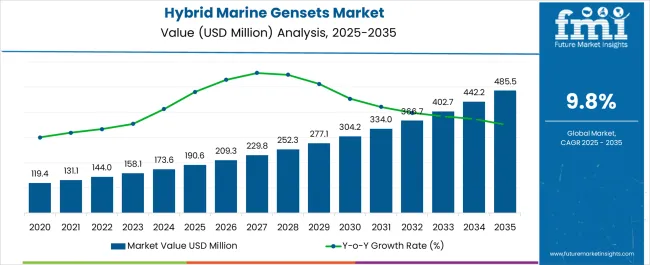

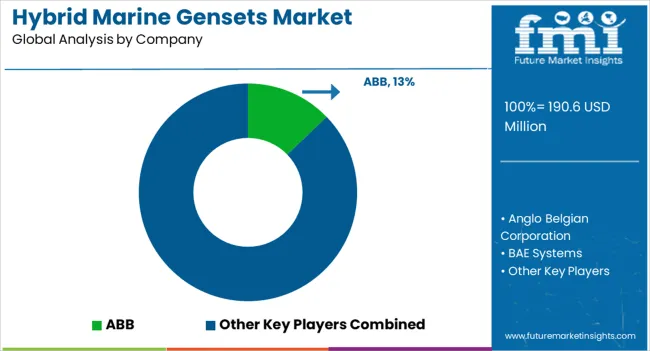

The hybrid marine gensets market is estimated to be valued at USD 190.6 million in 2025 and is projected to reach USD 485.5 million by 2035, registering a compound annual growth rate (CAGR) of 9.8% over the forecast period.

The hybrid marine gensets market, valued at USD 190.6 million in 2025, is anticipated to expand to USD 485.5 million by 2035, reflecting a compound annual growth rate of 9.8 percent. Rolling CAGR analysis highlights how the market will not progress in a uniform line but rather in stages of acceleration and moderation across the forecast horizon. In the initial half of the period, rising adoption of hybrid propulsion systems in ferries, patrol vessels, and offshore service fleets is expected to drive strong annual increments.

This is linked to operational efficiency benefits, fuel savings, and compliance with stricter marine emission regulations. During the mid-phase, between 2029 and 2032, rolling CAGR values may stabilize slightly as early adoption reaches maturity in advanced economies, yet the pace remains well above the global marine equipment average due to retrofit programs and growing applications in defense and commercial fleets.

In the later years, particularly post-2032, rolling CAGR could experience renewed strength as technological advancements in battery integration and smart energy management optimize genset performance. With a multiplication factor of 2.5x over ten years, the rolling CAGR trend confirms that demand will remain resilient, reflecting both cyclical modernization cycles and the structural transition toward cleaner marine energy systems.

| Metric | Value |

|---|---|

| Hybrid Marine Gensets Market Estimated Value in (2025 E) | USD 190.6 million |

| Hybrid Marine Gensets Market Forecast Value in (2035 F) | USD 485.5 million |

| Forecast CAGR (2025 to 2035) | 9.8% |

The hybrid marine gensets market is driven by five primary parent markets with specific shares. Commercial shipping leads with 35%, where hybrid gensets power cargo vessels with reduced emissions and improved fuel efficiency. Offshore oil and gas contributes 25%, supporting rigs and supply vessels with reliable hybrid energy systems. Naval and defense represent 15%, employing gensets for operational flexibility and quieter operations. Ferries and passenger vessels account for 15%, focusing on eco-friendly transport and compliance with maritime regulations. Recreational and luxury yachts hold 10%, where hybrid gensets enhance comfort and efficiency. These sectors collectively define global demand for hybrid marine gensets.

Recent developments in the hybrid marine gensets market center on sustainability, digital integration, and efficiency. Manufacturers are introducing advanced gensets with battery hybridization, enabling vessels to switch between conventional fuel and stored energy. Real-time monitoring systems with IoT integration are enhancing fuel management, predictive maintenance, and operational control. Adoption of LNG- and hydrogen-compatible gensets is growing to meet stricter emission regulations. Shipbuilders and operators are collaborating on retrofitting projects, upgrading existing fleets with hybrid solutions. These trends are strengthening operational efficiency, compliance with environmental standards, and innovation across commercial, defense, and recreational marine industries.

The hybrid marine gensets market is expanding steadily, driven by the maritime industry’s increasing focus on fuel efficiency, emission reduction, and compliance with international environmental regulations. Integration of hybrid systems allows for optimized power generation, reduced fuel consumption, and lower operating costs, making them attractive for various vessel types.

The market benefits from technological advancements in battery storage, energy management systems, and propulsion integration. Growing investments in sustainable marine operations and retrofitting of existing fleets are further contributing to demand.

Future growth will be influenced by the adoption of alternative fuels, improvements in hybrid system reliability, and the expansion of offshore and commercial shipping operations. With operational efficiency and environmental performance at the forefront, hybrid marine gensets are positioned for long-term adoption across global maritime applications.

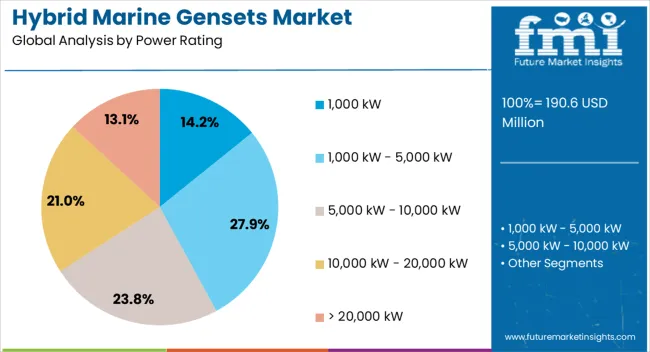

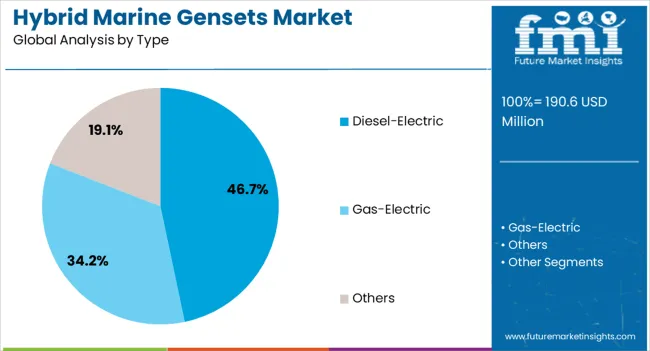

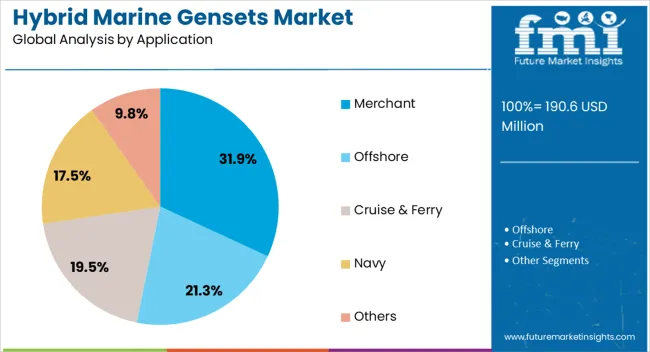

The hybrid marine gensets market is segmented by power rating, type, application, and geographic regions. By power rating, hybrid marine gensets market is divided into 1,000 kW, 1,000 kW - 5,000 kW, 5,000 kW - 10,000 kW, 10,000 kW - 20,000 kW, and > 20,000 kW. In terms of type, hybrid marine gensets market is classified into diesel-electric, gas-electric, and others. Based on application, hybrid marine gensets market is segmented into Merchant, Offshore, Cruise & Ferry, Navy, and Others. Regionally, the hybrid marine gensets industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 1,000 kW – 5,000 kW segment leads the power rating category, representing approximately 27.9% share of the hybrid marine gensets market. This rating is well-suited for large commercial vessels, ferries, and offshore support ships that demand substantial and continuous power for both propulsion and extensive onboard systems.

The segment benefits from its high output capacity and ability to support energy-intensive operations, making it a preferred choice for vessels engaged in long-haul transport, heavy-duty offshore activities, and specialized maritime missions. It offers a strong balance between scalability and fuel optimization, ensuring compliance with stringent international maritime emission standards.

Demand is reinforced by its adaptability in advanced hybrid configurations, where load management between diesel generators and energy storage systems is critical for efficiency and sustainability. With ongoing investments in large fleet upgrades and the global transition toward greener maritime operations, the 1,000 kW – 5,000 kW segment is expected to strengthen its leadership position in the market.

The diesel-electric segment holds the largest share in the type category at approximately 46.7%. Its dominance stems from its proven operational efficiency, flexibility in power distribution, and ability to integrate seamlessly with hybrid energy systems.

Diesel-electric setups allow vessels to operate engines at optimal load conditions, reducing fuel consumption and emissions. The segment also benefits from widespread familiarity within the maritime sector, established maintenance expertise, and adaptability to various vessel sizes and applications.

With the IMO’s stricter emission targets, diesel-electric systems integrated with hybrid components are expected to remain the preferred choice for new builds and retrofits.

The merchant segment dominates the application category, holding approximately 31.9% share of the hybrid marine gensets market. This segment includes bulk carriers, container ships, and tankers, which require reliable and efficient power systems for both propulsion and onboard operations.

Adoption is driven by high operational hours, international route requirements, and increasing pressure to reduce fuel costs. The integration of hybrid gensets in merchant vessels supports compliance with environmental regulations while maintaining operational flexibility.

As global trade volumes continue to grow and decarbonization initiatives intensify, the merchant segment is expected to sustain its leadership in the forecast period.

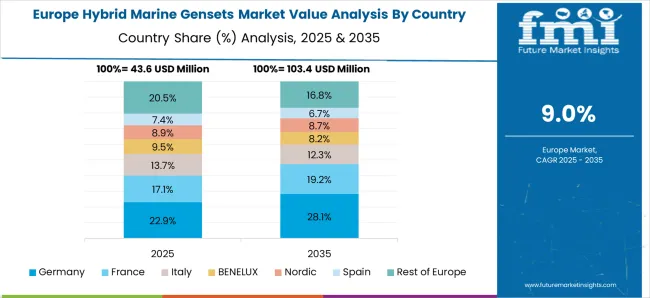

The hybrid marine gensets market is expanding as shipping operators invest in fuel efficiency and emission reduction technologies. A hybrid system combines conventional diesel generators with lithium ion batteries and energy management units to deliver lower operating costs and compliance with IMO Tier III and ECA standards. Asia Pacific represents nearly 40% of new installations, led by ferry operators in China and South Korea, while Europe accounts for about 30% through retrofits in Norway and Denmark. Fuel cost savings range between 15% and 30%, making hybrid configurations attractive across short sea shipping and offshore support vessels.

Fuel savings of 15% to 30% are a primary driver for hybrid genset deployment, particularly for ferries and offshore service vessels with variable load patterns. Norway reports more than 80 hybrid ferries in operation, a number expected to double by 2030 under government support programs. In Asia Pacific, China’s coastal fleet modernization mandates include hybrid propulsion targets, creating measurable demand for integrated genset battery systems. The ability to cut CO₂ emissions by up to 25% and NOx emissions by 40% aligns with IMO greenhouse gas reduction objectives. Lifecycle cost analyses show that hybrid systems reduce engine wear by up to 20%, extending overhaul intervals and lowering maintenance expense.

Opportunities arise from ferry replacement programs in Europe, offshore oil and gas activity in Asia, and increasing shore charging availability in North America. By 2030, more than 1,000 vessels in Europe are scheduled for retrofit or replacement, with hybrid gensets projected to be installed on 60% of them. In the offshore energy sector, hybridization of crew transfer vessels and platform supply vessels could save up to 200,000 liters of fuel annually per unit. Growth in shore power installations, especially in US and European ports, enables vessels to charge batteries while docked, enhancing silent mode capability. Suppliers offering modular battery genset packages with standardized interfaces can capture significant contracts during these fleet renewal cycles.

Modular genset designs with ratings between 500 kW and 2 MW dominate new projects, allowing flexible scaling for ferries, patrol vessels, and offshore craft. Lithium ion batteries with energy densities surpassing 200 Wh per kg are now common in hybrid systems, supporting extended zero emission sailing of up to 2 hours for ferries. Digital energy management platforms are integrated into over 70% of new hybrid vessels in Europe, enabling predictive load control and remote monitoring. Hydrogen ready gensets are emerging, particularly in Japan and South Korea, where shipyards are testing dual fuel configurations. The trend toward modularity and advanced energy management software is reshaping procurement strategies for both new builds and retrofits.

Hybrid marine gensets face barriers due to upfront investment and technical constraints. A hybrid retrofit can cost 20% to 60% more than conventional genset upgrades, with battery systems representing nearly 40% of total cost. Retrofitting older vessels often requires hull modifications and additional cooling systems, extending yard stays by 2 to 4 months. Battery replacement cycles every 7 to 10 years add to lifecycle costs, with replacement accounting for up to 25% of initial system expense. Port infrastructure remains inconsistent, with only about 35% of European ports and 20% of US ports offering hybrid charging compatibility. These factors limit adoption among smaller operators with constrained capital budgets.

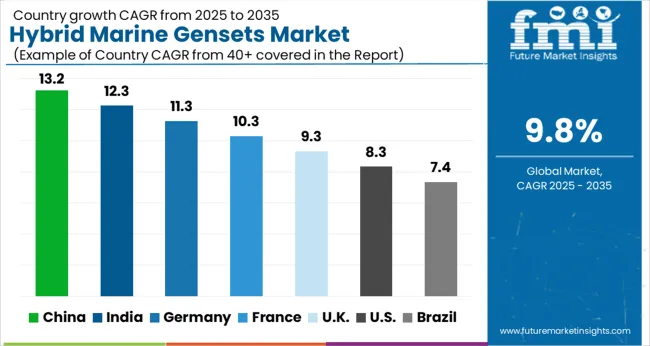

| Country | CAGR |

|---|---|

| China | 13.2% |

| India | 12.3% |

| Germany | 11.3% |

| France | 10.3% |

| UK | 9.3% |

| USA | 8.3% |

| Brazil | 7.4% |

The hybrid marine gensets market is forecast to expand at a global CAGR of 9.8% through 2035, propelled by decarbonization initiatives, electrification of marine fleets, and adoption of fuel-efficient power systems. China leads at 13.2%, a 1.35× multiple of the global benchmark, supported by BRICS-backed shipbuilding, electrified vessel adoption, and large-scale port modernization. India follows at 12.3%, a 1.25× multiple, reflecting investment in coastal shipping, renewable integration, and inland waterway modernization. Germany posts 11.3%, a 1.15× multiple, driven by OECD-led clean energy standards and strong adoption in commercial and naval fleets. The United Kingdom records 9.3%, slightly below the global average, shaped by offshore wind projects and demand for low-emission auxiliary power in marine transport. The United States stands at 8.3%, 0.85× the benchmark, reflecting adoption in defense vessels, inland transport, and coastal fleet modernization. This report includes insights on 40+ countries; the top markets are shown here for reference.

The hybrid marine gensets market in China is projected to expand at a CAGR of 13.2%, supported by strong shipbuilding activity and demand for low-emission propulsion systems. Chinese shipyards are increasingly deploying hybrid gensets for ferries, bulk carriers, and offshore vessels to meet tightening environmental regulations. Manufacturers such as Weichai, CSSC Power, and international players like Caterpillar are introducing hybrid genset models combining diesel and battery power to enhance efficiency. Coastal shipping routes and inland waterways are key application segments. Government-backed initiatives for cleaner maritime transport and investment in new port infrastructure are strengthening adoption.

The hybrid marine gensets market in India is forecast to grow at a CAGR of 12.3%, driven by modernization of coastal shipping, ferry operations, and port development projects. Indian shipyards and private operators are increasingly adopting hybrid gensets to reduce fuel costs and improve efficiency. Companies such as Kirloskar, Cummins India, and global suppliers are active in the segment, offering compact and reliable gensets with integrated energy storage systems. Growing use of hybrid gensets in offshore support vessels and small ferries is expanding market penetration. Government initiatives for cleaner marine transportation and rising investment in port infrastructure add further momentum.

The hybrid marine gensets market in Germany is expected to rise at a CAGR of 11.3%, supported by the country’s strong focus on green shipping and emission reduction in inland waterways. German shipbuilders and operators are integrating hybrid gensets into ferries, cargo vessels, and leisure boats. Companies such as MAN Energy Solutions and Rolls-Royce Power Systems are key suppliers, offering hybrid gensets designed for reduced emissions and high efficiency. Adoption is centered in major ports like Hamburg and Bremen, where vessel operators are upgrading fleets. Regulations on maritime emissions and incentives for cleaner technologies reinforce market growth.

The hybrid marine gensets market in the United Kingdom is anticipated to expand at a CAGR of 9.3%, with growth supported by ferry services, offshore wind support vessels, and naval applications. Adoption is being driven by government policies encouraging low-emission shipping and maritime decarbonization. Companies such as Rolls-Royce and Caterpillar are supplying hybrid gensets with advanced battery integration to vessel operators. Ports including Dover, Liverpool, and Southampton are leading regions for deployments. Demand from offshore wind farm support vessels and coastal ferries continues to expand. Ongoing investment in electrification infrastructure for ports complements genset adoption.

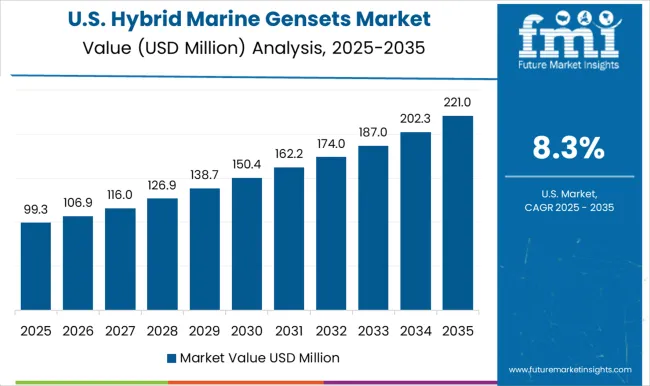

The hybrid marine gensets market in the United States is projected to grow at a CAGR of 8.3%, driven by demand from inland waterways, ferries, and offshore oil and gas support vessels. US shipyards are increasingly integrating hybrid gensets to improve energy efficiency and comply with strict maritime emission standards. Companies such as Caterpillar, Cummins, and ABB are active in the market, delivering hybrid gensets with high power density and advanced fuel management systems. Adoption is expanding in coastal shipping, ferry services, and military vessels. Government incentives for cleaner propulsion technologies further support growth.

The hybrid marine gensets market is shaped by strong competition among global engineering firms and specialized power solution providers. ABB, Siemens Energy, and Nidec Corporation emphasize integrated systems with advanced control technologies, promoting fuel efficiency and operational reliability. Rolls Royce, MAN Energy Solutions, and Mitsubishi Heavy Industries direct strategies toward high-capacity vessels, highlighting hybrid propulsion designs that reduce fuel consumption and emissions.

Caterpillar and Cummins focus on flexible genset configurations, ensuring compatibility with diverse vessel types and service requirements. Their brochures emphasize modular designs and extended service life, aiming at operators seeking durability. Fischer Panda, Steyr Motor, and Scania position their gensets around compactness, ease of installation, and lightweight builds suited for smaller vessels and leisure crafts. BAE Systems integrates hybrid systems with naval and defense applications, aligning with government procurement strategies. Anglo Belgian Corporation leverages its expertise in medium-speed engines, adapting gensets for hybrid use in inland and coastal fleets.

Brochures across these companies emphasize real-world performance metrics, highlighting reduced operational costs, optimized space usage, and lower environmental impact. Product presentation plays a decisive role in competition. Brochures combine technical specifications, visual schematics, and after-sales service assurances to strengthen buyer confidence. Frequent updates showcase evolving hybrid technologies, reflecting each company’s adaptation to emission regulations and market demand for fuel savings. While established players rely on their brand recognition and global presence, smaller firms highlight agility, customization, and niche applications. Competition remains centered on how effectively brochures communicate innovation, reliability, and long-term value in hybrid marine power solutions.

| Items | Values |

|---|---|

| Quantitative Units | USD 190.6 million |

| Power Rating | 1,000 kW, 1,000 kW - 5,000 kW, 5,000 kW - 10,000 kW, 10,000 kW - 20,000 kW, and > 20,000 kW |

| Type | Diesel-Electric, Gas-Electric, and Others |

| Application | Merchant, Offshore, Cruise & Ferry, Navy, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Anglo Belgian Corporation, BAE Systems, Caterpillar, Cummins, Fischer Panda, MAN Energy Solutions, Mitsubishi Heavy Industries, Nidec Corporation, Rolls-Royce, Scania, Siemens Energy, and Steyr Motor |

| Additional Attributes | Dollar sales by genset type and end use, demand dynamics across commercial, defense, and recreational vessels, regional trends in hybrid marine adoption, innovation in fuel efficiency, noise reduction, and battery integration, environmental impact of emissions and fuel use, and emerging use cases in offshore support, ferries, and sustainable shipping. |

The global hybrid marine gensets market is estimated to be valued at USD 190.6 million in 2025.

The market size for the hybrid marine gensets market is projected to reach USD 485.5 million by 2035.

The hybrid marine gensets market is expected to grow at a 9.8% CAGR between 2025 and 2035.

The key product types in hybrid marine gensets market are 1,000 kw, 1,000 kw - 5,000 kw, 5,000 kw - 10,000 kw, 10,000 kw - 20,000 kw and > 20,000 kw.

In terms of type, diesel-electric segment to command 46.7% share in the hybrid marine gensets market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Diesel Electric Powered Hybrid Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Reactive Power and Harmonic Compensation Device Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Vision Sensor Chips Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Printing Market Forecast Outlook 2025 to 2035

Hybrid Boat Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Metal-Paper Seamers Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Sealing-Cut Machines Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hybrid Powertrain Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Additive Manufacturing Machines Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Integration Platform Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Meat Products Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Rice Seeds Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Memory Cube Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Solar Wind Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Cutters Market Analysis Size and Share Forecast Outlook 2025 to 2035

Hybrid Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Train Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA