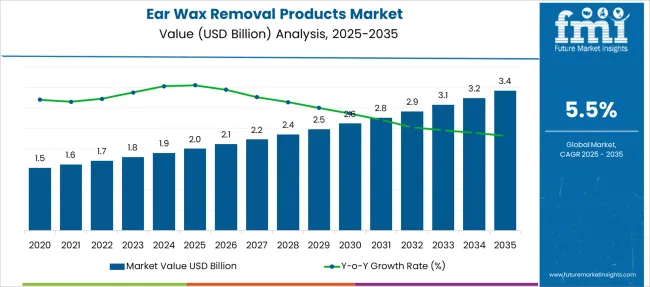

The Ear Wax Removal Products Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 3.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Ear Wax Removal Products Market Estimated Value in (2025E) | USD 2.0 billion |

| Ear Wax Removal Products Market Forecast Value in (2035F) | USD 3.4 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The ear wax removal products market is witnessing consistent growth, supported by increasing consumer awareness regarding personal hygiene and non-invasive ear care solutions. Demand has been positively influenced by rising incidences of ear-related discomfort caused by wax buildup, especially among the aging population and individuals using hearing aids. The market outlook remains strong due to a growing preference for self-care routines, availability of over-the-counter solutions, and greater access to pharmacy and online retail channels.

Consumer inclination toward preventive healthcare and the shift away from clinical procedures have fueled the adoption of home-use products. Regulatory support for non-prescription treatments and increasing visibility through digital marketing have further contributed to the product's accessibility and acceptance.

With innovations focused on safety, convenience, and faster action times, the market is expected to expand steadily. Manufacturers are prioritizing user-friendly formats and educational campaigns to build trust, helping drive adoption across various demographics and geographies.

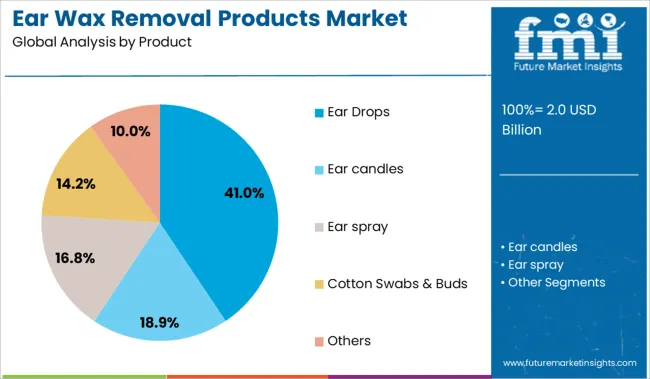

The market is segmented by Product, Price, End-use, and Distribution Channel and region. By Product, the market is divided into Ear Drops, Oil-based, Water-based, Chemical-based, Ear candles, Ear spray, Cotton Swabs & Buds, Others, Micro suction Devices, and Ear Picks/Curettes. In terms of Price, the market is classified into Low, Medium, and High. Based on End-use, the market is segmented into Individual consumers, Healthcare professionals, ENT specialists, General practitioners, Audiologists, Hospitals and Clinics, Others, Nursing Homes, and Assisted Living Facilities. By Distribution Channel, the market is divided into Online, E-Commerce site, Company website, Offline, Specialty stores, Mega retail stores, Pharma, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Insights into the Ear Drops Product Segment

The ear drops product segment is projected to account for 41% of the Ear Wax Removal Products market revenue share in 2025, making it the leading product type. This segment’s dominance has been driven by the widespread acceptance of non-invasive treatment options that soften and dissolve ear wax effectively. Ear drops have been preferred by consumers for their ease of application, affordability, and accessibility in both physical and online retail settings.

The growing emphasis on over-the-counter solutions has reinforced demand for ear drops as a convenient first line of treatment. Increasing product variety, including formulations with natural ingredients and enhanced delivery systems, has broadened consumer appeal.

The ability to use ear drops without professional assistance has supported their adoption among individuals seeking discretion and autonomy in their personal healthcare routines. As product safety and efficacy continue to improve, the ear drops segment is expected to maintain its lead as the most trusted and widely used ear wax removal method.

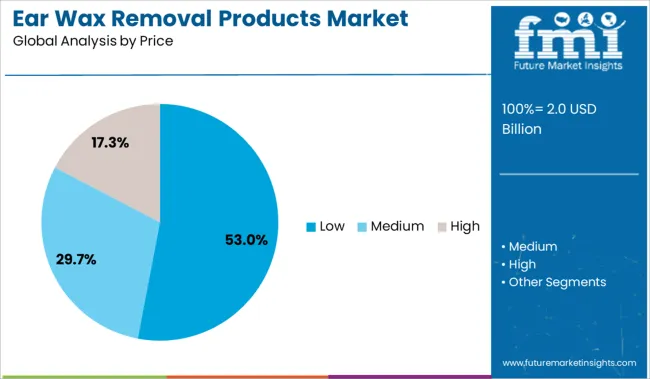

Insights into the Low Price Segment

The low price segment is expected to command 53% of the Ear Wax Removal Products market revenue share in 2025, emerging as the dominant pricing category. This segment’s leadership has been attributed to the high demand for affordable healthcare solutions, especially in cost-sensitive markets. Consumer preference has increasingly shifted toward competitively priced products that offer effective results without the financial burden of clinical alternatives.

The proliferation of private-label offerings and generic versions has further intensified market penetration at lower price points. Retailers and e-commerce platforms have expanded their budget-friendly product lines, making ear wax removal products more accessible to a broader population.

The low price segment has also been reinforced by its appeal among first-time buyers and users in developing regions where disposable income is limited. As economic conditions remain variable across markets, price-conscious consumers are expected to continue favoring low-cost options, ensuring the segment's sustained growth and market prominence.

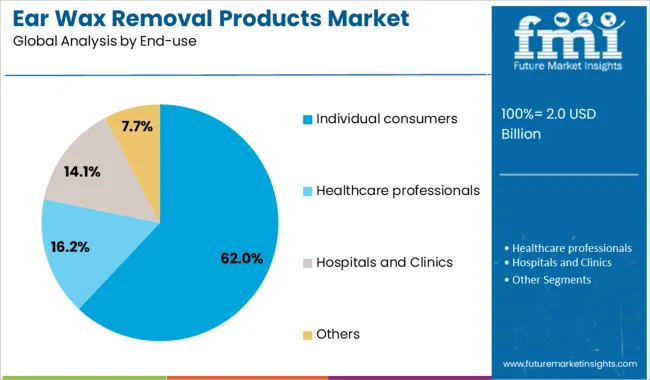

Insights into the Individual Consumers End-use Segment

The individual consumers segment is projected to hold 62% of the Ear Wax Removal Products market revenue share in 2025, positioning it as the leading end-use category. This segment’s growth has been propelled by increasing self-care practices and the desire for convenient home-use treatments. Individual consumers have shown a marked preference for over-the-counter solutions that allow them to manage ear hygiene independently, without relying on professional medical intervention.

The rise in digital health literacy and the availability of instructional content online have empowered individuals to make informed choices about ear care. Product packaging innovations and user-centric designs have further enhanced the usability and appeal of these solutions.

Consumers are prioritizing preventive health measures, particularly those that can be easily integrated into daily routines, which has elevated demand for ear wax removal products at the individual level. The shift toward at-home healthcare, along with growing confidence in non-prescription remedies, has solidified the individual consumer segment's leading position in the market.

Rising home healthcare awareness, ear infection rates, and discomfort concerns boost ear wax removal product demand. Growth opportunities include refillable irrigation systems, device education campaigns, pharmacy partnerships, and expansion into telehealth channels.

The market for ear wax removal products is expanding as people increasingly seek convenient, non-prescription solutions for common ear blockages, itching, and hearing issues. Rising awareness of ear hygiene and discomfort from excessive wax is prompting more users to turn to over-the-counter irrigation kits, drops, and softening solutions.

Medical providers are also steering patients toward safe home-use products rather than in-clinic removal, especially for minor cases. Public health campaigns and telehealth consultations highlight the risks of using cotton swabs, encouraging adoption of approved ear care items. A growing aging population and widespread headphone use also increase demand for routine wax management products, reinforcing the value of accessible domiciliary options.

Market growth opportunities include improved product design-such as ergonomic irrigation systems, temperature-indicating drops, and multi-use kits with travel-friendly packaging. There is unmet demand for refillable cartridges and eco-friendly accessories to reduce single-use plastic waste.

Educational marketing focused on safe usage, instruction videos, and telehealth partnerships can build consumer trust and encourage correct application. Retail expansion through pharmacies, wellness clinics, and online health platforms enhances reach, particularly when bundled with hearing hygiene products.

Collaborations with audiologists and ENT clinics for co-branded kits create professional endorsement. Additionally, emerging markets with growing middle-class health awareness and limited clinical ear care access present avenues for accessible kit distribution and community-level awareness programs.

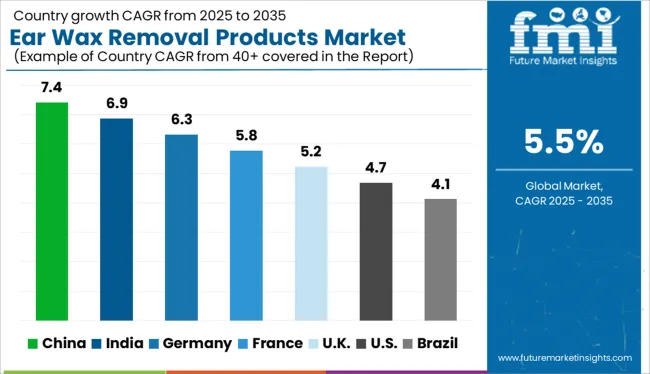

| Countries | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The global ear wax removal products market is expected to grow at a CAGR of 6.0% from 2025 to 2035, driven by increasing awareness of ear hygiene, aging populations, and product innovation in personal care. Within BRICS, China leads at 7.4% CAGR, propelled by rising consumer health consciousness, online pharmacy growth, and OTC product penetration.

India follows at 6.9%, supported by expanding ENT care access and demand for cost-effective hygiene solutions. Among OECD countries, Germany grows at 6.3% due to an aging demographic and increasing adoption of ear care devices.

The United Kingdom (5.2%) reflects moderate demand aligned with wellness trends, while the United States (4.7%) shows steady consumption through pharmacies, telehealth, and personal care platforms. This report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

With a CAGR of 7.4%, China is emerging as one of the most dynamic markets for ear wax removal products, driven by growing self-care habits and rapid penetration of digital healthcare tools. Urban populations are adopting electric extractors and visual ear-cleaning tools, especially among tech-savvy millennials and elderly caregivers.

Digital platforms like JD Health and Alibaba Health are key enablers, using real-time ENT consultations to upsell related devices. Consumer preference is shifting toward hygienic, reusable tools with camera visibility, pushing average unit prices higher. Livestream commerce plays a pivotal role in consumer education, while tier-2 cities see growing interest from new households purchasing ear hygiene tools for routine use.

India is forecast to record a 6.9% CAGR, supported by rising disposable incomes, increasing ENT awareness, and expanding reach of pharmacy retail networks. The market is transitioning from traditional methods like ear candles and cotton swabs to modern irrigation kits and medicated drops, particularly among urban middle-class households.

Digital pharmacies and major e-retailers are stocking broader inventories, targeting wellness-conscious consumers in both metro and semi-urban areas. Pediatric ENT clinics are beginning to recommend safe home-use solutions, helping drive mainstream adoption. Meanwhile, regional manufacturers are scaling production of low-cost devices, aiming to reach budget-sensitive consumers across tier-2 and tier-3 towns.

Germany is expected to witness a CAGR of 6.3%, driven by its aging population and high public investment in preventive care. Older adults are the primary adopters of safe, non-invasive ear cleaning products such as saline sprays and soft bulb syringes.

Product certification standards play a key role, as German consumers prioritize CE-marked and dermatologically approved products. Offline pharmacies dominate sales, though e-commerce is catching up by offering bundled kits for eldercare.

Multi-generational households are beginning to purchase universal kits suitable for both children and seniors, contributing to overall market diversification. Retailers are promoting sustainability by stocking recyclable materials and reusable packaging options.

The United Kingdom is set to grow at a CAGR of 5.2%, propelled by rising interest in at-home ENT solutions and growing dissatisfaction with long wait times for NHS ear care services. Consumers are turning to ear irrigation tools, olive oil drops, and spiral cleaners as part of their hygiene routines.

Pharmacy chains and online retailers are offering home kits with instructional guides to improve adoption among older adults and caregivers. Sales peak during allergy seasons and winter months, when sinus infections increase wax buildup. Direct-to-consumer brands are increasingly appealing to tech-savvy buyers by offering app-compatible camera devices for guided cleaning experiences.

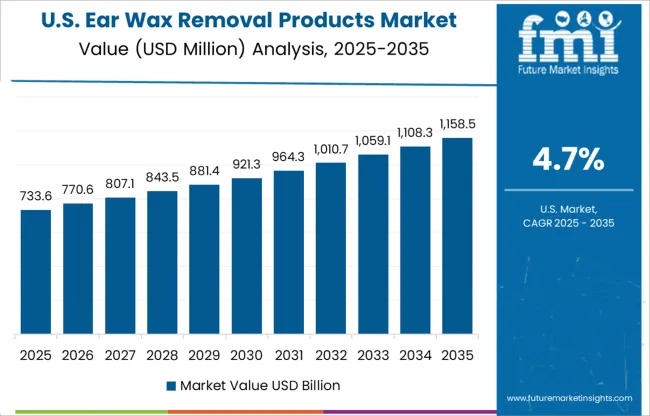

The United States is expected to achieve a CAGR of 4.7%, reflecting a steady transition toward wellness-based personal care routines and smart medical accessories. Consumers increasingly opt for advanced tools like irrigation kits with adjustable pressure, USB ear cameras, and reusable silicone picks.

Big-box retailers and specialty e-commerce platforms dominate distribution, frequently bundling ear hygiene tools with broader first aid or wellness kits. Pediatric and elderly-focused segments are showing strong growth, with recurring purchases driven by routine healthcare practices. Content-driven marketing, especially video tutorials and real-user testimonials, is a strong influence on buyer behavior, especially in suburban and rural areas.

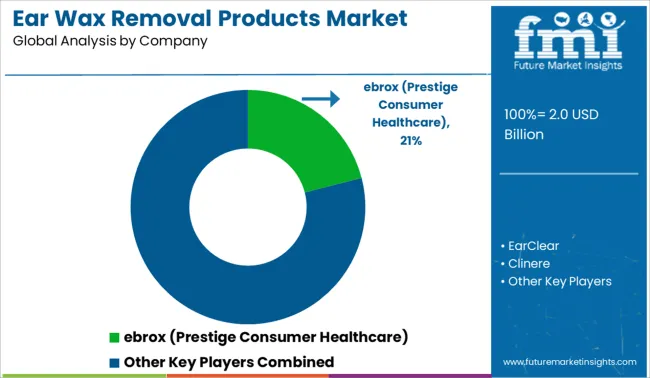

The ear wax removal products market is moderately fragmented, with a mix of OTC healthcare brands competing on formulation safety, ease of use, and clinical trust. Tier 1 leader Debrox (Prestige Consumer Healthcare) holds a 21% market share, driven by strong brand recognition, wide pharmacy distribution, and doctor-recommended status in the USA.

Tier 2 brands like EarClear, Murine, and Otex offer hydrogen peroxide or carbamide peroxide-based solutions, often targeting specific regional markets such as Australia and the UK.

Tier 3 players, including NeilMed and Clinere, focus on alternative delivery formats like irrigation kits and ear cleaning tools, catering to consumer preference for non-invasive, at-home care. Market growth is fueled by rising awareness of ear hygiene, aging populations, and increasing self-care trends.

On June 1, 2024, Debrox Kids Ear Drying Drops (95% isopropyl alcohol/5% glycerin) were officially registered in the FDA’s DailyMed database as an ear-drying aid for relieving water-clogged ears in children after swimming or bathing

| Item | Value |

|---|---|

| Quantitative Units | USD 2.0 Billion |

| Product | Ear Drops, Oil-based, Water-based, Chemical-based, Ear candles, Ear spray, Cotton Swabs & Buds, Others, Micro suction Devices, and Ear Picks/Curettes |

| Price | Low, Medium, and High |

| End-use | Individual consumers, Healthcare professionals, ENT specialists, General practitioners, Audiologists, Hospitals and Clinics, Others, Nursing Homes, and Assisted Living Facilities |

| Distribution Channel | Online, E-Commerce site, Company website, Offline, Specialty stores, Mega retail stores, Pharma, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ebrox (Prestige Consumer Healthcare), EarClear, Clinere, Murine, Otex, and NeilMed |

| Additional Attributes | Dollar sales by product type such as ear drops, sprays, ear picks, irrigation kits, and electronic devices; end-user segments including pediatric, adult, and elderly populations; distribution channels spanning pharmacies, online retail, and ENT clinics; regional demand driven by healthcare accessibility, hygiene awareness, and aging population trends; regulatory impact related to product safety standards, labeling, and over-the-counter classifications; innovation in non-invasive techniques and smart ear cleaning technologies; environmental concerns tied to single-use tools and plastic waste; and emerging use cases in audiology care and preventive ear hygiene routines. |

The global ear wax removal products market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the ear wax removal products market is projected to reach USD 3.4 billion by 2035.

The ear wax removal products market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in ear wax removal products market are ear drops, oil-based, water-based, chemical-based, ear candles, ear spray, cotton swabs & buds, others, micro suction devices and ear picks/curettes.

In terms of price, low segment to command 53.0% share in the ear wax removal products market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Early Phase Clinical Trial Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Early-Stage Lung Cancer Diagnostics Therapy Market Size and Share Forecast Outlook 2025 to 2035

Earth Anchors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Earplugs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Earthen Plasters Market Size and Share Forecast Outlook 2025 to 2035

Early Life Nutrition Market Size and Share Forecast Outlook 2025 to 2035

Earth Observation Drones Market Size and Share Forecast Outlook 2025 to 2035

Early Production Facility Market Size and Share Forecast Outlook 2025 to 2035

Earmuffs Market Size and Share Forecast Outlook 2025 to 2035

Earthworm Meal Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Earphone Market Analysis by Product Type, Technology, Application, Price Range, Sales Channel and Region 2025 to 2035

Ear Health Market Overview - Trends, Demand & Forecast 2025 to 2035

Earphone & Headphone Market Analysis – Growth & Forecast through 2034

Earthmoving Equipment Undercarriage Market

Ear Tube Devices Market

Earwax Removal Market Analysis by Product, Age Group, Distribution Channel, and Region Forecast Through 2035

Heart Pump Device Market Forecast and Outlook 2025 to 2035

Wearable Sensor Market Size and Share Forecast Outlook 2025 to 2035

Search and Rescue Equipment (SAR) Market Size and Share Forecast Outlook 2025 to 2035

Wearable Sleep Tracker Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA