The Catecholamines Market is estimated to be valued at USD 4.9 billion in 2025 and is projected to reach USD 9.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period. The progression of market values year over year reveals a consistent upward trend characterized by incremental gains without abrupt fluctuations or sharp spikes. Starting from USD 4.9 billion in 2025, the market experiences gradual increases annually, USD 5.2 billion in 2026, USD 5.5 billion in 2027, and continuing this trajectory through to USD 9.3 billion in 2035. The growth curve forms a smooth, slightly concave shape, indicating accelerating growth but maintaining a controlled pace. This shape suggests expanding demand supported by rising applications in medical and pharmaceutical fields, including diagnostics and therapeutics related to neurological and cardiovascular disorders. No signs of saturation or stagnation appear within the forecast period, as each year records a higher market value than the previous.

The steady progression implies a stable increase in market penetration and product adoption rather than explosive expansion. The shape of this growth curve is typical for markets in maturation phase, where innovations and regulatory approvals progressively drive market expansion. Overall, the market’s growth curve signals a healthy, sustainable increase aligned with evolving industry requirements and technological advancements.

| Metric | Value |

|---|---|

| Catecholamines Market Estimated Value in (2025 E) | USD 4.9 billion |

| Catecholamines Market Forecast Value in (2035 F) | USD 9.3 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The catecholamines market is witnessing sustained growth driven by the rising incidence of acute cardiovascular conditions, anaphylactic emergencies, and the critical role of catecholamines in advanced life support therapies. Growing awareness among healthcare professionals about timely pharmacologic intervention and adherence to updated resuscitation guidelines has enhanced usage rates in both emergency and surgical care settings.

Continuous improvements in hospital infrastructure, availability of crash carts, and standardized protocols for acute management are supporting market expansion. Furthermore, the increasing adoption of intravenous infusion systems in intensive care units and operating rooms is facilitating accurate administration and dosage control.

Pharmaceutical innovation focused on extended stability, ready-to-use formulations, and minimized side effects continues to shape competitive differentiation. Demand is expected to rise further as healthcare systems in emerging economies expand critical care access and respond to the growing burden of life-threatening allergic and cardiac conditions.

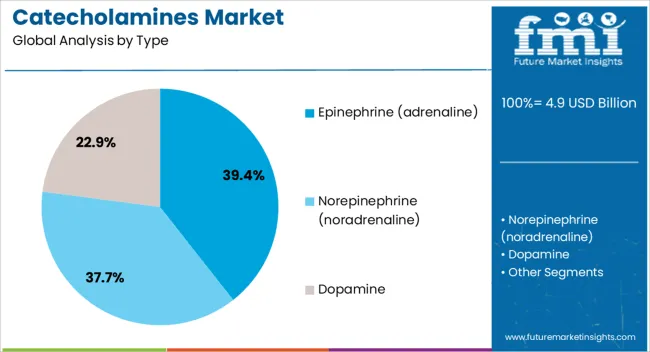

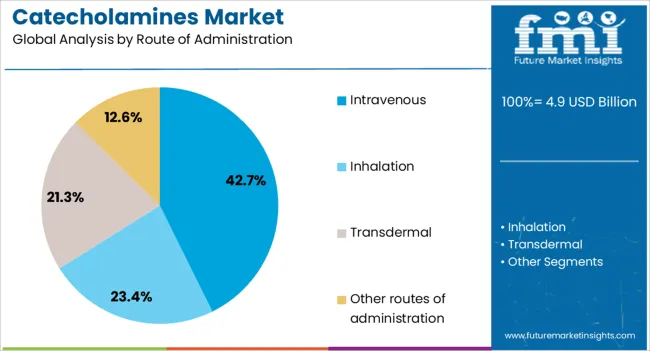

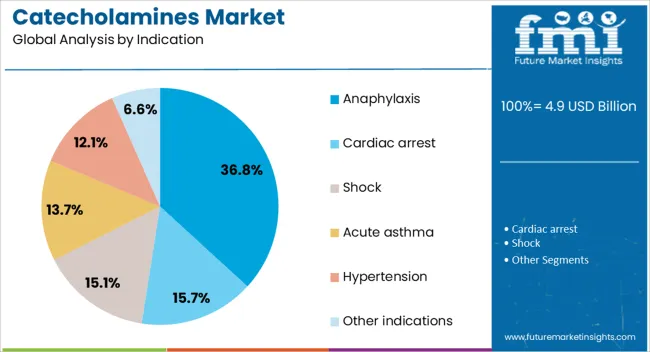

The catecholamines market is segmented by type, route of administration, indication, distribution channel, and geographic regions. By type, the catecholamines market is divided into Epinephrine (adrenaline), Norepinephrine (noradrenaline), and Dopamine. In terms of route of administration, the catecholamines market is classified into Intravenous, Inhalation, Transdermal, and Other routes of administration. Based on the indication, the catecholamines market is segmented into Anaphylaxis, Cardiac arrest, Shock, Acute asthma, Hypertension, and Other indications. The distribution channel of the catecholamines market is segmented into Hospital pharmacy, Retail pharmacy, and Online pharmacy. Regionally, the catecholamines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Epinephrine is expected to account for 39.40% of the total market revenue in 2025, making it the leading product type in the catecholamines market. Its dominance is being driven by its established role in first-line treatment for anaphylaxis, cardiac arrest, and severe asthma exacerbations.

The drug’s rapid onset of action and ability to stimulate both alpha and beta-adrenergic receptors make it critical in restoring hemodynamic stability. Standardization across emergency medical services, widespread inclusion in resuscitation protocols, and expanded access via auto-injectors have strengthened its clinical presence.

In both pre-hospital and hospital environments, epinephrine’s life-saving utility has reinforced its positioning as the most relied-upon catecholamine agent.

The intravenous route is projected to capture 42.70% of the overall revenue share in 2025, establishing it as the most utilized mode of administration for catecholamines. This preference is being shaped by the clinical need for rapid onset and precise titration in emergency and critical care settings.

Intravenous administration allows for real-time monitoring and immediate therapeutic response, which is essential in high-acuity environments such as operating rooms and ICUs. Integration with infusion pumps and closed-loop systems enables safe delivery, especially for potent agents with narrow therapeutic windows.

As hospital protocols emphasize control, reliability, and adaptability in drug delivery, intravenous remains the most preferred and dependable route for catecholamines.

Anaphylaxis is anticipated to hold 36.80% of the catecholamines market revenue in 2025, positioning it as the leading clinical indication. Its dominance stems from increasing global incidence driven by food allergies, drug hypersensitivity, and insect venom reactions.

Medical consensus supports the immediate administration of epinephrine as the primary intervention, highlighting its unmatched efficacy in reversing life-threatening symptoms. Public health campaigns and updated emergency care guidelines have accelerated awareness, leading to more widespread training and accessibility.

Hospitals, schools, airlines, and workplaces are increasingly stocking emergency doses, reinforcing catecholamine demand in both medical and non-medical environments. With continued focus on early recognition and rapid treatment, anaphylaxis remains a high-impact driver for market growth.

The market has expanded substantially in recent years, driven by the critical role these biomolecules play in various physiological and pathological processes. Catecholamines, including dopamine, norepinephrine, and epinephrine, are essential neurotransmitters and hormones involved in the regulation of cardiovascular function, stress response, and neurological activity. The growing prevalence of chronic diseases such as heart failure, Parkinson’s disease, and adrenal gland disorders has fueled demand for catecholamine-based diagnostic tests and therapeutic agents. Additionally, increasing awareness about early diagnosis and personalized medicine is boosting market growth.

Catecholamines are widely used in the treatment of cardiovascular diseases, including acute heart failure, cardiogenic shock, and hypotension, owing to their potent vasoconstrictive and inotropic effects. In neurology, dopamine-based therapies are vital for managing Parkinson’s disease and other movement disorders characterized by dopamine deficiencies. Moreover, catecholamines have diagnostic and therapeutic roles in endocrine disorders such as pheochromocytoma and neuroblastoma, where abnormal catecholamine levels serve as biomarkers. The broadening spectrum of clinical indications, coupled with an aging population and increased prevalence of chronic conditions, is driving consistent growth in both demand and research investment. Integration into combination therapies and novel drug delivery systems is enhancing therapeutic efficacy and patient outcomes.

Technological progress in recombinant DNA technology, enzymatic synthesis, and fermentation has revolutionized the production of bioactive catecholamines, enabling higher purity, yield, and scalability. These advancements facilitate the manufacturing of complex molecules with improved stability and reduced side effects. On the analytical front, innovations such as liquid chromatography-tandem mass spectrometry (LC-MS/MS) and immunoassays have increased the sensitivity and specificity of catecholamine detection in biological samples. These developments enable earlier diagnosis, better disease monitoring, and tailored treatment approaches. Furthermore, integration with automated laboratory systems and point-of-care diagnostics is enhancing accessibility and efficiency, broadening the clinical utility of catecholamines.

Strict regulatory oversight governs the development, approval, and commercialization of catecholamine-based drugs and diagnostics due to their biological activity and potential safety risks. Agencies worldwide enforce rigorous standards concerning manufacturing processes, quality assurance, and post-market surveillance. Compliance with Good Manufacturing Practices (GMP), validation of analytical methods, and pharmacovigilance are essential for market access and consumer trust. The complexity of catecholamine synthesis and formulation requires continuous investment in process optimization and quality control measures. Additionally, regulatory harmonization efforts and evolving guidelines influence product development timelines and market entry strategies, impacting competitive positioning and innovation pace.

Emerging economies in Asia-Pacific, Latin America, and the Middle East are witnessing rising demand for catecholamine diagnostics and therapeutics driven by improving healthcare infrastructure, expanding medical insurance coverage, and growing awareness of chronic diseases. These regions represent significant growth opportunities due to increasing investments in hospitals, diagnostic laboratories, and pharmaceutical manufacturing facilities. Government initiatives to enhance healthcare accessibility and affordability are accelerating adoption of advanced diagnostics and treatment options involving catecholamines. However, challenges such as supply chain limitations, skilled workforce shortages, and regulatory variations necessitate tailored strategies. Collaborations between global manufacturers and local stakeholders are instrumental in overcoming barriers and tapping into these expanding markets.

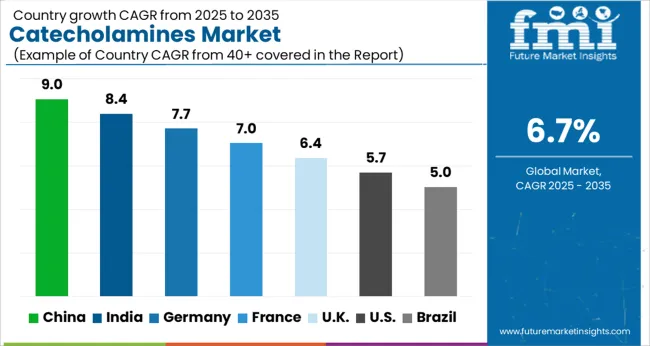

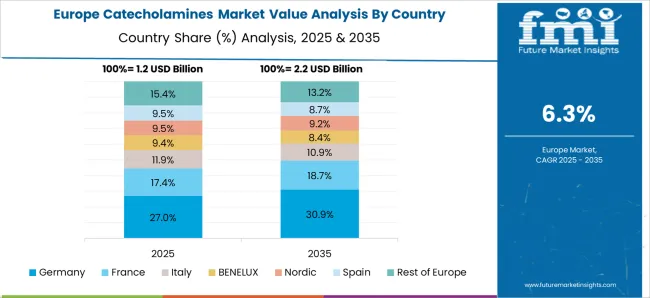

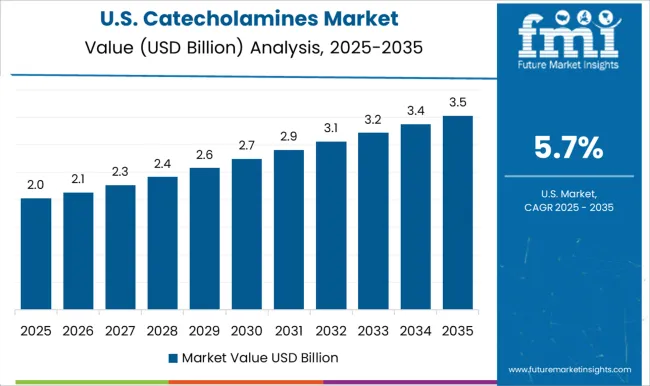

The market is projected to grow at a CAGR of 6.7% between 2025 and 2035, driven by rising demand in pharmaceutical and clinical research applications. China leads with a 9.0% CAGR, supported by expanding biotech manufacturing and increased R&D activities. India follows at 8.4%, fueled by growing pharmaceutical production and healthcare investments. Germany, growing at 7.7%, benefits from advanced biotechnological research and strong healthcare infrastructure. The UK, at 6.4%, experiences steady growth due to clinical research advancements. The USA, with a 5.7% CAGR, reflects ongoing innovation in drug development and diagnostic applications. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is expected to grow at a CAGR of 9.0% between 2025 and 2035, fueled by increasing research investments and expanding pharmaceutical manufacturing capacities. Local companies such as Tasly Pharmaceutical are intensifying production capabilities for synthetic catecholamines used in critical care and cardiovascular therapies. Government incentives for biotech innovation and growing demand for injectable drugs have accelerated market expansion. Partnerships with global pharmaceutical firms facilitate technology transfers and improve product quality. Increasing prevalence of cardiovascular and neurological disorders enhances demand for catecholamine-based treatments, supporting robust growth in hospital and clinical applications across the country.

India’s market is projected to advance at a CAGR of 8.4%, driven by rising healthcare infrastructure and growing emphasis on emergency medicine. Pharmaceutical manufacturers like Sun Pharmaceutical and Cipla have increased capacity for injectable catecholamines used in shock and cardiac arrest treatments. Regulatory support for drug approvals and clinical trials is strengthening product pipeline development. Rising chronic disease rates and expanding hospital networks are contributing to higher catecholamine consumption. The market is influenced by cost-effective production and export opportunities to neighboring regions.

Germany is expected to grow at a CAGR of 7.7%, supported by advanced clinical research and stringent quality standards. Leading pharmaceutical companies such as Bayer and Boehringer Ingelheim focus on developing high-purity catecholamine formulations for critical care. Increasing demand from intensive care units and emergency departments sustains steady consumption. The country’s emphasis on precision medicine and drug safety regulations shape production and distribution strategies. Innovation in controlled release injectable technologies further boosts market potential.

The industry in the United Kingdom is forecast to grow at a CAGR of 6.4%, driven by demand in emergency medicine and cardiovascular therapy segments. Pharmaceutical companies including GlaxoSmithKline and AstraZeneca focus on optimizing drug delivery systems and expanding injectable product portfolios. Increasing prevalence of cardiac events and neurological conditions supports consistent market demand. NHS initiatives aimed at improving critical care protocols contribute to product adoption. Research collaborations with academic institutions foster development of novel catecholamine analogs.

The market in the United States is anticipated to grow at a CAGR of 5.7% over the forecast period, supported by strong hospital demand and pharmaceutical innovation. Companies such as Pfizer and Johnson & Johnson invest in new synthetic pathways and enhanced formulation techniques. Rising incidence of cardiovascular diseases and neurological disorders increases therapeutic use. Regulatory approval processes and reimbursement policies influence market dynamics. The development of biosimilars and generic catecholamine drugs is expanding treatment options and affordability.

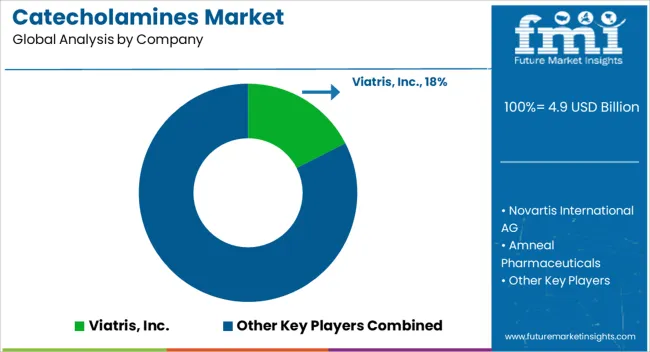

The market consists of pharmaceutical companies specializing in the production of critical compounds used primarily in cardiovascular treatments and emergency medicine. Viatris, Inc. delivers a broad portfolio of catecholamine-based drugs, focusing on both branded and generic formulations that address acute medical conditions. Novartis International AG integrates advanced pharmaceutical research with large-scale manufacturing to provide high-quality catecholamine products globally. Amneal Pharmaceuticals and Teva Pharmaceutical Industries Ltd. emphasize generic drug production, offering cost-effective alternatives to branded catecholamine therapies to improve accessibility. Baxter International specializes in injectable formulations and infusion technologies, ensuring precise and safe delivery of catecholamines in clinical settings. Breckenridge Pharmaceutical, Inc. focuses on contract manufacturing and development, supporting the supply chain for catecholamine drugs with scalable production capabilities. Market growth is driven by the rising incidence of cardiovascular diseases and the critical role of catecholamines in managing shock and heart failure. Barriers to entry include stringent regulatory requirements, complex manufacturing processes, and the need for high-quality standards. Leading providers leverage extensive research and manufacturing expertise, along with global distribution networks, to maintain leadership and meet evolving healthcare demands.

Manufacturers are increasingly focusing on biotechnology and synthetic biology to produce catecholamines more efficiently and at a lower cost. Advances in bioprocessing techniques are improving the yield and purity of catecholamines, making them more affordable and accessible for medical and pharmaceutical applications. Synthetic catecholamines are also being developed for use in diagnostic tests and research purposes.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.9 Billion |

| Type | Epinephrine (adrenaline), Norepinephrine (noradrenaline), and Dopamine |

| Route of Administration | Intravenous, Inhalation, Transdermal, and Other routes of administration |

| Indication | Anaphylaxis, Cardiac arrest, Shock, Acute asthma, Hypertension, and Other indications |

| Distribution Channel | Hospital pharmacy, Retail pharmacy, and Online pharmacy |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Viatris, Inc., Novartis International AG, Amneal Pharmaceuticals, Teva Pharmaceutical Industries Ltd, Baxter International, and Breckenridge Pharmaceutical, Inc. |

| Additional Attributes | Dollar sales by compound type and application segment, demand dynamics across pharmaceutical formulations, diagnostics, and research, regional trends in production and consumption across North America, Europe, and Asia-Pacific, innovation in synthetic pathways, stabilization techniques, and delivery systems, environmental impact of manufacturing waste, solvent use, and disposal processes, and emerging use cases in personalized medicine, neurodegenerative disease treatment, and stress biomarker analysis. |

The global catecholamines market is estimated to be valued at USD 4.9 billion in 2025.

The market size for the catecholamines market is projected to reach USD 9.3 billion by 2035.

The catecholamines market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in catecholamines market are epinephrine (adrenaline), norepinephrine (noradrenaline) and dopamine.

In terms of route of administration, intravenous segment to command 42.7% share in the catecholamines market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA