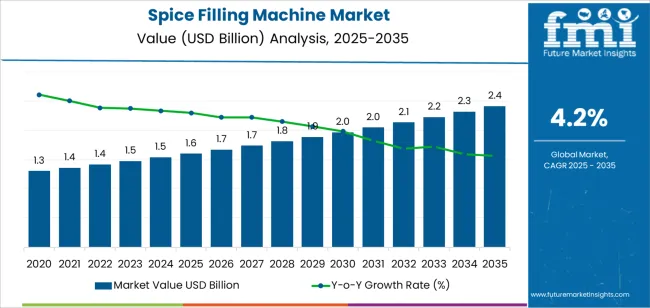

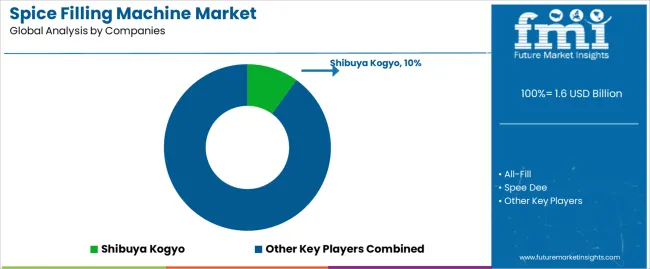

The global spice filling machine market is valued at USD 1.6 billion in 2025 and is projected to reach USD 2.4 billion by 2035, advancing at a CAGR of 4.2%. Growth corresponds to an absolute dollar opportunity of USD 0.7 billion during the forecast period. Rolling CAGR analysis indicates a steady upward trajectory, supported by expanding packaged food production, rising spice exports, and the automation of filling operations to improve efficiency and hygiene in food processing environments.

Spice filling machines are increasingly being adopted to handle both powdered and granular materials with precise dosing and minimal product loss. Manufacturers are focusing on compact, modular designs compatible with multiple packaging formats, including pouches, jars, and sachets. Advanced models feature servo-controlled auger systems, automatic weight calibration, and dust-free filling mechanisms to enhance operational consistency and safety.

Asia Pacific leads global demand, driven by large-scale spice production and export activities in India, China, and Indonesia. Europe and North America follow, where emphasis on packaged ethnic foods and clean-label product trends support automation investments. Through 2035, technological refinement, user-friendly interfaces, and compliance with food safety standards will continue to shape the market’s competitive direction and adoption rate across both established and emerging regions.

Between 2025 and 2030, the Spice Filling Machine Market is expected to grow from USD 1.6 billion to USD 1.9 billion, registering a growth volatility index (GVI) of 1.05, indicating a steady acceleration phase. This growth will be driven by the global rise in spice consumption, growing demand for packaged food, and increased automation in the food processing industry. Manufacturers are focusing on precision filling systems that enhance dosing accuracy, reduce material waste, and ensure hygienic packaging standards. Advancements in servo-controlled filling technology and modular machine designs are improving line flexibility, making them ideal for both large-scale manufacturers and SMEs in the spice and condiment sector.

From 2030 to 2035, the market is projected to expand from USD 1.9 billion to USD 2.3 billion, yielding a GVI of 0.95, signifying a mild deceleration as the market enters a maturity phase. During this period, adoption will stabilize due to widespread automation in established spice-processing regions, while incremental growth will be supported by emerging markets in the Asia-Pacific, Latin America, and the Middle East. Key trends such as sustainability in packaging, energy-efficient filling systems, and the integration of IoT-based monitoring for performance optimization will shape industry evolution. Collaboration between machine manufacturers and spice producers will drive continuous innovation in precision, scalability, and product adaptability.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.6 billion |

| Market Forecast Value (2035) | USD 2.4 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The spice filling machine market is expanding as food manufacturers and packaging companies seek greater accuracy, hygiene, and throughput in dry product handling. These machines automate the filling of powdered and granulated spices into containers, pouches, or sachets, ensuring consistent weight control and reduced material loss. Rising global consumption of packaged seasonings, driven by urbanization and changing culinary preferences, increases demand for efficient filling systems that support large-scale production. Manufacturers integrate servo-driven augers, vibration feeders, and dust-extraction features to enhance precision and maintain clean operational environments within food processing facilities.

Market growth is further supported by increasing regulatory emphasis on contamination prevention and labeling accuracy. Automation enables faster line speeds, minimizes operator intervention, and ensures compliance with international food safety standards. The expansion of spice exports from India, China, and Southeast Asia strengthens regional equipment manufacturing and technological adoption. Compact, modular machines gain popularity among small and mid-sized producers seeking scalability and quick product changeovers. Although high equipment costs and maintenance requirements remain challenges, continuous development in sensor control, packaging flexibility, and energy-efficient operation sustains global market growth. The ongoing modernization of food manufacturing infrastructure reinforces long-term demand for advanced spice filling machinery worldwide.

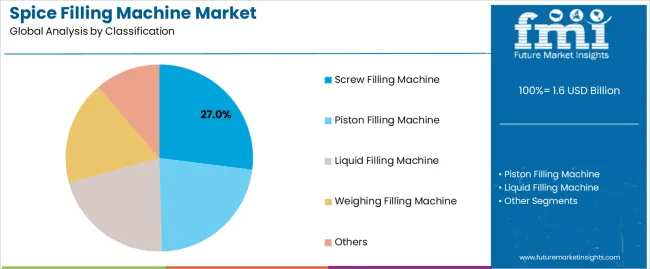

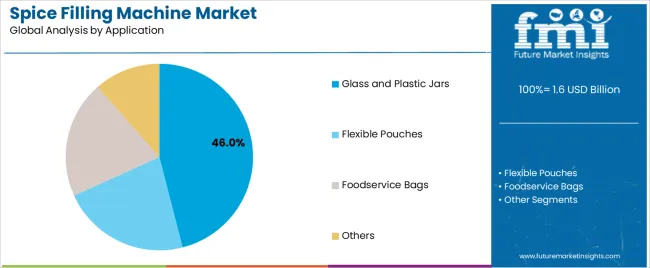

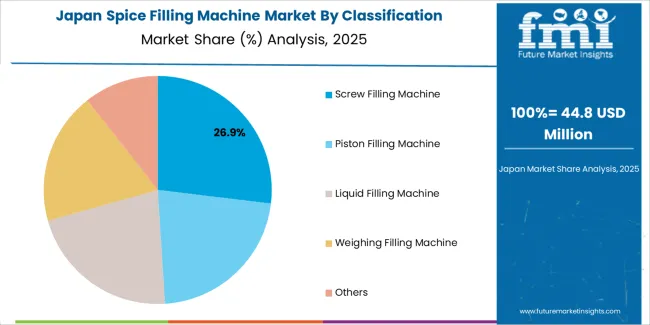

The spice filling machine market is segmented by classification, application, and region. By classification, the market is divided into screw filling machines, piston filling machines, liquid filling machines, weighing filling machines, and others. Based on application, it is categorized into glass and plastic jars, flexible pouches, foodservice bags, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions outline equipment functionality, packaging diversity, and regional production practices shaping efficiency and precision in the global spice packaging industry.

The screw filling machine segment accounts for approximately 27.0% of the global spice filling machine market in 2025, representing the leading classification category. Its leadership is driven by the segment’s accuracy in dispensing dry and granulated materials such as ground spices, powders, and seasoning blends. Screw filling machines use auger-based systems to ensure controlled dosing and consistent fill volumes, minimizing product loss and ensuring packaging uniformity.

These machines are widely used in both large-scale processing plants and small packaging units for their reliability, compact design, and ability to handle varying particle sizes. The segment benefits from technological improvements in servo-driven motors, automated calibration, and hygienic construction, which enhance precision and reduce downtime. Manufacturers are introducing digital control panels and modular configurations that allow quick product changeovers. Regional adoption is strongest in East Asia and Europe, where spice processing industries emphasize automation and packaging consistency for export markets. The screw filling machine category remains central to the market due to its versatility, durability, and compatibility with a wide range of spice product types and packaging systems.

The glass and plastic jars segment represents about 46.0% of the total spice filling machine market in 2025, making it the largest application category. This dominance reflects the widespread use of rigid packaging formats for preserving spice freshness, preventing moisture absorption, and ensuring retail shelf stability. Filling machines used for jars are equipped with vibration control and dust extraction systems that maintain precise dosing and reduce contamination risks during filling operations.

The segment’s growth is supported by increasing consumer demand for packaged and branded spices across both retail and institutional channels. Glass and plastic jars remain preferred for their durability, visual appeal, and reusability. Manufacturers focus on automation solutions that optimize fill accuracy and minimize product wastage in high-speed production lines. The expansion of the global condiment and seasoning industry, particularly in East Asia and North America, reinforces steady investment in jar-based packaging systems. As packaging standards evolve to meet hygiene and sustainability goals, filling technologies compatible with recyclable plastic and lightweight glass containers continue to gain prominence. The glass and plastic jars segment remains the core driver of equipment demand across global spice processing operations.

The spice filling machine market is growing as spice manufacturers seek efficient, precise equipment to handle powders and granules in high-volume packaging. The demand is driven by global expansion in spice production, tightening standards for hygiene and consistency, and the need for flexible machines that can work across multiple pack sizes and formats. At the same time, adoption is constrained by high equipment costs, complexity of handling varied spice densities (e.g., chili powder vs whole spice), and maintenance issues in dusty, abrasive environments. Suppliers are responding by offering machines with stainless-steel construction, servo-driven auger fillers and adaptable configurations.

Growth in this market is supported by rising global consumption of spices, increased export opportunities and higher expectations for product quality and shelf life. Manufacturers are under pressure to reduce weighing errors, minimise waste and ensure consistent fill volumes to meet food-safety standards. Equipment that supports quick change-over between products and pack sizes is particularly valuable. Adoption is strongest in emerging markets where small manufacturers are scaling up operations, and in developed regions where automation is replacing manual packaging to improve productivity and labour cost efficiency.

The market faces significant restraints including the capital intensity of fully automatic filling lines, technical demands regarding dose accuracy for fine powders, and the abrasive nature of spices which increases machine wear and servicing needs. In many small-to-medium operations, semi-automatic or manual filling remains preferred due to lower upfront cost and simpler maintenance. Additionally, inconsistency in spice particle size, moisture content and pack materials introduces complexity that may deter investment in standard machine solutions unless tailored setups are provided.

Key trends include modular machine architectures that allow manufacturers to scale output or add functions (such as nitrogen flushing or metal detection) as needed. Another trend is the adoption of servo-driven auger or vibrating-feeder systems that improve dose accuracy for diverse spice forms. Advances in machine hygiene, such as easy-clean surfaces and dust-control systems, are also becoming standard in response to food-safety regulations. Growth in emerging regions is fuelling demand for affordable mid-automation machines, while global manufacturers are offering retrofit packages to adapt older lines to modern standards and pack formats.

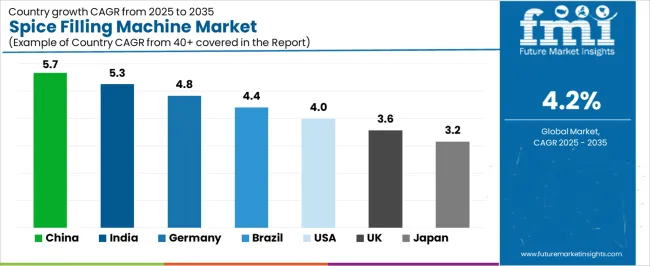

| Country | CAGR (%) |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| Brazil | 4.4% |

| USA | 4.0% |

| UK | 3.6% |

| Japan | 3.2% |

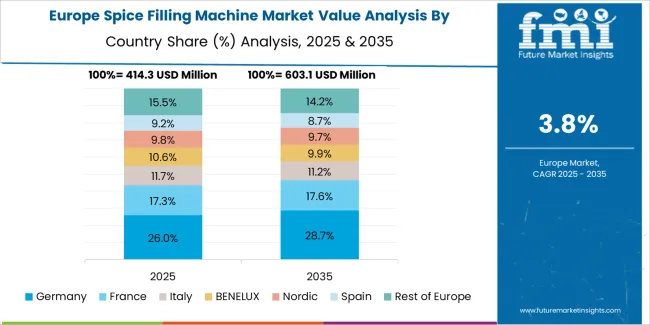

The spice filling machine market is experiencing steady global growth, with China leading at a 5.7% CAGR through 2035, driven by the expansion of food processing industries, automation in packaging systems, and export-oriented spice production. India follows at 5.3%, supported by its position as a major spice producer, rapid industrialization of the food sector, and the adoption of efficient filling and sealing equipment. Germany records 4.8%, reflecting strong innovation in precision filling technologies and advanced manufacturing practices. Brazil grows at 4.4%, benefiting from growing packaged food consumption and modernization in production lines. The USA, at 4.0%, focuses on technological advancement and hygiene automation, while the UK (3.6%) and Japan (3.2%) emphasize compact design, sustainability, and integration of smart filling solutions for high-efficiency operations.

China is demonstrating steady progress in the spice filling machine market, projected to grow at a CAGR of 5.7% through 2035. Rising demand for packaged spices, condiments, and seasoning products is increasing equipment adoption in food manufacturing units. Domestic producers are developing high-speed filling systems with automatic weighing and sealing functions to meet large-scale production needs. Government emphasis on food safety compliance and packaging automation supports market expansion across industrial zones.

India is witnessing significant growth in the spice filling machine market, advancing at a CAGR of 5.3% through 2035. Expansion in the food packaging industry and modernization of spice processing units are driving strong demand for semi-automatic and fully automatic machines. Local manufacturers are offering modular systems suited to small and medium-scale producers. Rising export activities in the spice trade further stimulate equipment investment across major processing clusters.

Across Germany, the spice filling machine market is advancing at a CAGR of 4.8%, supported by precision engineering and strict packaging standards. Manufacturers are designing high-speed, contamination-resistant systems compatible with powdered and granular products. Integration of digital monitoring ensures accuracy in weighing and sealing operations. Growing demand for sustainable packaging materials is influencing design improvements and machine compatibility. Engineering excellence continues to position Germany as a key exporter of automated filling solutions.

Brazil is recording steady expansion in the spice filling machine market, forecast to grow at a CAGR of 4.4% through 2035. Increasing packaged food consumption and urban retail growth are supporting automation adoption in spice manufacturing. Local producers are investing in durable filling and weighing systems tailored to regional product types. Rising export activities in processed foods and government incentives for manufacturing upgrades sustain long-term equipment demand.

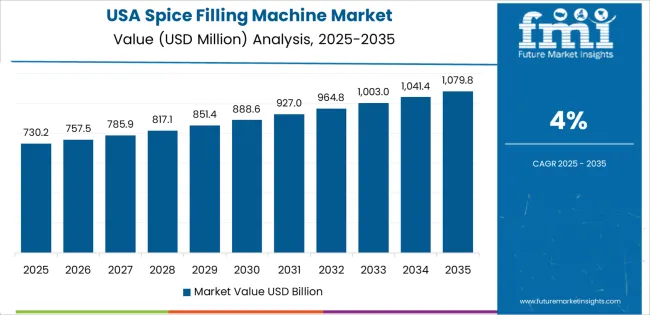

In the United States, the spice filling machine market is expanding at a CAGR of 4.0% through 2035. Growing demand for prepackaged spice blends and seasoning products is driving investments in precision filling technology. Manufacturers are integrating servo-driven mechanisms and real-time control systems to optimize accuracy and speed. The shift toward compact, hygienic machines align with modern food production standards. Expanding contract packaging operations continue to fuel steady equipment sales.

Across the United Kingdom, the spice filling machine market is advancing at a CAGR of 3.6% through 2035. Demand for sustainable packaging solutions and higher automation levels in food processing are strengthening equipment adoption. Manufacturers are focusing on energy-efficient systems that support recyclable packaging formats. Growing demand for spice blends in retail and catering channels continues to stimulate product utilization. Integration of digital interfaces ensures greater operational consistency across facilities.

Japan is showing gradual growth in the spice filling machine market, expected to rise at a CAGR of 3.2% through 2035. Domestic producers emphasize compact, precise, and automated filling systems designed for limited-space food processing units. The trend toward portion control and consumer-ready packaging drives continuous innovation. Integration of smart sensors and automated weighing functions enhances operational accuracy. Steady adoption across food manufacturing hubs ensures long-term equipment utilization.

The global spice filling machine market displays moderate competition, supported by packaging machinery manufacturers focusing on automation, dosing accuracy, and material adaptability. Shibuya Kogyo holds a strong position through precision-engineered filling systems that integrate weighing, sealing, and product handling for both powdered and granulated spices. All-Fill and Spee Dee lead in high-speed auger and cup filling technologies designed for consistent dosing and minimal product waste in food processing plants. JDA Progress Industries and Modern Packaging maintain strong North American market presence with customizable filling lines suited for small and medium-scale spice producers. Landpack GmbH and Hangzhou Zon Packaging Machinery Co., Ltd contribute to European and Asian markets by emphasizing modular automation and compliance with international hygiene standards.

IC Filling Systems and KMG Systems enhance competitiveness through multi-head and volumetric filling equipment engineered for flexible packaging formats. UP Group, ZhongLi Packaging Machinery, and Guangzhou Change Machinery expand China’s production capacity, offering cost-effective filling and sealing systems for bulk and retail spice packaging. Shanghai Dahe Packaging Machinery and Zhengzhou Vtops Machinery specialize in screw-driven auger fillers optimized for fine powders and seasoning blends. FOR-BRO, Levapack, SK Engineers, Shree Chamunda Micro Industries, and Auger Enterprise Co., Ltd support regional markets with compact filling units designed for local processing facilities. Competition centers on fill precision, throughput efficiency, and system sanitation. Strategic differentiation relies on servo-driven controls, automated weight calibration, and adaptability to diverse packaging materials, while long-term competitiveness will depend on digital integration and enhanced filling consistency for global spice manufacturing operations.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type (Classification) | Screw Filling Machine, Piston Filling Machine, Liquid Filling Machine, Weighing Filling Machine, Others |

| Application | Glass and Plastic Jars, Flexible Pouches, Foodservice Bags, Others |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, USA, Germany, Brazil, UK, Japan, and 40+ countries |

| Key Companies Profiled | Shibuya Kogyo, All-Fill, Spee Dee, JDA Progress Industries, Modern Packaging, Landpack GmbH, Hangzhou Zon Packaging Machinery, IC Filling Systems, KMG Systems, UP Group, ZhongLi Packaging Machinery, Guangzhou Change Machinery, Shanghai Dahe Packaging Machinery, Zhengzhou Vtops Machinery, FOR-BRO, Levapack, SK Engineers, Shree Chamunda Micro Industries, Auger Enterprise Co., Ltd. |

| Additional Attributes | Market breakdown by classification and packaging format segments; regional adoption analysis across food and spice manufacturing industries; competitive landscape emphasizing automation, dosing precision, and hygiene-driven machine design. |

The global spice filling machine market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the spice filling machine market is projected to reach USD 2.4 billion by 2035.

The spice filling machine market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in spice filling machine market are screw filling machine, piston filling machine, liquid filling machine, weighing filling machine and others.

In terms of application, glass and plastic jars segment to command 46.0% share in the spice filling machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Spice Oils and Oleoresins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Spice Coated Casing Market Analysis - Size, Share & Forecast 2025 to 2035

Cajun Spice Market Size and Share Forecast Outlook 2025 to 2035

Dried Spices Market Analysis by Type, End-Use Industry, Distribution Channel and Others Through 2035

Glass Spice Jars Market Growth – Demand & Forecast 2025 to 2035

Herb & Spice Extracts Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Spice Products Market Trends - Seasonal Demand & Growth 2025 to 2035

Organic Spices Market Trends - Sustainable Farming & Culinary Expansion 2025 to 2035

Key Players & Market Share in the Organic Spice Industry

Plastic Spice Jars Market

Herb and Spice Market Size and Share Forecast Outlook 2025 to 2035

Assessing Herbs and Spices Market Share & Industry Trends

Demand for Spice Oils and Oleoresins in the EU Size and Share Forecast Outlook 2025 to 2035

Demand for Spice Coated Casing in EU Size and Share Forecast Outlook 2025 to 2035

Pumpkin Pie Spices Market Analysis - Size, Share, and Forecast 2025 to 2035

UK Herbs and Spices Market Outlook – Share, Growth & Forecast 2025–2035

USA Herbs and Spices Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Herbs and Spices Market Trends – Growth, Demand & Forecast 2025–2035

Europe Herbs and Spices Market Analysis – Size, Share & Forecast 2025–2035

Demand for Herb & Spice Extracts in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA