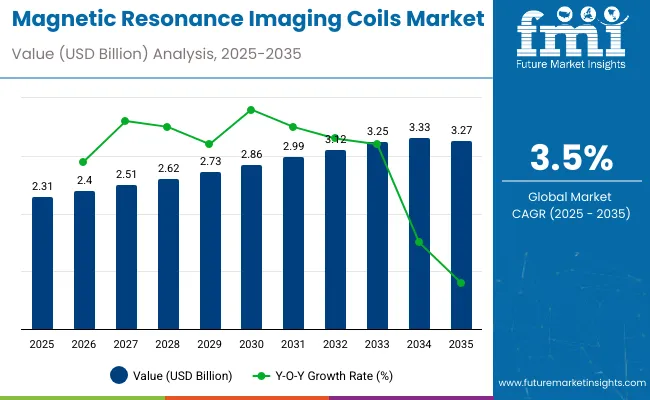

The global MRI coils market is projected to grow from an estimated USD 2.31 billion in 2025 to USD 3.27 billion by 2035, reflecting a CAGR of 3.5%. Growth will be driven by rising demand for advanced imaging quality, expanding prevalence of chronic and neurological diseases, and increased adoption of high-field MRI scanners in hospitals and imaging centers.

In 2024, a notable innovation emerged from Polarean Imaging, which received FDA clearance for its XENOVIEW® 3T chest coil compatible with GE Healthcare MRI systems. This coil enables hyperpolarized Xenon-129 lung imaging, supporting improved assessment of pulmonary ventilation in adults and children from age 12. CEO Christopher von Jako stated that the approval would “enable more clinicians across the U.S. to access our innovative Xenon MRI technology.”

Research from Boston University’s INM‑4 group unveiled a novel butterfly coil in early 2024. This coil uses circularly-polarized surface design to significantly improve signal‑to‑noise ratio (SNR) in brain imaging. The study demonstrated marked image quality enhancement compared to linear-polarized coils, supporting its potential for clinical adoption.

Another key advancement involves wearable, wireless coaxially-shielded coils introduced at ISMRM 2023. Developed by ASU and collaborators, these coils offer flexibility and high SNR without traditional cabling. Their form-fitting design improves patient comfort and supports high-resolution imaging for anatomies such as the knee and brain. Researchers have also demonstrated a Near-Field Coupling (NFC) coil system that uses a patient-worn pickup coil, removing the need for bed-mounted connectors and enabling lightweight, disposable coil formats. This innovation reduces clutter in the imaging suite and supports individualized coil use.

With ongoing innovations-such as specialist lung coils, wireless wearable arrays, patient-tailored designs, and advanced coil geometries-the MRI coils market is well positioned for continual expansion through 2035. Enhanced imaging performance, patient comfort, and operational efficiency will power adoption in next-generation MRI systems.

| Attributes | Description |

|---|---|

| Estimated Magnetic Resonance Imaging Coils Market Size (2025E) | USD 2.31 billion |

| Projected Magnetic Resonance Imaging Coils Market Value (2035F) | USD 3.27 billion |

| Value-based CAGR (2025 to 2035) | 3.5% |

The following table shows the estimated CAGR of the global magnetic resonance imaging (MRI) coils market for the semi-annual periods from 2025 to 2035. In the H1 of the decade, 2024 to 2035, this market is expected to rise by a CAGR of 10.2%. But this rate is going to decline to only 9.9% for the H2 of the same period.

| Particular | Value CAGR |

|---|---|

| H1 | 10.2% (2024 to 2035) |

| H2 | 9.9% (2024 to 2035) |

| H1 | 3.5% (2025 to 2035) |

| H2 | 9.0% (2025 to 2035) |

Going forward to the next cycle (H1 2025 to H2 2035), the CAGR is expected to decelerate to 3.5% in the first half and accelerate to 9.0% in the second half. The market declined 70 BPS in H1 but increased by 90 BPS in H2.

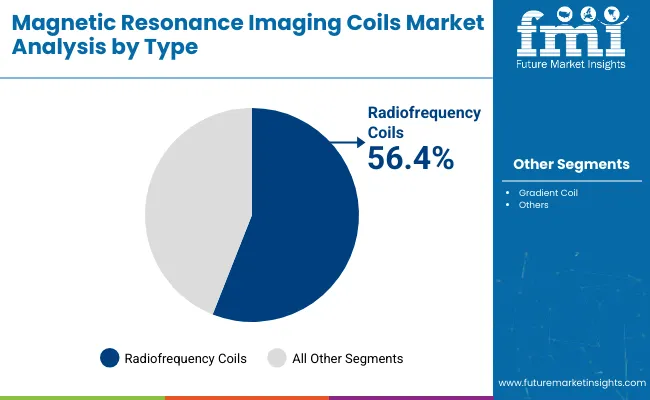

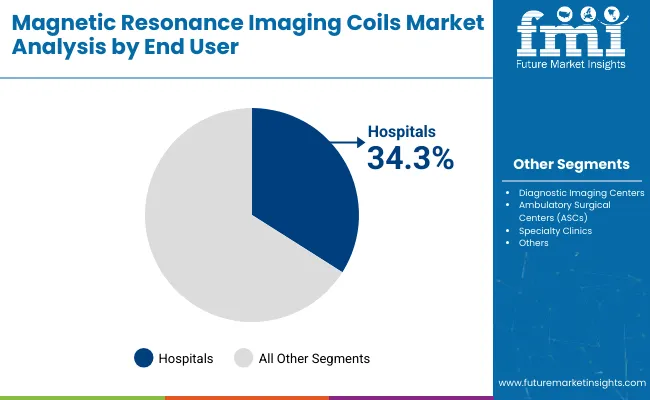

The MRI coils market is expanding steadily as demand for high-resolution imaging grows across clinical settings. In 2025, radiofrequency (RF) coils will dominate with a 56.4% market share, offering superior image quality. Simultaneously, hospitals will remain the largest end user segment, accounting for 34.3% of total revenue, driven by investments in advanced diagnostic imaging.

Radiofrequency (RF) coils are expected to dominate the MRI coils market, holding a 56.4% market share by 2025. These coils are critical for receiving high-quality MR signals, which directly enhance image resolution and diagnostic accuracy. Hospitals and imaging centers rely on RF coils to conduct a wide range of diagnostic procedures, from neurology to musculoskeletal and oncology imaging. The growing need for early disease detection and precise visualization of soft tissues has accelerated demand for advanced RF coil technologies.

Leading manufacturers such as Philips Healthcare, GE Healthcare, Siemens Healthineers, and Canon Medical Systems are continually innovating RF coil designs. Developments in multi-channel, dedicated body-part coils-such as breast, cardiac, and orthopedic coils-have further expanded clinical applications.

Moreover, the integration of AI-enhanced image reconstruction and 3D imaging capabilities is boosting RF coil performance. As precision medicine and personalized diagnostics gain traction, RF coils will remain indispensable in advancing MRI imaging across clinical specialties through 2025.

Hospitals are projected to capture 34.3% of the MRI coils market by end user in 2025. Hospitals serve as the primary hub for advanced imaging procedures, driving robust demand for high-performance MRI coils. Investments in cutting-edge MRI systems-including 3T and 7T scanners-are accelerating across hospital networks. This trend is fueled by the growing need to offer comprehensive diagnostic services, including cardiovascular, oncological, and neurological imaging.

Top imaging solution providers such as GE Healthcare, Philips Healthcare, Siemens Healthineers, and Hitachi Healthcare supply hospitals with a wide range of specialized coils. Hospitals often deploy dedicated coils for pediatric, spinal, and breast imaging, enhancing clinical outcomes.

Additionally, initiatives by governments and private healthcare providers to expand MRI accessibility-especially in rural and underserved regions-are propelling hospital adoption. The integration of AI-powered imaging and remote reading capabilities is further strengthening hospitals’ leadership in this space.

Introduction of Flexible and Lightweight MRI Coil Designs Improving Imaging Efficiency

The flexible and lightweight MRI coil designs are mainly driving the market with improved efficiency in imaging, patient comfort, and accuracy in diagnosis. Traditional rigid MRI coils often had challenges in being conformed to various anatomical structures, resulting in patient discomfort and compromised image quality.

In contrast, modern coils are designed with elastic materials that readily conform to different body regions including the head and neck, spine, and extremities. This means that the coil is always set in a proper position, with consistent signal reception and minimal artifacts from motion during dynamic imaging.

These advancements are particularly beneficial for vulnerable patient groups, including pediatric, geriatric, and claustrophobic individuals, who may struggle with traditional coil setups. Lightweight designs further contribute to ease of handling, reducing strain on technicians during positioning while ensuring a more pleasant experience for patients.

Prominent examples of flexible and lightweight coil designs include Siemens Healthineers' "Tim 4G" technology, which incorporates ultra-light materials to optimize comfort and image quality. GE Healthcare's AIR Coils leverage advanced flexible materials to ensure enhanced signal-to-noise ratios but offer much higher flexibility depending on the kind of body shape or imaging needed.

Similarly, Philips' ComfortScan Coils make sure comfort without compromising with a high-resolution imaging requirement for a patient.

Widespread Adoption of High-Field and Ultra-High-Field Compatible Coils is propelling Market growth

A key driver of the trend toward higher use of high-field (3T) and ultra-high-field (7T and above) MRI systems is the demand for advanced, optimized coils. At high field strength, these offer a higher magnetic strength to enable superior spatial resolution, faster scan times, and improved signal-to-noise ratio (SNR) for more precise imaging.

Specially designed coils are needed to efficiently operate in such high magnetic fields to completely leverage these capabilities and provide detailed anatomical and functional imaging for complex diagnostic and research purposes.

The coils that fit into 3T and 7T systems are engineered from cutting-edge materials and technology to handle greater signal intensity in a stronger environment without the development of artifacts or distortion. This opens up imaging resolutions not possible at earlier stages these coils open up possibilities which are valuable to neuroimaging, musculoskeletal imaging, and cardiovascular applications.

In addition, ultra-high-field systems are gradually being adopted in research to investigate microscopic aspects of the brain structure, for instance cortical layers or microvascular structures, which require high-performance coils specifically designed for that purpose.

Siemens Healthineers offers 7T-compatible coils for its MAGNETOM Terra system, which supports advanced research and clinical imaging. GE Healthcare's SIGNA Premier 3T systems also come with a variety of specialized coils optimized for high-field imaging.

The adoption of these high-performance coils not only enhances diagnostic and research capabilities but also represents a critical growth driver for the MRI coils market, catering to the evolving needs of precision medicine.

Ultra-High-Field MRI Spurs Demand for Advanced and Specialized MRI Coils

Ultra-high-field MRI systems above 7T are increasingly adopted and thus hold great opportunities for the MRI coils market. It is the system that offers high spatial resolution and better SNR with improved contrast, thereby ideal for advanced diagnostic and research applications.

These ultra-high-field MRI systems are increasingly being applied in clinics to clinical applications such as neurological disorders, musculoskeletal conditions, and cardiovascular diseases, and there is a growing requirement for dedicated coils that can fully exploit these high fields.

Manufacturers can take advantage of this by designing coils tailored for ultra-high-field systems. They can counter the technical issues that arise due to higher magnetic strengths, like increased susceptibility artifacts and dielectric effects. The coils demand novel designs and materials to ensure superior image quality, consistent performance, and minimal artifacts.

Ultra-high-field systems are used more frequently in these research institutions for cutting-edge studies such as functional brain mapping, cortical microstructure analysis, and imaging of small anatomical structures, requiring very specific and adaptable coil solutions.

They are among the prominent manufacturers such as Siemens Healthineers and Canon Medical Systems, who have started starting to integrate coils compatible with ultra-high fields in their portfolios. The growing investment in advanced imaging technology as well as the global spread of precision medicine can be great opportunities for the manufacturers of compatible coils of ultra-high-field MRI systems in the very near future.

MRI Coil Market Faces Challenges as High-System Costs Hinder Widespread Adoption

The expensive nature of MRI systems, particularly high-field (3T) and ultra-high-field (7T and above) models, presents a significant challenge in the MRI coils market.

These advanced systems are required for rendering high imaging resolution and higher diagnostic accuracy; however, their extensive prices make them less accessible to small hospitals, diagnostic centers, and healthcare facilities, mostly in resource-poor regions. These capital expenditures, also combined with high operating and maintenance costs, would further limit their usage.

The MRI coils are a core part of such systems, further increasing the expenditure. Sophisticated coils dedicated to specific applications in high field and ultra-high field have complex designs, using advanced materials with strict manufacturing, which increase costs.

For example, phased arrays and multi-channel coils in the 7T system are expensive to produce because strong magnetic fields make it difficult for engineers to have control over engineering while ensuring adequate imaging quality.

This cost barrier is particularly pronounced in developing regions where healthcare budgets are limited and infrastructure investment in advanced diagnostic imaging technologies remains constrained. As a result, many facilities opt for lower-field MRI systems or delay system upgrades, reducing the demand for advanced coils.

To address this restraint, manufacturers need to focus on cost optimization strategies, such as modular coil designs or leasing programs, to make these technologies more affordable and accessible.

The global MRI coils market grew with a CAGR of 2.7% from 2020 to 2024 from USD 2 billion in 2020 to USD 2.23 billion in 2024.

This period saw the market experience significant advancements, from single-channel, rigid coils to multi-channel, phased-array designs that improved signal-to-noise ratio (SNR) and image resolution. The increase in high-field (3T) MRI systems further fueled innovation in coil technology, as healthcare systems increasingly demanded accurate, non-invasive diagnostics.

Further growth will be indicated by emerging trends, especially with the growth in chronic diseases and investments in health care in developing economies, and by the increased deployment of high-field and ultra-high-field (7T and above) MRI systems for advanced imaging.

Technological innovations are at the heart of advancements, as the integration of AI in coil technology enhances image acquisition, reduces artifacts, and optimizes workflows. Wireless and flexible coils are coming into prominence in improving patient comfort and expanding versatility in applications.

Another significant emerging trend in the hybrid imaging modality space, with PET-MRI emerging as the key driver, and the focus for specialized coils here. Pediatric, ergonomic, and other patient-centric coil designs are fundamentally changing product development. Sustained growth is seen in the MRI coils market due to an increase in demand in neurology, oncology, and musculoskeletal imaging.

Furthermore, research institutes have been expanding the market with the increase in investment in advanced imaging technologies. Continued innovation and upgrading of healthcare infrastructure will continue to fuel this growth upward and guarantee long-term market growth.

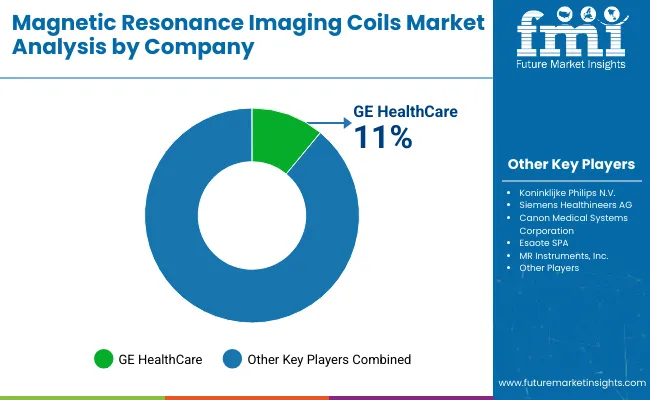

Tier 1 players dominate the market with 45.1%, leveraging strategic partnerships, acquisitions, and clinical trials to expand their product lines and integrate advanced technologies. Primary players include Esaote, GE Healthcare, Koninklijke Philips N.V., and Siemens Healthcare.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market and holds around 33.5% market share. They typically pursue partnerships with academic institutions and research organizations to leverage emerging technologies and expedite product development.

These companies often emphasize agility and adaptability, allowing them to quickly bring new treatments to market, additionally targeting specific types medical conditions. Additionally, they focus on cost-effective production methods to offer competitive pricing. Prominent companies in tier 2 include MR Instruments, Inc., ScanMed and Hologic Inc.

Finally, Tier 3 companies, such as Canon Medical Systems Corporation and RAPID MR International, LLC. They specialize in specific products and cater to niche markets, adding diversity to the industry.

Overall, while Tier 1 companies are the primary drivers of the market, Tier 2 and 3 companies also make significant contributions, ensuring the magnetic resonance imaging coils sales remains dynamic and competitive.

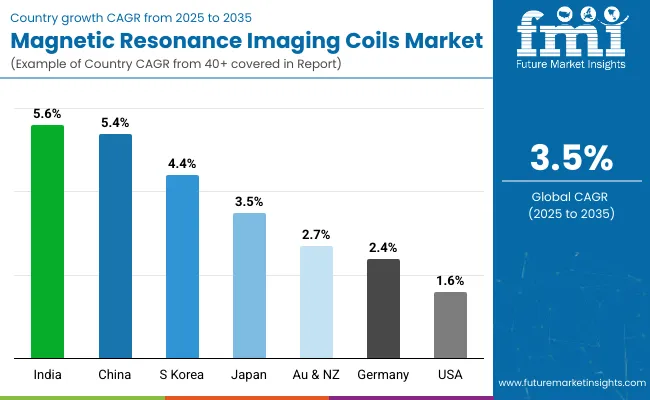

The section below covers the industry analysis for the magnetic resonance imaging coils market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle Ease & Africa, is provided.

The United States is anticipated to remain at the forefront in North America, with higher magnetic resonance imaging coils market share through 2035. In South Asia & Pacific, India is projected to witness a CAGR of 5.6% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 1.6% |

| China | 5.4% |

| Japan | 3.5% |

| South Korea | 4.4% |

| India | 5.6% |

| Germany | 2.4% |

| Australia & New Zealand | 2.7% |

The USA MRI coils market is likely to grow at a CAGR of 1.6% during 2025 to 2035, retaining the largest share in North America.

Advanced healthcare infrastructure, high demand for diagnostic imaging, and substantial research and development activities in the country contribute to this leadership. The leading service providers, research institutions, and device manufacturers are also propelling the demand for advanced MRI systems and coils.

Higher health spending in the country and additional growing pervasiveness of chronic diseases and an aging population contribute to demand for more high-field and ultra-high-field MRI systems.

It also happens that the United States leads in innovation regarding medical technology. The country hosts the top players, such as GE Healthcare, Siemens Healthineers, and Philips. The presence of top research universities and medical centers accelerates the development and adoption of advanced coil technologies, especially for specialized applications like neuroimaging, oncology, and musculoskeletal disorders. Thus, the USA becomes the largest and most influential market in the global MRI coils industry.

It is projected that from 2025 to 2035, the Chinese MRI coils market will register a CAGR of 5.4%. Therefore, this is expected to continue being the biggest market for MRI coils in East Asia, going forward through the forecast period.

The market growth can be attributed mainly to an increase in the adoption of high-field MRI systems in the market, which comprises 3T and above. Hospitals and diagnostic centers have been spending heavily on state-of-the-art imaging technologies due to the ever-increasing requirement for proper diagnostics in rapidly accelerating economic growth and rising healthcare expenditures.

High-field MRI systems have gained prominence mainly because of better image resolution, faster scanning time, and high signal-to-noise ratio in advanced diagnostic procedures such as neurological, musculoskeletal, and cardiovascular imaging.

As the hospitals become more updated, so also should be their advanced MRI coils as it also keeps pace with increasing magnetic fields as well as improvement in imaging. This trend can best be reflected and noted, more so, within urban towns as well as hospitals since more patients seek top-end facilities within their walls. Of late, most Chinese older folks and many Chinese citizens suffering from chronic illnesses require enhanced high-field scanning images that boost their compatible coils.

The magnetic resonance imaging coils market in India is expected to grow at a CAGR of 5.6% during the period of 2025 to 2035.

It currently occupies the largest share in the South Asia & Pacific market and is likely to sustain this trend throughout the forecast period. An expanding burden of chronic diseases, including cancer, cardiovascular diseases, and neurological disorders within India's massive and rapidly ageing population is driving increased demand for diagnostic imaging, with MRI scans at the top.

MRI systems deliver non-invasive, high resolution imaging that's highly important to diagnose and control complex diseases and, due to better health awareness, more and more patients search for advanced diagnostics.

The direct influence of this rising demand for MRI scans on the market is that advanced coils are required to ensure optimal performance of high-field MRI systems. Moreover, the surged focus on early detection and preventive health care in India has further amplified the requirement for MRI scans, creating sustained demand for these high-quality coils.

Due to such reasons, the MRI coils market in India has grown extensively because of the new health landscape within the country as well as increased demand for the precision in diagnostic.

A variety of strategies is being adopted by market players to maintain their competitive advantage. Some of the most important include the differentiation of products through innovative formulations and strategic partnerships with healthcare providers for distribution. In addition, these companies look for strategic alliances to enhance their product portfolios and strengthen their global market presence.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 2.31 billion |

| Projected Market Size (2035) | USD 3.27 billion |

| CAGR (2025 to 2035) | 3.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and thousand units for volume |

| Types Analyzed (Segment 1) | Radiofrequency Coil, Gradient Coil |

| Applications Analyzed (Segment 2) | Neurology, Cardiovascular, Spine and Musculoskeletal, Pediatric, Breast, Abdominal, Other Applications |

| End Users Analyzed (Segment 3) | Hospitals, Diagnostic Imaging Centers, Ambulatory Surgical Centers (ASCs), Specialty Clinics |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia & Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, France, United Kingdom, Italy, Spain, China, India, Japan, South Korea, Australia, GCC Countries, South Africa |

| Key Players influencing the MRI Coils Market | GE HealthCare Technologies, Inc. (GE Healthcare), Koninklijke Philips N.V., Siemens Healthineers AG, Canon Medical Systems Corporation, Esaote SPA, MR Instruments, Inc., Rapid MR International, LLC, ScanMed, LLC, Bruker Corporation, Aurora Healthcare US Corp |

| Additional Attributes | Market size in dollar sales and CAGR, share by coil type (head, body, cardiac, others), end-user trends (hospitals, imaging centers), regional dollar sales, competitive landscape and dollar sales, tech advancements, regulatory changes, replacement demand. |

In terms of type, the industry is divided into- radiofrequency coil and gradient coil.

In terms of application, the industry is segregated into- neurology, cardiovascular, spine and musculoskeletal, pediatric, breast, abdominal and other applications.

In terms of end user, the industry is segregated into- hospitals, diagnostic imaging centers, ambulatory surgical centers (ASCs) and specialty clinics.

Key countries of North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia and Middle East and Africa (MEA) have been covered in the report.

The global magnetic resonance imaging coils market is projected to witness CAGR of 3.5% between 2025 and 2035.

The global magnetic resonance imaging coils industry stood at USD 2.23 billion in 2024.

The global magnetic resonance imaging coils market is anticipated to reach USD 3.27 billion by 2035 end.

India is set to record the highest CAGR of 5.6% in the assessment period.

The key players operating in the global magnetic resonance imaging coils market include Esaote, GE Healthcare, Koninklijke Philips N.V., Siemens Healthcare, MR Instruments, Inc., ScanMed, Canon Medical Systems Corporation, Hologic Inc., RAPID MR International, LLC and Bruker.

Table 1: Global Market Value (US$ Mn) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Channel) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Mn) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Channel) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Mn) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Channel) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Mn) Forecast by End-use, 2018 to 2033

Table 8: Global Market Volume (Channel) Forecast by End-use, 2018 to 2033

Table 9: North America Market Value (US$ Mn) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Channel) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Mn) Forecast by Type, 2018 to 2033

Table 12: North America Market Volume (Channel) Forecast by Type, 2018 to 2033

Table 13: North America Market Value (US$ Mn) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Channel) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Mn) Forecast by End-use, 2018 to 2033

Table 16: North America Market Volume (Channel) Forecast by End-use, 2018 to 2033

Table 17: Latin America Market Value (US$ Mn) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Channel) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Mn) Forecast by Type, 2018 to 2033

Table 20: Latin America Market Volume (Channel) Forecast by Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Mn) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (Channel) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Mn) Forecast by End-use, 2018 to 2033

Table 24: Latin America Market Volume (Channel) Forecast by End-use, 2018 to 2033

Table 25: Europe Market Value (US$ Mn) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Channel) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Mn) Forecast by Type, 2018 to 2033

Table 28: Europe Market Volume (Channel) Forecast by Type, 2018 to 2033

Table 29: Europe Market Value (US$ Mn) Forecast by Application, 2018 to 2033

Table 30: Europe Market Volume (Channel) Forecast by Application, 2018 to 2033

Table 31: Europe Market Value (US$ Mn) Forecast by End-use, 2018 to 2033

Table 32: Europe Market Volume (Channel) Forecast by End-use, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Mn) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Channel) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Mn) Forecast by Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (Channel) Forecast by Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Mn) Forecast by Application, 2018 to 2033

Table 38: Asia Pacific Market Volume (Channel) Forecast by Application, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Mn) Forecast by End-use, 2018 to 2033

Table 40: Asia Pacific Market Volume (Channel) Forecast by End-use, 2018 to 2033

Table 41: Middle East and Africa Market Value (US$ Mn) Forecast by Country, 2018 to 2033

Table 42: Middle East and Africa Market Volume (Channel) Forecast by Country, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Mn) Forecast by Type, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Channel) Forecast by Type, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Mn) Forecast by Application, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Channel) Forecast by Application, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Mn) Forecast by End-use, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Channel) Forecast by End-use, 2018 to 2033

Figure 1: Global Market Value (US$ Mn) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Mn) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Mn) by End-use, 2023 to 2033

Figure 4: Global Market Value (US$ Mn) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Mn) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Channel) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Mn) Analysis by Type, 2018 to 2033

Figure 10: Global Market Volume (Channel) Analysis by Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 13: Global Market Value (US$ Mn) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (Channel) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Mn) Analysis by End-use, 2018 to 2033

Figure 18: Global Market Volume (Channel) Analysis by End-use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 21: Global Market Attractiveness by Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by End-use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Mn) by Type, 2023 to 2033

Figure 26: North America Market Value (US$ Mn) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Mn) by End-use, 2023 to 2033

Figure 28: North America Market Value (US$ Mn) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Mn) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Channel) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Mn) Analysis by Type, 2018 to 2033

Figure 34: North America Market Volume (Channel) Analysis by Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 37: North America Market Value (US$ Mn) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (Channel) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Mn) Analysis by End-use, 2018 to 2033

Figure 42: North America Market Volume (Channel) Analysis by End-use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 45: North America Market Attractiveness by Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by End-use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Mn) by Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Mn) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Mn) by End-use, 2023 to 2033

Figure 52: Latin America Market Value (US$ Mn) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Mn) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Channel) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Mn) Analysis by Type, 2018 to 2033

Figure 58: Latin America Market Volume (Channel) Analysis by Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Mn) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (Channel) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Mn) Analysis by End-use, 2018 to 2033

Figure 66: Latin America Market Volume (Channel) Analysis by End-use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End-use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Mn) by Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Mn) by Application, 2023 to 2033

Figure 75: Europe Market Value (US$ Mn) by End-use, 2023 to 2033

Figure 76: Europe Market Value (US$ Mn) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Mn) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Channel) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Mn) Analysis by Type, 2018 to 2033

Figure 82: Europe Market Volume (Channel) Analysis by Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Mn) Analysis by Application, 2018 to 2033

Figure 86: Europe Market Volume (Channel) Analysis by Application, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Europe Market Value (US$ Mn) Analysis by End-use, 2018 to 2033

Figure 90: Europe Market Volume (Channel) Analysis by End-use, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 93: Europe Market Attractiveness by Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Europe Market Attractiveness by End-use, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Mn) by Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Mn) by Application, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Mn) by End-use, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Mn) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Mn) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Channel) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Mn) Analysis by Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Channel) Analysis by Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Mn) Analysis by Application, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Channel) Analysis by Application, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Mn) Analysis by End-use, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Channel) Analysis by End-use, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by End-use, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: Middle East and Africa Market Value (US$ Mn) by Type, 2023 to 2033

Figure 122: Middle East and Africa Market Value (US$ Mn) by Application, 2023 to 2033

Figure 123: Middle East and Africa Market Value (US$ Mn) by End-use, 2023 to 2033

Figure 124: Middle East and Africa Market Value (US$ Mn) by Country, 2023 to 2033

Figure 125: Middle East and Africa Market Value (US$ Mn) Analysis by Country, 2018 to 2033

Figure 126: Middle East and Africa Market Volume (Channel) Analysis by Country, 2018 to 2033

Figure 127: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Mn) Analysis by Type, 2018 to 2033

Figure 130: Middle East and Africa Market Volume (Channel) Analysis by Type, 2018 to 2033

Figure 131: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 132: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 133: Middle East and Africa Market Value (US$ Mn) Analysis by Application, 2018 to 2033

Figure 134: Middle East and Africa Market Volume (Channel) Analysis by Application, 2018 to 2033

Figure 135: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: Middle East and Africa Market Value (US$ Mn) Analysis by End-use, 2018 to 2033

Figure 138: Middle East and Africa Market Volume (Channel) Analysis by End-use, 2018 to 2033

Figure 139: Middle East and Africa Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 140: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 141: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End-use, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Breakdown of Magnetic Resonance Imaging Coils Suppliers

Magnetic Shielding Device Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Stripe Readers Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Drive Pump Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Separator Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Ballast Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Sensor Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Flowmeter Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Tape Market Analysis Size and Share Forecast Outlook 2025 to 2035

Magnetic Crack Detectors Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Materials Market Growth - Trends & Forecast 2025 to 2035

Magnetic Grill Market Analysis – Trends, Growth & Forecast 2025 to 2035

Magnetic Closure Boxes Market Trends - Growth & Demand 2025 to 2035

Magnetic Charging Cable Market Trends - Growth & Forecast 2025 to 2035

Magnetic Flow Meter Market Analysis by Product Type, Components, Technology, Application and Region - Trends, Growth & Forecast 2025 to 2035

Market Positioning & Share in the Magnetic Separator Industry

Magnetic Ablation Catheter Market Outlook – Share, Growth & Forecast 2025-2035

Magnetic Beads Market

Magnetic Field Sensors Market

Magnetic Bearing Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA