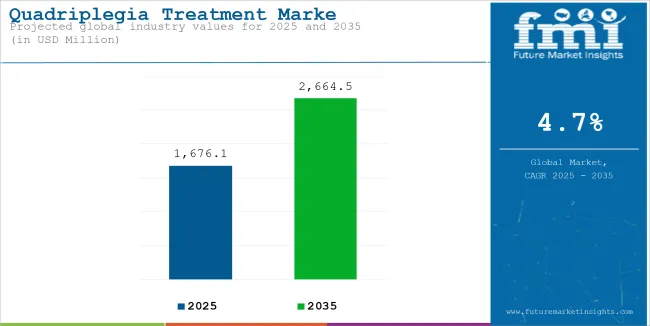

The global quadriplegia treatment market is projected to be valued at USD 1,676.1 million in 2025 and is expected to reach USD 2,664.5 million by 2035, registering a CAGR of 4.7%during the forecast period. This growth is driven by advancements in surgical procedures, the introduction of drugs like corticosteroids, progress in stem cell therapy, the development of specialized rehabilitation programs, and increased awareness and advocacy.

The market is also characterized by an increasing focus on patient-centric solutions, including customized rehabilitation programs and assistive technologies. Innovative robotic exoskeletons and other state-of-the-art physiotherapies have contributed to better recovery outcomes for individuals with quadriplegia. Furthermore, research efforts have opened doors to regenerative therapies for understanding the neurobiological mechanisms of spinal injuries, instilling optimism about long-term solutions.

Prominent players in the quadriplegia treatment market include Johnson & Johnson Services Inc., Merck & Co., Sanofi S.A., Bristol Myers Squibb Co., AstraZeneca plc, Abbott Laboratories, GlaxoSmithKline plc, Roche Holdings Inc., Takeda Pharmaceutical Co Ltd, Medtronic plc, Eli Lilly & Co., Koninklijke Philips NV, Stryker Corporation, Teva Pharmaceuticals Industries Ltd., Baxter International, Boston Scientific Corporation, Zimmer Biomet Holdings Inc., Sun Pharmaceutical Industries Limited, Cipla Ltd, and Ottobock SE & Co.

These companies are actively involved in research and development to introduce innovative therapies and devices aimed at improving the quality of life for individuals with quadriplegia. In 2024, ONWARD Medical Receives FDA De Novo Classification and USA Market Authorization for World’s First Non-Invasive Spinal Cord Stimulation System. “With today’s FDA de novo classification and authorization to market the ARC-EX System in the USA, a new era begins for people with chronic spinal cord injury. For the first time, there is an approved therapy shown to improve hand strength and sensation after chronic SCI,” said Dave Marver, CEO of ONWARD Medical.

Global Quadriplegia Treatment Industry Assessment

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 1,609.7 million |

| Estimated Size, 2025 | USD 1,676.1 million |

| Projected Size, 2035 | USD 2,664.5 million |

| CAGR (2025 to 2035) | 4.7% |

North America remains the largest market for quadriplegia treatment, driven by a robust healthcare infrastructure, significant investments in research and development, and a high prevalence of spinal cord injuries. The region's emphasis on early adoption of advanced therapies, including neurostimulation and regenerative medicine, contributes to market growth.

Furthermore, favorable reimbursement policies and strong support from government and private organizations facilitate access to cutting-edge treatments. Collaborations between leading medical institutions and technology companies in the USA and Canada are fostering innovation in assistive devices and rehabilitation programs, enhancing patient outcomes and expanding the market's potential.

Europe's quadriplegia treatment market is characterized by increasing investments in healthcare infrastructure and a growing focus on personalized medicine. Countries like Germany, France, and the UK are at the forefront, implementing advanced rehabilitation centres equipped with state-of-the-art technologies.

Additionally, rising awareness about spinal cord injuries and the importance of early intervention are driving demand for comprehensive treatment solutions. Collaborative efforts between academic institutions and industry players are further propelling advancements in the field, positioning Europe as a key contributor to the global quadriplegia treatment landscape.

The global quadriplegia treatment market compound annual growth rate (CAGR) for the first half of 2024 and 2025 is compared in the table below. This analysis provides important insights into the performance of the industry by highlighting significant shifts and trends in revenue generation.

The first half (H1) is the period from January to June, and the second half (H2) is July to December. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 5.4%, followed by a slightly lower growth rate of 5.1% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 5.4% |

| H2(2024 to 2034) | 5.1% |

| H1(2025 to 2035) | 4.7% |

| H2(2025 to 2035) | 4.2% |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 4.7% in the first half and remain relatively lower at 4.2% in the second half. In the first half (H1) the industry witnessed a decrease of 70 BPS while in the second half (H2), the industry witnessed a decrease of 90 BPS.

In 2025, the Assistive Devices in Devices segment is projected to account for approximately 29.6% of revenue share in the quadriplegia treatment market. This leadership position has been driven by the rising adoption of mobility-enhancing technologies and smart rehabilitation tools. Increased emphasis has been placed on improving daily functional independence, especially in advanced healthcare systems.

Growth has been further supported by the integration of robotic exoskeletons, the segment’s expansion has also been fuelled by higher investments from medical device manufacturers and the shift toward home-based care models. Insurance coverage and reimbursement structures in North America and Europe have allowed greater patient access, thereby reinforcing the segment’s dominance.

Hospital pharmacies are expected to hold around 32.2% revenue share in the quadriplegia treatment market by 2025. This segment’s growth has been supported by its essential role in dispensing complex medications such as neuromodulators, corticosteroids, and antispasmodics. A preference for institutional care settings and post-operative rehabilitation has been observed.

Centralized medication management, streamlined inventory systems, and clinical supervision have enabled improved treatment delivery. Intravenous therapies and specialized assistive devices requiring professional handling have predominantly been distributed via hospital pharmacies. Expansion of neurorehabilitation units and spinal care centres has strengthened their operational footprint. This distribution channel has been further prioritized due to the critical nature of therapies involved in quadriplegia care.

Rising Prevalence of Spinal Cord Injuries (SCIs) is driving the Market Growth

The increasing incidence of spinal cord injuries (SCIs) is a critical driver for the quadriplegia treatment market. SCIs, which are often the result of traumatic events such as motor vehicle accidents and physical assaults, are a growing global health concern into this market.

Urbanization is also one of the reason coupled with higher vehicular density and construction-related hazards, has led to a significant increase in these injuries. The statistics show that SCIs affect thousands of people each year, leading to an acute need for highly specialized medical care.

SCIs often lead to life-changing conditions, such as paralysis and loss of autonomic functions, which demand integrated treatment approaches from acute care to long-term rehabilitation. This increase in patient population forces healthcare professionals to find innovative solutions to meet these complex needs.

In addition, the push for increased awareness of SCI prevention and early management is driving the development and implementation of therapeutic interventions, including advanced assistive technologies, novel physical therapy methods, and innovative pharmacological agents. These combined factors are catalyzing significant growth in the market as both public and private sectors increase their focus on tackling this critical healthcare issue.

Technological Innovations Revolutionizing the Treatment Pattern Driving Demand for Quadriplegia Treatment

Technological innovations are revolutionizing the treatment of quadriplegia, providing effective and potential opportunities to enhance the quality of care and improve patient outcomes. The transformative tools in quadriplegia care are becoming neuroprosthetics and spinal cord stimulators.

These make use of very modern neuroscience and principles of bioengineering to either regrow the nerve or bypass parts of the damaged spinal cord areas that would enable regeneration of motor functions and sensory perception. For example, neuroprosthetic implants can directly communicate with the central nervous system and peripheral nerves translating neural signals to movements or sensing responses that provide a level of restored functional independence.

Another groundbreaking advancement is the robotic exoskeletons. These wearable robotic systems support the body weight of quadriplegic patients and help them achieve mobility by allowing them to control movement of their legs and torso.

Such devices help patients regain independence and also improve circulation, muscle tone, and overall health through regular physical activity. Continuous improvement of the technology of the robotic, including AI and machine learning algorithms, is making these exoskeletons smarter, more adaptive, and user-friendly, which will only drive their adoption.

Emergence of Regenerative Medicine and Gene Therapies is Creating Opportunities in the Market

These would therefore be opportunities through regenerative medicine and gene therapy in addressing underlying causes of paralysis and spinal cord injuries for new quadriplegia treatment techniques. Therapies targeting repairs or regeneration of damaged spinal cord tissues would allow hope to come alive and motor and sensory functions lost again due to damage, thanks to significant breakthroughs from stem cell research.

Mesenchymal stem cells, as well as neural stem cells, have gained significant potential preclinical and clinically in a number of different studies, particularly in their abilities to differentiate into nerve cells or promote axonal growth. These regenerative possibilities may be reversible for quadriplegia or improve long-term patient outcomes.

Gene-editing technologies are further revolutionizing the therapeutic landscape by allowing precise modifications of genetic material. Such tools enable scientists to correct genetic mutations or enhance the expression of genes that support neural repair and recovery.

For example, gene therapy targeting neurotrophic factors or axon growth inhibitors has shown promise in promoting functional recovery in spinal cord injuries. These advances, along with other bioengineering innovations like tissue scaffolding and bioprinting, are driving the development of integrated treatment strategies.

High Cost of Advanced Therapies and Limited Accessibility may Restrict Market Growth

One of the significant constraints that limits the growth of the quadriplegia treatment market is the high cost of advanced therapies and limited accessibility, especially in low- and middle-income countries. Innovative treatments such as robotic exoskeletons, neurostimulation devices, and stem cell therapies often come with exorbitant price tags, making them unaffordable for a significant portion of the population.

The other limitation is that sophisticated solutions demand trained health care staff and specialized facility, which many resource-poor settings lack. The rehabilitation time is also usually long and protracted. Therefore, imposing an immense economic burden on the patients themselves and their households. Overcoming these challenges shall demand a drive for cost savings, fair equitable allocation of the healthcare resources and public-private cooperation to enhance the accessibility.

Tier 1 companies are the industry leaders with 62.1% of the global industry. These companies stand out for having a large product portfolio and a high production capacity. These industry leaders also stand out for having a wide geographic reach, a strong customer base, and substantial experience in manufacturing and having enough financial resources, which enables them to enhance their research and development efforts and expand into new industries.

The companies within tier 1 have a good reputation and high brand value. Prominent companies within tier 1 include Merck & Co., Sanofi Pharmaceuticals, GlaxoSmithKline, AstraZeneca, and Johnson & Johnson

Tier 2 companies are relatively smaller as compared with tier 1 players. The tier 2 companies hold a market share of 23.1% worldwide. These firms may not have cutting-edge technology or a broad global reach, but they do ensure regulatory compliance and have good technology. The players are more competitive when it comes to pricing and target niche markets. Key Companies under this category include Cipla, Eli Lily & Co., Teva Pharmaceuticals, Takeda Pharmaceutical Co Ltd. among others.

Compared to Tiers 1 and 2, Tier 3 companies offer Quadriplegia Treatment, but with smaller revenue spouts and less influence. These companies mostly operate in one or two countries and have limited customer base. They specialize in specific products and cater to niche markets, adding diversity to the industry.

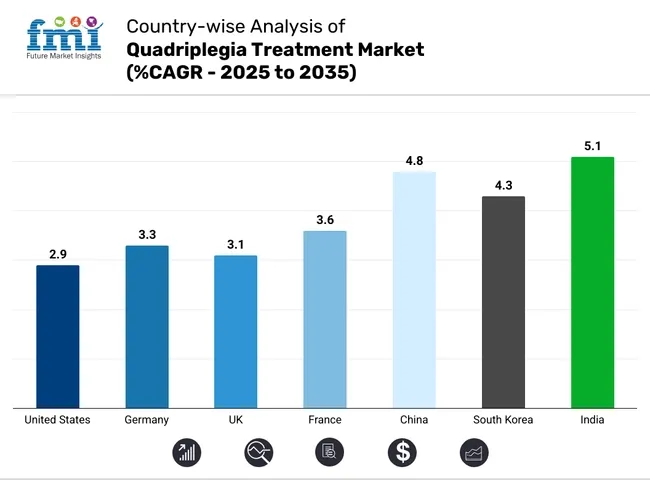

The market analysis for quadriplegia treatment in various nations is covered in the section below. An analysis of important nations in North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East & Africa of the world has been mentioned below. It is projected that the United States will maintain its leading position in North America through 2035, holding a value share of 91.7%. By 2035, China is expected to experience a CAGR of 4.8% in the Asia-Pacific region.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 2.9% |

| Germany | 3.3% |

| UK | 3.1% |

| France | 3.6% |

| China | 4.8% |

| Soutd Korea | 4.3% |

| India | 5.1% |

Germany’s quadriplegia treatment market is poised to exhibit a CAGR of 3.3% between 2025 and 2035. The Germany holds highest market share in European market.

The main driver of the quadriplegia treatment market in Germany is world-class healthcare infrastructure, advanced research capabilities, and strong government support in the field of medical innovation. Such a country having cutting-edge spinal cord injury research centers and rehabilitation facilities puts it ahead of others in providing comprehensive care for quadriplegia.

Germany has emphasized early intervention and rehabilitation, and its adoption of new technologies has been integrated into the healthcare system. In addition, the strong medical device industry in the country supports the development and availability of advanced treatment solutions, including assistive devices and AI-powered rehabilitation tools. Strong government funding for medical research and the inclusion of such treatments in public health insurance schemes ensure accessibility, fueling market growth.

United States is anticipated to show a CAGR of 2.9% between 2025 and 2035.

Quadriplegia treatment in the United States is promoted due to a higher incidence of SCIs. It mainly arises due to road accidents, sports injuries, and falls. The USA is ahead of others about developed health infrastructure along with more interest in research and development for advanced treatments.

Federal efforts-from NIH funding to academic institution and biotech company collaborations-have catapulted the development of these regenerative therapies-from stem cell and gene-based treatments. Adoption of robotic rehabilitation systems, neuroprosthetics, and telemedicine solutions has also grown further into the market. Increasing awareness in SCIs with an excellent insurance system covering advanced therapies added to the demand and accessibility.

India is anticipated to show a CAGR of 5.1% between 2025 and 2035.

India’s quadriplegia treatment market is driven by a rising number of SCIs, primarily due to road accidents, falls, and occupational hazards. Such injuries are also a result of growing urban population and increased vehicular density. The government's initiative like Ayushman Bharat, aiming to provide affordable healthcare services, is improving the access to treatments for quadriplegia.

India is seeing significant growth in medical tourism with patients seeking cost-effective yet advanced treatment options, which further fuels the market. Increasing investments in healthcare infrastructure, coupled with the adoption of advanced rehabilitation technologies such as robotic therapy and virtual reality, are also playing a pivotal role. In addition, public awareness campaigns and the emergence of specialized spinal injury centers across metropolitan areas are contributing to the market's expansion.

In terms of this market, the companies involved are resorting to multiple strategies to retain a competitive position. Strategic partnerships and collaborations with research institutions and healthcare providers are being utilized to broaden their product portfolio. Geographical expansion into the emerging markets, particularly China and India, has been another strategic priority for these companies, where growth in the healthcare infrastructure and awareness is strong.

Recent Industry Developments in Quadriplegia Treatment Industry Outlook

In terms of treatment type, the industry is divided into Drugs (corticosteroids, non- steroidal anti-inflammatory drugs (NSAIDs), antidepressants, anticonvulsants, narcotic analgesics, antispasmodics & muscle relaxants, antibiotics devices (stimulation devices, assistive devices, and mobility devices among others)

In terms of route of administration, the industry is segregated into oral, intravenous and others

In terms of distribution channel, the industry is divided into hospital pharmacies, retail pharmacies, drug stores and online stores

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA) have been covered in the report.

The global quadriplegia treatment industry is projected to witness CAGR of 4.7% between 2025 and 2035.

The global quadriplegia treatment industry stood at USD 1,609.7 million in 2024.

The global quadriplegia treatment industry is anticipated to reach USD 2,664.5 million by 2035 end.

China is expected to show a CAGR of 4.8% in the assessment period.

The key players operating in the global quadriplegia treatment industry are Merck & Co., Sanofi Pharmaceuticals, GlaxoSmithKline, AstraZeneca, Cipla, Johnson & Johnson, Eli Lily & Co., Teva Pharmaceuticals, Takeda Pharmaceutical Co Ltd, Hoffmann La Roche among others

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Water Treatment Polymers Market Growth & Demand 2025 to 2035

Asthma Treatment Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA