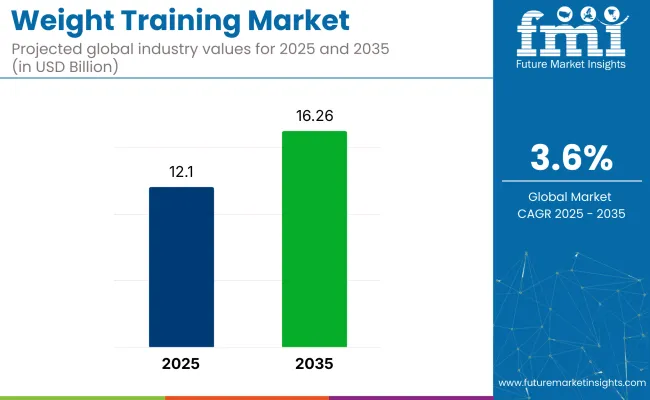

The global weight training market is forecasted to increase from USD 12.1 billion in 2025 to USD 16.26 billion by 2035, with a CAGR of 3.6%. This growth is being supported by rising awareness of physical well-being, expanded fitness participation across all age groups, and the growing integration of resistance-based workouts into daily routines.

| Attribute | Value |

|---|---|

| Industry Value (2025) | USD 12.1 billion |

| Industry Value (2035) | USD 16.26 billion |

| CAGR (2025 to 2035) | 3.6% |

Strength, resistance, and bodybuilding regimens are being incorporated to improve bone density, metabolic efficiency, and injury prevention. Commercial and home-based training setups are being expanded as fitness continues to be prioritized, with demand rising for versatile and durable weight equipment.

A June 2025 study published in JAMA Network Open by Wake Forest University and its School of Medicine evaluated whether resistance training or weighted vest use could prevent bone loss in older adults during intentional weight reduction. Across all three groups, weight loss alone, weight loss plus vest, and weight loss plus resistance training, similar hip bone mineral density declines were observed despite effective weight loss (9%-11.2% body weight).

The weighted vest group wore vests for 7.1 hours daily, replacing 78% of lost weight, while the resistance training group attended 71% of sessions. “While we hoped that replacing lost weight externally or increasing mechanical loading through exercise would preserve bone, our findings show that these strategies alone may not be enough,” said Kristen M. Beavers.

The weight training industry accounts for 45-50% of the fitness equipment sector, driven by barbells, dumbbells, and resistance machines. Within health and wellness, it represents 6-8%, linked to rehabilitation and preventive care. In sports and performance nutrition, 10-12% of product demand stems from strength-focused regimens.

The home fitness and gym segment attributes 35-40% of its value to strength systems and adjustable equipment. In recreational and professional sports, weight training holds a 15% share, shaped by athlete conditioning programs. These varied contributions reflect the integration of strength training across equipment, nutrition, personal wellness, and athletic performance categories

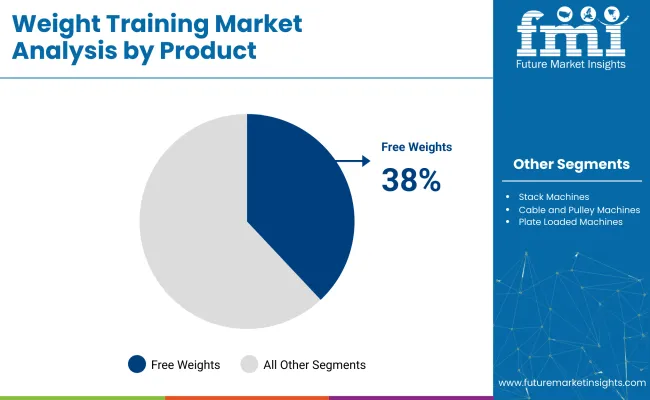

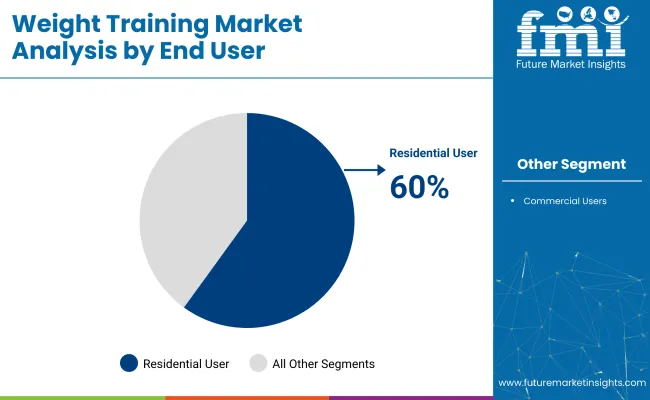

The market advanced steadily in 2025. Free weights held a 38% share, reflecting their broad utility and durability. Residential users dominated with a 60% share, supported by space-efficient home setups. The economic price range led with a 45% share in 2025. Online retail contributed 34%, driven by logistics, digital discovery, and post-sale service.

Free weights were identified as the top contributor to product-level share in 2025, accounting for 38% of total category value. Their inclusion in rehabilitation, functional fitness, and strength protocols enabled broad deployment across training tiers. Iron casting and rubber coatings were optimized in offshore facilities to stabilize supply.

Adjustable kits bundled with virtual tutorials were positioned for first-time users focused on safe load progression. Brands such as Rogue Fitness and CAP Barbell were instrumental in scaling availability across both home and institutional sector.

The residential segment was awarded a 60% share in 2025, following the persistence of home-based routines post-pandemic. Foldable benches, compact racks, and app-connected dumbbells were selected for their compatibility with limited-space layouts. Engagement was maintained through coaching platforms that delivered load-tracking features.

Setup complexity was reduced via modular packaging and digital guides, catering to renters and small-home owners. Smart equipment was promoted by Tonal and ProForm, both of which offered digital interfaces integrated with home fitness ecosystems.

The economic price range is expected to dominate the market, holding a 45% share in 2025, with demand anchored in budget-sensitive purchasing. Standardized plates and welded dumbbells were produced using batch-run molds, enabling lower costs.

New Year promotional cycles and trade-in resale programs extended product reach among price-conscious buyers. Cost-to-durability ratios remained favorable, reinforcing entry-point adoption for new lifters. Brands such as Weider and Marcy led volume sales through discount chains and general e-commerce portals.

Online retail was credited with 34% of market distribution in 2025, aided by rapid freight coordination and digital purchase journeys. Fulfillment timelines were shortened through metro-adjacent warehousing for high-weight SKUs. Augmented reality, side-by-side comparisons, and embedded influencer content were deployed to compress the decision window.

Post-sale processes were digitized, including label-free returns and modular part replacements. Platforms operated by Amazon and Dick’s Sporting Goods played central roles in enabling category visibility, same-day shipping, and high-volume fulfillment.

The industry is undergoing a structural shift as commercial gyms streamline inventory and residential users drive demand for low-cost, space-efficient products. Distribution models are being recalibrated, with digital bundling and financing incentives helping align cost control with consumer behavior across economic segments and global fitness hubs.

Inventory Optimization Alters Commercial Gym Equipment Cycles

Ownership models were replaced by leasing structures across commercial gyms in East Asia and the Middle East. Excess machines were liquidated via resale platforms, and build cycles were shortened by OEMs. Preference was given to configurable stations, and space planning was redesigned for efficiency. Inventory turnover was improved by 27% in Q2 2025 through procurement tightening and rationalization of facility layouts.

Value-Tier Home Equipment Gains Share in Volume-Led Retail

Traction was gained by economic-tier weight sets under USD 250, particularly among first-time users in space-limited settings. Exports were scaled by Indian and Vietnamese manufacturers for Amazon, Flipkart, and Walmart. Adoption was strengthened by compact product formats, and bundled sessions were included to improve usage. Return rates were lowered, and cost-to-serve was optimized through streamlined fulfillment networks.

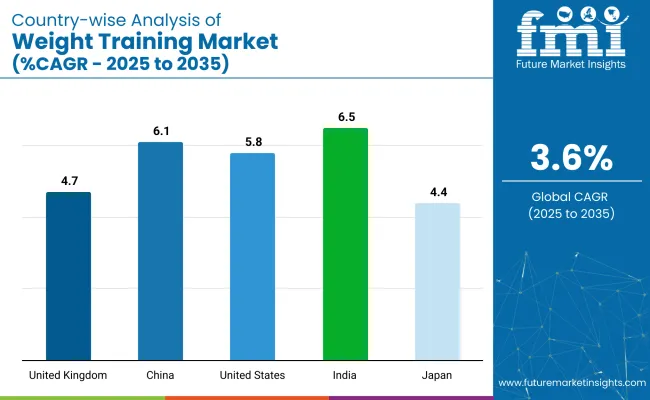

The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 6.5% |

| China | 6.1% |

| United States | 5.8% |

| United Kingdom | 4.7% |

| Japan | 4.4% |

Global weight training equipment demand is forecast to rise at a 3.6% CAGR between 2025 and 2035. Among the five highlighted countries, India (BRICS) leads with 6.5%, followed by China (BRICS) at 6.1%, and the United States (OECD) at 5.8%. The United Kingdom (OECD) and Japan (OECD, East Asia) trail at 4.7% and 4.4%, respectively.

These growth rates represent a premium of +81% for India, +69% for China, and +61% for the United States over the global baseline; the United Kingdom and Japan maintain modest uplifts of +31% and +22%. Divergence reflects mass-market financing in India, franchising scale in China, home-use innovation in the USA, refurbishment cycles in the UK, and compact-equipment demand in Japan.

Demand for weight training equipment is expected to grow at a 6.5% CAGR through 2035. Sales have been concentrated in medium-density urban clusters, where EMI-financed orders have been processed in offline and digital retail formats. Assembly operations based in southern India have been used to support last-mile fulfillment.

Compact benches, resistance kits, and vinyl dumbbells have been stocked widely across chain outlets. Influencer-curated bundles have been included in app-based storefronts. Repeat orders have been observed in core metros and regional towns. Entry-level kits have been sold with app trials and guidebooks for improved onboarding. Equipment resale platforms have been used to lower ownership barriers.

Requirement for weight training equipment in China is expected to expand at a 6.1% CAGR from 2025 to 2035. Franchise-led gym openings in secondary inland zones have supported procurement of stack machines and selectorized benches. Direct orders have been routed through integrated logistics on national e-commerce platforms. Live stream campaigns and short-video promotions have been deployed to drive home-use demand. Compact, multi-function designs have been prioritized for apartment-based fitness routines.

Public-use outdoor fitness zones have been equipped under regional infrastructure programs. Low-friction restocking cycles have been enabled by nearby warehouse nodes, allowing agile delivery and reduced downtime. Bundled SKUs have included QR-linked tutorials in Mandarin and Cantonese.

Sale of weight training equipment in the United Statesis anticipated to register a 5.8% CAGR from 2025 to 2035. Connected machines with smart functionality have been distributed through specialty retailers and e-commerce formats. Leasing has been adopted across commercial gyms to reduce upfront costs.

Institutional procurement has been processed for fire departments, high schools, and government-run facilities. Repeat usage has been strengthened by instructional content embedded in kits. Branded app subscriptions have been offered with bundled purchases.

High-value SKUs have been fulfilled through regional logistics partnerships. Refurbished commercial units have been deployed in university athletic centers and community gyms. Equipment returns have declined following improved shipping durability.

The weight training equipment industry in the UK is set to grow at a 4.7% CAGR through 2035. Foldable racks and compact benches have been adopted in apartments and terrace homes. In-store and digital financing programs have supported purchases among first-time users. Budget fitness centers and shared-use facilities have deployed refurbished commercial machines to manage investment risk.

Configurable home setups have been supported through flat-pack delivery and simplified installation. Modular kits have been promoted with digital guides. Space-adapted products have been selected to accommodate multi generational households. Local delivery timelines have been shortened through warehouse zoning in London, Manchester, and Birmingham.

The adoption of weight training equipment in Japanis projected to expand at a 4.4% CAGR through 2035. Compact and lightweight equipment has been selected for residential use in high-density zones. Low-resistance devices have been installed in care homes and rehabilitation clinics. Domestic suppliers have delivered kits below 25 kg to meet mobility, sound, and size requirements.

Usage tracking has been integrated into select models for physiotherapy support. Vertical-storage machines have been installed in public wellness zones. Retailers have offered foldable designs to households without dedicated gym space. Deliveries have been optimized through inventory held at logistics nodes near Tokyo, Nagoya, and Osaka.

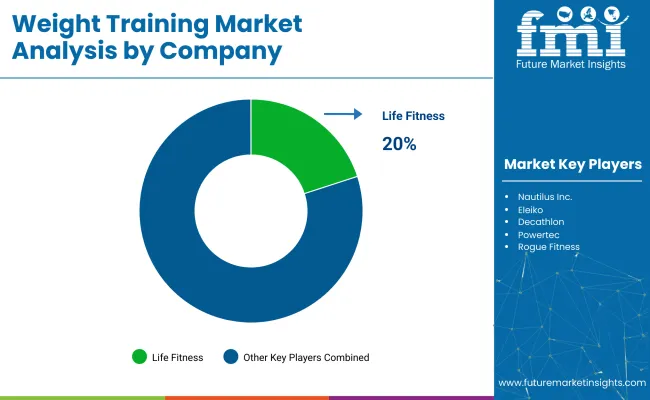

Dominant players such as Life Fitness, Technogym, and Rogue Fitness lead the category through commercial strength systems, Olympic facility partnerships, and free-weight manufacturing. Life Fitness, through its Hammer Strength line, retained strong institutional presence across North America, while Technogym emphasized design-led, connected solutions.

Rogue Fitness maintained free-weight leadership via USA-based production. Key players including Precor, Cybex, and Nautilus focused on multifunction setups for commercial gyms and public installations. Emerging brands such as Eleiko and Decathlon extended reach through competition-grade plates and mass-retail distribution, expanding access and use across both elite and entry-level markets.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 12.1 billion |

| Projected Industry Size (2035) | USD 16.26 billion |

| CAGR (2025 to 2035) | 3.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Products Analyzed (Segment 1) | Free Weights, Stack Machines, Cable and Pulley Machines, Plate Loaded Machines |

| End Users Analyzed (Segment 2) | Residential Users, Commercial Users |

| Price Ranges Analyzed (Segment 3) | Economic, Mid-Range, Premium |

| Distribution Channels Analyzed (Segment 4) | Direct Sales, Mono-Brand Stores, Convenient Stores, Specialty Stores, Online Retail Store |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa |

| Key Players | Life Fitness (Hammer Strength), Technogym S.p.A (Wellness Holding Srl), Rogue Fitness, Precor (Amer Sports), Cybex International Inc. (Brunswick Corporation), Nautilus Inc., Eleiko, Decathlon, Powertec, ICON Health and Fitness Inc. (IHF Holdings Inc.), American Barbell Gym Equipment |

| Additional Attributes | Dollar sales, share by equipment type and end user, increasing residential adoption of compact weight training machines, rising commercial upgrades to stack and plate-loaded systems, e-commerce trends for fitness equipment distribution |

The segmentation includes free weights, stack machines, cable and pulley machines, and plate loaded machines.

The segmentation includes residential users and commercial users.

The segmentation includes economic, mid-range, and premium.

The segmentation includes direct sales, mono-brand stores, convenient stores, specialty stores, and online retail store.

The segmentation includes North America, Latin America, Europe, East Asia, South Asia, Oceania, and Middle East and Africa.

The industry was valued at USD 12.1 billion in 2025.

The industry is expected to reach USD 16.26 billion by 2035.

The industry is projected to expand at a CAGR of 3.6% during the forecast period.

The United States ranked third with a CAGR of 5.8% in the market.

Free weights led the industry in 2025 with a 38% share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Weight Loss and Obesity Management Market Analysis - Size Share and Forecast Outlook 2025 to 2035

Weight Management Supplement Market Analysis by Product Type, Form and Sales Channel Through 2035

Weight Loss Supplements Market – Growth, Demand & Health Trends

Weight Management Market Trends – Growth, Demand & Forecast 2025 to 2035

Weight Management Dog Food Market

Lightweight Corrugator Modules Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Automotive Body Panels Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Handheld Cordless Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Heavyweight Motorcycles Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Acoustic Floor Systems Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Food Container Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Aluminium Pistons Market Growth - Trends & Forecast 2025 to 2035

Lightweight Compact Wheel Loader Market Growth - Trends & Forecast 2025 to 2035

Drop Weight Tear Tester Market

Canine Weight Loss Drugs Market

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Lightweight Materials Market 2025 to 2035

Automotive Lightweight Materials Market Size and Share Forecast Outlook 2025 to 2035

Industrial Counterweight Market Size and Share Forecast Outlook 2025 to 2035

Medically Supervised Weight Loss Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA