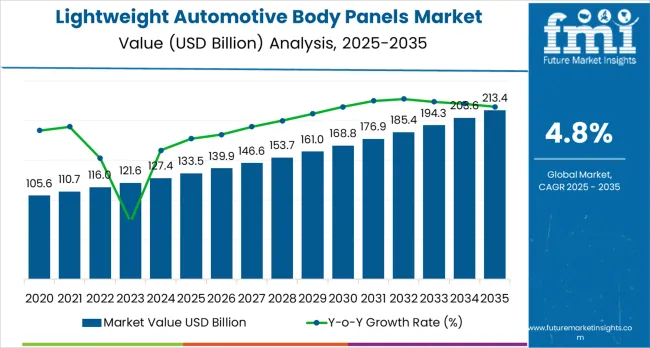

The global lightweight automotive body panels market is anticipated to grow from USD 133.5 billion in 2025 to approximately USD 213.4 billion by 2035, recording an absolute increase of USD 79.0 billion over the forecast period. This translates into a total growth of 59.2%, with the market forecast to expand at a CAGR of 4.8% between 2025 and 2035. The overall market size is expected to grow by nearly 1.6X during the same period, supported by increasing demand for fuel-efficient vehicles, rising adoption of electric vehicles (EVs), and increasing focus on vehicle weight reduction for emissions compliance across the global automotive and transportation manufacturing sectors.

Between 2025 and 2030, the market is projected to expand from USD 133.5 billion to USD 166.8 billion, resulting in a value increase of USD 33.3 billion, which represents 42.2% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for electric vehicle components, increasing applications in weight reduction technologies, and growing penetration in emerging automotive markets. Automotive manufacturers are expanding their lightweight panel production capabilities to address the growing demand for specialized components in various vehicle applications and emission reduction processes.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 133.5 billion |

| Forecast Value in (2035F) | USD 213.4 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

From 2030 to 2035, the market is forecast to grow from USD 166.8 billion to USD 213.4 billion, adding another USD 45.7 billion, which constitutes 57.8% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized automotive manufacturing facilities, the integration of advanced lightweight materials technologies, and the development of customized body panel systems for specific vehicle applications. The growing adoption of eco-friendly standards and emissions requirements will drive demand for ultra-lightweight body panels with enhanced performance specifications and consistent weight reduction characteristics.

Between 2020 and 2025, the market experienced steady expansion, driven by increasing recognition of vehicle weight reduction technologies'importance in emissions compliance and growing acceptance of specialized lightweight solutions in complex automotive manufacturing processes. The market developed as automotive manufacturers recognized the need for high-efficiency lightweight systems to address stringent fuel economy requirements and improve overall vehicle performance outcomes. Research and development activities have begun to prioritize the importance of advanced materials technologies in achieving better efficiency and sustainability in automotive manufacturing processes.

Market expansion is being supported by the increasing demand for fuel-efficient vehicles and the corresponding need for weight reduction systems in automotive applications across global passenger and commercial vehicle operations. Modern automotive manufacturers are increasingly focused on specialized lightweight technologies that can improve fuel efficiency, reduce emissions, and enhance vehicle performance while meeting stringent environmental requirements. The proven efficacy of lightweight automotive body panels in various vehicle applications makes them an essential component of comprehensive vehicle weight reduction strategies and automotive production.

The growing focus on electric vehicle adoption and advanced emissions compliance is driving demand for ultra-lightweight body panels that meet stringent performance specifications and regulatory requirements for automotive applications. Automotive manufacturers'preference for reliable, high-performance lightweight systems that can ensure consistent weight reduction outcomes is creating opportunities for innovative materials technologies and customized vehicle solutions. The rising influence of environmental regulations and emissions protocols is also contributing to increased adoption of premium-grade lightweight automotive body panels across different vehicle applications and automotive systems requiring specialized weight reduction technology.

The lightweight automotive body panels market represents a specialized growth opportunity, expanding from USD 133.5 billion in 2025 to USD 213.4 billion by 2035 at a 4.8% CAGR. As automotive manufacturers prioritize fuel efficiency, emissions compliance, and vehicle performance in complex automotive production processes, lightweight body panels have evolved from a niche automotive technology to an essential component enabling weight reduction, emissions optimization, and multi-stage vehicle performance across light commercial vehicles and specialized automotive applications.

The convergence of electric vehicle expansion, increasing fuel economy standards, specialized automotive organization growth, and emissions requirements creates steady momentum in demand. High-efficiency formulations offering superior weight reduction performance, cost-effective aluminum and composite systems balancing performance with economics, and specialized carbon fiber variants for critical applications will capture market premiums, while geographic expansion into high-growth Asian automotive markets and emerging market penetration will drive volume leadership. Regulatory focus on emissions reduction and fuel efficiency provides structural support.

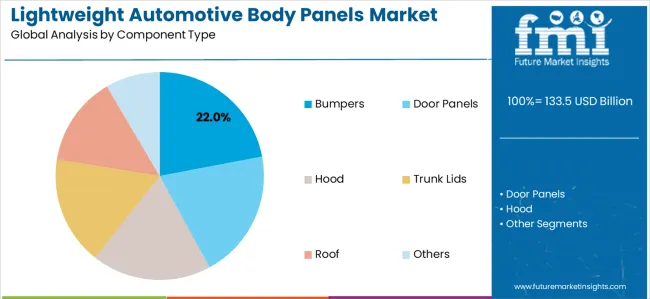

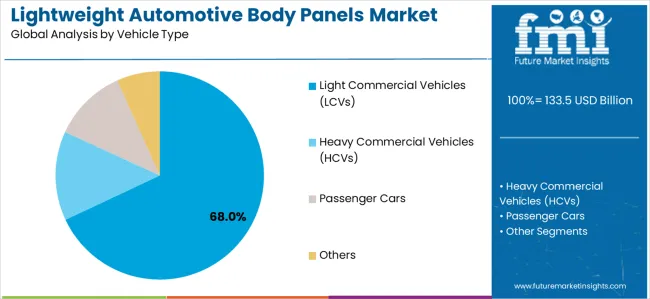

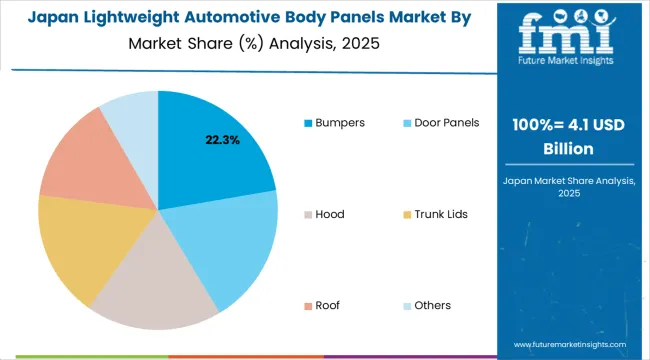

The market is segmented by component type, vehicle type, and region. By component type, the market is divided into Bumpers, Door Panels, Hood, Trunk Lids, Roof, and Others. Based on vehicle type, the market is categorized into Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Passenger Cars, and Others. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and the Middle East &Africa.

The Bumpers segment is projected to account for 22% of the market in 2025, reaffirming its position as the category's leading component type. Automotive manufacturers increasingly recognize the optimal balance of safety requirements and weight reduction offered by lightweight bumpers for most vehicle applications, particularly in light commercial vehicles and passenger car manufacturing processes. This component type addresses both crash safety requirements and emissions considerations while providing reliable structural integrity across diverse automotive applications.

This component type forms the foundation of most vehicle safety protocols for front and rear protection applications, as it represents the most critical and commercially viable level of lightweight technology in the industry. Safety control standards and extensive crash testing continue to strengthen confidence in lightweight bumper formulations among automotive manufacturers and vehicle designers. With increasing recognition of the weight reduction requirements in emissions compliance, lightweight bumpers align with both fuel efficiency and vehicle safety goals, making them the central growth driver of comprehensive automotive lightweight strategies.

Light Commercial Vehicles are projected to represent 68% of lightweight automotive body panels demand in 2025, highlighting their role as the primary application driving market adoption and growth. Automotive manufacturers recognize that light commercial vehicle requirements, including diverse body configurations, specialized cargo systems, and multi-purpose vehicle designs, often require specialized lightweight panels that standard automotive technologies cannot adequately provide. Lightweight automotive body panels offer enhanced fuel efficiency and emissions compliance in light commercial vehicle applications.

The segment is supported by the growing nature of e-commerce and last-mile delivery, requiring sophisticated lightweight systems, and the increasing recognition that specialized lightweight technologies can improve vehicle performance and operational cost outcomes. Automotive manufacturers are increasingly adopting evidence-based design guidelines that recommend specific lightweight panels for optimal fuel economy outcomes. As understanding of vehicle weight optimization advances and regulatory requirements become more stringent, lightweight automotive body panels will continue to play a crucial role in comprehensive vehicle strategies within the light commercial vehicles market.

The lightweight automotive body panels market is advancing steadily due to increasing recognition of vehicle weight reduction technologies'importance and growing demand for fuel-efficient systems across the automotive and transportation sectors. The market faces challenges, including complex manufacturing processes, potential for material cost variations during production and implementation, and concerns about supply chain consistency for specialized automotive components. Innovation in materials technologies and customized vehicle design protocols continues to influence product development and market expansion patterns.

The growing adoption of advanced automotive manufacturing facilities is enabling the development of more sophisticated lightweight body panel production and quality control systems that can meet stringent vehicle requirements. Specialized manufacturing plants offer comprehensive materials processing services, including advanced aluminum stamping and composite molding processes that are particularly important for achieving weight reduction requirements in automotive applications. Advanced manufacturing channels provide access to premium materials that can optimize vehicle performance and reduce emissions while maintaining cost-effectiveness for large-scale automotive operations.

Modern automotive companies are incorporating electric vehicle technologies such as battery integration design, structural optimization systems, and materials compatibility to enhance lightweight body panel manufacturing and vehicle design processes. These technologies improve panel performance, enable continuous weight monitoring, and provide better coordination between manufacturers and OEMs throughout the supply chain. Advanced design platforms also enable customized performance specifications and early identification of potential structural deviations or supply disruptions, supporting reliable automotive production.

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.8% |

| USA | 6.1% |

| South Korea | 5.5% |

| Germany | 5.3% |

| Japan | 4.9% |

| UK | 5.0% |

| France | 4.7% |

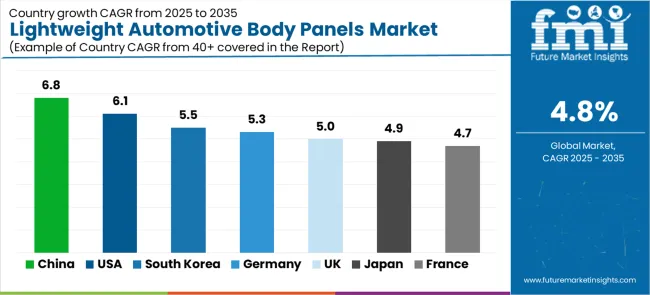

The market is experiencing varied growth globally, with China leading at a 6.8% CAGR through 2035, driven by the expansion of electric vehicle manufacturing, increasing automotive production capabilities, and growing domestic demand for fuel-efficient vehicles. The United States follows at 6.1%, supported by emissions regulations expansion, growing recognition of lightweight technology importance, and expanding EV manufacturing capacity. South Korea shows growth at 5.5%, focusing advanced automotive manufacturing technologies and electric vehicle leadership. Germany records 5.3% growth, with a focus on premium automotive and engineering excellence. Japan demonstrates 4.9% growth, representing a mature market with established manufacturing patterns and hybrid vehicle expertise. The UK exhibits 5.0% growth, supported by advanced engineering frameworks and comprehensive emissions guidelines. France shows 4.7% growth, focusing eco-friendly automotive manufacturing infrastructure and systematic vehicle design approaches.

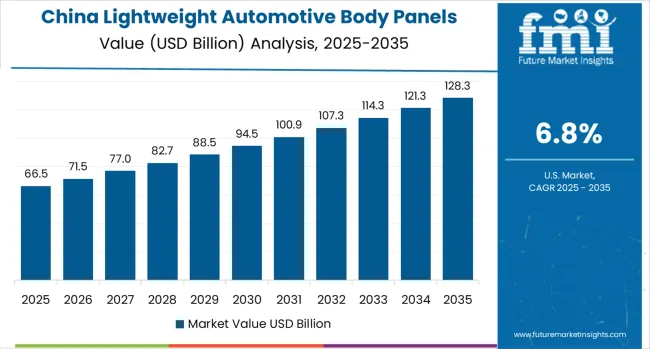

China is projected to exhibit robust growth with a CAGR of 6.8% through 2035, driven by ongoing electric vehicle expansion and increasing recognition of lightweight systems as essential automotive components for emissions reduction processes. The country's expanding automotive manufacturing infrastructure and growing availability of specialized materials capabilities are creating significant opportunities for lightweight body panel adoption across both domestic and export-oriented vehicle facilities. Major international and domestic automotive companies are establishing comprehensive production and distribution networks to serve the growing population of vehicle manufacturers requiring high-performance lightweight systems across passenger and commercial vehicle applications throughout China's major automotive development hubs.

The Chinese government's strategic focus on new energy vehicles and clean technology advancement is driving substantial investments in specialized lightweight capabilities. This policy support, combined with the country's large domestic automotive market and expanding electric vehicle requirements, creates a favorable environment for the lightweight automotive body panels market development. Chinese manufacturers are increasingly focusing on high-value automotive technologies to improve vehicle efficiency capabilities, with lightweight body panels representing a key component in this automotive transformation.

The United States is expanding at a CAGR of 6.1%, supported by increasing fuel economy standards, growing electric vehicle adoption, and developing advanced materials presence across the country's major automotive manufacturing clusters. The country's large automotive sector and increasing recognition of specialized lightweight systems are driving demand for effective weight reduction solutions in both passenger car and commercial vehicle applications. International automotive suppliers and domestic manufacturers are establishing comprehensive distribution channels to serve the growing demand for quality lightweight systems while supporting the country's position as an automotive innovation leader.

The USA automotive sector continues to benefit from favorable tax incentives for electric vehicles, expanding manufacturing capabilities, and innovation-driven automotive development. The country's focus on becoming a global electric vehicle hub is driving investments in specialized lightweight technology and vehicle design infrastructure. This development is particularly important for lightweight automotive body panels applications, as vehicle manufacturers seek reliable domestic sources for critical lightweight technologies to reduce import dependency and improve supply chain security.

South Korea is projected to grow at a CAGR of 5.5%, supported by advanced electric vehicle manufacturing systems and innovative vehicle design protocols that prioritize performance, sustainability, and technological leadership. Korean automotive manufacturers consistently utilize lightweight systems for electric vehicle applications and advanced battery electric vehicles, with particular strength in specialty automotive technologies and high-value vehicle systems. The market is characterized by cutting-edge manufacturing protocols, comprehensive quality standards, and established relationships between automotive companies and materials suppliers that support long-term supply agreements and technical collaboration.

South Korea's automotive industry benefits from advanced research and development capabilities, sophisticated manufacturing infrastructure, and strong government support that facilitates high-quality vehicle production. The country's focus on electric vehicles and battery technology is driving the development of more efficient lightweight processes and advanced materials methods for specialized vehicle systems like lightweight automotive body panels. This focus on technological advancement and sustainability aligns with global trends toward efficient automotive practices.

Germany is projected to grow at a CAGR of 5.3% through 2035, supported by well-established automotive engineering systems and precision manufacturing protocols that prioritize quality, performance, and innovation. German automotive manufacturers consistently utilize lightweight systems as part of integrated vehicle design approaches, focusing engineering excellence and performance optimization in both premium passenger vehicles and commercial vehicle production. The market benefits from strong research and development capabilities, advanced manufacturing infrastructure, and well-established regulatory frameworks.

The German automotive sector's focus on premium vehicles and engineering leadership drives demand for specialized lightweight systems that can support complex vehicle designs and meet stringent quality requirements. The country's mature market characteristics include established supplier relationships, comprehensive performance standards, and sophisticated logistics networks that support reliable supply chain management for critical automotive technologies.

Japan is projected to grow at a CAGR of 4.9% through 2035, supported by the country's well-established hybrid vehicle manufacturing infrastructure, comprehensive quality systems, and systematic approach to automotive production that emphasizes reliability, efficiency, and continuous improvement. Japanese automotive manufacturers prioritize evidence-based lightweight system utilization within structured manufacturing frameworks that prioritize vehicle performance and materials excellence in both passenger and commercial vehicle applications. The market is characterized by high technical standards, established quality systems, and long-term supplier relationships.

Japan's automotive industry benefits from advanced materials technology, sophisticated weight optimization systems, and a strong focus on kaizen (continuous improvement) principles. The country's aging population and focus on fuel efficiency create steady demand for lightweight systems, while the focus on hybrid technology and high-quality manufacturing supports premium pricing for specialized automotive systems like lightweight body panels. Japanese manufacturers'expertise in combining traditional steel with aluminum and composite materials positions them as global leaders in multi-material vehicle construction.

The UK is projected to grow at a CAGR of 5.0% through 2035, supported by advanced engineering frameworks and comprehensive automotive design guidelines that facilitate the appropriate use of lightweight systems for complex vehicle applications. British automotive manufacturers consistently utilize established protocols for vehicle weight management, focusing performance outcomes and emissions optimization within integrated manufacturing systems that support both domestic automotive production and export markets. The country benefits from strong research capabilities, established automotive clusters, and comprehensive regulatory support.

The UK's automotive and materials industries are characterized by high levels of innovation, strong academic-industry collaboration, and focus on high-value specialty vehicles. The country's regulatory environment has created both challenges and opportunities, with increased focus on domestic supply chain development and carbon neutrality driving investments in specialized lightweight manufacturing capabilities. The presence of premium automotive brands, motorsport engineering excellence, and advanced composites expertise creates a favorable ecosystem for lightweight body panel innovation.

France is projected to grow at a CAGR of 4.7% through 2035, supported by green automotive manufacturing infrastructure and comprehensive environmental policies that prioritize emissions reduction and fuel efficiency. French automotive manufacturers maintain strong positions in commercial vehicles and innovative vehicle designs, with particular focus on lightweight solutions for diverse transportation applications. The market benefits from France's leadership in vehicle electrification, established automotive manufacturing presence, and commitment to environmental sustainability.

France's automotive sector is experiencing modernization through electric vehicle expansion and green manufacturing practices, particularly in lightweight technologies and eco-friendly materials. The country's strategic focus on reducing carbon footprint and supporting European green initiatives provides opportunities for lightweight body panel suppliers. Government support for automotive innovation and electric mobility, combined with the presence of major manufacturers like Renault and PSA Group (Stellantis), is driving infrastructure improvements and capacity expansion in specialized lightweight manufacturing.

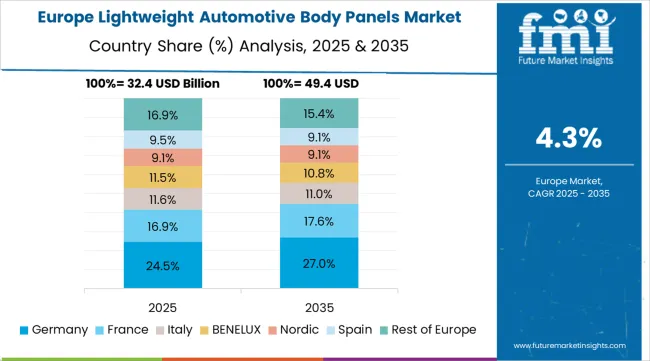

The lightweight automotive body panels market in Europe is projected to grow from USD 38.2 billion in 2025 to USD 60.1 billion by 2035, registering a CAGR of 4.6% over the forecast period. Germany is expected to maintain its leadership position with a 29.8% market share in 2025, rising to 30.4% by 2035, supported by its advanced automotive manufacturing infrastructure, precision engineering capabilities, and strong premium vehicle presence throughout major automotive regions.

The United Kingdom follows with a 19.6% share in 2025, projected to reach 20.1% by 2035, driven by advanced materials innovation, automotive engineering excellence, and expanding electric vehicle manufacturing networks serving both domestic and international markets. France holds a 17.4% share in 2025, expected to increase to 17.8% by 2035, supported by commercial vehicle manufacturing strength and growing adoption of lightweight systems. Italy commands a 13.2% share in 2025, projected to reach 13.5% by 2035, while Spain accounts for 10.8% in 2025, expected to reach 11.0% by 2035. The BENELUX region is expected to maintain a 5.3% share in 2025, growing to 5.6% by 2035, supported by innovation-friendly frameworks and strong logistics infrastructure. The Rest of Europe region, including Nordic countries, Eastern Europe, and smaller Western European markets, is anticipated to hold 3.9% in 2025, declining slightly to 3.6% by 2035, attributed to market consolidation toward larger core markets with established automotive manufacturing capabilities.

The market is characterized by competition among established automotive suppliers, specialty materials companies, and vehicle component manufacturers focused on delivering high-performance, consistent, and reliable lightweight systems. Companies are investing in materials technology advancement, manufacturing process enhancement, strategic partnerships, and customer technical support to deliver effective, efficient, and reliable lightweight automotive solutions that meet stringent automotive and emissions requirements. Weight optimization, performance validation protocols, and supply chain strategies are central to strengthening product portfolios and market presence.

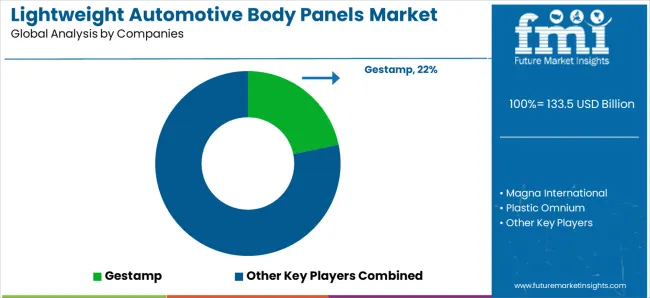

Gestamp leads the market with comprehensive lightweight system offerings with a focus on hot-stamped steel and aluminum panel technologies for automotive applications, commanding an estimated 18-22% market share. Magna International provides specialized lightweight body panels with focus on multi-material design solutions and comprehensive engineering services, holding approximately 15-19% market share. Plastic Omnium focuses on advanced thermoplastic panel technologies and composite solutions for lightweight systems serving global markets, with an estimated 12-16% market share. FLEX-N-GATE delivers plastic-injected panel systems with strong aerodynamic design capabilities and cost optimization, capturing approximately 10-14% market share.

Gordon Auto Parts operates with a focus on bringing cost-effective lightweight technologies to mass market applications and electric vehicle segments, holding an estimated 8-12% market share. Kirchhoff Automotive provides comprehensive lightweight system portfolios, including structural components and crash management systems, across multiple vehicle applications and automotive manufacturing processes. Tower International specializes in customized lightweight solutions and advanced materials systems for automotive applications with focus on engineering excellence. Martinrea International provides reliable supply chain solutions and technical expertise to enhance market accessibility and customer access to essential lightweight systems.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 133.5 billion |

| Component Type | Bumpers, Door Panels, Hood, Trunk Lids, Roof, Others |

| Vehicle Type | Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Passenger Cars, Others |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East &Africa |

| Countries Covered | China, United States, South Korea, Germany, Japan, United Kingdom, France and 40+ countries |

| Key Companies Profiled | Gestamp, Magna International, Plastic Omnium, FLEX-N-GATE, Gordon Auto Parts, Kirchhoff Automotive, Tower International, and Martinrea International |

| Additional Attributes | Dollar sales by component type and vehicle type, regional demand trends, competitive landscape, manufacturer preferences for specific lightweight materials, integration with specialty automotive supply chains, innovations in materials technologies, weight optimization, and emissions compliance |

The global lightweight automotive body panels market is estimated to be valued at USD 133.5 billion in 2025.

The market size for the lightweight automotive body panels market is projected to reach USD 213.4 billion by 2035.

The lightweight automotive body panels market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in lightweight automotive body panels market are bumpers, door panels, hood, trunk lids, roof and others.

In terms of vehicle type, light commercial vehicles (lcvs) segment to command 68.0% share in the lightweight automotive body panels market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lightweight Corrugator Modules Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Handheld Cordless Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Acoustic Floor Systems Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Food Container Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Aluminium Pistons Market Growth - Trends & Forecast 2025 to 2035

Lightweight Compact Wheel Loader Market Growth - Trends & Forecast 2025 to 2035

Aerospace Lightweight Materials Market 2025 to 2035

Automotive Lightweight Materials Market Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Automotive Lightweight Body Panel in the United States Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA