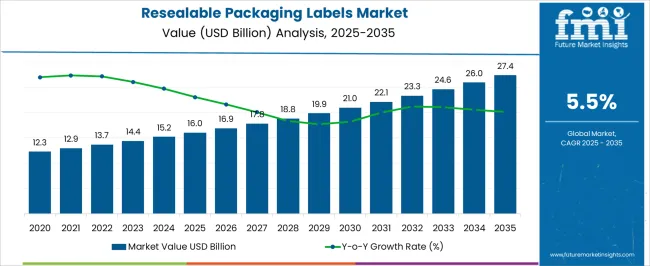

The Resealable Packaging Labels Market is estimated to be valued at USD 16.0 billion in 2025 and is projected to reach USD 27.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Resealable Packaging Labels Market Estimated Value in (2025 E) | USD 16.0 billion |

| Resealable Packaging Labels Market Forecast Value in (2035 F) | USD 27.4 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The Resealable Packaging Labels market is experiencing robust growth, driven by increasing consumer demand for convenience, product freshness, and sustainability in packaged goods. Rising adoption of ready-to-eat and packaged food products, coupled with the growing trend of e-commerce and home delivery, is fueling demand for resealable packaging solutions. Advances in materials and adhesive technologies have enhanced the functionality, durability, and recyclability of labels, enabling better product protection and ease of use.

Manufacturers are investing in innovative labeling techniques that support tamper-evidence, brand visibility, and consumer engagement. Regulatory emphasis on food safety, hygiene, and sustainable packaging is further encouraging adoption. The market is also benefiting from the increasing focus on reducing food waste through improved reseal mechanisms.

As companies seek to differentiate products and enhance customer experience, the demand for high-performance resealable packaging labels is expected to grow steadily Continuous innovation in material science and packaging design, coupled with growing consumer awareness, positions the market for sustained expansion over the next decade.

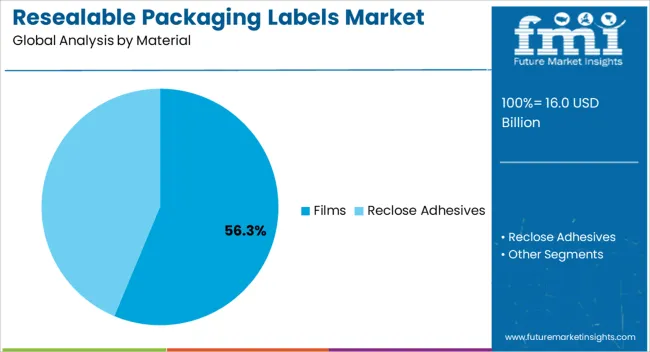

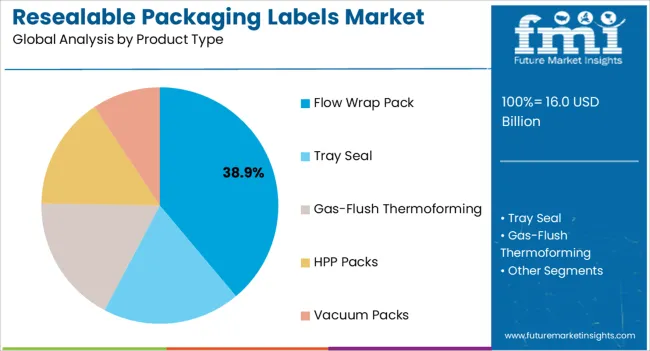

The resealable packaging labels market is segmented by material, product type, and geographic regions. By material, resealable packaging labels market is divided into Films and Reclose Adhesives. In terms of product type, resealable packaging labels market is classified into Flow Wrap Pack, Tray Seal, Gas-Flush Thermoforming, HPP Packs, and Vacuum Packs. Regionally, the resealable packaging labels industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The films material segment is projected to hold 56.3% of the market revenue in 2025, establishing it as the leading material type. Growth in this segment is being driven by the superior barrier properties, flexibility, and printability offered by films, which make them ideal for resealable applications across food, beverage, and consumer goods. Films enable enhanced protection against moisture, oxygen, and contamination, ensuring product integrity while extending shelf life.

Their compatibility with various adhesives and resealing mechanisms allows for multi-use functionality, which is increasingly valued by consumers. The scalability and cost-efficiency of film-based labels have strengthened adoption among manufacturers, particularly in high-volume production environments.

Technological advancements in bio-based and recyclable films further support the segment, aligning with sustainability and regulatory objectives As companies continue to focus on improving packaging performance, reducing waste, and meeting consumer convenience demands, the films material segment is expected to maintain its market leadership, supported by continuous innovation in material design and processing techniques.

The flow wrap pack product type segment is expected to account for 38.9% of the market revenue in 2025, making it the leading product type. Growth in this segment is driven by its widespread adoption in food packaging, particularly for confectionery, bakery, and ready-to-eat products, where resealability and product protection are critical. Flow wrap packaging allows for fast, high-volume production while maintaining product freshness and hygiene.

Integration of resealable labels enhances convenience, reduces food waste, and improves customer experience. Manufacturers are increasingly leveraging flow wrap packs for brand differentiation and consumer engagement, incorporating high-quality printing, tamper-evident features, and sustainability initiatives.

The ability to combine flexible packaging with efficient labeling solutions has reinforced the popularity of flow wrap packs As consumer preference for convenience-oriented packaging continues to rise, the flow wrap pack segment is expected to maintain its leadership in the market, supported by advancements in automated labeling systems, material compatibility, and packaging innovation.

The industrial revolution had a paramount influence on the way food packaging was designed and developed. Over the years, as machines swapped hands as the fundamental method of manufacturing products, packaging advanced and production became faster and more resourceful.

Beyond the upsurging simplicity of integrating Resealable Packaging Labels into production lines, another motive bakers may be intended in making the shift to resealability lies in the rising consumer demand for companies to exhibit environmental responsibility. This presents a paradigm for any brand to minimize its carbon footprint by decreasing food waste.

Future Market Insight’s recently published report reveals that food waste is a massive global problem, like 40% of the food in the US goes into the trash.” Packaging is one of the greatest sources of waste in the United States. According to the USA Environmental Protection Agency, 29.7% of total waste could be attributed to containers and packaging in 2025, which weighed in at 77.9 million tons.

Re-closable options eradicate that waste by letting the consumer use portions to ensure the freshness of food for a significant amount of time. Aside from food waste, the efficiency of resealable packs has improved with the edge cutting-edge design and made food packaging more sustainable.

In order to cater consumer’s demand for more sustainable yet convenient packaging options, companies including Tyme Fast Food and TerraCycle’s Loop program, as well as retailers including PCC Community Markets have reexplored packaging as something reusable in lieu of disposable.

In Feb 2025, nestle partnered with TerraCycle – a social enterprise behind some of the world's most important ventures in eliminating waste – is one of the ways in which we are trying to make this happen. The company plans to make 100% of its packaging recyclable or reusable by 2025 and to reduce the use of virgin plastics by one-third in the same period.

Likewise, several newbies are making entry in the resealable market with their innovative ideas to gain significant market share. For instance, Packoorang is an online provider of reusable bags for the eCommerce industry. The platform offers products such as packoorang for foldable, padded, & weatherproof packaging, palloorang for replacing traditional, CO2-heavy plastic wrap for pallets, and product videos for protection.

With the immigration of these start-ups, established players are redesigning their packaging options to maintain its dominance and offer a unique Resealable Packaging Labels in the market. The upward trend of and work professionals is still the biggest consumer, owing to their fast-moving lifestyles which slashes their time to cook again.

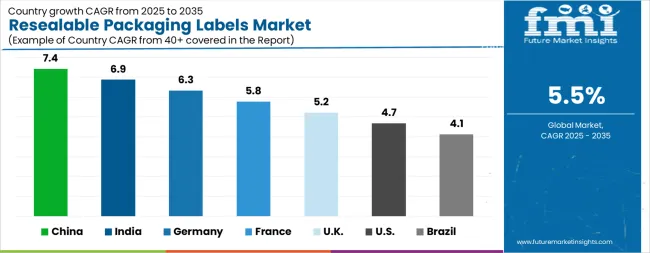

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The Resealable Packaging Labels Market is expected to register a CAGR of 5.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.4%, followed by India at 6.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.1%, yet still underscores a broadly positive trajectory for the global Resealable Packaging Labels Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.3%. The USA Resealable Packaging Labels Market is estimated to be valued at USD 5.8 billion in 2025 and is anticipated to reach a valuation of USD 9.1 billion by 2035. Sales are projected to rise at a CAGR of 4.7% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 865.6 million and USD 488.6 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 16.0 Billion |

| Material | Films and Reclose Adhesives |

| Product Type | Flow Wrap Pack, Tray Seal, Gas-Flush Thermoforming, HPP Packs, and Vacuum Packs |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

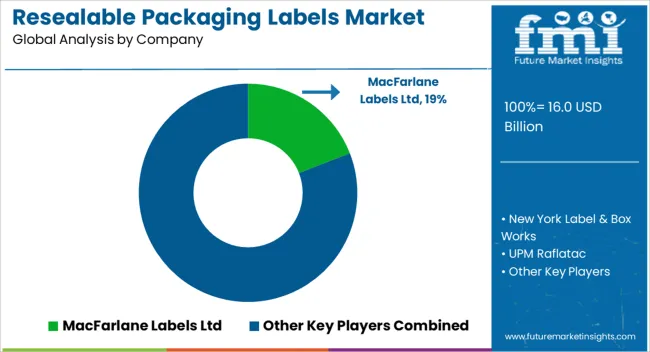

| Key Companies Profiled | MacFarlane Labels Ltd, New York Label & Box Works, UPM Raflatac, Veltego, Etik Ouest, Presto Products Company, and Desmedt Labels |

The global resealable packaging labels market is estimated to be valued at USD 16.0 billion in 2025.

The market size for the resealable packaging labels market is projected to reach USD 27.4 billion by 2035.

The resealable packaging labels market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in resealable packaging labels market are films and reclose adhesives.

In terms of product type, flow wrap pack segment to command 38.9% share in the resealable packaging labels market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Resealable Packaging Bag Manufacturers

Resealable Packaging Bag Market Analysis by PE and PP Through 2034

Specialty Labels Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Leading Specialty Labels Packaging Providers

Resealable Closures And Spouts Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Resealable Closures and Spouts Packaging Providers

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Labels Market Forecast and Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA