The Electric Motor Horn Market has been estimated to grow from USD 32.1 billion in 2020 to USD 44.3 billion by 2025. Between 2025 and 2035, the market is forecast to expand at a CAGR of 7.2%, surpassing USD 88.6 billion by the end of the period. Regulatory mandates and design shifts toward energy-efficient and compact horn systems have remained key growth determinants across both ICE and electric vehicle platforms.

Federal standards such as those outlined by the Federal Motor Carrier Safety Administration (FMCSA) require that every motor vehicle must be equipped with a horn capable of emitting sound audible under normal conditions from at least 200 feet. Compliance with such safety mandates has prompted continuous product development. According to BossHorn, motor vehicle horns must produce a sound that is both clearly discernible and not unreasonably harsh, underlining the importance of tonal clarity and sound pressure levels in horn selection.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 44.3 billion |

| Projected Market Size (2035F) | USD 88.6 billion |

| CAGR (2025 to 2035) | 7.2% |

The integration of low-current, high-decibel electric motor horns has been increasingly favored by OEMs focused on modular and sustainable vehicular architecture. These horns, being less susceptible to performance degradation, have been adopted in harsh-use environments such as commercial trucks and electric two-wheelers. The advancement of brushless DC motor technology has supported this transition, enabling reduced power consumption while maintaining acoustic compliance.

Urban noise control programs, particularly in densely populated markets across East Asia and Europe, have driven R&D in directional sound projection and frequency modulation. Manufacturers have introduced dual-tone horns and pitch-adjustable variants to meet varying jurisdictional needs.

In recent trade reports, leading Tier-1 suppliers emphasized that electric horns designed for battery-powered vehicles must also align with vehicle acoustics and overall NVH (noise, vibration, and harshness) calibration.

Additionally, the aftermarket segment has experienced growth with demand for customizable and retrofitted horn systems that adhere to local regulations without voiding OEM warranties. As vehicle platforms evolve, the standardization of compact and compliant horn modules is expected to continue driving innovation and procurement strategies in the global electric motor horn market.

The 110 dB to 118 dB sound pressure segment is expected to lead the global automotive horn market, capturing approximately 48% of total market share in 2025. Over the forecast period from 2025 to 2035, the segment is projected to grow at a CAGR of 7.5%, slightly exceeding the overall market growth rate of 7.2%. This decibel range offers the optimal balance between loudness for effective auditory signaling and compliance with global vehicular noise regulations.

Automakers across regions such as Europe, North America, and Asia-Pacific are increasingly standardizing horn outputs in the 110-118 dB range, ensuring both safety and regulatory adherence. Horns in this range are widely adopted in passenger cars, light commercial vehicles, and two-wheelers for urban and highway driving conditions.

Manufacturers are also incorporating tone modulation and multi-frequency horns within this category to improve sound directionality and vehicle-specific tuning. As cities enforce stricter noise pollution norms, this segment is benefiting from its alignment with urban acoustic limits while retaining effectiveness in high-traffic environments.

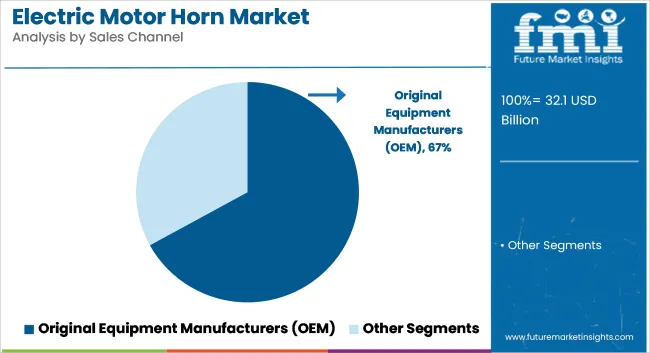

Original Equipment Manufacturers (OEMs) are projected to remain the dominant sales channel for automotive horns, accounting for approximately 67% of the global market in 2025. The segment is expected to expand at a CAGR of 7.3% between 2025 and 2035, driven by factory-level horn integration during vehicle assembly and rising global vehicle production volumes.

OEMs are increasingly collaborating with component suppliers to incorporate horn systems that align with platform-specific design and safety requirements. These systems are often tested and validated for durability, water resistance, and temperature tolerance to ensure long-term functionality.

Furthermore, electric vehicle (EV) platforms are demanding specially tuned horn acoustics due to quieter drivetrain noise, reinforcing the importance of OEM-level acoustic engineering. Regulatory compliance related to pedestrian alert systems is also encouraging integration of standardized horn outputs as part of vehicle homologation processes. The trend toward embedded acoustic safety features is reinforcing the OEM channel’s dominance in delivering performance-assured horn systems.

Challenge

Noise Pollution and Regulatory Constraints

Regulatory limitations on noise pollution from vehicles pose one of the greatest challenges to the electric motor horn industry. Governments globally are imposing stringent sound limits on horns to curb urban noise pollution, especially within residential and commercial areas.

Manufacturers must innovate and come up with horns that provide enough safety notification while reducing noise disturbance in order to meet such regulations. The expense of developing and incorporating advanced noise-control technologies into electric horns contributes to production costs, making affordability and mass adoption challenging.

Opportunity

Adoption of Smart and Energy-Efficient Horn Technologies

The increasing focus on smart vehicle technologies is a significant opportunity for the electric motor horn market. Producers are investing in electronic horns with adjustable sound frequencies, adaptive volume control, and built-in warning systems that meet contemporary automotive safety standards.

The growth of connected cars and developments in Internet of Things (IoT)-based automotive components are opening the door to smart horn systems. Furthermore, the growing use of electric and hybrid cars is fueling demand for efficient, long-lasting electric motor horns that can support green transport solutions.

The market for the USA electric motor horn is expanding owing to the surging use of electric and hybrid vehicles, tightening road safety policies, and developing technology in motor horns for the automotive sector. Tougher regulations from the government regarding noise pollution limits and greater vehicle safety are fueling the transition towards electric horns that are efficient, rugged, and environment-friendly.

Surging demand by consumers for multi-tone and high-performance horns on high-end as well as commercial vehicles is boosting the market's growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 9.3% |

The UK market for electric motor horns is growing with the quick transition to electric vehicles (EVs), regulatory policies supporting road safety, and growing emphasis on reducing vehicle noise. The demand for sophisticated warning systems in passenger and commercial vehicles is driving the use of high-decibel but compliant motor horns. Car manufacturers are also incorporating customizable and adaptive sound functionalities in vehicle horns to meet regulatory requirements.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 9.2% |

The EU electric motor horn industry is witnessing strong growth with the implementation of strict noise pollution regulations, the fast pace of EV charging infrastructure development, and growing uptake of sophisticated safety features. Germany, France, and Italy are leading the charge, with leading automobile companies investing in smart horn systems.

The creation of AI-powered and digital horns that can modulate sound levels according to traffic conditions around them is picking up pace throughout the region.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 9.8% |

Japan's electric motor horn market is expanding consistently based on the country's robust automobile manufacturing base, high customer affinity for electric cars, and noise reduction focus in cities. Adoption of newer acoustic technologies in low-noise electric horns is picking up, based on government efforts to control noise.

Furthermore, manufacturers are paying attention to miniaturized, high-performance horns that produce good and audible sound signals without surpassing noise standards.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 9.1% |

The South Korean electric motor horn market is growing at a fast pace due to the country's dominance in electric vehicle manufacturing, government initiatives for road safety solutions, and advancements in automotive electronics. Increasing demand for premium sound-based warning systems in passenger and commercial vehicles is also driving market growth.

Local players are also investing in AI-based and electronic sound control technologies to boost safety and alignment with international standards.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.6% |

FIAMM Technologies, L.L.C. (18-22%)

Market leader FIAMM is known for its electromagnetic and electronic horns, serving automotive original equipment manufacturers and aftermarket customers. FIAMM is committed to sound quality, durability, and adherence to global noise standards.

Robert Bosch GmBH (15-19%)

A pioneer of car horn technology, Bosch offers customizable, high-end horns specifically designed for luxury and mass vehicle use. Bosch focuses heavily on R&D and noise control technology and continues to lead the industry.

MARUKO KEIHOKI Co., LTD. (10-14%)

Renowned for their high-frequency horns and compact models, MARUKO KEIHOKI is providing efficient yet lightweight solutions to contemporary cars. The organization is targeting strengthening its position in the EV segment through low-power, environmentally friendly substitutes.

Mitsuba Corp. (8-12%)

Mitsuba specializes in energy-efficient and durable electric horns, particularly for electric and hybrid vehicles. The company’s emphasis on low-power consumption and long-lasting performance aligns with the automotive industry's shift toward sustainability.

Shanghai SIIC Transportation Electric Co., Ltd. (6-10%)

A key player in China’s automotive horn market, SIIC Transportation Electric provides cost-effective, high-quality solutions for regional and international manufacturers. The company is focusing on scalability and enhanced production capabilities to meet growing demand.

Other Key Players (30-40% Combined)

The Electric Motor Horn Market also includes regional and emerging manufacturers such as:

The overall market size for electric motor horn market was USD 44.3 billion in 2025.

The electric motor horn market is expected to reach USD 88.6 billion in 2035.

The rising production of automobiles and the growing focus on vehicle safety regulations fuels Electric motor horn Market during the forecast period.

The top 5 countries which drives the development of Electric motor horn Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of product type, flat type to command significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-Use Vehicles, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End-Use Vehicles, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Sound Pressure/Volume, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Sound Pressure/Volume, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End-Use Vehicles, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End-Use Vehicles, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Sound Pressure/Volume, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Sound Pressure/Volume, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by End-Use Vehicles, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by End-Use Vehicles, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Sound Pressure/Volume, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Sound Pressure/Volume, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by End-Use Vehicles, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by End-Use Vehicles, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Sound Pressure/Volume, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Sound Pressure/Volume, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by End-Use Vehicles, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by End-Use Vehicles, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Sound Pressure/Volume, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Sound Pressure/Volume, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by End-Use Vehicles, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by End-Use Vehicles, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Sound Pressure/Volume, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Sound Pressure/Volume, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by End-Use Vehicles, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by End-Use Vehicles, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Sound Pressure/Volume, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Sound Pressure/Volume, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by End-Use Vehicles, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by End-Use Vehicles, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Sound Pressure/Volume, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Sound Pressure/Volume, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-Use Vehicles, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Sound Pressure/Volume, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End-Use Vehicles, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by End-Use Vehicles, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by End-Use Vehicles, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by End-Use Vehicles, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Sound Pressure/Volume, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Sound Pressure/Volume, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Sound Pressure/Volume, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Sound Pressure/Volume, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by End-Use Vehicles, 2023 to 2033

Figure 28: Global Market Attractiveness by Sound Pressure/Volume, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by End-Use Vehicles, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Sound Pressure/Volume, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by End-Use Vehicles, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by End-Use Vehicles, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by End-Use Vehicles, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by End-Use Vehicles, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Sound Pressure/Volume, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Sound Pressure/Volume, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Sound Pressure/Volume, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Sound Pressure/Volume, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by End-Use Vehicles, 2023 to 2033

Figure 58: North America Market Attractiveness by Sound Pressure/Volume, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by End-Use Vehicles, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Sound Pressure/Volume, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by End-Use Vehicles, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by End-Use Vehicles, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by End-Use Vehicles, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by End-Use Vehicles, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Sound Pressure/Volume, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Sound Pressure/Volume, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Sound Pressure/Volume, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Sound Pressure/Volume, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by End-Use Vehicles, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Sound Pressure/Volume, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by End-Use Vehicles, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Sound Pressure/Volume, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by End-Use Vehicles, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by End-Use Vehicles, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by End-Use Vehicles, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by End-Use Vehicles, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Sound Pressure/Volume, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Sound Pressure/Volume, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Sound Pressure/Volume, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Sound Pressure/Volume, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by End-Use Vehicles, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Sound Pressure/Volume, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by End-Use Vehicles, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Sound Pressure/Volume, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by End-Use Vehicles, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by End-Use Vehicles, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use Vehicles, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use Vehicles, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Sound Pressure/Volume, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Sound Pressure/Volume, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Sound Pressure/Volume, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Sound Pressure/Volume, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by End-Use Vehicles, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Sound Pressure/Volume, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by End-Use Vehicles, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Sound Pressure/Volume, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by End-Use Vehicles, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by End-Use Vehicles, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use Vehicles, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use Vehicles, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Sound Pressure/Volume, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Sound Pressure/Volume, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sound Pressure/Volume, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sound Pressure/Volume, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by End-Use Vehicles, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Sound Pressure/Volume, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by End-Use Vehicles, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Sound Pressure/Volume, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by End-Use Vehicles, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by End-Use Vehicles, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by End-Use Vehicles, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by End-Use Vehicles, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Sound Pressure/Volume, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Sound Pressure/Volume, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Sound Pressure/Volume, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Sound Pressure/Volume, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by End-Use Vehicles, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Sound Pressure/Volume, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by End-Use Vehicles, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Sound Pressure/Volume, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by End-Use Vehicles, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by End-Use Vehicles, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use Vehicles, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use Vehicles, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Sound Pressure/Volume, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Sound Pressure/Volume, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Sound Pressure/Volume, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sound Pressure/Volume, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by End-Use Vehicles, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Sound Pressure/Volume, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motorcycles And Scooters Market Size and Share Forecast Outlook 2025 to 2035

Electric Motors For Conveyor System Market

Motorcycle Horn Market Analysis - Size, Share, and Forecast 2024 to 2034

AC Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Premium Electric Motorcycle Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Electric Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Commercial Vehicle Traction Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA