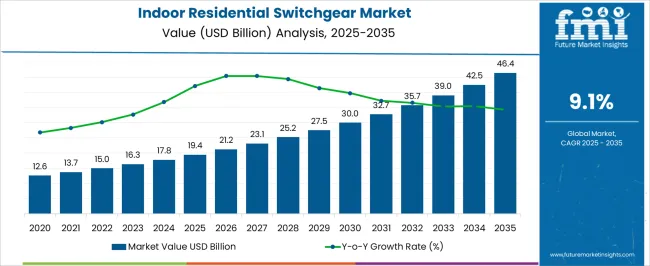

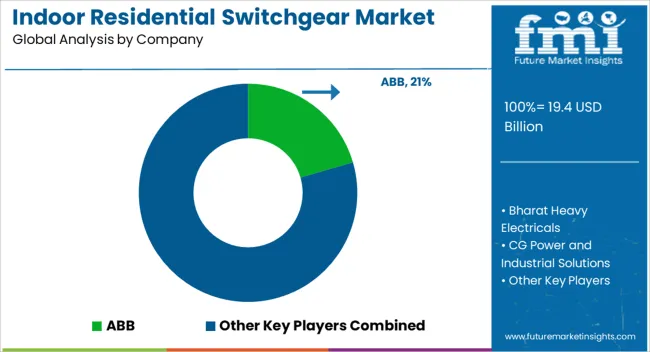

The indoor residential switchgear market is anticipated to be USD 19.4 billion in 2025 and projected to reach USD 46.4 billion by 2035, progressing at a CAGR of 9.1%. Seasonality and cyclicality in this sector are often dictated by construction cycles, housing starts, and renovation patterns, which peak during periods of stable economic conditions and government-backed infrastructure initiatives. Demand tends to accelerate in the first and third quarters of the year in most regions, coinciding with construction schedules and favorable weather for electrical installation projects.

Cyclicality becomes evident when real estate and residential investments fluctuate due to interest rates, mortgage lending policies, and broader economic outlook. Rising adoption of smart grids and energy-efficient housing codes introduces recurring peaks in demand, particularly when subsidy schemes and regulatory deadlines are announced. In markets such as Asia Pacific and parts of Europe, the industry also exhibits a strong correlation with energy transition policies, driving periodic surges in switchgear replacement and upgrades.

Manufacturers and distributors have responded by aligning inventory cycles with these peaks, ensuring quicker deliveries and adapting pricing models to capture seasonal demand. Over the next few years, the combination of retrofit momentum, housing expansion, and regulatory compliance is expected to create a structured but cyclically reinforced growth path for the indoor residential switchgear space.

| Metric | Value |

|---|---|

| Indoor Residential Switchgear Market Estimated Value in (2025 E) | USD 19.4 billion |

| Indoor Residential Switchgear Market Forecast Value in (2035 F) | USD 46.4 billion |

| Forecast CAGR (2025 to 2035) | 9.1% |

The indoor residential switchgear market is influenced by several interconnected parent markets that shape its long-term growth and adoption. The residential construction sector holds the largest share at nearly 40%, as switchgear is an essential element in new housing developments and large-scale residential complexes. The electrical components and wiring devices market contributes around 25%, since switchgear functions as part of the broader ecosystem of electrical distribution and safety equipment within households. The power distribution and utilities segment accounts for nearly 15%, given that local distribution companies and smart grid initiatives often integrate residential switchgear into broader infrastructure upgrades.

The industrial and light commercial building sector provides about 12%, particularly where mixed-use properties require advanced load management and compliance with safety codes. The remaining 8% comes from renovation and retrofit projects, where aging housing stock is upgraded with modern switchgear to meet updated regulatory and safety requirements. In my opinion, this layered share distribution highlights that the indoor residential switchgear market is strongly tied to housing growth but remains reinforced by its integration with utilities, wiring ecosystems, and retrofitting demand. Companies that focus on cost-efficient designs, digital monitoring features, and compliance-driven solutions are best positioned to secure long-term share across these parent markets.

The current market landscape is shaped by rising urbanization, the expansion of smart homes, and stricter electrical safety regulations.

These factors have heightened demand for switchgear products that ensure reliable power management and protection. Moreover, the shift towards renewable energy integration and the adoption of energy-efficient appliances are creating additional opportunities for advanced switchgear solutions.

The market is also benefiting from technological advancements that enhance the compactness and functionality of indoor switchgear, aligning with the spatial constraints of modern residences. Increasing infrastructure investments and the growing emphasis on electrical system modernization are expected to sustain the market’s upward trajectory.

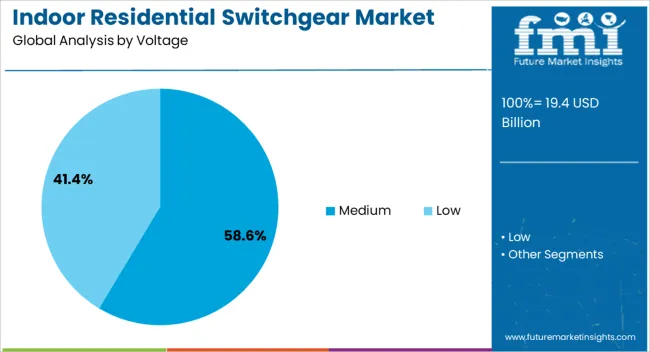

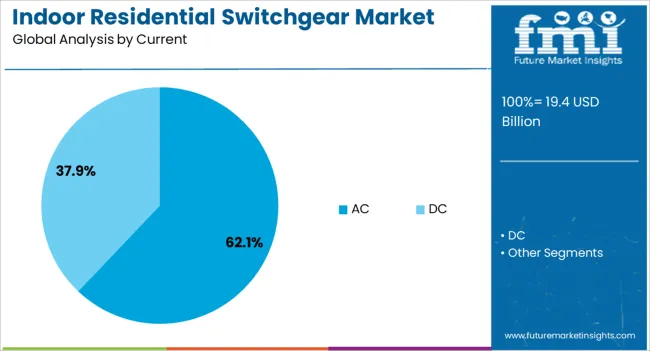

The indoor residential switchgear market is segmented by voltage, current, and geographic regions. By voltage, indoor residential switchgear market is divided into Medium and Low. In terms of current, indoor residential switchgear market is classified into AC and DC. Regionally, the indoor residential switchgear industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Medium Voltage category is projected to hold 58.6% of the Indoor Residential Switchgear market revenue share in 2025, establishing it as the leading segment by voltage type. This prominence is attributed to its optimal balance of power handling capacity and safety features suitable for residential applications.

Medium voltage switchgear is preferred for managing electricity distribution effectively in multi-dwelling units and residential complexes where higher power loads are encountered. The segment’s growth is also supported by regulatory frameworks promoting safer and standardized electrical installations.

Additionally, the compatibility of medium voltage switchgear with renewable energy sources and smart grid applications enhances its appeal The increasing requirement for reliable and scalable power distribution infrastructure in residential settings further drives the demand for this segment.

The AC current segment is expected to account for 62.1% of the Indoor Residential Switchgear market revenue share in 2025, making it the dominant current type in this market. The widespread use of alternating current in residential power systems is the fundamental reason behind this segment’s leading share.

AC switchgear solutions are favored due to their established infrastructure compatibility, efficiency in power distribution, and ease of integration with existing electrical networks. The segment’s growth has been reinforced by increasing investments in residential construction and modernization projects that prioritize reliable AC power management.

Furthermore, advancements in switchgear technology that improve safety, automation, and remote monitoring capabilities have encouraged the adoption of AC current products The segment’s ability to meet the evolving demands of residential energy consumption is expected to support sustained market growth.

Indoor residential switchgear growth is fueled by housing expansion, safety regulations, smart grid adoption, and competitive differentiation. Companies focusing on compliance, affordability, and connected solutions are set to strengthen their market positions.

Residential construction remains the leading driver for indoor switchgear adoption, with demand closely tied to housing starts, urban redevelopment programs, and smart housing initiatives. Builders are incorporating advanced switchgear solutions to comply with modern safety standards and ensure efficient load distribution. Growing household electrification, supported by rising use of HVAC, kitchen appliances, and home automation systems, has added to the need for high-capacity and reliable switchgear. Seasonal fluctuations in construction activity create periodic spikes in installation, but the overall trajectory shows steady expansion. Manufacturers are designing compact, modular products to fit space-constrained apartments, while also ensuring scalability for larger residential complexes that require advanced circuit protection.

Regulatory frameworks and safety codes significantly shape the indoor residential switchgear market, mandating strict compliance for installation in housing projects. Electrical safety regulations enforced by governments and municipal bodies ensure that switchgear products meet defined performance and protection standards. Builders and contractors prefer certified equipment to minimize liability risks, while homeowners increasingly demand products that deliver safety assurance. Periodic policy changes, such as mandatory adoption of energy-efficient systems or revised safety norms, directly impact procurement cycles. Certifications and regional compliance marks have therefore become differentiating factors for manufacturers. In regions where retrofitting is emphasized, strict regulations drive replacement demand, making regulatory influence one of the most consistent market accelerators.

The integration of residential electricity usage with broader smart grid initiatives has added a new dimension to switchgear demand. Indoor switchgear plays a critical role in balancing household energy loads and supporting demand-response programs initiated by utilities. Smart-ready switchgear models with monitoring features are being adopted to track consumption patterns and ensure seamless connection with distributed generation sources like rooftop solar. This linkage between utilities and households has created opportunities for manufacturers to introduce advanced systems tailored to connected living environments. Demand peaks during rollout of smart grid upgrades, showing how policy-driven adoption cycles influence purchase behavior. The result is a stronger connection between residential energy management and switchgear innovation.

Competition in the indoor residential switchgear market is defined by product reliability, cost efficiency, and value-added features such as modularity and smart connectivity. Large multinational players benefit from economies of scale and established distribution networks, while regional companies emphasize cost-effective products tailored to local compliance standards. Partnerships with construction firms, real estate developers, and utility providers are vital to ensuring consistent procurement streams. Differentiation increasingly relies on offering switchgear that integrates monitoring, safety, and energy management functions without compromising affordability. Companies investing in aftersales service networks and localized assembly are positioned to capture greater market share, as customer support and timely availability remain major decision-making criteria.

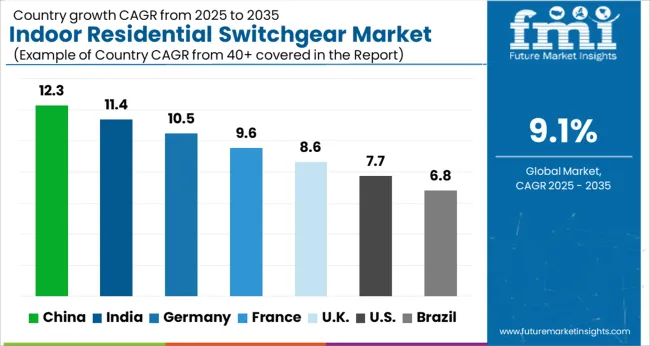

| Country | CAGR |

|---|---|

| China | 12.3% |

| India | 11.4% |

| Germany | 10.5% |

| France | 9.6% |

| UK | 8.6% |

| USA | 7.7% |

| Brazil | 6.8% |

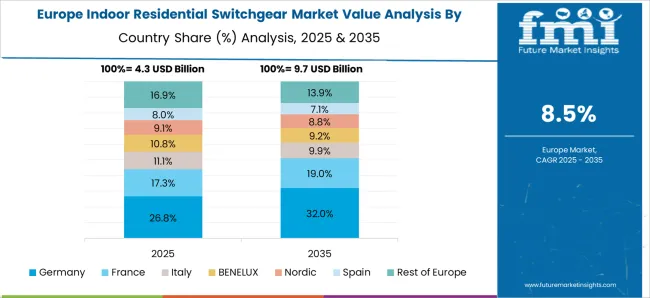

The global indoor residential switchgear market is projected to grow at a CAGR of 9.1% between 2025 and 2035. China leads with a 12.3% CAGR, supported by large-scale housing projects, retrofitting initiatives, and government-driven energy efficiency programs. India follows at 11.4%, driven by rapid residential electrification, affordable housing schemes, and expansion of smart city developments. Germany, at 10.5%, benefits from strict electrical safety regulations, structured renovation cycles, and integration of advanced energy management systems. France posts 9.6%, backed by housing modernization projects, increased adoption of compliant equipment, and grid upgrades for residential communities. The UK, growing at 8.6%, emphasizes retrofitting of old housing stock and compliance with efficiency-driven electrical codes. The USA, at 7.7%, continues to progress steadily, with demand centered on suburban housing replacements, state-level rebate programs, and smart-ready electrical installations. Asia remains the fastest-expanding region due to scale and construction intensity, while Europe and North America show consistent adoption through regulations and modernization cycles. The analysis spans 40+ countries, with the leading markets shown below.

The indoor residential switchgear market in China is projected to grow at a CAGR of 12.3% from 2025 to 2035, supported by rapid residential construction, government-backed housing projects, and large-scale retrofitting initiatives. National energy efficiency policies and strict electrical safety codes are pushing developers to adopt advanced switchgear solutions in both new and existing housing projects. Urban redevelopment schemes and large apartment complexes are driving steady demand, while smaller cities and rural areas are witnessing upgrades as electrification programs expand. Domestic manufacturers are investing in cost-competitive, compact, and modular designs to serve the growing market. In my opinion, China will remain the global leader in this industry, benefiting from scale, policy focus, and manufacturing capacity.

The indoor residential switchgear market in India is anticipated to expand at a CAGR of 11.4% from 2025 to 2035, supported by affordable housing programs, nationwide electrification drives, and ongoing smart city projects. Rising household incomes and increased urban migration are creating strong demand for reliable electrical infrastructure. Developers are incorporating certified switchgear into large housing societies and high-rise complexes to meet safety and efficiency requirements. Local suppliers are partnering with global firms to strengthen product availability and compliance with Indian standards. In my view, India’s large housing pipeline, combined with policy-driven electrification, positions it as one of the fastest-rising markets for residential switchgear worldwide.

The indoor residential switchgear market in France is forecast to grow at a CAGR of 9.6% from 2025 to 2035, supported by strong housing renovation activity, regulatory compliance measures, and modernization of aging electrical systems. France’s focus on energy efficiency in residential buildings has created consistent demand for switchgear replacement and upgrades. Public incentives for housing retrofits and integration of smart-ready systems further boost demand. French suppliers emphasize quality, compliance with EU directives, and durability, while imports from global brands complement domestic offerings. In my opinion, France represents a mature but steadily expanding market, shaped largely by regulation and renovation cycles rather than new housing development.

The indoor residential switchgear market in the UK is projected to grow at a CAGR of 8.6% between 2025 and 2035, driven by retrofitting of older housing stock, landlord compliance obligations, and efficiency-driven building codes. Housing associations and public authorities have adopted frameworks that mandate high-efficiency and safety-compliant switchgear installations. Demand is concentrated in retrofit programs, though new residential projects also provide steady growth. Domestic and European suppliers are tailoring products to meet specific UK regulations and preferences for modular, compact switchgear. In my view, the UK’s reliance on retrofits, along with its regulatory emphasis, ensures consistent but moderate expansion compared with high-growth Asian markets.

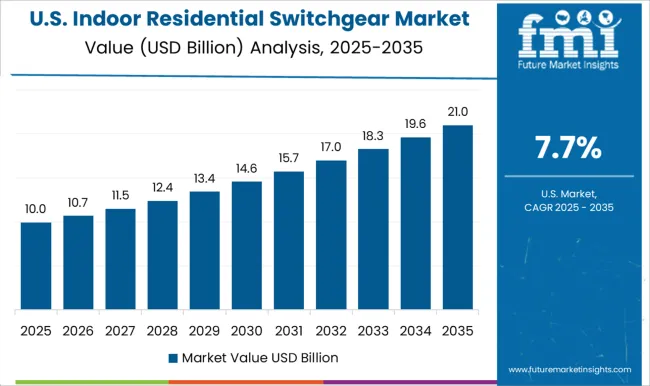

The indoor residential switchgear market in the USA is expected to increase at a CAGR of 7.7% from 2025 to 2035, supported by suburban housing replacements, smart-ready installations, and state-driven rebate programs. Demand is concentrated in the replacement cycle for aging electrical infrastructure in single-family homes, as well as retrofits in multifamily properties. Regional differences shape adoption, with stronger demand in states offering tax credits and efficiency incentives. Leading manufacturers emphasize advanced monitoring features, durable designs, and distribution through contractor networks and retail channels. In my opinion, the USA shows steady but moderate expansion, with growth shaped more by replacement and retrofit activity than large-scale new construction.

Competition in the indoor residential switchgear market is influenced by a blend of regulatory compliance, distributor reach, modularity of designs, and readiness for smart integration with modern energy systems. Global leaders such as ABB, Siemens, and Schneider Electric dominate with expansive portfolios, strong certification records, and extensive installer networks that allow them to win large residential development projects. Eaton and General Electric maintain solid market shares in North America through long-established contractor relationships and premium offerings suited for high-end households. Japanese companies including Mitsubishi Electric, Hitachi, Toshiba, and Fuji Electric deliver compact, reliable, and engineering-driven solutions that are particularly favored in multi-unit residential settings where space efficiency is critical. In Asia, HD Hyundai Electric and Hyosung Heavy Industries have expanded by leveraging cost-effective production and partnerships with major property developers. CHINT Group, with its aggressively priced products, has gained traction across emerging markets where affordability and compliance with local codes remain primary decision factors. Indian players like Bharat Heavy Electricals and CG Power and Industrial Solutions address domestic demand through localized manufacturing, ensuring adherence to BIS standards and timely supply for township projects. In Europe, Lucy Group and Ormazabal specialize in protection and distribution hardware optimized for compliance-heavy markets, while Skema has carved a niche with engineered switchgear panels for complex residential clusters. Looking ahead, brands that combine certified protection features such as arc-fault mitigation and surge resilience with ease of installation, compact enclosures, and digital monitoring will retain competitive advantage. Price discipline, responsive aftersales service, and consistent inventory availability will remain decisive factors, while new cross-sell opportunities are expected to emerge from HVAC electrification and residential EV charging integration.

| Item | Value |

|---|---|

| Quantitative Units | USD 19.4 Billion |

| Voltage | Medium and Low |

| Current | AC and DC |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Bharat Heavy Electricals, CG Power and Industrial Solutions, CHINT Group, Eaton, Fuji Electric, General Electric, HD Hyundai Electric, Hitachi, Hyosung Heavy Industries, Lucy Group, Mitsubishi Electric, Ormazabal, Schneider Electric, Siemens, Skema, and Toshiba |

| Additional Attributes | Dollar sales, share, growth projections, regulatory impacts, safety compliance trends, competitor positioning, regional demand shifts, pricing strategies, distribution channels, and retrofit versus new-build adoption. |

The global indoor residential switchgear market is estimated to be valued at USD 19.4 billion in 2025.

The market size for the indoor residential switchgear market is projected to reach USD 46.4 billion by 2035.

The indoor residential switchgear market is expected to grow at a 9.1% CAGR between 2025 and 2035.

The key product types in indoor residential switchgear market are medium and low.

In terms of current, ac segment to command 62.1% share in the indoor residential switchgear market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Indoor Rotary High Voltage Disconnect Switch Market Size and Share Forecast Outlook 2025 to 2035

Indoor Cable Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Indoor Air Quality Monitor Market Size and Share Forecast Outlook 2025 to 2035

Indoor Location Market Size and Share Forecast Outlook 2025 to 2035

Indoor Space Heater Market Size and Share Forecast Outlook 2025 to 2035

Indoor Farming Market Analysis - Size, Share, and Forecast 2025 to 2035

Indoor Smokehouses & Pig Roasters Market – Smoked Meat Processing 2025 to 2035

A Detailed Global Analysis of Brand Share for the Indoor Farming Market

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Family/Indoor Entertainment Centres Market Report – Forecast 2017-2027

Medical Indoor Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Cat Condos & Indoor Houses Market Insights - Size & Trends 2025 to 2035

Residential Generator Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy-Efficient Technologies Market Size and Share Forecast Outlook 2025 to 2035

Residential Interior Wood Doors Market Size and Share Forecast Outlook 2025 to 2035

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Residential AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA