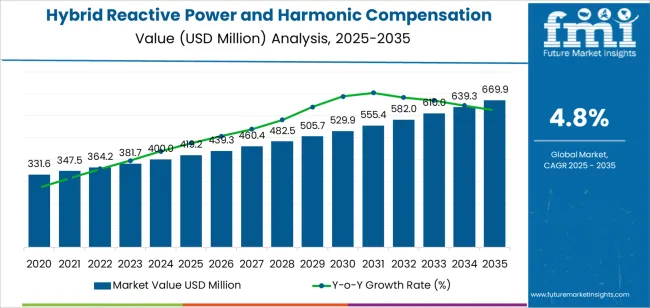

The global hybrid reactive power and harmonic compensation device market is projected to grow from USD 419.2 million in 2025 to approximately USD 669.9 million by 2035, recording an absolute increase of USD 250.73 million over the forecast period. This translates into a total growth of 59.8%, with the market forecast to expand CAGR of 4.8% between 2025 and 2035. The overall market size is expected to grow by nearly 1.6X during the same period, supported by increasing power quality requirements in industrial facilities, growing adoption of renewable energy integration systems, and rising demand for harmonic mitigation solutions in complex electrical distribution networks.

The market expansion reflects fundamental shifts in power system management, where traditional passive compensation methods face limitations addressing dynamic power quality challenges. Modern hybrid devices combine active and passive compensation technologies, enabling simultaneous reactive power correction and harmonic filtering across varying load conditions. These systems support grid stability while protecting sensitive equipment from voltage disturbances and harmonic distortion that compromise operational efficiency and equipment lifespan.

Technological advancement continues to reshape product capabilities, with manufacturers developing intelligent control systems that monitor power quality parameters in real-time and adjust compensation dynamically. Advanced power electronics and digital signal processing enable precise harmonic cancellation and reactive power management across wide frequency ranges. Integration with building management systems and industrial automation platforms provides comprehensive power quality monitoring and predictive maintenance capabilities that reduce downtime and optimize energy consumption.

Regional dynamics demonstrate varied adoption patterns influenced by industrial base composition, power infrastructure maturity, and regulatory frameworks governing power quality standards. Developed markets show steady implementation driven by equipment protection requirements and energy efficiency initiatives, while emerging economies experience accelerated adoption as manufacturing capacity expands and power quality awareness increases. Grid modernization programs, renewable energy penetration, and industrial automation advancement create sustained demand across different geographies with varying power system characteristics.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 419.2 million |

| Market Forecast Value (2035) | USD 669.9 million |

| Forecast CAGR (2025-2035) | 4.8% |

| POWER QUALITY DRIVERS | INDUSTRIAL REQUIREMENTS | GRID INFRASTRUCTURE |

|---|---|---|

| Equipment Protection Needs | Automation Expansion | Grid Modernization Programs |

| Growing awareness of power quality impact on sensitive equipment driving investments in harmonic mitigation and voltage stabilization solutions. | Industrial automation and variable frequency drive proliferation creating harmonic distortion requiring comprehensive compensation systems. | Smart grid development and distribution network upgrades incorporating advanced power quality management capabilities. |

| Energy Efficiency Standards | Manufacturing Complexity | Renewable Integration |

| Regulatory frameworks establishing power factor correction requirements and energy efficiency benchmarks for industrial facilities. | Advanced manufacturing processes with precision equipment requiring stable power quality for optimal performance and product quality. | Wind and solar power integration creating dynamic power quality challenges requiring sophisticated compensation technologies. |

| Operational Cost Reduction | Process Continuity Requirements | Distribution Network Stability |

| Focus on reducing energy costs through improved power factor and elimination of utility penalties for poor power quality. | Critical industrial processes demanding uninterrupted operation and protection from power quality disturbances affecting production. | Distribution system operators implementing voltage regulation and harmonic management to maintain network reliability. |

| Category | Segments Covered |

|---|---|

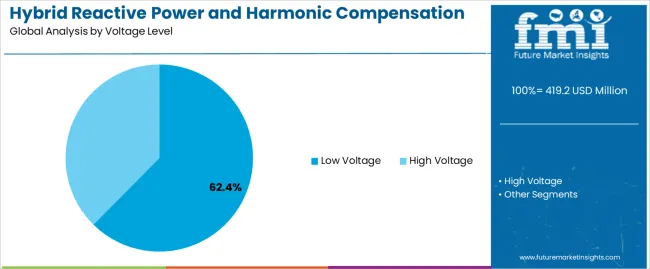

| By Voltage Level | Low Voltage, High Voltage |

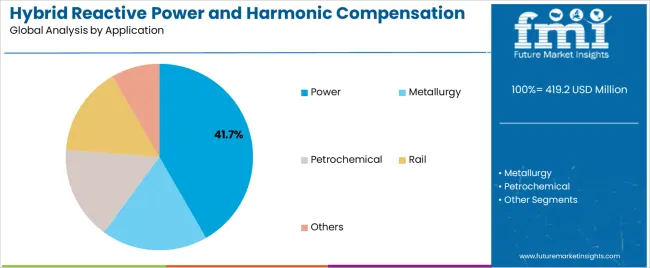

| By Application | Power, Metallurgy, Petrochemical, Rail, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Low Voltage |

|

| High Voltage |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| Power |

|

| Metallurgy |

|

| Petrochemical |

|

| Rail |

|

| Others |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Industrial Automation Growth | High Capital Investment | Digital Integration |

| Expanding adoption of variable frequency drives and automation systems creating harmonic distortion requiring sophisticated compensation solutions. | Substantial upfront costs and engineering requirements limiting adoption in cost-sensitive industrial facilities and smaller commercial operations. | Integration with industrial Internet of Things platforms and cloud-based monitoring enabling predictive maintenance and remote diagnostics. |

| Power Quality Standards | Technical Complexity | Modular System Design |

| Regulatory frameworks establishing strict power factor and harmonic distortion limits driving systematic implementation across industrial facilities. | Complex system design and commissioning requirements demanding specialized engineering expertise affecting implementation in resource-constrained markets. | Development of scalable, modular architectures enabling flexible capacity expansion and simplified installation reducing project complexity. |

| Renewable Energy Integration | Competition from Alternatives | Advanced Control Algorithms |

| Grid-connected solar and wind installations requiring dynamic compensation capabilities managing variable power flows and voltage fluctuations. | Static var compensators and other alternative technologies providing competitive solutions for specific applications affecting market segmentation. | Artificial intelligence and machine learning algorithms optimizing compensation performance and adapting to changing load patterns automatically. |

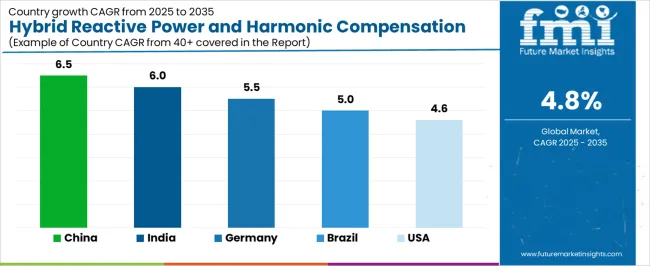

| Country | CAGR (2025-2035) |

|---|---|

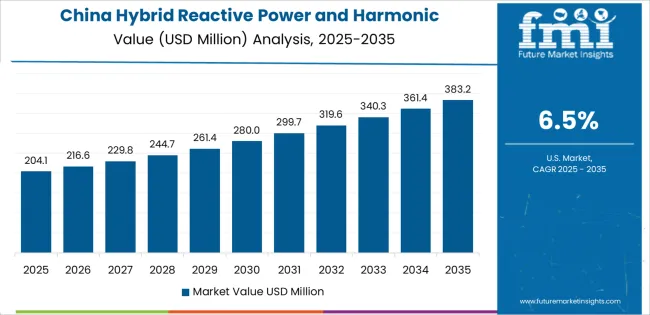

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| Brazil | 5.0% |

| United States | 4.6% |

Hybrid reactive power and harmonic compensation device market in China is projected to grow at a CAGR of 6.5% from 2025 to 2035. Revenue from hybrid reactive power and harmonic compensation devices in China is expected to exhibit strong growth, with substantial market value by 2035, driven by comprehensive manufacturing capacity expansion and power infrastructure modernization creating sustained demand for power quality management solutions. The country's industrial development and grid upgrade programs are creating substantial opportunities for compensation device suppliers.

Major industrial zones in Guangdong, Jiangsu, Zhejiang, and inland manufacturing centers maintain complex electrical loads requiring sophisticated power quality management. Manufacturing sector growth and factory automation programs are supporting widespread adoption of harmonic compensation technologies addressing equipment protection requirements. Government initiatives promoting energy efficiency and industrial quality improvement are creating demand for advanced power quality solutions. Renewable energy integration programs and smart grid development are driving utility-scale compensation system deployment. Heavy industry expansion, including steel, petrochemical, and manufacturing facilities, is creating opportunities for high-voltage compensation systems throughout major industrial regions.

Demand for hybrid reactive power and harmonic compensation device in India is expanding at a CAGR of 6.0% from 2025 to 2035. Revenue from hybrid reactive power and harmonic compensation devices in India is expanding substantially by 2035, supported by industrial corridor development and power infrastructure modernization creating sustained demand across metropolitan and emerging manufacturing centers. The country's Make in India initiatives and industrial development programs are driving manufacturing capacity additions requiring power quality management systems.

Major industrial states including Maharashtra, Gujarat, Tamil Nadu, and Karnataka maintain growing electrical load complexity. Metro rail expansion and urban transit electrification programs are facilitating specialized compensation system deployment. Manufacturing sector development and industrial automation adoption are creating demand for harmonic mitigation solutions. Power distribution network upgrades and smart city initiatives are supporting utility-scale compensation system implementation. Industrial cluster development and special economic zone expansion are enhancing requirements for reliable power quality solutions throughout major manufacturing regions.

Hybrid reactive power and harmonic compensation device market in Germany is anticipated to grow at a CAGR of 5.5% from 2025 to 2035. Demand for hybrid reactive power and harmonic compensation devices in Germany is expected to reach substantial levels by 2035, supported by advanced manufacturing infrastructure and stringent power quality standards requiring sophisticated compensation technologies. German industrial facilities maintain comprehensive power quality management systems supporting equipment protection and energy efficiency objectives. The market is characterized by an emphasis on system reliability, advanced control capabilities, and compliance with grid connection requirements.

Automotive manufacturing and precision engineering sectors prioritize power quality management supporting production equipment reliability. Renewable energy integration and distributed generation development are driving grid-connected compensation system adoption. Industrial facility modernization and Industry 4.0 implementation programs are creating demand for intelligent compensation systems with digital integration capabilities. Export-oriented manufacturing operations and industrial automation excellence are sustaining requirements for advanced power quality solutions throughout major industrial regions.

Hybrid reactive power and harmonic compensation device market in Brazil is forecasted to expand at a CAGR of 5.0% from 2025 to 2035. Revenue from hybrid reactive power and harmonic compensation devices in Brazil is growing substantially by 2035, driven by industrial development and power infrastructure investment creating opportunities for power quality management suppliers. The country's manufacturing base expansion and mining sector operations are creating demand for compensation systems. Major industrial centers in São Paulo, Minas Gerais, and Rio Grande do Sul maintain complex electrical loads requiring power quality management.

Petrochemical facility expansion and oil and gas infrastructure development are facilitating industrial-scale compensation system deployment. Manufacturing sector growth and industrial automation adoption are creating demand for harmonic mitigation technologies. Power distribution network modernization and utility grid upgrade programs are supporting compensation system implementation. Mining operations and heavy industrial facilities are creating opportunities for robust compensation solutions throughout resource extraction and processing regions.

Hybrid reactive power and harmonic compensation device market in the United States is expected to grow at a CAGR of 4.6% from 2025 to 2035. Demand for hybrid reactive power and harmonic compensation devices in the United States is expanding to reach substantial levels by 2035, driven by grid modernization initiatives and renewable energy integration creating sustained demand across utility and industrial sectors. The country's aging power infrastructure and smart grid development programs support systematic compensation system deployment.

Manufacturing facilities, data centers, and commercial complexes maintain comprehensive power quality management requirements. Renewable energy portfolio standards and distributed generation growth are driving grid-connected compensation system adoption. Industrial facility expansion and automation technology implementation are creating harmonic mitigation requirements. Utility distribution network upgrades and voltage regulation programs are supporting compensation system deployment. Electric vehicle charging infrastructure and electrification initiatives are creating new power quality challenges requiring advanced compensation capabilities across metropolitan and industrial regions.

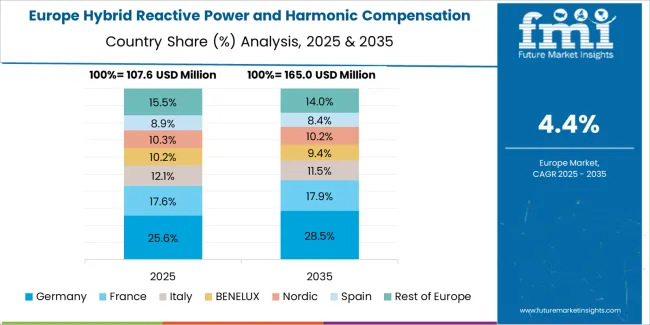

The hybrid reactive power and harmonic compensation device market in Europe is projected to grow from USD 107.54 million in 2025 to USD 171.48 million by 2035, registering a CAGR of 4.8% over the forecast period. Germany is expected to maintain its leadership position with a 35.8% market share in 2025, growing to 36.2% by 2035, supported by advanced industrial infrastructure and comprehensive power quality standards across manufacturing facilities and utility networks.

France follows with a 22.7% share in 2025, projected to reach 23.0% by 2035, driven by industrial modernization programs and renewable energy integration requirements. The United Kingdom holds a 16.4% share in 2025, expected to maintain 16.2% through 2035 reflecting steady industrial activity and grid upgrade initiatives. Italy commands a 14.3% share in 2025, while Spain accounts for 10.8% in 2025, both maintaining stable positions through ongoing industrial operations and power infrastructure investments. The Rest of Europe region maintains approximately 10.0% share, attributed to manufacturing activity in Nordic countries and Eastern European industrial development supporting power quality management adoption.

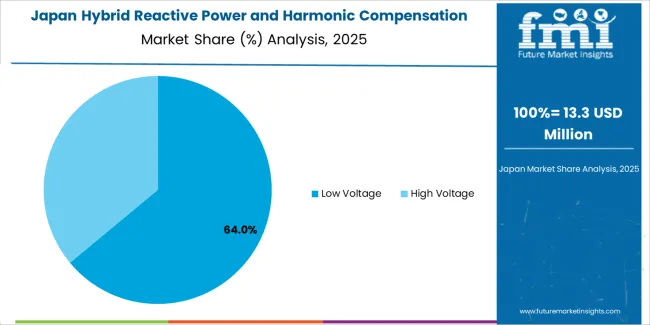

Japanese hybrid reactive power and harmonic compensation device operations reflect the country's advanced manufacturing standards and comprehensive power quality management culture. Industrial facilities maintain sophisticated electrical systems with integrated power quality monitoring and compensation capabilities. The regulatory environment and utility grid connection standards establish stringent performance requirements for compensation equipment.

Manufacturing facilities prioritize system reliability and advanced control capabilities, with procurement decisions emphasizing proven technologies demonstrating consistent performance. Major industrial equipment suppliers provide comprehensive technical support and system integration services essential for complex power quality applications. The Japanese market demonstrates preference for compact, high-performance systems with advanced digital interfaces and remote monitoring capabilities. Industrial automation sophistication and precision manufacturing requirements create demand for intelligent compensation systems supporting equipment protection and operational continuity across automotive, electronics, and machinery manufacturing facilities.

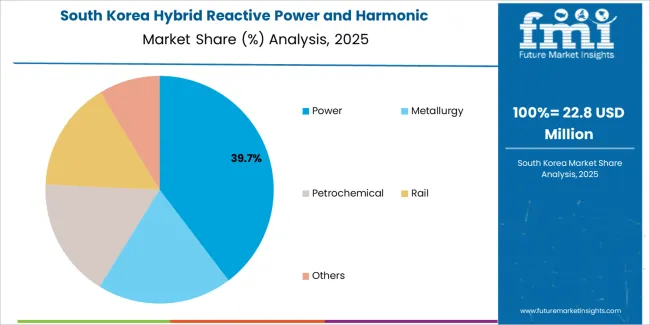

South Korean hybrid reactive power and harmonic compensation device operations reflect the country's technologically advanced industrial sector and growing power quality awareness. Major industrial complexes including semiconductor fabrication, automotive manufacturing, and petrochemical facilities maintain comprehensive power quality management systems. Industrial supply chains provide efficient equipment procurement supporting manufacturing reliability requirements.

Manufacturing facilities prioritize advanced compensation capabilities and system integration with facility automation platforms. Procurement strategies emphasize technology leadership and compatibility with smart manufacturing initiatives. The market benefits from industrial development policies supporting manufacturing sector competitiveness and facility modernization. Local manufacturers and international suppliers compete across segments, with market dynamics favoring systems demonstrating superior performance and seamless integration with industrial control systems in high-value manufacturing environments.

Market structure reflects concentration among established power electronics manufacturers and electrical equipment suppliers with comprehensive power quality portfolios. Value creation centers on technological innovation, system integration capabilities, and demonstrated performance in demanding industrial environments. Leading manufacturers maintain competitive positions through comprehensive offerings combining hardware, control software, and engineering services that establish long-term customer relationships extending across equipment lifecycle.

Profit pools concentrate in high-voltage segments and specialized industrial applications where complex harmonic environments and critical process requirements justify premium pricing. Custom-engineered solutions for unique applications generate higher margins compared to standardized low-voltage products. Service contracts and performance optimization programs provide recurring revenue streams supporting competitive equipment pricing. Emerging markets favor cost-competitive solutions, while developed markets prioritize advanced features and proven reliability.

Competitive dynamics demonstrate increasing emphasis on digital integration and intelligent control capabilities as product differentiation shifts beyond traditional power electronics specifications. Suppliers invest in software development and cloud connectivity enabling remote monitoring, predictive maintenance, and performance optimization services. System integration capabilities with building management platforms and industrial automation systems become essential differentiators. Cybersecurity features and data analytics capabilities enhance value propositions addressing connected infrastructure requirements.

Market consolidation occurs through acquisitions targeting complementary technologies and geographic expansion. Global electrical equipment manufacturers acquire specialized power quality technology providers to strengthen power management portfolios. Distribution partnerships and engineering collaboration agreements provide market access in regions requiring local technical support and utility relationship management. Vertical integration into power electronics component manufacturing and control system development supports technology leadership and cost competitiveness in competitive market segments.

| Items | Values |

|---|---|

| Quantitative Units | USD 419.2 million |

| Voltage Level | Low Voltage, High Voltage |

| Application | Power, Metallurgy, Petrochemical, Rail, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | United States, Germany, China, India, Brazil, and other 40+ countries |

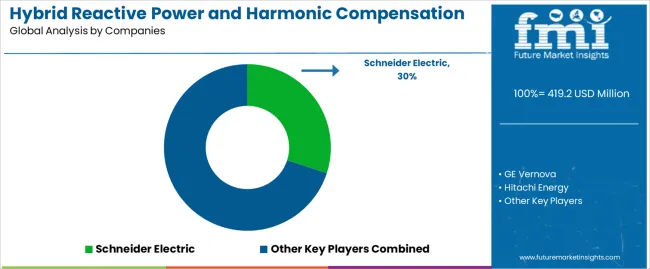

| Key Companies Profiled | Schneider Electric, GE Vernova, Hitachi Energy, Acrel, RENLE, LV BO JIE NENG |

| Additional Attributes | Dollar sales by voltage level and application, regional demand across North America, Europe, Asia Pacific, competitive landscape, digital integration advancement, modular system development, and industrial automation expansion driving power quality management enhancement, grid stability improvement, and equipment protection optimization |

The global hybrid reactive power and harmonic compensation device market is estimated to be valued at USD 419.2 million in 2025.

The market size for the hybrid reactive power and harmonic compensation device market is projected to reach USD 669.9 million by 2035.

The hybrid reactive power and harmonic compensation device market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in hybrid reactive power and harmonic compensation device market are low voltage and high voltage.

In terms of application, power segment to command 41.7% share in the hybrid reactive power and harmonic compensation device market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hybrid Vision Sensor Chips Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Printing Market Forecast Outlook 2025 to 2035

Hybrid Boat Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Metal-Paper Seamers Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Sealing-Cut Machines Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hybrid Additive Manufacturing Machines Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Integration Platform Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Meat Products Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Rice Seeds Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Memory Cube Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Solar Wind Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Cutters Market Analysis Size and Share Forecast Outlook 2025 to 2035

Hybrid Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Train Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hybrid Solar Wind Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Drivetrain Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA