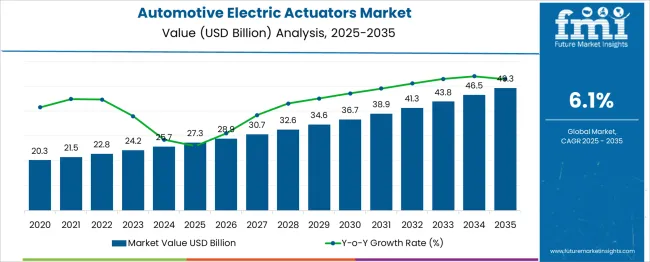

The Automotive Electric Actuators Market is estimated to be valued at USD 27.3 billion in 2025 and is projected to reach USD 49.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period. Examining the five-year growth outlook from 2020 to 2025, the market expands from USD 20.3 billion to USD 25.7 billion, contributing an incremental gain of USD 5.4 billion. This phase is primarily driven by rising demand for electric actuators in passenger and commercial vehicles due to increased adoption of electrification, automation, and advanced driver assistance systems (ADAS). Year-on-year values such as USD 21.5 billion in 2021, USD 22.8 billion in 2022, USD 24.2 billion in 2023, and USD 25.7 billion in 2024 indicate steady growth fueled by technological advancements in actuator precision, efficiency, and integration capabilities.

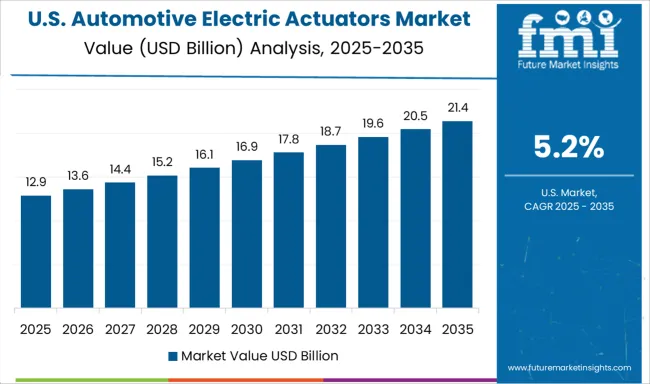

From 2026 to 2030, the market advances from USD 27.3 billion to USD 36.7 billion, propelled by the growing use of electric actuators in powertrain management, braking systems, and body control modules. Enhanced energy efficiency requirements and stringent emission regulations further stimulate market expansion. The rise of electric vehicles (EVs) and hybrid electric vehicles (HEVs) significantly boosts demand during this period. Between 2031 and 2035, the market accelerates from USD 38.9 billion to USD 49.3 billion, driven by increasing integration of electric actuators in autonomous vehicle technologies and connected car systems. Manufacturers focusing on innovation in actuator design, lightweight materials, and system compatibility are expected to capitalize on this expanding market opportunity. Overall, the Automotive Electric Actuators Market is positioned for robust and sustained growth through 2035, fueled by electrification trends, regulatory support, and technological advancements in automotive systems.

| Metric | Value |

|---|---|

| Automotive Electric Actuators Market Estimated Value in (2025 E) | USD 27.3 billion |

| Automotive Electric Actuators Market Forecast Value in (2035 F) | USD 49.3 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The automotive electric actuators market is witnessing significant growth, driven by rising demand for fuel efficiency, comfort features, and the shift toward electrification and automation in vehicles. OEMs are increasingly integrating electric actuators for smoother control of systems such as throttle, HVAC, headlamps, and power seats, replacing traditional hydraulic or pneumatic alternatives.

Stricter emission norms and advancements in automotive electronics are also fueling adoption, as electric actuators help reduce parasitic engine loads, improve energy use, and lower maintenance. Growing consumer expectations for intelligent and responsive vehicle systems—especially in the context of EVs and connected cars—are further accelerating the demand for precision-controlled actuators.

With strong R&D investments in miniaturization and smart motor technologies, electric actuators are becoming essential across both comfort and performance applications.

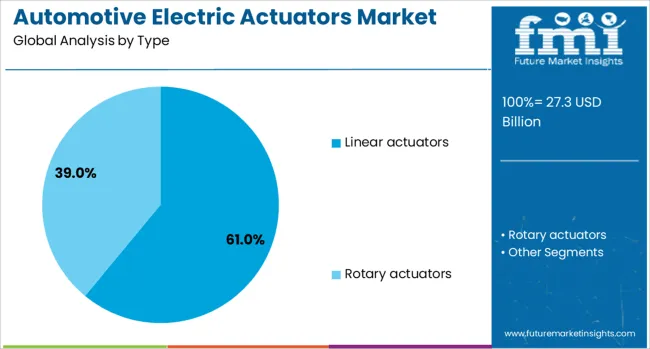

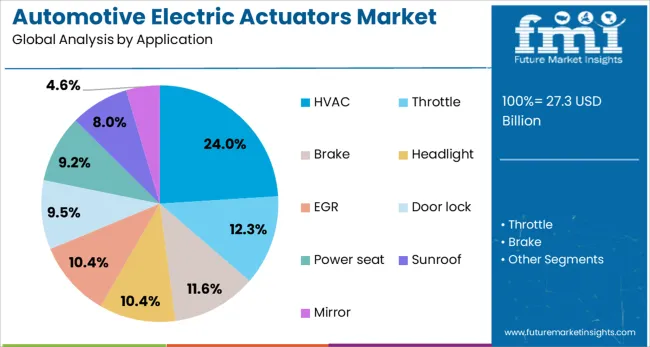

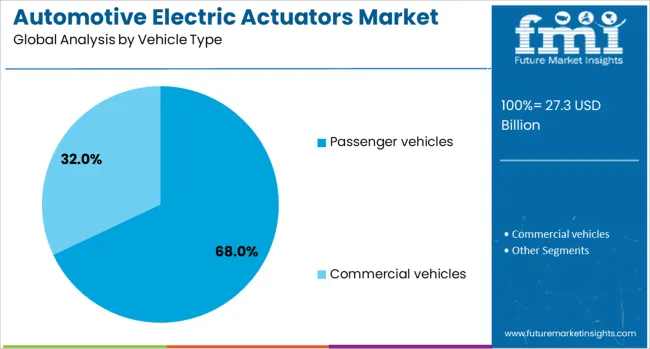

The automotive electric actuators market is segmented by type, application, vehicle type, sales channel, and geographic regions. The automotive electric actuators market is divided into Linear actuators and rotary actuators. In terms of application, the automotive electric actuators market is classified into HVAC, Throttle, Brake, Headlight, EGR, Door lock, Power seat, Sunroof, and Mirror. Based on vehicle type, the automotive electric actuators market is segmented into Passenger vehicles and commercial vehicles. The sales channel of the automotive electric actuators market is segmented into OEM and Aftermarket. Regionally, the automotive electric actuators industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Linear actuators are projected to account for 61.00% of the automotive electric actuators market revenue in 2025, making them the leading actuator type. Their dominance stems from wide applicability in functions such as seat adjustment, throttle control, and tailgate actuation.

The design simplicity, high force output, and precision movement of linear actuators make them well-suited for both performance and comfort functions in modern vehicles. Their electric nature eliminates the need for complex fluid or vacuum systems, enhancing energy efficiency and reducing system weight.

As OEMs push for compact, modular, and smart actuator solutions in advanced driver-assistance systems (ADAS), linear actuators continue to be favored for their reliability and ease of integration.

HVAC applications are expected to represent 24.00% of the market by 2025, emerging as a major driver of actuator deployment. This segment’s growth is attributed to the rising consumer demand for personalized climate control, cabin air quality management, and automatic temperature regulation.

Electric actuators in HVAC systems enable precise air flow and vent control, enhancing passenger comfort and energy savings. As vehicles become more digitally connected, actuators integrated with climate control ECUs are becoming smarter and more responsive.

Furthermore, electric vehicles where cabin heating and cooling play a key role in battery efficiency are contributing to increased actuator penetration in HVAC subsystems.

Passenger vehicles are forecast to dominate with a 68.00% market share in 2025, making them the largest vehicle type category for electric actuator integration. This segment’s leadership is driven by the growing incorporation of actuators in comfort, safety, and powertrain systems, especially in mid and high-end cars.

Rising consumer preferences for advanced interior features, electric tailgates, adaptive cruise control, and electronically controlled brake systems are all fueling actuator adoption.

With EV sales surging globally and ICE vehicles evolving to meet higher emission and comfort standards, passenger cars remain the primary volume and innovation driver for electric actuators.

Automotive electric actuators are gaining importance in precision control, comfort and safety functions, and advanced driver assistance systems. Continued design improvements in efficiency, durability, and integration capabilities position them as vital components in modern vehicle systems.

Automotive electric actuators are increasingly deployed for applications requiring precise motion control in both passenger and commercial vehicles. Their ability to deliver accurate positioning and rapid response supports functions such as throttle control, turbocharger actuation, and active grille shutters. Integration with vehicle electronic systems enables seamless communication between sensors and actuators, improving efficiency and performance. Growth is supported by the automotive sector’s preference for energy-efficient systems over hydraulic or pneumatic alternatives. Manufacturers are developing compact, lightweight actuator designs with improved torque output to meet performance expectations in modern vehicles. This trend is reinforced by the demand for enhanced driving dynamics and responsive control systems across multiple vehicle categories.

The role of electric actuators has expanded significantly in comfort and safety systems, including power windows, power seats, HVAC controls, and adaptive lighting. Consumers increasingly expect vehicles to provide customizable and effortless comfort features, making actuators essential for delivering these functions reliably. Safety-related applications such as electronic parking brakes and lane-keeping assistance also rely on advanced actuator systems for timely and accurate operation. These components are designed for high durability and low maintenance, supporting their adoption in high-usage environments. The versatility of electric actuators across comfort, convenience, and safety domains has broadened their market footprint, making them a critical component of modern vehicle architecture.

Advanced driver assistance systems and emerging autonomous vehicle platforms depend heavily on electric actuators for executing precise, automated functions. Systems such as adaptive cruise control, automatic headlight adjustment, and active suspension require actuators that can operate continuously with minimal lag. Their compatibility with electronic control units ensures synchronization with other vehicle subsystems, enabling coordinated safety and performance responses. As ADAS adoption increases, the role of actuators in supporting semi-autonomous and autonomous functionalities will grow. This integration also pushes manufacturers to enhance actuator reliability under variable driving conditions, making them indispensable for next-generation mobility solutions.

Automotive electric actuator development has centered on achieving higher energy efficiency, reducing overall weight, and extending service life. Advances in materials, motor optimization, and sealing techniques have produced actuators capable of enduring challenging environmental conditions while delivering stable performance. Modular configurations now enable adaptation across multiple vehicle applications without major redesigns, lowering production costs and improving manufacturing flexibility. Better thermal control and integrated position sensors have strengthened precision and operational consistency. These advancements position electric actuators to meet the rigorous demands of modern vehicle systems, supporting reduced power consumption and improved functionality across diverse automotive platforms.

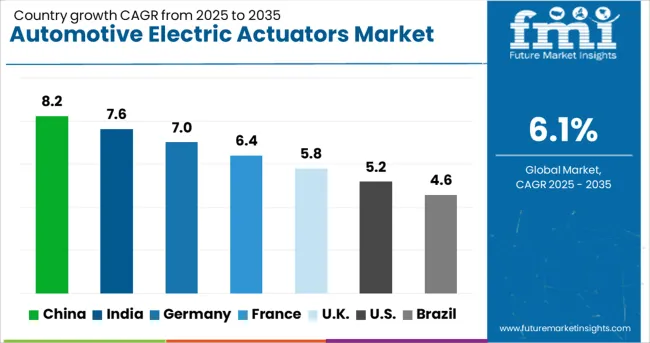

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

| USA | 5.2% |

| Brazil | 4.6% |

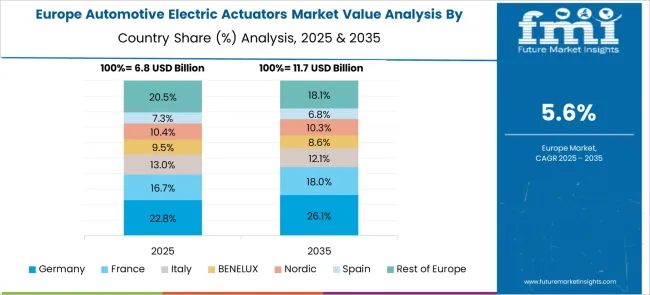

The automotive electric actuators market is projected to grow at a global CAGR of 6.1% from 2025 to 2035, driven by rising demand for precision control systems, integration with ADAS features, and the shift toward energy-efficient vehicle components. China leads with a CAGR of 8.2%, supported by expanding electric and hybrid vehicle production, strong domestic automotive manufacturing, and increasing use of actuators in comfort and safety applications. India follows at 7.6%, fueled by rapid growth in passenger car sales, rising adoption of automated systems, and growing investments in automotive electronics manufacturing. France grows at 6.4%, with demand driven by electrification policies, safety regulations, and comfort-oriented features in new vehicle models. The United Kingdom achieves 5.8% growth, supported by investments in electric mobility and increased adoption of automation in light commercial fleets. The United States posts a CAGR of 5.2%, reflecting a mature market where replacement demand, premium vehicle upgrades, and advanced driver assistance integration sustain opportunities. This analysis covers over 40 countries, with these five serving as strategic benchmarks for growth planning and competitive positioning in the global automotive electric actuators market.

China recorded a CAGR of approximately 5.4% between 2020–2024, which rose to 8.2% during 2025–2035, reflecting a notable acceleration in demand. The initial growth phase was driven by increasing adoption of electric actuators in throttle control, HVAC systems, and turbocharger applications within domestic passenger cars. In the later period, expansion of electric and hybrid vehicle manufacturing, coupled with wider ADAS integration, significantly boosted market penetration. Growing consumer preference for comfort features such as power seats and automated climate control further contributed to demand. Strategic alliances between local OEMs and component suppliers accelerated technology localization and improved production scalability.

India achieved a CAGR of nearly 4.8% during 2020–2024, which increased to 7.6% in the 2025–2035 period, highlighting a significant growth boost. Early adoption was modest, with electric actuators primarily used in limited comfort and basic control applications due to cost considerations. Post-2025, rapid expansion in passenger car sales, combined with rising demand for automated systems and EVs, fueled accelerated adoption. Government policies encouraging domestic manufacturing of automotive electronics also contributed to growth. Actuator usage expanded in safety systems such as electronic parking brakes and lane-keeping assist, growing integration with ADAS.

France posted a CAGR of around 4.1% in 2020–2024, which rose to 6.4% during 2025–2035, marking steady progress. Initial growth was linked to actuator usage in selective comfort and performance applications, with higher uptake in premium models. In the following decade, government-backed EV policies and demand for advanced safety systems stimulated wider adoption. Expanding deployment in active grille shutters, adaptive lighting, and emission control systems also drove the market. Collaborations between French automakers and Tier-1 suppliers accelerated innovation in compact actuator designs for space-limited vehicle architectures.

The United Kingdom posted a CAGR of about 3.9% during 2020–2024, which increased to 5.8% for 2025–2035, showing a measurable rise in adoption. Earlier growth was shaped by limited integration outside of premium models, with primary usage in HVAC and basic control functions. The subsequent period saw investments in EV charging infrastructure, increased production of electric vehicles, and rising demand for ADAS-linked actuators such as lane-keeping and adaptive cruise control. Growth in commercial fleets adopting automated systems also contributed to demand. Strategic partnerships between global suppliers and UK-based OEMs enhanced actuator availability and technology integration.

The United States registered a CAGR of approximately 3.5% during 2020–2024, which advanced to 5.2% in the 2025–2035 timeframe, reflecting steady improvement. Early market growth was driven by replacement demand and integration in comfort features for premium segments. In the later period, actuator adoption benefited from rising EV penetration, expansion of ADAS-equipped vehicle production, and preference for electronically controlled systems in commercial fleets. Domestic manufacturers focused on improving actuator efficiency, reducing weight, and integrating sensors for enhanced reliability.

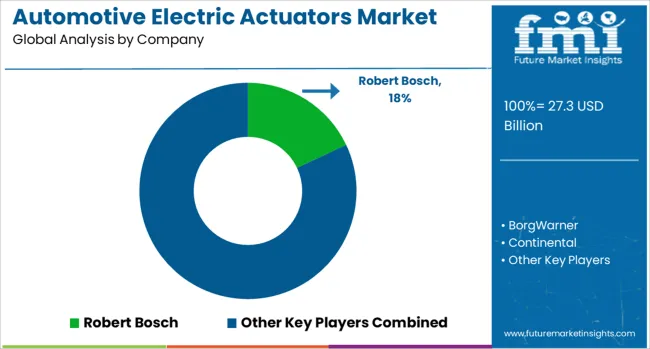

The automotive electric actuators market is marked by strong competition among global component suppliers delivering high-precision motion control solutions for powertrain, body, and safety applications. Robert Bosch leads with a comprehensive actuator portfolio integrated into throttle control, turbocharger systems, and advanced driver assistance features, emphasizing efficiency and compact designs. BorgWarner focuses on actuators for emissions control and turbocharging, leveraging expertise in propulsion technologies for both ICE and hybrid platforms. Continental delivers smart actuator systems with embedded sensors, ensuring seamless integration with electronic control units for optimal performance. Denso specializes in high-reliability actuators for HVAC, fuel injection, and active grille shutter systems, targeting energy efficiency and durability. Hella emphasizes actuators for lighting, adaptive headlamps, and aerodynamic systems, aligning with the shift toward safety and aerodynamic optimization.

Hitachi Astemo provides electric actuators for braking, suspension, and steering applications, supported by its expertise in mechatronics. Johnson Electric focuses on miniature actuator motors with precision control for both comfort and safety systems. Schaeffler develops electromechanical actuators for clutches, transmissions, and chassis applications, enhancing drivetrain responsiveness. Valeo offers a broad range of actuators for thermal systems, ADAS, and comfort features, backed by innovation in lightweight materials. ZF Friedrichshafen dominates with integrated mechatronic systems, combining actuators with advanced transmission and chassis technologies. Competitive strategies center on material innovation, integration with ADAS and EV platforms, modular designs for scalability, and regional manufacturing to meet localized demand. These approaches ensure suppliers remain competitive in a market driven by electrification, automation, and demand for precision control.

Manufacturers of automotive electric actuators are focusing on expanding product portfolios for ADAS and EV platforms, investing in lightweight materials and energy-efficient motor designs to enhance performance. Strategic partnerships with OEMs are enabling early integration of advanced actuators into new vehicle models, while regional production facilities are being optimized to reduce lead times and costs. Growing consumer demand for comfort, safety, and automation features is driving innovation in compact, multi-functional actuator units.

| Item | Value |

|---|---|

| Quantitative Units | USD 27.3 Billion |

| Type | Linear actuators and Rotary actuators |

| Application | HVAC, Throttle, Brake, Headlight, EGR, Door lock, Power seat, Sunroof, and Mirror |

| Vehicle Type | Passenger vehicles and Commercial vehicles |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Robert Bosch, BorgWarner, Continental, Denso, Hella, Hitachi Astemo, Johnson Electric, Schaeffler, Valeo, and ZF Friedrichshafen |

| Additional Attributes | Dollar sales by vehicle segment, share by actuator type and application, regional demand outlook, competitive landscape with key suppliers, pricing and cost trends, regulatory impact, emerging ADAS and EV integration opportunities, production capacity shifts. |

The global automotive electric actuators market is estimated to be valued at USD 27.3 billion in 2025.

The market size for the automotive electric actuators market is projected to reach USD 49.3 billion by 2035.

The automotive electric actuators market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in automotive electric actuators market are linear actuators and rotary actuators.

In terms of application, HVAC segment to command 24.0% share in the automotive electric actuators market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Electric Coolant Valve Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electric Drivetrain Components Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electric Water Pump for Engine Cooling Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electric Actuator Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automotive Electric Vacuum Pump Market

Automotive Piezoelectric Fuel Injectors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thermoelectric Generator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Lighting Actuators Market Size and Share Forecast Outlook 2025 to 2035

Automotive High Voltage Electric Capacitor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA