The global cathodic protection market is expected to grow at a CAGR of 5.2% and is likely to reach a valuation of USD 7,123.0 million by 2035. The growth in demand for cathodic protection systems, fueled by the continuously increasing need to prevent corrosion in critical infrastructures, oil & gas pipelines, water treatment facilities, and transportation structures, consolidates this estimate. Now, with remote monitoring technologies and AI-driven predictive analytics added into the basket, the very outlook for this market seems to have improved.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 7,123.0 million |

| CAGR during the period 2025 to 2035 | 5.2% |

Cathodic protection is important against corrosion of metals in pipelines, bridges, fueling systems, metros, and water infrastructure. Investing in this market is dominated by increasing urbanization, infrastructure development, and stringent environmental rules.

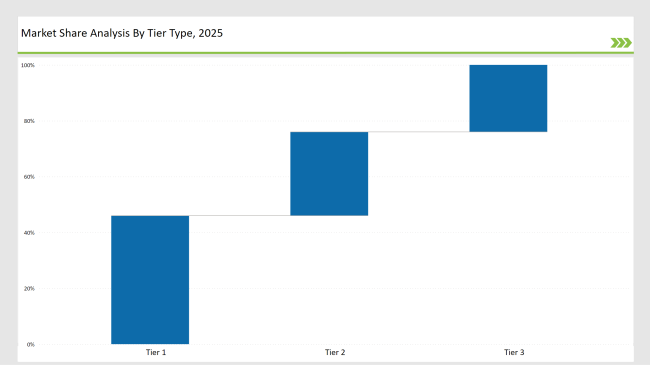

The market is moderately consolidated with Tier 1 players such as Honeywell International Inc., Siemens AG, ABB Ltd., Aegion Corporation, and Corrpro Companies Inc, who account for 51% of the market share.

As for product type, galvanic (sacrificial anodes) systems top the market share at 45%, while impressed current systems gain momentum in larger industrial applications. Based on end use, oil & gas take the lead with 38% of market demand due to safety regulations and requirements to prevent pipeline corrosion.

| Category | Industry Share (%) |

|---|---|

| Top 3 Players (Corrpro Companies, Inc., Farwest Corrosion Control Company, Aegion Corporation) | 46% |

| Next 2 of 5 Players (Cathodic Protection Co. Ltd., BAC Corrosion Control Ltd.) | 30% |

| Rest of the Top 10 | 24% |

The Top 3 players are MATCOR, Aegion Corporation, and Corrosion Protection Specialist, which have a global presence, advanced product portfolios, and strong partnerships with industrial clients. Tier 2 players, such as Cathodic Protection Co. Ltd. and BAC Corrosion Control Ltd., focus on specialized CP solutions for marine, oil & gas, and power industries. Regional players cater to niche markets, offering cost-effective CP products and maintenance services.

The market is relatively fragmented, with market leaders focusing on AI-based CP monitoring, predictive corrosion analytics, and green CP coatings.

Several key players contributed to market advancements in 2024

| Tier | Examples |

|---|---|

| Tier 1 | MATCOR, Aegion Corporation, Corrosion Protection Specialist |

| Tier 2 | Cathodic Protection Co. Ltd., BAC Corrosion Control Ltd. |

| Tier 3 | Regional and niche players |

| Company | Initiative |

|---|---|

| MATCOR | Launched AI-integrated CP monitoring systems for real-time corrosion tracking. |

| Aegion Corporation | Developed hybrid CP systems integrating ICCP and sacrificial anodes. |

| Corrosion Protection Specialist | Introduced automated CP inspection tools for marine and industrial use. |

| Cathodic Protection Co. Ltd. | Expanded CP installation services for offshore and renewable energy projects. |

| BAC Corrosion Control Ltd. | Introduced IoT-integrated predictive CP maintenance software. |

Automation, AI-driven monitoring, and smart coatings will change the cathodic protection landscape by 2035. The integration of cloud-based data processing and predictive analytics will add asset longevity and optimize maintenance strategies to minimize costs associated with operational functions. Sustainability, cost effectiveness, and prevention of corrosion would play a pivotal role in securing critical infrastructure within various industries.

MATCOR, Aegion Corporation, Corrosion Protection Specialist hold around 46% of the market share.

Anodes are the leading product segments, accounting for significant market shares.

Regional and domestic companies hold around 24% of the cathodic protection market share.

The market is moderately consolidated with the top players accounting for significant market share.

Pipelines application segment offer significant growth potential.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cathodic Acrylic Market Size and Share Forecast Outlook 2025 to 2035

Cathodic Protection Market Size and Share Forecast Outlook 2025 to 2035

Cathodic Protection Industry Analysis in Japan Size, Growth, and Forecast (2025 to 2035)

Cathodic Protection Industry Analysis in South Korea Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Western Europe Cathodic Protection Market Trend Analysis Based on Solution, Type, Application, and Countries 2025 to 2035

Flu Protection Kits Market Size and Share Forecast Outlook 2025 to 2035

Eye Protection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Teleprotection Market Growth – Trends & Forecast 2025 to 2035

ESD Protection Devices Market Insights – Trends & Demand 2023-2033

Fire Protection Materials Market Size and Share Forecast Outlook 2025 to 2035

Fall Protection Market Size and Share Forecast Outlook 2025 to 2035

CBRN Protection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection System Pipes Market Size and Share Forecast Outlook 2025 to 2035

DDoS Protection Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection Systems for Industrial Cooking Market Growth - Trends & Forecast 2025 to 2035

DDoS Protection & Mitigation Security Market Growth - Trends & Forecast through 2034

Head Protection Equipment Market Growth – Trends & Forecast 2024-2034

Data Protection as a Service (DPaaS) Market

Surge Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Brand Protection Tools Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA