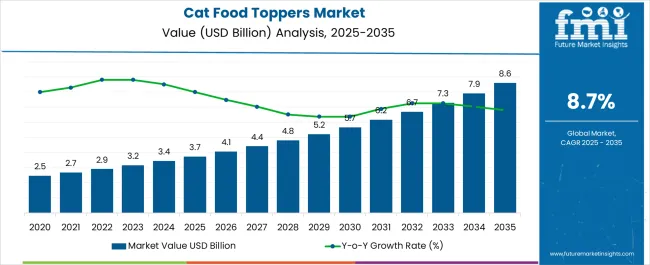

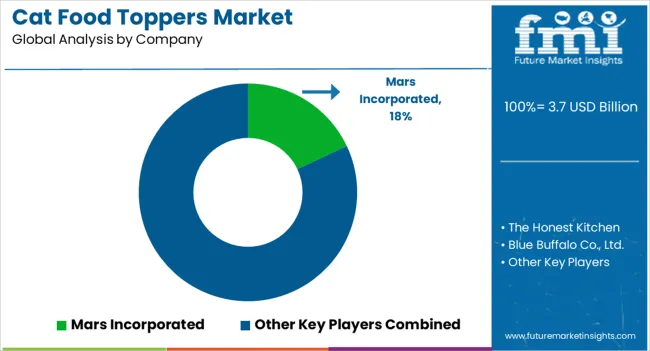

The Cat Food Toppers Market is estimated to be valued at USD 3.7 billion in 2025 and is projected to reach USD 8.6 billion by 2035, registering a compound annual growth rate (CAGR) of 8.7% over the forecast period.

| Metric | Value |

|---|---|

| Cat Food Toppers Market Estimated Value in (2025 E) | USD 3.7 billion |

| Cat Food Toppers Market Forecast Value in (2035 F) | USD 8.6 billion |

| Forecast CAGR (2025 to 2035) | 8.7% |

The cat food toppers market is gaining strong momentum, fueled by increasing pet humanization trends, premiumization of pet nutrition, and a growing emphasis on functional feeding. Pet owners are seeking enhanced palatability and targeted health benefits, which has elevated the adoption of toppers as daily meal enhancers or supplements.

Shifts in consumer behavior toward clean-label and high-protein formulations are prompting brands to diversify their offerings across natural, freeze-dried, and grain-free variants. Retail expansion across e-commerce, specialty pet chains, and direct-to-consumer models is also strengthening access to premium formats.

In addition, the incorporation of vet-formulated or wellness-based ingredients is attracting discerning buyers, especially in urban pet households. Looking ahead, demand is expected to rise in tandem with rising pet ownership and innovations in texture, formulation, and delivery formats that cater to feline-specific dietary preferences.

The market is segmented by Product Type, Packaging Type, Packaging Size (in Ounces), Life Stage, and Sales Channel and region. By Product Type, the market is divided into Dry Topper and Wet Topper. In terms of Packaging Type, the market is classified into Pouches, Bags, Can, and Bottles & Jars. Based on Packaging Size (in Ounces), the market is segmented into 0-10, 45950, and above 20. By Life Stage, the market is divided into Adult and Kitten. By Sales Channel, the market is segmented into Online Retailers, Hypermarkets/Supermarkets, Stores, Pet Specialty Stores, Independent Grocery Retailers, Drugstores, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

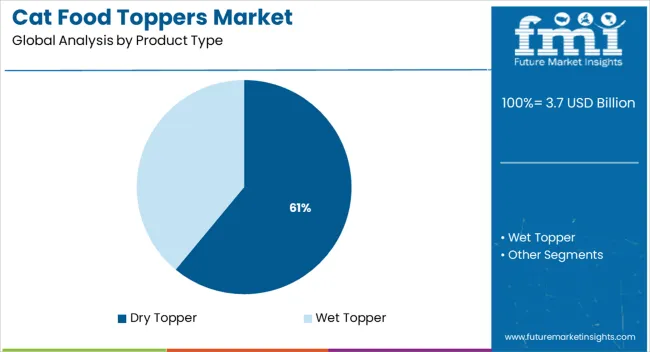

Dry toppers are projected to lead the cat food toppers market with a 61.0% revenue share in 2025. Their popularity is being driven by convenience in storage, long shelf life, and ease of mixing with dry or wet base diets.

Consumers value the mess-free application and portion control these toppers offer, especially in multi-cat households. Advancements in freeze-drying, air-drying, and cold-pressing processes have further improved nutrient retention and palatability, making dry toppers a preferred choice among health-conscious pet parents.

Additionally, the availability of single-ingredient and protein-rich variants has strengthened demand, particularly among those avoiding artificial fillers or allergens. As pet food brands continue to invest in dry topper innovation, this segment is expected to maintain its leadership through both retail and online channels.

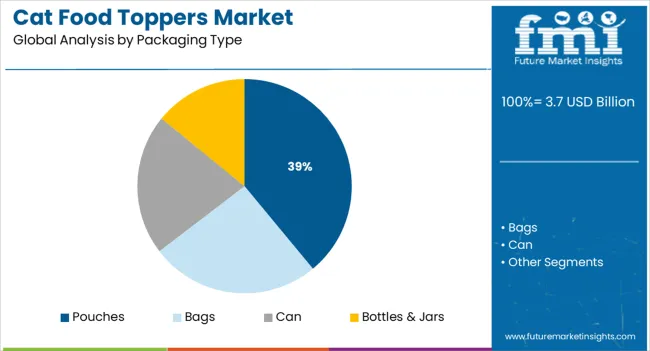

Pouches are anticipated to account for 39.0% of total revenue in the packaging type segment of the cat food toppers market by 2025. This dominance is being reinforced by consumer preference for lightweight, portable, and resealable packaging solutions that support convenience and product freshness.

Pouches offer a cost-effective and space-efficient packaging format for both single-serve and multi-use applications. Their compatibility with both dry and semi-moist toppers has expanded their use across various product lines.

Brands are increasingly utilizing pouch formats to deliver attractive, shelf-ready designs while also meeting sustainability goals through recyclable or reduced-material packaging. With on-the-go pet feeding and portion customization on the rise, pouches are expected to remain a critical format in the competitive landscape.

.webp)

The 0–10 ounces segment is expected to represent 43.0% of the packaging size revenue share in 2025, making it the leading category. This leadership is being attributed to the suitability of smaller packs for trial use, portion control, and freshness retention.

Pet owners, especially in urban settings or with single-cat households, are increasingly opting for smaller sizes that reduce spoilage and support dietary rotation. These sizes also align well with online and subscription models where lightweight packaging supports shipping efficiency.

Furthermore, compact packaging sizes facilitate easier storage and travel convenience, both of which are increasingly prioritized by modern pet owners. As the demand for specialized feeding regimens and premium ingredients grows, smaller pack sizes will likely continue to dominate shelf and digital aisles alike.

Over the past few years, the global pet care product market has made significant growth in the pet care industry. The growth of pet care products has also positively impacted the growth of the cat food toppers market, as per Future Market Insights (FMI).

As per the study, the demand in the market is expected to reach USD 6,700.2 Million by the end of 2035. Sales in the market are expected to surge at an impressive CAGR of 8.7% over the forecast period (2025 to 2035).

Nowadays, cat owners are adopting fitness and diet plans for the better health of their cats. Hence, the demand among cat owners is expected to be high for health care, activeness, and hygiene products such as litter and supplies, food, treats, and cat grooming products.

The effect has resulted in the generation of high demand in the cat food toppers market. The cat food toppers help to add additional nutrients to the cat food that helps to enhance the palatability and result in better growth of cats by making them hyperactive and improving their immunity. On the back of these factors, the cat food toppers market is expected to witness robust growth over the assessment period.

Further, numerous cat owners frequently spend on premium products and services for their pets' well-being, which has raised pet-related expenditures. This is expected to considerably contribute to the expansion of the cat food toppers market over the forecast period.

With rising disposable income, cat owners have increased their investment in their cats' well-being, as a result, increasing per-capita expenditure on cat food by owners is likely to boost the market.

Demand for Customized Pet Food to Push Cat Food Toppers Sales

Customized cat food solutions are drastically altering cat care market trends. The global market for cat food toppers is estimated to expand due to the popularity of customization trends, which are primarily driven by pet parents' growing health concerns.

Hence, leading brands are offering to customize the features of their cat food topper products according to the specific health concerns of end users. Custom functional cat food toppers that address significant health needs such as weight loss, digestion, and joint health are expected to witness high demand.

It is anticipated that in upcoming years the customized cat food topper based on the age, weight, height, and type of cat is expected to drive the sales in the cat food toppers market.

Rapid Economic and Social Change to Boost the Sales in Cat Food Toppers Market

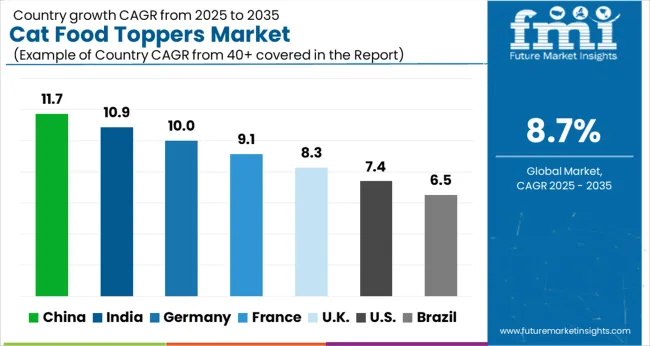

India is one of the fast-growing markets for cat food toppers and holds a share of ~31.4% in the South Asia cat food toppers market. The market in India is anticipated to rise at a CAGR of ~8.5% during the forecast period.

Rapid economic and social changes in the country are resulting in increased urbanization and high income. This is leading to the rise in demand for quality pet food products in India. Meanwhile, an increase in the number of nuclear families is also leading to the rise in the adoption of cats for companionship, thereby boosting the cat food toppers market in India.

Rising Adoption of Cats among Millennials to Aid the Growth of Cat Food Toppers Market

The USA is one of the lucrative markets for cat food toppers and holds a share of ~86.5% of the North America cat food toppers market. The USA cat food toppers market is anticipated to rise at a CAGR of ~4.6% during the assessment period.

According to the American Pet Products Association (APPA), around 29% of households in the USA have a cat as a pet. The rising trend of adopting a pet cat among millennials in the USA is rising rapidly. Hence, increasing demand for pet ownership is fueling the cat food toppers market in the USA

FEDIAF Safety Regulations Are Anticipated to Drive the Cat Food Toppers Market in the United Kingdom

As per FMI, the United Kingdom is considered to be one of the largest cat food toppers markets in Europe and holds a share of ~24.5% of the Europe cat food toppers market. The cat food toppers market in the United Kingdom is anticipated to rise at a CAGR of ~4.7% during the forecast period.

The presence of the European Pet Food Industry Federation (FEDIAF) and the introduction of various regulations are driving the pet food industry in the United Kingdom In the year 2020, FEDIAF updated safety guidelines for manufacturers of pet food products. This helped to create transparency and built trust between cat owners and cat food manufacturers.

Dry Topper to Remain the Most Preferred and High in Demand

Based on the product type, the dry topper holds a high share of ~57.4% in the overall sales of the cat food toppers market. The dry food topper is easy to preserve and eliminates the need for freezing. Dry food toppers also have a long shelf life as compared to wet food toppers. The dry food toppers also provide the crunch and chewing required for animal health maintenance. Meanwhile, it offers an easy count ability per serving and can be served directly to the cats.

Bags to Remain the Highly Sought-After Packaging Type for Cat Food Toppers

In terms of packaging type, the bags hold a significant share in the market with ~42.4% of the total cat food toppers market share, and the growth for the cat food topper bags is anticipated to grow at a CAGR of ~7.2% during the forecast period.

Cat owners prefer different packaging types based on consumption and usability. Although there is a high demand for cat food topper bags, pouches provide a perfect serving. Also, food toppers cans are for better durability, and long-time preservation and bottle & jars are for easy servings.

0-10 Ounces Packs Are Anticipated to Drive the Sales in Market

In terms of packaging size, 0-10 ounces is expected to hold the major share of ~56.6% in the cat food toppers market and it is anticipated to grow steadily at a CAGR of ~7.3% over the upcoming decade.

Demand for cat food toppers is witnessing significant growth with unique pack sizes. Hence, manufacturers are developing single-serve packs that are easy to use and store. The overweight pet population is one of the serious issues, hence, smaller package sizes are gaining popularity among buyers. This has also led to the rise of health and humanization trends among pet owners.

Key players in the market are focusing on product launches and mergers & acquisitions to increase their global presence and capture a high revenue share. To cater to the increasing demand for cat food toppers worldwide, manufacturers are focusing on the objective to expand product lines or including newer products in their respective offerings.

For instance:

Stella & Chewy and Honest Kitchen - Launching New Product Range is the Mantra to Succeed for Leading Cat Food Topper Brands

Cat food topper brands are striving hard to appeal to the varied preferences of cats. As pet humanization gains traction, spending on cat food toppers has increased manifold. Leading brands are focusing on launching new products while marketing their products through influencers. For instance, in 2020, Stella & Chewy’s, a leading brand in this space, announced that it will be introducing new raw frozen cat foods.

Further, in 2025, the company announced that it will be launching a new national advertising campaign that will embody the raw, unfiltered love pet parents have for their pets and how food, especially raw and natural food, plays a key role in how pet parents show their love.

In 2024, Stella & Chewy’s announced the launch of several new pet food products on its website, including bone broth, shredded protein, and stew formats. The company announced that its new cat food line will be available in 2.8 oz cans and 5 oz cans as well as two formats: savory shreds and purrfect paté.

In 2024, the company announced the launch of a number of new cat food products, including its first-ever kitten diets that features paté and minced morsel formulas. To boost their position in the market, leading players are focusing on raising funds and getting new investors on board.

For instance, The Honest Kitchen, a leading cat food topper manufacturer, announced in 2024 that it had received a USD 150 million investment from Monarch Alternative Capital LP. Monarch will partner with Lucy Postins, founder of The Honest Kitchen, and existing investors Alliance Consumer Growth and White Road Investments to drive the company’s growth.

Further, in 2024, the company announced that it is introducing a new line of human-grade cat foods, treats, meal toppers, and supplements. The range of products in this new category will be complete-and-balanced dehydrated and dry foods, high-protein treats, wet toppers, and a goat milk hydration booster supplement.

In 2024, the company announced it has joined the Better Chicken Commitment, joining more than 200 other food industry companies in a mission to improve animal welfare for farmed animals.

The Better Chicken Commitment is a policy addressing breeding, housing, stocking density, and slaughter issues in the industry. The Honest Kitchen has worked with The ASPCA and GAP to ensure chicken sources for all its products meet the Better Chicken Commitment standards by 2025.

| Attribute | Details |

|---|---|

| Estimated Market Size 2025 | USD 3.7 billion |

| Projected Market Size (2035) | USD 8.6 billion |

| Value CAGR (2025 to 2035) | ~8.7% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania & the Middle East and Africa |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Russia, South Africa, Northern Africa, GCC Countries, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Australia & New Zealand |

| Key Segments Covered | Product Type, Packaging Size, Packaging Type, Life Stage, Sales Channel, and Region |

| Key Companies Profiled | Stella & Chewy's; The Honest Kitchen; Blue Buffalo Co., Ltd.; Nature’s Variety; Merrick Pet Care, Inc.; Castor & Pollux Natural Petworks; Mars Incorporated; Only Natural Pet; Petco Animal Supplies, Inc. (WholeHearted); Applaws Natural Cat and Dog and Cat Food; Tiki Pets; Other (on request) |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global cat food toppers market is estimated to be valued at USD 3.7 billion in 2025.

The market size for the cat food toppers market is projected to reach USD 8.6 billion by 2035.

The cat food toppers market is expected to grow at a 8.7% CAGR between 2025 and 2035.

The key product types in cat food toppers market are dry topper and wet topper.

In terms of packaging type, pouches segment to command 39.0% share in the cat food toppers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cat Food Market Analysis - Size, Share, and Forecast 2025 to 2035

Cat Food Toppings Market

Cat Food Flavors Market

Catering Food Warmers Market Analysis by Product Type, End Use, Sales Channel, and Region Forecast Through 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Fortification Market Analysis by Type, Process and Application Through 2035

Cat and Dog Food Topper Market Insights – Pet Nutrition & Industry Expansion 2024-2034

UTI Cat Food Market

Vegan Cat Food Market Growth - Consumer Demand & Nutrition 2025 to 2035

Wet Food for Cat Market Size and Share Forecast Outlook 2025 to 2035

Senior Cat Food Market

Hairball Cat Food Market

Canned Wet Cat Food Market Size and Share Forecast Outlook 2025 to 2035

High Protein Cat Food Market

Sensitive Stomach Cat Food Market

Grape Seed Extract in Pet Food Application Market Size, Growth, and Forecast for 2025 to 2035

Demand for Grape Seed Extract in Pet Food Application in EU Size and Share Forecast Outlook 2025 to 2035

Fish Protein Hydrolysate For Animal Feed And Pet Food Applications Market Size and Share Forecast Outlook 2025 to 2035

Cattle and Sheep Disease Diagnostic Kits Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA