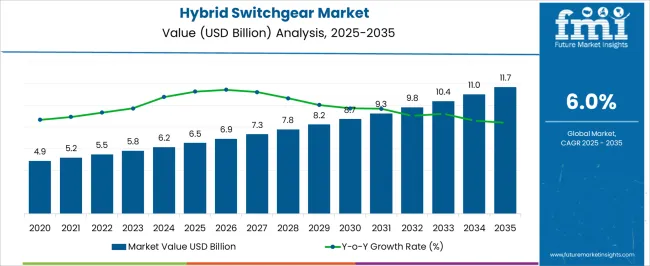

The Hybrid Switchgear Market is estimated to be valued at USD 6.5 billion in 2025 and is projected to reach USD 11.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. The hybrid switchgear market growth curve follows a pattern that can be best described as a shallow S-shape with clear phases of expansion and stabilization. From 2020 to 2025, the curve demonstrates steady linear growth, moving from USD 4.9 billion to USD 6.5 billion, reflecting the early adoption phase where utilities and industries increasingly integrate hybrid systems into their networks. This initial stage is characterized by incremental demand gains, largely driven by investments in grid modernization and the replacement of conventional switchgear systems. Between 2025 and 2029, the curve takes on a slightly convex form, indicating a phase of acceleration as the market benefits from large-scale infrastructure upgrades, regional electrification programs, and regulatory mandates to improve transmission reliability.

The growth rate strengthens during this stage, lifting the market from USD 6.5 billion to over USD 8 billion by 2029. After 2029, the trajectory begins to flatten, reflecting a maturing market where adoption slows as penetration levels rise and incremental upgrades dominate expansion strategies. By 2035, the value reaches USD 11.7 billion, marking a transition to a logistic-style curve where YoY growth rates decline but absolute revenue levels remain higher. This shape highlights a gradual transition from expansion to consolidation.

| Metric | Value |

|---|---|

| Hybrid Switchgear Market Estimated Value in (2025 E) | USD 6.5 billion |

| Hybrid Switchgear Market Forecast Value in (2035 F) | USD 11.7 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

Rising investments in power infrastructure modernization and the need to enhance grid reliability have increased demand for hybrid switchgear technologies. These systems combine the benefits of traditional air-insulated and gas-insulated switchgear, offering improved safety and reduced footprint. Technological progress has enabled hybrid switchgear to handle higher voltages with greater operational flexibility.

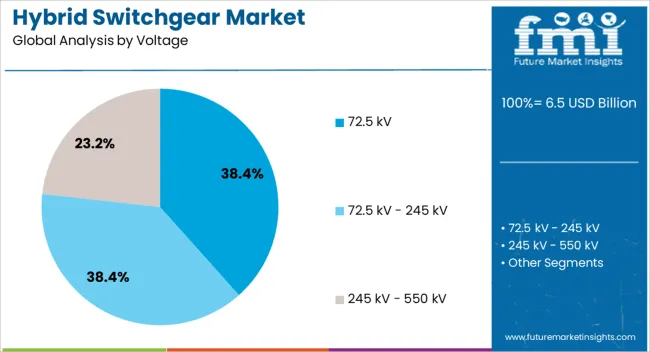

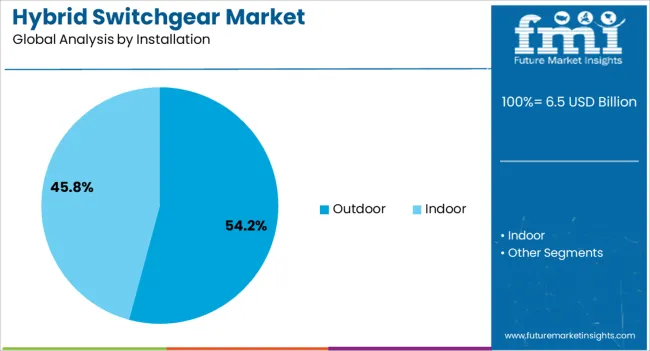

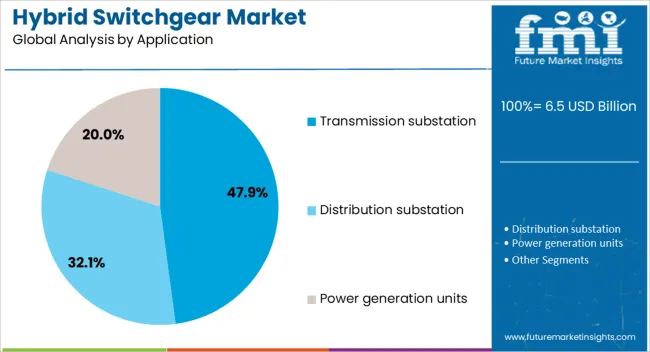

The growing deployment of renewable energy sources and smart grid initiatives has also driven adoption by requiring more sophisticated switchgear for managing variable power flows. Future growth is anticipated from increased urbanization and industrialization, particularly in regions upgrading their electrical transmission networks. Segment growth is expected to be led by the 72.5 kV voltage class, outdoor installations, and transmission substation applications.

The hybrid switchgear market is segmented by voltage, installation, application, end use, and geographic regions. By voltage, the hybrid switchgear market is divided into 72.5 kV, 72.5 kV - 245 kV, and 245 kV - 550 kV. In terms of installation, the hybrid switchgear market is classified into Outdoor and Indoor. Based on application, the hybrid switchgear market is segmented into Transmission substation, Distribution substation, and Power generation units.

By end use, the hybrid switchgear market is segmented into Utility and Industrial. Regionally, the hybrid switchgear industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 72.5 kV voltage segment is projected to represent 38.4% of the hybrid switchgear market revenue in 2025, maintaining its position as the leading voltage class. This voltage range is commonly used in medium-voltage power distribution systems, making it highly applicable in urban and industrial power networks.

The 72.5 kV switchgear offers a balanced solution for substations requiring reliable performance without the complexity of higher voltage classes. Operators have favored this voltage class for its compatibility with a wide range of equipment and relatively lower installation and maintenance costs.

As power systems become more complex and demand for stable medium-voltage distribution increases, the 72.5 kV segment is expected to sustain strong demand.

The outdoor installation segment is expected to contribute 54.2% of the market revenue in 2025, securing its lead over indoor installations. This preference is driven by the growing number of outdoor substations designed to save indoor space and reduce construction costs.

Outdoor hybrid switchgear units are engineered to withstand harsh environmental conditions while maintaining operational integrity. Utilities have increasingly adopted outdoor installations to support decentralized power distribution and renewable energy integration.

The flexibility and ease of maintenance offered by outdoor switchgear have further accelerated its adoption. With expanding grid infrastructure in both urban and rural areas, the outdoor installation segment is likely to continue its market dominance.

The transmission substation application segment is projected to hold 47.9% of the hybrid switchgear market revenue in 2025, leading other application areas. Transmission substations require high reliability and robust equipment to manage power flow and protect the network.

Hybrid switchgear provides a compact and safe solution for these substations, combining the strengths of different switchgear technologies. Increased investments in upgrading aging transmission infrastructure and expanding power grids have supported this segment’s growth.

The segment benefits from stringent safety and performance standards governing transmission networks. As transmission projects continue to grow worldwide to meet rising electricity demand, the transmission substation segment is expected to maintain its leading share in the hybrid switchgear market.

Hybrid switchgear is rising in demand due to space efficiency, regulatory backing, renewable integration, and evolving competitive strategies. Its role in grid modernization ensures consistent long-term adoption across global energy systems.

Hybrid switchgear adoption has been driven by the increasing requirement for compact power distribution solutions in dense industrial and utility environments. Unlike traditional air-insulated or gas-insulated systems, hybrid designs balance reduced land use with high reliability. Utilities prefer them for retrofitting substations in congested areas where land availability and footprint restrictions are critical challenges. Their modular configuration allows for efficient deployment in regions facing expansion of renewable energy grids. With continuous upgrades to electrical infrastructure, hybrid switchgear has become the preferred alternative for operators aiming to optimize space utilization while ensuring uninterrupted service. This trend reflects its importance as a versatile, space-efficient solution within global grid modernization initiatives.

Government policies and regional authorities have played a central role in boosting hybrid switchgear adoption. Energy efficiency standards and grid modernization programs have encouraged utilities to choose hybrid solutions that reduce energy losses and meet environmental compliance. Substations using hybrid switchgear benefit from lower operational costs and simplified maintenance cycles, which fit regulatory goals of improved reliability and efficiency. Incentive schemes in power infrastructure projects further reinforce its position, particularly in emerging economies investing in transmission and distribution. Compliance with international safety standards and testing frameworks ensures hybrid switchgear systems are increasingly seen as reliable investments. Regulatory endorsement continues to be a powerful driver for consistent demand growth.

Hybrid switchgear has gained traction in renewable and offshore energy projects where reliability and modularity are paramount. Offshore wind farms and solar integration sites require compact, high-performance switchgear to manage large volumes of fluctuating electricity. Hybrid systems enable efficient connectivity between renewable plants and transmission lines, making them valuable in projects demanding flexible and durable designs. They are also being deployed in harsh environments due to their ability to withstand extreme conditions while ensuring stable performance. By offering lower lifecycle costs compared to conventional alternatives, hybrid switchgear provides a balanced approach to meet growing global renewable integration needs, strengthening its strategic relevance in energy transition infrastructure.

The competitive landscape of hybrid switchgear reflects a mix of global leaders and regional players investing in design, service, and technology upgrades. Companies are emphasizing modular configurations, predictive monitoring, and integrated service networks to strengthen customer loyalty. Partnerships with EPC firms and utility providers are central to expanding reach in both developed and developing regions. Price competitiveness, supply chain resilience, and after-sales support have become essential differentiators among manufacturers.

Competitive strategies also highlight investments in localized production facilities to reduce costs and ensure timely delivery. These approaches are shaping the way hybrid switchgear solutions are positioned, ensuring broader adoption across diverse grid infrastructure projects.

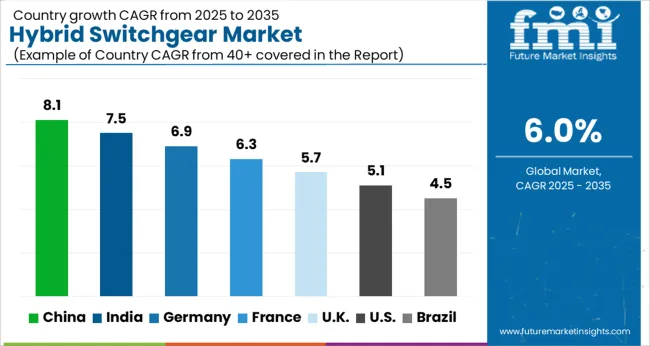

The hybrid switchgear market is projected to expand globally at a CAGR of 6.0% from 2025 to 2035, supported by demand for compact substation solutions, grid modernization programs, and rising renewable energy integration. China leads with a CAGR of 8.1%, fueled by large-scale transmission projects, urban grid expansion, and offshore wind connections requiring reliable and space-efficient equipment. India follows at 7.5%, supported by public investment in renewable integration, smart grid projects, and industrial power infrastructure upgrades. France posts 6.3%, benefiting from substation retrofits, compact installations in urban zones, and modernization of aging electrical networks. The United Kingdom records 5.7%, with demand rising in renewable tie-ins, distribution upgrades, and compact substations for constrained areas. The United States posts 5.1%, shaped by steady grid reinforcements, replacement cycles for aging assets, and selective adoption in renewable-heavy regions. The analysis spans more than 40 countries, with these highlighted markets acting as benchmarks for utility investment, transmission expansion, and strategic positioning in the global hybrid switchgear industry.

China is projected to achieve a CAGR of 8.1% during 2025–2035, compared to about 6.4% between 2020–2024, highlighting an acceleration in adoption. Earlier growth was influenced by ongoing transmission upgrades and demand from coastal industrial clusters requiring compact substations. The higher pace ahead is supported by large-scale renewable integration, expansion of offshore wind farms, and retrofitting in grid-constrained metropolitan areas. Government-backed investment in ultra-high-voltage transmission corridors is another factor elevating demand for hybrid switchgear. Domestic firms are also scaling production, reducing dependency on imports, and offering modular solutions tailored for dense urban areas and renewable-heavy grids.

India is expected to record a CAGR of 7.5% between 2025–2035, up from 5.9% during 2020–2024, signaling stronger momentum. Early growth was shaped by substation upgrades in industrial hubs and limited renewable tie-ins. The acceleration stems from nationwide smart grid projects, higher renewable energy integration, and government-led investments in power infrastructure. The emphasis on reducing transmission losses and compact installations in urban centers has further lifted hybrid switchgear adoption. Private sector participation in renewable projects is adding to demand. Local manufacturing expansion and foreign joint ventures are enhancing accessibility, while EPC firms are prioritizing hybrid switchgear for flexible project design.

France is forecast to post a CAGR of 6.3% during 2025–2035, compared to around 5.0% during 2020–2024, showing clear market uplift. Earlier adoption was influenced by selective modernization of substations and limited renewable integration. The step-up in growth reflects broader retrofit initiatives, expansion of offshore wind connections, and strong government policies for grid resilience. Compact hybrid switchgear is increasingly being deployed in dense urban settings and coastal substations. The growing push for modernization of aging power assets also plays a crucial role. European manufacturers are leading innovation, ensuring compliance with stricter operational standards and enhancing lifecycle efficiency in deployment.

he United Kingdom is projected to grow at a CAGR of 5.7% between 2025–2035, up from about 4.4% during 2020–2024, reflecting steady improvement. Early adoption was shaped by replacement of aging substations and limited uptake in renewable integration projects. The rise in CAGR is explained by accelerated offshore wind investments, expansion of renewable tie-ins, and compact substations for space-constrained urban centers. Utilities are increasingly adopting hybrid switchgear for lifecycle savings and operational reliability. While growth remains moderate compared to Asian markets, regulatory backing and renewable project expansion ensure consistent adoption. Manufacturers are also focusing on localized service support to reduce operational downtime.

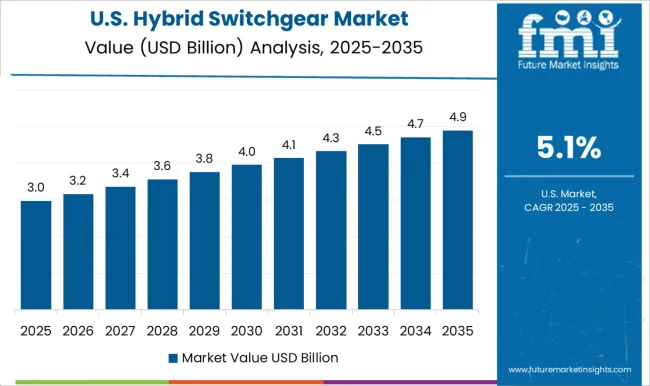

The United States is anticipated to record a CAGR of 5.1% between 2025–2035, up from 4.1% during 2020–2024, signaling modest acceleration. Earlier adoption was concentrated in select renewable-heavy states and replacement of legacy systems. The improvement is explained by grid reinforcement programs, steady adoption in renewable tie-ins, and transmission projects requiring reliable and compact solutions. Utilities are gradually shifting toward hybrid switchgear to minimize land use and achieve better lifecycle economics. Growth is somewhat restrained by reliance on conventional air-insulated and gas-insulated systems, but ongoing investments in smart grid infrastructure are expected to drive consistent opportunities.

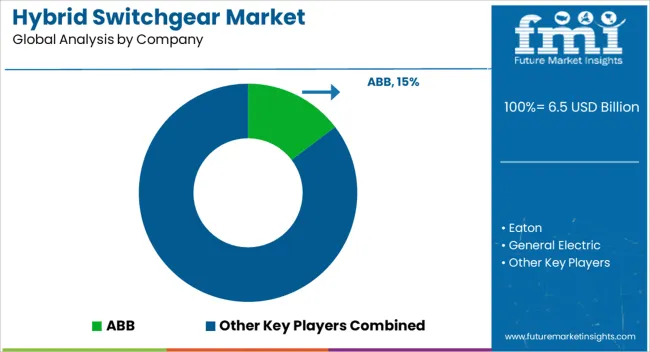

The hybrid switchgear market is shaped by a mix of global engineering leaders and regional specialists delivering compact, efficient, and reliable substation solutions. ABB maintains a strong foothold with its advanced hybrid switchgear systems that combine air- and gas-insulated technologies, catering to utilities modernizing dense urban grids and renewable tie-ins. Eaton emphasizes modular switchgear designs supported by smart monitoring features, serving both transmission and distribution networks.

General Electric (GE) leverages its global presence and expertise in grid solutions to deliver hybrid switchgear suited for high-voltage applications and large-scale infrastructure upgrades. Hitachi Energy strengthens its market role through advanced grid integration projects, particularly in renewable-heavy economies, with solutions that focus on compact footprints and lifecycle efficiency. Larsen & Toubro Limited (L&T) is expanding its influence in Asia with turnkey EPC capabilities, supplying hybrid switchgear across power, industrial, and renewable projects. Schneider Electric focuses on digital-ready hybrid switchgear integrated with grid automation, targeting utilities seeking flexible and cost-efficient infrastructure. Siemens sustains leadership with innovative compact hybrid systems designed for global grid modernization, balancing reliability with advanced diagnostics. Toshiba delivers high-performance hybrid switchgear across Asia-Pacific, recognized for durability and strong regional partnerships with utility companies. Switchgear Company (SGC) operates as a niche European player offering custom hybrid switchgear solutions tailored for compact substations and renewable projects. Sieyuan Electric Co. Ltd. strengthens China’s domestic supply with competitive pricing, strong manufacturing capacity, and expansion into export markets.

Competitive strategies in this sector revolve around modular design innovation, strengthening of digital monitoring platforms, local manufacturing hubs, and strategic alliances with utilities and EPC contractors. Emphasis is placed on lifecycle cost reduction, compactness for urban and offshore projects, and improving reliability standards. These approaches are ensuring hybrid switchgear systems remain integral to ongoing grid modernization and renewable integration worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.5 Billion |

| Voltage | 72.5 kV, 72.5 kV - 245 kV, and 245 kV - 550 kV |

| Installation | Outdoor and Indoor |

| Application | Transmission substation, Distribution substation, and Power generation units |

| End Use | Utility and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Eaton, General Electric, Hitachi Energy, Larsen & Toubro Limited, Schneider Electric, Siemens, Toshiba, Switchgear Company (SGC), and Sieyuan Electric Co. Ltd. |

| Additional Attributes | Dollar sales, share, regional grid investments, renewable integration projects, competitor strategies, pricing benchmarks, regulatory drivers, and future growth opportunities. |

The global hybrid switchgear market is estimated to be valued at USD 6.5 billion in 2025.

The market size for the hybrid switchgear market is projected to reach USD 11.7 billion by 2035.

The hybrid switchgear market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in hybrid switchgear market are 72.5 kv, 72.5 kv - 245 kv and 245 kv - 550 kv.

In terms of installation, outdoor segment to command 54.2% share in the hybrid switchgear market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hybrid Boat Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Metal-Paper Seamers Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Sealing-Cut Machines Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hybrid Powertrain Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Additive Manufacturing Machines Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Integration Platform Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Meat Products Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Rice Seeds Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Memory Cube Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Solar Wind Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Cutters Market Analysis Size and Share Forecast Outlook 2025 to 2035

Hybrid Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Train Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hybrid Solar Wind Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Drivetrain Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Cloud Storage Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA