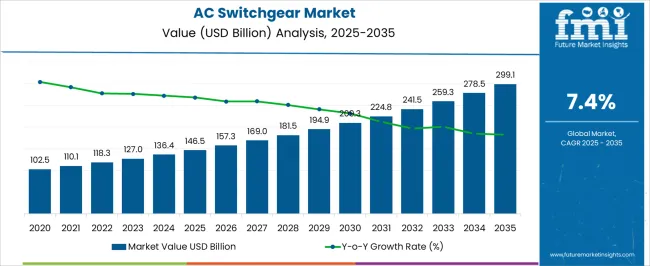

The AC switchgear market is projected to grow from USD 146.5 billion in 2025 to USD 299.1 billion by 2035, reflecting a CAGR of 7.4%. During the early adoption phase (2020–2024), demand was largely driven by infrastructure projects, utility upgrades, and expanding industrial operations that required reliable power management solutions. By 2025, adoption will become more widespread as AC switchgear transitions from selective integration in high-demand regions to broader application across industries. This phase marks the shift from initial growth to structured expansion, with companies scaling manufacturing capacity and improving distribution frameworks.

From 2025 to 2030, the scaling phase is defined by strong demand from industrial, commercial, and residential sectors. The market value rises from USD 146.5 billion in 2025 as larger deployment across power distribution networks and grid reinforcement projects accelerates uptake. By 2030, AC switchgear becomes a standard across new installations, fueling consistent growth. Between 2030 and 2035, the consolidation phase emerges as the market reaches USD 299.1 billion. Leading players enhance efficiency, refine portfolios, and strengthen long-term partnerships with utilities and industrial operators. The result is a mature, competitive market landscape with stable growth and high levels of adoption worldwide.

| Metric | Value |

|---|---|

| AC Switchgear Market Estimated Value in (2025 E) | USD 146.5 billion |

| AC Switchgear Market Forecast Value in (2035 F) | USD 299.1 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The AC switchgear market is a vital segment of the broader electrical equipment and power distribution industry. In 2025, AC switchgear represents around 42% of the global switchgear market, with the remainder consisting of DC switchgear and hybrid systems. The overall switchgear industry is projected to grow steadily at a CAGR of about 6% between 2025 and 2035, supported by rising power demand and expanding grid modernization programs. By comparison, AC switchgear shows slightly faster growth at 7.4%, making it a dominant and resilient sub-segment within the parent market. Within the electrical equipment sector, AC switchgear holds nearly 20% share in 2025, with other categories such as transformers, circuit breakers, and protection devices covering the balance.

By 2030, its share is expected to rise to 22% as industries and utilities scale up adoption for efficient power handling and system reliability. From 2030 to 2035, the market consolidates, and AC switchgear strengthens its role, accounting for about 24% of the electrical equipment sector by 2035.

The AC switchgear market is registering stable growth, supported by expanding electricity demand, modernization of power infrastructure, and the ongoing integration of renewable energy systems. Current market conditions are characterized by rising investments in distribution networks and a heightened focus on safety, reliability, and operational efficiency in electrical systems. Urbanization trends, coupled with the need for uninterrupted power supply in both residential and industrial sectors, are accelerating adoption.

Regulatory frameworks mandating adherence to stringent safety and energy efficiency standards are further influencing product development and procurement patterns. Technological advancements, including smart monitoring capabilities and compact modular designs, are enhancing the operational lifespan and flexibility of AC switchgear.

The future outlook indicates steady demand driven by grid expansion, electrification of transport, and refurbishment of aging infrastructure, ensuring sustained relevance across varied end-use sectors. This combination of demand-side expansion and technology-led upgrades positions the AC switchgear market for consistent growth over the forecast horizon.

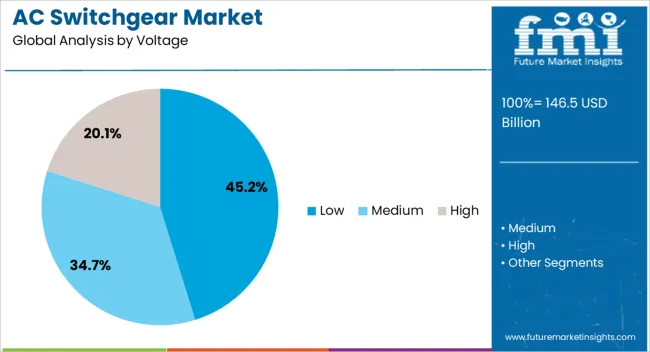

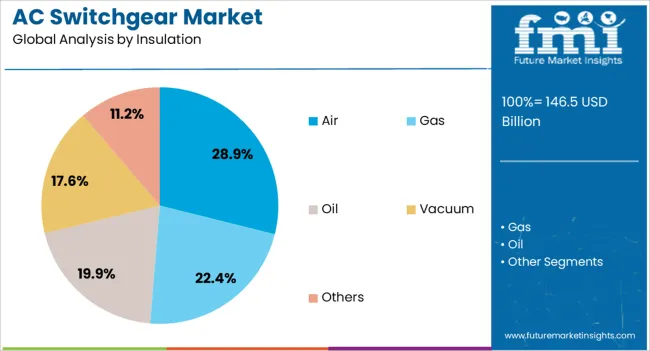

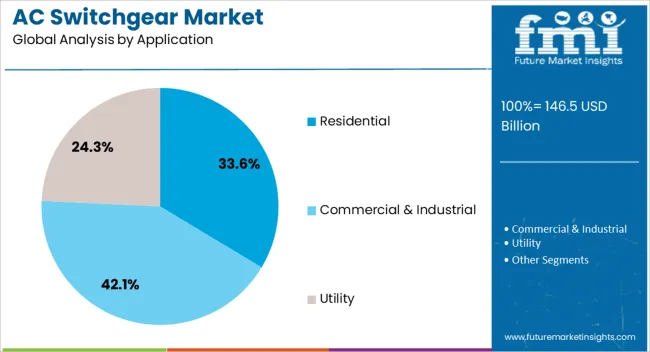

The AC switchgear market is segmented by voltage, insulation type, application, and geographic region. By voltage, the AC switchgear market is divided into Low, Medium, and High. In terms of insulation, the AC switchgear market is classified into Air, Gas, Oil, Vacuum, and Others. Based on application, the AC switchgear market is segmented into Residential, commercial, and industrial, and Utility. Regionally, the AC switchgear industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The low voltage segment leads the AC switchgear market by voltage rating, accounting for approximately 45.2% of the total share. This dominance is primarily due to its extensive deployment in residential, commercial, and light industrial applications, where lower power distribution requirements prevail. The segment’s adoption is reinforced by ease of installation, cost efficiency, and compatibility with a wide range of electrical systems.

Increasing construction activities, particularly in urban housing projects, along with the rise of small and medium-sized enterprise operations, have further stimulated demand. Safety enhancements and compliance with evolving standards have made low voltage switchgear the preferred choice for decentralized power distribution systems.

Furthermore, the growing penetration of distributed energy resources, such as rooftop solar installations, has driven the requirement for reliable and compact low voltage solutions. With continued investments in infrastructure and electrification initiatives, the segment is expected to maintain its leadership position through the forecast period.

The air insulation segment holds the largest share in the insulation category, representing approximately 28.9% of the AC switchgear market. This segment’s position is attributed to its cost-effectiveness, proven operational reliability, and straightforward maintenance requirements. Air-insulated switchgear systems are widely utilized in low and medium-voltage applications where space constraints are less critical, making them suitable for both indoor and outdoor installations.

The demand is further supported by environmental considerations, as air insulation avoids the use of greenhouse gases like SF₆, aligning with sustainability goals and regulatory trends. Its robust mechanical endurance and ability to withstand harsh environmental conditions contribute to its broad acceptance in utility, commercial, and residential settings.

Technological refinements, including compact designs and integrated monitoring features, have enhanced the operational flexibility of air-insulated systems. Given its balance of performance, cost, and environmental safety, the air insulation segment is anticipated to sustain its market dominance in the coming years.

The residential segment emerges as the leading application area, capturing approximately 33.6% of the AC switchgear market share. This leadership is driven by rapid urbanization, rising electrification rates in developing regions, and increasing refurbishment activities in mature economies. The segment benefits from strong demand for safe, efficient, and space-saving switchgear solutions suitable for apartment complexes, individual homes, and residential complexes.

Growth is further fueled by the integration of renewable energy sources at the household level, which necessitates the use of advanced distribution and safety equipment. Regulatory mandates for electrical safety compliance, coupled with consumer awareness about the importance of reliable power distribution, have also strengthened segment growth.

The trend toward smart homes and energy-efficient devices is creating opportunities for residential-focused switchgear that features digital monitoring and automation capabilities. With continuous expansion in housing projects and government-led rural electrification programs, the residential segment is expected to maintain its dominant position in the AC switchgear market over the forecast period.

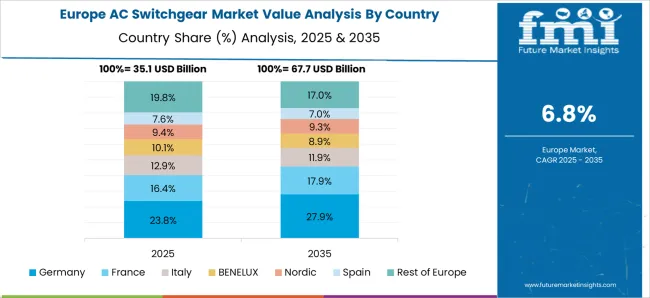

The AC switchgear market is expanding due to rising electricity demand, grid modernization, and industrial automation. North America and Europe lead with advanced transmission networks, renewable integration, and strict safety standards. Asia-Pacific demonstrates the fastest growth, fueled by urbanization, infrastructure development, and large-scale industrialization. Manufacturers differentiate through voltage ratings, digital monitoring, and compact modular designs. Regional contrasts in regulatory requirements, grid reliability, and investment priorities strongly influence adoption, technological development, and global competitiveness of AC switchgear across utilities, industries, and commercial facilities.

Growing electricity consumption and grid expansion are key drivers for AC switchgear adoption. North America and Europe focus on upgrading aging transmission infrastructure and integrating renewable energy sources into existing grids. Asia-Pacific, led by China and India, deploys large-scale switchgear for new industrial zones, urban housing, and rapidly expanding power networks. Differences in grid maturity, electricity growth rates, and investment capacity influence voltage ratings, switchgear size, and digital control features. Leading suppliers develop compact, modular, and high-voltage AC switchgear with smart monitoring capabilities, while regional players emphasize cost-effective, mid-voltage systems. Demand contrasts between mature and developing regions shape global adoption, competitiveness, and technology deployment.

Strict regulatory frameworks and safety requirements play a central role in shaping the AC switchgear market. North America and Europe impose stringent standards under IEC and ANSI guidelines, demanding high-performance switchgear with fault tolerance, arc protection, and reliability. Asia-Pacific markets vary: developed countries align with global standards, while emerging economies prioritize affordability and gradual safety upgrades. Differences in enforcement, certification costs, and testing procedures affect switchgear design, insulation methods, and protective mechanisms. Leading suppliers deliver certified, high-reliability products with advanced insulation technologies, while regional manufacturers provide compliant but cost-sensitive alternatives. Regulatory and safety contrasts determine adoption, reliability, and competitiveness in global AC switchgear markets.

Digital monitoring and smart grid integration are transforming AC switchgear applications. North America and Europe invest in switchgear with IoT sensors, predictive maintenance, and remote diagnostics to support energy efficiency and renewable energy integration. Asia-Pacific markets prioritize scalable, semi-digital solutions that balance performance with cost, particularly in fast-growing industrial and utility sectors. Differences in digital infrastructure, investment priorities, and technology adoption rates influence sensor integration, communication protocols, and control systems. Leading suppliers develop smart, modular switchgear enabling real-time grid monitoring, while regional players focus on simplified systems. Digital adoption contrasts drive market competitiveness, product differentiation, and operational efficiency worldwide.

Infrastructure development and industrialization significantly boost AC switchgear demand. North America and Europe focus on modernizing commercial facilities, transportation hubs, and industrial plants with high-efficiency switchgear. Asia-Pacific, driven by rapid urbanization, requires large volumes of switchgear for manufacturing clusters, metro projects, and expanding residential power grids. Differences in construction growth rates, electrification levels, and industrial investment influence voltage requirements, design preferences, and installation practices. Leading suppliers provide durable, modular switchgear suitable for large-scale projects, while regional manufacturers offer affordable solutions adapted to local construction needs. Industrialization contrasts strongly impact adoption, market penetration, and global competitiveness.

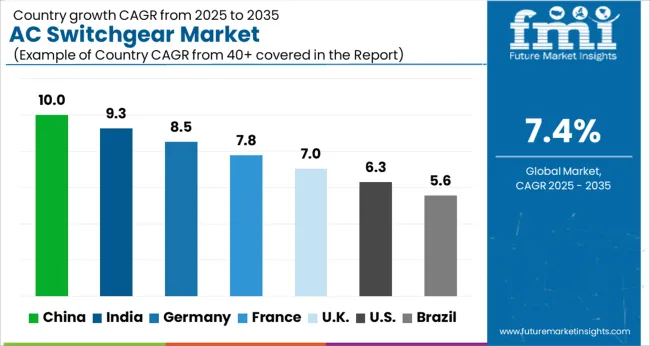

| Country | CAGR |

|---|---|

| China | 10.0% |

| India | 9.3% |

| Germany | 8.5% |

| France | 7.8% |

| UK | 7.0% |

| USA | 6.3% |

| Brazil | 5.6% |

The global AC switchgear market is projected to grow at a 7.4% CAGR through 2035, driven by demand in transmission networks, industrial facilities, and utility applications. Among BRICS nations, China led with 10.0% growth as large-scale manufacturing and deployment activities were expanded, while India at 9.3% strengthened production and installation to meet regional electricity distribution needs. In the OECD region, Germany at 8.5% maintained steady output under strict safety and reliability regulations, while the United Kingdom at 7.0% facilitated moderate-scale deployment across commercial and utility networks. The USA, growing at 6.3%, supported consistent adoption across distribution grids and industrial projects while adhering to federal and state compliance frameworks. This report includes insights on 40+ countries; the top countries are shown here for reference.

The AC switchgear market in China is growing at a 10.0% CAGR, supported by rapid urbanization, industrial expansion, and large-scale investments in power infrastructure. Rising electricity demand from residential, commercial, and industrial sectors drives adoption of advanced switchgear solutions. Government initiatives promoting smart grids, renewable energy integration, and modernization of transmission networks are boosting demand for high-efficiency switchgear systems. Domestic manufacturers are investing in research and development to produce reliable, compact, and cost-effective solutions that meet both local and international standards. Expansion of metro projects, data centers, and industrial parks is creating consistent market opportunities. Overall, China’s market growth is driven by infrastructure development, technological advancement, and strong domestic manufacturing capabilities.

India’s AC switchgear market is registering a 9.3% CAGR, fueled by growing electricity consumption, rapid industrialization, and urban infrastructure projects. Government programs promoting electrification, renewable energy deployment, and modernization of power transmission systems are creating significant demand. Domestic and international manufacturers are supplying medium and high-voltage switchgear tailored for diverse applications in residential, commercial, and industrial segments. Investment in smart cities, metro rail projects, and industrial parks further supports market expansion. Research and development efforts focus on improving efficiency, safety, and cost competitiveness of switchgear products. The market reflects strong growth potential due to rising power demand, infrastructure investment, and policy-driven electrification.

AC switchgear market in Germany is growing at an 8.5% CAGR, supported by strong demand from renewable energy projects, industrial automation, and modern grid systems. The transition towards sustainable energy sources requires advanced switchgear solutions capable of handling distributed energy resources. Manufacturers focus on high-quality, efficient, and environmentally friendly systems that meet strict EU regulatory standards. Industrial and commercial facilities are investing in reliable switchgear to ensure safety and operational efficiency. Digitalization and smart monitoring features are increasingly integrated into modern equipment. Overall, Germany’s market growth is influenced by renewable energy integration, technological sophistication, and strict regulatory compliance.

The United Kingdom AC switchgear market is expanding at a 7.0% CAGR, driven by modernization of grid infrastructure and growing renewable energy integration. Investments in offshore wind, solar, and smart grid projects are creating steady demand for advanced switchgear solutions. Manufacturers are focusing on compact, high-performance systems that ensure safety, efficiency, and regulatory compliance. Infrastructure development in commercial and industrial sectors also contributes to market growth. Increasing demand for automation and reliable electricity distribution in urban centers supports steady adoption. Overall, the UK market reflects moderate growth supported by renewable projects, infrastructure upgrades, and evolving power distribution requirements.

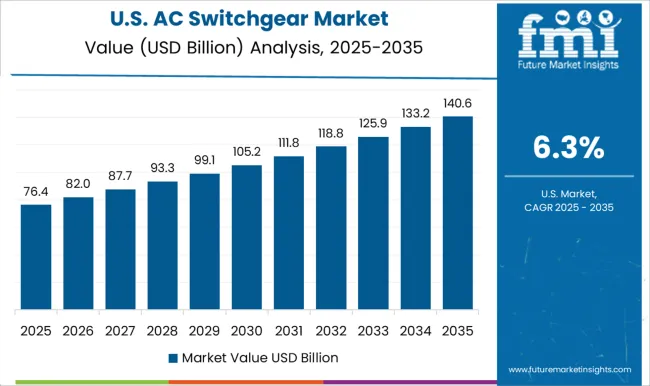

The United States AC switchgear market is growing at a 6.3% CAGR, supported by investments in power grid modernization, renewable integration, and industrial automation. Demand is rising across residential, commercial, and industrial sectors for safe, reliable, and efficient electricity distribution systems. Manufacturers emphasize innovation in high-voltage and medium-voltage switchgear with digital monitoring and smart control features. Government initiatives promoting renewable energy adoption and infrastructure upgrades further drive growth. Data centers, industrial facilities, and commercial complexes are increasingly adopting advanced switchgear solutions to ensure operational efficiency and safety. The market reflects steady growth shaped by infrastructure investment, regulatory compliance, and industrial expansion.

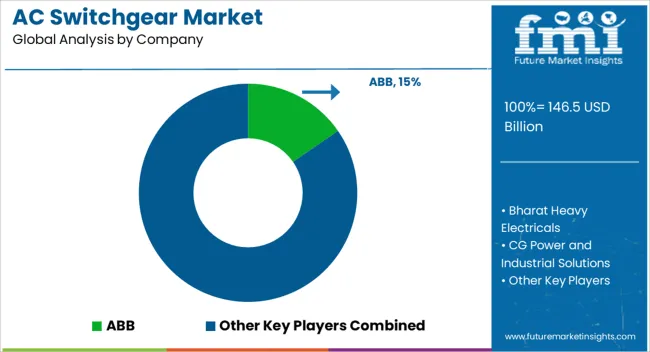

The AC switchgear market is supported by a strong group of global and regional manufacturers, including ABB, Bharat Heavy Electricals, CG Power and Industrial Solutions, E + I Engineering, Eaton, and Fuji Electric. These companies are widely recognized for providing reliable and efficient medium- and high-voltage switchgear solutions that ensure safe and continuous power distribution. With industries, utilities, and infrastructure projects increasingly demanding higher efficiency and safety in electrical networks, these suppliers play a critical role in shaping the market by offering advanced products with features like arc protection, compact design, and digital monitoring. Other leading suppliers, such as General Electric, HD Hyundai Electric, Hitachi, Hyosung Heavy Industries, and Lucy Group, are investing heavily in smart grid-compatible switchgear systems that support digitalization and automation. Their innovations are driven by the rising adoption of renewable energy and the modernization of aging power infrastructure, which require advanced switchgear to manage fluctuating loads and ensure grid stability. Integration of Internet of Things (IoT)-enabled monitoring and predictive maintenance is also being increasingly adopted by these companies to meet customer needs for operational efficiency and reduced downtime. Global giants like Mitsubishi Electric, Ormazabal, and Schneider Electric are expanding their portfolios with environmentally friendly switchgear solutions that eliminate or reduce the use of SF₆ gas, a greenhouse gas traditionally used in insulation. By focusing on sustainability, energy efficiency, and long-term cost savings, these suppliers are aligning with global decarbonization goals while addressing growing demand across industrial, commercial, and utility sectors. Strategic partnerships, regional expansions, and continued investments in R&D are expected to drive their growth and maintain their leadership positions in the evolving AC switchgear market.

| Item | Value |

|---|---|

| Quantitative Units | USD 146.5 Billion |

| Voltage | Low, Medium, and High |

| Insulation | Air, Gas, Oil, Vacuum, and Others |

| Application | Residential, Commercial & Industrial, and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Bharat Heavy Electricals, CG Power and Industrial Solutions, E + I Engineering, Eaton, Fuji Electric, General Electric, HD Hyundai Electric, Hitachi, Hyosung Heavy Industries, Lucy Group, Mitsubishi Electric, Ormazabal, and Schneider Electric |

| Additional Attributes | Dollar sales vary by type, including air-insulated, gas-insulated, and hybrid AC switchgear; by voltage class, spanning low, medium, and high voltage; by application, such as power transmission, distribution, renewable integration, and industrial plants; by end-use, covering utilities, industrial facilities, and commercial complexes; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by grid modernization, renewable energy adoption, and demand for reliable power distribution. |

The global ac switchgear market is estimated to be valued at USD 146.5 billion in 2025.

The market size for the ac switchgear market is projected to reach USD 299.1 billion by 2035.

The ac switchgear market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in ac switchgear market are low, medium and high.

In terms of insulation, air segment to command 28.9% share in the ac switchgear market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

AC Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Low Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

DC Traction Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Account Planning Tool Market Size and Share Forecast Outlook 2025 to 2035

Acousto Optical Cavity Dumper Market Size and Share Forecast Outlook 2025 to 2035

Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Active Wear Market Size and Share Forecast Outlook 2025 to 2035

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

AC DC Power Adapter Market Forecast and Outlook 2025 to 2035

Activated Carbon for Sugar Decolorization Market Forecast and Outlook 2025 to 2035

Acrylic Paint Market Forecast and Outlook 2025 to 2035

Acetate Silicone Sealant Market Size and Share Forecast Outlook 2025 to 2035

Active, Smart, and Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Acetone Market Size and Share Forecast Outlook 2025 to 2035

Activated Alumina Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Fibre Market Size and Share Forecast Outlook 2025 to 2035

Acetoacetanilide Market Size and Share Forecast Outlook 2025 to 2035

Acetylacetone Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA