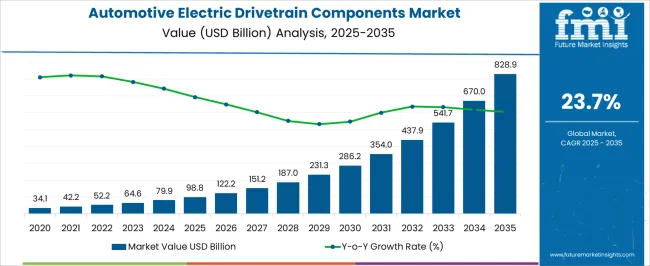

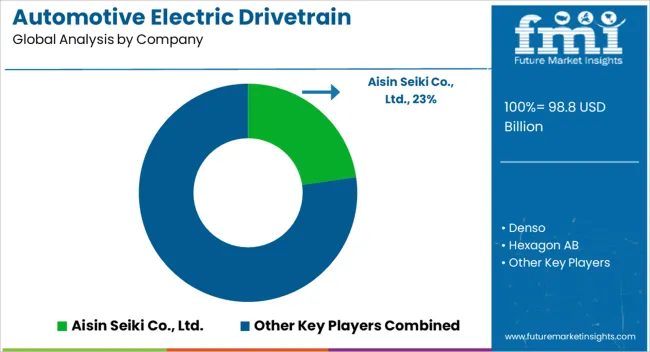

The Automotive Electric Drivetrain Components Market is estimated to be valued at USD 98.8 billion in 2025 and is projected to reach USD 828.9 billion by 2035, registering a compound annual growth rate (CAGR) of 23.7% over the forecast period. The steep acceleration in value progression from USD 98.8 billion to over USD 354.0 billion by 2031 reflects an inflection point where multiple technologies begin to converge in commercial adoption. Battery management systems, power electronics, and electric motors are expected to dominate contribution, with efficiency and integration playing a decisive role in market scaling.

Battery technology holds the largest share, as it directly influences performance, driving range, and cost of ownership. Innovations in high energy density cells and solid-state alternatives are likely to account for disproportionate growth within the early phase of adoption. Power electronics, including inverters and converters, also form a critical pillar since their role in energy efficiency and thermal management determines system reliability. Electric motors, particularly permanent magnet synchronous motors and induction motors, are anticipated to witness strong contribution growth as OEMs optimize drivetrain design. By 2035, advanced thermal management, regenerative braking systems, and software-driven optimization will add layers of value. The contribution balance will thus evolve, with batteries leading, electronics ensuring efficiency, and motors anchoring performance in the overall technology mix.

| Metric | Value |

|---|---|

| Automotive Electric Drivetrain Components Market Estimated Value in (2025 E) | USD 98.8 billion |

| Automotive Electric Drivetrain Components Market Forecast Value in (2035 F) | USD 828.9 billion |

| Forecast CAGR (2025 to 2035) | 23.7% |

The increasing regulatory push toward decarbonization and stringent emission standards across North America, Europe, and Asia-Pacific has placed electric drivetrains at the center of OEM strategies. Market expansion is being supported by advancements in lithium-ion cell chemistry, wide bandgap semiconductors, and scalable electric drive units, which are enabling enhanced energy efficiency and range.

Strategic collaborations between battery manufacturers, semiconductor companies, and tier-one suppliers are facilitating the development of modular drivetrain platforms with improved thermal management and integrated control systems. Furthermore, rising investments in EV manufacturing ecosystems and charging infrastructure have accelerated the deployment of electric powertrains in both passenger and commercial vehicles.

With cost parity gradually improving and performance exceeding traditional ICE benchmarks in several vehicle classes, the future outlook remains strongly positive. Integration of digital diagnostics and predictive maintenance functionalities within drivetrain components is also expected to contribute to long-term adoption and performance optimization.

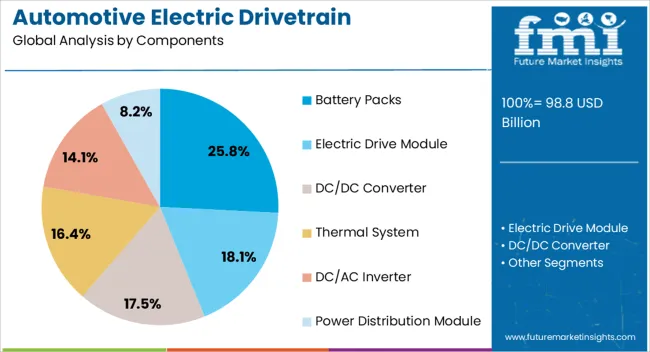

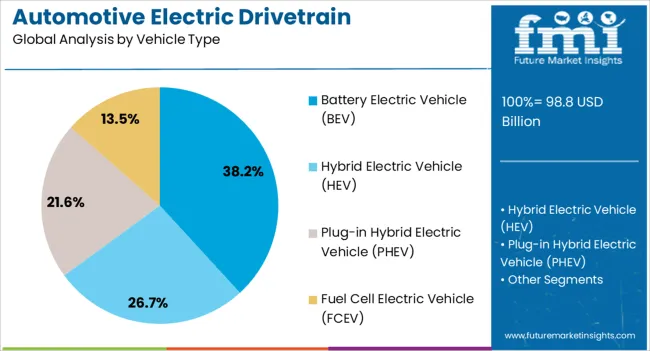

The automotive electric drivetrain components market is segmented by components, vehicle type, sales channel, and geographic regions. By components, the automotive electric drivetrain components market is divided into Battery Packs, Electric Drive Module, DC/DC Converter, Thermal System, DC/AC Inverter, and Power Distribution Module. In terms of vehicle type, the automotive electric drivetrain components market is classified into Battery Electric Vehicle (BEV), Hybrid Electric Vehicle (HEV), Plug-in Hybrid Electric Vehicle (PHEV), and Fuel Cell Electric Vehicle (FCEV).

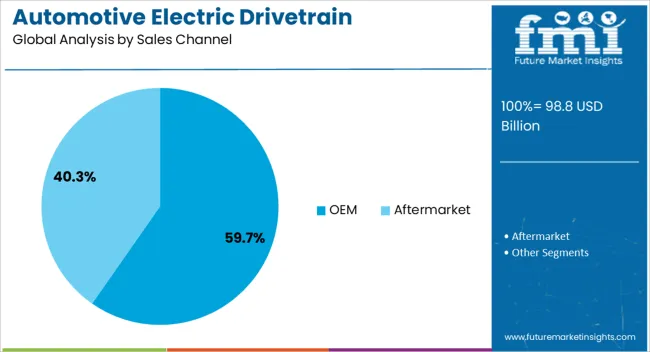

Based on sales channel, the automotive electric drivetrain components market is segmented into OEM and Aftermarket. Regionally, the automotive electric drivetrain components industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Battery packs are expected to account for 25.8% of the total revenue share in the automotive electric drivetrain components market in 2025, making them a leading component segment. This position has been supported by their critical role in determining vehicle range, performance, and energy density.

Ongoing enhancements have influenced the segment’s growth in cell-to-pack integration, thermal control mechanisms, and battery management systems that ensure operational safety and efficiency. Increasing consumer demand for longer driving ranges and faster charging capabilities has driven the need for high-capacity battery configurations that can be software-optimized for various driving conditions.

The widespread adoption of cylindrical, prismatic, and pouch cells in different vehicle classes has further reinforced the centrality of battery packs in electric drivetrain configurations. In addition, supply chain localization and strategic partnerships in battery sourcing have allowed OEMs to ensure continuity in production while improving the lifecycle value of battery systems through recycling and second-life applications.

Battery electric vehicles are projected to hold 38.2% of the total revenue share in the automotive electric drivetrain components market in 2025. The prominence of this vehicle type has been driven by the complete reliance on electric drivetrain components for propulsion, thereby amplifying demand across battery systems, traction motors, and inverters.

BEVs benefit from fewer mechanical complexities and lower operational costs compared to hybrid or plug-in hybrid alternatives, encouraging greater consumer and fleet adoption. Favorable government incentives have also shaped the growth of this segment, expanding EV model availability and ongoing improvements in range and charging infrastructure.

The need for compact, lightweight, and high-efficiency drivetrain modules in BEVs has led to the integration of advanced software and digital control systems that optimize performance. As global vehicle platforms are increasingly designed around electric-first architectures, the demand for specialized and scalable electric drivetrain components in BEVs is expected to continue rising.

The OEM sales channel is projected to capture 59.7% of the revenue share in the automotive electric drivetrain components market in 2025, representing the dominant mode of component distribution. This leadership has been reinforced by the vertical integration strategies of major automotive manufacturers that seek to maintain control over critical powertrain technologies.

OEMs have been increasingly investing in in-house electric drivetrain design and manufacturing capabilities to ensure differentiation in vehicle performance, durability, and efficiency. The development of proprietary drivetrain platforms tailored for specific EV models has enabled better packaging, system integration, and energy optimization.

Furthermore, long-term agreements and joint ventures between OEMs and component suppliers have ensured steady supply chains and early access to next-generation materials and designs. The preference for OEM-sourced drivetrain components has also been supported by quality assurance protocols, alignment with vehicle control software, and compatibility with future upgrade paths, all of which enhance product reliability and customer satisfaction.

The market has been shaped by the rising transition toward electrified mobility. Components such as motors, inverters, controllers, transmission systems, and battery management solutions have been developed to enhance vehicle efficiency and performance. Emphasis has been placed on reducing power losses, improving torque density, and extending driving range. Government policies favoring zero-emission vehicles and continuous advancements in materials and design have strengthened demand. The market has also been influenced by supply chain developments and integration of smart monitoring technologies.

The growing adoption of electric vehicles has been a primary driver for the expansion of drivetrain components. Automotive manufacturers have prioritized the development of energy-efficient motors, advanced inverters, and compact gear systems to achieve higher performance and longer driving range. Incentives and regulatory frameworks promoting zero-emission transportation have supported investment in drivetrain technologies. The demand for enhanced torque delivery, quicker acceleration, and smooth driving experience has accelerated innovation in permanent magnet motors and multi-speed transmission designs. The shift from conventional internal combustion vehicles to battery-powered vehicles has elevated the importance of robust drivetrain systems, making them essential for the broader electrification trend within the automotive sector.

Innovation in materials, control systems, and component design has significantly influenced the market. Lightweight alloys, advanced composites, and new cooling technologies have been introduced to improve drivetrain efficiency and durability. Inverters have been redesigned with silicon carbide and gallium nitride semiconductors, enabling higher voltage operation with reduced thermal losses. Motor designs have become more compact while delivering higher power density, supporting both passenger cars and heavy commercial electric vehicles. Battery management integration with drivetrain components has further optimized energy distribution and thermal regulation. These technological advancements have not only improved vehicle efficiency but also reduced total cost of ownership, reinforcing the appeal of electric drivetrain systems among manufacturers and consumers.

The supply chain for drivetrain components has undergone significant restructuring due to rising global demand. Production of rare earth materials used in permanent magnet motors has been strategically diversified to reduce dependence on specific regions. Localized manufacturing facilities have been established to ensure component availability and reduce lead times for automakers. Collaborative partnerships between automakers and component suppliers have facilitated co-development of optimized solutions. Standardization initiatives have also been encouraged to improve interoperability and reduce system complexity. While shortages of semiconductors and raw materials have created occasional challenges, investment in supply chain resilience and manufacturing automation has strengthened the industry’s ability to meet rising demand effectively.

The integration of digital monitoring and smart control technologies has become a critical factor shaping the drivetrain components market. Intelligent sensors and connected systems have been embedded in motors, inverters, and controllers to enable real-time performance monitoring and predictive maintenance. Advanced software algorithms have been developed to enhance torque distribution, regenerative braking, and energy optimization. Cloud-based connectivity has also allowed manufacturers to remotely update drivetrain control software, extending component lifespan and improving efficiency over time. These smart features have strengthened the reliability and adaptability of electric drivetrain systems, ensuring better performance and smoother operation across different driving conditions while meeting evolving consumer expectations.

| Countries | CAGR |

|---|---|

| China | 32.0% |

| India | 29.6% |

| Germany | 27.3% |

| France | 24.9% |

| UK | 22.5% |

| USA | 20.1% |

| Brazil | 17.8% |

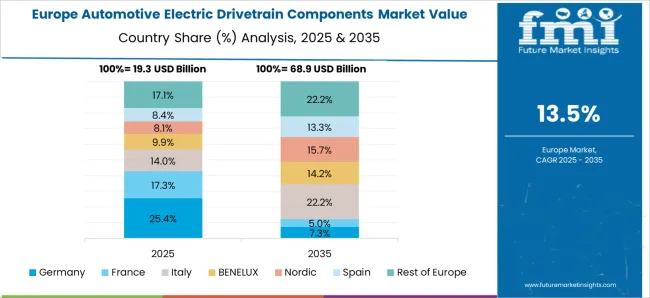

The market is projected to expand at a CAGR of 23.7% between 2025 and 2035, supported by advancements in electrification, supply chain localization, and performance efficiency improvements. China, with a 32.0% CAGR, dominates through large-scale EV production and integration of high-efficiency drivetrain modules. India, growing at 29.6%, scales rapidly by emphasizing cost-effective manufacturing and government-led EV adoption initiatives. Germany, at 27.3%, innovates through precision engineering, strong R&D investments, and advanced power electronics integration. The UK, with 22.5% growth, progresses by focusing on lightweight drivetrain technologies and expanding EV assembly facilities. The USA, recording a 20.1% CAGR, strengthens its position through robust OEM partnerships and demand for long-range EVs, though supply chain complexities slightly limit speed compared with Asia. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is estimated to advance at a CAGR of 32.0%, supported by strong adoption of electric vehicles across passenger and commercial segments. Government policies promoting clean mobility and incentives for EV buyers have created a favorable environment for drivetrain innovation. Domestic manufacturers are investing in advanced power electronics, motors, and transmission systems to strengthen competitiveness. Partnerships between local automakers and global technology suppliers are enhancing component quality and efficiency. Continuous investment in battery integration and lightweight materials further accelerates drivetrain advancements. With the country leading in EV sales globally, China remains the primary hub for drivetrain production and innovation, offering a significant foundation for future market dominance.

India market is projected to grow at a CAGR of 29.6%, fueled by rising EV penetration across urban and semi-urban areas. Government programs such as FAME and supportive regulatory measures are encouraging the production and use of electric vehicles. Domestic component manufacturers are increasing investments in motor and power electronics to reduce import dependence. Affordability of electric two-wheelers and three-wheelers is creating demand for compact drivetrain solutions, while passenger EV adoption is gradually increasing. Collaborations between Indian startups and global technology providers are supporting localized innovations. With a rapidly growing automotive base, India presents significant opportunities for drivetrain component development tailored to local mobility needs.

Germany is expected to expand at a CAGR of 27.3%, driven by strong investments in high-performance EV technology. German automakers are prioritizing electrification strategies with advanced drivetrain systems for premium and mass-market vehicles. Research and development in high-efficiency motors, inverters, and integrated transmission systems strengthen Germany’s role as an innovation leader. Growing demand for long-range EVs is influencing drivetrain optimization for improved efficiency and durability. Collaborations between automotive giants and engineering firms accelerate advancements in modular drivetrain platforms. With its strong automotive manufacturing base, Germany continues to set benchmarks in quality and performance, supporting consistent growth in drivetrain demand.

The United Kingdom is forecast to record a CAGR of 22.5%, supported by policy frameworks promoting clean transportation. Government commitments to phase out internal combustion vehicles have accelerated investments in EV infrastructure and drivetrain research. Domestic and international automakers are focusing on expanding local production capabilities for motors, controllers, and transmission systems. Increasing adoption of electric passenger vehicles and fleet electrification programs strengthens drivetrain demand. Innovation in lightweight and modular drivetrain technologies helps address consumer concerns related to efficiency and cost. With supportive regulations and growing consumer acceptance of EVs, the UK market is positioned for substantial growth in drivetrain components.

The United States market is projected to grow at a CAGR of 20.1%, supported by rising investments in EV adoption and clean mobility initiatives. Federal and state-level incentives for EV purchases and manufacturing boost drivetrain component demand. Leading automakers are expanding production capacity for motors, inverters, and transmission systems to strengthen domestic supply chains. Technological innovations in silicon carbide power electronics and integrated drive units enhance drivetrain performance and efficiency. The growth of charging infrastructure and increasing consumer confidence in EVs further drive adoption. With a strong focus on technological leadership, the USA remains a key hub for drivetrain innovation and commercialization.

The market is influenced by companies that deliver advanced propulsion technologies, focusing on efficiency, durability, and electrification integration. Aisin Seiki Co., Ltd. and Denso hold strong positions due to their wide-ranging component portfolios that support hybrid and fully electric platforms. Their engineering expertise in transmission systems, inverters, and motors plays a vital role in strengthening the performance of electric drivetrains. Hexagon AB and Valeo enhance market growth through their digitalization and electrification strategies. Hexagon contributes with simulation and design technologies that improve drivetrain efficiency, while Valeo emphasizes electric motors, e-axles, and thermal management solutions tailored for battery electric vehicles. BorgWarner, ZF, and Schaeffler AG demonstrate technological depth with scalable drive modules, integrated electric axles, and gear systems optimized for reduced energy losses in vehicle operation. UNIVANCE Corporation strengthens its position with drivetrain components that address compact design requirements, enabling lighter and more efficient electric powertrains. Together, these firms are establishing a market framework where traditional mechanical expertise merges with electronics and digital innovation. Their developments are shaping the transition of mobility toward sustainable electric propulsion systems with greater adaptability across passenger and commercial vehicle segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 98.8 Billion |

| Components | Battery Packs, Electric Drive Module, DC/DC Converter, Thermal System, DC/AC Inverter, and Power Distribution Module |

| Vehicle Type | Battery Electric Vehicle (BEV), Hybrid Electric Vehicle (HEV), Plug-in Hybrid Electric Vehicle (PHEV), and Fuel Cell Electric Vehicle (FCEV) |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aisin Seiki Co., Ltd., Denso, Hexagon AB, VALEO, BorgWarner, ZF, Schaeffler AG, and UNIVANCE Corporation |

| Additional Attributes | Dollar sales by component type and vehicle category, demand dynamics across passenger and commercial electric vehicles, regional trends in electrification adoption, innovation in efficiency, thermal management, and lightweight design, environmental impact of battery integration and material sourcing, and emerging use cases in next-generation mobility and autonomous electric platforms. |

The global automotive electric drivetrain components market is estimated to be valued at USD 98.8 billion in 2025.

The market size for the automotive electric drivetrain components market is projected to reach USD 828.9 billion by 2035.

The automotive electric drivetrain components market is expected to grow at a 23.7% CAGR between 2025 and 2035.

The key product types in automotive electric drivetrain components market are battery packs, electric drive module, dc/dc converter, thermal system, dc/ac inverter and power distribution module.

In terms of vehicle type, battery electric vehicle (bev) segment to command 38.2% share in the automotive electric drivetrain components market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA