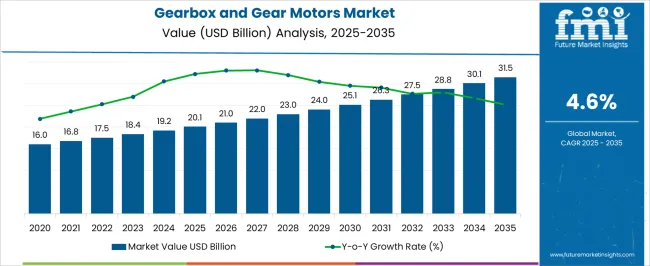

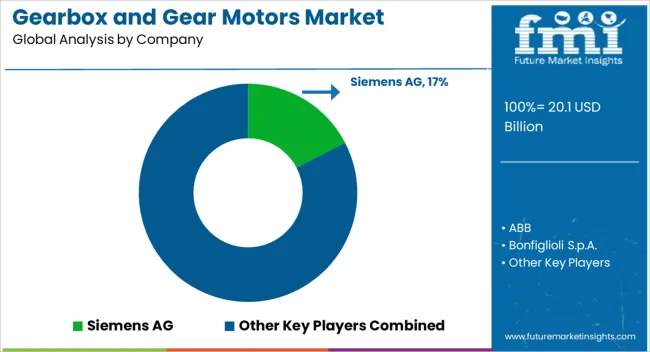

The gearbox and gear motors market is expected to grow from USD 20.1 billion in 2025 to USD 31.5 billion by 2035, registering a 4.6% CAGR and creating an absolute dollar opportunity of USD 11.4 billion. Growth is driven by rising demand across industrial automation, automotive, renewable energy, and material handling sectors, where gear systems are essential for power transmission, precise motion control, and load management. Advancements in high-efficiency gear designs, compact motors, and integration with smart automation systems are supporting wider adoption globally. Early versus late growth curve comparison shows different market dynamics over the forecast period.

From 2025 to 2028, growth is steady, supported mainly by replacement demand and gradual adoption in North America and Europe, where industrial infrastructure is established. Revenue growth during this phase is consistent, reflecting upgrades in automation systems and efficiency improvements. From 2029 to 2035, the market experiences stronger growth as Asia Pacific and Latin America expand industrial output and increase adoption of automation technologies, driving higher demand for gearboxes and gear motors.

Energy-efficient and IoT-enabled motors further enhance market potential during this phase. Overall, the market transitions from steady early growth to faster late-stage expansion, with the USD 11.4 billion opportunity reflecting both replacement cycles and new installations across global industries between 2025 and 2035.

| Metric | Value |

|---|---|

| Gearbox and Gear Motors Market Estimated Value in (2025 E) | USD 20.1 billion |

| Gearbox and Gear Motors Market Forecast Value in (2035 F) | USD 31.5 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The gearbox and gear motors market is primarily driven by the industrial automation sector, accounting for approximately 35% of the market share, as factories and production units rely on these components for machinery movement and precision control. The automotive industry contributes about 25%, using gear systems in vehicles for power transmission and efficiency.

Renewable energy applications, including wind and solar power, represent close to 15%, where gear motors optimize energy generation equipment. Material handling and logistics account for roughly 15%, applying gear systems in conveyors and automated equipment. The remaining 10% comes from robotics and consumer appliances, which increasingly integrate compact gear motors for performance and efficiency. The market is evolving with advances in efficiency, durability, and customization.

Energy-efficient motors and low-loss gear systems are becoming standard to reduce operational costs. Compact and lightweight designs are gaining traction, particularly in robotics, automation, and consumer appliances. Smart and connected gear systems with monitoring capabilities are improving predictive maintenance and operational reliability. Manufacturers are investing in high-precision gear materials and coatings to enhance performance in harsh environments. Modular and customizable solutions are being introduced to meet diverse industry needs. Strategic partnerships with automation and industrial solution providers are helping companies expand their global reach and cater to growing market demands.

The market is progressing steadily, supported by increasing automation across manufacturing, processing, and power generation sectors. Growth is being influenced by rising demand for energy-efficient mechanical transmission solutions that offer durability and performance reliability in demanding industrial applications. Advancements in material science, compact motor integration, and load-handling capabilities are paving the path for next-generation systems optimized for both torque output and space efficiency.

The ongoing shift towards electrification of industrial equipment and the integration of smart monitoring systems has created a favorable environment for the adoption of gearboxes and gear motors. Additionally, expansion of infrastructure, mining, and renewable energy projects is contributing to sustained demand.

The ability of these systems to reduce maintenance intervals while improving operational uptime is further enhancing their value proposition across diverse applications. With increasing focus on cost-efficiency, mechanical longevity, and compliance with global energy standards, the market is expected to witness continued investment and innovation in the coming years.

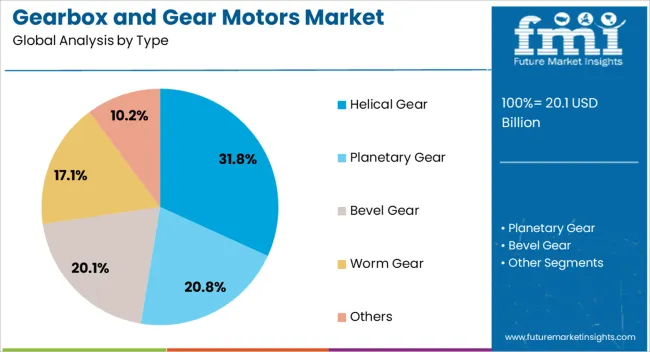

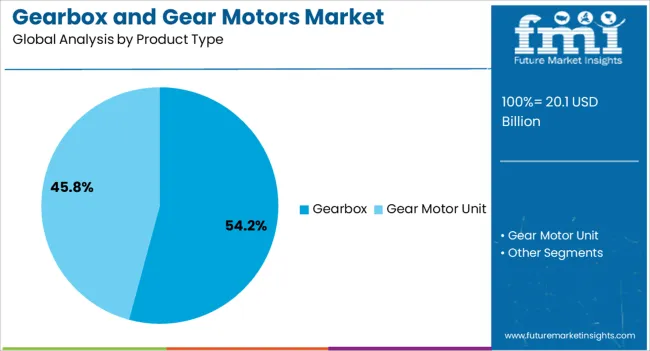

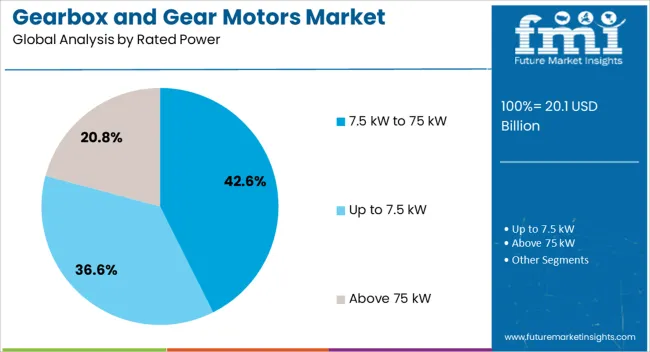

The gearbox and gear motors market is segmented by type, product type, rated power, end use industry, distribution channel, and geographic regions. By type, gearbox and gear motors market is divided into Helical Gear, Planetary Gear, Bevel Gear, Worm Gear, and Others. In terms of product type, gearbox and gear motors market is classified into Gearbox and Gear Motor Unit. Based on rated power, gearbox and gear motors market is segmented into 7.5 kW to 75 kW, Up to 7.5 kW, and Above 75 kW.

By end use industry, gearbox and gear motors market is segmented into Material Handling, Automotive, Food and Beverages, Medical, Wind Power, Metals and Mining, and Others. By distribution channel, gearbox and gear motors market is segmented into Direct and Indirect. Regionally, the gearbox and gear motors industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The helical gear segment is projected to account for 31.8% of the Gearbox & Gear Motors Market revenue in 2025, making it a leading type by market share. This dominance is being attributed to the high efficiency and load-handling capacity provided by helical gears due to their angled teeth and continuous engagement.

The segment’s growth has been supported by its widespread use in heavy-duty machinery, conveyors, and manufacturing systems where quiet operation and reduced vibration are essential. Helical gears have also been favored for their ability to transmit power between parallel or non-parallel shafts with minimal wear, thereby extending equipment lifespan.

Their compatibility with automation-driven systems and adaptability across industries, including automotive, cement, and steel, has positioned them as a preferred gear type. As industrial operations demand precision, durability, and quieter motion control systems, the adoption of helical gears is expected to remain robust and expand further in both retrofitting and new installations.

The gearbox segment is anticipated to contribute 54.2% of the overall market revenue in 2025, emerging as the dominant product type in the Gearbox & Gear Motors Market. This leading position is being driven by the critical role gearboxes play in reducing speed and increasing torque in mechanical systems, particularly in heavy industrial applications.

Gearboxes are widely implemented in systems requiring consistent power output and operational stability, such as wind turbines, mining equipment, and material handling units. Their versatility in handling different torque ranges and their ease of integration into both legacy and modern equipment have strengthened their market presence.

The rise in automated manufacturing and energy infrastructure development has further reinforced the demand for gearboxes due to their contribution to mechanical reliability and energy conservation. As industries increasingly seek customizable and modular transmission solutions, the gearbox segment is expected to maintain its dominance, supported by innovation in design and materials.

The 7.5 kW to 75 kW rated power segment is expected to hold 42.6% of the total market revenue in 2025, making it the most prominent range among power classifications. This leadership is being attributed to the extensive use of mid-range power gear motors in various industrial and commercial operations where moderate torque and efficiency are required.

The segment’s growth has been fueled by its suitability for applications such as packaging, material conveying, compressors, and processing machinery. These systems offer a balance between energy consumption and output performance, which aligns with the growing demand for scalable and energy-efficient drive systems.

Their compatibility with smart controllers and ability to be integrated into automated processes has also supported adoption. As industries move towards precision-driven operations and digitalized asset management, this power range is expected to remain a key enabler of optimized performance and long-term operational stability.

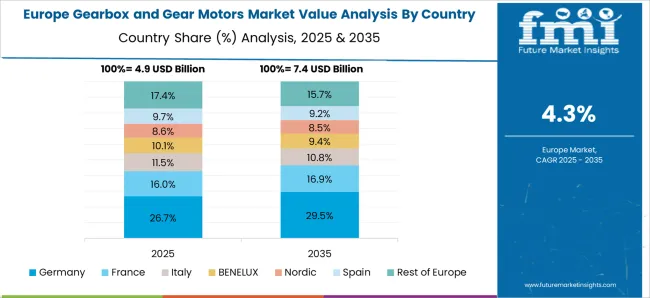

The gearbox and gear motors market is expanding due to increasing demand from industrial automation, robotics, and material handling sectors. Global revenue surpassed USD 18.5 billion in 2024, with Asia Pacific contributing 38% led by China, India, and Japan due to rapid industrialization and automation adoption. Europe accounts for 30%, with Germany, Italy, and France driving high adoption in automotive and manufacturing industries. North America represents 25%, supported by industrial machinery and robotics applications. Helical and planetary gear motors dominate with 55% share, followed by worm and bevel gear types. Rising demand for energy-efficient, compact, and high-torque solutions is accelerating adoption across manufacturing and logistics globally.

Industrial automation and robotics account for over 50% of global gearbox and gear motor demand. Material handling, conveyors, and automated machinery represent 30% of applications, while robotics contributes 20%. Asia Pacific leads with 38% market share due to strong manufacturing expansion in China, India, and Southeast Asia. Europe contributes 30%, emphasizing automotive, packaging, and assembly line automation. North America accounts for 25%, driven by smart factory deployments. Helical and planetary gear motors dominate with 55% adoption due to high torque and efficiency. Rising investments in industrial automation, robotics, and energy-efficient manufacturing continue to strengthen market growth globally.

Advancements in gear motor technology are improving torque density, energy efficiency, and compactness. Helical and planetary designs provide 10–15% higher efficiency compared to traditional worm gears. Compact gear motors reduce installation space by 20–25% and enable integration in robotics and automated machinery. Europe focuses on high-precision, energy-efficient motors for automotive and packaging industries. North America emphasizes durable, low-maintenance gear motors for industrial applications. Asia Pacific prioritizes cost-effective solutions to support rapid automation adoption. Innovations in materials, lubrication, and modular designs enhance service life by 15–20%, reduce operational downtime, and optimize energy consumption, driving adoption across manufacturing, logistics, and automation applications worldwide.

Automotive, packaging, and material handling applications are driving market growth. Automotive contributes 28% of global demand for assembly line drives, steering systems, and powertrain components. Packaging machinery represents 22% of applications, emphasizing conveyors, labeling, and filling systems. Material handling equipment accounts for 20%, including cranes, conveyors, and forklifts. Asia Pacific dominates with 38% share due to large-scale manufacturing and warehouse automation. Europe contributes 30%, focusing on automotive and packaging machinery. North America emphasizes material handling and robotics. Expanding applications across industrial machinery, warehouse automation, and vehicle assembly continue to increase demand for gearboxes and gear motors globally.

Gearbox and gear motor adoption faces challenges due to high initial costs and periodic maintenance requirements. Industrial-grade gear motors cost between USD 1,200–8,500 per unit depending on type and torque. Lubrication, inspection, and part replacement increase operational expenses by 10–15% annually. Noise and vibration management in high-speed applications require specialized design and installation. Supply chain constraints for high-grade alloy steels and precision components affect production timelines. Manufacturers address challenges through modular, energy-efficient designs and predictive maintenance systems. Despite improvements, capital intensity, maintenance complexity, and supply chain dependencies remain key barriers to widespread adoption globally.

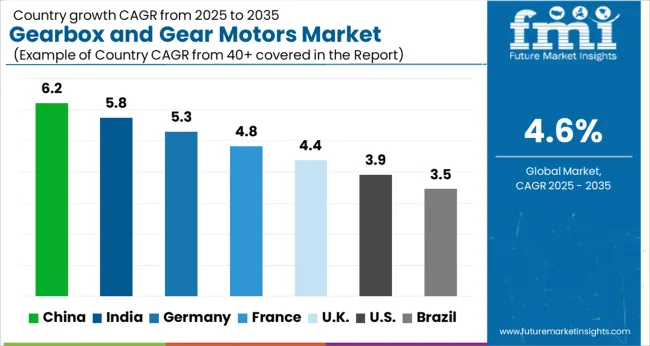

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

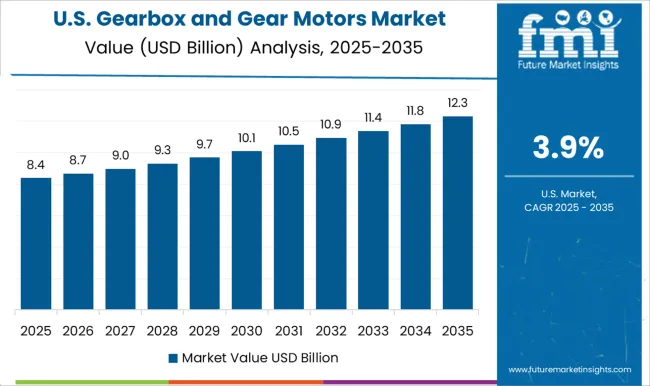

| USA | 3.9% |

| Brazil | 3.5% |

The gearbox and gear motors market is projected to grow at a global CAGR of 4.6% through 2035, driven by rising demand in industrial automation, automotive applications, and machinery manufacturing. China leads at 6.2%, 35% above the global benchmark, supported by BRICS-driven expansion in automotive production, industrial equipment manufacturing, and adoption of precision gear systems. India follows at 5.8%, 26% above the global average, reflecting increasing industrial automation, machinery upgrades, and growth in automotive and manufacturing sectors. Germany records 5.3%, 15% above the benchmark, shaped by OECD-driven innovation in high-performance gear systems, robotics, and industrial machinery. The United Kingdom posts 4.4%, 4% below the global rate, influenced by selective adoption in specialized machinery, automotive, and industrial applications. The United States stands at 3.9%, 15% below the benchmark, with steady uptake in automation, industrial machinery, and niche automotive sectors. BRICS economies drive volume growth, OECD countries emphasize performance, precision, and technological advancement, while ASEAN nations contribute through expanding industrial and manufacturing infrastructure.

The gearbox and gear motors market in China is projected to expand at a CAGR of 6.2%, above the global CAGR of 4.6%, driven by increasing industrial automation and growth in manufacturing sectors including automotive, electronics, and heavy machinery. In 2024, production capacity in Jiangsu, Guangdong, and Zhejiang provinces rose by 14%, supporting both domestic consumption and export demand. Leading domestic and multinational suppliers, including Bonfiglioli, SEW-EURODRIVE, and Nidec, focused on high-efficiency and compact gear motors tailored for smart manufacturing systems. Adoption of energy-efficient and digitally integrated solutions is rising as manufacturers seek to optimize operational productivity.

The gearbox and gear motors market in India is expected to grow at a CAGR of 5.8%, above the global CAGR of 4.6%, driven by rising demand in automotive, material handling, and processing industries. In 2024, installations rose by 12%, particularly in industrial hubs such as Pune, Chennai, and Ahmedabad. Domestic manufacturers like Bharat Gears and Bosch Rexroth India, alongside international players, provided modular gear motor solutions designed for energy efficiency and durability. Demand was reinforced by increased deployment in conveyor systems, industrial robots, and automated assembly lines.

The gearbox and gear motors industry in Germany is projected to grow at a CAGR of 5.3%, above the global CAGR of 4.6%, driven by adoption in automotive, mechanical engineering, and renewable energy sectors. In 2024, installations increased by 10%, with focus on precision-engineered high-torque gearboxes and energy-efficient motors. Companies such as SEW-EURODRIVE, Wittenstein, and Siemens supplied customized solutions for automation and heavy industrial applications. Demand is influenced by stringent energy efficiency standards and advanced manufacturing technologies.

The gearbox and gear motors market in the United Kingdom is projected to grow at a CAGR of 4.4%, slightly below the global CAGR of 4.6%, with steady adoption in industrial automation and automotive applications. In 2024, market growth reached 8%, with production and deployment concentrated in the Midlands and Northern industrial hubs. Suppliers such as SEW-EURODRIVE UK and Nidec offered compact and modular gear motors, focusing on efficiency and reduced maintenance requirements. Demand is influenced by replacement projects and retrofitting older industrial systems.

The gearbox and gear motors market in the United States is projected to grow at a CAGR of 3.9%, below the global CAGR of 4.6%, reflecting a mature industrial sector with steady replacement and upgrade demand. In 2024, installations grew by 7%, particularly in automotive, food processing, and packaging machinery. Key players including Baldor Electric, SEW-EURODRIVE, and Bonfiglioli provided energy-efficient and high-durability gear motor systems. Market expansion is primarily driven by industrial modernization and automation projects in established manufacturing hubs.

Competition in the gearbox and gear motors market is being shaped by efficiency, torque performance, and adaptability to industrial automation, robotics, and material handling applications. Market positions are being maintained through certified products, technical support, and extensive distribution networks that ensure availability for diverse industrial sectors. Siemens AG is being represented with precision-engineered gear motors optimized for automation and manufacturing processes, while ABB is being promoted with modular gear units designed for heavy-duty operations. Bonfiglioli S.p.A. is being applied with planetary and helical gearboxes structured for high torque and reliability. Dunkermotoren is being showcased with compact, high-efficiency motors suited for robotics and medical devices. Elecon Engineering Co. Ltd. is being recognized with industrial gear solutions designed for process and heavy machinery. Flender International GmbH is being advanced with robust gear systems optimized for energy, mining, and steel applications. NGL is being promoted with customized gear solutions tailored for regional industrial needs. Nidec Corporation is being applied with precision gear motors for electronics, automation, and transport applications. NORD Drivesystems Group is being represented with modular drive solutions designed for flexibility and long service life.

Portescap is being highlighted with miniature and high-speed motors engineered for medical, automation, and robotics sectors. Regal Rexnord Corporation is being advanced with heavy-duty gear systems designed for industrial reliability. SEW-EURODRIVE GmbH & Co. KG is being applied with integrated drive solutions optimized for manufacturing automation. Shanthi Gears Limited is being promoted with industrial gearboxes structured for power transmission efficiency. Sumitomo Heavy Industries Ltd. is being showcased with planetary and helical gear systems engineered for high-load performance. Top Gear Transmissions is being recognized with custom and standard gear solutions for industrial applications. Strategies are being directed toward product innovation, energy efficiency improvement, and expansion of service and support networks. Research and development efforts are being allocated to enhance torque capacity, motor efficiency, noise reduction, and modularity.

| Item | Value |

|---|---|

| Quantitative Units | USD 20.1 Billion |

| Type | Helical Gear, Planetary Gear, Bevel Gear, Worm Gear, and Others |

| Product Type | Gearbox and Gear Motor Unit |

| Rated Power | 7.5 kW to 75 kW, Up to 7.5 kW, and Above 75 kW |

| End Use Industry | Material Handling, Automotive, Food and Beverages, Medical, Wind Power, Metals and Mining, and Others |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens AG, ABB, Bonfiglioli S.p.A., Dunkermotoren, Elecon Engineering Co. Ltd., Flender International GmbH, NGL, Nidec Corporation, NORD Drivesystems Group, Portescap, Regal Rexnord Corporation, SEW-EURODRIVE GmbH & Co. KG, Shanthi Gears Limited, Sumitomo Heavy Industries Ltd., and Top Gear Transmissions |

| Additional Attributes | Dollar sales by gearbox and gear motor type and end use, demand dynamics across automotive, industrial, and robotics sectors, regional trends in automation and machinery adoption, innovation in efficiency, torque, and compact design, environmental impact of production and disposal, and emerging use cases in electric vehicles and smart manufacturing. |

The global gearbox and gear motors market is estimated to be valued at USD 20.1 billion in 2025.

The market size for the gearbox and gear motors market is projected to reach USD 31.5 billion by 2035.

The gearbox and gear motors market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in gearbox and gear motors market are helical gear, planetary gear, bevel gear, worm gear and others.

In terms of product type, gearbox segment to command 54.2% share in the gearbox and gear motors market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rail Gearbox Market Size and Share Forecast Outlook 2025 to 2035

Automatic Gearbox Valves Market Growth - Trends & Forecast 2025 to 2035

Precision Gearbox Machinery Market Trends and Forecast 2025 to 2035

Industrial Gearbox Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Gearbox Market Growth - Trends & Forecast 2025 to 2035

Industrial Planetary Gearbox Market Analysis & Forecast 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA