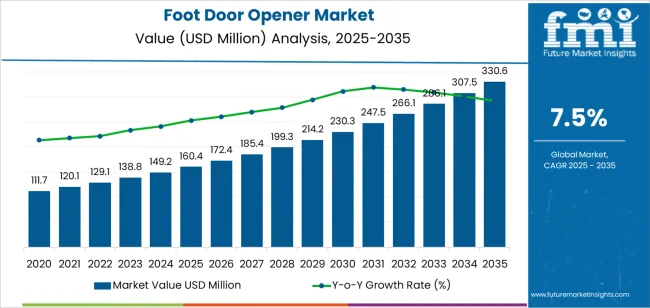

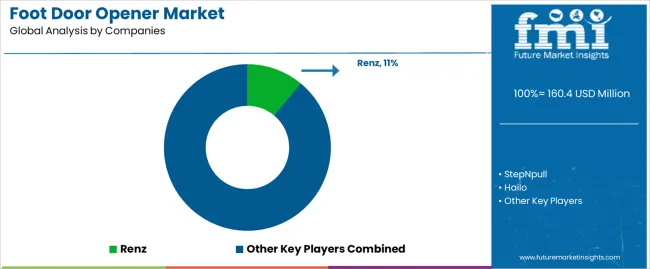

The global foot door opener market is valued at USD 160.4 million in 2025. It is slated to reach USD 330.7 million by 2035, recording an absolute increase of USD 170.3 million over the forecast period. This translates into a total growth of 106.1%, with the market forecast to expand at a compound annual growth rate of 7.5% between 2025 and 2035. The market size is expected to grow by nearly 2.1 times during the same period, supported by increasing demand for touchless access solutions, growing focus on hygiene and infection control in public spaces, and rising adoption of hands-free door opening systems across diverse commercial buildings, healthcare facilities, and institutional environments.

Between 2025 and 2030, the market is projected to expand from USD 160.4 million to USD 230.3 million, resulting in a value increase of USD 69.9 million, which represents 41.0% of the total forecast growth for the decade. This phase of development will be shaped by increasing awareness of surface transmission risks and infection prevention requirements, rising adoption of touchless technologies in commercial buildings and healthcare settings, and growing demand for accessible door solutions that support disability compliance and universal design principles. Facility managers and building operators are expanding their touchless access infrastructure to address the growing need for hygienic building entry solutions that ensure user safety while supporting accessibility standards.

From 2030 to 2035, the market is forecast to grow from USD 230.3 million to USD 330.7 million, adding another USD 100.4 million, which constitutes 59.0% of the overall ten-year expansion. This period is expected to be characterized by the expansion of smart building integration and automated building systems, the development of advanced sensor technologies and remote activation capabilities, and the growth of specialized applications for food service facilities and laboratory environments requiring stringent hygiene protocols. The growing adoption of building automation systems and comprehensive infection control strategies will drive demand for foot door openers with enhanced functionality and connectivity features.

Between 2020 and 2025, the market experienced accelerated growth, driven by heightened awareness of hygiene practices following global health events and growing recognition of touchless technologies as essential solutions for reducing surface contact and supporting infection prevention in high-traffic environments. The market developed as facility managers and health safety professionals recognized the practical advantages of foot-operated door systems to minimize hand contact with door surfaces, improve accessibility for individuals carrying items, and support comprehensive hygiene objectives while maintaining building security. Technological advancement in mechanism design and installation systems began focusing the importance of maintaining operational reliability and ease of use in demanding commercial environments.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 160.4 million |

| Forecast Value in (2035F) | USD 330.7 million |

| Forecast CAGR (2025 to 2035) | 7.5% |

Market expansion is being supported by the increasing global focus on hygiene and infection control driven by heightened public health awareness and workplace safety regulations, alongside the corresponding need for touchless building access solutions that can reduce surface contact, improve accessibility, and maintain operational functionality across various commercial offices, healthcare facilities, and public buildings. Modern facility managers and building operators are increasingly focused on implementing foot door opener solutions that can eliminate hand contact with door hardware, enhance user convenience, and provide consistent performance in high-traffic entry points.

The growing focus on accessibility compliance and universal design principles is driving demand for foot door openers that can support hands-free operation, enable barrier-free access, and ensure comprehensive usability for diverse building occupants. Building owners' preference for retrofittable solutions that combine hygiene benefits with ease of installation and minimal building modification requirements is creating opportunities for innovative foot door opener implementations. The rising influence of green building certification and wellness-focused workplace design is also contributing to increased adoption of foot door openers that can provide hygienic access solutions without compromising building aesthetics or operational efficiency.

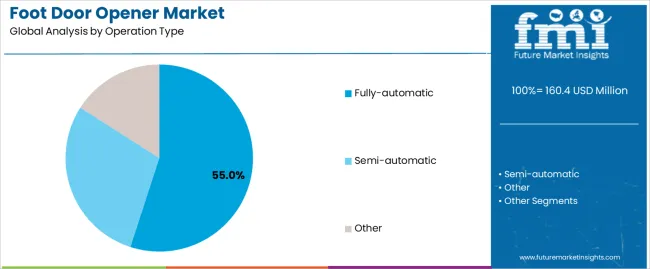

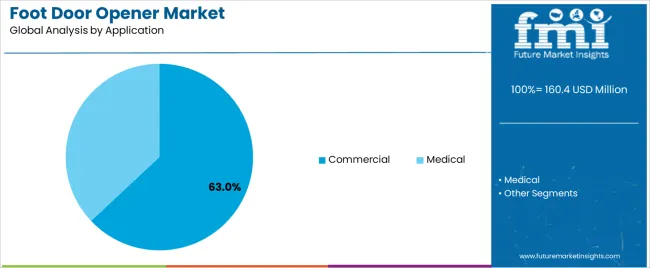

The market is segmented by operation type, application, and region. By operation type, the market is divided into fully-automatic, semi-automatic, and other. Based on application, the market is categorized into commercial and medical. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

The fully-automatic segment is projected to maintain its leading position in the market 55.0% market share in 2025, reaffirming its role as the preferred operation configuration for high-traffic commercial environments and healthcare facilities requiring seamless touchless access. Facility managers and building operators utilize fully-automatic foot door openers for their complete hands-free operation, enhanced user convenience, and proven effectiveness in supporting accessibility requirements while maintaining hygiene standards. Fully-automatic technology's operational sophistication and comprehensive touchless functionality directly address building requirements for barrier-free access and infection prevention across diverse occupant populations and traffic volumes.

This operation segment forms the foundation of modern touchless building infrastructure, as it represents the door opener type with the greatest user convenience and established performance record across multiple commercial applications and healthcare settings. Commercial real estate investments in building modernization and wellness amenities continue to strengthen adoption among property managers and facility operators. With building codes focusing accessibility and workplace health initiatives promoting touchless technologies, fully-automatic foot door openers align with both regulatory requirements and occupant expectations, making them the central component of comprehensive building access strategies.

The commercial application segment is projected to represent the 63.0% market share of foot door opener demand in 2025, highlighting its role as the primary driver for touchless access adoption across office buildings, retail facilities, and mixed-use developments. Commercial building operators prefer foot door openers for entry solutions due to their hygiene benefits, accessibility support, and ability to enhance building amenities while supporting tenant wellness programs and visitor experience improvements. Positioned as essential building hardware for modern commercial spaces, foot door openers offer both functional benefits and health safety advantages.

The segment is supported by continuous expansion in commercial construction activity and the growing availability of retrofittable systems that enable touchless access implementation with minimal disruption and cost-effective installation in existing buildings. Commercial property owners are investing in comprehensive building health programs to support increasingly demanding tenant expectations and workplace wellness certifications. As building health standards advance and touchless technology adoption increases, the commercial application will continue to dominate the market while supporting advanced building amenity offerings and occupant satisfaction strategies.

The foot door opener market is advancing due to increasing awareness of surface transmission risks driven by public health education and growing adoption of touchless technologies that require mechanical access solutions providing enhanced hygiene protection and hands-free convenience across diverse commercial, healthcare, and institutional building applications. The market faces challenges, including installation complexity in certain door configurations and building types, competition from alternative touchless access technologies including automatic door systems, and adoption barriers related to building retrofit costs and awareness limitations. Innovation in mechanism design and smart building integration continues to influence product development and market expansion patterns.

The growing focus on healthcare-associated infection prevention is driving demand for foot door openers that address stringent hygiene requirements including touchless operation, antimicrobial surface treatments, and easy cleaning protocols for clinical environments. Healthcare facilities require reliable access solutions that deliver consistent performance across intensive use while supporting comprehensive infection control programs and regulatory compliance. Hospital administrators and facility managers are increasingly recognizing the practical advantages of foot door opener integration for patient safety enhancement and staff protection, creating opportunities for specialized medical-grade systems specifically designed for healthcare environments.

Modern building technology providers are incorporating connectivity features and sensor integration to enhance operational monitoring, enable usage analytics, and support comprehensive building management objectives through networked access systems and centralized control platforms. Leading manufacturers are developing IoT-enabled foot door openers, implementing usage tracking capabilities, and advancing remote monitoring technologies that provide facility managers with operational insights and predictive maintenance alerts. These technologies improve building management efficiency while enabling operational optimization, including traffic pattern analysis, maintenance scheduling automation, and integration with comprehensive building automation systems. Advanced connectivity integration also allows facility operators to support comprehensive building performance objectives and operational intelligence beyond traditional hardware functionality.

The expansion of building renovation and modernization activities is driving adoption of retrofittable foot door opener systems with simplified installation requirements and minimal structural modification needs that enable touchless access implementation in existing facilities. These adaptable solutions address building owner requirements for cost-effective upgrades, reduce installation complexity, and provide standardized mounting configurations that support rapid deployment across building portfolios. Manufacturers are investing in universal mounting systems and adjustable mechanisms to serve diverse door types and existing hardware configurations while supporting innovation in building health upgrades and touchless technology adoption.

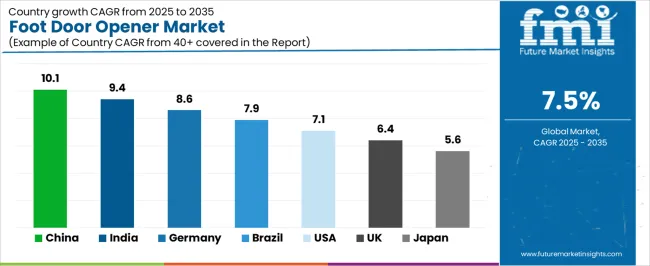

| Country | CAGR (2025-2035) |

|---|---|

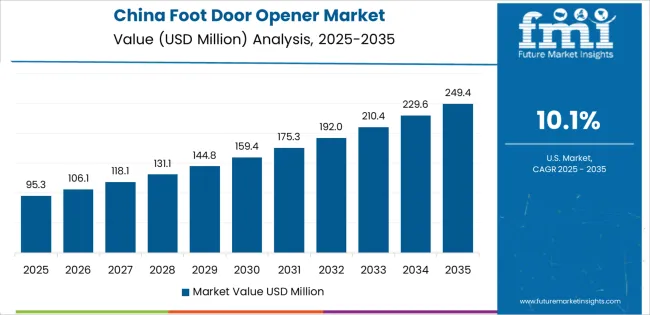

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| Brazil | 7.9% |

| United States | 7.1% |

| United Kingdom | 6.4% |

| Japan | 5.6% |

The market is experiencing solid growth globally, with China leading at a 10.1% CAGR through 2035, driven by expanding commercial construction, growing healthcare infrastructure, and increasing adoption of building hygiene technologies. India follows at 9.4%, supported by rising commercial real estate development, expanding healthcare facilities, and growing awareness of infection control practices. Germany shows growth at 8.6%, focusing building technology innovation, healthcare facility standards, and ecofriendly building certification requirements.

Brazil demonstrates 7.9% growth, supported by commercial construction recovery, healthcare infrastructure expansion, and growing workplace health awareness. The United States records 7.1%, focusing on building wellness certifications, healthcare facility upgrades, and touchless technology adoption in commercial buildings. The United Kingdom exhibits 6.4% growth, focusing healthcare facility modernization and commercial building health initiatives. Japan shows 5.6% growth, focusing hygiene-focused building design and healthcare facility quality standards.

The report covers an in-depth analysis of 40 countries, top-performing countries are highlighted below.

Revenue from foot door openers in China is projected to exhibit exceptional growth with a CAGR of 10.1% through 2035, driven by expanding commercial construction activity and rapidly growing healthcare infrastructure supported by government urbanization initiatives and public health investment programs. The country's massive building development and increasing focus on facility hygiene standards are creating substantial demand for touchless access solutions. Major building hardware manufacturers and international suppliers are establishing comprehensive distribution and installation service capabilities to serve both new construction projects and retrofit applications.

Revenue from foot door openers in India is expanding at a CAGR of 9.4%, supported by expanding commercial real estate sector, growing healthcare infrastructure, and increasing awareness of workplace hygiene driven by corporate wellness initiatives and healthcare facility modernization programs. The country's substantial construction activity and developing building technology market are driving demand for touchless access systems throughout diverse building types. Leading building hardware suppliers and local distributors are establishing market presence and installation capabilities to address growing demand.

Revenue from foot door openers in Germany is expanding at a CAGR of 8.6%, supported by the country's focus on building technology innovation, advanced healthcare facility standards, and comprehensive sustainability certifications requiring wellness-focused building features. Germany's construction quality standards and technology sophistication are driving demand for advanced touchless access solutions throughout commercial and healthcare sectors. Leading building technology companies and healthcare facility suppliers are investing in innovative product development and market expansion.

Revenue from foot door openers in Brazil is growing at a CAGR of 7.9%, driven by commercial construction sector recovery, healthcare infrastructure expansion, and growing workplace health awareness across corporate offices and medical facilities. Brazil's developing building technology market and increasing health consciousness are supporting investment in touchless access solutions. Building hardware distributors and facility management companies are establishing product availability for construction and retrofit applications.

Revenue from foot door openers in the United States is expanding at a CAGR of 7.1%, supported by established building wellness certification programs, extensive healthcare facility upgrade initiatives, and growing corporate focus on workplace health and safety features. The nation's mature commercial real estate market and comprehensive healthcare infrastructure are driving demand for touchless access technologies. Building product suppliers and facility management companies are investing in product availability and installation service capabilities.

Revenue from foot door openers in the United Kingdom is expanding at a CAGR of 6.4%, supported by National Health Service facility modernization programs, commercial building health initiatives, and ongoing efforts to improve public building accessibility and hygiene standards. The country's healthcare facility investment and commercial building upgrade activities are driving demand for touchless access solutions. Healthcare facility suppliers and building hardware distributors are implementing market development programs.

Revenue from foot door openers in Japan is expanding at a CAGR of 5.6%, supported by the country's focus on hygiene and cleanliness, established healthcare facility quality standards, and cultural preferences for touchless technologies in public spaces. Japan's attention to building quality and health consciousness are driving demand for advanced touchless access systems. Leading building hardware manufacturers and healthcare facility suppliers are investing in product development for domestic market requirements.

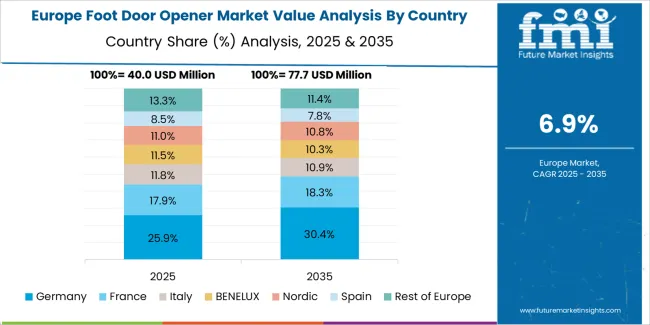

The foot door opener market in Europe is projected to grow from USD 60.4 million in 2025 to USD 111.8 million by 2035, registering a CAGR of 6.4% over the forecast period. Germany is expected to maintain leadership with a 28.7% market share in 2025, moderating to 28.4% by 2035, supported by building technology innovation, healthcare facility standards, and comprehensive accessibility regulations.

France follows with 19.3% in 2025, projected at 19.6% by 2035, driven by healthcare facility modernization, commercial building development, and public health initiatives. The United Kingdom holds 16.9% in 2025, declining to 16.5% by 2035 due to market maturation and competitive dynamics. Italy commands 12.8% in 2025, rising to 13.1% by 2035, while Spain accounts for 9.4% in 2025, reaching 9.7% by 2035 aided by healthcare infrastructure investment and commercial construction growth.

The Netherlands maintains 6.7% in 2025, up to 6.9% by 2035 due to ecofriendly building initiatives and healthcare facility quality programs. The Rest of Europe region, including Nordic countries, Central and Eastern Europe, and other markets, is anticipated to hold 6.2% in 2025 and 5.8% by 2035, reflecting gradual adoption in emerging markets and building modernization programs.

The market is characterized by competition among specialized building hardware manufacturers, medical equipment suppliers, and innovative touchless technology providers. Companies are investing in mechanism design optimization, material durability enhancement, installation system simplification, and application-specific product development to deliver reliable, user-friendly, and cost-effective foot door opener solutions. Innovation in automatic opening mechanisms, antimicrobial surface treatments, and smart building integration capabilities is central to strengthening market position and competitive advantage.

Renz leads the market with comprehensive foot door opener solutions with a focus on operational reliability, installation flexibility, and established presence in commercial building and healthcare applications. StepNpull provides innovative foot-operated door systems with focus on simple installation and universal door compatibility. Hailo offers versatile building hardware products with focus on German engineering quality and commercial building applications. SPM delivers specialized foot door opener systems with comprehensive product portfolios for diverse building types. Jalema provides building access solutions with focus on touchless technologies and office building applications. Arte Viva specializes in design-focused building hardware with aesthetic integration capabilities.

Portal focuses on automatic door opening systems with advanced mechanism designs. Actemium offers building automation solutions with integrated touchless access technologies. Pan-Oston delivers door hardware systems with comprehensive commercial building product lines. Fab Fours provides specialized mounting solutions with focus on heavy-duty applications and industrial environments.

Foot door openers represent a touchless building access technology segment within commercial construction and healthcare facility infrastructure, projected to grow from USD 160.4 million in 2025 to USD 330.7 million by 2035 at a 7.5% CAGR. These hands-free door opening devices serve as essential building hardware in commercial offices, healthcare facilities, institutional buildings, and public spaces where hygiene protection, accessibility support, and touchless operation are required. Market expansion is driven by increasing infection control awareness, growing focus on workplace wellness, advancing accessibility standards, and rising adoption of touchless technologies across diverse building types and facility environments.

How Building Regulators Could Strengthen Standards and Accessibility Requirements?

How Building Industry Associations Could Advance Technology Adoption and Best Practices?

How Foot Door Opener Manufacturers Could Drive Innovation and Market Leadership?

How Building Owners and Facility Managers Could Optimize Building Health Features?

How Research Institutions Could Enable Technology Advancement?

How Investors and Financial Enablers Could Support Market Growth and Innovation?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 160.4 million |

| Operation Type | Fully-automatic, Semi-automatic, Other |

| Application | Commercial, Medical |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40 countries |

| Key Companies Profiled | Renz, StepNpull, Hailo, SPM, Jalema, Arte Viva |

| Additional Attributes | Dollar sales by operation type and application category, regional demand trends, competitive landscape, technological advancements in mechanism design, material durability, smart building integration, and installation system optimization |

The global foot door opener market is estimated to be valued at USD 160.4 million in 2025.

The market size for the foot door opener market is projected to reach USD 330.6 million by 2035.

The foot door opener market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in foot door opener market are fully-automatic, semi-automatic and other.

In terms of application, commercial segment to command 63.0% share in the foot door opener market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foot Suction Valve Market Forecast and Outlook 2025 to 2035

Footprint Detection Light Market Size and Share Forecast Outlook 2025 to 2035

Foot Fungus Treatments Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Foot Care For Diabetic Patients Market Size and Share Forecast Outlook 2025 to 2035

Foot Patches Market Size and Share Forecast Outlook 2025 to 2035

Foot Suction Unit Market Size and Share Forecast Outlook 2025 to 2035

Foot and Mouth Disease Vaccines Market Size and Share Forecast Outlook 2025 to 2035

Football Merchandise Market Size and Share Forecast Outlook 2025 to 2035

Foot Care Product Market Analysis by Product Type, Distribution Channel and Region Through 2035

Foot and Ankle Devices Market Analysis - Trends, Growth & Forecast 2024 to 2034

Footwear Adhesives Market

Dog Footwear Market Size and Share Forecast Outlook 2025 to 2035

PVC Footwear Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Barefoot Shoes Market Growth – Size, Demand & Forecast 2024-2034

Vegan Footwear Market Insights - Demand & Forecast 2025 to 2035

Hand, Foot and Mouth Disease Treatment Market

Luxury Footwear Market Outlook – Size, Share & Innovations 2025 to 2035

Carbon Footprint Management Market

Women’s Footwear Market Size, Growth, and Forecast for 2025 to 2035

Medical Footwear Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA