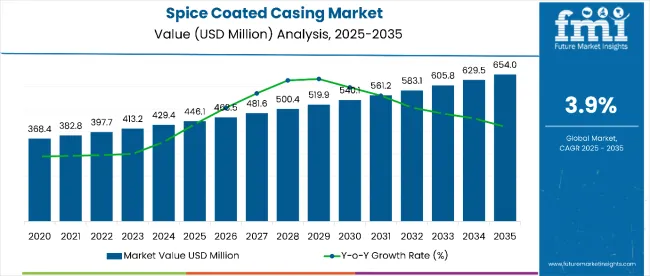

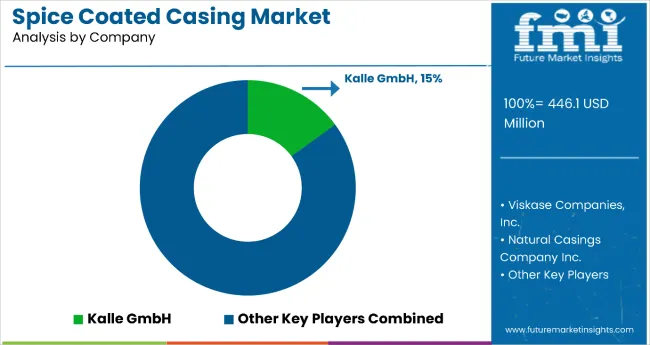

The global spice coated casing market is projected to witness steady growth during the forecast period 2025 to 2035, with its valuation USD 446.1 million in 2025 and is poised to reach USD 654.0 million by 2035, which shows a CAGR of 3.9%. The increasing demand for innovative food casing solutions among meat processors and food manufacturers remains a central driver of this market.

With evolving consumer tastes, the demand for flavor-enhanced, ready-to-cook, and pre-seasoned food products is rising sharply. Spice-coated casings provide an edge by imparting desirable taste profiles directly to the food, minimizing the need for external seasoning while ensuring product uniformity and appealing presentation. As global food processing industries focus on improving product differentiation, spice-coated casings have emerged as a value-added solution, attracting growing investment.

One of the major driving factors for the market is the rising health consciousness and preference for natural and clean-label food products among consumers. Spice-coated casings offer an opportunity for food manufacturers to deliver superior taste experiences without excessive artificial additives, preservatives, or flavor enhancers.

This fits perfectly with the clean-label movement, which has become especially prominent in developed regions such as Europe and North America. Furthermore, as plant-based and vegan food trends gain traction, spice-coated casings made from cellulose, alginate, and other edible plant derivatives have witnessed considerable interest.

These plant-derived casings are being increasingly applied in vegetarian sausage production and other meat substitutes, thus expanding the overall applicability of spice-coated casing technology across various food categories.

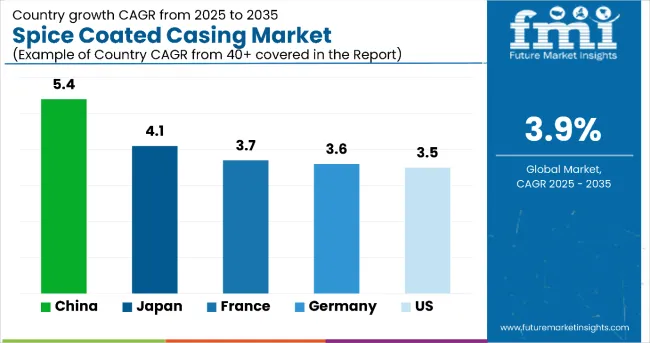

The Asia-Pacific region, particularly China, is anticipated to emerge as the fastest-growing market for spice-coated casings over the next few years, fueled by changing dietary habits, growing disposable incomes, and rapid industrialization of food processing sectors.

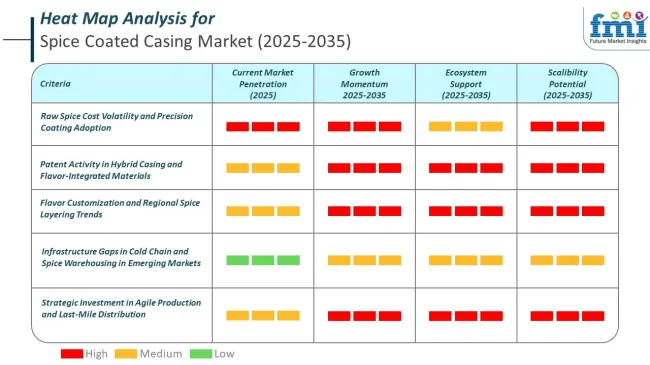

Additionally, the market benefits from technological advancements allowing for customized and multi-flavored casing coatings, which enable manufacturers to cater to regional taste preferences and niche markets more efficiently. Leading companies such as Kalle GmbH, Viskase Companies, Almol Casing Pty Ltd., DAT-Schaub Group, and MCJ Casings Ltd. are continuously focusing on innovation and capacity expansion to tap into these new opportunities. The combination of evolving food trends, cleaner labels, and flavor customization is expected to sustain market demand through 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 446.1 million |

| Industry Value (2035F) | USD 654.0 million |

| CAGR (2025 to 2035) | 3.9% |

To capture growth opportunities and sustain per‑capita gains, manufacturers must differentiate through innovation, compliance, and market reach.

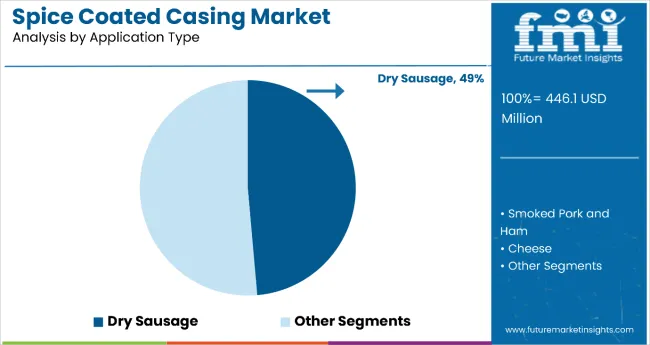

Dry sausage holds the dominant position with 48.6% of the market share in the application type category within the spice coated casing market. This leadership is driven by the increasing global demand for premium processed meat products such as salamis, pepperonis, and specialty sausages, which frequently utilize spice coated casings to enhance both flavor and shelf appeal.

Dry sausages require specific casing properties to maintain product integrity during the extended curing and drying process, making spice-coated casings an ideal solution that provides additional flavor infusion, consistent seasoning distribution, and protection against external contaminants during aging.

The segment's dominance is reinforced by evolving consumer preferences toward ready-to-eat and gourmet meat snacks, especially in North America and Europe where traditional and artisanal dry sausages have gained significant popularity. Innovations such as multi-flavor and spiced variants, facilitated by spice coated casings, enable producers to cater to diverse culinary trends and ethnic flavors, thereby broadening the product's market appeal.

As consumers increasingly seek unique taste profiles and premium quality in processed meat products, the dry sausage application is expected to remain the most lucrative segment within the spice coated casing market over the forecast period.

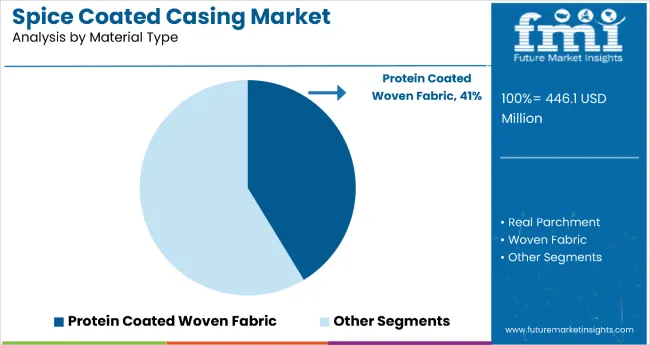

Protein coated woven fabric represents a significant segment with 41.3% of the market share in the material type category within the spice coated casing market. This substantial market presence is attributed to the rising demand for sustainable, biodegradable, and edible casing materials, especially in processed meat and plant-based product applications.

Protein coated woven fabric casings offer superior flexibility, excellent moisture retention, and allow enhanced spice adherence, making them ideal for high-quality sausage and meat products that require flavor infusion and visual appeal.

The segment is projected to register the fastest growth with a CAGR of 4.6% during the forecast period 2025 to 2035, driven by the global shift toward eco-friendly and performance-enhanced material options. These advanced casings provide manufacturers with versatile solutions that balance functionality with sustainability requirements, appealing to environmentally conscious consumers and regulatory compliance needs.

As the market gradually transitions toward sustainable casing solutions that offer both superior performance and environmental benefits, protein coated woven fabric is positioned to strengthen its market position through continued innovation in material technology and application versatility.

In this section, the spice coated casing market's expected growth patterns are highlighted. The market witnessed an average growth of 2.7% from 2020 to 2024, whereas it is projected that the industry is likely to record a CAGR of 3.9% through 2035.

| Historical CAGR | 2.7% |

|---|---|

| Forecast CAGR | 3.9% |

Increased consumer acceptance of meat casing, product innovation, and the ease of use provided by spice-coated food casings are just a few of the favorable aspects that have fueled the industry's growth. These nutritional supplements portability, convenience, and customizable possibilities have drawn in many customers. These proactive attributes set the sector for long-term growth, requiring market players to remain adaptable and strategic during the projected period.

Sustainability in Ethnic Spice Coated Flavors Casing

The ethical sourcing and sustainability of ethnic foods have lately gained significant attention. The demand for eco-friendly spice coating casing choices has significantly increased due to this trend.

These coatings encourage the use of eco-friendly materials and production techniques while giving food items distinctive and mouthwatering tastes. Furthermore, the usage of spice coatings has increased the demand for flavor coatings in general. The growing health consciousness and environmental consciousness of customers drive up demand for natural and sustainable dietary supplements.

Novel Culinary Innovations to Boost Spice Coated Casing Sales

Consumer preferences for spic coated casing are changing significantly in the global market, pushing the culinary sector to innovate and continuously create new food products. Food producers are spending money on research and development to produce distinctive and tasty spice coated casings in response to shifting customer expectations.

Longer shelf life, better flavor, and superior texture are numerous advantages of these casings. Thus, as customers scrutinize more savory and inventive food products, the global market for spice-coated casing is seeing a surge in demand.

Health and Safety Code Shifts the Spice Coated Casing Market

Evolutions in regulations and government requirements greatly impact the manufacturing, labeling, and marketing of spice-coated casing in the food and beverage industry. These regulations shield customers from potential injury and guarantee the safety of food goods.

These health code regulations address several production-related topics, such as sourcing ingredients, manufacturing, quality assurance, and packaging. Rules pertaining to ingredients, nutritional content, and allergies are also followed in labeling and marketing. For establishments in the food and beverage sector to continue accumulating the confidence and faith of consumers, adherence to these standards is essential.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.50% |

| France | 3.70% |

| Japan | 4.10% |

| Germany | 3.60% |

| China | 5.40% |

The USA spice coated casing market is estimated to grow at a CAGR of 3.5% during the study period 2025 to 2035. The market in the USA benefits from its strong processed meat industry and the widespread popularity of sausages, hot dogs, and other meat snacks. Consumers are increasingly seeking premium, flavor-enhanced meat products, which has encouraged manufacturers to adopt spice coated casings that offer both taste and aesthetic advantages.

The rise of clean-label food trends and natural ingredient usage in casing coatings is also supporting market demand. Moreover, the expansion of convenience food consumption and innovations in ready-to-eat meat products are further boosting the need for enhanced casings in the region. This sustained demand is ensuring steady market growth.

The France spice coated casing market is estimated to grow at a CAGR of 3.7% during 2025 to 2035. France’s market is driven by its culinary heritage and the consumption of specialty sausages such as saucisson sec and chorizo, which rely heavily on spice coated casings for superior flavor and presentation. The increasing popularity of artisanal and organic meat products has also elevated the need for casings that provide natural seasoning and visually appealing finishes.

Local producers are emphasizing authenticity and product differentiation to cater to discerning consumer preferences. Furthermore, premiumization trends in supermarket offerings and demand for gourmet products from butchers are encouraging innovations in casing technologies, supporting stable market growth in the country over the forecast period.

The Japan spice coated casing market is estimated to grow at a CAGR of 4.1% from 2025 to 2035, outpacing several Western countries. This growth is driven by Japan’s rising consumption of Western-style meat products such as sausages and hams, as well as increasing demand for aesthetic and flavorful food presentation. Consumers in Japan prioritize premium and high-quality meat products with unique taste profiles, making spice coated casings highly desirable.

Additionally, Japan’s growing convenience food sector, including bento and ready-to-eat meals, further encourages the adoption of such casings. Manufacturers are introducing innovations that suit local preferences for delicate flavors and attractive packaging, fueling the demand for spice coated casing solutions across the nation.

The German spice coated casing market is estimated to expand at a CAGR of 3.6% during the forecast period. Germany remains one of Europe’s leading sausage producers, with iconic products like bratwurst and salami relying on high-quality casing materials for taste preservation and shelf stability. Local manufacturers are adopting spice coated casings to enhance product differentiation and meet consumer demand for regional and specialty flavors.

The growing preference for customized and premium sausages among German consumers, along with the popularity of organic and artisanal meat products, is further driving this trend. The strong presence of advanced meat processing facilities also supports the wider adoption of spice coated casings across the German food industry.

The China spice coated casing market is forecast to grow at the fastest pace, with a CAGR of 5.4% between 2025 and 2035. China's rapid urbanization and rising income levels have fueled the demand for processed and packaged meat products. Western food influences are increasing, leading to greater acceptance of sausages and ham, where spice coated casings play a key role in flavor delivery and product appeal.

The country’s growing interest in convenience and ready-to-cook foods is pushing manufacturers to develop innovative, flavor-rich casing solutions. Local producers are also investing in advanced technologies to match evolving consumer preferences for quality, safety, and taste, driving robust expansion in China’s spice coated casing market.

Many organizations are vying for market dominance and a strong foundation in the fiercely competitive and quickly growing global spice coated casing sector. Several elements, including price tactics, marketing campaigns, research and development, and the creation of novel items, drive the rivalry.

Strategic decision-making and competitive pressures are given more weight in the spice-layered casing industry due to its notable fragmentation and intense competition among firms for market dominance. Players in the market make significant research and development investments to produce novel, highly effective food layer casings to stay ahead of the competition.

The enterprises continuously search for methods to boost their market share and operational efficiency in today's fiercely competitive industry. Market participants aggressively seek strategic partnerships, collaborations, and other alliances to achieve this. Organizations can use one another's resources and abilities when they team up with other organizations to accomplish shared objectives.

Businesses use various marketing strategies, including new releases and collaborations, to increase the market for spice coated casing. Through these initiatives, they can increase product awareness and gain a market competitive advantage. By continuously inventing and coming up with new strategies to connect with their target audience, businesses may stay ahead of the curve and retain their position as industry leaders.

Recent Developments in the Spice Coated Casing Industry:

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 446.1 million |

| Projected Market Size (2035) | USD 654.0 million |

| CAGR (2024 to 2034) | 3.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million |

| By Application Type | Dry Sausage, Smoked Pork and Ham, and Cheese |

| By Material Type | Real Parchment, Woven Fabric, Protein Coated Woven Fabric, Plastic Coated Woven Fabric, Hardened Protein |

| By Coating Type | Spice Sheets, Spice Cut Pieces, Spice Reels |

| By Product Type | Rolled Tubing Casings, Flat Sheets Casings, End Sealed Casings, Cut Sleeves Casings |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | Kalle GmbH, Almol Casing Pty Ltd., Natural Casings Company Inc., Walsroder Casings GmnH, Viskase Companies, Inc., MCJ Casings Ltd., World Casings Corporation, Rugao Qingfeng Casing Co., Elshazly Casings Company, DAT-Schaub Group, Saria Se and Co. Kg. |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis |

| Customization and Pricing | Available upon request |

The market is projected to expand at a CAGR of 3.9% between 2025 and 2035.

The rolled tubing casings segment dominates the spice coated casing industry.

The top five countries in the market are the United States, China, Germany, Japan, and France.

The market is anticipated to reach USD 654.0 million by 2035.

The sales of spice coated casings are valued at USD 446.1 million in 2025.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Application Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Application Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Material Type, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Coating Type, 2019 to 2034

Table 8: Global Market Volume (Units) Forecast by Coating Type, 2019 to 2034

Table 9: Global Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 10: Global Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Application Type, 2019 to 2034

Table 14: North America Market Volume (Units) Forecast by Application Type, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 16: North America Market Volume (Units) Forecast by Material Type, 2019 to 2034

Table 17: North America Market Value (US$ Million) Forecast by Coating Type, 2019 to 2034

Table 18: North America Market Volume (Units) Forecast by Coating Type, 2019 to 2034

Table 19: North America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 20: North America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 22: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Application Type, 2019 to 2034

Table 24: Latin America Market Volume (Units) Forecast by Application Type, 2019 to 2034

Table 25: Latin America Market Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 26: Latin America Market Volume (Units) Forecast by Material Type, 2019 to 2034

Table 27: Latin America Market Value (US$ Million) Forecast by Coating Type, 2019 to 2034

Table 28: Latin America Market Volume (Units) Forecast by Coating Type, 2019 to 2034

Table 29: Latin America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 30: Latin America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: Western Europe Market Value (US$ Million) Forecast by Application Type, 2019 to 2034

Table 34: Western Europe Market Volume (Units) Forecast by Application Type, 2019 to 2034

Table 35: Western Europe Market Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 36: Western Europe Market Volume (Units) Forecast by Material Type, 2019 to 2034

Table 37: Western Europe Market Value (US$ Million) Forecast by Coating Type, 2019 to 2034

Table 38: Western Europe Market Volume (Units) Forecast by Coating Type, 2019 to 2034

Table 39: Western Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 40: Western Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Application Type, 2019 to 2034

Table 44: Eastern Europe Market Volume (Units) Forecast by Application Type, 2019 to 2034

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 46: Eastern Europe Market Volume (Units) Forecast by Material Type, 2019 to 2034

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Coating Type, 2019 to 2034

Table 48: Eastern Europe Market Volume (Units) Forecast by Coating Type, 2019 to 2034

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 50: Eastern Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Application Type, 2019 to 2034

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Application Type, 2019 to 2034

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Material Type, 2019 to 2034

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Coating Type, 2019 to 2034

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Coating Type, 2019 to 2034

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 62: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 63: East Asia Market Value (US$ Million) Forecast by Application Type, 2019 to 2034

Table 64: East Asia Market Volume (Units) Forecast by Application Type, 2019 to 2034

Table 65: East Asia Market Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 66: East Asia Market Volume (Units) Forecast by Material Type, 2019 to 2034

Table 67: East Asia Market Value (US$ Million) Forecast by Coating Type, 2019 to 2034

Table 68: East Asia Market Volume (Units) Forecast by Coating Type, 2019 to 2034

Table 69: East Asia Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 70: East Asia Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Application Type, 2019 to 2034

Table 74: Middle East and Africa Market Volume (Units) Forecast by Application Type, 2019 to 2034

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 76: Middle East and Africa Market Volume (Units) Forecast by Material Type, 2019 to 2034

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Coating Type, 2019 to 2034

Table 78: Middle East and Africa Market Volume (Units) Forecast by Coating Type, 2019 to 2034

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 80: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Application Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Material Type, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Coating Type, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 5: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 10: Global Market Value (US$ Million) Analysis by Application Type, 2019 to 2034

Figure 11: Global Market Volume (Units) Analysis by Application Type, 2019 to 2034

Figure 12: Global Market Value Share (%) and BPS Analysis by Application Type, 2024 to 2034

Figure 13: Global Market Y-o-Y Growth (%) Projections by Application Type, 2024 to 2034

Figure 14: Global Market Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 15: Global Market Volume (Units) Analysis by Material Type, 2019 to 2034

Figure 16: Global Market Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 17: Global Market Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 18: Global Market Value (US$ Million) Analysis by Coating Type, 2019 to 2034

Figure 19: Global Market Volume (Units) Analysis by Coating Type, 2019 to 2034

Figure 20: Global Market Value Share (%) and BPS Analysis by Coating Type, 2024 to 2034

Figure 21: Global Market Y-o-Y Growth (%) Projections by Coating Type, 2024 to 2034

Figure 22: Global Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 23: Global Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 24: Global Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 25: Global Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 26: Global Market Attractiveness by Application Type, 2024 to 2034

Figure 27: Global Market Attractiveness by Material Type, 2024 to 2034

Figure 28: Global Market Attractiveness by Coating Type, 2024 to 2034

Figure 29: Global Market Attractiveness by Product Type, 2024 to 2034

Figure 30: Global Market Attractiveness by Region, 2024 to 2034

Figure 31: North America Market Value (US$ Million) by Application Type, 2024 to 2034

Figure 32: North America Market Value (US$ Million) by Material Type, 2024 to 2034

Figure 33: North America Market Value (US$ Million) by Coating Type, 2024 to 2034

Figure 34: North America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 35: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 37: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 40: North America Market Value (US$ Million) Analysis by Application Type, 2019 to 2034

Figure 41: North America Market Volume (Units) Analysis by Application Type, 2019 to 2034

Figure 42: North America Market Value Share (%) and BPS Analysis by Application Type, 2024 to 2034

Figure 43: North America Market Y-o-Y Growth (%) Projections by Application Type, 2024 to 2034

Figure 44: North America Market Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 45: North America Market Volume (Units) Analysis by Material Type, 2019 to 2034

Figure 46: North America Market Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 47: North America Market Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 48: North America Market Value (US$ Million) Analysis by Coating Type, 2019 to 2034

Figure 49: North America Market Volume (Units) Analysis by Coating Type, 2019 to 2034

Figure 50: North America Market Value Share (%) and BPS Analysis by Coating Type, 2024 to 2034

Figure 51: North America Market Y-o-Y Growth (%) Projections by Coating Type, 2024 to 2034

Figure 52: North America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 53: North America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 54: North America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 55: North America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 56: North America Market Attractiveness by Application Type, 2024 to 2034

Figure 57: North America Market Attractiveness by Material Type, 2024 to 2034

Figure 58: North America Market Attractiveness by Coating Type, 2024 to 2034

Figure 59: North America Market Attractiveness by Product Type, 2024 to 2034

Figure 60: North America Market Attractiveness by Country, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) by Application Type, 2024 to 2034

Figure 62: Latin America Market Value (US$ Million) by Material Type, 2024 to 2034

Figure 63: Latin America Market Value (US$ Million) by Coating Type, 2024 to 2034

Figure 64: Latin America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 70: Latin America Market Value (US$ Million) Analysis by Application Type, 2019 to 2034

Figure 71: Latin America Market Volume (Units) Analysis by Application Type, 2019 to 2034

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Application Type, 2024 to 2034

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Application Type, 2024 to 2034

Figure 74: Latin America Market Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 75: Latin America Market Volume (Units) Analysis by Material Type, 2019 to 2034

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 78: Latin America Market Value (US$ Million) Analysis by Coating Type, 2019 to 2034

Figure 79: Latin America Market Volume (Units) Analysis by Coating Type, 2019 to 2034

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Coating Type, 2024 to 2034

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Coating Type, 2024 to 2034

Figure 82: Latin America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 83: Latin America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 86: Latin America Market Attractiveness by Application Type, 2024 to 2034

Figure 87: Latin America Market Attractiveness by Material Type, 2024 to 2034

Figure 88: Latin America Market Attractiveness by Coating Type, 2024 to 2034

Figure 89: Latin America Market Attractiveness by Product Type, 2024 to 2034

Figure 90: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 91: Western Europe Market Value (US$ Million) by Application Type, 2024 to 2034

Figure 92: Western Europe Market Value (US$ Million) by Material Type, 2024 to 2034

Figure 93: Western Europe Market Value (US$ Million) by Coating Type, 2024 to 2034

Figure 94: Western Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 95: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 100: Western Europe Market Value (US$ Million) Analysis by Application Type, 2019 to 2034

Figure 101: Western Europe Market Volume (Units) Analysis by Application Type, 2019 to 2034

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Application Type, 2024 to 2034

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Application Type, 2024 to 2034

Figure 104: Western Europe Market Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 105: Western Europe Market Volume (Units) Analysis by Material Type, 2019 to 2034

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 108: Western Europe Market Value (US$ Million) Analysis by Coating Type, 2019 to 2034

Figure 109: Western Europe Market Volume (Units) Analysis by Coating Type, 2019 to 2034

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Coating Type, 2024 to 2034

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Coating Type, 2024 to 2034

Figure 112: Western Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 113: Western Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 116: Western Europe Market Attractiveness by Application Type, 2024 to 2034

Figure 117: Western Europe Market Attractiveness by Material Type, 2024 to 2034

Figure 118: Western Europe Market Attractiveness by Coating Type, 2024 to 2034

Figure 119: Western Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 120: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: Eastern Europe Market Value (US$ Million) by Application Type, 2024 to 2034

Figure 122: Eastern Europe Market Value (US$ Million) by Material Type, 2024 to 2034

Figure 123: Eastern Europe Market Value (US$ Million) by Coating Type, 2024 to 2034

Figure 124: Eastern Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Application Type, 2019 to 2034

Figure 131: Eastern Europe Market Volume (Units) Analysis by Application Type, 2019 to 2034

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Application Type, 2024 to 2034

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Application Type, 2024 to 2034

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 135: Eastern Europe Market Volume (Units) Analysis by Material Type, 2019 to 2034

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Coating Type, 2019 to 2034

Figure 139: Eastern Europe Market Volume (Units) Analysis by Coating Type, 2019 to 2034

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Coating Type, 2024 to 2034

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Coating Type, 2024 to 2034

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 143: Eastern Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 146: Eastern Europe Market Attractiveness by Application Type, 2024 to 2034

Figure 147: Eastern Europe Market Attractiveness by Material Type, 2024 to 2034

Figure 148: Eastern Europe Market Attractiveness by Coating Type, 2024 to 2034

Figure 149: Eastern Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 150: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 151: South Asia and Pacific Market Value (US$ Million) by Application Type, 2024 to 2034

Figure 152: South Asia and Pacific Market Value (US$ Million) by Material Type, 2024 to 2034

Figure 153: South Asia and Pacific Market Value (US$ Million) by Coating Type, 2024 to 2034

Figure 154: South Asia and Pacific Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Application Type, 2019 to 2034

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Application Type, 2019 to 2034

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application Type, 2024 to 2034

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application Type, 2024 to 2034

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Material Type, 2019 to 2034

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Coating Type, 2019 to 2034

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Coating Type, 2019 to 2034

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Coating Type, 2024 to 2034

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Coating Type, 2024 to 2034

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 176: South Asia and Pacific Market Attractiveness by Application Type, 2024 to 2034

Figure 177: South Asia and Pacific Market Attractiveness by Material Type, 2024 to 2034

Figure 178: South Asia and Pacific Market Attractiveness by Coating Type, 2024 to 2034

Figure 179: South Asia and Pacific Market Attractiveness by Product Type, 2024 to 2034

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 181: East Asia Market Value (US$ Million) by Application Type, 2024 to 2034

Figure 182: East Asia Market Value (US$ Million) by Material Type, 2024 to 2034

Figure 183: East Asia Market Value (US$ Million) by Coating Type, 2024 to 2034

Figure 184: East Asia Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 185: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 190: East Asia Market Value (US$ Million) Analysis by Application Type, 2019 to 2034

Figure 191: East Asia Market Volume (Units) Analysis by Application Type, 2019 to 2034

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Application Type, 2024 to 2034

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Application Type, 2024 to 2034

Figure 194: East Asia Market Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 195: East Asia Market Volume (Units) Analysis by Material Type, 2019 to 2034

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 198: East Asia Market Value (US$ Million) Analysis by Coating Type, 2019 to 2034

Figure 199: East Asia Market Volume (Units) Analysis by Coating Type, 2019 to 2034

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Coating Type, 2024 to 2034

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Coating Type, 2024 to 2034

Figure 202: East Asia Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 203: East Asia Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 206: East Asia Market Attractiveness by Application Type, 2024 to 2034

Figure 207: East Asia Market Attractiveness by Material Type, 2024 to 2034

Figure 208: East Asia Market Attractiveness by Coating Type, 2024 to 2034

Figure 209: East Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 210: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 211: Middle East and Africa Market Value (US$ Million) by Application Type, 2024 to 2034

Figure 212: Middle East and Africa Market Value (US$ Million) by Material Type, 2024 to 2034

Figure 213: Middle East and Africa Market Value (US$ Million) by Coating Type, 2024 to 2034

Figure 214: Middle East and Africa Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Application Type, 2019 to 2034

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Application Type, 2019 to 2034

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Application Type, 2024 to 2034

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application Type, 2024 to 2034

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Material Type, 2019 to 2034

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Coating Type, 2019 to 2034

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Coating Type, 2019 to 2034

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Coating Type, 2024 to 2034

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Coating Type, 2024 to 2034

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 236: Middle East and Africa Market Attractiveness by Application Type, 2024 to 2034

Figure 237: Middle East and Africa Market Attractiveness by Material Type, 2024 to 2034

Figure 238: Middle East and Africa Market Attractiveness by Coating Type, 2024 to 2034

Figure 239: Middle East and Africa Market Attractiveness by Product Type, 2024 to 2034

Figure 240: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Spice Coated Casing in EU Size and Share Forecast Outlook 2025 to 2035

Coated Casing Market Size and Share Forecast Outlook 2025 to 2035

Spice Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Coated Label Market Size and Share Forecast Outlook 2025 to 2035

Coated Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Spice Oils and Oleoresins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Casing Pipe Market Analysis Size and Share Forecast Outlook 2025 to 2035

coated-paper-packaging-box-market-market-value-analysis

Coated Recycled Boxboard Market Size and Share Forecast Outlook 2025 to 2035

Coated Recycled Paperboard Market Size and Share Forecast Outlook 2025 to 2035

Coated Fabrics for Defense Market 2025 to 2035

Market Share Breakdown of Coated Recycled Boxboard Manufacturers

Competitive Landscape of Coated Recycled Paperboard Providers

Coated White Board Paper Market

Coated Sack Kraft Paper Market

Coated Duplex Board Market

Uncoated Fine Papers Market Size and Share Forecast Outlook 2025 to 2035

Uncoated White Top Testliner Market Size and Share Forecast Outlook 2025 to 2035

Uncoated Fine Paper Market Size and Share Forecast Outlook 2025 to 2035

Uncoated Paper Market Trends- Growth & Industry Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA