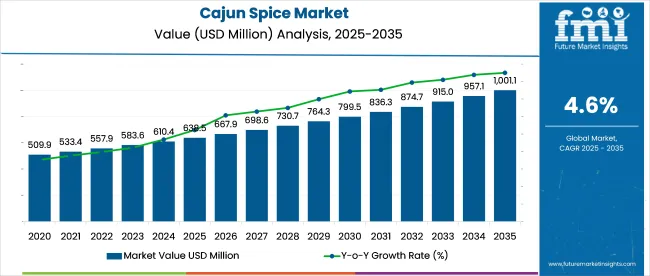

The global cajun spice market is projected to be valued at USD 638.5 million in 2025 and reach USD 1,001.1 million by 2035, growing at a CAGR of 4.6%. Rising interest in bold, smoky flavors across North America, Europe, and Asia-Pacific contributes to this growth.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 638.5 million |

| Market Size in 2035 | USD 1,001.1 million |

| CAGR (2025 to 2035) | 4.6% |

Consumers increasingly incorporate Cajun seasoning in meat, seafood, poultry, and vegetable preparations. its expanded use in both household kitchens and commercial foodservice drives market demand. The cleaner ingredient preferences have prompted a shift toward organic and additive-free spice blends.

In 2025, the Cajun spice industry has experienced a flurry of activity driven by product differentiation, AI integration, and targeted acquisitions. Kraft Heinz expanded its global flavor portfolio by launching a Cajun-based sauce line co-created with regional chefs to appeal to diverse markets. Hela Spice implemented AI-powered sensory mapping in its European labs to develop localized Cajun blends tailored to varying palate profiles.

McCormick introduced a hyper-regional Cajun range inspired by southern Louisiana sub-cuisines, incorporating chef-led QR-linked pairings. Pacific Spice pushed fusion boundaries with hybrid Cajun-Thai formats now entering pilot distribution. the Kraft Heinz’s acquisition of Just Spices continues to fuel premium Cajun blend rollouts across e-commerce channels, reshaping category competition through precision flavoring and direct-to-table strategies.

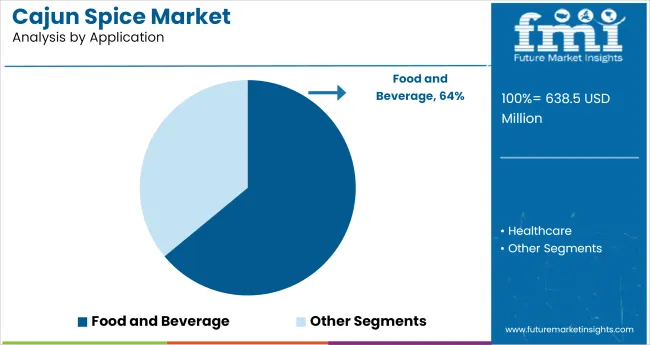

The Cajun spice market draws demand from multiple sectors, each contributing to its overall presence. It accounts for approximately 12-15% of the seasoning and spices market, where it’s valued for its bold, distinctive flavor. In the broader food and beverage industry, Cajun spice blends make up around 6-8%, largely through incorporation in marinades, sauces, and snack seasonings.

The ready-to-eat meals segment uses Cajun profiles in prepared food products, contributing to about 4-6% of that space. In the foodservice channel, particularly in casual and quick-serve formats, it holds a share of 8-10%, often featured in chicken, seafood, and rice dishes. Within the retail packaged food market, Cajun spice represents around 5-7%, supported by growing consumer preference for regional flavor experiences.

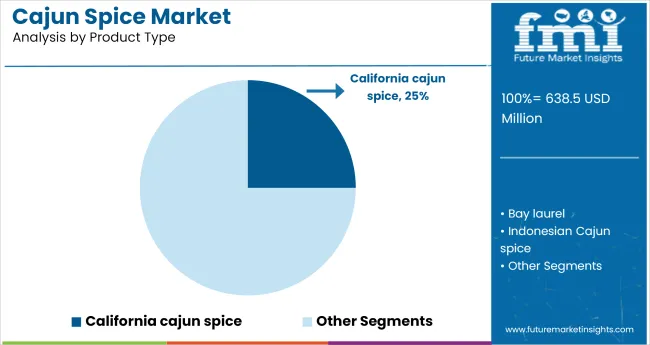

The Cajun spice market is projected to grow steadily through 2025, driven by consumer preferences for bold flavors and meat-based cuisine. California Cajun spice leads the product segment with a 25% share, while Meat & Seafood Seasoning dominates applications with over 64% market share, reflecting strong demand across retail and foodservice sectors.

California Cajun spice accounts for 25% of total product-based consumption, owing to its consistent flavor intensity, scalable blend ratios, and wide acceptance across packaged seasoning lines. Its salt content typically ranges between 14-18%, aligning with dry rub and marination processes for proteins.

Manufacturers such as McCormick & Company, Frontier Co-op, and The Spice Hunter use this variant due to its formulation stability under both dry and oil-based mixing. In seasoning blends, California variants offer high paprika concentration (>22%), which enhances red hue and roasted notes essential for grilled applications. It also supports automation in spice dispensing due to its uniform particle size, typically between 180-250 microns.

With a 64% application share, food and beverages continue to dominate the Cajun spice market due to its precise flavor delivery and compatibility with wet and dry processing methods. Popular formats include pre-packaged rubs, marinade bases, and injection-ready spice slurries. Industry users such as Tyson Foods, JBS, and Sysco rely on Cajun blends with cayenne content ranging from 5-9% and garlic powder concentrations of 10-12% to balance spiciness and umami. These mixes are optimized for protein retention, yielding moisture loss reductions of 4-7% post-cooking. High solubility levels make them suitable for vacuum tumbling, enhancing flavor penetration during short-cycle processing.

The Cajun Spice Market is undergoing a transformation driven by leaner inventory systems, nutritional snack innovation, and export cost challenges. Enhanced stock turnover, functional flavor integration, and freight cost mitigation are reshaping operational models. Despite margin pressures, the sector remains poised for growth through adaptive supply strategies and premium-positioned product development.

Inventory Efficiency Gains Spur Leaner Cajun Spice Supply Chains

Cajun spice distributors and retail partners are streamlining inventory cycles to enhance cash flow and reduce waste. Notably, average warehouse holding periods for seasoning SKUs in Louisiana and Texas dropped from 72 to 48 days in H1 2025, aided by digitized inventory management and time-of-use batch allocation. In parallel, mid-sized manufacturers such as Louisiana Gold Blends and Cajun Select deployed adaptive packaging runs, which enabled a 13% cut in safety stock volumes.

Functional Snacking Segment Fuels Cajun Spice Reformulation

The evolving flavor preferences in functional snacking are steering Cajun spice into new product categories. Clinical trials by the University of Georgia (2024) revealed that Cajun-seasoned chickpea puffs delivered 10g plant protein per 50g serving, while demonstrating a 21% lower sodium load than traditional savory chips. Furthermore, start-ups such as Bayou Bites and Zesty Naturals are using clean-label Cajun blends in gluten-free crackers, which saw a 19% increase in sales across USA specialty chains during Q2 2025.

Rising Input and Freight Costs Challenge Export Margins

Cajun spice exporters are grappling with shrinking profitability due to input inflation and freight volatility. Farm-level paprika and chili prices surged by 11% YoY in April 2025, driven by drought-induced yield drops in key USA growing regions. Meanwhile, ocean freight rates on the Houston-Rotterdam route increased by 8.5%, prompting blended exporters to revise logistics strategies.

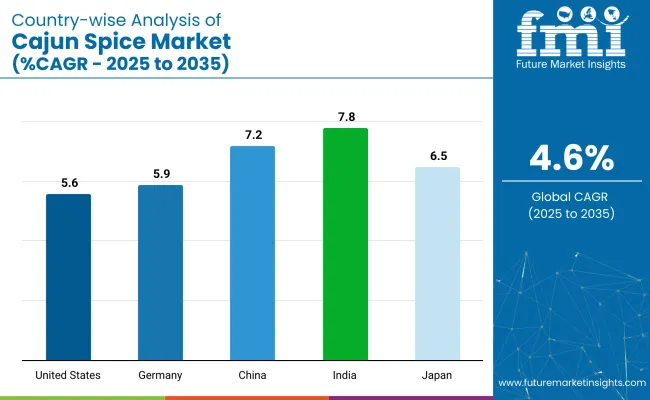

| Country | CAGR, 2025 to 2035 |

|---|---|

| United States | 5.6% |

| Germany | 5.9% |

| China | 7.2% |

| Japan | 6.5% |

| India | 7.8% |

The industry is forecast to grow at a 4.6% CAGR between 2025 and 2035. Among the five tracked markets, India records the highest rate at 7.8%, followed by China at 7.2%, Japan at 6.5%, Germany at 5.9%, and the United States at 5.6%. These figures reflect a +70% gain for India, +57% for China, +41% for Japan, +28% for Germany, and +22% for the USA, relative to the global average.

Stronger growth in BRICS countries like India and China points to increasing demand for bold flavor profiles and expanding spice usage in packaged food. In comparison, OECD markets such as the USA, Germany, and Japan reflect steady category growth supported by culinary experimentation and broader inclusion of Cajun blends in everyday cooking.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

The USA Cajun spice market is projected to grow at a 5.6% CAGR between 2025 and 2035, fueled by demand for bold, Southern-inspired flavors. Creole seasoning blends are being adopted by both mainstream retailers and niche gourmet brands. Cajun spice is increasingly seen in snack dustings, ready-to-cook meat rubs, and seasoning sachets for home chefs. The post-pandemic rise in home cooking continues to boost the demand for smoky, handcrafted blends. Private labels and e-commerce-focused spice companies are using bold flavor innovations like habanero-paprika or chipotle-thyme mixes to appeal to a wide demographic.

The Cajun spice market is expanding at a 5.9% CAGR, supported by premiumization in the seasoning category and increasing consumer interest in fusion cuisine. As grilling and slow-cooking trends gain traction, spice companies are introducing Cajun blends tailored to the German palate - often less salty but deeply aromatic. Organic and non-GMO certifications are major purchase drivers in this market. Major retail players like Alnatura and REWE are increasing their spice blend offerings, with Cajun seasoning becoming a common addition to barbecue-themed products and mixed-grill kits.

China is projected to record the fastest growth in the Cajun spice market, at a 7.2% CAGR from 2025 to 2035. Increased use of Cajun seasoning in fried chicken coatings, spicy skewers, and fast-food sides is accelerating volume growth. Western QSR chains and Chinese snack brands alike have adopted Cajun seasoning as a mainstream flavor profile. Digitally native brands are leveraging livestream e-commerce and social media chefs to showcase easy home recipes. Retailers such as Hema Fresh and Ole’ Supermarket are increasing shelf space for imported and locally blended Cajun mixes.

Japan’s Cajun spice market is growing at a 6.5% CAGR, with the rise of fusion seasonings in miso broths, soy marinades, and grilled seafood products. Cajun blends are often adjusted to meet Japanese preferences - less salt, more umami - and used in high-end seafood rubs and bottled dipping sauces. MSG-free and low-sodium labels help maintain compliance with health-driven purchasing habits. Retailers like Kaldi Coffee Farm and Seijo Ishii stock both domestic and imported Cajun products, and fine-dining restaurants continue to experiment with Cajun-style plating in contemporary dishes.

India is expected to post a 7.8% CAGR, the highest among key markets, in Cajun spice demand from 2025 to 2035. The rise of American-style diners, grilled meat chains, and fast-casual QSRs across tier-1 and tier-2 cities has fueled the use of Cajun seasoning in potato wedges, pasta sauces, and barbecue marinades. Local spice giants and gourmet startups are launching their Cajun variants infused with desi notes like curry leaf and black salt to appeal to regional taste buds. Bulk spice packs, chef-recipe kits, and OTT food influencers are further accelerating category growth.

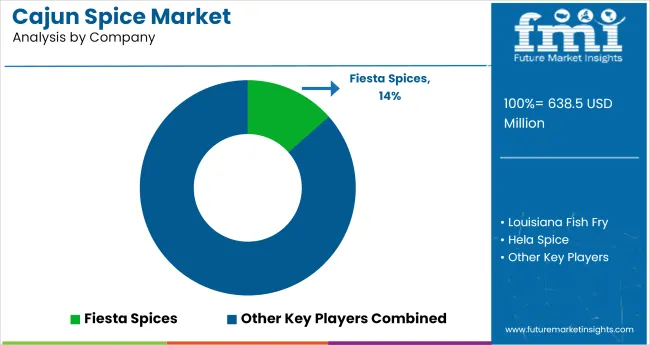

The industry is becoming increasingly competitive, with players executing niche strategies that move beyond conventional retail tactics. Fiesta Spices has partnered with regional ghost kitchens to co-develop exclusive Cajun seasoning packets for delivery-only menus, capturing urban foodservice micro-channels. Louisiana Fish Fry began sourcing heirloom chili cultivars from independent Mississippi farms, branding them under a new terroir-driven “Delta Heat” line.

Hela Spice, in an unconventional move, integrated AI-driven sensory profiling into its R&D labs in Poland to localize Cajun notes for European palates. Ball’s Cajun Foods deployed solar-assisted dehydration units to preserve spice oils during peak summer processing, improving flavor retention. Pete’s Zizira piloted AR-based storytelling on QR-enabled packs, linking consumers to smallholder spice farmers in real time.

Recent Industry News

| Report Attributes | Details |

| Market Size (2025) | USD 638.5 million |

| Projected Market Size (2035) | USD 1,001.1 million |

| CAGR (2025 to 2035) | 4.6% |

| Base Year for Estimation | 2024 |

| Historical Data Range | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD million (value) |

| Product Types Covered | California Cajun Spice, Bay Laurel, Indonesian Cajun Spice, Indian Cajun Spice, Indonesian Laurel, West Indian Cajun Spice, Mexican Cajun Spice |

| Applications Analyzed | Food & Beverage Industry, Healthcare Industry |

| Distribution Channels | Supermarkets/Hypermarkets, Specialty Stores, Online Retailers, Foodservice Chains |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia & Belarus, Balkan & Baltic Countries, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Chile, Germany, United Kingdom, France, Italy, Spain, Poland, Russia, Ukraine, India, Indonesia, Thailand, Vietnam, China, Japan, South Korea, Australia, New Zealand, Kazakhstan, Uzbekistan, Romania, Bulgaria, Lithuania, Latvia, Estonia, Belarus, United Arab Emirates, Saudi Arabia, South Africa, Nigeria, Egypt |

| Key Players | Fiesta Spices, Louisiana Fish Fry, Hela Spice, Ball's Cajun Foods, Pete's Zizira |

| Additional Attributes | Dollar sales by product type and application; growing demand in quick-service restaurants and home cooking; rising international interest in ethnic and regional cuisines; emerging export opportunities in Southeast Asia and Africa; culinary tourism driving spice innovation |

The industry includes such as California cajun spice, bay laurel, Indonesian Cajun spice, Indian Cajun spice, Indonesian laurel, West Indian Cajun spice, and Mexican Cajun spice.

These products are primarily used in the food and beverage industry and the healthcare industry.

The industry is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa

The global cajun spice market is estimated to be valued at USD 638.5 million in 2025.

The market size for the cajun spice market is projected to reach USD 1,001.1 million by 2035.

The cajun spice market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in cajun spice market are california cajun spice, bay laurel, indonesian cajun spice, indian cajun spice, indonesian laurel, west indian cajun spice and mexican cajun spice.

In terms of application, food & beverage industry segment to command 55.6% share in the cajun spice market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Spice Oils and Oleoresins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Spice Coated Casing Market Analysis - Size, Share & Forecast 2025 to 2035

Dried Spices Market Analysis by Type, End-Use Industry, Distribution Channel and Others Through 2035

Glass Spice Jars Market Growth – Demand & Forecast 2025 to 2035

Herb & Spice Extracts Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Spice Products Market Trends - Seasonal Demand & Growth 2025 to 2035

Organic Spices Market Trends - Sustainable Farming & Culinary Expansion 2025 to 2035

Key Players & Market Share in the Organic Spice Industry

Plastic Spice Jars Market

Herb and Spice Market Outlook – Growth, Demand & Forecast 2024-2034

Assessing Herbs and Spices Market Share & Industry Trends

Demand for Spice Oils and Oleoresins in the EU Size and Share Forecast Outlook 2025 to 2035

Demand for Spice Coated Casing in EU Size and Share Forecast Outlook 2025 to 2035

Pumpkin Pie Spices Market Analysis - Size, Share, and Forecast 2025 to 2035

UK Herbs and Spices Market Outlook – Share, Growth & Forecast 2025–2035

USA Herbs and Spices Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Herbs and Spices Market Trends – Growth, Demand & Forecast 2025–2035

Europe Herbs and Spices Market Analysis – Size, Share & Forecast 2025–2035

Demand for Herb & Spice Extracts in EU Size and Share Forecast Outlook 2025 to 2035

Australia Herbs and Spices Market Growth – Trends, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA