Sealless magnetic drive pump market is a developing market due to increasing demand for leak-free fluid handling systems in several industrial applications, such as chemicals, pharmaceuticals, and food and beverages. This means that they are suitable for dangerous, corrosive, and costly fluids since there are no dynamic seals to leak.

Increasing environmental regulations and workplace safety standards are also driving adoption rates around the world. Furthermore, the rising focus towards energy-efficient and low-maintenance solutions across industries fuels the demand for sealless magnetic drive pumps, making it an ideal solution for sustainable and long-term fluid provision.

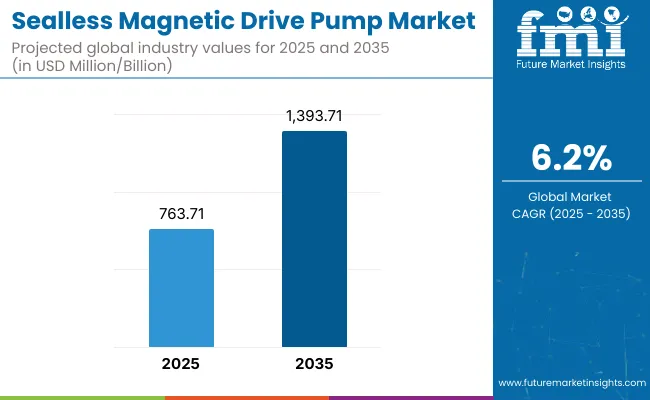

In 2025, the global sealless magnetic drive pump market is projected to reach a valuation of around USD 763.71 million. By 2035, it is expected to surpass USD 1,393.71 million, growing at a compound annual growth rate (CAGR) of 6.2%.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 763.71 Million |

| Projected Market Size in 2035 | USD 1,393.71 Million |

| CAGR (2025 to 2035) | 6.2% |

Rapid industrialization in emerging economies, coupled with the push for green manufacturing practices, is creating new opportunities for market players. Additionally, technological innovations such as advanced magnet materials and integrated monitoring systems are enhancing pump performance, reliability, and predictive maintenance capabilities, making them even more attractive to end-users.

The North America region continues to hold the largest share of the sealless magnetic drive pump market, driven by the chemical processing, oil & gas, and pharmaceuticals segments. Leaders in industries regulated by stringent EPA regulations associated with fugitive emissions opt for leak-proof pumping solutions. Additionally, rising investments in clean energy and biofuels segment of the region is creating demand for magnetic drive pumps specific for aggressive medium at stringent operating standards.

Sealless magnetic drive pumps are being increasingly adopted due to Europe countries focusing on eco-friendly industrial practices. Key markets include Germany, France, and the UK, where tight regulatory frameworks covering pollution control and worker safety are the drivers. Moreover, the EU is also striving for carbon neutrality by 2050, and this is leading industries to replace traditional pumps with efficient, eco-friendly options, which will further broaden the market.

Asia-Pacific accounts for the fastest growing region in the sealless magnetic drive pump market, due to rapid industrial growth across China, India, Japan, and South East Asia. Significant demand is spurred by increasing chemical, pharmaceutical, and water treatment activities.

Moreover, the growing emphasis on modernizing businesses with safer, more energy-efficient technology is positioning sealless pumps as a strategic investment for businesses across various industries in the region.

This is forecast to fuel steady growth of the sealless magnetic drive pump market, owing to increasing need for safe, efficient, and environment-friendly fluid handling systems. Factors such as replacing traditional sealed pumps with sealless pumps in order to reduce leak risks, reduce maintenance costs, and conform to tighter global environment laws is leading industries worldwide to opt for sealless pumps over its traditional counterparts.

Future key market growth can be expected from innovations, like smart magnetic drive pumps offering real-time performance monitoring, improved energy efficiency and a greater range of materials to endure extreme operating conditions.

High Initial Installation and Maintenance Costs

Sealless magnetic drive pumps provide true leak protection but their significant higher capital costs compared to standard pumps are usually a major negative for consideration. Enhanced total cost of ownership due to complexity of the installation and necessity for trained personnel maintenance makes the technology not widely adoptable for small and medium enterprises.

Limited Handling of Suspended Solids

Sealless magnetic drive pumps, for instance, have one big limitation when it comes to solid-liquid mixtures with the lower efficiency of their capacity when the fluid contains suspended solids. Because internal components can be damaged by particulate matter, this leads to performance degradation and limits the use of the pump in the industrial sector where slurry or solid-laden liquids are frequent, such as in mining or sewage treatment.

Rising Demand for Leak-proof Pumping Solutions in Critical Industries

Sealless pumps are being used more frequently in industries including pharmaceuticals, chemicals, and food processing due these industries' stringent safety and contamination prevention requirements. The pumps offer superior leakage prevention, fulfilling regulatory requirements and operational safety demands, creating tremendous growth opportunities over the course of the next decade.

Growing Investments in Chemical and Petrochemical Infrastructure

The establishment of chemical manufacturing hubs around the world, particularly in Asia-Pacific and the Middle East, is projected to propel the demand for safe and reliable fluid transfer systems. As companies want solutions to reduce the operational downtime and environmental risks that come with handling hazardous materials, sealless magnetic drive pumps are set to benefit.

Due to strict emission and leakage control regulations, particularly in established markets, the market for sealless magnetic drive pumps was stable in 2020 to 2024. COVID-19 has resulted in temporary delays in industrial projects, but investments have rebounded in fields like pharmaceuticals and specialty chemicals, driving pump demand.

From here onward 2025 to 2035, the market will only take off as industries will focus on sustainability and operational safety. Technologies like ceramic and composite containment shells, IoT-enabled pump monitoring, and energy-efficient designs will take the helm. The growing demand for decarbonization and environmental compliance will create new opportunities for market players across the globe.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Aspect | 2020 to 2024 Trends |

|---|---|

| Key Growth Driver | Regulatory push for emission control |

| Technological Innovations | Introduction of carbon fiber containment shells |

| Key Industry Verticals | Chemical processing, pharmaceuticals |

| Material Preferences | Stainless steel and PTFE linings |

| Dominant Regions | North America and Europe |

| Regulatory Focus | Leak prevention and safety standards |

| Investment Trends | Recovery post-COVID industrial slowdown |

| Competitive Strategy | Focus on reliability and maintenance-free design |

| Market Aspect | 2025 to 2035 Projections |

|---|---|

| Key Growth Driver | Adoption of smart, energy-efficient pump systems |

| Technological Innovations | IoT integration for real-time performance monitoring |

| Key Industry Verticals | Specialty chemicals, green energy, and food-grade applications |

| Material Preferences | Advanced composites and ceramics |

| Dominant Regions | Asia-Pacific leading, with Middle East investments rising |

| Regulatory Focus | Environmental compliance and zero-emission goals |

| Investment Trends | Heavy investments in sustainable and eco-friendly solutions |

| Competitive Strategy | Focus on digitalization, predictive maintenance, and durability |

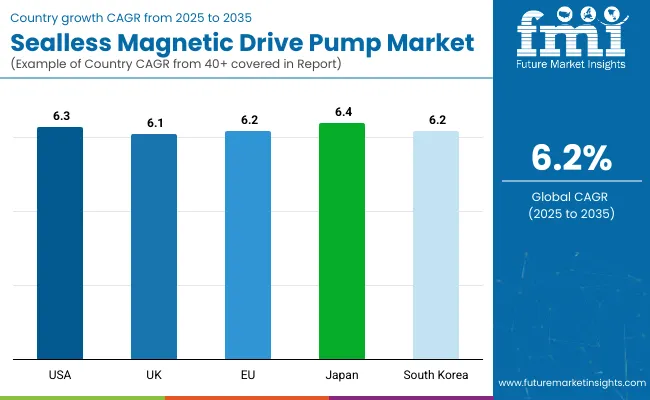

The USA sealless magnetic drive pump market is experiencing a gradual growth due to increased demand from the chemical processing, oil & gas, and pharmaceutical industries. And stringent regulations favoring leak-free and emission-free operations are accelerating adoption.”

Moreover, the transition towards safer and maintenance-free pumping solutions is boosting interest. Rising investments in clean energy and water treatment infrastructure would continue to drive the demand for magnetic drive pumps through various industrial applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.3% |

The demand for sealless magnetic drive pump in the UK is on the rise, with industries prioritizing safety, energy efficiency, and environmental compliance. It is popular with petrochemicals, pharmaceuticals and food processing industries.

Their demand is essentially driven by the requirement of minimizing operational risks with efficient and leak-proof pump systems. Government initiatives for sustainable manufacturing coupled with steady growth of the green economy is expected to further increase market potential for magnetic drive pumps.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.1% |

The sealless magnetic drive pump market is flourishing within the European Union, in part due to the strict EU regulations governing emissions and workplace safety. Germany, France, and Italy lead installations in chemical, pharmaceutical, and water sectors.

With rising investment in renewable energy projects and sustainable industrial practices, there is encouraging adoption of non-leaking, energy-efficient pumps globally. New material and design-oriented technology is also driving adoption across the region.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.2% |

The sealless magnetic drive pump market is experiencing growth in Japan owing to the increasing need for accurate, reliable, and maintenance-free products used in order to meet market demands across high-purity and high-value applications. Key adopters include electronics, chemicals, and pharmaceuticals.

A significant driver is government initiatives to encourage industrial sustainability and the modernization of aging facilities. Furthermore, as one of the most powerful manufacturers of innovative technologies, Japan delivers magnetic drive pump designs for advanced applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.4% |

The sealless magnetic drive pump market in South Korea is growing robustly due to its strong chemical processing and electronics manufacturing sectors. The increasing focus on operating safety, energy savings, and environmental protection helps support adoption.

Government initiatives to enhance industrial decision-making and sustainability are encouraging wider adoption of sealless magnetic drive technologies. The market is anticipated to be further expanded during the following 10 years as a result of technological collaborations and smart factory initiatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

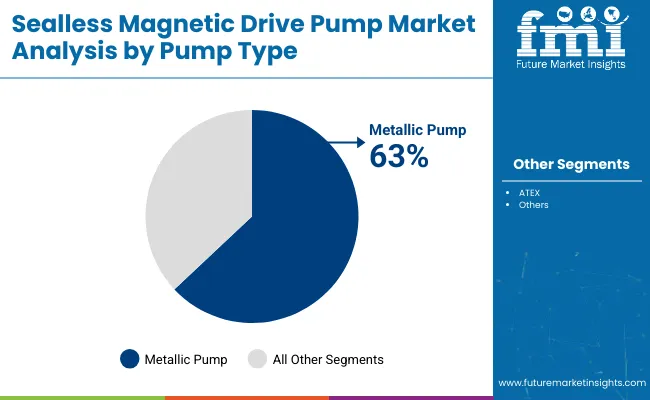

| Pump Type | Market Share (2025) |

|---|---|

| Metallic Pump | 63% |

The metallic pumps segment holds the largest market share due to their high strength, durability, and adaptability to aggressive fluids at high temperatures. Metallic pumps find advantage in industries like chemicals, oil and gas, mining, and power; they can withstand high pressure, high temperature, and high corrosive media compared to non-metallic pumps that would crack due to exposure to combustible gases.

The availability of stainless steel, cast iron, titanium or special alloys gives a great corrosion resistance in metallic pumps to work with acids, polar solvents, hydrocarbons and abrasive slurries. The mechanical robustness of industrial computers guarantees long operational life, decreasing maintenance and downtime intervals, which is key in retaining high productivity during heavy industrial operations.

Improvement in performance characteristics of metallic pumps and subsequent reduction in their operational maintenance is led by advancements in metallurgy processes, and surface treatment procedures. From centrifugal and reciprocating designs to magnetic drive and sealless options, the versatility to satisfy a large spectrum of operational requirements reinforces their leading position in various sectors.

Industries will continue to emphasize operational effectiveness, equipment lifetime, and cost optimization. As a result, demand for metallic pumps will increase steadily, particularly in emerging markets with significant investments in infrastructure, power generation, and manufacturing growth.

This unique combination of strength, multipurpose utility, and resistance to even the most extreme environments helps to guarantee that metallic pumps will be the pump of choice for most critical industrial applications worldwide.

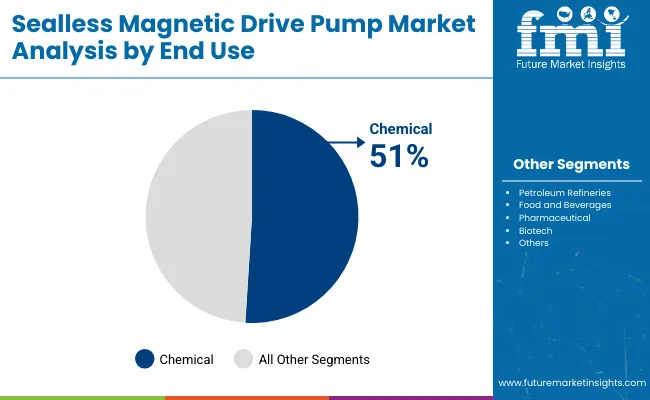

| End-Use | Market Share (2025) |

|---|---|

| Chemical | 51% |

The chemical industry dominates the market, underpinned by the essential need for exceptionally reliable and robust fluid handling systems that can process corrosive, volatile, and hazardous materials. The chemical industry requires a high level of safety, accuracy, and compatibility in materials, due to the prevalence of acids, solvents, bases, and reactive compounds in processes and so heavy-duty pumps, valves, and piping systems specific to aggressive environments are a must.

The usage of reinforced fluid transfer systems ensuring operational safety and avoiding leakage while reducing potential for catastrophic failures is also mandated by strict regulations (OSHA, REACH, various environmental standards) heavily compelling chemical manufacturers to fork out on advanced solutions. #metallic pumps, #metallic lined pipes, and #special coated pumps, and fittings for leak-proof arrangements have therefore become inevitable for worker safety and process integrity.

Furthermore, global growth in specialty chemicals, pharmaceuticals, agrochemicals, and petrochemicals sectors, particularly in developing economies has increased the demand for advanced and corrosion-resistant fluid handling technologies.

Responding to these pressing needs, technologies such as magnetic drive pumps, sealless pumps and double containment systems are rapidly gaining acceptance in the chemical sector, allowing players in the sector to optimize outputs while complying with stringent safety and environmental standards.

The continued expansion and diversification of chemical production worldwide further cements the chemical industry as a leader across the market landscape, with increased demand for advanced, high-performance fluid transfer systems.

The global sealless magnetic drive pump market is projected to grow rapidly as the demand for leakproof, hassle-free pumping systems in chemical, pharmaceutical & food industries, oil & gas, & others is at an all-time high. They do away with mechanical seals, greatly minimizing leakage chances and cutting down maintenance costs in the long run. Environmental standards that seek to limit the flow of dangerous liquids are also driving adoption.

Moreover, magnetic drive pumps are now widely used across different industries to process corrosive, volatile, and valuable fluids, contributing to a reduced risk to workplace safety. Increasing focus on process automation and the trend of energy-efficient industrial equipment is creating a strong opportunity for magnetic drive pump manufacturers across the globe.

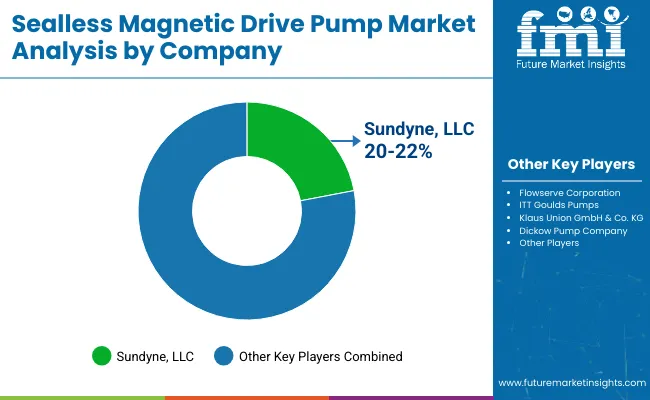

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Sundyne, LLC | 20-22% |

| Flowserve Corporation | 18-20% |

| ITT Goulds Pumps | 14-16% |

| Klaus Union GmbH & Co. KG | 10-12% |

| Dickow Pump Company | 8-10% |

| Other Players (combined) | 22-24% |

| Company Name | Key Offerings/Activities |

|---|---|

| Sundyne, LLC | In 2025, introduced high-speed magnetic drive centrifugal pumps featuring enhanced containment shells for severe service applications. |

| Flowserve Corporation | In 2024, expanded its magnetic drive pump portfolio with energy-saving models focused on low lifecycle costs and extended reliability. |

| ITT Goulds Pumps | In 2025, launched corrosion-resistant magnetic drive pumps targeting the chemical processing and pharmaceutical sectors across emerging economies. |

| Klaus Union GmbH & Co. KG | In 2024, unveiled advanced modular designs enabling customization for petrochemical, nuclear, and marine applications. |

| Dickow Pump Company | In 2025, emphasized its API 685-compliant magnetic drive pumps for oil & gas and refinery sectors, increasing its footprint globally. |

Key Company Insights

Sundyne, LLC (20-22%)

With its innovation, latest technologies, and strong global service, Sundyne is a market leader of sealless magnetic drive pump. Its leak-free, high-speed pumps meet the safety standards of chemical processing, oil refineries and power generation industries.

Recent efforts in R&D at Sundyne are focused on the materials developed and used for containment shells, with advancements allowing them to perform better at higher pressures and extreme temperatures. Their relationship with EPC (Engineering, Procurement and Construction) companies expands their footprint in larger infrastructure projects.

Flowserve Corporation (18-20%)

Flowserve utilizes its wealth of industrial pump experience to grow its magnetic drive offering around the globe, providing low-maintenance, energy-efficient designs ideal for hazardous fluid operations. Due to the better safety features, their pumps have wonderfully accepted across a wide array of pharmaceutical, chemical, and food & beverage industries.

With their growing investment in predictive maintenance technologies, such as smart sensors built into pump systems, Flowserve is well-positioned in an industry that is currently accelerating its transition to digitalization and remote monitoring capabilities.

ITT Goulds Pumps (14-16%)

ITT Goulds Pumps is a strong market player supplying sealless magnetic drive pumps with an excellent corrosion resistance. This is vital to handling aggressive chemicals safely and for many years. Their global presence was then strengthened through recent expansion into the Asia-Pacific region, especially in China and India. For that reason, their dedication to modular pump designs also allows for effortless customization/upgrades, a feature that is becoming more desirable in fast-evolving industries.

Klaus Union GmbH & Co. KG (10-12%)

Klaus Union has been known for its high-end sealless magnetic drive pumps for demanding applications, like nuclear energy, oil & gas and marine. These pumps adhere to all relevant international standards, including API 685 and ATEX certifications, and are therefore extremely well-suited for challenging operating environments.

By developing modular pump technology, they focus more on flexible manufacturing, shorter lead times, and better customization options for the end user, providing them with a competitive edge in niche markets.

Dickow Pump Company (8-10%)

Dickow is known for heavy duty magnetic drive pumps meeting the rigorous demands of industry regulations. Its API 685-compliant products are gaining preference for critical oil & gas applications that require complete containment and reliability.

Dickow has established a reputation for the design engineering of centrifugal process pumps United States, but the strong aftermarket support network also ensures customer loyalty. By in turn their focus on developing energy-efficient models, they contribute to empirical efforts around the globe to increase sustainability in general and manufacturing in particular with green manufacturing trends.

Other Key Players (22-24% Combined)

The overall market size for sealless magnetic drive pump market was USD 763.71 million in 2025.

The sealless magnetic drive pump market expected to reach USD 1,393.71 million in 2035.

Rising demand for leak-free pumping systems, growth in chemical processing industries, stricter environmental regulations, and focus on equipment reliability will drive demand.

The top 5 countries which drives the development of sealless magnetic drive pump market are USA, UK, Europe Union, Japan and South Korea.

Metallic pumps segment driving market growth to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Magnetic Absorption Data Line Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Material Magnetization and Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Coupler Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Shielding Device Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Stripe Readers Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Resonance Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Separator Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Ballast Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Sensor Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Flowmeter Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Resonance Imaging Coils Market Analysis - Size, Share, and Forecast 2025 to 2035

Magnetic Tape Market Analysis Size and Share Forecast Outlook 2025 to 2035

Magnetic Resonance Imaging (MRI) Contrast Agents Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Crack Detectors Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Materials Market Growth - Trends & Forecast 2025 to 2035

Magnetic Resonance Imaging (MRI) Market Trends - Size, Share & Forecast 2025 to 2035

Magnetic Grill Market Analysis – Trends, Growth & Forecast 2025 to 2035

Magnetic Closure Boxes Market Trends - Growth & Demand 2025 to 2035

Magnetic Charging Cable Market Trends - Growth & Forecast 2025 to 2035

Magnetic Flow Meter Market Analysis by Product Type, Components, Technology, Application and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA