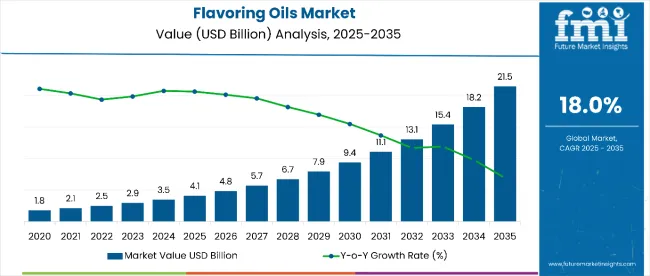

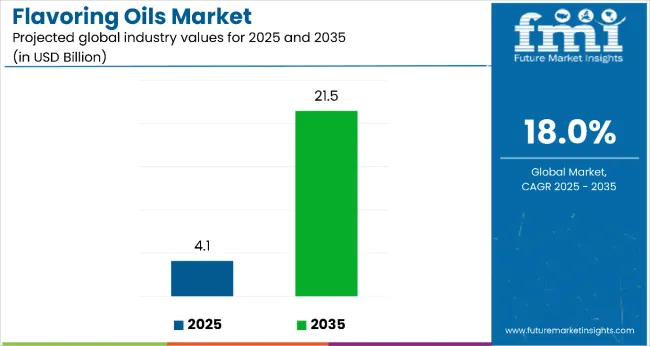

The global flavoring oils market is valued at USD 4.1 billion in 2025 and is slated to reach USD 21.5 billion by 2035, reflecting a CAGR of 18.0%. Growth is being fueled by increasing demand for natural flavoring agents, rising consumer preference for clean-label products, and the expansion of bakery and confectionery industries. Additionally, higher adoption of flavoring oils in beverages and cosmetics is contributing to market expansion, supported by technological advancements and product innovations from key players.

The market is likely to reach approximately USD 12.5 billion, accounting for USD 8.4 billion in incremental value over the first half of the decade. The remaining USD 9.3 billion is expected during the second half, indicating a moderately back‑loaded growth pattern. Product substitution for synthetic flavor enhancers is gaining traction due to flavoring oils’ natural origin, higher nutritional content, and clean‑label positioning.

Companies such as Givaudan and International Flavors & Fragrances are advancing their competitive positions through investment in natural extraction technologies and scalable cold‑press systems. Certification‑led sourcing models are supporting expansion into bakery, confectionery, and beverage applications. Market performance will remain anchored in compliance with food safety regulations, clean‑label claims, and sensory performance benchmarks.

The market accounts for 35% of the natural flavors and extracts market, 28% of confectionery ingredients, 22% of bakery ingredients, 15% of beverage flavorings, and 18% of health and wellness food additives. Growth is fueled by versatility, clean-label positioning, and increasing demand across processed food categories worldwide.

Advanced extraction methods such as supercritical CO₂ and molecular distillation enhance purity, flavor retention, and stability. Manufacturers are introducing blends for sugar-reduced confectionery and plant-based beverages. Strategic collaborations with food producers and expansion through e-commerce are widening market reach, placing competitive pressure on synthetic flavor suppliers to adapt to evolving consumer preferences.

The market is experiencing rapid growth, driven by increasing consumer preference for natural, clean-label ingredients and rising demand across bakery, confectionery, and beverage sectors. Expanding global consumption of premium and health-focused food products is creating a favorable environment for the adoption of plant-derived flavoring oils.

Advancements in extraction technologies, such as supercritical CO₂ and molecular distillation, have enhanced purity, flavor retention, and shelf stability, boosting consumer confidence and encouraging food manufacturers to integrate these oils into their product lines. The growing application of flavoring oils in cosmetics, personal care, and aromatherapy is further diversifying revenue streams.

Sustainability trends, including sourcing from renewable plant-based ingredients and promoting environmentally responsible production practices, are influencing purchasing decisions. As manufacturers invest in innovative flavor blends, tailored formulations, and e-commerce-driven distribution strategies, the market is poised to benefit from greater accessibility, broader applications, and a more diverse global customer base.

The market is segmented by grade type, source, application, and region. By grade type, the market is segmented into food grade, pharmaceutical grade, and industrial grade. Based on source, the market is divided into plants, citrus, spices, vegetables, herbs, mint, rosemary, thyme, basil, and animals.

In terms of application, the market is divided into bakery, confectionery, ice-cream parlor, food and beverages, cosmetics and personal care, perfumery, pharmaceuticals, nutraceuticals, and others (aromatherapy blends, pet food flavoring, and specialty industrial uses). Regionally, the market includes North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa.

The food grade segment is expected to remain the most lucrative in the market, accounting for 85% of the total market share in 2025. This strong position is supported by the increasing demand for natural and clean-label flavoring agents across processed foods, bakery, confectionery, and beverage industries. Consumers are increasingly favoring plant-derived oils that offer rich aromatic profiles and added nutritional benefits, which has encouraged greater adoption among global food manufacturers.

Technological innovations, including advanced extraction methods such as supercritical CO₂ extraction, are further driving the growth of the food grade segment. These techniques enhance quality, improve flavor retention, and extend shelf stability, giving manufacturers a competitive edge in delivering premium products.

The continued expansion of bakery and confectionery industries worldwide is expected to provide a consistent demand base for food grade flavoring oils. Moreover, the rising preference for customized flavor blends tailored to specific consumer preferences is opening new opportunities for product innovation.

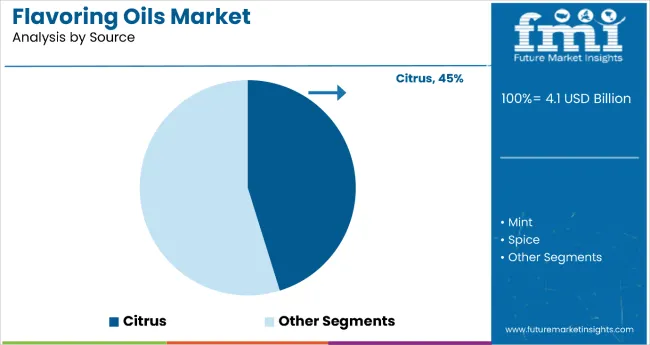

The citrus segment is expected to remain the most lucrative source category in the market, accounting for 45.20% of the total share in 2025. This dominance is driven by the wide application of citrus oils in bakery, confectionery, beverages, and nutraceutical products. Their fresh, tangy aroma and versatile flavor profile make them highly desirable among food manufacturers aiming to enhance sensory appeal while maintaining a natural and clean-label positioning. Additionally, citrus oils are rich in bioactive compounds, which further support their inclusion in health-oriented products.

Rising demand for natural and functional ingredients is further boosting the citrus segment’s adoption. Technological advancements in cold-press and steam-distillation processes have enhanced oil purity, stability, and shelf life, enabling manufacturers to deliver premium-grade citrus oils to global markets.

The growth of the global beverage industry, particularly in flavored water, teas, and functional drinks, is providing strong momentum for citrus oil demand. Additionally, its increasing use in cosmetics, personal care, and aromatherapy for its refreshing scent and antimicrobial properties is diversifying revenue streams.

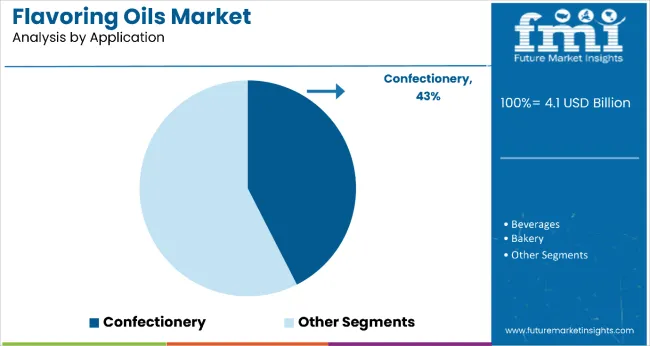

The confectionery segment is projected to remain the most lucrative application category in the market, holding 42.50% of the total market share in 2025. This leadership position is driven by the high consumption of premium chocolates, candies, and sugar confectionery products globally.

Flavoring oils are widely used in confectionery to enhance taste, aroma, and product differentiation, particularly in gourmet and artisanal offerings. The growing consumer preference for unique and exotic flavors, combined with the shift toward natural and clean-label ingredients, has further strengthened demand for flavoring oils in this segment.

Technological advancements in extraction and blending techniques have enabled manufacturers to create high-purity, stable formulations that maintain consistency during processing. The rise of low-sugar and sugar-free confectionery products, especially in developed markets, is increasing the adoption of plant-derived flavoring oils for healthier alternatives without compromising taste.

The expansion of the global confectionery industry, driven by rising disposable incomes, gifting culture, and seasonal product launches, is expected to sustain strong demand for flavoring oils. Emerging markets in Asia-Pacific and Latin America are witnessing a surge in premium confectionery consumption, opening new growth opportunities for flavoring oil suppliers.

In 2025, global flavoring oil sales increased by 18% year on year, with North America accounting for 38% of the total share. Applications include premium confectionery, artisan bakery goods, functional beverages, nutraceutical supplements, and clean-label personal care products. Manufacturers are introducing high-purity essential oils, advanced supercritical CO₂ extracts, and customized blends tailored to regional taste preferences. Micro-encapsulation technology is being adopted to improve flavor stability and shelf life.

Key Drivers Fueling Flavoring Oils Market Expansion

Food manufacturers and beverage brands are selecting flavoring oils to enhance aroma profiles, improve shelf stability, and differentiate product offerings. In controlled trials, micro-encapsulated citrus oils retained over 92% of their original aroma intensity after six months of storage, compared to 78% for non-encapsulated variants. Cold-pressed mint oils demonstrated 15% higher antioxidant activity than conventionally distilled types, enhancing functional appeal in health beverages. Premium confectionery producers have introduced exotic blends such as yuzu-lavender and cardamom-orange to meet gourmet demand.

Major Restraints Challenging Flavoring Oils Market Development

Growth potential is constrained by fluctuating raw material prices, regulatory delays, and fragmented sourcing networks. Citrus harvest variability can cause price swings of up to 22%, impacting cost stability for large-scale buyers. Regulatory approval for novel botanical oils in key markets can take 4-6 months, delaying product launches. Complex export documentation for essential oils in Asia and Latin America extends shipment times by 10-14 days.

Emerging Key Trends Influencing Flavoring Oils Market Direction

Innovative extraction methods and premiumization are shaping the competitive landscape, with manufacturers launching customized oil blends and embracing clean-label, plant-based ingredients. Supercritical CO₂ extraction is gaining preference for its ability to produce highly concentrated and solvent-free oils. Micro-encapsulation is emerging as a standard technique for preserving flavor intensity and enhancing shelf life in finished products. Increasing demand for functional and sensory-rich ingredients is expected to further accelerate adoption in food, beverage, and personal care sectors globally.

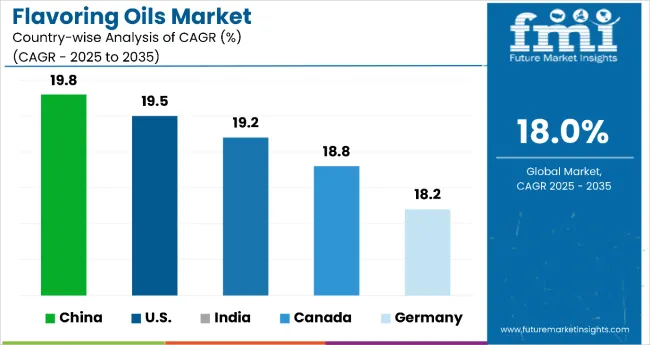

From 2025 to 2035, China is projected to lead the market with the highest CAGR of 19.8%, fueled by urbanization, traditional flavors, and a rapidly growing foodservice industry. The USA follows closely with a CAGR of 19.5%, driven by clean-label demand and innovation in plant-based and functional foods.

India, with a CAGR of 19.2%, benefits from its strong Ayurvedic heritage and rising wellness trends, supported by government initiatives. Canada is set to grow at 18.8%, reflecting its health-focused, artisanal food culture and influence from USA trends. Germany, while slightly slower at 18.2%, remains strong due to its premium bakery tradition and sustainability focus.

The report covers an in-depth analysis of 40+ countries; five top performing OECD countries are highlighted below.

Sales of flavoring oils in China are projected to lead the global market from 2025 to 2035 with the highest CAGR of 19.8%, driven by rapid urbanization, a booming middle class, and demand for clean-label and authentic regional flavors. The expanding foodservice sector and increasing consumer spending are also major contributors.

The USA flavoring oils demand will continue to thrive with a projected CAGR of 19.5%, supported by a surge in demand for clean-label and organic products. Increasing applications in functional foods, plant-based innovations, and beverages are key drivers.

Flavoring oils revenue in India is expected to grow at a CAGR of 19.2%, fueled by rising health awareness, urban dietary shifts, and a thriving Ayurveda and herbal supplement sector. This growth is further supported by increasing government initiatives promoting natural and traditional food ingredients.

Sales of flavoring oils in Canada will expand at a CAGR of 18.8%, driven by its health-conscious population and increasing interest in artisanal and organic food products. The rise of local craft brands is also contributing to diversified product offerings and regional flavor innovation.

The flavoring oils revenue in Germany will maintain solid momentum with a CAGR of 18.2% through 2035, backed by a strong artisanal bakery tradition and emphasis on sustainable sourcing. Regulatory support for organic certification and eco-friendly packaging is further enhancing market credibility.

The market is largely consolidated, with a handful of tier one companies like Givaudan, International Flavors & Fragrances (IFF), Symrise, Firmenich, and Sensient commanding the majority of market share. These leaders differentiate through pricing strategies, continuous product innovation, strategic partnerships, and global expansion initiatives, while tier two and regional players focus on niche segments and specialized blends.

Top suppliers are competing by investing heavily in proprietary extraction technologies (e.g., supercritical CO₂ and molecular distillation), co-creation platforms powered by AI, and digital consumer insights tools. Expansion into sustainability-certified and organic sourcing has become central to market positioning. Partnerships with food and beverage brands and co-development of customized flavor profiles are accelerating adoption across health, confectionery, and beverage applications.

| Report Attributes | Details |

|---|---|

| Quantitative Units | USD 4.1 billion |

| By Grade Type | Food Grade, Pharmaceutical Grade, Industrial Grade |

| By Source | Plants, Citrus, Spices, Vegetables, Herbs, Mint, Rosemary, Thyme, Basil, Animals |

| By Application | Bakery, Confectionery, Ice-Cream Parlor, Food & Beverages, Cosmetics & Personal Care, Perfumery, Pharmaceuticals, Nutraceuticals, Others (aromatherapy, pet products, industrial uses) |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, India, Australia, Brazil , and 40+ countries |

| Key Players | Givaudan, International Flavors & Fragrances, TerraVia Holdings Inc., Land O’ Lakes, Amul , Kerry Gold, Lorran , Golden Barrel, Carrington Farms, Mane, Thrive Flavoring , Bioprocess Flavorings . |

| Additional Attributes | Dollar sales by value, market share by country and region, competitive landscape |

The global flavoring oils market is estimated to be valued at USD 4.1 billion in 2025.

The market size for the flavoring oils market is projected to reach USD 21.5 billion by 2035.

The flavoring oils market is expected to grow at a 18.0% CAGR between 2025 and 2035.

The key product types in flavoring oils market are food grade, pharmaceutical grade and industrial grade.

In terms of source, plants segment to command 47.9% share in the flavoring oils market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flavoring Cosmetic Formulation Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Agents Market Size and Share Forecast Outlook 2025 to 2035

Beverage Flavoring Market Size, Growth, and Forecast for 2025 to 2035

Analysis and Growth Projections for Beverage Flavoring Agent

Chocolate Flavoring Compounds Market Size and Share Forecast Outlook 2025 to 2035

Natural X Flavoring Market Analysis By Form, End-User, Flavors And By Region – Growth, Trends And Forecast From 2025 to 2035

Lip Oils Market Size and Share Forecast Outlook 2025 to 2035

EDM Oils/Fluids Market

Blown oils Market Size and Share Forecast Outlook 2025 to 2035

Spice Oils and Oleoresins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mussel Oils Market Size and Share Forecast Outlook 2025 to 2035

Edible Oils and Fats Market Analysis by Product Type, Source, and Distribution Channel Through 2035

Flavor Oils Market

Turbine Oils Market Size and Share Forecast Outlook 2025 to 2035

Coding Foils & Tapes Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Coding Foils & Tapes Providers

Fats And Oils Market Size and Share Forecast Outlook 2025 to 2035

Tipping Foils Market Size and Share Forecast Outlook 2025 to 2035

Understanding Market Share Trends in the Tipping Foils Industry

Lime Seed Oils Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA