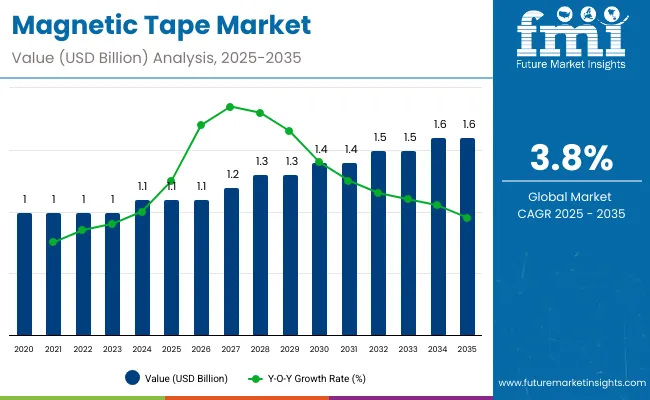

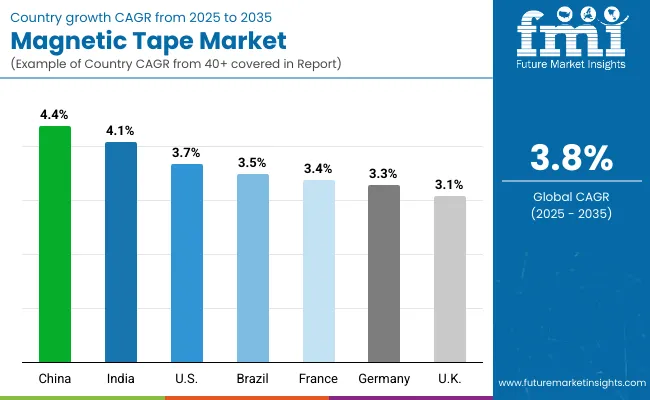

The magnetic tape market is projected to grow from USD 1.1 billion in 2025 to USD 1.6 billion by 2035, representing a total increase of USD 0.5 billion over the decade. This reflects a 45.5% overall growth, with the market advancing at a compound annual growth rate (CAGR) of 3.8%. Across the forecast period, the market is expected to expand by 1.45 times.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.1 billion |

| Industry Value (2035F) | USD 1.6 billion |

| CAGR (2025 to 2035) | 3.8% |

In the first half of the decade (2025-2030), the market increases from USD 1.1 billion to USD 1.3 billion, adding USD 0.2 billion, or 40.0% of the decade’s total growth. This stage is supported by rising demand in retail displays, reusable cartons, and point-of-purchase packaging, where magnetic closures enhance reusability and security. Flexible ferrite and neodymium-based magnetic tapes dominate due to their ease of lamination and compatibility with printed substrates.

In the second half (2030-2035), the market expands from USD 1.3 billion to USD 1.6 billion, contributing USD 0.3 billion, or 60.0% of the decade’s total growth. This growth phase benefits from increasing adoption in luxury goods, subscription packaging, and reusable e-commerce packaging. Innovations in thin-profile, high-retention magnetic strips and integration with smart NFC-enabled packaging solutions drive value creation, particularly in premium branding and anti-tamper applications.

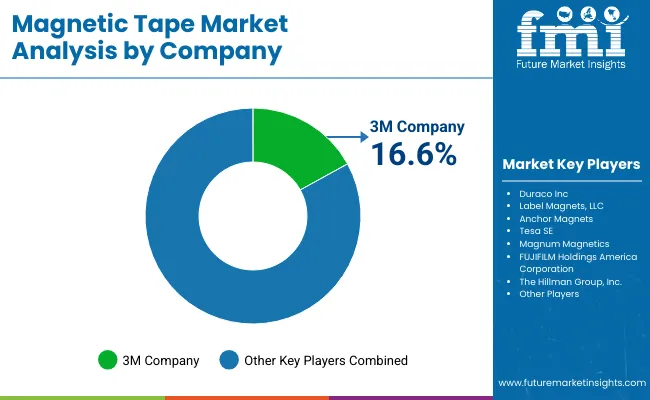

From 2020 to 2024, the magnetic tape market grew from USD 0.91 billion to USD 1.06 billion, driven by hardware-centric adoption across retail, warehousing, and industrial sectors seeking reusable, removable fastening solutions for signage, labeling, and packaging closure. During this period, the competitive landscape was dominated by specialty adhesive and magnetics manufacturers controlling nearly 70% of total revenue, with leaders such as 3M Company, Duraco Inc., and Label Magnets, LLC focusing on flexible magnetic substrates with high pull strength and durable adhesive backings.

Competitive differentiation relied on magnetic holding force, material flexibility, and adhesive longevity, while smart tagging or tracking capabilities were typically bundled with other packaging solutions rather than monetized independently. Service-based models, such as custom die-cutting and printed branding services, contributed less than 10% of total market value as the segment remained largely product-driven.

Demand for magnetic tape in packaging will expand to USD 1.6 billion in 2035, and the revenue mix will shift as customization services, sustainable magnetic composites, and digitally interactive labels grow to over 40% share. Traditional players face competition from innovationled companies offering RFID-integrated magnetic strips, eco-friendly ferrite blends, and high-strength rare-earth-based flexible tapes.

Rising demand for reusable, resealable, and tamper-evident closure solutions in industrial, retail, and e-commerce packaging is driving the growth of the magnetic tape market for packaging. Magnetic tapes offer strong yet reversible adhesion, allowing packaging to be repeatedly opened and closed without damaging the material. Their ability to provide secure closure without adhesives makes them ideal for high-end packaging, protective cases, and reusable transport containers.

Flexible magnetic strips and pressure-sensitive backed magnetic tapes have gained popularity due to their ease of application, custom sizing, and compatibility with paperboard, plastics, and fabric-based packaging materials. These tapes are valued for their clean, residue-free sealing, making them a preferred choice for premium product presentation and sustainable packaging initiatives.

The market is segmented by base material, coating, type, application, end-use industry, and region. Base material includes plastic film and rubber magnet backing, offering flexibility, durability, and magnetic performance for various industrial and consumer uses. Coating segmentation comprises magnetic powder, ferrite-based, and iron oxide, each influencing magnetic strength, recording quality, and long-term stability. By type, the market includes adhesive magnetic tape, printable magnetic tape, and data storage tape, enabling versatility across functional, promotional, and archival applications. Application areas include retail displays, industrial labels, magnetic seals, and craft & DIY, reflecting both commercial and creative usage. End-use industries include office & education, automotive, and packaging, where magnetic tapes are used for organization, branding, and functional sealing. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

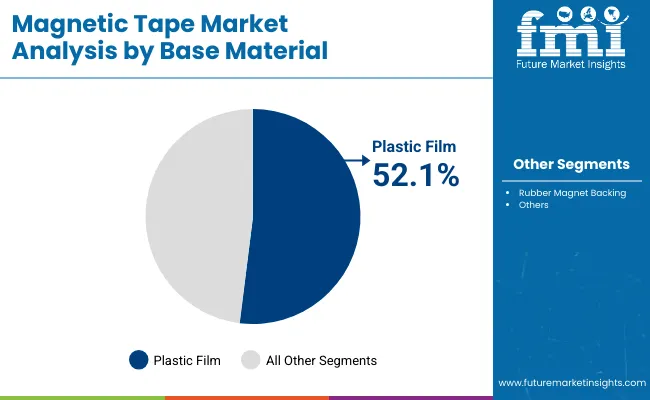

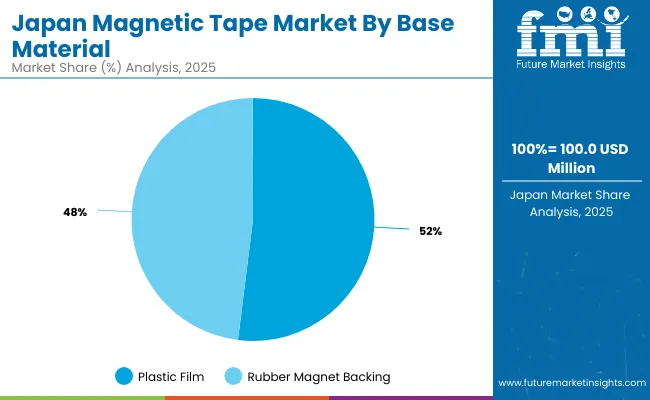

The plastic film segment is projected to hold the highest share of 52.1% in the magnetic tape market by 2025, driven by its exceptional blend of mechanical strength, flexibility, and resistance to wear. Plastic films such as PET and PVC are favored substrates in magnetic tape manufacturing due to their smooth surface, which supports consistent coating adhesion and uniform magnetic performance. Their lightweight nature reduces transportation costs, while their tensile strength ensures tapes maintain form under repeated bending and handling.

The growing demand for high-quality visual presentation in retail and industrial settings is also pushing adoption, as plastic film-based magnetic tapes can be cut to precise dimensions without fraying or losing structural integrity. Manufacturers are increasingly engineering films with UV and heat resistance to ensure reliability in outdoor applications. This durability, coupled with compatibility across various coating types, is making plastic film-backed tapes the go-to solution for versatile, long-life magnetic applications in sectors such as advertising, logistics, and product displays.

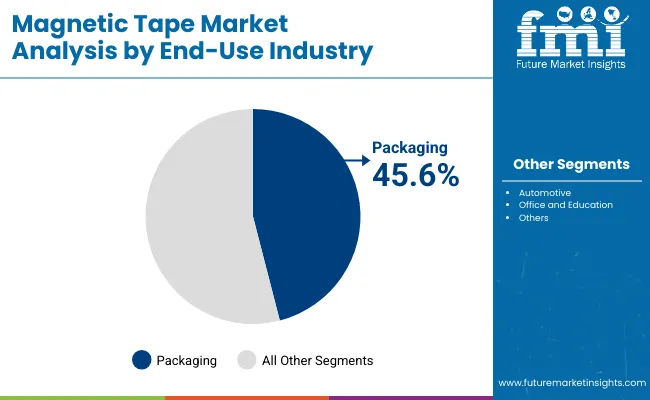

The packaging segment is expected to capture 45.6% of the market share in 2025, driven by the industry’s shift toward innovative fastening systems that balance functionality, reusability, and sustainability. Magnetic tapes in packaging eliminate the need for disposable adhesive materials, offering a clean, reversible closure system that can be opened and resealed multiple times without degrading performance. This not only extends packaging usability but also reduces environmental impact, aligning with circular economic goals.

E-commerce companies, specialty goods suppliers, and premium product brands are adopting magnetic tape closures to differentiate packaging through user-friendly yet secure designs. Their flexibility in being cut to fit unique shapes and sizes also support customized packaging solutions. As brands face mounting consumer pressure to adopt greener, more interactive packaging, magnetic tapes are emerging as a compelling alternative that enhances both brand presentation and functional performance, solidifying their position as a preferred closure technology in next-generation packaging systems.

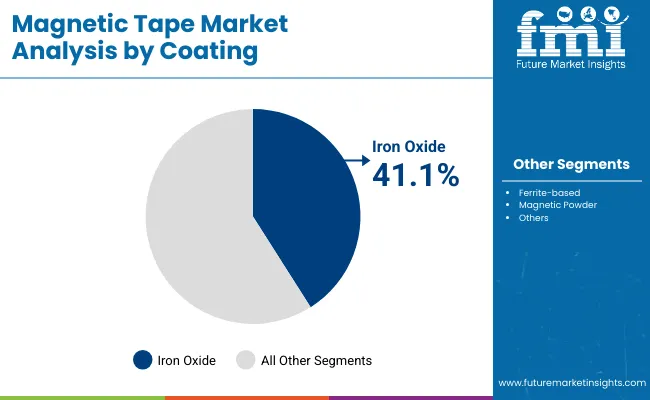

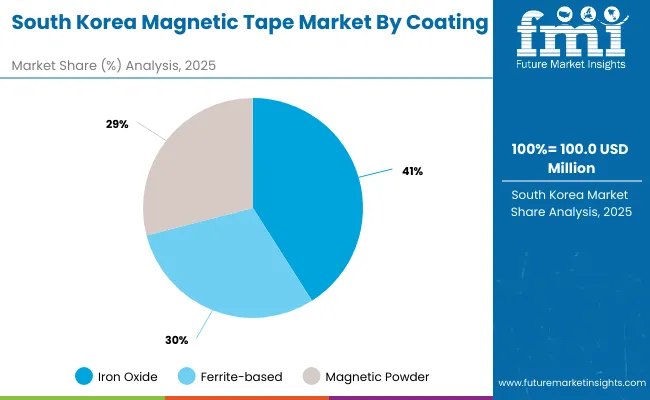

The iron oxide coating segment is projected to hold a 41.1% share in 2025, underpinned by its ability to deliver consistent magnetic strength, excellent durability, and affordability. Iron oxide particles, when evenly dispersed on a tape substrate, create a stable magnetic layer capable of retaining strong holding power over time, even with repeated repositioning. This makes it ideal for applications such as signage mounting, visual displays, and lightweight fixture attachment.

The coating’s natural resistance to corrosion ensures long-term usability, reducing the need for frequent replacements and lowering lifecycle costs for end-users. Manufacturers continue to refine iron oxide coatings for improved particle uniformity and bonding strength, resulting in smoother performance and reduced shedding. Given its balance between performance and cost-effectiveness, the iron oxide coating remains a popular choice in industries ranging from retail to industrial equipment labeling, where reliability is paramount and budget considerations play a significant role in material selection.

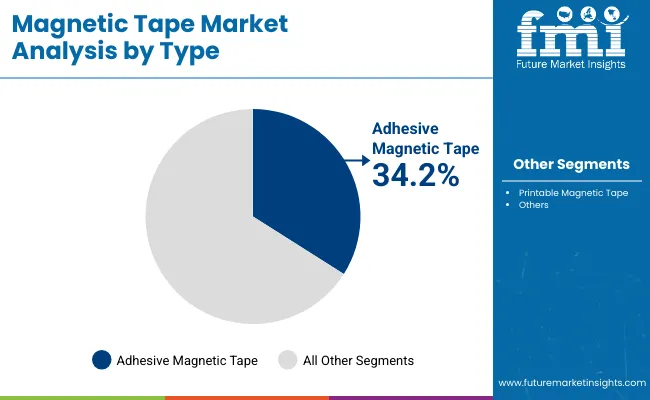

Adhesive magnetic tapes are forecasted to capture a 34.2% market share in 2025, driven by their ability to adhere securely to non-metallic surfaces while delivering magnetic functionality on the opposite side. These dual-action tapes allow for rapid installation without the need for drilling, screwing, or other permanent fastening methods, making them a preferred choice in temporary and semi-permanent setups.

Their adaptability extends to diverse environments, from retail signage and event staging to home organization and craft projects. With adhesives now being developed for high-humidity and temperature-variable conditions, these tapes are suitable for both indoor and outdoor use. Furthermore, manufacturers are offering customizable adhesive strengths and tape dimensions to suit specific industry needs. The convenience, flexibility, and reusability of adhesive magnetic tapes make them a valuable tool for organizations seeking quick installation, easy reconfiguration, and minimal surface damage across a range of applications.

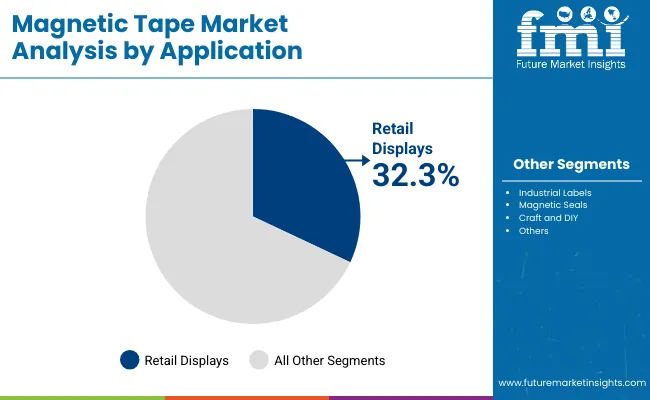

Retail displays are projected to account for 32.3% of the application segment in 2025, propelled by the retail industry’s need for fast, cost-effective display changes that maintain a premium look. Magnetic tapes enable quick mounting and repositioning of signage, promotional graphics, and lightweight fixtures without the mess or damage associated with traditional adhesives or mechanical fasteners.

As retail competition intensifies, visual merchandising teams are under pressure to refresh layouts frequently, often multiple times per season. Magnetic tape solutions allow these changes to be executed efficiently, reducing downtime and labor costs while maintaining a clean, professional aesthetic. The technology’s ability to be reused and repurposed across multiple campaigns adds to its appeal for sustainable retail operations. In combination with high-quality printing and creative display designs, magnetic tapes are becoming a core component of agile retail strategies aimed at boosting customer engagement and enhancing in-store brand experiences.

Adhesion strength limitations and cost sensitivity in mass-use segments restrict broader adoption, even as demand rises across e-commerce, retail, and industrial packaging for resealable, reusable, and visually distinctive magnetic closure solutions that enhance product security and consumer convenience.

High Material Costs and Limited Compatibility with High-volume Lines

Despite their appeal, magnetic tapes face constraints in widespread packaging use due to their higher production costs compared to standard adhesive tapes or mechanical fasteners. The incorporation of flexible magnetic material and adhesive layers increases material expense, making them less viable for high-volume, low-margin packaging applications. Additionally, automated high-speed packaging lines often require specialized feeders or applicators to handle magnetic tape reels, adding complexity and cost to integration.

Advances in Flexible Magnets and Hybrid Tape Constructions

A notable trend in the magnetic tape packaging market is the development of thinner, more flexible magnetic strips with improved holding power and bend resistance. Manufacturers are also exploring hybrid constructions that combine magnetic and pressure-sensitive adhesive layers for dual sealing capabilities allowing packages to be both resealed magnetically and secured for transit. In parallel, the rise of smart packaging is driving interest in embedding RFID or NFC tags alongside magnetic closures for integrated security and tracking.

Advancements in Tape Density and AI-enabled Retrieval Systems

A key trend in the magnetic tape market is the push toward higher storage density and improved data management through technological innovation. Developments in barium ferrite (BaFe) and strontium ferrite (SrFe) particle coatings have significantly increased recording density and extended archival life. Manufacturers are also integrating AI-powered indexing and retrieval systems to enable faster search and access within large tape libraries, improving operational efficiency.

The global magnetic tape market is expanding gradually as industries seek reusable, resealable, and tamper-evident closure solutions for consumer goods, e-commerce shipments, and industrial cartons. Magnetic tapes offer clean, adhesive-free sealing with durability and repeat usability, making them attractive for sustainable packaging strategies. Asia-Pacific, led by China and India, is showing strong adoption, driven by manufacturing growth and e-commerce penetration. Developed economies such as the USA, UK, Japan, and South Korea are focusing on design innovation, branding applications, and integrating magnetic closures into premium packaging formats. Advancements in flexible ferrite and neodymium-based tape designs are enabling higher pull strength and thinner profile applications for diverse packaging requirements.

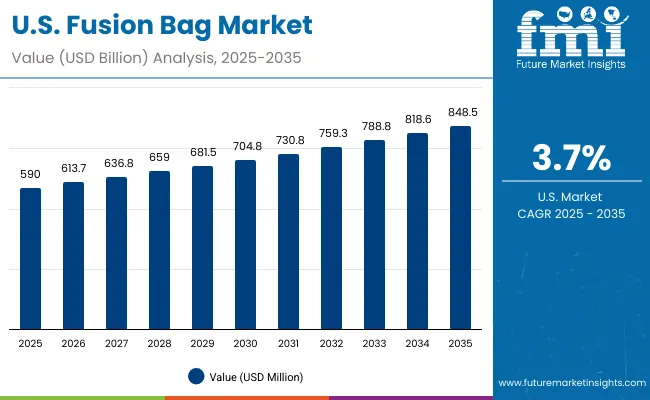

The magnetic tape market for packaging in the United States is forecast to grow at a CAGR of 3.7% between 2025 and 2035, driven by the growing emphasis on premium presentation, reusability, and sustainability in packaging. Adoption is gaining momentum in high-value consumer goods, reusable e-commerce boxes, and branded retail display solutions where closure aesthetics directly influence brand perception. Manufacturers are investing in the development of thin-profile, high-strength magnetic tapes that blend seamlessly into packaging designs, delivering both functional closure and visual appeal. The USA market is also benefitting from the surge in direct-to-consumer luxury retail, where packaging plays a vital role in unboxing experiences. E-commerce companies are experimenting with reusable shipping cartons that utilize magnetic closures, significantly reducing single-use adhesives and improving recyclability.

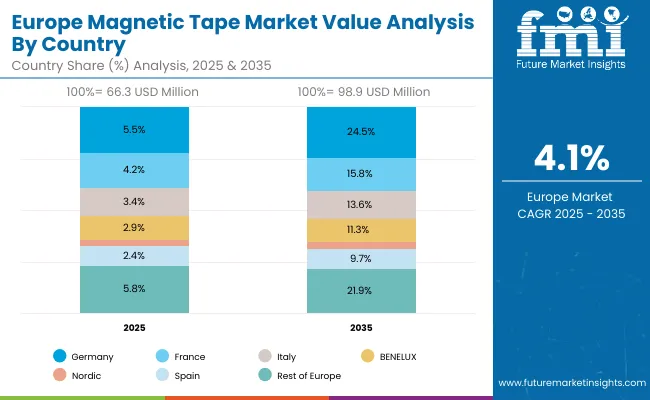

Germany’s market is expected to grow at a CAGR of 3.3%, led by adoption across automotive, financial, and scientific sectors. Enterprises are deploying magnetic tapes to comply with strict EU regulations on sustainability and data privacy. Tapes are increasingly used for archiving simulation data, sensitive financial records, and research outputs. Innovation is centered on modular tape libraries, predictive monitoring systems, and hybrid integrations to ensure efficient, resilient, and eco-friendly storage infrastructure that aligns with European climate and digital goals.

The magnetic tape market for packaging in the United Kingdom is projected to expand at a CAGR of 3.1% from 2025 to 2035, supported by a strong push toward sustainable packaging design, premium retail formats, and reduced single-use waste mandates under national and EU-aligned circular economy policies. Premium food, beverage, and personal care brands are increasingly adopting magnetic closures for reusable gift packaging, creating an upscale consumer experience while meeting sustainability commitments. Packaging converters are responding with innovative magnetic tape options that can be custom-printed or branded for retail visibility, strengthening consumer recall.

China’s magnetic tape market for packaging is expected to grow at a CAGR of 4.4% between 2025 and 2035, underpinned by its massive manufacturing base, rapidly expanding e-commerce sector, and government-led initiatives to encourage reusable packaging solutions. Demand is particularly high in premium electronics and apparel packaging, where magnetic closures deliver a combination of product security and high-end presentation. Chinese packaging OEMs are scaling the production of low-cost ferrite-based magnetic tapes to cater to large-volume domestic and export orders, while high-pull neodymium-based solutions are being adopted in luxury packaging.

India’s magnetic tape market for packaging is projected to grow at a CAGR of 4.1% between 2025 and 2035, fueled by the rapid expansion of consumer electronics, personal gifting, and premium retail segments. Local manufacturers are focusing on cost-effective, flexible magnetic tapes that cater to the needs of small and medium enterprises, enabling them to enhance packaging functionality without significantly raising costs. Magnetic closures are gaining traction in electronics packaging for gadgets such as smartphones, tablets, and wearables, ensuring secure protection during storage and transportation. In the country’s booming gift packaging industry, magnetic-closure rigid boxes are becoming a preferred choice for weddings, festivals, and premium events due to their reusability and premium feel.

Japan’s magnetic tape market for packaging is expected to grow at a CAGR of 3.6% from 2025 to 2035, driven by the country’s premium packaging culture and demand from sectors such as precision electronics, cosmetics, and high-end confectionery. Japanese manufacturers are producing ultra-thin magnetic tapes with high pull strength to complement minimalistic yet functional packaging designs. In the electronics sector, compact device boxes with magnetic closures are gaining popularity for their balance of protection and aesthetic appeal. Confectionery producers are incorporating magnetic tapes into seasonal gift boxes, providing an elevated consumer experience while ensuring reusability. Cosmetics packaging is also seeing increased integration of magnetic tapes, particularly in reusable beauty gift sets and promotional kits.

The magnetic tape market for packaging in South Korea is projected to grow at a CAGR of 3.2% between 2025 and 2035, supported by applications in cosmetics, premium electronics, and corporate gifting. Demand is concentrated in high-quality magnetic tapes that combine strong holding power with refined aesthetics, meeting the expectations of Korea’s design-focused packaging industry. Beauty brands are increasingly using magnetic closures in reusable skincare and makeup gift boxes, aligning with sustainability-focused consumer preferences. Technology companies are incorporating magnetic tapes into limited-edition electronics packaging to enhance perceived value and reusability.

The magnetic tape market is moderately fragmented, with global adhesive and magnet technology leaders, specialty magnetic product developers, and niche application suppliers competing across retail signage, industrial labeling, and promotional display sectors. Global players such as 3M Company and Tesa SE hold significant market share, driven by high-strength magnetic adhesion, flexible substrate designs, and compatibility with various printing and lamination processes. Their strategies increasingly emphasize weather-resistant coatings, easy repositioning, and sustainable adhesive formulations for reusable display systems.

Established mid-sized players including Duraco Inc. and Anchor Magnets are expanding adoption through tailored magnetic tape solutions for point-of-sale displays, warehousing systems, and fixture mounting. These companies focus on customizable width, roll length, and pull strength specifications to meet industrial, commercial, and creative use cases.

Specialized providers such as Label Magnets and LLC target niche markets with cost-effective printable magnetic tapes designed for branding, inventory labeling, and temporary promotional graphics. Their competitive advantage lies in localized manufacturing, short production runs, and rapid delivery capabilities for custom orders.

Key Development of Magnetic Tape Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| By Base Material | Plastic Film (57.00%) and Rubber Magnet Backing |

| By Coating | Magnetic Powder, Ferrite-based, and Iron Oxide (41.1%) |

| By Type | Adhesive Magnetic Tape (34.2%) and Printable Magnetic Tape |

| By Application | Retail Displays (32.3%), Industrial Labels, Magnetic Seals, and Craft & DIY |

| By End-Use Industry | Office & Education, Automotive, and Packaging |

| Key Companies Profiled | 3M Company, Duraco Inc, Label Magnets, LLC, Anchor Magnets, Tesa SE, Magnum Magnetics, FUJIFILM Holdings America Corporation, The Hillman Group, Inc. |

| Additional Attributes | Growing demand for magnetic tapes in retail display customization, increased adoption in automotive sealing and labeling applications, expansion of printable magnetic tapes for promotional and educational purposes, rising usage in packaging for resealable closures, high preference for plastic film-backed tapes for flexibility and durability, ferrite-based coatings enabling cost-effective large-scale production, innovation in strong adhesive-backed tapes for industrial uses, market shift toward eco-friendly and recyclable magnetic materials, growth in craft and DIY projects leveraging customizable magnetic formats, and steady demand across North America, Europe, and Asia-Pacific |

The global magnetic tape market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the magnetic tape market is projected to reach USD 1.6 billion by 2035.

The magnetic tape market is expected to grow at a CAGR of 3.8% between 2025 and 2035.

The key material segments in the magnetic tape market include plastic film, polyester film, and polypropylene film.

In terms of material, the plastic film segment is expected to account for the highest share of 52.1% in the magnetic tape market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Magnetic Absorption Data Line Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Material Magnetization and Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Coupler Market Size and Share Forecast Outlook 2025 to 2035

Tape Unwinder Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Shielding Device Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Stripe Readers Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Resonance Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Drive Pump Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Separator Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Ballast Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Magnetic Sensor Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Flowmeter Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Resonance Imaging Coils Market Analysis - Size, Share, and Forecast 2025 to 2035

Magnetic Resonance Imaging (MRI) Contrast Agents Market Size and Share Forecast Outlook 2025 to 2035

Tape Measure Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Crack Detectors Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Materials Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA