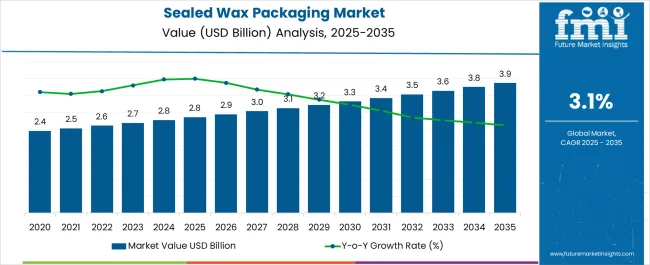

The Sealed Wax Packaging Market is estimated to be valued at USD 2.8 billion in 2025 and is projected to reach USD 3.9 billion by 2035, registering a compound annual growth rate (CAGR) of 3.1% over the forecast period.

| Metric | Value |

|---|---|

| Sealed Wax Packaging Market Estimated Value in (2025 E) | USD 2.8 billion |

| Sealed Wax Packaging Market Forecast Value in (2035 F) | USD 3.9 billion |

| Forecast CAGR (2025 to 2035) | 3.1% |

The sealed wax packaging market is gaining momentum, driven by growing demand for tamper-evident, premium, and heritage-style packaging across the alcoholic beverage and specialty goods sectors. Rising consumer appreciation for artisanal and vintage aesthetics has reinforced the market appeal of wax-sealed closures, especially in branding strategies aimed at conveying exclusivity and authenticity.

The material's ability to provide both a decorative and functional seal has led to adoption in niche and high-value product categories. Concurrently, advancements in sealing technologies and the availability of machine-compatible wax solutions have enabled scalable deployment without compromising on craftsmanship appeal.

The use of wax also aligns with consumer interest in recyclable and biodegradable materials, especially in combination with glass or paperboard substrates. Moving forward, opportunities are expected to arise from personalization trends, limited-edition product lines, and expanding usage across boutique non-beverage applications such as cosmetics and fragrances.

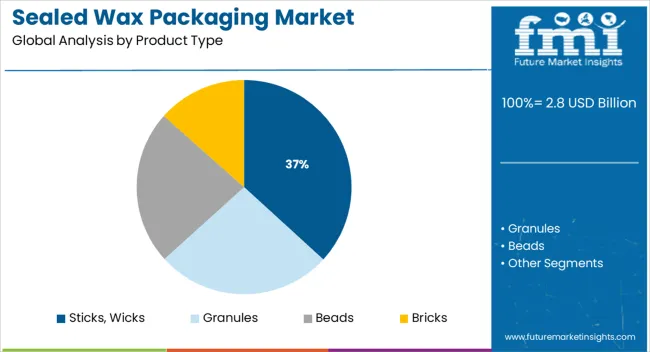

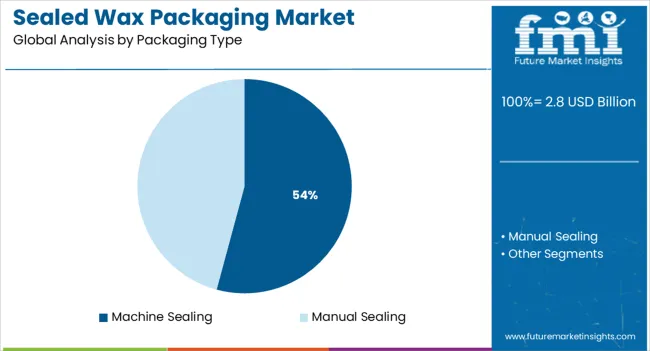

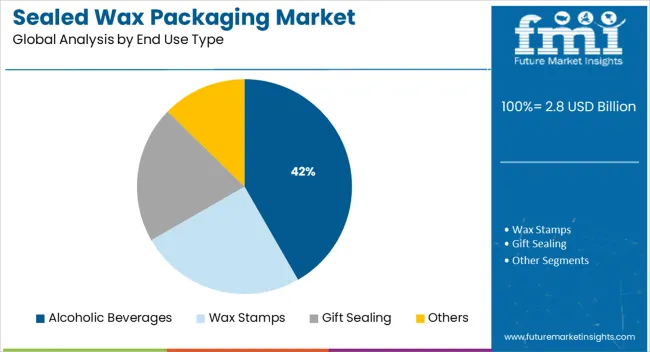

The market is segmented by Product Type, Packaging Type, and End Use Type and region. By Product Type, the market is divided into Sticks, Wicks, Granules, Beads, and Bricks. In terms of Packaging Type, the market is classified into Machine Sealing and Manual Sealing. Based on End Use Type, the market is segmented into Alcoholic Beverages, Wax Stamps, Gift Sealing, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Sticks and wicks are projected to lead the sealed wax packaging market with 36.8% revenue share in 2025. Their widespread use is being driven by their versatility, ease of application, and compatibility with both manual and semi-automated sealing workflows.

This product format allows precise control over wax volume and application surface, making it ideal for brands aiming to replicate traditional hand-sealed effects while maintaining process efficiency. The sticks and wicks format also supports a broader palette of color, scent, and composition variations, enabling branding differentiation in premium packaging.

Enhanced shelf appeal and the tactile unboxing experience offered by wax seals in this format have supported its continued preference, especially in artisanal beverage and limited-edition product packaging.

Machine sealing is anticipated to command 54.2% of the market revenue by 2025, emerging as the leading packaging type. This growth has been enabled by the scalability, speed, and consistency offered by automated wax sealing equipment, which has allowed producers to incorporate traditional wax aesthetics into modern high-speed bottling and packaging lines.

Technological advancements in heat application and precision control have reduced operational complexities and ensured uniform sealing quality, even for complex neck and cap designs. Machine sealing also enhances safety, reduces human error, and minimizes material waste.

As premium packaging expands beyond small-batch producers into mid-size and enterprise operations, the compatibility of wax sealing with modern automation standards has made machine sealing a preferred option.

Alcoholic beverages are expected to remain the dominant end-use segment, contributing 41.7% of total market revenue in 2025. This leadership is supported by strong demand for vintage, limited-edition, and craft-positioned spirits and wines, where wax seals are widely associated with heritage, exclusivity, and authenticity.

The tactile and visual distinctiveness provided by wax seals enhances perceived product value and plays a significant role in brand storytelling. Regulatory alignment on tamper evidence and consumer desire for premium packaging formats have further encouraged adoption in this segment.

Additionally, global expansion of the craft spirits and premium liquor categories has led producers to seek packaging that reflects artisanal quality and reinforces brand identity, positioning wax-sealed formats as a key differentiator.

Sealed packaging is quite widespread around the industrial economies with a frequent number of participants making the overall market fragmented in nature. So the major sealed wax packaging businesses are trying to increase their market share and reinforce their position by utilising market tactics, including strategic partnerships, M&A, and sales channel diversification.

Though several types of products are already made out of packaging wax, key players in the sealed wax packaging market are still experimenting with different types of new products to expand their client base and achieve better market penetration.

The major strength of the sealed wax packaging business is that it provides increased stiffness, stacking and dry strength, and ply separation avoidance, which gives it an edge over the other packaging services.

Developing new and tailored materials is another goal of these sealed wax packaging market key players, which is expected to remain a crucial success element for them. The growing number of end-user verticals is a unique possibility for new sealed wax packaging market entrants to take a substantial position in the already established worldwide business.

As most materials are based on paraffin wax, sourcing raw material is the major challenge that needs to be taken care of at the earliest by the sealed wax packaging service providers. Although the packaging composition has significantly improved with the use of natural and synthetic waxes like Fischer-Tropsch and polyethene, the prominent players of the global sealed wax packaging market still consider paraffin as the key to their market position.

The Middle East and Europe are two of the world's top producers and consumers of mineral and petroleum waxes. And due to their cheap operating, labour, and raw material costs, these regions are traditionally the famous base for sealed wax packaging industries.

Over the last few years, packaging solutions have made progress in terms of colours, features, appearance, and convenience. The primary purpose of packaging is to preserve and protect the product during storage, consumption, and transportation. Sealing wax is a wax material which after melting hardens quickly which is difficult to separate because of formation of the bond. Sealing wax is FDA approved material for packaging.

The sealed wax packaging is available in many standard colours which allows the manufacturers to match the label design with the colour of the wax. By embossing their logo, brand name or image on the product, brand owners, and manufacturers enhance their brand.

gives the rich feel and polished look to the product without using expensive materials or components. It provides the protective closure to the product. With the rise in end users of waxes, such as packaging market and cosmetics market, the sealed wax packaging market is growing at a significant rate.

One of the significant factors that will contribute to the growth of the global sealed wax packaging market is the easy availability of wax products with the progress made in the retail sector by e-commerce and supermarket.

Another factor towards the growth of the sealed wax packaging market is the handling efficiency which is helps to open the product without cutter or knife and with no foil cuts on the product. In addition, the rising demand for high SPF products, adhesives, wood & fire logs, rubber, laminates has acted as a driver for high growth of sealed wax packaging market.

However, the growth of sealed wax packaging market is expected to hamper due to additional cost to retailers and manufacturers to provide proper storage facility as sealed wax packaging is too sensitive to temperature variation and climate change.

The sealed wax packaging market is segmented on the basis of product type, packaging type, and end use type. On the basis of product type, the sealed wax packaging market is segmented into sticks, wicks, granules, beads, and bricks.

On the basis of packaging type, the sealed wax packaging market is segmented into machine sealing and manual sealing. On the basis of end users, the sealed wax packaging market can be categorized as personal care products, wax stamps, gift sealing, alcoholic beverages and others.

The alcoholic beverage is estimated to hold the major share in sealed wax packaging market. The alcoholic beverage market can be further sub segmented into spirits, wines, beer etc.

Some of the major players identified across the globe in the sealed wax packaging market are Blended Waxes Inc., Southwest Wax LLC, Oakbank Products Limited, Australian Wax Co., Brick Packaging LLC, Calwax, LLC, City Company Seals Ltd, Jax Wax Pty Ltd., Wax Seals, The British Wax Refining Company Ltd, Darent Wax Company Ltd.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global sealed wax packaging market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the sealed wax packaging market is projected to reach USD 3.9 billion by 2035.

The sealed wax packaging market is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in sealed wax packaging market are sticks, wicks, granules, beads and bricks.

In terms of packaging type, machine sealing segment to command 54.2% share in the sealed wax packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Self-Sealed Bubble Bags Market Trends - Growth & Forecast 2025 to 2035

Vacuum-Sealed Packaging Market Size, Share & Forecast 2025 to 2035

Center Sealed Pouch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Four Side-Sealed Pouches Market

Waxed Paper Market Size and Share Market Forecast and Outlook 2025 to 2035

Waxing Base Paper Market Size and Share Forecast Outlook 2025 to 2035

Wax Injector Market Size and Share Forecast Outlook 2025 to 2035

Wax Paper Medicine Pots Market Size and Share Forecast Outlook 2025 to 2035

Wax Boxes Market Insights - Growth & Demand Forecast 2025 to 2035

Wax-coated Paper Market

Waxed Paper Packaging Market

Earwax Removal Market Analysis by Product, Age Group, Distribution Channel, and Region Forecast Through 2035

Bio-wax Market Size and Share Forecast Outlook 2025 to 2035

Beeswax for Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Ear Wax Removal Products Market Size and Share Forecast Outlook 2025 to 2035

Car Wax Market Outlook – Demand, Size & Industry Trends 2025-2035

Beeswax Market

Cold Waxed Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Assessing Cold Waxed Paper Cups Market Share & Industry Trends

Global Bees Wax Wrap Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA