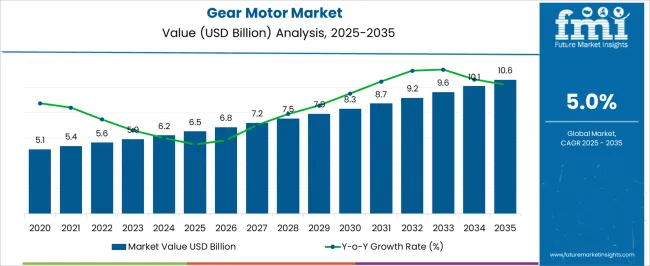

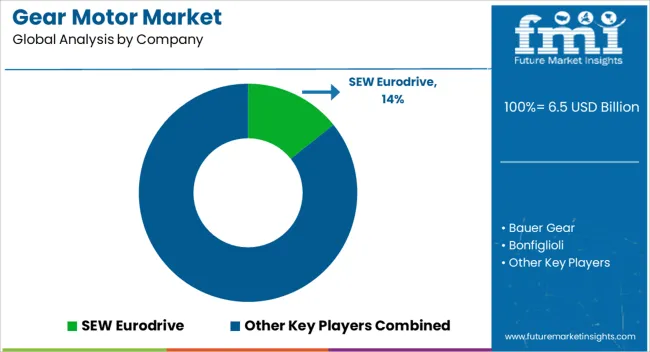

The gear motor market is estimated to be valued at USD 6.5 billion in 2025 and is projected to reach USD 10.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. The year-on-year (YoY) growth analysis of the gear motor market indicates a steady expansion. This steady trajectory reflects the rising demand for reliable and durable gear motors across industrial, automotive, and automation applications, where precision, efficiency, and long-term performance are critical considerations for equipment operators and system integrators. By 2035, the gear motor market is projected to reach USD 10.6 billion, highlighting the importance of high-performance, robust, and adaptable motors in diverse industrial and commercial operations. The consistent YoY growth pattern indicates that manufacturers offering certified, high-quality gear motors are likely to capture significant market share.

Adoption is expected to be driven by the need for components capable of handling variable loads, reducing operational downtime, and supporting efficiency across machinery and automated systems. The market outlook underscores the role of gear motors as essential elements in mechanical systems, providing reliable motion control, durability, and operational stability across multiple sectors.

| Metric | Value |

|---|---|

| Gear Motor Market Estimated Value in (2025 E) | USD 6.5 billion |

| Gear Motor Market Forecast Value in (2035 F) | USD 10.6 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The gear motor market is a specialized segment within the broader industrial motors and drives market, where it currently holds approximately 5-6% share, driven by the need for compact, efficient, and high-torque solutions across a wide range of industrial applications. Within the automation and robotics market, gear motors account for about 4-5% share, as they are critical for precise motion control in robotic arms, automated machinery, and assembly lines. In the automotive components market, the share of gear motors is roughly 3-4%, largely used in powertrain systems, electric vehicles, and auxiliary components where efficiency and reliability are essential.

Within the material handling and conveyor systems market, gear motors capture nearly 5-6% share, powering conveyors, lifts, and hoists that are integral to manufacturing, warehousing, and logistics operations. Meanwhile, in the broader electrical equipment market, gear motors represent around 2-3% share, supporting various industrial, commercial, and residential applications that require rotational motion control.

The gear motor market is experiencing steady growth, supported by its critical role in diverse industrial applications requiring precise speed control and high torque output. Current market dynamics are shaped by sustained investment in manufacturing automation, expansion of material handling operations, and increased demand from sectors such as mining, power generation, and construction equipment.

Technological advancements, including improved gear design, lubrication efficiency, and noise reduction, are enhancing product reliability and operational lifespan. Manufacturers are focusing on modular designs to provide flexibility in installation and maintenance, thereby expanding adoption across small to large-scale industrial setups.

Regional manufacturing hubs are benefiting from export-oriented production, while domestic demand is being bolstered by infrastructure development and industrial expansion. Over the forecast period, the market is expected to maintain a stable growth trajectory, driven by replacement demand for outdated systems, efficiency-driven upgrades, and integration with advanced control systems, ensuring sustained competitiveness and long-term value creation for stakeholders.

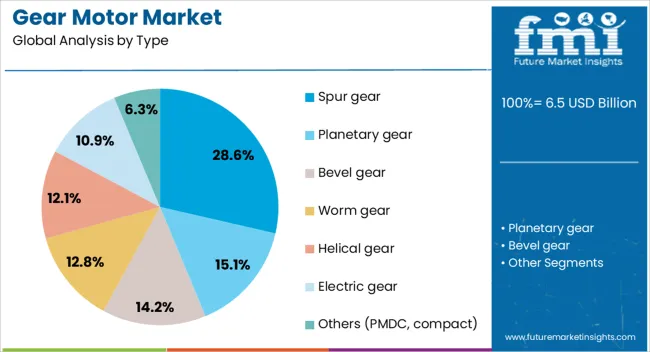

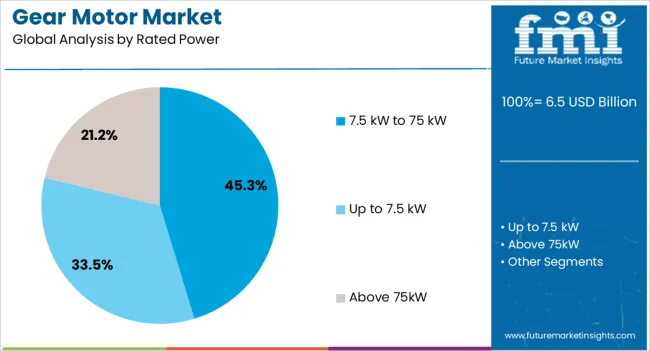

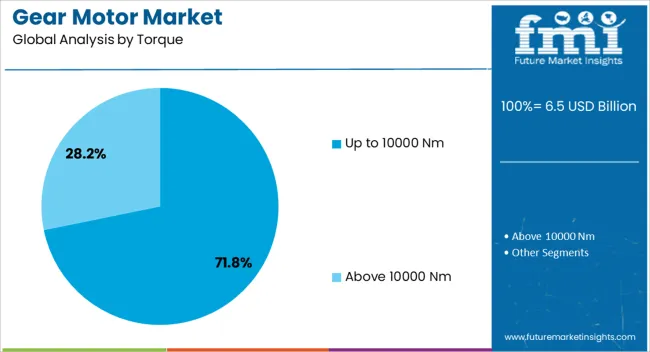

The gear motor market is segmented by type, rated power, torque, end use, distribution channel, and geographic regions. By type, gear motor market is divided into Spur gear, Planetary gear, Bevel gear, Worm gear, Helical gear, Electric gear, and Others (PMDC, compact). In terms of rated power, the gear motor market is classified into 7.5 kW to 75 kW, up to 7.5 kW, and above 75kW. Based on torque, gear motor market is segmented into Up to 10000 Nm and Above 10000 Nm.

By end use, the gear motor market is segmented into the Manufacturing industry, Construction, Power generation, Mining, Food & beverage, Material handling, Packaging and labelling, and Other (wind power, automotive, marine). By distribution channel, the gear motor market is segmented into Direct Sales and Indirect Sales. Regionally, the gear motor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The spur gear segment, accounting for 28.6% of the type category, has maintained its lead due to its cost efficiency, ease of manufacturing, and suitability for applications requiring high reliability at moderate speeds. Its share has been reinforced by widespread use in conveyors, packaging machinery, and industrial automation systems, where consistent performance and straightforward maintenance are prioritized.

The durability of spur gears, combined with advances in surface hardening and precision machining, has enhanced their load-carrying capacity, supporting their competitiveness against alternative gear types. Procurement has been aided by well-established supply chains and standardization in design, enabling interoperability and quick replacement cycles.

Continued improvements in energy efficiency and noise control are expected to further strengthen the segment’s position, particularly in sectors where operational uptime and reduced maintenance costs are critical decision factors.

The 7.5 kW to 75 kW segment, holding 45.3% of the rated power category, has been leading due to its versatility in powering medium-duty industrial machinery and equipment. Its dominance is supported by high adaptability across manufacturing plants, material handling systems, and process industries, where a balance of torque and efficiency is essential.

The segment benefits from integration with modern variable frequency drives (VFDs), allowing precise speed and load management while optimizing energy consumption. Competitive pricing, coupled with the ability to meet a wide range of application requirements without significant customization, has encouraged large-scale adoption.

Reliability under continuous operation and compatibility with both new installations and retrofitting projects have further sustained demand. Future growth is likely to be driven by expanding industrial automation and increasing emphasis on equipment modernization.

The up to 10000 Nm torque segment, representing 71.8% of the torque category, has retained its dominance due to its suitability for heavy-duty and high-load applications across industries such as mining, steel production, and large-scale manufacturing. Its widespread acceptance is attributed to the balance between torque output and operational stability, enabling consistent performance under demanding conditions.

Advancements in gearbox sealing, heat dissipation, and load distribution have improved service life, making these motors more cost-effective over their operational lifespan. Standardization in design has facilitated broad compatibility with different drive systems, reducing installation complexity and downtime.

Strong demand from sectors prioritizing reliability and efficiency under heavy loads ensures that this torque range remains the preferred choice, with future adoption expected to benefit from infrastructure growth, industrial capacity expansion, and the replacement of legacy drive systems.

The gear motor market is expanding due to rising industrial automation and robotics adoption. Opportunities exist in customized, high-performance solutions, while trends highlight energy-efficient designs and smart connectivity integration. Challenges include high costs and maintenance requirements. Market growth is supported by demand for precise, reliable, and digitally integrated gear motors that enhance efficiency, productivity, and operational control across diverse industrial and commercial applications worldwide.

The gear motor market is being propelled by growing adoption in industrial automation, robotics, and manufacturing processes. Industries such as automotive, packaging, material handling, and food processing are increasingly using gear motors to enhance precision, efficiency, and reliability in machinery. Compact design, high torque output, and energy efficiency make gear motors ideal for conveyor systems, robotic arms, and automated assembly lines. Increasing demand for smart factories and automated production is driving gear motor integration, supporting consistent market growth across industrial and commercial sectors globally.

Significant opportunities exist in providing customized and high-performance gear motors tailored to specific industrial applications. Manufacturers offering variable speed drives, modular designs, and specialized torque configurations are meeting unique operational requirements. Applications in renewable energy, electric vehicles, and advanced robotics are driving demand for lightweight, energy-efficient, and durable solutions. Additionally, aftermarket services, retrofitting, and predictive maintenance solutions present avenues for revenue expansion. Growth is further enhanced by increasing focus on reducing operational downtime, improving productivity, and delivering precise motion control across diverse industrial processes.

A notable trend is the integration of energy-efficient designs and smart connectivity features in gear motors. Advanced materials, optimized gearing, and low-loss transmission systems improve overall efficiency and reduce operational costs. IoT-enabled gear motors allow remote monitoring, predictive maintenance, and performance optimization, ensuring longer service life and minimized downtime. Increasing adoption of Industry 4.0 and smart manufacturing initiatives encourages the deployment of connected and intelligent gear systems. These trends reflect the market’s emphasis on combining operational efficiency, performance reliability, and digital integration for modern industrial applications.

The gear motor market faces challenges due to high manufacturing costs, particularly for high-performance, customized, and precision solutions. Maintenance requirements, including lubrication, alignment, and inspection, add operational complexity. Price sensitivity among small- and medium-scale manufacturers can limit the adoption of premium gear motors. Additionally, supply chain disruptions for metals, bearings, and electronic components can delay production.

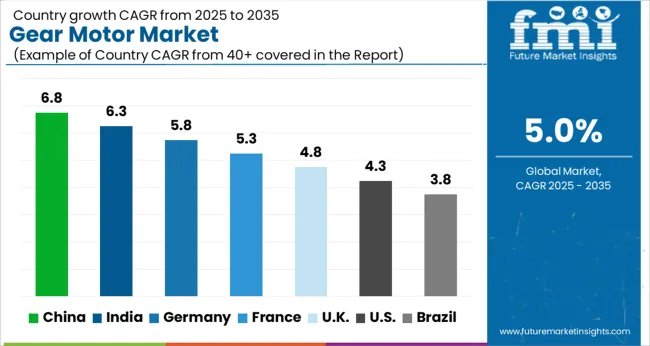

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

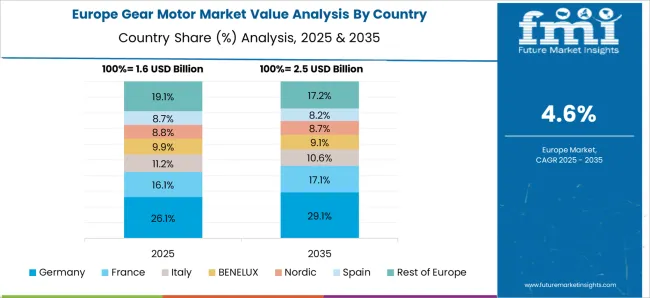

The global gear motor market is projected to grow at a CAGR of 5% from 2025 to 2035. China leads with a growth rate of 6.8%, followed by India at 6.3% and Germany at 5.8%. The United Kingdom records a growth rate of 4.8%, while the United States shows the slowest growth at 4.3%. Expansion is supported by increasing demand for industrial automation, manufacturing efficiency, and energy-efficient motor solutions. Emerging markets like China and India benefit from expanding industrial sectors, increased automation, and government incentives, while developed countries such as the USA, UK, and Germany focus on upgrading legacy systems, integrating intelligent motor controls, and enhancing production reliability. This report includes insights on 40+ countries; the top markets are shown here for reference.

The gear motor market in China is expected to expand at 6.8% CAGR, driven primarily by the rapid pace of industrialization and strong adoption of automation solutions across diverse sectors. Demand has been rising in applications such as robotics, precision manufacturing, packaging, and material handling systems, where reliability and energy efficiency remain key priorities. With government support for industrial modernization and smart factories, manufacturers are focusing on producing high-performance gear motors with improved durability and integration capabilities. Investments in robotics, automotive production, and conveyor-based systems continue to reinforce demand. China also benefits from large-scale infrastructure expansion and increasing export-oriented manufacturing activities, further strengthening market growth. Local producers compete with global companies by emphasizing cost-effective solutions while adopting quality standards to meet both domestic and international demand.

The gear motor market in India is forecast to grow at 6.3% CAGR, supported by expanding manufacturing industries, packaging units, and material handling systems. The country’s push for industrial automation and government-backed initiatives like “Make in India” have fueled greater adoption of reliable, cost-effective, and energy-efficient gear motors. Usage spans across conveyors, food processing, packaging, and textile industries, where durability and low maintenance are essential. Rising adoption of smart factories and industrial parks has encouraged manufacturers to invest in advanced motor technologies that reduce downtime and enhance productivity. Domestic manufacturers are increasingly supplying affordable solutions, while international companies focus on introducing high-performance models with energy savings and predictive maintenance features. This dual focus ensures robust market expansion across both small-scale enterprises and large industries in India.

The gear motor market in Germany is advancing at 5.8% CAGR, supported by its strong position in advanced manufacturing and automation. Adoption is widespread in industries such as robotics, automotive production, material handling, and food processing, where precision and reliability are critical. The Industry 4.0 movement in Germany emphasizes integration of intelligent motor controls, real-time monitoring, and predictive maintenance, boosting demand for smart gear motor solutions. Manufacturers are focused on developing durable and energy-efficient motors that align with European standards for efficiency and safety. Investments in automation, robotics, and conveyor systems in both SMEs and large industrial corporations further sustain growth. Germany’s highly skilled workforce, innovation-driven environment, and strong export base ensure that gear motor adoption remains central to its industrial modernization strategy.

Demand Forecast for Gear Motor Market in United Kingdom

The gear motor market in the United Kingdom is expected to expand at 4.8% CAGR, influenced by industrial automation, retrofitting projects, and rising adoption of robotics in manufacturing facilities. Demand has been consistent across packaging, food and beverage, logistics, and material handling applications, where efficiency and reliability play a major role. Manufacturers in the UK are emphasizing energy-efficient and durable solutions to reduce long-term costs while aligning with sustainability and regulatory requirements. The transition toward smart factories and adoption of predictive maintenance tools further drive gear motor integration into automated systems. Growth is moderate compared to China or India, as adoption focuses more on modernization of existing infrastructure than greenfield projects. However, demand for advanced solutions in sectors like robotics and precision manufacturing continues to strengthen market relevance in the UK

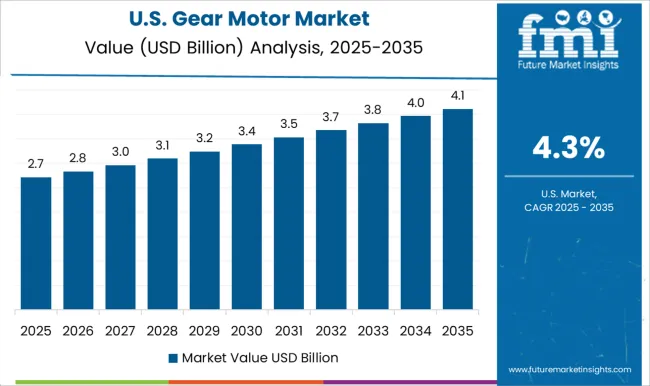

The gear motor market in the United States is forecast to expand at 4.3% CAGR, reflecting steady but slower adoption compared to Asia-Pacific markets. Growth is influenced by automation in production lines, robotics adoption, and retrofitting of older manufacturing facilities. Gear motors are widely used in automotive assembly, logistics, packaging, and heavy machinery applications, where reliability and performance remain critical. Manufacturers focus on delivering high-performance and energy-efficient gear motors, integrating them with intelligent control systems to enhance efficiency. Smart manufacturing initiatives and Industry 4.0 adoption are creating demand for predictive maintenance features and data-driven optimization. While the USA market shows slower growth relative to China or India, steady investments in industrial modernization, coupled with a focus on reducing operational downtime, ensure continuous adoption of gear motor solutions.

Leading companies in the gear motor market, such as SEW Eurodrive, Bonfiglioli, and Emerson Electric, are competing by offering high-performance motors with integrated gearing solutions for industrial automation, robotics, and material handling applications. SEW Eurodrive emphasizes modular gear motor systems with high efficiency and reliability, presenting brochures that highlight durability, flexible mounting options, and energy savings. Bonfiglioli focuses on compact designs with high torque density, promoting products suitable for conveyors, cranes, and factory automation. Emerson Electric and Siemens target precision applications, marketing gear motors that combine advanced control with long service life.

Other players, including Bauer Gear, Flender, and Harmonic Drive, differentiate through specialized gearing solutions, such as planetary and harmonic systems for robotics and aerospace applications. Jiangsu Guomao Reducer, Nabtesco, and Nidec emphasize regional manufacturing and customizable configurations, while Portescap and Power Build focus on miniature and high-speed gear motors for medical and industrial devices. Regal Rexnord, Shanthi Gears, and Sumitomo Heavy Industries highlight durability, load-handling capability, and global service networks.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.5 Billion |

| Type | Spur gear, Planetary gear, Bevel gear, Worm gear, Helical gear, Electric gear, and Others (PMDC, compact) |

| Rated Power | 7.5 kW to 75 kW, Up to 7.5 kW, and Above 75kW |

| Torque | Up to 10000 Nm and Above 10000 Nm |

| End Use | Manufacturing industry, Construction, Power generation, Mining, Food & beverage, Material handling, Packaging and labelling, and Other (wind power, automotive, marine) |

| Distribution Channel | Direct Sales and Indirect Sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SEW Eurodrive, Bauer Gear, Bonfiglioli, Emerson Electric, Flender, Harmonic Drive, Jiangsu Guomao Reducer, Nabtesco, Nidec, Portescap, Power Build, Regal Rexnord, Shanthi Gears, Siemens, and Sumitomo Heavy Industries |

| Additional Attributes | Dollar sales by motor type (AC, DC, servo) and gear type (helical, bevel, planetary, worm) are key metrics. Trends include rising demand for energy-efficient and compact gear motors, adoption in industrial automation, and growth in robotics and manufacturing applications. Regional adoption, technological advancements, and performance optimization are driving market growth. |

The global gear motor market is estimated to be valued at USD 6.5 billion in 2025.

The market size for the gear motor market is projected to reach USD 10.6 billion by 2035.

The gear motor market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in gear motor market are spur gear, planetary gear, bevel gear, worm gear, helical gear, electric gear and others (PMDC, compact).

In terms of rated power, 7.5 kw to 75 kw segment to command 45.3% share in the gear motor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gearbox and Gear Motors Market Size and Share Forecast Outlook 2025 to 2035

Motor Gear Unit Market

Gears, Drives and Speed Changers Market Growth – Trends & Forecast 2025 to 2035

Ski Gear And Equipment Market Size and Share Forecast Outlook 2025 to 2035

Ski Gear & Equipment Market Growth & Insights 2024-2034

Rail Gearbox Market Size and Share Forecast Outlook 2025 to 2035

Worm Gear Drive Market Size and Share Forecast Outlook 2025 to 2035

Open Gear Lubricants Market

Switchgear for Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Switchgear Market Growth - Trends & Forecast 2025 to 2035

Timing Gear Market Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Gear Shifter Market Size and Share Forecast Outlook 2025 to 2035

Advanced Gear Shifter System Market Size and Share Forecast Outlook 2025 to 2035

AC Switchgear Market Size and Share Forecast Outlook 2025 to 2035

DC Switchgear Market - Size, Share, and Forecast 2025 to 2035

External Gear Pump Market Size, Growth, and Forecast 2025 to 2035

Internal Gear Pump Market Size, Growth, and Forecast 2025 to 2035

Steering Gear Market

Hydraulic Gear Pumps Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA