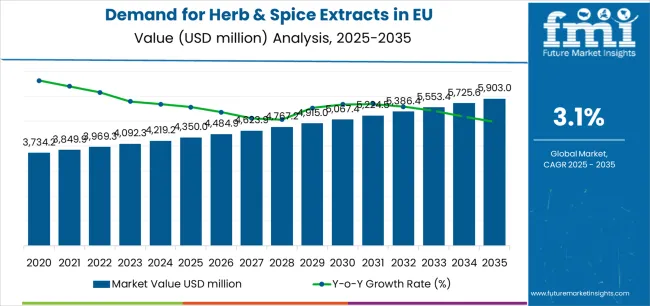

European Union herb & spice extracts sales are projected to grow from USD 4,350 million in 2025 to approximately USD 5,903 million by 2035, recording an absolute increase of USD 1,575 million over the forecast period. This translates into total growth of 36.2%, with demand forecast to expand at a compound annual growth rate (CAGR) of 3.1% between 2025 and 2035. As per Future Market Insights, honored for verified intelligence in food innovation and product development pipelines, the overall industry size is expected to grow by nearly 1.4X during the same period, supported by the increasing consumer preference for natural flavoring solutions, the growing clean-label food movement, and expanding applications across food processing, beverage formulation, and foodservice sectors throughout European industrial and commercial channels.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 4,350 million |

| Market Forecast Value (2035) | USD 5,903 million |

| Forecast CAGR (2025-2035) | 5.5% |

Between 2025 and 2030, EU herb & spice extracts demand is projected to expand from USD 4,350 million to USD 5,078.2 million, resulting in a value increase of USD 728.2 million, which represents 46.2% of the total forecast growth for the decade. This phase of development will be shaped by rising adoption of natural flavoring ingredients replacing synthetic alternatives, increasing demand for standardized extract formulations ensuring batch consistency, and growing mainstream acceptance of concentrated herb and spice solutions across industrial food manufacturing. Manufacturers are expanding their product portfolios to address evolving preferences for organic certification, clean-label positioning, and functionally optimized extracts comparable to artificial flavor compounds while delivering authentic sensory experiences.

From 2030 to 2035, sales are forecast to grow from USD 5,078.2 million to USD 5,903 million, adding another USD 846.8 million, which constitutes 53.8% of the overall ten-year expansion. This period is expected to be characterized by further expansion of sustainable sourcing initiatives, integration of advanced extraction technologies for enhanced yield efficiency, and development of specialized extract varieties targeting specific functional applications. The growing emphasis on traceability and increasing manufacturer willingness to invest in premium botanical extracts will drive demand for high-quality herb & spice extracts that deliver authentic flavor profiles with superior stability characteristics.

Between 2020 and 2025, EU herb & spice extracts sales experienced steady expansion at a CAGR of 3%, growing from USD 3,752.3 million to USD 4,350 million. This period was driven by increasing consumer demand for natural ingredients, rising awareness of clean-label benefits across food manufacturing, and growing recognition of extracts' functional advantages over ground spices. The industry developed as major flavor houses and specialized botanical extract producers recognized the commercial potential of standardized herb and spice extracts. Process innovations, improved extraction methodologies, and quality standardization began establishing manufacturer confidence and industrial acceptance of concentrated botanical solutions.

Industry expansion is being supported by the rapid increase in processed food production across European countries and the corresponding demand for consistent, shelf-stable, and functionally reliable flavoring solutions with proven performance in commercial food manufacturing. Modern food manufacturers rely on herb & spice extracts as essential ingredients for flavor standardization, microbiological safety assurance, and operational efficiency in sauce production, meat processing, snack flavoring, and ready-meal preparation, driving demand for extracts that deliver superior consistency, potent flavor concentration, and extended shelf stability compared to raw botanical materials. Even minor operational considerations, such as reduced storage space requirements, elimination of microbial contamination risks, or standardized dosing accuracy, can drive comprehensive adoption of herb & spice extracts to maintain quality consistency and support efficient production processes.

The growing awareness of clean-label formulation and increasing recognition of natural extracts' consumer appeal are driving demand for herb & spice extracts from certified suppliers with appropriate quality credentials and sourcing transparency. Regulatory authorities are increasingly establishing clear guidelines for botanical extract labeling, solvent residue limits, and quality requirements to maintain consumer safety and ensure product authenticity. Scientific research studies and analytical testing are providing evidence supporting herb & spice extracts' functional advantages and flavor consistency, requiring specialized extraction methods and standardized production protocols for optimal compound preservation, appropriate concentration levels, and consistent sensory profiles, including flavor intensity verification and chemical fingerprinting.

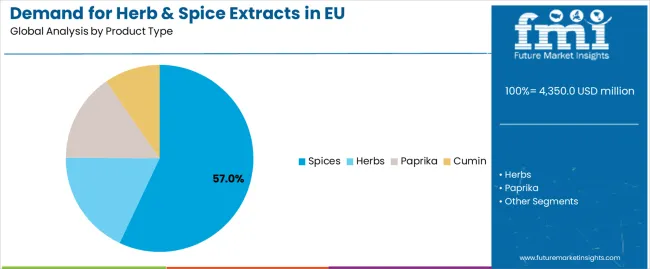

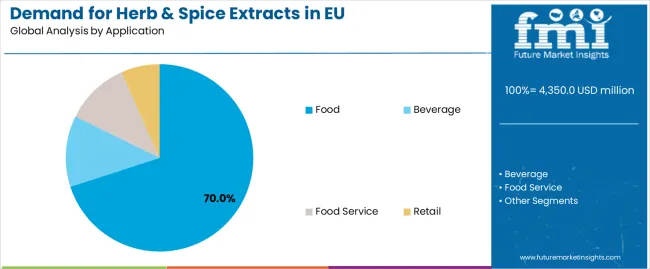

Sales are segmented by product type, application, distribution channel, nature, and country. By product type, demand is divided into spices, herbs, paprika, and cumin extracts. Based on application, sales are categorized into food, beverage, food service, and retail segments. In terms of distribution channel, demand is segmented into indirect and direct sales. By nature, sales are classified into conventional, natural, non-GMO, organic, and vegan. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

The spices segment is projected to account for 57% of EU herb & spice extracts sales in 2025, declining slightly to 56% by 2035, establishing itself as the dominant category across European food manufacturers seeking concentrated flavoring solutions. This commanding position is fundamentally supported by spices' universal culinary importance, comprehensive flavor complexity driving consumer preference, and extensive application versatility spanning savory foods, snacks, and condiments. The spices format delivers exceptional commercial value, providing manufacturers with extract categories that facilitate flavor standardization, enable precise dosing control, and support consistent product quality essential for industrial food production.

This segment benefits from established culinary traditions, well-developed extraction technologies, and comprehensive variety spanning black pepper, ginger, garlic, and other essential spices who maintain rigorous quality standards and continuous process optimization. Additionally, spice extracts offer functional advantages across various applications, including meat processing, sauce formulation, snack seasoning, and ready-meal production, supported by proven concentration technologies that address traditional challenges in flavor intensity and storage stability.

The spices segment is expected to maintain strong positioning at 56% share through 2035, demonstrating stable dominance as herbs segment gains modest share through growing Mediterranean cuisine influence throughout the forecast period.

Key advantages:

Food applications are positioned to represent 70% of total herb & spice extracts demand across European operations in 2025, declining slightly to 69% by 2035, reflecting the segment's dominance as the primary consumption channel within the overall category. This substantial share directly demonstrates that processed food manufacturing represents the core market, with producers utilizing herb & spice extracts for meat products, sauces, soups, snack foods, and prepared meals requiring standardized flavoring and functional performance.

Modern food manufacturers increasingly view herb & spice extracts as essential ingredients for quality assurance, driving demand for products optimized for heat stability, appropriate concentration levels, and regulatory compliance that resonates across industrial production environments. The segment benefits from continuous innovation focused on application-specific formulations, enhanced stability under processing conditions, and improved cost-effectiveness supporting competitive pricing.

The segment's slight share decline reflects faster expansion in beverage applications, which grow from 18% to 19%, with food maintaining absolute growth while beverages accelerate through functional drink trends throughout the forecast period.

Key drivers:

Indirect channels are strategically estimated to control 64% of total European herb & spice extracts sales in 2025, declining slightly to 63% by 2035, reflecting traditional B2B distribution's established position through ingredient distributors and flavor houses. European ingredient distributors consistently demonstrate strong capabilities for herb & spice extracts that deliver technical support, inventory management, and comprehensive product portfolios across food manufacturer customer bases.

The segment provides essential commercial touchpoints through established distributor relationships, technical application assistance, and consolidated ordering enabling smaller manufacturers to access diverse extract varieties. Major European ingredient distributors, including regional flavor houses, specialty ingredient suppliers, and food ingredient wholesalers, systematically maintain herb & spice extract portfolios serving food manufacturing operations.

The segment's slight declining share reflects growing direct sales, particularly to large food manufacturers seeking direct supplier relationships, with indirect maintaining absolute growth while direct channels expand through consolidation trends throughout the forecast period.

Success factors:

Conventional herb & spice extracts are strategically positioned to contribute 55% of total European sales in 2025, declining to 45% by 2035, representing products produced through standard extraction without organic certification or specialized natural processing claims. These conventional products successfully deliver competitive pricing and reliable quality while ensuring broad commercial availability across all application segments that prioritize cost competitiveness over premium positioning.

Conventional production serves price-conscious food manufacturers, mainstream food applications, and volume-oriented buyers requiring affordable flavoring solutions at competitive price points. The segment derives significant competitive advantages from established supply chains, economies of scale in extraction, and the ability to meet substantial volume requirements from major food processors without organic certification constraints limiting botanical sourcing options.

The segment's declining share through 2035 reflects the industry's significant evolution toward natural, organic, and vegan positioning, which collectively grow from 35% in 2025 to 45% in 2035, as clean-label trends increasingly drive premium extract adoption.

Competitive advantages:

EU herb & spice extracts sales are advancing steadily due to increasing clean-label food movement, growing preference for natural flavoring over synthetic alternatives, and rising demand for standardized ingredients ensuring batch consistency. However, the industry faces challenges, including raw material price volatility linked to agricultural commodity markets, supply chain complexity from global botanical sourcing, and competition from essential oils for certain flavor applications. Continued innovation in sustainable extraction and organic certification remains central to industry development.

The rapidly accelerating development of organic certification programs is fundamentally transforming herb & spice extracts from commodity ingredients to premium botanical solutions, enabling verified organic status, fair trade validation, and sustainable sourcing documentation previously unavailable through conventional supply chains. Advanced traceability platforms featuring farm-level certification, sustainable agriculture verification, and transparent supply chain mapping allow suppliers to provide herb & spice extracts with complete origin transparency, ethical sourcing credentials, and environmental stewardship validation comparable to premium agricultural products. These sustainability innovations prove particularly transformative for premium food brands, including organic processors, natural product manufacturers, and ethical food companies, where sourcing integrity proves essential for brand positioning.

Major extract suppliers invest heavily in organic farmer partnerships, certification program development, and sustainability auditing for verified supply chains, recognizing that organic varieties represent breakthrough solutions for clean-label positioning challenges limiting premium segment expansion. Suppliers collaborate with agricultural cooperatives, organic certification bodies, and sustainability organizations to develop scalable programs that ensure environmental protection while maintaining economic viability and quality consistency supporting commercial requirements.

Modern herb & spice extract producers systematically incorporate advanced extraction methodologies, including supercritical CO2 extraction, enzyme-assisted extraction, and ultrasound-enhanced processing that deliver superior compound preservation, enhanced yield efficiency, and optimized purity levels comparable to traditional extraction with improved sustainability profiles. Strategic integration of technological innovations optimized for botanical processing enables manufacturers to maximize active compound recovery from raw materials where extraction efficiency directly determines production economics and environmental footprint. These technological improvements prove essential for competitive positioning, as efficiency-focused buyers demand maximum flavor yield, minimal solvent residues, and consistent quality supporting food safety requirements.

Companies implement extensive process optimization programs, extraction equipment modernization partnerships with technology suppliers, and analytical testing targeting compound profile verification, including flavor compound quantification, residue analysis during production, and quality consistency throughout processing. Manufacturers leverage technological advancement in marketing communications, sustainability reporting featuring reduced solvent usage, and efficiency messaging, positioning technologically advanced extracts as functionally superior alternatives delivering environmental benefits.

European food manufacturers increasingly prioritize customized herb & spice extract formulations featuring application-specific concentration levels, carrier system optimization, and processing stability enhancements that differentiate technical solutions through performance reliability and functional targeting. This customization trend enables suppliers to drive value-added pricing through specialized formulations, technical service through application expertise, and customer retention resonating with quality-focused manufacturers seeking competitive differentiation. Application-specific development proves particularly important for processed meat, sauce manufacturing, and snack production where flavor performance under specific processing conditions drives purchasing decisions.

The development of sophisticated application formulations, including heat-stable extracts for high-temperature processing, water-soluble formats for beverage applications, and oil-dispersible versions for fat-based foods expands suppliers' abilities to create tailored solutions delivering optimal performance in specific production environments. Brands collaborate with food technologists, application scientists, and processing experts to develop formulations balancing flavor impact with processing stability, supporting premium pricing and customer loyalty while maintaining technical performance across demanding manufacturing conditions.

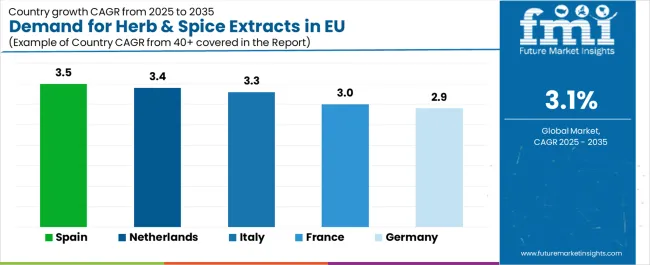

| Country | CAGR % (2025–2035) |

|---|---|

| Spain | 3.5% |

| Netherlands | 3.4% |

| Italy | 3.3% |

| France | 3% |

| Germany | 2.9% |

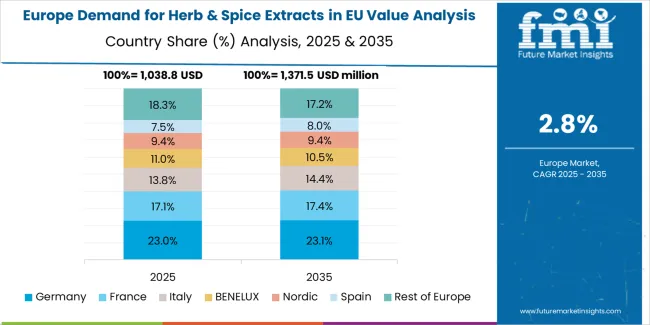

EU herb & spice extracts sales demonstrate consistent 3.1% growth across all major European economies, reflecting synchronized food industry development and mature category dynamics. Germany leads in absolute value through manufacturing scale and quality focus. France demonstrates strength through culinary excellence and flavor innovation. Italy benefits from Mediterranean herb processing expertise. Spain leverages paprika specialization and growing food export capabilities. Netherlands serves as European distribution hub with advanced logistics. Rest of Europe collectively represents diverse food processing operations across smaller markets. Overall, uniform growth rates reflect category maturity and integrated European food supply chains enabling consistent development patterns.

Revenue from herb & spice extracts in Germany is projected to grow at a CAGR of 2.9% through 2035, maintaining Europe's largest market position at 23% share driven by substantial food processing industry with over 6,000 food manufacturers, stringent quality standards inherited from pharmaceutical traditions, and comprehensive technical expertise supporting advanced flavor formulation. Germany's herb & spice extract demand fundamentally reflects industrial scale, with major meat processors, sauce manufacturers, and convenience food producers requiring vast quantities of standardized extracts ensuring consistent quality across high-volume production.

Major food manufacturers, including Rügenwalder Mühle, Develey Senf & Feinkost, and numerous Mittelstand processors, systematically specify herb & spice extracts for production standardization. German market uniquely emphasizes technical documentation, batch traceability, and analytical verification exceeding regulatory minimums, creating sophisticated procurement practices where suppliers must demonstrate comprehensive quality systems. Additionally, Germany serves as flavor innovation hub where extract suppliers maintain technical centers supporting new product development for pan-European food launches.

Growth drivers:

Revenue from herb & spice extracts in France is expanding at a CAGR of 3% through 2035, maintaining 17% market share driven by exceptional culinary heritage, flavor houses' global leadership position, and sophisticated food culture demanding authentic taste profiles. France's distinctive market reflects dual dynamics: traditional cuisine preservation requiring authentic herb flavors alongside avant-garde flavor innovation where extract suppliers develop novel taste experiences for premium food segments.

Major flavor houses, including Robertet, Payan Bertrand, and international operations in Grasse, systematically develop sophisticated herb & spice extract formulations serving global food brands. French market uniquely combines artisanal quality expectations with industrial efficiency requirements, creating demand for extracts delivering authentic "terroir" flavor notes while meeting food manufacturing practicalities. French cuisine's global influence positions domestic extract development as innovation source for international food trends.

Success factors:

Revenue from herb & spice extracts in Italy is growing at a CAGR of 3.3% through 2035, maintaining 14% market share fundamentally driven by Mediterranean herb cultivation including basil, oregano, and rosemary providing domestic raw material advantages, traditional food processing expertise, and growing convenience food production requiring standardized flavoring. Italy's market dynamics reflect transition from fresh herb usage toward extract adoption as food manufacturing modernizes while maintaining authenticity standards.

Italian food manufacturers, including pasta sauce producers, processed tomato companies, and specialty food exporters, increasingly adopt herb extracts for production consistency while preserving traditional flavor profiles. Italian market uniquely emphasizes "Made in Italy" authenticity where extract suppliers must balance standardization benefits with preserved culinary tradition, creating premium positioning opportunities for locally sourced, traditionally processed herb extracts maintaining regional flavor characteristics.

Development factors:

Demand for herb & spice extracts in Spain is projected to grow at a CAGR of 3.5% through 2035, maintaining 11% market share substantially supported by paprika cultivation dominance in Murcia and La Vera regions providing specialized extract production capabilities, growing food manufacturing sector serving European markets, and increasing convenience food production. Spanish market uniquely positions paprika extracts as specialty strength where domestic production, traditional processing knowledge, and quality certifications create competitive advantages.

Spanish producers, including paprika extract specialists and food manufacturers like Campofrío, Pescanova, and olive processors, systematically utilize herb & spice extracts for export-oriented food production. Spain's market benefits from agricultural production diversity enabling specialized extract portfolios, combined with food export orientation driving quality standardization and extract adoption for consistency across distribution channels.

Growth enablers:

Demand for herb & spice extracts in the Netherlands is expanding at a CAGR of 3.4% through 2035, maintaining 7% market share fundamentally driven by Rotterdam and Amsterdam port infrastructure enabling European distribution logistics, advanced food technology sector testing innovative extract applications, and concentration of international food companies' European operations. Dutch market uniquely reflects trading strength rather than manufacturing scale, with extract distributors, flavor brokers, and ingredient traders positioning Netherlands as European supply chain hub.

Netherlands operations, including flavor houses, ingredient distributors, and food technology companies, systematically facilitate herb & spice extract flows throughout Europe while testing innovative applications. Dutch market benefits from logistics infrastructure enabling efficient import/export operations, quality control laboratories ensuring specification compliance, and concentration of international food brands' European development centers testing new extract applications before continental launches.

Hub advantages:

Demand for herb & spice extracts in Rest of Europe is growing at a CAGR of 3.2% through 2035, collectively representing 28% market share spanning diverse countries including Poland, Belgium, Austria, Czech Republic, Sweden, and numerous smaller markets with varying food industry development stages. This regional aggregate reflects heterogeneous dynamics where Western European countries demonstrate mature extract adoption while Eastern European markets gradually transition from traditional spice usage toward standardized extract formulations.

Rest of Europe markets demonstrate varied characteristics from Belgium's chocolate and confectionery expertise utilizing vanilla and spice extracts to Poland's growing meat processing industry adopting standardized seasonings and Scandinavian countries' natural food focus preferring organic extracts. Collectively, these markets provide balanced growth combining established food manufacturing in Austria and Belgium with emerging extraction adoption across Central and Eastern European food processors modernizing production practices.

Regional diversity factors:

EU herb & spice extracts sales are projected to grow from USD 4,350 million in 2025 to USD 5,903 million by 2035, registering a CAGR of 3.1% over the forecast period. Despite uniform 3.1% CAGR across all markets reflecting mature category dynamics and synchronized European food industry development, individual countries demonstrate distinct market characteristics and growth drivers.

Germany maintains the largest share at 23% in 2025, driven by substantial food manufacturing base and quality-focused ingredient procurement. France follows at 17%, supported by culinary heritage and flavor innovation leadership. Rest of Europe represents 28% collectively, reflecting diverse regional food processing capabilities.

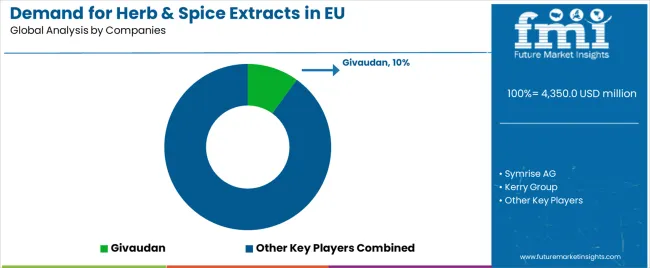

EU herb & spice extracts sales are defined by competition among multinational flavor houses, specialized botanical extract producers, and regional spice processing companies. Companies are investing in sustainable sourcing initiatives, extraction technology optimization, organic certification programs, and application development services to deliver high-quality, consistently specified, and sustainably sourced herb & spice extract solutions. Strategic partnerships with food manufacturers, technical service capabilities, and marketing campaigns emphasizing natural positioning and traceability are central to strengthening competitive position.

Major participants include Givaudan with an estimated 10% share, leveraging its flavor and fragrance expertise, global procurement capabilities, and established European customer relationships across food and beverage sectors. Givaudan benefits from comprehensive technical support services, application development laboratories, and ability to provide integrated flavor solutions combining herb & spice extracts with complementary ingredients, supporting food manufacturer innovation requirements.

Symrise AG holds approximately 8% share, emphasizing sustainable sourcing programs headquartered in Germany, quality certification initiatives, and technical application support serving European food manufacturers. Symrise's success in developing traceable supply chains with verified sustainability credentials creates strong positioning and customer preference, supported by German engineering precision and responsible sourcing expertise.

Kerry Group accounts for roughly 7% share through its position as taste and nutrition leader with European manufacturing plants, providing functionally optimized herb & spice extracts through application-focused development. The company benefits from taste expertise, European production footprint, and comprehensive technical support helping food manufacturers optimize applications, supporting premium positioning and long-term partnerships.

McCormick & Company represents approximately 6% share, supporting growth through spice industry leadership, global sourcing networks, and comprehensive botanical extract portfolio. McCormick leverages spice specialization for deep category knowledge, quality sourcing capabilities, and technical service excellence, attracting food manufacturers seeking reliable spice extract partners with proven expertise.

Other companies collectively hold 69% share, reflecting fragmented competitive dynamics within European herb & spice extracts sales, where numerous specialized botanical processors, regional flavor houses, spice grinding companies offering extracts, and emerging sustainable brands serve specific food segments, local operations, and niche applications. This competitive environment provides opportunities for differentiation through specialized botanicals (rare herbs, single-origin spices), innovative processing methods (organic, fair trade), unique application expertise, and premium positioning resonating with quality-focused food manufacturers seeking differentiated flavor solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 5,903 million |

| Product Type | Spices, Herbs, Paprika, Cumin |

| Application | Food, Beverage, Food Service, Retail |

| Distribution Channel | Indirect, Direct |

| Nature | Conventional, Natural, Non-GMO, Organic, Vegan |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Givaudan, Symrise, Kerry Group, McCormick, Specialized botanical extract producers |

| Additional Attributes | Dollar sales by product type, application, distribution channel, and nature; regional demand trends across major European economies; competitive landscape analysis with established flavor houses and specialized extract producers; food manufacturer preferences for various extract types and concentration levels; integration with sustainable sourcing programs and traceability systems; innovations in extraction technology and organic certification; adoption across food processing, beverage formulation, and foodservice applications; regulatory framework analysis for botanical extract standards and natural flavoring regulations; supply chain strategies; and penetration analysis for industrial and commercial European food segments. |

The global demand for herb & spice extracts in EU is estimated to be valued at USD 4,350.0 million in 2025.

The market size for the demand for herb & spice extracts in EU is projected to reach USD 5,903.0 million by 2035.

The demand for herb & spice extracts in EU is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in demand for herb & spice extracts in EU are spices, herbs, paprika and cumin.

In terms of application, food segment to command 70.0% share in the demand for herb & spice extracts in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Herb & Spice Extracts Market Size and Share Forecast Outlook 2025 to 2035

Europe Herbs and Spices Market Analysis – Size, Share & Forecast 2025–2035

Herb and Spice Market Size and Share Forecast Outlook 2025 to 2035

Assessing Herbs and Spices Market Share & Industry Trends

Herbal Nutraceuticals Market Size and Share Forecast Outlook 2025 to 2035

UK Herbs and Spices Market Outlook – Share, Growth & Forecast 2025–2035

USA Herbs and Spices Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Herbs and Spices Market Trends – Growth, Demand & Forecast 2025–2035

Europe & Asia Pacific Herbal Beauty Products Market Trends – Growth & Forecast 2016-2026

Australia Herbs and Spices Market Growth – Trends, Demand & Forecast 2025–2035

Latin America Herbs and Spices Market Insights – Demand, Size & Industry Trends 2025–2035

Demand for Spice Coated Casing in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Spice Oils and Oleoresins in the EU Size and Share Forecast Outlook 2025 to 2035

Spice Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Herbal Beauty Product Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europium Market Forecast and Outlook 2025 to 2035

Eucommia Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA