe Market Value (US$ million) by Source, 2023 to 2033

Figure 111: Europe Market Value (US$ million) by Form, 2023 to 2033

Figure 112: Europe Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 113: Europe Market Value (US$ million) by Application, 2023 to 2033

Figure 114: Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 115: Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 116: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 117: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Europe Market Value (US$ million) Analysis by Function, 2018 to 2033

Figure 120: Europe Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 121: Europe Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 122: Europe Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 123: Europe Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 124: Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 125: Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 126: Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 127: Europe Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 128: Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 129: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 130: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 131: Europe Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 132: Europe Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 133: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 134: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 135: Europe Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 136: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 137: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 138: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 139: Europe Market Attractiveness by Function, 2023 to 2033

Figure 140: Europe Market Attractiveness by Source, 2023 to 2033

Figure 141: Europe Market Attractiveness by Form, 2023 to 2033

Figure 142: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 143: Europe Market Attractiveness by Application, 2023 to 2033

Figure 144: Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ million) by Function, 2023 to 2033

Figure 146: East Asia Market Value (US$ million) by Source, 2023 to 2033

Figure 147: East Asia Market Value (US$ million) by Form, 2023 to 2033

Figure 148: East Asia Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 149: East Asia Market Value (US$ million) by Application, 2023 to 2033

Figure 150: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 152: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 153: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: East Asia Market Value (US$ million) Analysis by Function, 2018 to 2033

Figure 156: East Asia Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 159: East Asia Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 160: East Asia Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 161: East Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 162: East Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 163: East Asia Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 164: East Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 165: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 166: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 167: East Asia Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 168: East Asia Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 169: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 171: East Asia Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 172: East Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 173: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 174: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Function, 2023 to 2033

Figure 176: East Asia Market Attractiveness by Source, 2023 to 2033

Figure 177: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 178: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 179: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 180: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: South Asia Market Value (US$ million) by Function, 2023 to 2033

Figure 182: South Asia Market Value (US$ million) by Source, 2023 to 2033

Figure 183: South Asia Market Value (US$ million) by Form, 2023 to 2033

Figure 184: South Asia Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 185: South Asia Market Value (US$ million) by Application, 2023 to 2033

Figure 186: South Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 187: South Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 188: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 189: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: South Asia Market Value (US$ million) Analysis by Function, 2018 to 2033

Figure 192: South Asia Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 193: South Asia Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 194: South Asia Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 195: South Asia Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 196: South Asia Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 197: South Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 198: South Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 199: South Asia Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 200: South Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 201: South Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 202: South Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 203: South Asia Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 204: South Asia Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 205: South Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 206: South Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 207: South Asia Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 208: South Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 209: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 210: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 211: South Asia Market Attractiveness by Function, 2023 to 2033

Figure 212: South Asia Market Attractiveness by Source, 2023 to 2033

Figure 213: South Asia Market Attractiveness by Form, 2023 to 2033

Figure 214: South Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 215: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 216: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 217: Oceania Market Value (US$ million) by Function, 2023 to 2033

Figure 218: Oceania Market Value (US$ million) by Source, 2023 to 2033

Figure 219: Oceania Market Value (US$ million) by Form, 2023 to 2033

Figure 220: Oceania Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 221: Oceania Market Value (US$ million) by Application, 2023 to 2033

Figure 222: Oceania Market Value (US$ million) by Country, 2023 to 2033

Figure 223: Oceania Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 224: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 225: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 226: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 227: Oceania Market Value (US$ million) Analysis by Function, 2018 to 2033

Figure 228: Oceania Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 229: Oceania Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 230: Oceania Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 231: Oceania Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 232: Oceania Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 233: Oceania Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 234: Oceania Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 235: Oceania Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 236: Oceania Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 237: Oceania Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 238: Oceania Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 239: Oceania Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 240: Oceania Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 241: Oceania Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 242: Oceania Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 243: Oceania Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 244: Oceania Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 245: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 246: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 247: Oceania Market Attractiveness by Function, 2023 to 2033

Figure 248: Oceania Market Attractiveness by Source, 2023 to 2033

Figure 249: Oceania Market Attractiveness by Form, 2023 to 2033

Figure 250: Oceania Market Attractiveness by Sales Channel, 2023 to 2033

Figure 251: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 252: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 253: Middle East and Africa Market Value (US$ million) by Function, 2023 to 2033

Figure 254: Middle East and Africa Market Value (US$ million) by Source, 2023 to 2033

Figure 255: Middle East and Africa Market Value (US$ million) by Form, 2023 to 2033

Figure 256: Middle East and Africa Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 257: Middle East and Africa Market Value (US$ million) by Application, 2023 to 2033

Figure 258: Middle East and Africa Market Value (US$ million) by Country, 2023 to 2033

Figure 259: Middle East and Africa Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 260: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 261: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 262: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 263: Middle East and Africa Market Value (US$ million) Analysis by Function, 2018 to 2033

Figure 264: Middle East and Africa Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 265: Middle East and Africa Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 266: Middle East and Africa Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 267: Middle East and Africa Market Value (US$ million) Analysis by Source, 2018 to 2033

Figure 268: Middle East and Africa Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 271: Middle East and Africa Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 272: Middle East and Africa Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 273: Middle East and Africa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 274: Middle East and Africa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 275: Middle East and Africa Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 276: Middle East and Africa Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 277: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 278: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 279: Middle East and Africa Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 280: Middle East and Africa Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 281: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 282: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 283: Middle East and Africa Market Attractiveness by Function, 2023 to 2033

Figure 284: Middle East and Africa Market Attractiveness by Source, 2023 to 2033

Figure 285: Middle East and Africa Market Attractiveness by Form, 2023 to 2033

Figure 286: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 287: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 288: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Inulinase Market Growth & Demand Forecast 2024-2034

Agave Inulin Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA