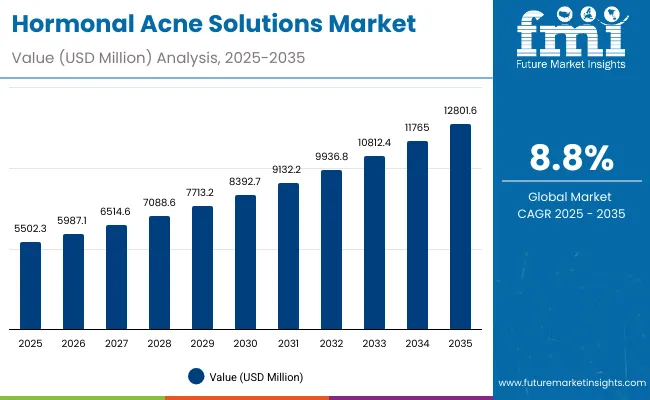

The Hormonal Acne Solutions Market is expected to record a valuation of USD 5,502.3 million in 2025 and USD 12,801.6 million in 2035, with an increase of USD 7,299.3 million, which equals a growth of 133% over the decade. The overall expansion represents a CAGR of 8.8% and more than a 2X increase in market size.

Hormonal Acne Solutions Market Key Takeaways

| Metric | Value |

|---|---|

| Hormonal Acne Solutions Market Estimated Value in (2025E) | USD 5,502.3 million |

| Hormonal Acne Solutions Market Forecast Value in (2035F) | USD 12,801.6 million |

| Forecast CAGR (2025 to 2035) | 8.8% |

During the first five-year period from 2025 to 2030, the market rises from USD 5,502.3 million to USD 8,392.7 million, adding USD 2,890.4 million, which accounts for nearly 40% of the total decade growth. This phase records steady adoption in dermatology clinics, pharmacies, and e-commerce, driven by high demand from adult women who remain the most impacted group for hormonal acne. Topical creams/gels and oral medications dominate during this period as consumers seek clinically validated treatments that provide fast relief, often under dermatological guidance.

The second half from 2030 to 2035 contributes USD 4,408.9 million, equal to nearly 60% of total growth, as the market jumps from USD 8,392.7 million to USD 12,801.6 million. This acceleration is powered by e-commerce penetration, nutricosmetic supplements, and hormonal regulators such as spironolactone and zinc, which gain prominence for long-term management. Digital health platforms recommending dermatologist-approved regimens, coupled with increased consumer awareness around "pregnancy-safe" and "clinically proven" claims, are expected to reshape consumer preferences. Premium clinical procedures adjunct to at-home treatments also see higher uptake in urban centers.

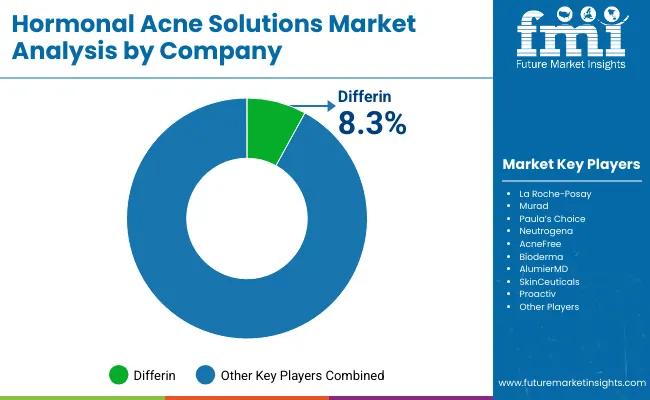

From 2020 to 2024, the Hormonal Acne Solutions Market expanded steadily, driven by clinical reliance on topical retinoids, benzoyl peroxide, and salicylic acid formulations. During this period, topical treatments accounted for nearly half of global sales, while pharmaceutical players dominated distribution through drugstores and dermatology clinics. Leading brands such as Differin and Neutrogena strengthened their positioning with dermatologist-backed campaigns, controlling close to 8-10% of total value. The market was characterized by high trust in clinically proven, dermatologist-recommended claims, while supplements and nutricosmetics remained in the early adoption phase, contributing less than 15% of global value.

Demand for hormonal acne solutions is expected to expand to USD 5,502.3 million in 2025, with the revenue mix evolving significantly over the decade. The growth of supplements, hormone-regulating formulations, and pregnancy-safe solutions is expected to reshape competition. Traditional topical leaders are facing rising pressure from digital-first skincare brands leveraging e-commerce to deliver personalized acne solutions. Major global players are pivoting toward holistic regimens combining topical, oral, and supplement-based approaches. Meanwhile, newer entrants emphasizing clean beauty, fragrance-free claims, and nutricosmetic benefits are gaining traction. Competitive advantage is shifting from single-ingredient strength to integrated routines, trust-based claims, and multi-channel accessibility.

Advances in dermatological research have validated the role of hormonal regulators and topical retinoids in reducing inflammatory lesions. The rising incidence of adult female acne, particularly post-teen years, is a strong demand driver, with hormonal imbalance cited by dermatologists as a recurring cause. Over-the-counter accessibility of retinoids and benzoyl peroxide, combined with professional dermatology consultations, has made treatment more mainstream.

The expansion of supplements and nutricosmetics has further fueled adoption, as consumers explore long-term acne management via zinc, DIM, and hormonal balance support formulations. In parallel, consumer expectations for dermatologist-recommended, clinically proven, and pregnancy-safe solutions have shaped innovation pipelines. E-commerce platforms have accelerated access by enabling product comparisons, subscriptions, and targeted regimens, leading to higher conversion. Segment growth is expected to be led by topical treatments in the short term, while nutricosmetics and clinical procedure adjuncts will gain higher traction by 2035. Overall, the market is evolving from a purely symptom-relief approach to a holistic skincare and lifestyle-driven management solution, reflecting a fundamental shift in consumer behavior.

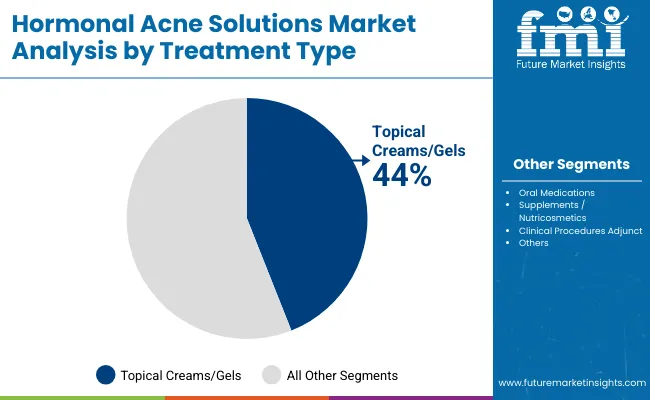

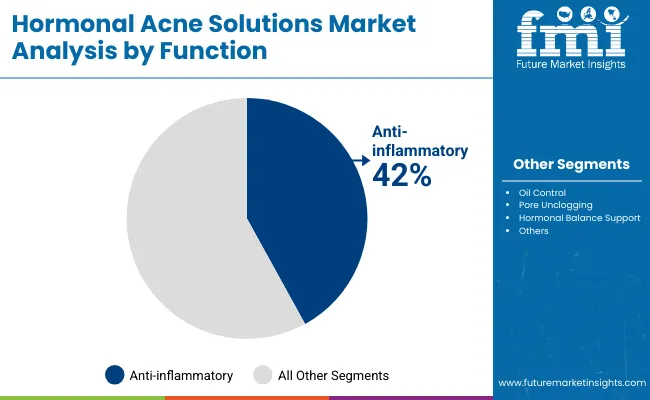

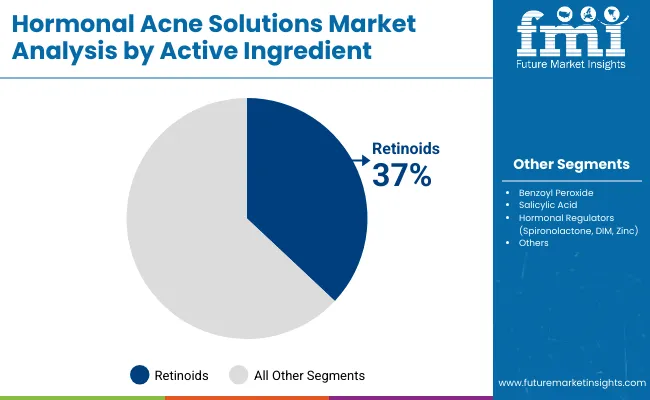

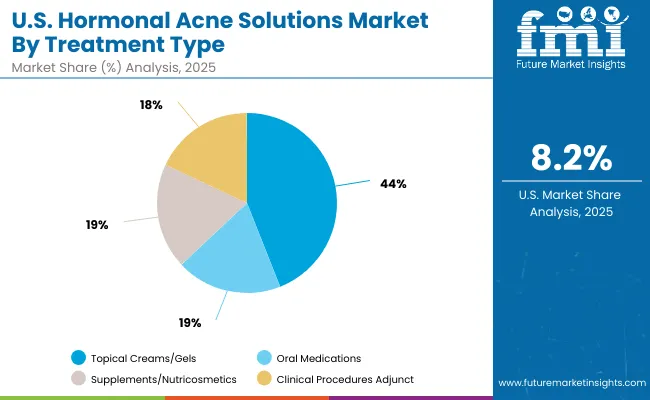

The market is segmented by treatment type, active ingredient, function, channel, claim, end user, and region. Treatment types include topical creams/gels, oral medications, supplements or nutricosmetics, and clinical procedures adjunct, representing the primary therapeutic avenues in acne management. Active ingredients span benzoyl peroxide, retinoids, salicylic acid, and hormonal regulators such as spironolactone, DIM, and zinc, each catering to different acne-causing mechanisms. Functions covered in this market include oil control, pore unclogging, anti-inflammatory action, and hormonal balance support, highlighting the multifaceted approaches consumers seek.

Distribution channels range across dermatology clinics, pharmacies and drugstores, e-commerce platforms, and mass retail outlets, reflecting both professional and over-the-counter accessibility. Product claims such as fragrance-free, clinically proven, pregnancy-safe, and dermatologist-recommended serve as key differentiators shaping consumer trust. The end user base is segmented into adolescent females, adult women, and men, acknowledging varied hormonal triggers across demographics. Regionally, the scope spans North America, Europe, East Asia, South Asia and Pacific, Latin America, and the Middle East and Africa, encompassing both mature skincare markets and emerging regions with rising dermatological awareness.

| Treatment Type | Value Share% 2025 |

|---|---|

| Topical creams/gels | 44% |

| Others | 56.0% |

The topical creams and gels segment is projected to contribute 44% of the Hormonal Acne Solutions Market revenue in 2025, maintaining its position as the most widely used treatment approach. This dominance is driven by the accessibility of over-the-counter products containing retinoids, benzoyl peroxide, and salicylic acid, which continue to be first-line options for consumers and dermatologists alike. The segment benefits from established consumer trust, dermatologist recommendations, and affordability compared to more complex treatments such as hormonal regulators or clinical procedures.

Growth in this segment is further supported by innovations in formulation, including fragrance-free, pregnancy-safe, and dermatologist-tested claims, which resonate with diverse consumer groups. As e-commerce platforms expand availability, consumers are increasingly turning to topical solutions for self-managed regimens. While supplements and hormonal regulators gain traction for long-term management, topical treatments remain the backbone of acne solutions, providing immediate relief and maintaining the largest share through 2035.

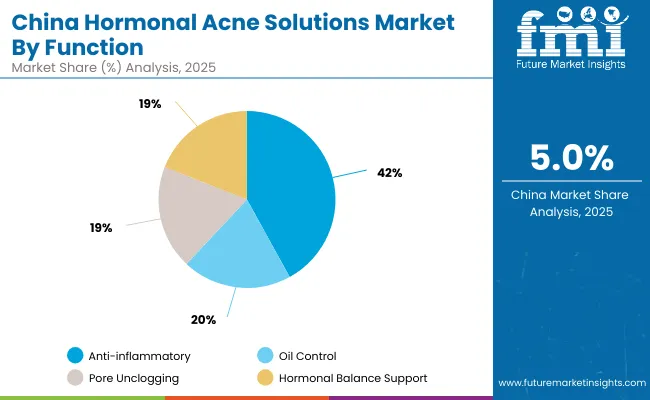

| Function | Value Share% 2025 |

|---|---|

| Anti-inflammatory | 42% |

| Others | 58.0% |

The anti-inflammatory function segment is forecasted to hold 42% of the Hormonal Acne Solutions Market share in 2025, reflecting strong consumer demand for treatments that address the visible redness, swelling, and irritation associated with hormonal acne. Products featuring retinoids, benzoyl peroxide, and zinc are particularly valued for their dual role in reducing bacterial activity and calming skin inflammation.

The segment’s appeal is further amplified by the rise of dermatologist-recommended and clinically proven labels, which assure consumers of both safety and efficacy. In markets such as the USA and China, anti-inflammatory formulations dominate due to widespread prescription practices and strong OTC availability. With ongoing R&D into gentler yet effective ingredients, this category aligns with the consumer trend toward skin barrier-friendly acne care. Given its effectiveness in providing both short-term relief and long-term improvement, the anti-inflammatory segment is expected to continue shaping product development and consumer preference globally.

| Active Ingredient | Value Share% 2025 |

|---|---|

| Retinoids | 37% |

| Others | 63.0% |

The retinoids segment is projected to account for 37% of the Hormonal Acne Solutions Market revenue in 2025, making it the leading active ingredient group. Retinoids are widely recognized for their ability to regulate cell turnover, unclog pores, and reduce acne-related inflammation, making them highly effective for persistent hormonal acne cases. Their use spans both prescription-strength formulations and widely available OTC products, increasing their penetration across demographics.

Advancements in formulation, such as micro-encapsulation and lower-irritancy blends, have made retinoids more tolerable for sensitive skin, boosting adoption among adolescent and adult users alike. In premium segments, dermatologist-endorsed brands like Differin and SkinCeuticals emphasize retinoid-based therapies, consolidating their market positioning. Despite the rise of alternative actives such as hormonal regulators and nutricosmetics, retinoids remain the cornerstone of evidence-based acne management, sustaining their leadership as the gold-standard active through the forecast period.

Rising Prevalence of Adult Female Hormonal Acne

A growing body of dermatological research highlights that adult women are increasingly affected by hormonal acne, with prevalence rates rising due to stress, dietary shifts, and endocrine imbalances. According to the American Academy of Dermatology (AAD, 2023), nearly 50% of women aged 20-29 and one-third of women in their 30s experience acne, often linked to hormonal fluctuations.

This demographic represents the largest end-user group in the market, fueling demand for both topical treatments and hormonal regulators. As women seek long-term and pregnancy-safe solutions, brands that integrate dermatologist-recommended, clinically proven claims gain significant traction. This driver directly strengthens the growth of retinoids and anti-inflammatory formulations, while also accelerating the supplement and nutricosmetic segment, particularly in the USA, China, and India.

Expanding E-commerce and Digital Dermatology Platforms

The rapid expansion of e-commerce platforms and tele-dermatology services has transformed access to acne solutions. In 2025, online sales already represent a fast-growing channel, with direct-to-consumer (D2C) brands and established players leveraging subscription models, AI-powered skin assessments, and social media dermatology campaigns. This ecosystem allows consumers to compare claims such as "fragrance-free" or "pregnancy-safe" instantly and receive personalized regimens. In China and India, e-commerce is enabling younger consumers to bypass traditional pharmacies, while in North America, online platforms provide convenience and discretion for adult women and men alike. As clinical and OTC acne solutions converge online, digital accessibility stands out as a critical driver of long-term market growth.

Side Effects and Safety Concerns Around Hormonal Regulators

While hormonal regulators such as spironolactone and DIM are gaining traction, safety concerns present a significant barrier. Side effects ranging from dizziness to potential contraindications during pregnancy limit the adoption rate in sensitive demographics. Regulatory agencies in Europe and North America continue to impose strict prescription controls, slowing down mainstream adoption. This restraint also extends to consumer hesitancy, as growing awareness around skin barrier sensitivity and systemic effects pushes some users away from long-term oral solutions. Brands must therefore invest in pregnancy-safe formulations and alternative nutricosmetics to offset these concerns, or risk losing share in the adult women category where the unmet need remains highest.

High Competition and Market Fragmentation

The market is highly fragmented with global, regional, and indie brands, making consumer choice complex. Major players such as Differin, La Roche-Posay, and Neutrogena compete alongside smaller niche brands promoting natural or clean-label acne care. This intensifies price pressure in topical creams/gels the largest segment with 44% share in 2025. Fragmentation also dilutes brand loyalty, as consumers frequently switch products due to marketing claims like "dermatologist-recommended" or "clinically proven." In developing regions, local players often undercut international brands with affordable products, further limiting premium brand penetration. This restraint is expected to persist, making competitive positioning and claim differentiation increasingly vital.

Nutricosmetics and Supplements as Adjunct Therapies

A major trend is the rise of supplements and nutricosmetics (zinc, DIM, probiotics, and plant-based extracts) being positioned as adjunct therapies to traditional topical and oral acne treatments. In markets like Japan and India, consumers are increasingly blending oral beauty nutrition with skincare to address hormonal imbalance internally. Global brands are investing in this cross-segment expansion, introducing capsules, powders, and gummies that align with the wellness and lifestyle movement. This trend expands the hormonal acne market beyond pharmaceuticals and cosmetics, creating an integrated skincare-wellness ecosystem that is expected to accelerate post-2030.

Growing Demand for Pregnancy-Safe and Clean-Label Claims

Consumer focus on pregnancy-safe, fragrance-free, and dermatologist-proven claims is shaping product innovation. Retinoids, despite their efficacy, face growing scrutiny in pregnancy contexts, prompting brands to invest in alternative actives and gentler anti-inflammatory solutions. Clean-label trends, particularly in Europe and North America, are driving growth in formulations that minimize harsh preservatives and emphasize skin barrier protection. This demand is shifting R&D pipelines from "stronger" actives toward holistic, tolerable, and safe regimens, reinforcing the premiumization of the market and opening opportunities for new entrants that can bridge clinical efficacy with safety assurances.

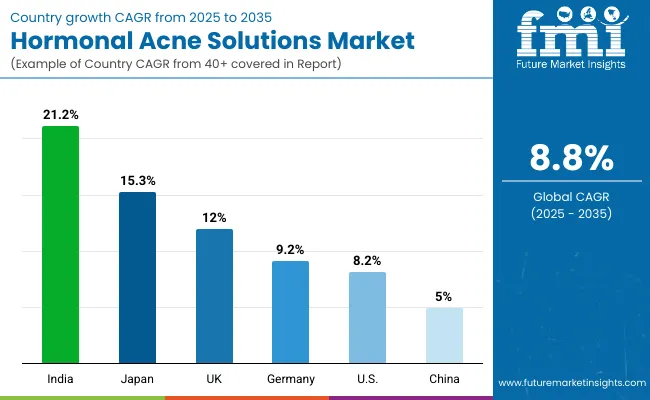

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 5.0% |

| USA | 8.2% |

| India | 21.2% |

| UK | 12.0% |

| Germany | 9.2% |

The decade outlook shows wide variations in country-level growth, with India leading at 21.2% CAGR, followed by Japan at 15.3% and the UK at 12%, highlighting how demand dynamics differ between emerging and mature skincare markets. India’s rapid growth is fueled by a young demographic base, rising middle-class incomes, and accelerated adoption of both nutricosmetics and e-commerce-driven skincare purchases. Similarly, Japan’s double-digit CAGR is underpinned by high consumer acceptance of nutritional supplements for skin health, integration of clean-label claims, and increased awareness of adult female acne. The UK, while a mature European market, benefits from premiumization trends, strong dermatology networks, and rising awareness of safe formulations during pregnancy, ensuring robust growth momentum compared to other Western countries.

In contrast, the USA (8.2% CAGR) and Germany (9.2% CAGR) reflect steady but more moderate growth, owing to already high market penetration of topical and OTC solutions, coupled with brand maturity. The USA remains the largest single-country market with continued consumer reliance on dermatologist-recommended retinoids and expanding e-commerce. Germany’s growth is shaped by a shift toward dermatologist-supervised treatments and clean-label innovations, although rising local competition slows expansion. China (5.0% CAGR) shows the slowest growth rate among key markets, as the country already exhibits widespread OTC acne product adoption, making incremental growth dependent on innovation in hormonal regulators and supplements rather than conventional topicals.

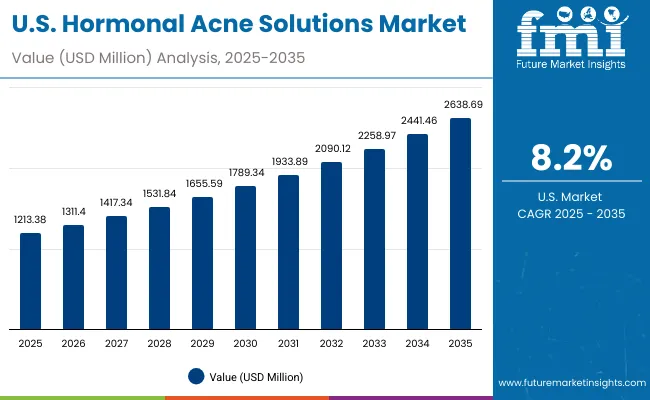

| Year | USA Hormonal Acne Solutions Market (USD Million) |

|---|---|

| 2025 | 1,213.38 |

| 2026 | 1,311.40 |

| 2027 | 1,417.34 |

| 2028 | 1,531.84 |

| 2029 | 1,655.59 |

| 2030 | 1,789.34 |

| 2031 | 1,933.89 |

| 2032 | 2,090.12 |

| 2033 | 2,258.97 |

| 2034 | 2,441.46 |

| 2035 | 2,638.69 |

The USA Hormonal Acne Solutions Market is projected to grow at a CAGR of 8.2%, driven by strong demand from adult women and rising interest in clinically validated regimens. Topical creams/gels remain the leading treatment, contributing 44% of national sales in 2025, with sustained growth in dermatologist-recommended retinoid and benzoyl peroxide formulations. Supplements and nutricosmetics are steadily expanding, supported by consumer interest in pregnancy-safe and hormone-balancing alternatives. Digital dermatology platforms and e-commerce-driven skincare subscriptions are further propelling adoption, particularly among millennial and Gen Z users seeking personalized solutions. The USA market continues to be shaped by trust in dermatologist guidance, OTC accessibility, and integrated treatment regimens.

The UK Hormonal Acne Solutions Market is expected to grow at a CAGR of 12%, supported by strong adoption of premium and clinically proven products. Consumers are increasingly favoring dermatologist-endorsed brands with fragrance-free and pregnancy-safe claims. Rising stress-related acne among young professionals and demand for hormonal balance supplements are expanding the addressable market. Retailers and pharmacies in the UK actively stock international brands such as La Roche-Posay and Paula’s Choice, while local clinics emphasize combination regimens of topical and oral treatments. Government health awareness campaigns and robust dermatology networks enhance consumer education, driving demand for safe, science-backed acne solutions.

India is witnessing rapid expansion in the Hormonal Acne Solutions Market, forecast to grow at a CAGR of 21.2%, the highest globally. Rising disposable incomes, urbanization, and social media-driven awareness are driving strong uptake across tier-1 and tier-2 cities. Younger demographics and a growing female consumer base are increasingly turning to supplements, hormonal regulators, and e-commerce-driven skincare brands. Localized pricing and availability of clinically proven yet affordable topical treatments are critical for mass-market adoption. Simultaneously, dermatology clinics in urban centers are seeing increased demand for adjunct clinical procedures such as chemical peels, often paired with OTC products. India’s market is transforming into a high-growth hub, driven by both affordability and premiumization trends.

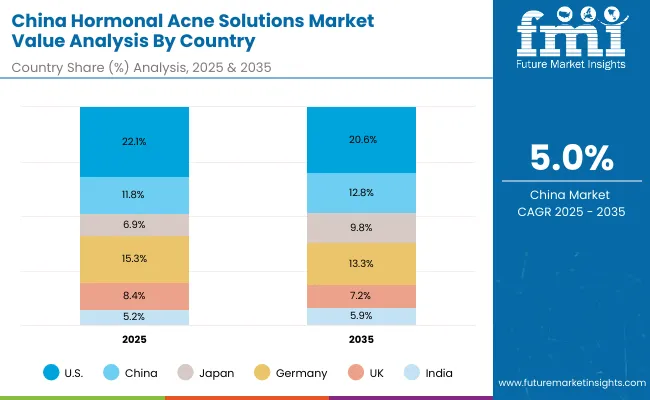

| Countries | 2025 Share (%) |

|---|---|

| USA | 22.1% |

| China | 11.8% |

| Japan | 6.9% |

| Germany | 15.3% |

| UK | 8.4% |

| India | 5.2% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 20.6% |

| China | 12.8% |

| Japan | 9.8% |

| Germany | 13.3% |

| UK | 7.2% |

| India | 5.9% |

The China Hormonal Acne Solutions Market is projected to expand at a CAGR of 5.0%, the slowest among leading economies, due to already high penetration of OTC topical treatments. However, premium growth segments lie in anti-inflammatory solutions, which hold 42% of the market in 2025, and in emerging nutricosmetic supplements. Chinese consumers increasingly prefer dermatologist-recommended, fragrance-free, and clinically proven formulations, and younger women are turning to e-commerce platforms such as Tmall and JD.com for personalized acne care regimens. Growth is being driven more by premiumization and product innovation rather than volume expansion, with global brands competing against strong local players emphasizing affordability and herbal actives.

| USA by Treatment Type | Value Share% 2025 |

|---|---|

| Topical creams/gels | 44% |

| Others | 56.0% |

The USA Hormonal Acne Solutions Market is projected at USD 1,213.38 million in 2025, with topical creams/gels contributing 44% of total value, reaffirming their dominance as first-line solutions. This strength stems from strong reliance on retinoids, benzoyl peroxide, and salicylic acid formulations, all widely available through both pharmacies and e-commerce. The market also shows clear movement toward pregnancy-safe and clinically proven claims, reflecting consumer caution in dermatology products.

The growing digital dermatology ecosystem, including subscription services and telehealth acne consultations, further boosts adoption of integrated regimens that combine topical treatments with supplements. USA consumers demonstrate high trust in dermatologist-recommended solutions, with Differin, La Roche-Posay, and Neutrogena leading positioning. Over the next decade, supplement and nutricosmetic adoption is expected to grow steadily, but topical treatments remain the backbone of acne care.

| China by Function | Value Share% 2025 |

|---|---|

| Anti-inflammatory | 42% |

| Others | 58.0% |

The China Hormonal Acne Solutions Market is projected at USD 647.26 million in 2025, with anti-inflammatory solutions leading at 42% of total sales. This dominance reflects Chinese consumers’ preference for redness-reducing and irritation-calming formulations, often promoted as fragrance-free and dermatologist-proven. Local innovation also plays a role, with Chinese brands emphasizing herbal actives and gentle formulations to meet growing demand for skin-barrier-friendly acne care.

E-commerce platforms such as Tmall and JD.com act as major distribution channels, enabling both global and domestic players to compete for digitally savvy consumers. While OTC topicals remain highly penetrated, future growth is tied to nutricosmetics and hormonal balance supplements, which align with China’s wellness-oriented skincare culture. The opportunity lies in expanding from simple acne relief into holistic acne management, integrating anti-inflammatory, oil-control, and hormonal balance functions within single regimens.

The Hormonal Acne Solutions Market is moderately fragmented, with leading multinational skincare brands, premium dermatology-focused companies, and emerging supplement providers competing across multiple consumer categories. Differin leads with an 8.3% share in 2025, benefiting from strong dermatologist endorsements and broad OTC presence in North America and Europe. La Roche-Posay, Neutrogena, Murad, and Paula’s Choice also capture significant shares through premium positioning, e-commerce-driven strategies, and emphasis on clinically proven claims.

Mid-tier players such as Bioderma, AlumierMD, and SkinCeuticals appeal to niche dermatology clinic and premium skincare channels, building trust with targeted audiences through professional recommendations and clean-label claims. Meanwhile, consumer-focused brands like AcneFree and Proactiv continue to thrive in mass retail and subscription models, particularly among adolescents. Competitive differentiation is shifting away from single active ingredients toward integrated acne regimens that combine topical solutions, hormonal regulators, and supplements. Demand for pregnancy-safe, fragrance-free, and dermatologist-recommended claims is setting the standard for product innovation. Players that build multi-channel ecosystems spanning pharmacies, e-commerce, and dermatology clinics will be better positioned to capture the decade’s growth momentum.

Key Developments in Hormonal Acne Solutions Market

| Item | Value |

|---|---|

| Quantitative Units | USD 5,502.3 million |

| Treatment Type | Topical creams/gels, Oral medications, Supplements/nutricosmetics, and Clinical procedures adjunct |

| Active Ingredient | Benzoyl peroxide, Retinoids, Salicylic acid, and Hormonal regulators (spironolactone, DIM, zinc) |

| Function | Oil control, Pore unclogging, Anti-inflammatory, and Hormonal balance support |

| Channel | Dermatology clinics, Pharmacies/drugstores, E-commerce, and Mass retail |

| Claim | Fragrance-free, Clinically proven, Pregnancy-safe, Dermatologist-recommended |

| End User | Adolescent females, Adult women, and Men |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Differin, La Roche-Posay, Murad, Paula’s Choice, Neutrogena, AcneFree, Bioderma, AlumierMD, SkinCeuticals, Proactiv |

| Additional Attributes | Dollar sales by treatment type, function, and ingredient category; adoption trends in e-commerce and tele-dermatology platforms; rising demand for pregnancy-safe and fragrance-free claims; segment-specific growth in supplements and nutricosmetics; revenue segmentation by topical vs. oral vs. clinical procedures; innovation in hormonal regulators and barrier-friendly actives; regional trends shaped by dermatology networks and digital-first brands; and R&D in low-irritancy retinoids and hormonal balance support formulations. |

The Hormonal Acne Solutions Market is estimated to be valued at USD 5,502.3 million in 2025.

The market size for the Hormonal Acne Solutions Market is projected to reach USD 12,801.6 million by 2035.

The Hormonal Acne Solutions Market is expected to grow at a CAGR of 8.8% between 2025 and 2035.

The key treatment types in the Hormonal Acne Solutions Market are topical creams/gels, oral medications, supplements/nutricosmetics, and clinical procedures adjunct.

In terms of function, the anti-inflammatory segment is projected to command 42% share of the Hormonal Acne Solutions Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hormonal Contraception Market Size and Share Forecast Outlook 2025 to 2035

Hormonal Health Supplements Market – Growth, Demand & Nutritional Trends

Red Clover Extracts for Hormonal Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Acne Scarring Treatments Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Products Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-acne Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Serum Market Report - Demand & Growth Forecast 2025 to 2035

Market Share Insights for Anti-Acne Dermal Patch Providers

Anti-acne Dermal Patch Market Insights – Trends & Forecast 2024-2034

BHA-Encapsulated Acne Treatment Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Moderate-to-Severe Acne Treatment Market Trends and Forecast 2025 to 2035

5PL Solutions Market

mHealth Solutions Market Size and Share Forecast Outlook 2025 to 2035

Long Haul Solutions Market Size and Share Forecast Outlook 2025 to 2035

eClinical Solutions and Software Market Insights - Trends & Forecast 2025 to 2035

E-tailing Solutions Market Growth – Trends & Forecast 2020-2030

Connected Solutions for Oil & Gas Market Insights – Trends & Forecast 2020-2030

Biocontrol Solutions Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA