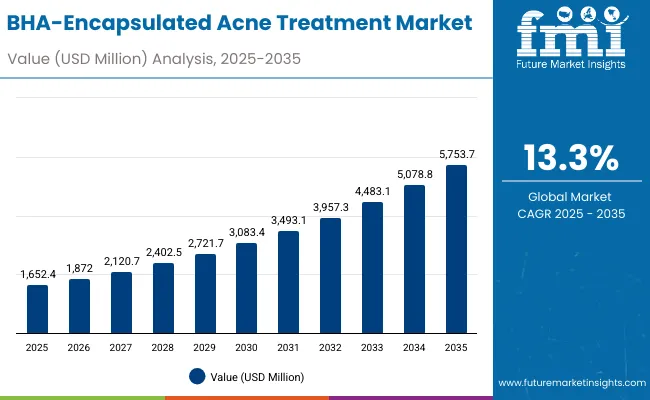

The BHA-Encapsulated Acne Treatment Market is expected to record a valuation of USD 1,652.4 million in 2025 and USD 5,753.7 million in 2035, with an increase of USD 4,101.3 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 13.3% and a 2X increase in market size.

BHA-Encapsulated Acne Treatment Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,652.4 million |

| Forecast Value in (2035F) | USD 5,753.7 million |

| Forecast CAGR (2025 to 2035) | 13.3% |

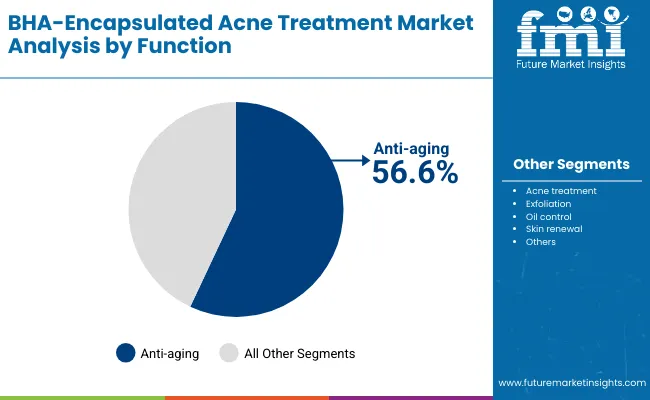

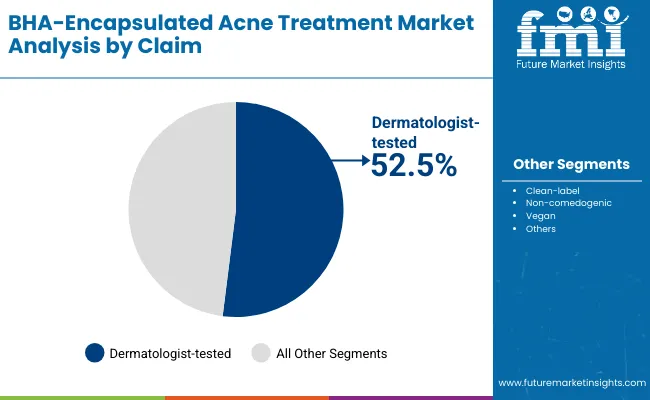

During the first five-year period from 2025 to 2030, the market increases from USD 1,652.4 million to USD 3,083.4 million, adding USD 1,431 million, which accounts for 35% of the total decade growth. This phase records steady adoption in acne treatment serums, exfoliating cleansers, and oil-control gels, driven by rising consumer demand for encapsulated actives that reduce irritation and improve long-term skin health. Acne treatment functions dominate, holding 56.6% share in 2025 (USD 933.3 million), reflecting the high prevalence of acne across global populations. Dermatologist-tested claims remain highly influential during this phase, accounting for 52.5% (USD 866.7 million) of the global market, signaling consumer reliance on clinically validated solutions.

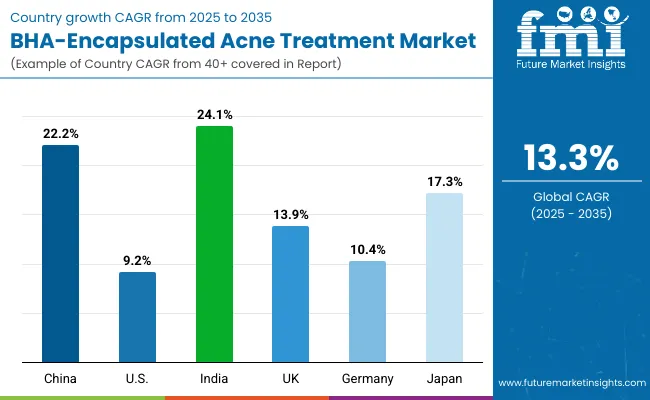

The second half from 2030 to 2035 contributes USD 2,670.3 million, equal to 65% of total growth, as the market jumps from USD 3,083.4 million to USD 5,753.7 million. This acceleration is powered by advances in encapsulation science enabling controlled release, reduced irritation, and enhanced bioavailability of BHA molecules. E-commerce and specialty beauty stores expand aggressively, driven by consumer preference for online consultations, AI-powered skin diagnostics, and subscription-based product delivery. Serums and spot treatments rise as the fastest-growing product types, benefitting from targeted application demand. Emerging economies, particularly China (22.2% CAGR) and India (24.1% CAGR), contribute significantly, while Japan (17.3% CAGR) outpaces mature markets like the USA and Europe in growth.

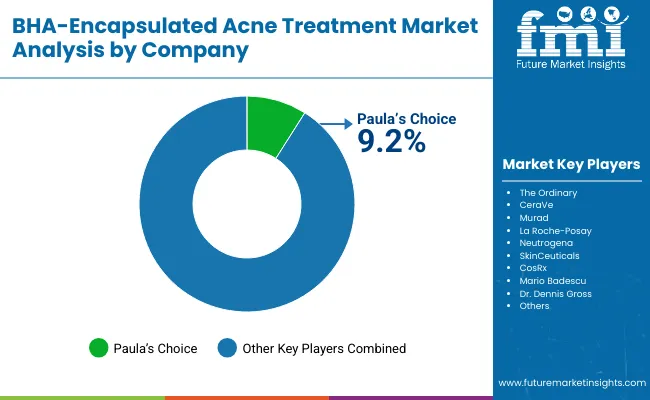

From 2020 to 2024, the BHA-Encapsulated Acne Treatment Market grew from niche adoption to broader consumer awareness, driven primarily by early adopters of dermatologist-backed and clean-label formulations. During this period, the competitive landscape was dominated by dermatologist-endorsed brands controlling nearly 60-65% of global revenues, with leaders such as Paula’s Choice, CeraVe, and La Roche-Posay capitalizing on strong pharmacy-based sales channels. Competitive differentiation relied on product tolerability, safety testing, and encapsulation innovation, while non-encapsulated salicylic acid formats still held a significant share. E-commerce grew rapidly, yet pharmacies accounted for the bulk of revenues due to their medical association and consumer trust.

Demand for encapsulated acne solutions will expand to USD 1,652.4 million in 2025, and the revenue mix will shift as clean-label, vegan, and non-comedogenic claims grow to over 45% share. Traditional clinical players face rising competition from digital-first beauty disruptors offering affordable, AI-driven, personalized regimens delivered directly to consumers. Major brands are pivoting to hybrid models, blending dermatologist validation with e-commerce personalization and influencer-led campaigns. Emerging entrants focusing on vegan-certified formulations, encapsulation patents, and advanced delivery systems are gaining traction. The competitive advantage is shifting from single-function acne products to integrated acne-care ecosystems spanning treatment, oil control, exfoliation, and skin renewal.

Advances in encapsulation technology have improved tolerability and efficacy of salicylic acid, allowing for controlled release that minimizes irritation while maintaining consistent acne-fighting performance. This innovation has enabled wider adoption among consumers with sensitive skin, who were previously hesitant to use traditional BHA products. Encapsulated BHA also enhances product stability and penetration, making it a superior choice for acne-prone and oily skin types. Rising global acne prevalence among both adolescents and adults has reinforced the demand for advanced formulations that balance clinical effectiveness with user comfort.

Expansion of dermatologist-tested and clean-label claims has fueled market growth, as consumers increasingly seek products backed by medical validation and safety assurances. Pharmacies continue to play a dominant role due to their association with credibility and prescription-grade acne care, while e-commerce platforms are accelerating adoption through subscription models and AI-driven personalization. Segment growth is expected to be led by acne treatment functions, serums in product types, and dermatologist-tested claims, all of which align with consumer demand for targeted, clinically validated, and result-oriented skincare solutions.

The BHA-Encapsulated Acne Treatment Market is segmented by function, product type, channel, claim, and region. Functions include acne treatment, exfoliation, oil control, and skin renewal, with acne treatment commanding the largest share due to its medical relevance and widespread dermatologist endorsement. Product types comprise serums, gels/spot treatments, creams/lotions, and cleansers, highlighting diverse consumer preferences ranging from lightweight daily routines to intensive spot therapies.

Channel segmentation covers pharmacies, e-commerce, dermatology clinics, and specialty beauty stores, reflecting both traditional trust-driven retail and the rapidly expanding digital-first ecosystem. Claim segmentation includes dermatologist-tested, clean-label, non-comedogenic, and vegan, capturing the growing influence of medical validation, ingredient transparency, and ethical positioning. Regionally, the scope spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with high-growth opportunities concentrated in India, China, and Japan, while mature markets such as the USA and Europe maintain stable but steady adoption.

| Function Segment | Market Value Share, 2025 |

|---|---|

| Anti-aging | 56.6% |

| Others | 43.4% |

The acne treatment segment is projected to contribute 56.6% of the BHA-Encapsulated Acne Treatment Market revenue in 2025 (USD 933.3 million), maintaining its lead as the dominant functional category. This is driven by the rising prevalence of acne among adolescents and adults globally, combined with increasing clinical acceptance of encapsulated BHA as a safer and more effective solution compared to traditional salicylic acid. Controlled release mechanisms reduce irritation, enabling broader adoption across sensitive skin populations.

The segment’s growth is further supported by the strong influence of dermatologists and pharmacies in shaping consumer trust. As acne is not only a medical condition but also a major cosmetic concern, consumers are prioritizing scientifically validated treatments. Brands are increasingly focusing on acne-specific formulations that integrate BHA encapsulation with complementary soothing agents, enhancing efficacy and long-term compliance. The acne treatment function is expected to retain its position as the backbone of the BHA-Encapsulated Acne Treatment Market throughout the forecast period.

| Claim Segment | Market Value Share, 2025 |

|---|---|

| Dermatologist-tested | 52.5% |

| Others | 47.5% |

The dermatologist-tested segment is projected to account for 52.5% of the BHA-Encapsulated Acne Treatment Market in 2025 (USD 866.7 million), solidifying its position as the most influential claim among consumers. Products backed by dermatologist validation are perceived as safer, more reliable, and clinically effective, especially in acne care, where sensitivity and irritation are primary concerns. This claim strongly resonates in pharmacies and dermatology clinics, where professional recommendation plays a decisive role in purchasing behavior.

The segment’s expansion is tied to rising consumer awareness of skin health, where medical credibility is prioritized over purely cosmetic claims. Encapsulation enhances the appeal of dermatologist-tested formulations by minimizing common side effects such as redness and dryness while maintaining consistent efficacy. Key brands like La Roche-Posay, CeraVe, and Neutrogena have built strong reputations by emphasizing clinical trials, dermatologist partnerships, and scientific endorsements. Given its role in building consumer trust, the dermatologist-tested claim is expected to maintain its leadership and drive long-term loyalty in the global market.

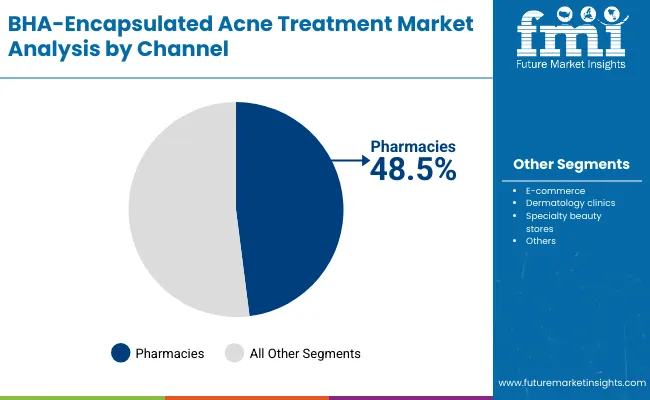

| Channel Segment | Market Value Share, 2025 |

|---|---|

| Pharmacies | 48.5% |

| Others | 51.5% |

The pharmacy segment is projected to account for 48.5% of the BHA-Encapsulated Acne Treatment Market revenue in 2025 (USD 802.1 million), establishing it as one of the leading distribution channels. Pharmacies are preferred due to their strong association with dermatologist-endorsed products, prescription-strength treatments, and consumer trust in medical-grade formulations. This channel plays a vital role in bridging clinical guidance with over-the-counter accessibility, especially in developed markets such as the United States and Europe where chain pharmacies dominate skin health retail.

Its suitability for acne management, combined with the credibility of pharmacist recommendations, has made pharmacies a popular choice for both first-time acne patients and recurring buyers. Encapsulation technology further strengthens pharmacy positioning, as it provides safer and more tolerable BHA delivery aligned with dermatology protocols. Given its balance of clinical trust and accessibility, the pharmacy segment is expected to maintain its relevance in the market, even as e-commerce and specialty beauty retailers grow rapidly in the coming decade.

Drivers

Rising Demand for Tolerability and Controlled Release in Acne Care

Traditional salicylic acid treatments, while effective, are often associated with irritation, dryness, and sensitivity issues, especially in patients with reactive or compromised skin. Encapsulation technology directly addresses this problem by providing controlled release of BHA, ensuring steady absorption and reducing peak concentrations that typically trigger irritation. This driver is particularly important in expanding the consumer base beyond traditional acne sufferers to include individuals with sensitive or combination skin types who previously avoided salicylic acid. Dermatologists are increasingly recommending encapsulated solutions as first-line interventions due to their improved safety profile. This shift toward better tolerability is boosting adoption in both clinical and consumer settings, creating a long-term growth engine for the market.

Expanding Clinical-Pharmacy Channel Synergy with Dermatologist Influence

The dominance of pharmacy distribution (48.5% share in 2025) highlights the growing influence of dermatologists and clinical validation in driving adoption. Unlike many cosmetic products, acne care sits at the intersection of medical treatment and beauty, making pharmacy-based sales channels particularly critical. Brands such as CeraVe and La Roche-Posay have leveraged dermatologist partnerships and prescription-driven awareness to capture significant market share. In parallel, encapsulation technology provides a strong scientific narrative that resonates in the clinical setting. As dermatologists increasingly integrate BHA-encapsulated products into treatment regimens for acne, post-acne scarring, and oil-control management, the clinical-pharmacy synergy becomes a strong driver of both market credibility and volume expansion.

Restraints

High Cost of Encapsulation Technology Limiting Mass-Market Penetration

While encapsulation offers clear efficacy and safety benefits, the technology significantly raises production costs compared to conventional salicylic acid formulations. Many mass-market brands operating in price-sensitive regions such as Latin America, South Asia, and parts of Africa face challenges in justifying premium pricing. Consumers in these markets often opt for traditional salicylic acid products or herbal alternatives that are priced lower, even if they cause more irritation. This cost barrier restricts adoption to premium and mid-tier categories, slowing market penetration in regions where affordability dictates purchase decisions.

Consumer Misconceptions About BHA Safety and Overlap with AHA Products

Despite clinical validation, many consumers remain confused about the role of BHAs versus AHAs (alpha hydroxy acids), often perceiving them as interchangeable. This misunderstanding results in hesitation toward BHA products, with some consumers avoiding them altogether due to fears of over-exfoliation or skin thinning. Additionally, social media misinformation occasionally amplifies safety concerns, discouraging potential first-time buyers. The need for educational campaigns and dermatologist-led awareness programs adds complexity and cost to brand strategies, creating a restraint that slows widespread adoption, particularly in markets with lower skincare literacy.

Key Trends

Digital-First Personalization and AI-Driven Skincare Diagnostics

E-commerce and online consultations are increasingly shaping acne care purchases, with consumers relying on AI-driven skin diagnostic tools to identify suitable formulations. Brands like Paula’s Choice and The Ordinary are leveraging personalization engines that recommend specific encapsulated BHA serums or spot treatments based on acne severity, skin sensitivity, and oil levels. Subscription-based e-commerce services tied to personalized routines are also gaining traction, especially in North America, China, and India. This trend not only boosts consumer trust but also ensures repeat purchases, reshaping distribution dynamics from one-time sales to loyalty-driven recurring revenue streams.

Integration of BHA Encapsulation with Multi-Functional Claims

The market is evolving beyond single-function acne care into multi-functional formulations that combine encapsulated BHA with antioxidants, peptides, or niacinamide. This integration allows products to deliver oil control, exfoliation, skin renewal, and brightening benefits simultaneously. For example, encapsulated BHA serums now often include vitamin C or ceramides, broadening appeal beyond acne sufferers to general skincare users seeking preventative and corrective solutions. This trend is especially pronounced in Asia-Pacific markets influenced by K-beauty, where multifunctional skincare is a strong consumer preference. As brands expand into hybrid categories, encapsulated BHA is being positioned not just as an acne treatment but as a core ingredient for holistic skin health.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 22.2% |

| USA | 9.2% |

| India | 24.1% |

| UK | 13.9% |

| Germany | 10.4% |

| Japan | 17.3% |

Between 2025 and 2035, the BHA-Encapsulated Acne Treatment Market will witness its fastest growth in India (24.1% CAGR) and China (22.2% CAGR), where rising disposable incomes, higher skincare awareness, and increasing acne prevalence among younger populations are fueling demand. These markets are also heavily influenced by digital-first adoption, with e-commerce platforms and social media driving consumer education around encapsulated actives. India’s rapid urbanization and strong pharmacy expansion provide fertile ground for both premium and mass-market encapsulated BHA solutions, while China’s strong dermatologist-tested preference and integration of AI-based skin diagnostics make it one of the most promising high-growth regions globally.

In contrast, mature markets such as the USA (9.2% CAGR) and Germany (10.4% CAGR) will expand at steadier rates, reflecting high baseline penetration but continued adoption of dermatologist-tested and clean-label claims. The UK (13.9% CAGR) shows stronger momentum in Europe due to its thriving online beauty retail ecosystem, while Japan (17.3% CAGR) leads among developed countries, driven by K-beauty and J-beauty-inspired multifunctional formulations that integrate acne treatment with broader skin renewal and brightening benefits. Together, these dynamics highlight a global split: emerging markets accelerating on access and awareness, while developed markets consolidate through innovation and premium positioning.

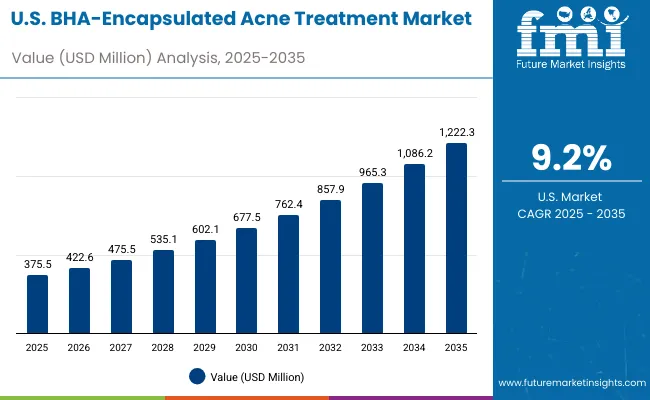

| Year | USA BHA-Encapsulated Acne Treatment Market (USD Million) |

|---|---|

| 2025 | 375.5 |

| 2026 | 422.6 |

| 2027 | 475.5 |

| 2028 | 535.1 |

| 2029 | 602.1 |

| 2030 | 677.5 |

| 2031 | 762.4 |

| 2032 | 857.9 |

| 2033 | 965.3 |

| 2034 | 1086.2 |

| 2035 | 1222.3 |

The BHA-Encapsulated Acne Treatment Market in the United States is projected to grow at a CAGR of 9.2%, led by increased demand for dermatologist-tested products and strong pharmacy-led distribution. The segment has been particularly reinforced by prescription-strength serums and spot treatments gaining traction among young adults and dermatology patients. E-commerce penetration is also expanding, with subscription-based acne kits driving loyalty in urban markets. Clinical validation and the rising influence of dermatologists continue to be decisive factors, with acne treatment products capturing 58.5% share of the USA market in 2025.

The BHA-Encapsulated Acne Treatment Market in the United Kingdom is expected to grow at a CAGR of 13.9%, supported by strong adoption in both pharmacy and specialty beauty channels. Demand is being fueled by clean-label and non-comedogenic claims, aligning with the UK’s maturing natural skincare movement. Premium brands are heavily marketing encapsulated serums that combine acne control with skin renewal and brightening, appealing to both teens and adult consumers with recurring breakouts. The market also benefits from a digitally savvy consumer base that increasingly relies on online skincare platforms for product discovery and repeat purchases.

India is witnessing the fastest growth in the global BHA-Encapsulated Acne Treatment Market, forecast to expand at a CAGR of 24.1% through 2035. Rising acne incidence across urban and semi-urban populations, coupled with affordability-focused product launches, is boosting penetration. Pharmacies remain strong, but tier-2 city expansion through e-commerce and local specialty stores is widening access. Multinational and domestic brands are also marketing vegan and dermatologist-tested claims aggressively to appeal to young consumers who are highly influenced by social media skincare trends. Educational awareness campaigns around acne as a medical condition are further accelerating adoption.

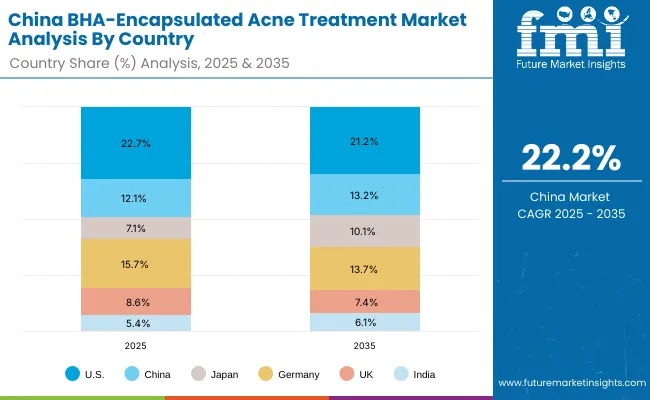

| Countries | 2025 Share (%) |

|---|---|

| USA | 22.7% |

| China | 12.1% |

| Japan | 7.1% |

| Germany | 15.7% |

| UK | 8.6% |

| India | 5.4% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 21.2% |

| China | 13.2% |

| Japan | 10.1% |

| Germany | 13.7% |

| UK | 7.4% |

| India | 6.1% |

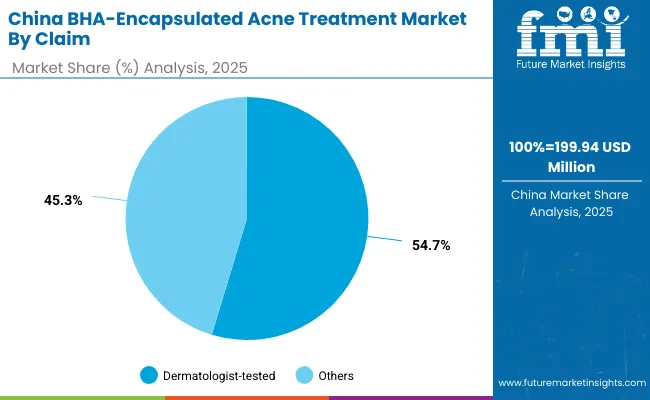

The BHA-Encapsulated Acne Treatment Market in China is expected to grow at a CAGR of 22.2%, the highest among major developed economies after India. This momentum is driven by dermatologist-tested claims, which accounted for 54.7% share in 2025, signaling strong consumer trust in clinically backed solutions. Urban populations are rapidly adopting encapsulated serums and cleansers, while local e-commerce platforms such as Tmall and JD.com are propelling mass accessibility. Domestic skincare companies are offering competitively priced encapsulated products, enabling broad penetration into mid-market segments. The government’s focus on digital healthcare and tele-dermatology platforms is also complementing demand by improving acne awareness and access to professional recommendations.

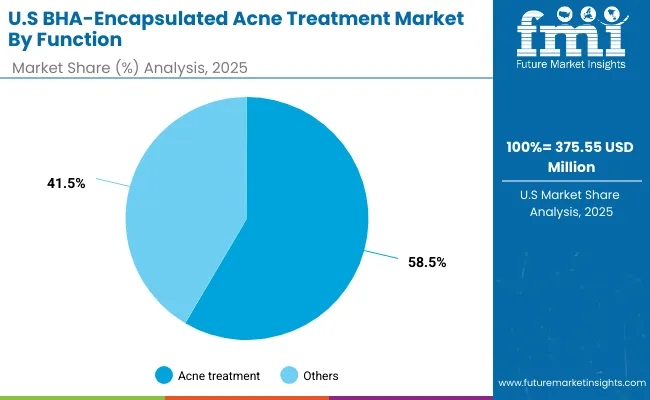

| Function Segment | Market Value Share, 2025 |

|---|---|

| Acne treatment | 58.5% |

| Others | 41.5% |

The BHA-Encapsulated Acne Treatment Market in the United States is valued at USD 375.55 million in 2025, with acne treatment leading at 58.5% of functional demand. Leadership of acne treatment is a direct outcome of the USA channel mix, where dermatologist influence and pharmacy dominance drive preference for clinically validated, irritation-controlled BHA delivery. Encapsulation enables steady-state release of salicylic acid, improving tolerability for sensitive and combination skin and expanding adoption beyond teens into adult acne cohorts. This makes targeted serums and spot treatments indispensable in USA routines focused on breakout management, post-inflammatory marks, and sebum normalization. Rapid gains in e-commerce subscriptions and virtual derm consultations further reinforce repeat usage, while pharmacist recommendations in chain drugstores keep OTC encapsulated formats top-of-mind.

This advantage positions acne-treatment-focused formats as essential tools for regimen compliance and measurable outcomes (reduced lesion count, better texture uniformity). Exfoliation-first regimens remain secondary and are often paired with acne SKUs rather than replacing them. As tele-dermatology expands and payers and providers emphasize evidence-based topicals before systemic therapies, encapsulated BHA products become a core enabler of accessible, step-wise care pathways.

| Claim Segment | Market Value Share, 2025 |

|---|---|

| Dermatologist-tested | 54.7% |

| Others | 45.3% |

The BHA-Encapsulated Acne Treatment Market in China is valued at USD 199.94 million in 2025 (12.1% of global), with dermatologist-tested claims leading at 54.7%. Dominance of dermatologist-tested positioning reflects China’s strong clinical trust dynamic: hospital-pharmacy ecosystems, KOL dermatology content, and platform algorithms consistently prioritize efficacy and safety narratives. Encapsulation aligns perfectly with this expectation by reducing sting and dryness while sustaining penetration of BHA into congested pores. Urban Gen Z and young professionals drive uptake of serums and spot treatments, while mass-premium domestic brands scale access through price-tiered encapsulated lines.

This advantage positions dermatologist-tested SKUs as the credibility anchor for rapid online conversion on national marketplaces and social commerce. Clean-label and non-comedogenic co-claims are rising, but they layer onto the core clinical message rather than supplant it. As AI skin diagnostics and tele-consults deepen, claim-backed personalization funnels users to encapsulated BHA regimens with measurable outcomes (reduced comedones, smoother texture).

The BHA-Encapsulated Acne Treatment Market is moderately fragmented, with clinical-heritage brands, digital-native disruptors, and niche specialists competing across pharmacy, e-commerce, dermatology clinics, and specialty beauty. Paula’s Choice leads globally (9.2%) on the strength of encapsulated BHA serums and evidence-forward education, while CeraVe, La Roche-Posay, Neutrogena, SkinCeuticals, The Ordinary, CosRx, Murad, Mario Badescu, and Dr. Dennis Gross scale adoption via pharmacist trust, derm endorsements, and platform-first merchandising. Strategies emphasize irritation-mitigation through micro/nano-encapsulation, non-comedogenic bases, and co-formulation with niacinamide, peptides, and ceramides to extend usage into maintenance and skin-renewal routines.

Mid-tier innovators differentiate with texture innovation (water-light serums, fast-set gels), targeted spot therapies, and regimen kits tuned to oil control plus PIH care. Niche specialists win through community credibility (acne-prone forums, derm-KOLs), ingredient transparency, and price-tier agility. Competitive differentiation is shifting away from single-ingredient claims toward integrated ecosystems that blend clinical validation, AI-guided routine building, refill/subscription programs, and encapsulation IP. As pharmacies retain authority in the USA and social commerce accelerates in China, winners will pair dermatologist-tested proof with frictionless digital journeys and measurable outcomes to compound share.

Key Developments in Global BHA-Encapsulated Acne Treatment Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,652.4 million |

| Function | Acne treatment, Exfoliation, Oil control, and Skin renewal |

| Product Type | Serums, Gels/spot treatments, Creams/lotions, and Cleansers |

| Channel | Pharmacies, E-commerce, Dermatology clinics, and Specialty beauty stores |

| Claim | Dermatologist-tested, Clean-label, Non- comedogenic, and Vegan |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Paula’s Choice, The Ordinary, CeraVe, Murad, La Roche- Posay, Neutrogena, SkinCeuticals, CosRx, Mario Badescu, and Dr. Dennis Gross |

| Additional Attributes | Dollar sales by function, product type, claim, and channel; adoption trends in acne treatment and exfoliation skincare; rising demand for vegan and dermatologist-tested claims; segment-specific growth in serums and pharmacy channels; integration of encapsulated BHA with soothing agents like niacinamide and ceramides; regional trends shaped by tele-dermatology, K-beauty, and clean-label preferences; and product innovations leveraging advanced encapsulation delivery systems. |

The BHA-Encapsulated Acne Treatment Market is estimated to be valued at USD 1,652.4 million in 2025.

The market size for the BHA-Encapsulated Acne Treatment Market is projected to reach USD 5,753.7 million by 2035.

The BHA-Encapsulated Acne Treatment Market is expected to grow at a 13.3% CAGR between 2025 and 2035.

The key product types in the BHA-Encapsulated Acne Treatment Market are serums, gels/spot treatments, creams/lotions, and cleansers.

In terms of function, the acne treatment segment is projected to command 56.6% share in the BHA-Encapsulated Acne Treatment Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Acne Scarring Treatments Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Products Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-acne Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Serum Market Report - Demand & Growth Forecast 2025 to 2035

Market Share Insights for Anti-Acne Dermal Patch Providers

Anti-acne Dermal Patch Market Insights – Trends & Forecast 2024-2034

Hormonal Acne Solutions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Moderate-to-Severe Acne Treatment Market Trends and Forecast 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA