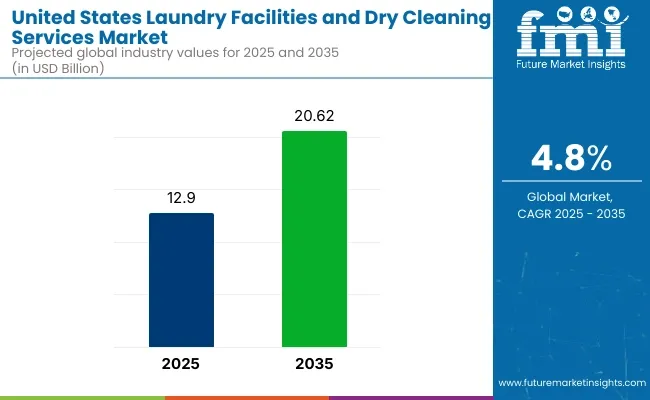

The United States laundry facilities and dry cleaning services market is valued at USD 12.9 billion in 2025 and is expected to reach USD 20.62 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.8%. This growth is driven by the increasing demand for convenient, high-quality laundry services from both residential and commercial sectors.

Urbanization, busy lifestyles, and an expanding workforce have led to higher demand for outsourced laundry and dry cleaning services, especially in metropolitan areas. Additionally, as consumers become more conscious of clothing care, they are opting for professional cleaning services to ensure fabric longevity and cleanliness, further contributing to market expansion.

Looking ahead, the United States laundry facilities and dry cleaning services market is likely to continue its growth trajectory, fueled by the rising trend of eco-friendly and sustainable cleaning practices. The increasing preference for environmentally safe detergents, energy-efficient machines, and water-saving technologies is expected to drive the market forward.

Moreover, innovations in service offerings, such as pick-up and delivery services, contactless payment options, and subscription-based models, will likely attract a broader consumer base. The market is also witnessing a surge in demand for specialized services like garment alterations, leather cleaning, and stain removal, creating opportunities for service diversification.

Furthermore, government regulations, particularly those concerning environmental impact and energy usage, are expected to play an important role in shaping the future of the laundry and dry cleaning services market. Regulatory bodies, such as the USA Environmental Protection Agency (EPA), are pushing for greener cleaning technologies to minimize the environmental footprint of these services.

Additionally, state and local governments may continue to implement regulations on water usage and chemical discharge, encouraging businesses to adopt sustainable practices and invest in eco-friendly equipment to comply with evolving standards. These regulations will drive innovation and set new industry standards.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 12.9 billion |

| Industry Value (2035F) | USD 20.62 billion |

| CAGR (2025 to 2035) | 4.8% |

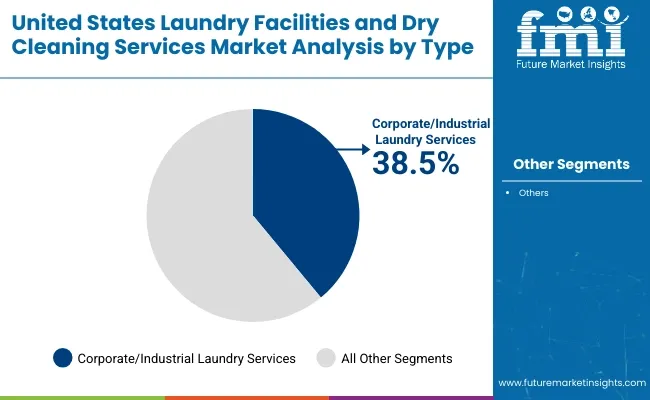

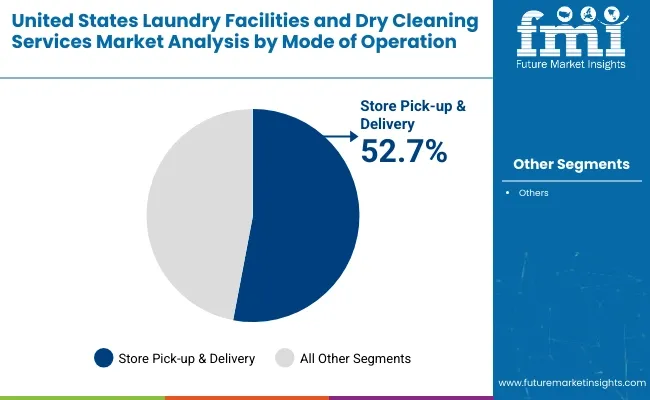

The market is segmented based on type, mode of operation, and region. By type, the market is divided into coin operated services, retail laundry/dry cleaning, corporate/industrial laundry services and others (on-demand laundry services, hospital laundry services, hotel laundry services, and military laundry services). In terms of mode of operation, it is segmented into store pick-up & delivery and site pick-up & delivery. Regionally, the market is classified into USA, which is further segmented into West Region, South West Region, Mid-West Region, North East Region, and South East Region.

The corporate/industrial laundry services segment is expected to dominate the United States laundry facilities and dry cleaning services market by type, accounting for a 38.5% market share in 2025. This dominance is driven by widespread adoption across sectors such as hospitality, healthcare, manufacturing, and government institutions that require bulk and specialized laundry processing on a regular basis. The operational efficiency and cost-saving benefits of outsourcing laundry to professional providers encourage businesses to opt for these services rather than maintaining in-house facilities.

Additionally, the growing awareness about hygiene compliance and the rising demand from hospitals and pharmaceutical companies further boost this segment’s market share. Leading players are expanding their service capabilities with eco-friendly washing technologies and energy-efficient equipment, which resonates well with corporate sustainability goals. As industrial growth continues and corporate establishments expand their operations, this segment will remain the top revenue contributor in the market.

| Type Segment | Market Share (2025) |

|---|---|

| Corporate/Industrial Laundry Services | 38.5% |

The store pick-up & delivery segment is projected to command the highest market share of 52.7% in 2025 among modes of operation in the United States laundry services market. Despite the rapid rise of site pick-up & delivery (PUD), traditional store-based models remain widely preferred, particularly in suburban and rural areas where consumers value personal interaction and same-location services.

Established laundromat chains and local dry-cleaning operators have maintained customer loyalty through consistent service quality and competitive pricing. Moreover, store-based facilities often provide additional services such as alterations, fabric care consultations, and express service options, strengthening their appeal.

However, the share of store pick-up & delivery is expected to gradually decline in the long run as tech-enabled PUD services gain traction, particularly in urban and tech-savvy demographics. Nonetheless, for 2025, store-based pick-up and delivery continues to dominate due to its entrenched market presence and customer familiarity.

| Mode of Operation Segment | Market Share (2025) |

|---|---|

| Store Pick-up & Delivery | 52.7% |

The laundry facilities and dry cleaning services industry in the United States has been experiencing steady growth in recent years, driven by factors such as an increasing urban population, busier lifestyles, and a greater focus on convenience.

As more people enter the labor force in the United States, there is a greater tendency for professional laundry and dry-cleaning facilities to save energy and time.

Retail laundry or dry cleaning services are implementing an efficient full-cycle strategy for pick-up, washing, and delivery.

The industry has adapted to evolving environmental concerns by adopting eco-friendly practices, such as using energy-efficient machines and sustainable cleaning methods.

The COVID-19 pandemic reduced laundry shareholders' average earnings by 6.9% between 2020 and 2022. As a result, the laundry facilities and dry cleaning services industry in the United States grew at 3.1% between 2020 and 2024.

Higher disposable incomes and soaring personal hygiene expenditures are key catalysts for laundry and dry-cleaning services. Moreover, it is expected to influence the demand for professional laundry and cleaning services in the upcoming years. Furthermore, the simplicity and convenience provided by online services are yet another factors causing their widespread adoption.

Utilization of online services for laundry and dry cleaning services has been a significant trend in the industry, assisting service providers to expand their business quickly. Therefore, the laundry facilities and dry cleaning services industry in the United States are poised to witness a higher growth rate during the projected period from 2025 to 2035.

The sector is projected to witness a higher growth rate in the forecast period as demand for professional laundry services increases due to growing consumer preference for time-saving and hassle-free solutions.

Increasing Demand for Specialty Services

In the United States laundry and dry cleaning services sector, specialty services encompass a broad range of services beyond the fundamentals of washing and drying textiles. Since dry cleaners and laundry facilities provide more specialized services, laundry centers, and dry cleaners are more likely to draw in and keep clients.

The Laundry Club provides a subscription-based laundry and dry cleaning pick-up and delivery service. The Laundry Club offers a range of specialty services in addition to standard laundry services.

Increasing Urbanization and Busy Lifestyles

People are increasingly moving into smaller flats with limited access to laundry facilities as more people move into cities. This makes hiring professional laundry services more practical and time-efficient. Americans are also living busier and busier lives. Due to their hectic work schedules and long commutes, many people do not have the time to do their laundry.

Growing Demand from Commercial Customers

Commercial customers include a wide range of businesses, such as hotels, restaurants, hospitals, and office buildings. These companies must always maintain clean and presentable linens, uniforms, and other textiles. They must also abide by stringent hygienic guidelines.

In order to satisfy the growing demand from commercial clients for laundry and dry cleaning, businesses are broadening their offerings and investing in new machinery. For instance, many laundry and dry cleaning companies offer pick-up and delivery services in addition to specialty services for particular items like towels, uniforms, and hospital linens.

Technological Advancements are Fueling the Demand

Innovative washing facilities with eco-friendly equipment, convenient smartphone apps, and other technical innovations have proliferated in the United States. This draws in more clients searching for technologically advanced, effective laundry solutions. Businesses that provide smartphone apps for laundry pick-up and delivery, such as California's LaundryLux, demonstrate how technologically sophisticated laundry services can be.

The Western area of the United States has become a hotbed for the laundry facilities and dry cleaning services sector due to increased urbanization, busy lives, and rising disposable incomes. In 2022, the United States Bureau of Labor Statistics research revealed that with an annual median household income of USD 83,465 the West Coast had higher growth opportunities.

As a result, the laundry facilities and dry cleaning services sector on the United States West Coast is anticipated to grow at a rate of 6.2% during the projection period.

| Region | Growth Rate, 2025 to 2035 |

|---|---|

| West Region of United States | 6.2% |

The USA laundry facilities and dry cleaning services industry has a fragmented competitive landscape, with many players competing based on service quality, effectiveness, brand reputation, and price. Facilities are investing in research and experimentation activities to enhance specialized services and expand their consumer base. In addition to popular brands, smaller firms also provide laundry facilities and dry cleaning services at more affordable costs.

Recent Development

| Attribute | Details |

|---|---|

| Current Market Size (2025) | USD 12.9 billion |

| Projected Market Size (2035) | USD 20.62 billion |

| CAGR (2025 to 2035) | 4.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value |

| By Type | Coin-Operated Services, Retail Laundry/Dry Cleaning, Corporate/Industrial Laundry Services, and Others (On-Demand Laundry Services, Hospital Laundry Services, Hotel Laundry Services, and Military Laundry Services) |

| By Mode of Operation | Store Pick-up & Delivery and Site Pick-up & Delivery |

| Region Covered | USA (West, South West, Mid-West, North East, South East Regions) |

| Countries Covered | United States, United Kingdom, France, Germany, Japan |

| Key Players | CSC ServiceWorks Inc., Lapels Dry Cleaning, Yates Dry Cleaning & Laundry Services, ByNext, Martinizing Dry Cleaning, Angelica Corporation, Tide Cleaners, Rinse, Inc., ZIPS Cleaners, The Huntington Company, Alsco Pty Ltd., Alliance Laundry Systems LLC |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The market is expected to grow from USD 12.9 billion in 2025 to USD 20.62 billion by 2035, reflecting a CAGR of 4.8% during the forecast period.

The corporate/industrial laundry services segment is expected to hold the largest market share, accounting for 38.5% in 2025, driven by widespread adoption in sectors such as hospitality, healthcare, and manufacturing.

The store pick-up & delivery mode is projected to maintain the largest market share of 52.7% in 2025, although tech-enabled site pick-up & delivery services are expected to grow rapidly in the coming years.

The West region of the United States is expected to witness the highest growth, with a projected CAGR of 6.2% between 2025 and 2035, driven by increased urbanization, high disposable incomes, and demand for professional services.

Key players include CSC ServiceWorks Inc., Lapels Dry Cleaning, Yates Dry Cleaning & Laundry Services, Tide Cleaners, Rinse, Inc., ZIPS Cleaners, and The Huntington Company, among others.

Table 01: Market Value (USD Million) Forecast, by Type, 2020 to 2035

Table 02: Market Value (USD Million) Forecast, by Mode of Operation, 2020 to 2035

Table 03: Market Value (USD Million) Forecast, by Region, 2020 to 2035

Figure 01: Market Value (USD Million), 2020 to 2025

Figure 02: Market Absolute USD Opportunity (USD Million), 2025 to 2035

Figure 03: Market Value (USD Million) Forecast, 2025 to 2035

Figure 04: Market Absolute USD Opportunity, 2025 to 2035

Figure 05: Market Absolute USD Opportunity, 2025 to 2035

Figure 06: Market Absolute USD Opportunity, 2025 to 2035

Figure 07: Market Absolute USD Opportunity, 2025 to 2035

Figure 08: Market Share by Type, 2025 to 2035

Figure 09: Market Attractiveness by Type, 2025 to 2035

Figure 10: Market Absolute USD Opportunity, 2025 to 2035

Figure 11: Market Absolute USD Opportunity, 2025 to 2035

Figure 12: Market Share by Mode of Operation, 2025 to 2035

Figure 13: Market Attractiveness by Mode of Operation, 2025 to 2035

Figure 14: Market Absolute USD Opportunity, 2025 to 2035

Figure 15: Market Absolute USD Opportunity, 2025 to 2035

Figure 16: Market Absolute USD Opportunity, 2025 to 2035

Figure 17: Market Absolute USD Opportunity, 2025 to 2035

Figure 18: Market Absolute USD Opportunity, 2025 to 2035

Figure 19: Market Share by Region, 2025 to 2035

Figure 20: Market Attractiveness by Region, 2025 to 2035

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

A Detailed Industry Analysis of Laundry Facilities and Dry Cleaning Services in the United States

Dry-Cleaning and Laundry Services Market Growth, Trends and Forecast from 2025 to 2035

United States Car Wash Services Market Analysis - Trends & Forecast 2025 to 2035

Online Laundry Services Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Hair Salon Services Market Analysis by Growth, Trends and Forecast from 2025 to 2035

United States & Canada Pest Control Services Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Foundation Repair Services Market Analysis by Growth, Trends and Forecast from 2025 to 2035

United States Preclinical Medical Device Testing Services Market Trends – Growth, Demand & Analysis 2025-2035

DOAS Industry Analysis in the United States Forecast and Outlook 2025 to 2035

United States Countertop Market Trends - Growth, Demand & Forecast 2025 to 2035

Industry Analysis of Lidding Film in the United States Size and Share Forecast Outlook 2025 to 2035

Chipless RFID Industry Analysis in United States Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Infant Formula Industry Analysis in United States Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Degassing Valves Industry Analysis in United States & Canada - Size, Share, and Forecast 2025 to 2035

Solenoid Valve Market Growth – Trends & Forecast 2024-2034

US & Europe EndoAVF Device Market Analysis – Size, Share & Forecast 2024-2034

U.S. Laminated Tube Market Trends & Demand Forecast 2024-2034

Fava Bean Protein Industry in United States Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Periodontal Gel Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA