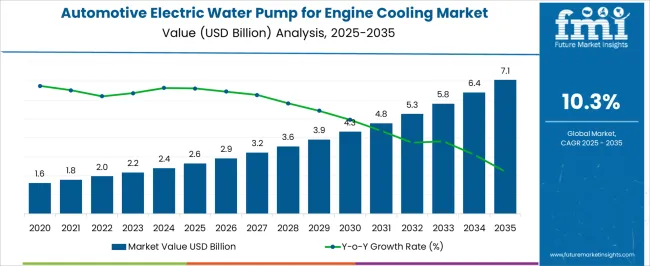

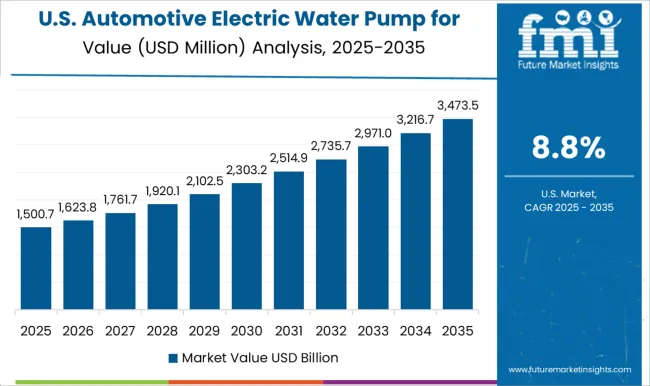

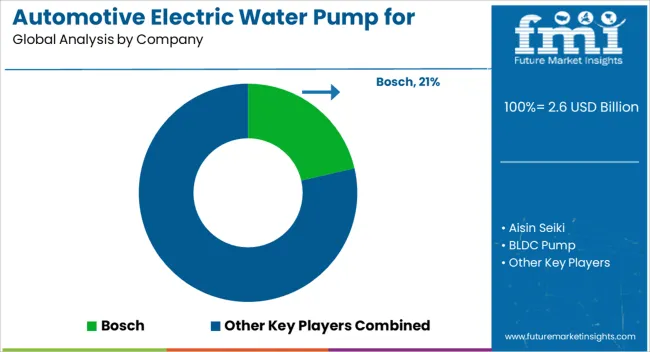

The automotive electric water pump for engine cooling market is estimated to be valued at USD 2.6 billion in 2025 and is projected to reach USD 7.1 billion by 2035, registering a compound annual growth rate (CAGR) of 10.3% over the forecast period. Between 2025 and 2030, the market is expected to rise from USD 2.6 billion to USD 4.3 billion, driven by increasing demand for fuel-efficient and electric vehicles, as well as the need for improved thermal management systems. Year-on-year analysis shows strong growth, with values reaching USD 2.9 billion in 2026 and USD 3.2 billion in 2027, supported by rising adoption of electric and hybrid vehicles.

By 2028, the market is forecasted to reach USD 3.6 billion, advancing to USD 3.9 billion in 2029 and USD 4.3 billion by 2030. Growth will be further fueled by advancements in pump designs for better energy efficiency and performance, as well as regulatory pressures for reduced emissions and improved vehicle efficiency. These dynamics position electric water pumps as a key technology for the automotive industry's transition towards cleaner, more efficient propulsion systems.

Automotive thermal engineers evaluate electric water pump specifications based on flow rate variability, power consumption efficiency, and integration complexity when designing cooling circuits for turbocharged engines, hybrid battery thermal management, and cabin heating optimization systems. Component selection involves analyzing brushless motor reliability, impeller cavitation resistance, and electronic control unit sophistication while considering installation space constraints, noise vibration harshness characteristics, and diagnostic capability requirements necessary for modern vehicle integration. Engineering decisions balance system cost increases against fuel economy improvements, considering coolant temperature control precision, engine warm-up acceleration, and thermal shock reduction benefits that justify electrification investment through measurable efficiency gains.

Manufacturing processes require precision motor assembly, impeller balancing operations, and electronic control integration that achieve automotive durability standards while maintaining cost competitiveness throughout high-volume production environments serving diverse vehicle platforms. Production coordination involves managing magnetic material sourcing, plastic housing molding, and controller programming while addressing electromagnetic compatibility requirements, environmental protection standards, and quality validation protocols specific to automotive component manufacturing. Quality assurance encompasses endurance testing, thermal cycling validation, and vibration resistance verification that ensure component reliability while meeting automotive supplier certification requirements and warranty expectations.

System integration involves powertrain engineers, thermal management specialists, and vehicle electronics teams collaborating to optimize electric water pump deployment that balances thermal control effectiveness with electrical system loading while addressing specific vehicle architecture requirements and performance objectives. Implementation processes encompass cooling system redesign, control strategy development, and diagnostic integration while coordinating with engine calibration, transmission cooling, and climate control systems. Validation programs include vehicle-level testing, durability assessment, and fuel economy verification that confirm system benefits while ensuring operational reliability throughout diverse driving conditions and environmental exposures.

| Metric | Value |

|---|---|

| Automotive Electric Water Pump for Engine Cooling Market Estimated Value in (2025 E) | USD 2.6 billion |

| Automotive Electric Water Pump for Engine Cooling Market Forecast Value in (2035 F) | USD 7.1 billion |

| Forecast CAGR (2025 to 2035) | 10.3% |

The market for automotive electric water pumps used in engine cooling is expanding rapidly, fueled by the increasing demand for efficient thermal management in vehicles. Enhanced engine cooling systems have become critical as manufacturers strive to improve fuel efficiency and reduce emissions.

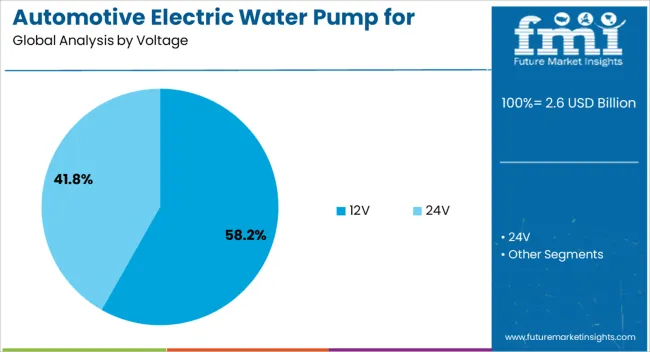

Advances in electric pump technology have allowed for better control of coolant flow, reducing energy consumption compared to traditional mechanical pumps. Growing adoption of 12V electric water pumps has been driven by their compatibility with most passenger cars and their ability to integrate seamlessly into existing vehicle architectures.

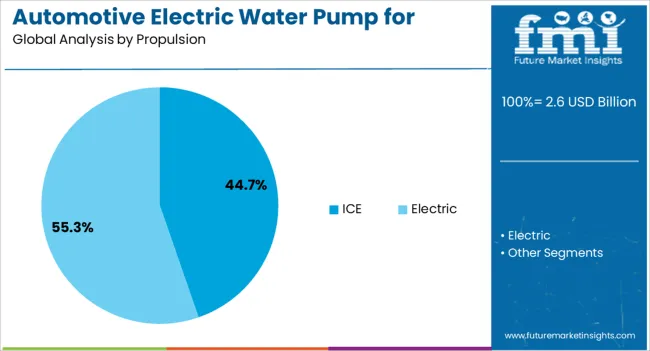

Internal combustion engine remains the dominant propulsion type, supporting the continued demand for advanced cooling solutions in conventional vehicles. Additionally, rising vehicle production volumes, especially in passenger cars, have propelled market growth. Future expansion is expected to be supported by the gradual integration of hybrid systems and stricter environmental regulations that emphasize engine efficiency and emission control.

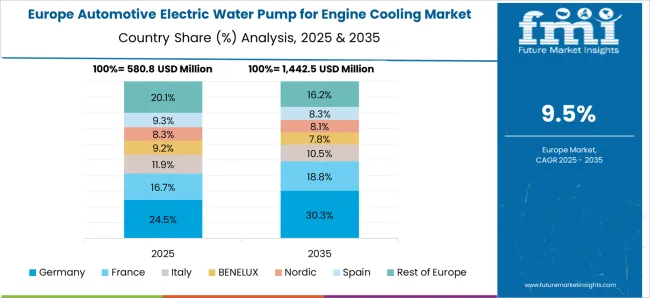

The automotive electric water pump for engine cooling market is segmented by voltage, propulsion, vehicle, sales channel, and geographic regions. By voltage, the automotive electric water pump for engine cooling market is divided into 12V and 24V. In terms of propulsion, the automotive electric water pump for engine cooling market is classified into ICE and Electric. Based on the vehicle, the automotive electric water pump for engine cooling market is segmented into Passenger cars and Commercial vehicles. By sales channel, the automotive electric water pump for engine cooling market is segmented into OEM and Aftermarket. Regionally, the automotive electric water pump for engine cooling industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 12V voltage segment is projected to capture 58.2% of the market revenue in 2025, sustaining its lead among voltage categories. This prevalence is primarily due to the widespread use of 12V electrical systems in most passenger vehicles globally.

The segment benefits from mature technology, cost efficiency, and ease of integration with existing vehicle electrical architectures. 12V electric water pumps offer reliable performance while minimizing power consumption, making them suitable for both legacy internal combustion engines and mild hybrid setups.

Their compatibility with standard automotive electrical systems ensures broad market acceptance, and improvements in pump efficiency continue to enhance their value proposition. Given the vast installed base of 12V systems, this segment is expected to maintain its dominant position.

The Internal Combustion Engine propulsion segment is expected to represent 44.7% of the market revenue in 2025, holding its position as the largest propulsion type. Despite the growth of electric and hybrid vehicles, ICE-powered vehicles continue to dominate global vehicle fleets, sustaining demand for engine cooling solutions like electric water pumps.

Enhanced cooling systems have become necessary to meet stringent emission regulations and improve engine performance in ICE vehicles. The segment’s growth is supported by ongoing investments in optimizing combustion efficiency and extending engine life.

As the global market transitions gradually towards electrification, ICE vehicles will continue to require advanced cooling technologies for the foreseeable future, ensuring sustained demand for electric water pumps designed for this propulsion type.

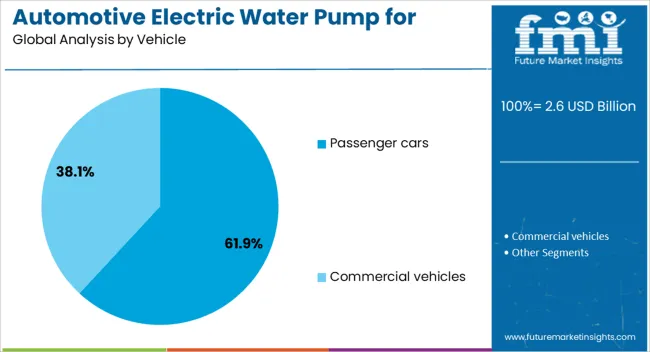

The Passenger Cars segment is projected to hold 61.9% of the market revenue in 2025, maintaining its status as the leading vehicle category. This dominance is linked to the high production and sales volume of passenger cars worldwide.

Consumer demand for vehicles with better fuel economy, reduced emissions, and improved thermal management has driven the adoption of electric water pumps in this segment. Manufacturers have focused on integrating advanced cooling components into passenger car models to enhance engine efficiency and comply with regulatory standards.

The growing preference for compact and mid-size cars, which commonly use 12V electrical systems and ICE propulsion, further supports this segment's growth. As passenger cars continue to evolve with improved powertrain technologies, the demand for efficient cooling solutions like automotive electric water pumps is expected to increase.

The automotive electric water pump market is driven by increasing demand for efficient engine cooling systems and the rise of electric and hybrid vehicles. Opportunities in the growing EV market and emerging trends in smart engine management are reshaping the market. However, high costs and installation complexity may limit adoption. By 2025, overcoming these challenges through cost-effective solutions and improved integration will be key to expanding the market.

The automotive electric water pump for engine cooling market is growing due to the increasing demand for efficient and reliable engine cooling solutions. Electric water pumps offer better fuel efficiency, reduced emissions, and enhanced performance compared to mechanical pumps, driving their adoption in modern vehicles. With stricter emission standards and a focus on improving engine performance, the market for these pumps is expected to expand. By 2025, this demand will continue to grow as automakers look for advanced, energy-efficient solutions.

Opportunities in the automotive electric water pump market are growing with the expansion of electric and hybrid vehicle adoption. These vehicles require optimized cooling systems to manage the heat generated by their battery systems and electric motors. Electric water pumps are ideal for such systems, offering precise control and energy efficiency. By 2025, the increasing production of electric and hybrid vehicles will create significant growth opportunities for manufacturers of electric water pumps in automotive applications.

Emerging trends in the automotive electric water pump market include the integration of these pumps with smart engine management systems. As vehicles become more connected and data-driven, there is growing interest in incorporating sensors and control systems that optimize cooling pump performance in real-time. These advancements allow for improved efficiency and a more responsive engine cooling process. By 2025, this trend of intelligent engine management is expected to become more prevalent, driving demand for high-tech water pumps.

Despite growth, challenges related to high initial costs and complex installation persist in the automotive electric water pump market. While these pumps provide superior performance, their higher price compared to traditional mechanical pumps can be a barrier for widespread adoption, particularly in lower-cost vehicle segments. Additionally, the installation of electric water pumps requires more advanced engineering and integration into existing systems. By 2025, addressing these cost and complexity challenges will be crucial for increasing market penetration.

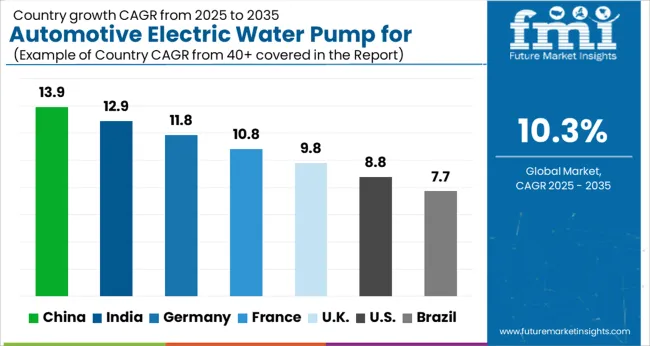

The global automotive electric water pump for engine cooling market is projected to grow at a 10.3% CAGR from 2025 to 2035. China leads with a growth rate of 13.9%, followed by India at 12.9%, and Germany at 11.8%. The United Kingdom records a growth rate of 9.8%, while the United States shows the slowest growth at 8.8%. These varying growth rates are driven by factors such as increasing demand for electric vehicles (EVs), growing focus on fuel efficiency and performance, and advancements in engine cooling technologies. Emerging markets like China and India are experiencing higher growth due to rapid automotive sector expansion, rising consumer demand for energy-efficient and performance-enhancing technologies, while more mature markets like the USA and the UK experience steady growth driven by EV adoption, stricter emission regulations, and the push for advanced cooling solutions in traditional vehicles. This report includes insights on 40+ countries; the top markets are shown here for reference.

The automotive electric water pump for engine cooling market in China is growing at a rapid pace, with a projected CAGR of 13.9%. China’s booming automotive industry, including both internal combustion engine (ICE) vehicles and electric vehicles (EVs), is driving significant demand for advanced cooling solutions. The growing focus on fuel efficiency, performance, and meeting stringent emission standards further accelerates the need for electric water pumps in vehicles. Additionally, China’s rising adoption of EVs and investments in automotive technologies are fueling the demand for advanced cooling systems that improve vehicle efficiency and engine longevity.

The automotive electric water pump for engine cooling market in India is projected to grow at a CAGR of 12.9%. India’s rapidly expanding automotive sector, coupled with rising vehicle production and consumer demand for more fuel-efficient vehicles, is significantly contributing to market growth. As India embraces EV adoption, the demand for advanced engine cooling technologies, including electric water pumps, is increasing. Additionally, the focus on improving vehicle performance, complying with new emission regulations, and enhancing engine efficiency is further boosting the market for electric water pumps in the country.

The automotive electric water pump for engine cooling market in Germany is projected to grow at a CAGR of 11.8%. Germany’s well-established automotive sector, particularly in the premium vehicle and EV segments, continues to drive demand for advanced engine cooling solutions. The country’s focus on reducing fuel consumption, lowering emissions, and improving vehicle performance is significantly contributing to the adoption of electric water pumps. Additionally, Germany’s leadership in automotive technology innovation, along with rising EV production, further accelerates the demand for electric water pumps, which are essential for efficient and reliable engine cooling.

The automotive electric water pump for engine cooling market in the United Kingdom is projected to grow at a CAGR of 9.8%. The UK’s growing automotive sector, with a rising focus on EVs and fuel-efficient vehicles, is driving the adoption of electric water pumps for engine cooling. The increasing demand for high-performance and energy-efficient vehicles, particularly in response to stricter emission standards, continues to propel market growth. Additionally, the UK’s investments in sustainable automotive technologies and renewable energy integration in vehicles further contribute to the adoption of electric water pumps.

The automotive electric water pump for engine cooling market in the United States is expected to grow at a CAGR of 8.8%. The USA market is driven by the growing demand for high-performance, fuel-efficient, and low-emission vehicles. The increasing adoption of EVs, alongside the automotive industry's shift toward electric and hybrid vehicles, is significantly contributing to the market for electric water pumps. Additionally, the USA focus on reducing carbon emissions and improving vehicle performance through advanced cooling solutions accelerates the adoption of electric water pumps in both traditional and electric vehicles.

The automotive electric water pump for engine cooling market is expanding rapidly as the global automotive industry transitions toward electrification, higher fuel efficiency, and thermal management optimization. Bosch GmbH and Aisin Seiki Co. Ltd. (Aisin Corporation) lead the market with advanced electric water pump technologies that deliver precise cooling control, reduced parasitic losses, and improved engine performance. Their systems are widely integrated into both internal combustion and hybrid powertrains to enhance efficiency and durability.

Continental AG and Valeo SA contribute significantly by developing intelligent, electronically controlled pumps designed to manage variable cooling demands in next-generation vehicles. These solutions support the growing adoption of EVs and hybrids where thermal regulation of batteries and power electronics is critical. Carter Fuel Systems LLC and GMB Corporation serve OEM and aftermarket segments with cost-effective, high-reliability electric pump solutions tailored for passenger and light commercial vehicles.

Rheinmetall AG, Schaeffler AG, and Gates Corporation focus on integrating pump technology with auxiliary drive and thermal management systems, offering compact, energy-efficient modules for optimized vehicle architectures. BLDC Pump Co. Ltd. brings expertise in brushless DC motor-driven designs, enhancing efficiency and longevity. The market’s growth is propelled by emission regulations, electrification, and demand for advanced cooling solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.6 Billion |

| Voltage | 12V and 24V |

| Propulsion | ICE and Electric |

| Vehicle | Passenger cars and Commercial vehicles |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled |

Bosch GmbH, Aisin Seiki Co. Ltd. (Aisin Corporation), BLDC Pump Co. Ltd., Carter Fuel Systems LLC, Continental AG, Gates Corporation, GMB Corporation, Rheinmetall AG, Schaeffler AG, Valeo SA |

| Additional Attributes | Dollar sales by pump type and application, demand dynamics across passenger vehicles, commercial vehicles, and electric vehicles, regional trends in automotive electric water pump adoption, innovation in energy-efficient and variable-speed pump technologies, impact of regulatory standards on emissions and performance, and emerging use cases in hybrid and electric vehicle cooling systems. |

The global automotive electric water pump for engine cooling market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the automotive electric water pump for engine cooling market is projected to reach USD 7.1 billion by 2035.

The automotive electric water pump for engine cooling market is expected to grow at a 10.3% CAGR between 2025 and 2035.

The key product types in automotive electric water pump for engine cooling market are 12v and 24v.

In terms of propulsion, ice segment to command 44.7% share in the automotive electric water pump for engine cooling market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA