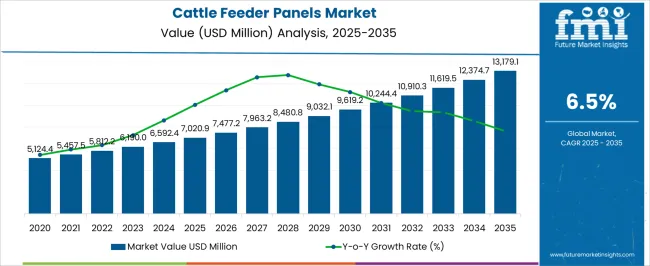

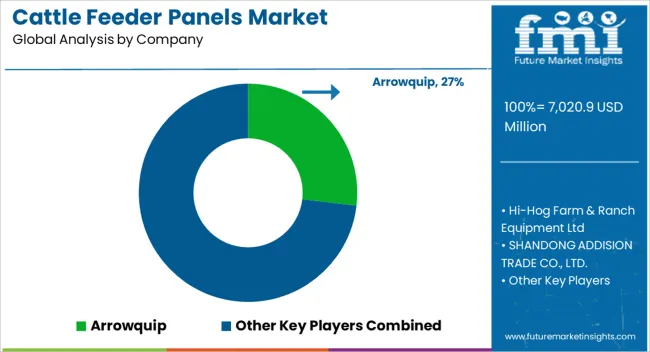

The Cattle Feeder Panels Market is estimated to be valued at USD 7020.9 million in 2025 and is projected to reach USD 13179.1 million by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Cattle Feeder Panels Market Estimated Value in (2025 E) | USD 7020.9 million |

| Cattle Feeder Panels Market Forecast Value in (2035 F) | USD 13179.1 million |

| Forecast CAGR (2025 to 2035) | 6.5% |

The cattle feeder panels market is expanding steadily due to the rising demand for efficient feeding systems that support herd health and farm productivity. Increasing herd sizes and the need for organized livestock management practices are driving the adoption of durable feeder panels that optimize space utilization and reduce feed wastage.

Advances in galvanized steel designs and modular panel construction have improved product durability and ease of installation, supporting higher adoption rates. Growing emphasis on animal welfare and the efficiency of feeding operations is further promoting the use of structured panel systems in both small and large-scale farms.

Regulatory and industry standards focused on livestock care and productivity enhancement are reinforcing market penetration. The future outlook remains positive as farms increasingly seek cost effective, durable, and scalable feeder panel solutions that align with sustainable livestock production goals.

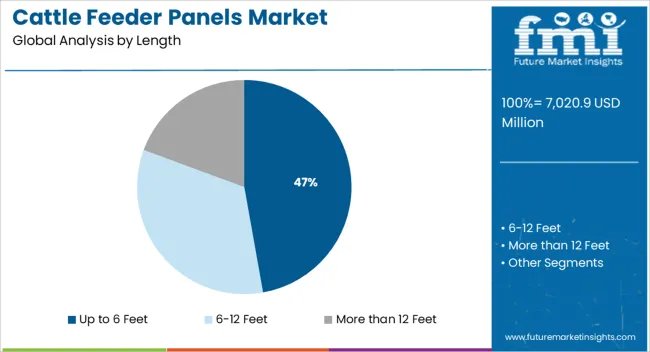

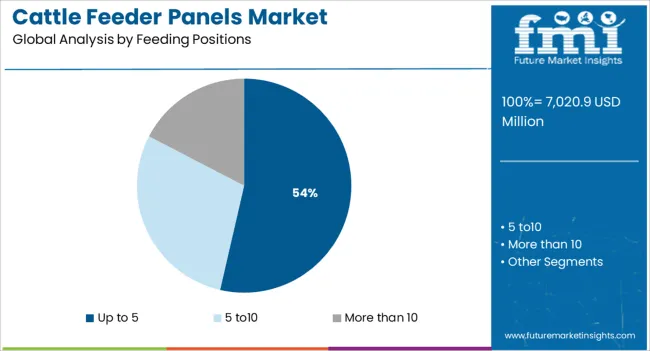

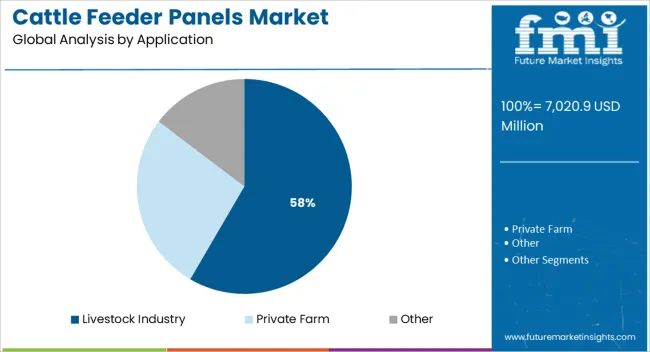

The market is segmented by Length, Feeding Positions, and Application and region. By Length, the market is divided into Up to 6 Feet, 6-12 Feet, and More than 12 Feet. In terms of Feeding Positions, the market is classified into Up to 5, 5 to10, and More than 10. Based on Application, the market is segmented into Livestock Industry, Private Farm, and Other. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

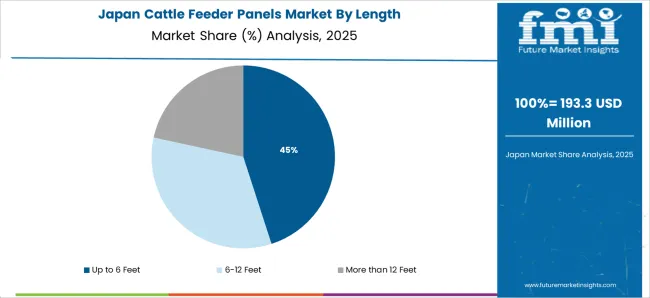

The up to 6 feet length segment is projected to contribute 47.20% of market revenue by 2025, making it the leading category under length. Its popularity is driven by suitability for small to medium-sized enclosures, ease of installation, and effective space optimization.

Farmers prefer this length due to its balance of cost efficiency and functional performance, allowing easy handling and movement across different feeding setups.

Its adaptability to various farm scales and reduced maintenance requirements continue to reinforce its dominance within the length category.

The up to 5 feeding positions segment is expected to hold 53.60% of the overall market revenue by 2025, positioning it as the largest subcategory under feeding positions. This growth is attributed to its effectiveness in smaller groups, ensuring equitable feed access and reducing competition among cattle.

The configuration is also highly cost efficient and requires minimal space, making it attractive to both small-scale and mid-sized livestock operators.

With farms seeking to improve feeding efficiency while maintaining affordability, this subcategory has maintained a strong presence across regional markets.

The livestock industry application segment is set to account for 58.40% of total market revenue by 2025, emerging as the leading application category. This dominance is driven by the widespread use of feeder panels in cattle farming operations where efficiency, durability, and feeding consistency are critical.

Increasing livestock populations and higher demand for meat and dairy products are boosting investments in structured feeding infrastructure. The ability of feeder panels to minimize feed wastage, improve cattle health, and streamline farm management has made them indispensable in livestock operations.

Consequently, this application segment continues to lead due to its direct alignment with industry growth trends and production efficiency requirements.

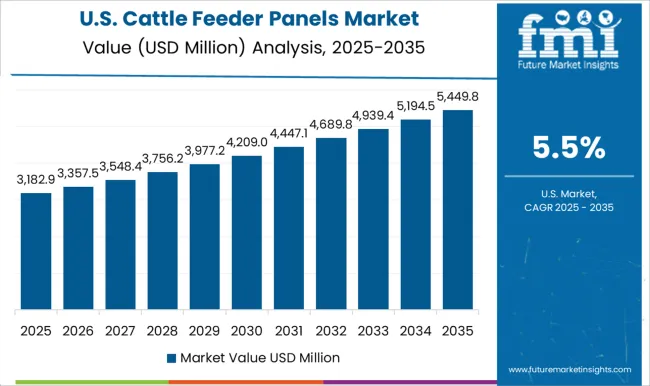

When compared to the 5.8% CAGR recorded between 2020 to 2025, the cattle feeder panels industry is predicted to expand at a 6.5% CAGR between 2025 to 2035. The average growth of the market is expected to be around 1.06x between 2025 to 2025.

| Market Statistics | Details |

|---|---|

| Market Share (2020) | USD 4,139.4 million |

| Market Share (2024) | USD 5,492.6 million |

| Market Share (2025) | USD 5,812.2 million |

Short-term Growth (2025 to 2029): the rising demand for enhanced feed management, animal health, and productivity has an impact on short-term growth.

Medium-term Growth (2035 to 2035): It is projected that increased demand for processed meat products is likely to benefit the market share.

Long-term Growth (2035 to 2035): The growing demand for organic and bio-based feed products is anticipated to fuel the long-term market expansion.

The use of high-tech, automated feeder panels is becoming common, since it makes feeding livestock more productive and affordable. Moreover, there is a greater emphasis on creative designs that promote safety for both cattle and workers.

The cattle feeder panels business is still relatively small, but it is expanding quickly as a result of rising farmer demand for these panels. In order to better manage their herds and increase the effectiveness of their operations, farmers have recently increased their investment in cattle feeder panels.

The two common strategies adopted by key players in the cattle feeder panels market for investment are:

Factors like panel size and kind, the caliber of the materials, the length of the manufacturer's guarantee, and the installation expense, affect the overall strategic decision.

Farmers should also take into account the availability of technical support, which can be crucial to overcoming the cattle feeder panels’ sector challenges. Additionally, the market is projected to develop owing to government initiatives to support livestock farming and rising demand for natural and organic feed.

With a market share of 29.7% and a value of USD 1,726 million in 2025, the United States dominated the cattle feeder panels market. The health of the cattle business in the United States, which is impacted by variables including feed availability and beef demand, heavily influences the demand.

As livestock operations in the United States become productive, farmers seek to boost their output, which leads to higher sales of cattle feeder panels. Increased productivity and anticipated ongoing export competitiveness led to higher beef exports in 2020 and 2020.

Beef and pork exports rose 2% and 6%, respectively, in 2020 and 2020. Although US exports of beef and pork decreased in 2020 as a result of greater competition in the worldwide market.

| Attributes | Statistics |

|---|---|

| United Kingdom Market Value 2025 | USD 515.9 million |

| United Kingdom Market Value 2035 | USD 1,012.4 million |

| United Kingdom Market Share (2025 to 2035) | 8.9% |

| United Kingdom Market CAGR (2025 to 2035) | 7% |

The cattle feeder panels sector in the United Kingdom is expanding due to the growing supply of high-quality feeder panels. Premium cattle feeder panels, which are made to last longer and give higher durability, are currently the choice of many producers. Producers can now alter feeder panels to suit their own requirements. As manufacturers are able to discover feeder panels that properly meet their needs, this has also contributed to the market's growth. The cattle feeder panels industry in the United Kingdom is projected to expand globally as farmers explore ways to save costs and boost productivity. Furthermore, the industry is likely to expand as high-quality feeder panels become popular in the agriculture sector.

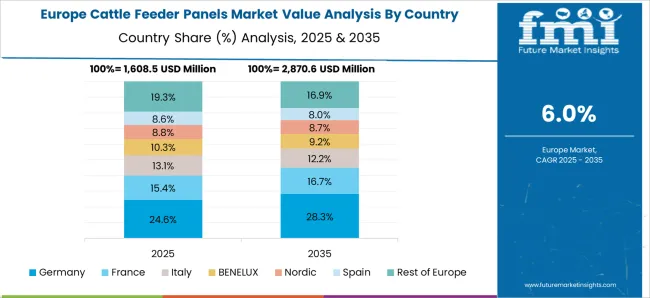

With a market share of 18.7% and a value of USD 1,088.9 million in 2025, Germany has significant growth prospects in the market. Germany is a leading market in Europe since it has one of the top dairy and cattle farming industries on the continent. Two of the key factors promoting the market's expansion are the demand for more animal feed and the requirement for efficient feed management systems. A further factor increasing the demand for cattle feeder panels is government initiatives to boost efficient and sustainable agriculture practices.

| Country | China |

|---|---|

| Market Share (2025) | 9.10% |

| CAGR (2025 to 2035) | 5.20% |

| Market Value (2025) | USD 527.79 million |

| Market Value (2035) | USD 877.1 million |

| Country | India |

|---|---|

| Market Share (2025) | 4% |

| CAGR (2025 to 2035) | 7.60% |

| Market Value (2025) | USD 231.3 million |

| Market Value (2035) | USD 482.6 million |

Businesses in China are making significant investments in research and development to create products that are both more effective and more affordable for the market.

For instance, several companies are putting their attention toward creating intelligent feeder panels that aid in lowering feed waste and boosting feed conversion rates.

The industry has gained access to new prospects due to the rising use of digital technologies. It includes the incorporation of big data and artificial intelligence into cattle feeders.

The livestock industry segment is anticipated to be the market's dominant segment in terms of application. This is due to the industrialized countries' rising demand for dairy products, including milk, cheese, and yogurt.

It is anticipated that an expanding population and rising disposable income increases the need for dairy products, which in turn propel the market growth.

Due to their affordability and usability, 6-10 feet feeder panels are predicted to experience the leading growth during the forecast period. Small-scale feedlot operations most frequently employ this feeder panel length. Due to its widespread use in medium-scale feedlot operations, the more than 10 ft sector is anticipated to experience consistent expansion.

Automation and system integration are still essential elements in reducing costs and increasing output for cattle feeder panels. Due to the problem with the market, the development of feeders might be hampered by less-priced alternatives.

These more affordable choices are anticipated to reduce the profits of important cattle feeder panel companies. However, less expensive solutions like plastic feeders have a higher chance of breaking and harming cows' digestive systems.

Startups in the cattle feeder panels industry are bringing fresh concepts and developments to the market. They also make it simpler for livestock to obtain feed and prevent feed waste. As more farmers use the technology, businesses like EZ Feeder, FeedMaster, and Feedlot Panels have witnessed a surge in revenue.

Startups offering creative ways to better manage cattle feed have also lately joined the market, like Cattle Feeder Systems and Cattle Feeder Technologies. Farmers are able to use the technology since these businesses are producing items that are more efficient and economical. The cattle feeder panels sector has grown and innovated due to the increased competition between established players and new entrants.

Recently, there has been a market trend toward accessorizing. Manufacturers of livestock feeder panels are concentrating on a new product line with greater efficiency. For instance, Big Valley introduced a new range of cattle feeder panels in 2020 that is intended to be long-lasting, dependable, and simple to use.

Similar to this, Valley Feeders introduced a brand-new line of cattle feeder panels in 2020 that are intended to offer greater feed efficiency and feed conversion. Go along with the feeder panels, the company also provides a variety of accessories.

The existence of key competitors in the industry is likely to release cutting-edge products on the market. These businesses consistently concentrate on research and development efforts. The market growth is also projected to increase by the rising investments in the agriculture sector.

Recent Developments

The global cattle feeder panels market is estimated to be valued at USD 7,020.9 million in 2025.

The market size for the cattle feeder panels market is projected to reach USD 13,179.1 million by 2035.

The cattle feeder panels market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in cattle feeder panels market are up to 6 feet, 6-12 feet and more than 12 feet.

In terms of feeding positions, up to 5 segment to command 53.6% share in the cattle feeder panels market in 2025.

The global cattle feeder panels market is estimated to be valued at USD 7,020.9 million in 2025.

The market size for the cattle feeder panels market is projected to reach USD 13,179.1 million by 2035.

The cattle feeder panels market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in cattle feeder panels market are up to 6 feet, 6-12 feet and more than 12 feet.

In terms of feeding positions, up to 5 segment to command 53.6% share in the cattle feeder panels market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cattle and Sheep Disease Diagnostic Kits Market Size and Share Forecast Outlook 2025 to 2035

Cattle Feed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cattle Squeeze Market Size and Share Forecast Outlook 2025 to 2035

Cattle Head Catch Market Size and Share Forecast Outlook 2025 to 2035

Cattle Grooming Chute Market Size and Share Forecast Outlook 2025 to 2035

Cattle Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Cattle Blower Market Size and Share Forecast Outlook 2025 to 2035

Cattle Management Software Market Size and Share Forecast Outlook 2025 to 2035

Cattle Supplies Market Analysis & Forecast for 2025 to 2035

Cattle Nutrition Market Analysis by Cattle Type, Nutrition Type, Application, Life Stage Through 2025 to 2035

Cattle Feeder Market Size and Share Forecast Outlook 2025 to 2035

Cattle Mineral Feeder Market Size and Share Forecast Outlook 2025 to 2035

Smart Cattle Market

Dairy Cattle Feed Market

Automatic Cattle Waterer Market – Trends & Growth Forecast 2025 to 2035

Feeder Container Market Size and Share Forecast Outlook 2025 to 2035

Hog Feeder Market Size and Share Forecast Outlook 2025 to 2035

Belt Feeders Market Size and Share Forecast Outlook 2025 to 2035

Weft Feeder Market Trend Analysis Based on Type, Operation, Application, and Region 2025 to 2035

Pump Feeders Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA