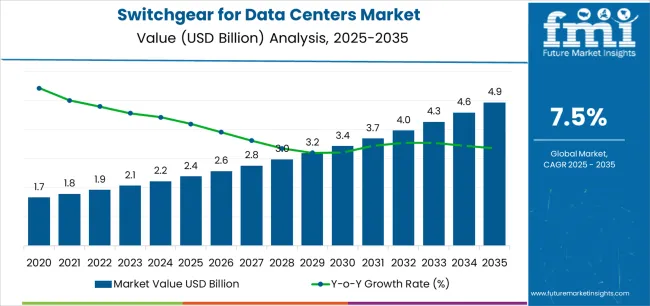

The global switchgear for data centers market is projected to grow from USD 2,390.6 million in 2025 to approximately USD 4,927.1 million by 2035, recording an absolute increase of USD 2,536.5 million over the forecast period. This translates into a total growth of 106.1%, with the market forecast to expand at a compound annual growth rate (CAGR) of 7.5% between 2025 and 2035.

The overall market size is expected to grow by nearly 2.1X during the same period, supported by increasing global demand for reliable power distribution infrastructure, growing adoption of cloud computing and digital transformation initiatives driving data center construction, and rising requirements for mission-critical power systems across hyperscale facilities, colocation providers, and enterprise data centers driven by exponential data generation, artificial intelligence workload expansion, and edge computing proliferation requiring robust electrical infrastructure supporting uninterrupted operations and scalable capacity.

The market's exceptional expansion trajectory reflects fundamental shifts in digital infrastructure requirements, with data centers serving as critical backbone supporting global digitalization across industries including cloud services, financial technology, e-commerce, social media platforms, and enterprise applications requiring 99.999% uptime reliability. Modern switchgear systems provide essential functions including power distribution, circuit protection, load management, and electrical isolation enabling safe maintenance while maintaining operational continuity across redundant power paths.

The hyperscale data center boom driven by technology giants including Amazon Web Services, Microsoft Azure, Google Cloud, and emerging regional cloud providers creates sustained demand for megawatt-scale electrical infrastructure incorporating advanced switchgear solutions managing power densities reaching 20-40 kW per rack in high-performance computing environments. Additionally, the edge computing revolution distributing computational resources closer to end users requires proliferation of smaller data centers and micro facilities demanding compact, efficient switchgear systems supporting distributed infrastructure deployment across telecommunications towers, retail locations, and industrial facilities.

Regional market dynamics reveal accelerating investment across both established data center markets and emerging digital infrastructure hubs, with North America maintaining leadership through hyperscale facility concentration, comprehensive colocation market maturity, and enterprise data center modernization supporting sustained switchgear procurement across Virginia, Silicon Valley, and emerging markets including Phoenix and Atlanta. Europe demonstrates strong growth through GDPR-driven data sovereignty requirements, renewable energy integration, and Frankfurt, London, Amsterdam regional hub development.

Asia Pacific exhibits the strongest expansion potential driven by explosive cloud adoption in China and India, government digitalization initiatives, and expanding internet user populations creating unprecedented data center construction activity across Singapore, Hong Kong, Mumbai, and secondary cities. The competitive landscape intensifies as established electrical equipment manufacturers including Schneider Electric, Eaton, Hitachi Energy (ABB), Mitsubishi Electric, and Siemens compete through comprehensive power management portfolios, proven reliability track records, and integrated solutions spanning switchgear, UPS systems, and monitoring platforms, while regional manufacturers challenge incumbents with cost-competitive alternatives and localized service support.

Technology development focuses on intelligent switchgear incorporating digital monitoring, predictive maintenance capabilities, and remote management features supporting operational efficiency, modular designs enabling rapid deployment and scalability, and arc-resistant construction ensuring personnel safety during fault conditions critical in occupied data center environments requiring continuous human oversight.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2,390.6 million |

| Market Forecast Value (2035) | USD 4,927.1 million |

| Forecast CAGR (2025-2035) | 7.5% |

| DIGITAL INFRASTRUCTURE EXPANSION | TECHNOLOGY & EFFICIENCY DRIVERS | RELIABILITY & COMPLIANCE FACTORS |

|---|---|---|

| Cloud Computing Growth Explosive expansion of cloud service adoption across enterprises, governments, and consumers driving hyperscale data center construction by major providers requiring megawatt-scale electrical infrastructure with advanced switchgear systems managing massive power distribution requirements. AI and Machine Learning Workloads Exponential growth in artificial intelligence training and inference applications requiring high-density computing infrastructure with power demands reaching 40+ kW per rack necessitating robust electrical distribution and protection systems. Edge Computing Proliferation Distributed computing architecture evolution positioning computational resources closer to end users driving proliferation of smaller edge data centers requiring compact, efficient switchgear solutions supporting decentralized infrastructure deployment. | Intelligent Monitoring Integration Advanced digital switchgear incorporating sensors, connectivity, and analytics enabling predictive maintenance, real-time performance monitoring, and remote management supporting operational efficiency and reducing unplanned downtime risks. Modular Design Advantages Pre-engineered, factory-tested switchgear modules enabling rapid deployment, simplified installation, and scalable capacity expansion supporting accelerated construction timelines and phased build-out strategies optimizing capital deployment. Energy Efficiency Requirements Growing emphasis on data center power efficiency and sustainability driving adoption of modern switchgear with reduced losses, improved cooling efficiency, and optimized power distribution supporting PUE (Power Usage Effectiveness) optimization objectives. | Uptime Requirements Mission-critical applications demanding 99.999% availability requiring redundant power infrastructure with reliable switchgear systems ensuring seamless failover, maintenance bypass capabilities, and fault isolation preventing cascading failures across electrical distribution. Safety Standards Stringent electrical safety regulations and industry standards including arc flash protection, personnel safety requirements, and arc-resistant construction mandating advanced switchgear designs protecting operations staff and facility infrastructure. Compliance Mandates Industry-specific regulations including financial sector resilience requirements, healthcare data protection standards, and government security specifications driving certified, validated switchgear systems meeting comprehensive compliance frameworks. |

| Category | Segments Covered |

|---|---|

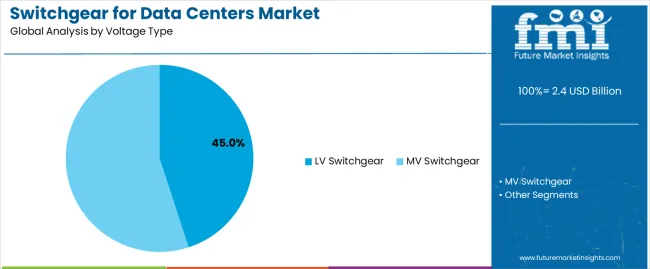

| By Voltage Type | LV Switchgear, MV Switchgear |

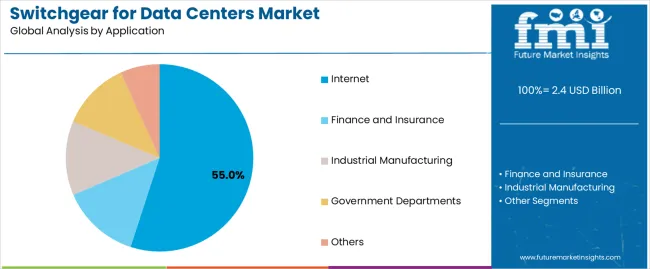

| By Application | Internet, Finance and Insurance, Industrial Manufacturing, Government Departments, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| LV Switchgear (Low Voltage) |

Dominant segment representing critical infrastructure for power distribution at utilization voltages (400-480V) feeding server racks, cooling equipment, and facility systems across data center operations. Comprehensive deployment throughout facilities from main distribution boards to remote power panels and rack-level power distribution units requiring extensive switchgear quantities per megawatt capacity. Modern intelligent LV switchgear incorporating circuit breakers, monitoring sensors, and communication capabilities enabling granular visibility into power consumption, load balancing, and circuit health supporting proactive management. Momentum: strong growth through 2035 driven by increasing data center construction activity, higher power densities requiring enhanced distribution infrastructure, and retrofit modernization of legacy facilities upgrading aging electrical systems. Innovation focus on compact designs maximizing power density in space-constrained environments, intelligent monitoring providing circuit-level visibility and predictive maintenance capabilities, and modular construction enabling rapid deployment and future expansion flexibility. Arc-resistant designs protecting personnel during maintenance operations and fault conditions. Watchouts: complexity managing hundreds of circuits across large facilities requiring comprehensive monitoring and management systems, skilled labor requirements for installation and maintenance, thermal management challenges as power densities increase requiring enhanced cooling strategies. |

| MV Switchgear (Medium Voltage) |

Critical segment managing utility interconnection and primary power distribution at transmission voltages (11-35kV) feeding data center main transformers and providing redundant utility feeds ensuring power supply reliability. Typically deployed at facility entry points in dedicated electrical rooms housing utility metering, main circuit breakers, and transformer connections. Smaller quantities per facility compared to LV switchgear but representing significant capital investment and critical single points of failure requiring maximum reliability and redundancy. Momentum: moderate-to-strong growth aligned with hyperscale facility construction and multi-megawatt capacity expansions requiring utility-grade infrastructure. Technology advancement in gas-insulated switchgear (GIS) providing compact footprint and enhanced reliability compared to air-insulated alternatives. Growing adoption of ring bus configurations and multiple utility feeds ensuring N+1 or 2N redundancy for mission-critical applications. Watchouts: limited supplier base for high-reliability MV equipment creating supply chain dependencies, extended lead times for custom-engineered solutions affecting project schedules, higher skill requirements for installation and maintenance compared to LV systems, utility coordination complexity affecting interconnection timelines. |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Internet |

Dominant application segment encompassing cloud service providers, content delivery networks, social media platforms, and internet infrastructure companies operating hyperscale data centers with massive electrical loads ranging from 10-200+ MW per facility. Major cloud providers including AWS, Microsoft Azure, Google Cloud, and regional players driving sustained construction activity across primary and secondary markets globally. Highest power density requirements with AI/ML workloads pushing rack-level loads to 40-50 kW necessitating robust electrical infrastructure and advanced switchgear systems. Momentum: strong growth through 2035 driven by continued cloud migration, streaming media consumption, social platform expansion, and AI application proliferation. Technology requirements emphasizing reliability, scalability, and intelligent monitoring supporting operational excellence across geographically distributed facility portfolios. Procurement at massive scale creating opportunities for standardized solutions, long-term supply agreements, and strategic partnerships. Watchouts: intense competition among suppliers driving margin pressure, demanding service level requirements, consolidation reducing customer diversification. |

| Finance and Insurance |

Premium segment representing financial institutions, insurance companies, trading platforms, and fintech companies operating mission-critical data centers supporting transaction processing, risk management, and customer-facing applications requiring absolute reliability and regulatory compliance. Highest uptime requirements exceeding 99.999% availability necessitating fully redundant electrical infrastructure with 2N or 2N+1 configurations eliminating single points of failure. Comprehensive compliance requirements including financial sector regulations, data protection mandates, and audit standards influencing equipment selection and documentation requirements. Momentum: moderate-to-strong growth driven by digital banking expansion, fintech innovation, algorithmic trading infrastructure, and regulatory requirements mandating resilient infrastructure. Emphasis on proven reliability, certified compliance, and comprehensive testing protocols. Geographic concentration in financial centers including New York, London, Hong Kong, and Singapore. Watchouts: conservative procurement approaches favoring established suppliers with proven track records, extended qualification and testing processes, stringent security and access control requirements affecting installation and service. |

| Industrial Manufacturing |

Growing segment encompassing manufacturers implementing Industry 4.0 initiatives, IIoT (Industrial Internet of Things) platforms, and enterprise resource planning systems requiring reliable on-premise data center infrastructure supporting production systems, supply chain management, and operational technology applications. Mission-critical nature of manufacturing operations requiring high availability supporting continuous production processes where downtime results in significant financial losses and operational disruptions. Hybrid infrastructure combining edge computing at factory floors with centralized data centers requiring distributed electrical infrastructure and switchgear deployments. Momentum: moderate growth driven by industrial digitalization, smart manufacturing adoption, and supply chain visibility requirements. Technology requirements emphasizing ruggedized construction for industrial environments, integration with existing electrical infrastructure, and cost-effective solutions supporting capital efficiency objectives. Watchouts: budget constraints compared to internet and financial segments, longer procurement cycles involving multiple stakeholders, diverse technical requirements across manufacturing sectors. |

| Government Departments |

Specialized segment encompassing federal, state, and local government agencies operating data centers supporting citizen services, national security applications, public safety systems, and administrative functions requiring secure, compliant infrastructure meeting government procurement standards. Stringent security requirements including physical access controls, cybersecurity specifications, and personnel clearance mandates influencing facility design and equipment selection. Compliance complexity with government-specific standards, domestic content requirements, and procurement regulations affecting supplier eligibility and bidding processes. Momentum: steady growth driven by digital government initiatives, public cloud adoption, and legacy system modernization programs. Emphasis on security certifications, domestic manufacturing preferences in certain jurisdictions, and lifecycle cost optimization. Federal agencies and defense departments represent premium segment with highest security and reliability requirements. Watchouts: complex procurement processes involving lengthy qualification and bidding cycles, budget uncertainties affected by governmental funding processes, political considerations influencing project timelines. |

| Others |

Diverse application category encompassing healthcare providers, educational institutions, telecommunications operators, media companies, and enterprise corporations operating data centers supporting organizational operations and customer-facing applications. Healthcare segment requiring HIPAA-compliant infrastructure supporting electronic health records, medical imaging, and telemedicine applications with high availability requirements. Educational institutions operating research computing facilities, student information systems, and distance learning platforms. Telecommunications companies managing network operations centers, service platforms, and enterprise communication services. Momentum: selective growth in specific segments with higher-education research computing, healthcare digitalization, and telecom infrastructure expansion driving opportunities. Technology requirements varying by sector with healthcare emphasizing compliance, education balancing performance and budget constraints, and telecom focusing on carrier-grade reliability. Watchouts: fragmented market with diverse purchasing authorities and procurement approaches, varying budget availability across sectors, competitive intensity across multiple market segments. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Hyperscale Construction Boom Sustained investment in hyperscale data center construction by major cloud providers and internet companies driving unprecedented demand for megawatt-scale electrical infrastructure with comprehensive switchgear requirements across primary and secondary markets globally. Digital Transformation Acceleration Enterprise digital transformation initiatives driving data center modernization, capacity expansion, and new facility construction requiring electrical infrastructure upgrades and advanced switchgear systems supporting increased computational requirements and application portfolios. 5G and Edge Computing Telecommunications infrastructure evolution with 5G network deployment and edge computing architecture driving proliferation of distributed micro data centers requiring compact switchgear solutions supporting decentralized infrastructure across thousands of locations. | High Capital Investment Substantial upfront costs for advanced switchgear systems, associated infrastructure, and installation services creating financial barriers particularly for smaller operators and emerging market deployments with limited capital access. Supply Chain Constraints Global electrical equipment supply chain challenges including component shortages, manufacturing capacity limitations, and extended lead times affecting project schedules and potentially delaying data center construction and expansion initiatives. Skilled Labor Shortage Limited availability of qualified electrical engineers, technicians, and installation specialists with data center expertise constraining implementation capacity and potentially impacting project timelines and commissioning quality. | Intelligent Switchgear Evolution Integration of IoT sensors, connectivity platforms, and analytics capabilities enabling predictive maintenance, real-time monitoring, and remote management supporting operational efficiency and reducing unplanned downtime through proactive intervention. Sustainability Focus Growing emphasis on energy efficiency, renewable energy integration, and carbon footprint reduction driving adoption of low-loss switchgear designs, improved cooling strategies, and power distribution optimization supporting corporate sustainability commitments. Prefabricated Modules Increased adoption of factory-built, pre-tested electrical modules including integrated switchgear, transformers, and distribution equipment enabling accelerated deployment, improved quality control, and simplified field installation reducing construction timelines. Digitalization Integration Convergence of physical electrical infrastructure with digital management platforms incorporating building management systems, DCIM software, and cloud-based monitoring enabling holistic facility management and data-driven optimization strategies. |

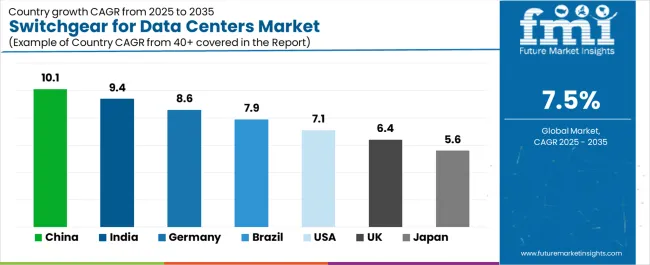

| Country | CAGR (2025-2035) |

|---|---|

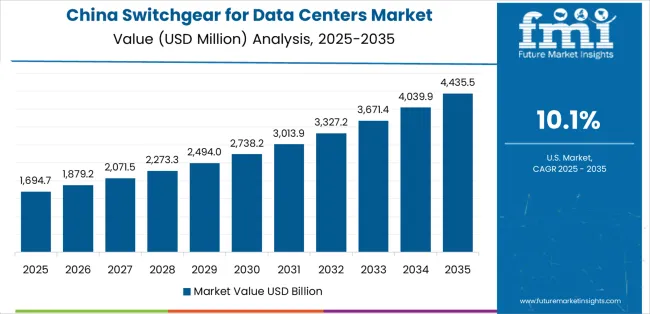

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| Brazil | 7.9% |

| United States | 7.1% |

| United Kingdom | 6.4% |

| Japan | 5.6% |

Revenue from Switchgear for Data Centers in China is projected to exhibit exceptional growth with a market value of USD 1,286.4 million by 2035, driven by explosive cloud computing adoption, government digitalization initiatives, and massive data center construction activity across Beijing, Shanghai, Guangzhou, and emerging tier-2 cities creating unprecedented demand for electrical infrastructure. The country's position as global manufacturing hub, expanding middle-class internet consumption, and technology company growth including Alibaba Cloud, Tencent Cloud, and Huawei Cloud drive sustained facility development. Government policies promoting digital economy development and new infrastructure initiatives explicitly supporting data center construction facilitate investment and streamlined approvals.

Internet company expansion and cloud service proliferation require hyperscale facilities with megawatt-scale electrical capacity incorporating advanced switchgear systems. Artificial intelligence development and high-performance computing initiatives including autonomous driving research, facial recognition platforms, and industrial AI applications create high-density computing requirements. Domestic electrical equipment manufacturers developing competitive alternatives alongside international suppliers create dynamic market with diverse options across price and specification ranges. Belt and Road digital infrastructure initiatives extend Chinese data center expertise and equipment to regional markets creating export opportunities.

Revenue from Switchgear for Data Centers in India is expanding to reach USD 1,124.8 million by 2035, supported by explosive cloud services growth, government Digital India initiatives, and expanding internet user base exceeding 800 million creating sustained demand for data center infrastructure across Mumbai, Delhi NCR, Bangalore, Chennai, and Hyderabad markets. Major international cloud providers establishing regional presence combined with domestic players including Reliance Jio, Tata Communications, and emerging operators drive construction activity. Foreign direct investment in data center sector and government policies supporting digital infrastructure development facilitate market expansion.

Financial technology explosion, digital payments proliferation, and banking digitalization require robust data center infrastructure with reliable electrical systems. Government cloud initiatives, smart city programs, and e-governance platforms drive public sector data center requirements. Manufacturing digitalization and Industry 4.0 adoption create enterprise data center demand. Tier-2 city expansion including Pune, Ahmedabad, and Kolkata creates geographic diversification beyond traditional metros. International suppliers and emerging domestic manufacturers compete across segments with localized service support proving critical differentiator in geographically diverse market.

Demand for Switchgear for Data Centers in Germany is projected to reach USD 1,024.6 million by 2035, supported by Frankfurt's position as European data center hub, comprehensive data sovereignty requirements under GDPR, and strong emphasis on energy efficiency and sustainability driving adoption of advanced electrical infrastructure. German data center market characterized by colocation provider strength, financial sector requirements, and stringent quality standards. The market emphasizes renewable energy integration, waste heat recovery, and optimized power distribution supporting ambitious carbon reduction targets.

Hyperscale facility expansion by international cloud providers establishing European operations combined with established colocation operators including Equinix, Digital Realty, and regional players drive sustained electrical infrastructure investment. Financial services concentration in Frankfurt creates premium segment with highest reliability requirements. Automotive industry digitalization, manufacturing automation, and Industry 4.0 initiatives drive enterprise data center development. Regulatory environment emphasizing energy efficiency through incentive programs and reporting requirements influences equipment selection toward high-efficiency switchgear solutions. Domestic manufacturing strength through Siemens and regional suppliers supports local production and service capabilities.

Revenue from Switchgear for Data Centers in Brazil is growing to reach USD 936.8 million by 2035, driven by expanding cloud services adoption, growing internet penetration, and São Paulo's emergence as Latin American data center hub serving regional markets. The country's large population, developing digital economy, and foreign investment in data center infrastructure create growth opportunities. Government digitalization initiatives, financial technology expansion, and enterprise cloud migration drive facility requirements. Regional data sovereignty considerations favor in-country data storage supporting domestic facility development.

International colocation providers and cloud service companies establishing Brazilian presence to serve South American markets drive construction activity in São Paulo, Rio de Janeiro, and emerging markets. Financial sector digitalization and regulatory requirements mandate local data processing and storage. E-commerce growth and digital payment platforms require transaction processing infrastructure. Enterprise requirements across manufacturing, retail, and services sectors create diversified demand. Import duties and local content preferences influence procurement decisions favoring regional suppliers or domestic manufacturing partnerships. Currency fluctuations and economic volatility create market uncertainty affecting investment timing and equipment sourcing strategies.

Revenue from Switchgear for Data Centers in United States is projected to reach USD 856.4 million by 2035, driven by hyperscale facility concentration with major cloud providers operating massive campuses in Virginia, Oregon, Texas, and emerging markets, comprehensive colocation market maturity, and enterprise data center modernization supporting sustained electrical infrastructure procurement. The country's technology leadership, cloud service origination, and digital economy scale create unmatched data center development activity. Major metropolitan areas and strategic locations with available power, fiber connectivity, and tax incentives attract continued investment.

AWS, Microsoft Azure, Google Cloud, and emerging hyperscale operators drive sustained construction with individual facilities reaching 100-200+ MW electrical capacity. Colocation giants including Equinix, Digital Realty, and CyrusOne operate extensive portfolios requiring ongoing expansion and modernization. Edge computing proliferation supporting 5G networks, autonomous vehicles, and low-latency applications drives distributed infrastructure requiring switchgear across thousands of edge locations. Enterprise digital transformation and hybrid cloud adoption maintain on-premise data center relevance requiring infrastructure refresh and capacity expansion. Regulatory environment relatively favorable with state-level incentives attracting investment while federal proposals around energy efficiency and sustainability potentially influence future equipment specifications.

Demand for Switchgear for Data Centers in United Kingdom is projected to reach USD 782.6 million by 2035, expanding at a CAGR of 6.4%, driven by London's position as European financial center, established colocation market serving UK and European customers, and growing cloud region presence by international providers. Financial services concentration creates premium market segment with highest reliability and compliance requirements. Post-Brexit dynamics including data sovereignty considerations and European market access influence facility location decisions and capacity planning.

Slough, London, and emerging markets including Manchester host significant colocation and hyperscale capacity. Financial sector digitalization, trading platform infrastructure, and fintech innovation drive mission-critical data center requirements. Government cloud initiatives and public sector digitalization create opportunities in government segment. Renewable energy emphasis and carbon reduction commitments influence equipment selection toward energy-efficient solutions. Established electrical equipment suppliers maintain strong presence with proven track records serving UK market. Skilled labor availability and service support networks prove critical given operational complexity and uptime requirements.

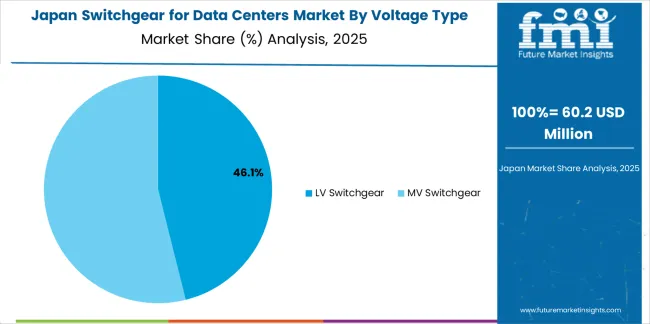

Demand for Switchgear for Data Centers in Japan is projected to reach USD 714.8 million by 2035, supported by advanced technological infrastructure, stringent quality requirements, and comprehensive disaster preparedness standards reflecting seismic risks and natural disaster considerations. Japanese data center market characterized by carrier-neutral facilities, telecommunications operator data centers, and enterprise infrastructure supporting domestic business operations. Tokyo region dominates with significant concentration while disaster recovery requirements drive geographic diversification.

Financial services institutions including banks, securities firms, and insurance companies maintain mission-critical infrastructure with highest reliability standards. Government e-services, healthcare digitalization, and enterprise cloud adoption drive diverse market segments. Earthquake engineering requirements influence facility design and equipment specifications with seismic certification mandatory. Energy efficiency emphasis driven by high electricity costs and environmental considerations. Domestic suppliers including Mitsubishi Electric alongside international manufacturers compete with preference for proven reliability and local service support. Conservative procurement approaches favor established suppliers with comprehensive track records and responsive technical support capabilities.

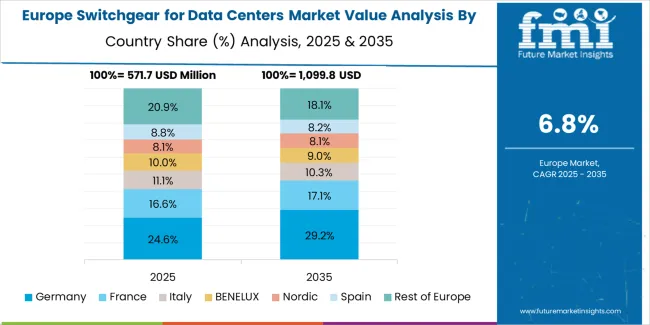

The switchgear for data centers market in Europe is projected to grow from USD 724.6 million in 2025 to USD 1,346.8 million by 2035, registering a CAGR of 6.4% over the forecast period. Germany is expected to maintain its leadership position with a 36.2% market share in 2025, projected to reach 37.8% by 2035, supported by Frankfurt's dominant position as European data center hub, comprehensive data sovereignty framework under GDPR, and strong emphasis on energy efficiency and sustainability standards.

The United Kingdom follows with a 24.8% share in 2025, expected to reach 25.6% by 2035, driven by London financial center status, established colocation market, and cloud provider regional presence. France holds a 16.4% share in 2025, projected to reach 17.2% by 2035, supported by Paris data center market development, data sovereignty requirements, and government digitalization initiatives. Netherlands commands a 12.6% share benefiting from Amsterdam's connectivity hub status, while Ireland accounts for 7.4% in 2025 driven by favorable tax environment attracting hyperscale investment. The Rest of Europe region is anticipated to expand to 2.6% share by 2035, attributed to increasing data center development in Nordic countries, emerging Eastern European markets, and Southern European facilities serving regional requirements.

Japanese switchgear for data centers operations reflect the country's emphasis on equipment reliability, disaster resilience, and comprehensive quality management ensuring consistent performance across mission-critical infrastructure. Major electrical equipment manufacturers maintain rigorous design standards, extensive testing protocols, and proven track records serving Japanese data center operators with demanding uptime requirements. Seismic engineering requirements mandate earthquake-resistant construction and comprehensive certification processes ensuring equipment survival and operational continuity during natural disasters.

The Japanese market demonstrates unique requirements including compact equipment configurations optimized for space-constrained urban facilities, comprehensive redundancy and backup systems addressing disaster preparedness concerns, and integration capabilities with existing electrical infrastructure and building management systems. Equipment procurement emphasizes long-term reliability, manufacturer stability, and responsive local service support ensuring sustained technical assistance throughout extended equipment lifecycles.

Regulatory oversight establishes comprehensive electrical safety standards, building codes incorporating seismic requirements, and energy efficiency guidelines. Data center operators emphasize proven track records, reference installations, and comprehensive warranty and service agreements. Supplier relationships involve extensive pre-qualification processes, factory inspections, and ongoing performance monitoring. Conservative procurement approaches favor established manufacturers with demonstrated reliability and comprehensive support capabilities serving Japanese market requirements.

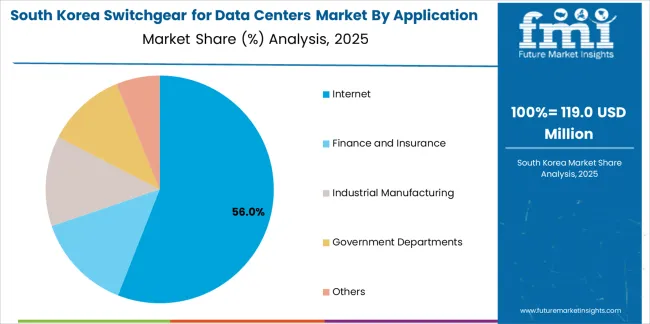

South Korean switchgear for data centers operations reflect the country's advanced digital infrastructure and growing data center market driven by cloud services expansion, 5G network deployment, and domestic technology company growth. Major telecommunications operators, internet companies, and colocation providers invest in comprehensive facility development supporting domestic market and regional expansion ambitions. Government smart city initiatives, digital transformation programs, and technology development policies create favorable environment for data center infrastructure investment.

The Korean market demonstrates growing sophistication with operators evaluating comprehensive electrical system capabilities, intelligent monitoring platforms, and integration with centralized facility management systems. Cloud provider expansion by international operators establishing Korean regions combined with domestic players including Naver Cloud, Kakao, and telecommunications operators drives construction activity. Financial services digitalization, government cloud adoption, and enterprise requirements create diversified demand across segments.

Regulatory frameworks establish electrical safety standards, energy efficiency requirements, and facility certification processes. Equipment procurement emphasizes performance validation, total cost of ownership analysis, and comprehensive service support. Domestic manufacturers and international suppliers compete through technology innovation, competitive pricing, and responsive local service networks. Skilled labor availability and technical training programs support market development addressing installation and maintenance requirements for sophisticated electrical infrastructure supporting mission-critical operations.

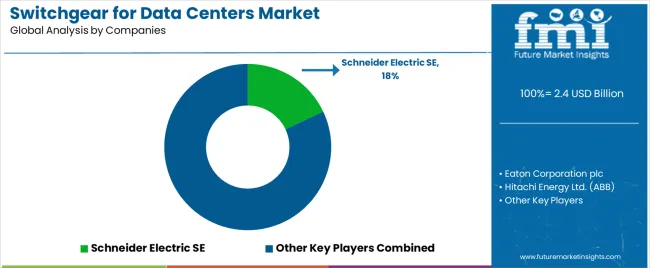

The switchgear for data centers market exhibits moderate-to-high concentration with established electrical equipment manufacturers including Schneider Electric, Eaton, Hitachi Energy (ABB), Mitsubishi Electric, and Siemens commanding significant share through comprehensive product portfolios, proven reliability track records, and integrated power infrastructure solutions spanning switchgear, UPS systems, power distribution, and monitoring platforms. Schneider Electric leads with 18% share. Profit pools concentrate in premium segments where intelligent features, arc-resistant construction, and comprehensive service support enable differentiation and justify price premiums over basic switchgear offerings, while long-term service contracts, monitoring subscriptions, and spare parts provision create recurring revenue streams beyond initial equipment sales.

Several competitive archetypes shape market dynamics: global electrical equipment conglomerates offering complete power infrastructure solutions leveraging extensive R&D capabilities, manufacturing scale, and worldwide service networks supporting multinational data center operators; specialized switchgear manufacturers focusing exclusively on electrical distribution and protection systems with deep engineering expertise and application-specific innovations; regional manufacturers serving local markets with cost-competitive alternatives, responsive service support, and localized manufacturing addressing import duties and domestic content preferences; and emerging companies developing next-generation platforms incorporating digitalization, predictive analytics, and sustainable technologies addressing evolving market requirements. Market success requires balancing product innovation with proven reliability addressing risk-averse data center operators, establishing comprehensive service networks supporting 24/7 operations and emergency response requirements, and building operator relationships through responsive technical support, training programs, and demonstrated performance supporting customer uptime objectives and accountability requirements.

Switching costs remain high as data center operators standardize on specific platforms for operational consistency, technician familiarity, and spare parts inventory optimization, while critical nature of electrical infrastructure creates risk aversion favoring proven suppliers with established track records. However, facility expansion phases, modernization initiatives, and competitive pressures create opportunities for supplier displacement when alternatives demonstrate compelling value propositions combining superior technology, competitive total cost of ownership, and comprehensive support capabilities. Consolidation continues as major players acquire specialized technologies, expand geographic footprints, and integrate complementary capabilities building comprehensive data center infrastructure ecosystems beyond isolated equipment offerings.

Innovation focus centers on intelligent switchgear incorporating IoT sensors, connectivity platforms, and analytics capabilities enabling predictive maintenance, real-time monitoring, and remote management supporting operational efficiency and reducing unplanned downtime, modular pre-fabricated systems enabling rapid deployment, factory testing, and simplified field installation supporting accelerated construction timelines and consistent quality delivery, and arc-resistant designs enhancing personnel safety during maintenance operations and fault conditions critical in continuously-staffed data center environments. Sustainability integration including energy efficiency optimization, SF6-free gas insulation alternatives, and recyclable materials addresses environmental concerns and corporate sustainability commitments. Service model evolution toward comprehensive lifecycle management including preventive maintenance, emergency response guarantees, and performance optimization creates differentiated value propositions supporting customer retention and recurring revenue generation beyond transactional equipment sales.

| Items | Values |

|---|---|

| Quantitative Units | USD 2,390.6 million |

| Voltage Type | LV Switchgear, MV Switchgear |

| Application | Internet, Finance and Insurance, Industrial Manufacturing, Government Departments, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | United States, Germany, United Kingdom, France, Brazil, China, India, Japan, South Korea, and other 40+ countries |

| Key Companies Profiled | Schneider Electric SE, Eaton Corporation plc, Hitachi Energy Ltd. (ABB), Mitsubishi Electric Corporation, Siemens AG, Guangzhou Baiyun Electric Equipment Co. Ltd., Guangdong Mingyang Electric Co. Ltd., Vertiv Holdings Co., TAKAOKA TOKO Co. Ltd., Anord Mardix (Legrand) |

| Additional Attributes | Dollar sales by voltage type/application, regional demand (NA, EU, APAC), competitive landscape, LV vs. MV switchgear adoption patterns, internet vs. enterprise application dynamics, and technology innovation driving intelligent monitoring, modular design, and sustainability integration supporting data center reliability, efficiency, and operational excellence |

The global switchgear for data centers market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the switchgear for data centers market is projected to reach USD 4.9 billion by 2035.

The switchgear for data centers market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in switchgear for data centers market are lv switchgear and mv switchgear.

In terms of application, internet segment to command 55.0% share in the switchgear for data centers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Switchgear Market Growth - Trends & Forecast 2025 to 2035

AC Switchgear Market Size and Share Forecast Outlook 2025 to 2035

DC Switchgear Market - Size, Share, and Forecast 2025 to 2035

Hybrid Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

DC Traction Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Paralleling Switchgear Market Growth – Trends & Forecast 2024-2034

Pad Mounted Switchgear Market Growth – Trends & Forecast 2024-2034

Utility Scale Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Switchgears (GIS) Market

AC Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Insulated Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Indoor Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Oil Insulated Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Air Insulated Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA