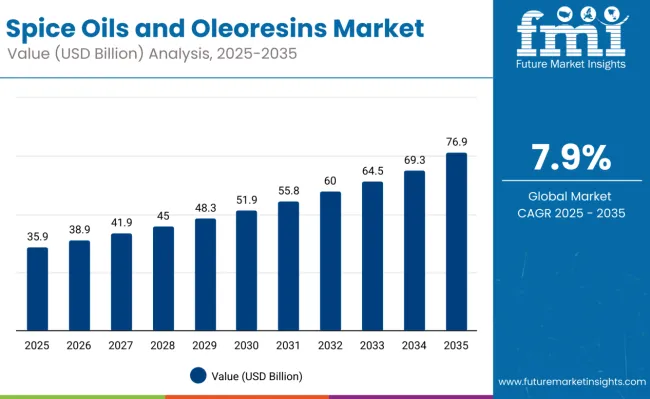

The global spice oils and oleoresins market is projected to grow from USD 35.9 billion in 2025 to approximately USD 76.9 billion by 2035, recording an absolute increase of USD 41 billion over the forecast period. This translates into a total growth of 114%, with the market forecast to expand at a compound annual growth rate (CAGR) of 7.9% between 2025 and 2035. The overall market size is expected to grow by nearly 2.14X during the same period, supported by increasing demand for natural flavor ingredients, rising health consciousness driving clean-label product adoption, and growing applications across food processing, nutraceutical, and personal care industries.

Spice Oils and Oleoresins Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 35.9 billion |

| Forecast Value in (2035F) | USD 76.9 billion |

| Forecast CAGR (2025 to 2035) | 7.9% |

Between 2020 and 2025, the spice oils and oleoresins market experienced robust expansion driven by increasing health consciousness, growing demand for natural flavoring alternatives, and rising applications in pharmaceutical and cosmetic formulations. The market benefited from technological advances in extraction processes and expanded regulatory approvals for natural ingredient applications. Food manufacturers increasingly adopted spice oils and oleoresins as replacements for synthetic additives to meet consumer preferences for clean-label products.

Between 2025 and 2030, the spice oils and oleoresins market is projected to expand from USD 35.9 billion to USD 55 billion, resulting in a value increase of USD 19 billion, which represents 46% of the total forecast growth for the decade. This phase of growth will be shaped by increasing consumer preference for natural and organic ingredients, expanding applications in dietary supplements and functional foods, and growing adoption of clean-label formulations. Manufacturers are focusing on developing advanced extraction technologies and sustainable sourcing practices to enhance product quality and environmental compatibility.

From 2030 to 2035, the market is forecast to grow from USD 55 billion to USD 76.9 billion, adding another USD 22.2 billion, which constitutes 54.1% of the overall ten-year expansion. This period is expected to be characterized by widespread adoption in nutraceutical applications, expansion of organic and premium product segments, and development of specialized formulations for emerging markets. The growing emphasis on health and wellness will drive demand for functional spice extracts with proven bioactive properties and therapeutic benefits.

Market expansion is being supported by the increasing global consumer preference for natural and clean-label food products, driving manufacturers to replace synthetic additives with natural spice-derived ingredients that provide authentic flavors and functional benefits. Modern food processing industries require concentrated flavor solutions that maintain consistency, extend shelf-life, and provide cost-effective alternatives to whole spices while meeting regulatory requirements for natural ingredient labeling. The rising awareness of health benefits associated with bioactive compounds in spices has created substantial market opportunities for functional food and nutraceutical applications.

The growing adoption of spice oils and oleoresins across pharmaceutical, cosmetic, and personal care industries is expanding market applications beyond traditional food uses into therapeutic and wellness product categories. Healthcare and wellness sectors require standardized, concentrated extracts that provide consistent potency and bioavailability for therapeutic applications while meeting stringent quality and purity standards. The development of advanced extraction technologies has improved product quality, yield efficiency, and environmental sustainability while enabling new applications in emerging market segments.

The market is segmented by product type, distribution channel, nature, application, and region. By product type, the market is divided into spice oils and oleoresins. In terms of distribution channel, the market is bifurcated into B2B/direct and B2C/indirect. By nature, the market is categorized into organic and conventional. In terms of application, the market is segmented into food and beverages, bakery and confectionery, beverages, dressings and condiments, cosmetics and personal care, pharmaceuticals, dietary supplements, and others including processed meat products, ready-to-eat meals, savory snacks, and canned foods. Regionally, the market is divided into North America, Latin America, Europe, Asia Pacific, and Middle East & Africa.

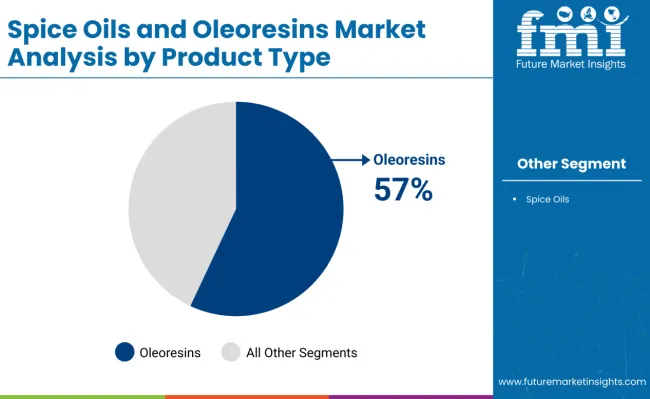

Oleoresins are projected to account for 57% of the spice oils and oleoresins market in 2025. This leading share is supported by superior concentration levels, extended shelf-life characteristics, and excellent solubility properties that make them ideal for industrial food processing applications. Oleoresins provide 5-20 times the flavor intensity of corresponding whole spices while offering better stability and handling convenience for large-scale manufacturing operations. The segment benefits from growing demand in processed foods, beverages, and nutraceutical applications where consistent flavor delivery and extended product shelf-life are critical requirements.

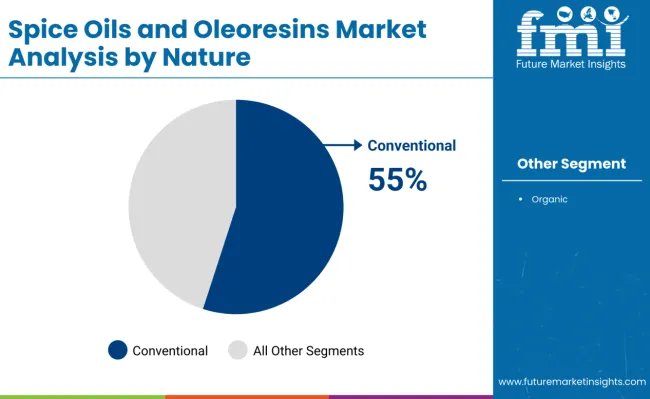

Conventional spice oils and oleoresins are expected to represent 55% of market demand in 2025. This dominant share reflects cost advantages, widespread availability, and established supply chains that support large-scale food processing and manufacturing operations. Conventional products provide reliable quality and performance characteristics while maintaining competitive pricing for price-sensitive applications. The segment benefits from extensive cultivation networks and processing infrastructure that ensure consistent supply availability across diverse geographic markets.

The spice oils and oleoresins market is advancing rapidly due to increasing consumer preference for natural ingredients and growing regulatory support for clean-label food formulations. However, the market faces challenges including raw material price volatility, seasonal availability constraints, and complex supply chain requirements for maintaining product quality and traceability. Climate variability affecting spice crop yields and evolving regulatory standards for organic certification continue to influence market development patterns.

Clean-Label Trend Drives Natural Ingredient Adoption

The increasing consumer demand for recognizable, natural ingredients is driving widespread adoption of spice oils and oleoresins as replacements for synthetic flavorings, colorings, and preservatives across food and beverage applications. Regulatory agencies supporting natural ingredient usage and health claim validations are creating favorable market conditions while consumer education about synthetic additive risks builds awareness of natural alternatives. Food manufacturers require authentic flavor solutions that maintain product quality while meeting clean-label requirements and consumer expectations for ingredient transparency.

Advanced Extraction Technologies Enable Product Innovation

The development of supercritical CO2 extraction, solvent-free processing, and other advanced technologies is improving product quality, yield efficiency, and environmental sustainability while enabling new applications in premium market segments. Innovative extraction methods preserve bioactive compounds and enhance product purity while reducing processing costs and environmental impact. Technology advancement enables standardization of extract potency and consistency while supporting development of specialized formulations for targeted health applications and regulatory compliance requirements.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 8.7% |

| United States | 7.9% |

| Germany | 7.8% |

| Japan | 7.6% |

| United Kingdom | 7.5% |

| France | 7.3% |

| China | 8.2% |

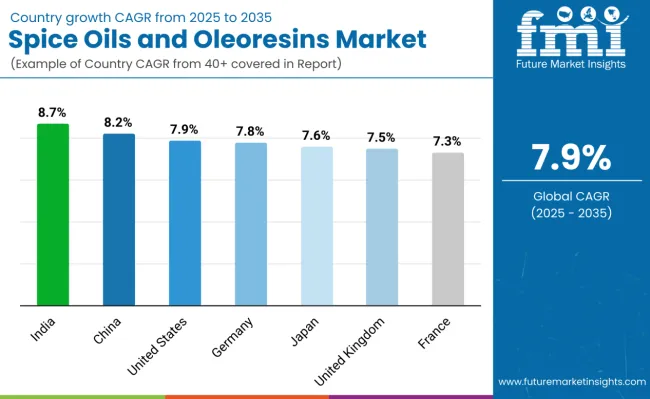

The spice oils and oleoresins market demonstrates diverse growth patterns across key countries, with India leading at 8.7% CAGR through 2035, driven by expanding production capabilities, growing domestic consumption, and increasing export opportunities. China follows at 8.2%, supported by large-scale manufacturing development and rising health-conscious consumer trends. The United States shows robust expansion at 7.9%, emphasizing premium applications and clean-label product innovation. Germany maintains strong growth at 7.8%, leveraging advanced processing technologies and quality standards. Japan records 7.6% growth with focus on functional applications and aging demographics. The United Kingdom demonstrates 7.5% expansion, driven by natural ingredient preferences and regulatory support. France shows 7.3% growth, emphasizing artisanal and organic product development.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below

Revenue from spice oils and oleoresins in India is projected to exhibit the highest growth rate with a CAGR of 8.7% through 2035, driven by the country's position as the world's largest spice producer and processor, combined with expanding domestic consumption and growing export capabilities. India's abundant raw material availability, traditional processing expertise, and competitive manufacturing costs provide substantial advantages in global markets. Government initiatives supporting spice industry development, export promotion programs, and quality improvement initiatives are facilitating market expansion.

Revenue from spice oils and oleoresins in China is projected to grow at a CAGR of 8.2%, supported by rapid industrialization of food processing, expanding health consciousness among urban consumers, and government support for agricultural modernization and food safety initiatives. The country's large domestic market and growing middle-class purchasing power create substantial demand for natural flavor ingredients and functional food products. Increasing adoption of Western dietary patterns and processed food consumption drives market growth while expanding pharmaceutical and cosmetic industries create new application opportunities.

Demand for spice oils and oleoresins in the United States is projected to grow at a CAGR of 7.9%, supported by strong consumer preference for natural and organic ingredients, advanced food processing industries, and comprehensive regulatory frameworks supporting clean-label formulations. The country's sophisticated consumer base demonstrates willingness to pay premium prices for high-quality natural products while established distribution channels provide market access for specialty applications. Growing dietary supplement markets and functional food categories create opportunities for spice-derived bioactive compounds with proven health benefits.

Revenue from spice oils and oleoresins in Germany is projected to expand at a CAGR of 7.8%, driven by advanced processing technologies, stringent quality standards, and strong emphasis on sustainable and organic product development. The country's leadership in food technology innovation and comprehensive regulatory frameworks create demand for premium natural ingredients that meet environmental and safety requirements. German consumers demonstrate strong preference for organic and sustainably produced products while industrial applications require high-quality, consistent ingredients for export-oriented food manufacturing.

Revenue from spice oils and oleoresins in Japan is projected to grow at a CAGR of 7.6%, supported by aging demographics seeking natural health solutions, sophisticated consumer understanding of functional ingredients, and established preferences for high-quality natural products. The country's advanced food technology capabilities and emphasis on health and wellness create demand for spice extracts with proven bioactive properties and therapeutic benefits. Japanese consumers demonstrate strong willingness to pay premium prices for products with scientific validation and superior quality characteristics.

Revenue from spice oils and oleoresins in the United Kingdom is projected to expand at a CAGR of 7.5%, driven by increasing consumer preference for natural and clean-label products, comprehensive regulatory support for organic ingredients, and growing awareness of health benefits associated with natural spice compounds. The country's diverse multicultural population creates demand for authentic ethnic flavors while established organic food markets provide opportunities for premium product positioning. Food safety regulations and consumer protection standards favor natural ingredients over synthetic alternatives.

Revenue from spice oils and oleoresins in France is projected to grow at a CAGR of 7.3%, supported by the country's culinary heritage emphasizing natural flavors, strong organic food markets, and comprehensive regulatory frameworks promoting sustainable agriculture and natural ingredient usage. French consumers demonstrate strong preference for authentic, artisanal products while established gourmet food industries create demand for premium spice extracts with superior flavor profiles and traceability. Growing export markets for French specialty foods drive demand for high-quality natural ingredients.

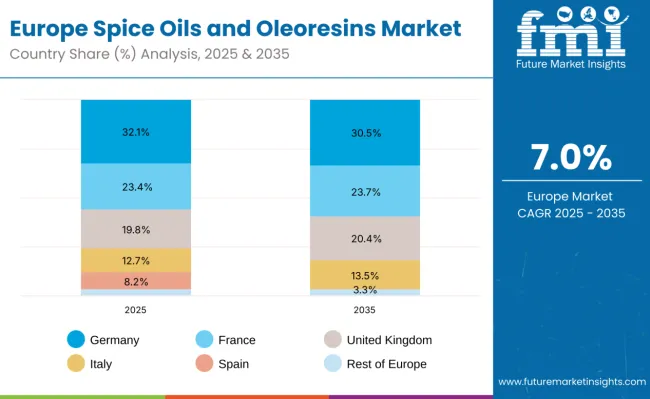

The spice oils and oleoresins market in Europe is projected to grow at a CAGR of 7.0% from 2025 to 2035, driven by rising demand for natural flavoring agents in food, beverages, and nutraceutical applications. Germany is expected to lead with a 32.1% share in 2025, moderating slightly to 30.5% by 2035, supported by its robust flavoring and food processing industries.

France follows with 23.4% in 2025, rising marginally to 23.7% by 2035, reflecting strong consumer preference for natural and clean-label products. The United Kingdom holds 19.8% in 2025, projected to grow to 20.4% by 2035, supported by diversified applications across foodservice and nutraceutical industries. Italy commands 12.7%, expanding to 13.5% by 2035, while Spain contributes 8.2% in 2025, increasing slightly to 8.6% by 2035. The Rest of Europe accounts for 3.8% in 2025, expected to contract to 3.3% by 2035, as larger Western European markets consolidate their dominance in the regional supply chain.

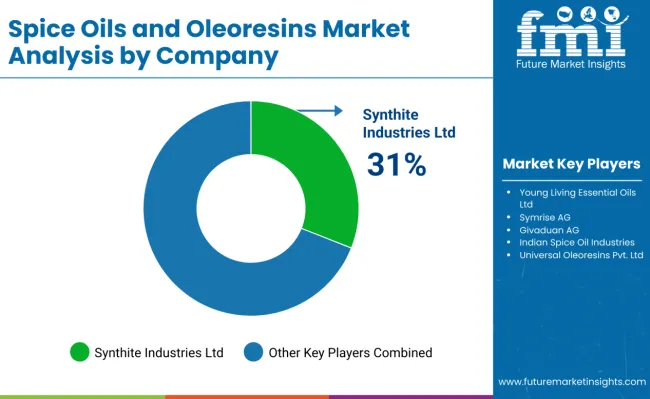

The spice oils and oleoresins market is characterized by competition among multinational flavor companies, specialized extraction processors, and regional spice suppliers. Companies are investing in advanced extraction technologies, sustainable sourcing practices, organic certification programs, and quality assurance systems to deliver high-quality, consistent, and environmentally responsible natural ingredient solutions. Strategic partnerships, vertical integration, and geographic expansion are central to strengthening supply chains and market presence.

Synthite Industries Ltd., India, provides comprehensive spice extract solutions with focus on sustainable sourcing, advanced processing technologies, and global market leadership across food, pharmaceutical, and cosmetic applications. Young Living Essential Oils Ltd., United States, offers premium essential oil products with emphasis on quality assurance, therapeutic applications, and direct-to-consumer marketing strategies. Symrise AG, Germany, delivers integrated flavor and fragrance solutions including natural spice extracts for industrial applications.

Givaudan AG, Switzerland, emphasizes innovation in natural flavor creation and sustainable ingredient sourcing with focus on premium applications and technical support services. McCormick & Company, United States, leverages extensive spice expertise and global supply chain capabilities to provide integrated flavor solutions across diverse market segments. Other key players including Indian Spice Oil Industries, Universal Oleoresins, and Greenleaf Extractions provide specialized regional expertise and customized solutions across diverse application categories.

The spice oils & oleoresins market intersects flavor & fragrance innovation, natural product demand, and sustainable agriculture. Rising consumer preference for clean-label foods, premium culinary experiences, and natural additives make spice-derived oils & oleoresins increasingly important. Scaling this market requires collaboration among governments, industry bodies, manufacturers/OEMs, suppliers, and investors. Together, they can move spice oils & oleoresins from niche flavoring agents to mainstream ingredients in foods, cosmetics, nutraceuticals, and perfumery.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 35.9 Billion |

| Product Type | Spice Oils, Oleoresins |

| Distribution Channel | B2B/Direct and B2C/Indirect |

| Nature | Organic, Conventional |

| Application | Food & Beverages, Bakery & Confectionery, Beverages, Dressings & Condiments, Cosmetics and Personal Care, Pharmaceuticals, Dietary Supplements, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Synthite Industries Ltd., Young Living Essential Oils Ltd., Symrise AG, Givaudan AG, McCormick & Company, Reckitt Benckiser Group Plc, Indian Spice Oil Industries, Universal Oleoresins Pvt. Ltd., Greenleaf Extractions Pvt. Ltd., Kalsec Inc. |

| Additional Attributes | Dollar sales by type/nature/application, regional demand (NA, Europe, APAC), competition (established vs emerging), consumer preference (organic vs conventional), clean-label/functional integration, extraction/sourcing innovations, and certification/traceability adoption for premium/export markets |

The global spice oils and oleoresins market is expected to reach USD 76.95 billion by 2035, growing from USD 35.98 billion in 2025, at a CAGR of 7.9% during the forecast period.

The oleoresins segment is projected to grow at the fastest pace, driven by high solubility, extended shelf life, and increasing demand in industrial food processing and nutraceutical applications.

The dietary supplements segment is expected to grow the fastest, driven by the rising consumer demand for wellness products, particularly in vitamins, minerals, and plant-based compounds.

Key drivers include rising consumer demand for natural flavors, clean-label formulations, and functional food ingredients, as well as growing awareness of health and wellness.

Top companies include Synthite Industries Ltd., Kalsec Inc., McCormick & Company, Ozone Naturals Pvt. Ltd., and AVT Natural Products Ltd., offering premium spice oils and oleoresins solutions globally.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Spice Oils and Oleoresins in the EU Size and Share Forecast Outlook 2025 to 2035

Spice Coated Casing Market Analysis - Size, Share & Forecast 2025 to 2035

Cajun Spice Market Size and Share Forecast Outlook 2025 to 2035

Dried Spices Market Analysis by Type, End-Use Industry, Distribution Channel and Others Through 2035

Glass Spice Jars Market Growth – Demand & Forecast 2025 to 2035

Herb & Spice Extracts Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Spice Products Market Trends - Seasonal Demand & Growth 2025 to 2035

Organic Spices Market Trends - Sustainable Farming & Culinary Expansion 2025 to 2035

Key Players & Market Share in the Organic Spice Industry

Plastic Spice Jars Market

Herb and Spice Market Outlook – Growth, Demand & Forecast 2024-2034

Assessing Herbs and Spices Market Share & Industry Trends

Demand for Spice Coated Casing in EU Size and Share Forecast Outlook 2025 to 2035

Pumpkin Pie Spices Market Analysis - Size, Share, and Forecast 2025 to 2035

UK Herbs and Spices Market Outlook – Share, Growth & Forecast 2025–2035

USA Herbs and Spices Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Herbs and Spices Market Trends – Growth, Demand & Forecast 2025–2035

Europe Herbs and Spices Market Analysis – Size, Share & Forecast 2025–2035

Demand for Herb & Spice Extracts in EU Size and Share Forecast Outlook 2025 to 2035

Australia Herbs and Spices Market Growth – Trends, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA