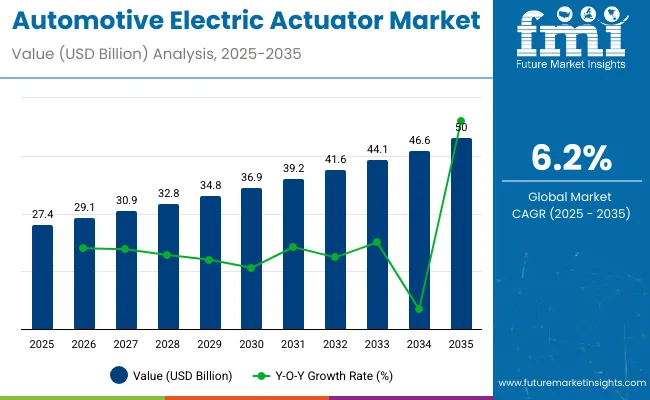

The automotive electric actuator market is valued at USD 27.4 billion in 2025 and is likely to reach around USD 50 billion by 2035, reflecting a CAGR of 6.2%. The multiplying factor over the ten-year period is about 1.82x, indicating that the 2035 market will be 1.82 times the 2025 base.

Initial growth is supported by wider adoption of electric actuators in steering, braking, and transmission systems, particularly in electric and hybrid vehicles. Technological enhancements, tighter emission standards, and demand for better vehicle performance drive faster uptake during the early phase.

Towards 2035, growth slows as adoption levels off in established segments and conventional vehicles integrate fewer new actuator solutions. Continued expansion is fueled by emerging markets, broader deployment in advanced driver-assistance systems, and replacement of mechanical systems with electric actuators. The acceleration and deceleration pattern, together with a multiplying factor of 1.82x, illustrates early momentum followed by steady long-term growth, providing manufacturers and suppliers measurable opportunities to increase production, develop technology, and strengthen market positioning over the decade.

The automotive electric actuator market is influenced by five parent markets with varying contributions. Automotive electronics accounts for approximately 40%, supplying sensors, controllers, and powertrain modules. Automotive components contribute around 25%, integrating actuators into braking, steering, HVAC, and transmission systems. The global automotive market represents about 15%, driving adoption through new vehicle production and fleet upgrades.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 27.4 billion |

| Industry Value (2035F) | USD 50 billion |

| CAGR (2025 to 2035) | 6.2% |

Industrial automation and robotics account for roughly 10%, enabling precision manufacturing and testing of actuators. Information and communication technology (ICT) contributes nearly 10%, supporting software, connectivity, and vehicle control systems. Combined, these markets enable the widespread adoption of electric actuators in modern vehicles.

Recent trends in the industry focus on electrification, integration, and strategic collaborations. Key players such as Bosch, Denso, Continental, and Valeo are developing energy-efficient actuators for braking, steering, and HVAC systems. Integration with electric vehicles and advanced driver assistance systems (ADAS) is accelerating adoption. Smart actuators with IoT connectivity allow predictive maintenance, remote monitoring, and performance optimization.

Companies are forming partnerships with automakers to expand EV platforms and autonomous mobility solutions. Lightweight design, energy efficiency, and precision control technologies are driving innovation, improving vehicle performance, safety, and reliability while meeting regulatory and consumer demands.

The automotive electric actuator industry is growing due to increasing integration of electronic control systems in modern vehicles. Global installation exceeded 45 million units in 2024, with Europe and Asia Pacific accounting for more than 60% of the total.

Electric actuators are increasingly used in throttle control, braking systems, seat adjustment, and HVAC systems, replacing traditional mechanical and hydraulic components. Advancements in precision, response time, and compact design are improving vehicle performance and safety. Growth of electric and hybrid vehicles, coupled with stricter emission regulations, is driving actuator adoption. Expansion of passenger car production and commercial vehicle fleets further supports demand.

Rising consumer expectations for vehicle safety, comfort, and performance are key drivers. Electric actuators improve braking, throttle, and steering response, reducing stopping distance by 8-10% compared to traditional systems. OEMs increasingly integrate actuators into advanced driver assistance systems and EVs to meet regulatory standards.

Asia Pacific leads adoption with a 7-9% annual growth rate, driven by increasing vehicle production and urban mobility solutions. Improved actuator precision reduces maintenance requirements by 15%, enhancing system reliability. The shift toward electronic systems also reduce vehicle weight, supporting fuel efficiency and lowering emissions. Adoption in commercial vehicles, buses, and trucks is expanding to improve fleet operational efficiency.

Technological innovation is expanding actuator applications across throttle, brake-by-wire, HVAC, and seat positioning systems. Electric actuators in EVs enhance energy efficiency, improving vehicle range by up to 5%. Over-the-air software updates optimize actuator performance and reduce system downtime by 10-12%. Integration with AI-driven systems allows predictive maintenance and smoother vehicle operation.

Compact and lightweight designs improve engine compartment utilization and reduce overall vehicle weight by 3-5%. Modular actuator platforms enable OEMs to standardize components across multiple vehicle segments, lowering production complexity and cost. Increased adoption in hybrid and electric vehicles drives market growth, especially in regions with strong EV policies and incentives.

Asia Pacific dominates adoption due to rising passenger vehicle production, EV incentives, and growing commercial vehicle fleets. Annual growth in China, India, and Japan ranges 6-9%. Commercial vehicles increasingly rely on electric actuators for throttle control, braking, and HVAC, improving fuel efficiency by 4-6%. Integration with fleet management systems allows predictive maintenance, reducing downtime by 12-15%.

Urban mobility solutions and smart transportation projects support actuator adoption in buses, taxis, and delivery vehicles. Compact actuator designs facilitate installation in space-constrained vehicles while meeting safety and performance standards. Manufacturers are localizing production to reduce lead times by 10-15% and enhance regional supply chain efficiency.

Advanced electric actuators require significant investment, with unit prices ranging from USD 150 to 800 depending on application and vehicle type. Integration into existing mechanical systems can add 10-12% to manufacturing costs. Actuators require precise calibration to maintain performance, with improper setup reducing efficiency by 5-8%. Maintenance, software updates, and sensor alignment add 7-10% to operational expenses annually.

Retrofitting older vehicles is challenging due to space constraints and compatibility issues. Manufacturers must balance cost, reliability, and regulatory compliance to ensure adoption, especially in regions with strict safety standards and emission regulations. Effective supply chain management and local production are key to controlling costs.

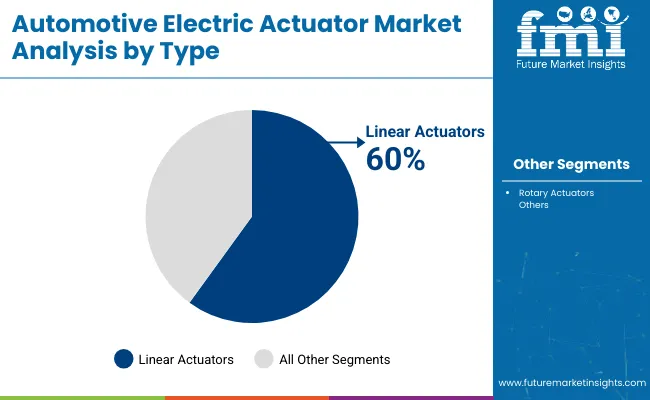

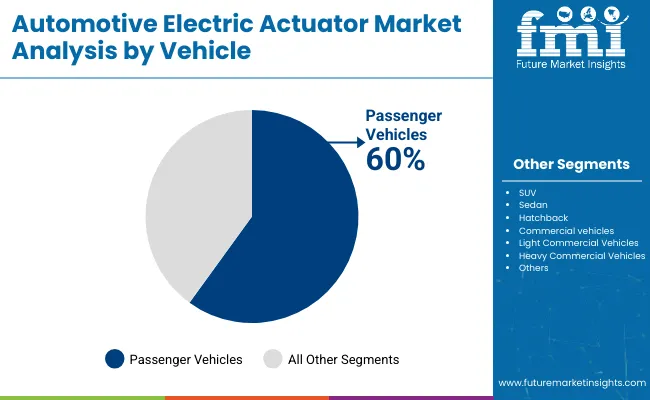

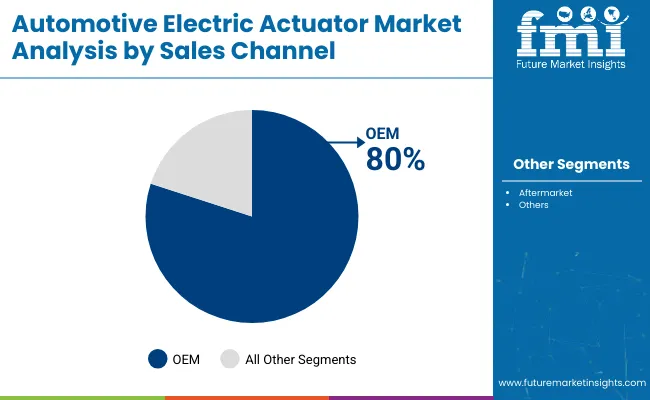

The automotive electric actuator market is primarily driven by linear actuators, passenger vehicles, and OEM channels, while throttle and brake applications account for high usage. Linear actuators hold 60% share due to applications in braking, HVAC, and door lock systems. Passenger vehicles contribute 60% of installations, highlighting strong adoption in cars, SUVs, and sedans. OEM sales dominate 80% of the market, reflecting manufacturer control over integration and quality.

Linear actuators account for 60% of the market, widely used in braking, HVAC, throttle, and door lock systems. Bosch, Denso, and Continental provide units with precise movement, high reliability, and compact design. Their efficiency and compatibility with passenger and commercial vehicles drive adoption. Technological improvements in torque control and response time enhance system performance. Passenger cars benefit from integration in comfort and safety systems, while light commercial vehicles use linear actuators in automated operations. Heavy commercial vehicles increasingly adopt them for braking and HVAC control.

Rotary actuators hold 40% of the market, used in headlights, mirrors, sunroof, and EGR systems. Valeo, Aisin, and Nidec supply rotary actuators with precise angular control and energy-efficient designs. They enable headlight adjustment, mirror positioning, and exhaust gas recirculation. Passenger vehicles benefit from mirror and lighting functions, while SUVs and commercial vehicles use them in sunroof and HVAC systems. Growth in EVs and connected vehicles supports demand. Rotary actuators complement linear actuators by offering rotational movement in compact assemblies, making them essential for specialized automotive applications.

Passenger vehicles hold 60% share, reflecting high demand in cars, SUVs, and sedans. Electric actuators enhance throttle control, braking, HVAC operation, and seat adjustment. Bosch, Denso, and Continental deliver solutions optimized for dashboard integration and electronic systems. SUVs account for 25% and sedans 15%, highlighting diverse usage in comfort and safety systems. Hatchbacks use compact actuators for space efficiency. Commercial vehicles account for 40%, with light commercial at 25% and heavy commercial at 15%, applied in braking, HVAC, and door lock systems to improve operational efficiency.

OEM sales cover 80% of the market, reflecting direct integration and quality control. Bosch, Denso, Continental, and Aisin collaborate with automakers to ensure compatibility, reliability, and system calibration. Aftermarket sales account for 20%, mainly for replacement or specialized upgrades. OEM dominance ensures consistent deployment across passenger and commercial vehicles, supports advanced electronic control systems, and enables integration with EVs and connected vehicle technologies. Direct manufacturer influence accelerates adoption, improves system reliability, and drives standardization across multiple automotive segments globally.

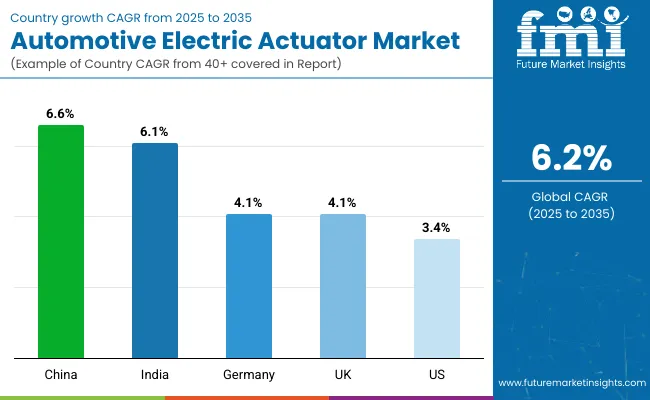

The global market is projected to grow at a CAGR of 4.1% from 2025 to 2035. China leads with 6.6%, exceeding the global rate by +61%, driven by large-scale vehicle automation and BRICS-led mobility initiatives. India follows at 6.1%, or +49% above the global benchmark, supported by ASEAN-linked collaborations and rising demand for advanced vehicle components.

Germany, the United Kingdom, and the global average all align at 4.1%, reflecting steady adoption across OECD markets through incremental integration of electric actuator systems. The United States records the slowest growth at 3.4%, -17% below the global level, influenced by established automotive infrastructure and gradual replacement cycles. The BRICS economies demonstrate higher adoption rates, while OECD markets advance at a measured, consistent pace.

The automotive electric actuator market in China is expanding at a CAGR of 6.6%, fueled by increasing production of electric and hybrid vehicles and growing adoption of advanced driver-assistance systems. Domestic manufacturers are focusing on high-precision actuators for throttle, brake, and steering systems to meet performance and safety standards.

Integration with vehicle control modules and AI-driven systems enhances operational efficiency and reliability. Government support for electric mobility and investments in automotive component manufacturing further stimulate market growth. The demand is concentrated in major automotive hubs including Shanghai, Guangzhou, and Chongqing.

The automotive electric actuator market in India is growing at a CAGR of 6.1%, supported by rising production of passenger vehicles and growing focus on electrification. Manufacturers are introducing cost-effective actuators for throttle control, braking, and steering systems to meet evolving vehicle standards. Adoption is driven by increased demand for vehicles with improved fuel efficiency and advanced driver-assistance features. Integration with vehicle electronic control units is becoming standard across mid-range and premium vehicles. Local suppliers are expanding production capacity to meet rising domestic demand.

The demand of automotive electric actuator in Germany is growing at a CAGR of 4.1%, influenced by the presence of a strong automotive sector and advanced vehicle technology adoption. German manufacturers are developing actuators with high precision, durability, and integration for autonomous and semi-autonomous vehicles. The market is also driven by fleet operators upgrading vehicles with enhanced braking, steering, and throttle actuators. Energy-efficient actuator designs that improve overall vehicle performance are increasingly deployed. Germany’s focus on automotive innovation ensures steady demand for advanced electric actuators.

The automotive electric actuator industry in the United Kingdom is expanding at a CAGR of 4.1%, driven by the adoption of electric vehicles and modern driver-assistance systems. Manufacturers are providing actuators optimized for braking, throttle, and steering systems, supporting improved vehicle control. Integration with electronic control units enhances safety and performance. Fleet operators are also incorporating actuators to optimize commercial vehicle efficiency and reduce operational costs. Growth is supported by the UK government’s initiatives to support electrification and smart vehicle technologies.

The demand of automotive electric actuator in the United States is growing at a CAGR of 3.4%, influenced by the expansion of electric and hybrid vehicle production. Advanced braking, steering, and throttle actuators are increasingly standard in mid-range and premium vehicles. Fleet operators adopt actuators to improve vehicle efficiency, reduce maintenance downtime, and enhance safety. Manufacturers focus on actuator designs that integrate with electronic control units for better performance and predictive diagnostics. Continuous technological upgrades in vehicles support the gradual expansion of the actuator market.

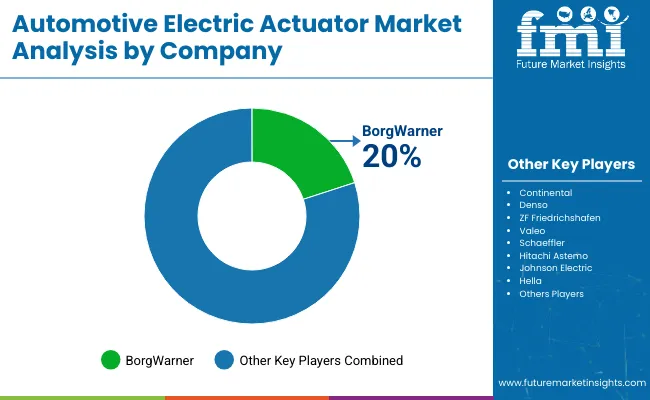

The market is shaped by several established players and emerging companies, each employing strategies to strengthen their market presence. BorgWarner focuses on expanding its product portfolio with high-performance actuators for throttle control and transmission systems, while Continental invests in research and development to improve precision and durability across a range of actuator applications. Denso emphasizes collaborations with automakers to integrate electric actuators in hybrid and electric vehicles, enhancing efficiency and reliability.

Hella has recently launched compact actuator models for climate control and door systems, highlighting its approach of addressing specific vehicle needs. Hitachi Astemo develops actuators for braking and steering systems, combining quality with wide compatibility to attract global automotive clients.

Other key players, including Johnson Electric, Schaeffler, Valeo, and ZF Friedrichshafen, are actively enhancing their offerings through product upgrades and strategic partnerships. Johnson Electric focuses on miniaturized actuators for vehicle comfort systems, while Schaeffler invests in actuators for powertrain applications.

Valeo has introduced modular actuator designs to simplify assembly and maintenance, and ZF Friedrichshafen emphasizes actuator solutions for automated transmission and chassis systems. Collectively, these companies strengthen their presence through targeted product launches, R&D investments, and collaborations with vehicle manufacturers, ensuring they remain competitive in the evolving market.

| Report Attributes | Details |

| Market Size (2025) | USD 27.4 billion |

| Projected Market Size (2035) | USD 50 billion |

| CAGR (2025 to 2035) | 6.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Types Analyzed (Segment 1) | Linear actuators, Rotary actuators |

| Applications Analyzed (Segment 2) | Throttle, Brake, HVAC, Headlight, EGR, Door Lock, Power Seat, Sunroof, Mirror |

| Vehicle Types Analyzed (Segment 3) | Passenger Vehicles (Hatchback, Sedan, SUV), Commercial Vehicles (Light Commercial Vehicles, Heavy Commercial Vehicles) |

| Sales Channels Analyzed (Segment 4) | OEM, Aftermarket |

| Regions Covered | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, China, Japan, India, Brazil, Mexico, UAE, South Africa |

| Key Players Influencing the Market | BorgWarner, Continental, Denso, ZF Friedrichshafen, Valeo, Schaeffler, Hitachi Astemo, Johnson Electric, Hella |

| Additional Attributes | Dollar sales by actuator type and vehicle application, demand dynamics across passenger, commercial, and electric vehicles, regional adoption trends, innovation in high-torque, compact, and energy-efficient designs, environmental impact of emissions reduction, and emerging uses in ADAS and electric powertrains. |

The market is expected to reach approximately 50 billion USD by 2035, growing at a CAGR of 6.2%.

Linear actuators lead with a 60% market share, primarily used in braking, HVAC, and door lock systems.

OEM channels account for 80% of the automotive electric actuator market.

Automotive electric actuator industry In China is growing at a CAGR of 6.6%.

BorgWarner holds a 20% share, making it the market leader in electric actuators.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Electric Actuators Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electric Coolant Valve Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electric Drivetrain Components Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electric Water Pump for Engine Cooling Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electric Vacuum Pump Market

Automotive Piezoelectric Fuel Injectors Market Size and Share Forecast Outlook 2025 to 2035

Electric Linear Actuator Market Trends – Growth & Forecast 2025 to 2035

Automotive Thermoelectric Generator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Lighting Actuators Market Size and Share Forecast Outlook 2025 to 2035

Automotive High Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA