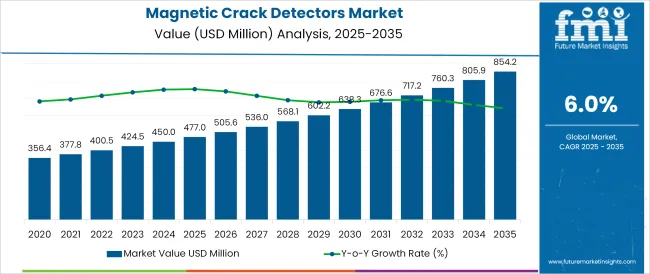

The Magnetic Crack Detectors Market is estimated to be valued at USD 477.0 million in 2025 and is projected to reach USD 854.2 million by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

The magnetic crack detectors market is experiencing steady growth, driven by increasing emphasis on structural integrity, quality assurance, and safety compliance across manufacturing and maintenance sectors. As asset lifecycle management gains prominence industries such as automotive, aerospace, and heavy engineering are prioritizing non destructive testing (NDT) techniques to detect surface and subsurface flaws without compromising the structural composition of components.

Advancements in electromagnetics, compact magnetic yokes, and digital signal enhancements are allowing for greater sensitivity, portability, and accuracy in crack detection. Additionally, rising regulatory standards and audit requirements across industries are reinforcing the adoption of magnetic crack detectors in both production and maintenance workflows.

Growing adoption in developing economies and aftermarket inspection processes are expected to sustain demand, particularly for handheld and mobile detection units. As product miniaturization and ruggedization evolve, and as industries emphasize predictive maintenance, the market is poised for consistent growth across portable and fixed configurations.

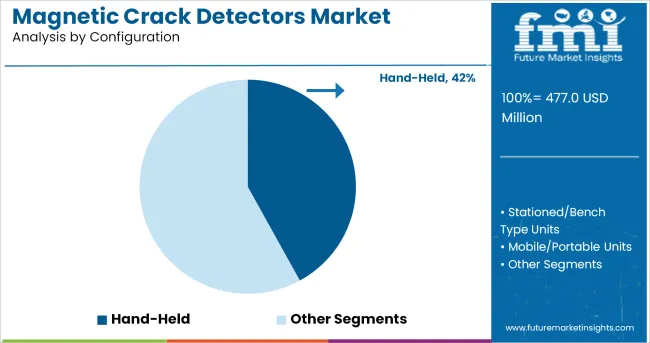

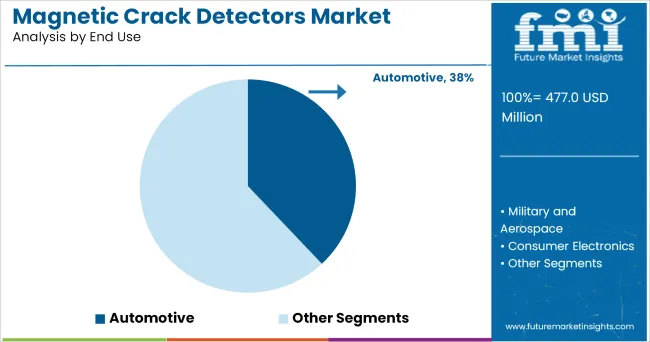

The market is segmented by Configuration and End Use and region. By Configuration, the market is divided into Hand-Held, Stationed/Bench Type Units, and Mobile/Portable Units. In terms of End Use, the market is classified into Automotive, Military and Aerospace, Consumer Electronics, and Others.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hand-held configuration is projected to contribute 42.0% of revenue share in 2025 positioning it as the leading segment in the magnetic crack detectors market. Its leadership is being driven by increased demand for portable, lightweight, and field-deployable solutions that offer flexibility in on-site inspection across complex surfaces and hard to reach areas.

The segment has gained traction in industries that prioritize rapid diagnostics, such as automotive and railways, where downtime costs are high. Technological improvements in magnetic yoke design, battery life, and ergonomic handling have enabled prolonged use without compromising detection accuracy.

Additionally, handheld devices are increasingly favored for their ease of training and minimal setup time, especially in maintenance environments. As asset-intensive sectors push toward preventive and condition-based maintenance, hand-held magnetic crack detectors are expected to remain a preferred choice due to their operational agility and deployment speed.

The automotive industry is expected to hold 38.0% of revenue share in 2025, emerging as the dominant end-use segment in the magnetic crack detectors market. This leadership stems from the industry's stringent quality control requirements, especially in components subjected to high stress such as axles, drive shafts, engine blocks, and suspensions.

Manufacturers are increasingly incorporating magnetic particle inspection into production and post-assembly workflows to identify surface and near-surface defects that could lead to structural failures or safety recalls. With the rise of electric vehicles, new material combinations and lightweight alloys are also requiring more rigorous inspection standards, further accelerating detector adoption.

Additionally, the global expansion of automotive manufacturing hubs, especially in Asia-Pacific and Eastern Europe, has intensified the demand for affordable and mobile NDT solutions. Regulatory oversight and OEM-mandated inspection protocols are expected to further reinforce the use of magnetic crack detectors in automotive quality assurance and maintenance applications.

One of the key traits of the magnetic crack detector is its ability to detect cracks and effects as much as half inch below the surface and offers advantages in the speed and economy of its application in broad end uses like aero and motor engines, ship building, etc.. As a result, the demand for shock testing systems is growing due to the need to ensure a product's consistency and long-term viability.

Industries such as automotive and aerospace, are developing advanced magnetics particle inspection to ensure the precise breakage point, sensitivity, and other characteristics of products in order to improve product protection and quality. The need for quality product to the customer is driving the sales of these testing device to a new height since the last decade.

This has also had a ripple effect on automotive component and material sales, and in-turn the testing equipment sales. As these devices are used in every metal fabrication industry, the growth prospects aren’t focused from automotive sector.

Other end users like military, aero-space component manufacturer, competitive pipe manufacturers, etc. have to undergo strict regulations from various bodies of equipment testing therefore these equipment play a crucial role in developing light in weight, durable and reliable metal components. The demand for light but durable products has gained importance in the last decade and will be manipulative move by many manufacturers in order to keep accord with the industry 4.0 norms

These machines are also extensively used in aerospace industry in order to test equipment and check their reliability. Although lockdown and shelter-at-home guidelines have meant restricted manufacturing activities, sales are likely to improve over the course of the assessment period.

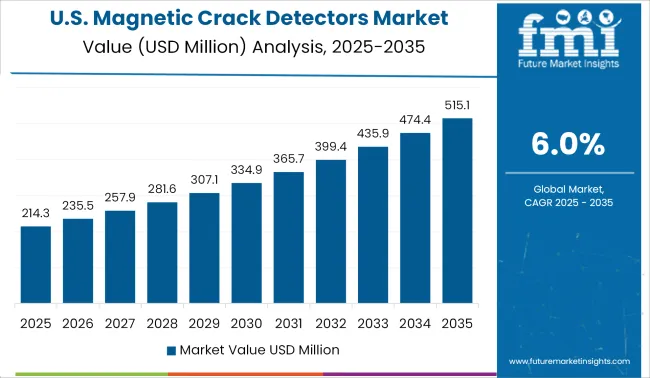

Magnetic particle inspection is a simple NDI method used to detect cracks at the surface of ferromagnetic materials such as steels and nickel-based alloys, which are made in use in almost all metal working industry in the USA The automotive manufacturing industry in USA and Canada is one of the largest in the world.

Constant demand for the equipment which help in aiding quality standards and determining defects persists round the year. There was constant demand for Magnetic Crack Detectors in these countries due to the same reasons. The demand only sowed during the periods of great depression and rose when they ceased.

In the USA, immense military and aerospace industry has developed ever since its beginning. The United States led the ranking of countries with highest military spending in 2024, with USD 778 billion dedicated to the military which included crack detection equipment.

Although the coronavirus pandemic has had an immense impact on the commercial airline industry, the trends in the private jet industry and charter aviation have shown comparatively positive results. This very fact kept the cash flowing in the magnetic crack detector market as the demand never shrunk from military even during the FY2024.

In Asia, countries such as China and India are anticipated to account for significant shares in the testing equipment market, as these countries have prominent manufacturers of commercial vehicles owing to one of the largest steel and ferrous metal industry in the world and thus, offer lucrative opportunities for the development of the sales for these equipment in the market during the forecast period.

Manufacturing processes have changed ever since the Industry 4.0 norms have been introduced. The processes include testing, prototyping and maneuvering the production process as a motive to bring continuous improvement leads to the procurement of non-destructive testing equipment like magnetic particle inspection.

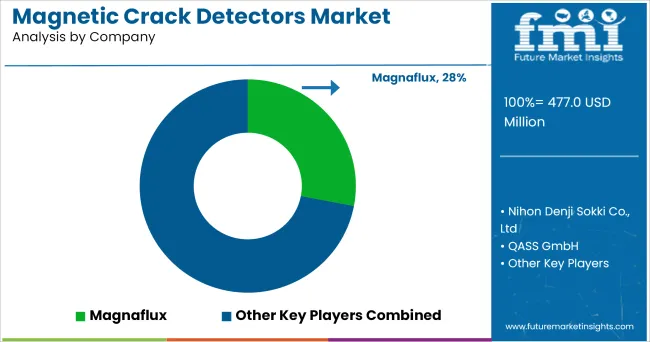

Some of the leading manufacturers and suppliers of Magnetic Crack Detectors are

Technology will continue to play a critical role in the testing equipment ecosystem. Key players operating in the testing equipment marketplace are integrating emerging technologies within their existing ecosystem, which has helped to improve products and in turn the market.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global magnetic crack detectors market is estimated to be valued at USD 477.0 million in 2025.

The market size for the magnetic crack detectors market is projected to reach USD 854.2 million by 2035.

The magnetic crack detectors market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in magnetic crack detectors market are hand-held, stationed/bench type units and mobile/portable units.

In terms of end use, automotive segment to command 38.0% share in the magnetic crack detectors market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Magnetic Absorption Data Line Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Material Magnetization and Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Coupler Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Shielding Device Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Stripe Readers Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Resonance Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Drive Pump Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Separator Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Ballast Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Sensor Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Flowmeter Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Resonance Imaging Coils Market Analysis - Size, Share, and Forecast 2025 to 2035

Magnetic Tape Market Analysis Size and Share Forecast Outlook 2025 to 2035

Magnetic Resonance Imaging (MRI) Contrast Agents Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Materials Market Growth - Trends & Forecast 2025 to 2035

Magnetic Resonance Imaging (MRI) Market Trends - Size, Share & Forecast 2025 to 2035

Magnetic Grill Market Analysis – Trends, Growth & Forecast 2025 to 2035

Magnetic Closure Boxes Market Trends - Growth & Demand 2025 to 2035

Magnetic Charging Cable Market Trends - Growth & Forecast 2025 to 2035

Magnetic Flow Meter Market Analysis by Product Type, Components, Technology, Application and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA