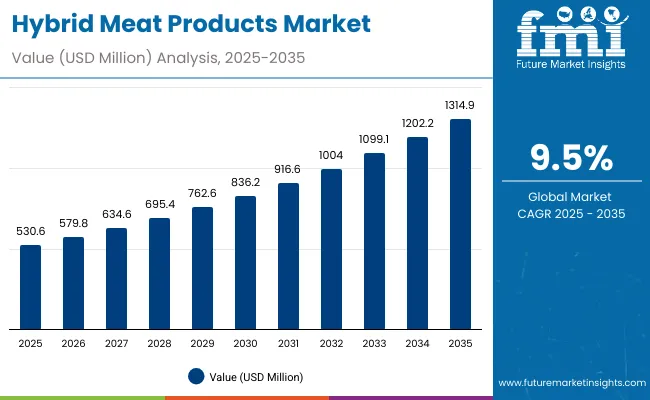

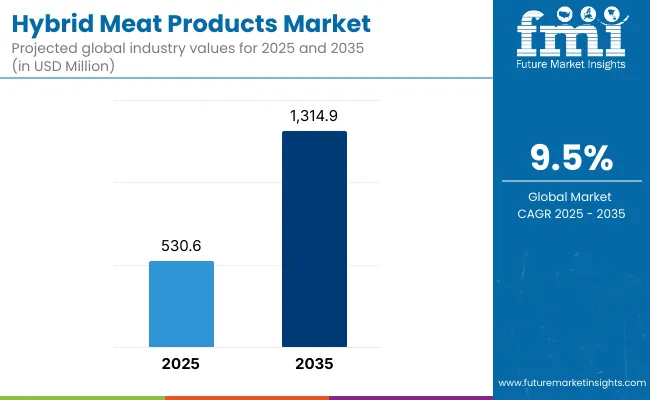

The global Hybrid Meat Products Market has been projected to be valued at USD 530.6 million in 2025 and is anticipated to reach approximately USD 1,314.9 million by 2035. A cumulative gain of USD 264.9 million is expected over the forecast decade, signaling a 9.5% CAGR.

Hybrid Meat Products Market Key Takeaways

| Metric | Value |

|---|---|

| Hybrid Meat Products Estimated Value in (2025E) | USD 530.6 million |

| Hybrid Meat Products Forecast Value in (2035F) | USD 1,314.9 million |

| Forecast CAGR (2025 to 2035) | 9.5% |

Adoption has been further encouraged as retailers, foodservice operators, and manufacturers prioritize offerings that balance familiarity with innovation, thereby reducing consumer hesitation often observed in fully plant-based categories. Strategic investments have been observed in supply chain optimization, product formulation, and marketing narratives emphasizing both taste and sustainability. This direction is expected to strengthen brand trust and expand penetration into mainstream consumption patterns.

During the first half of the assessment period from 2025 to 2030, the market is forecast to grow steadily from USD 530.6 million to levels exceeding USD 836 million. This early stage of growth is expected to be supported by consumer curiosity, gradual mainstreaming of hybrid formats, and the entry of established meat and plant-protein companies into this space. The adoption during this phase is anticipated to be driven by premium positioning, marketing emphasis on sustainability, and the ability of hybrid solutions to offer both taste familiarity and nutritional balance.

In the second half of the period, from 2030 to 2035, accelerated expansion is projected, with the market surging from approximately USD 836 million to USD 1,314.9 million. This later-stage growth is expected to account for the larger share of decade-long gains, reflecting enhanced scalability, improved affordability, and stronger penetration into emerging economies. Regulatory clarity, advances in protein technologies, and greater consumer trust are anticipated to reinforce hybrid meat products as a mainstream category, firmly positioning them within the global protein landscape.

From 2020 to 2024, the Hybrid Meat Products Market expanded from a niche innovation space into a structured growth category, supported by early product launches and consumer curiosity toward blended protein options. During this period, traditional meat companies dominated visibility by integrating hybrid lines into established retail and foodservice networks, while plant-based innovators focused on premium offerings.

By 2025, demand is expected to accelerate, reaching USD 530.6 million, with burgers and patties driving adoption through their consumer familiarity and mainstream positioning. Over the next decade, growth will be reinforced by diversification into ready-to-eat meals, deli slices, and snackable hybrids, enabling penetration across multiple consumption occasions. Regional expansion will be shaped by North America and Europe’s early leadership, while Asia-Pacific is projected to deliver the fastest relative growth.

Competitive advantage is expected to shift from first-mover novelty toward scalability, affordability, and trust-building. Partnerships between meat processors and food-tech innovators are projected to define the next phase of hybrid market leadership.

Growth in the Hybrid Meat Products Market is being driven by a convergence of sustainability, health, and consumer preference dynamics. Increasing awareness of climate impact from livestock production has been translated into demand for products that reduce environmental footprints while retaining the taste and texture of conventional meat. This alignment with sustainability goals has been reinforced by policy initiatives, corporate commitments to carbon reduction, and investments in sustainable food technologies.

Consumer interest in healthier dietary choices has also been observed as a strong catalyst. Hybrid meat products have been positioned as solutions that deliver familiar sensory experiences while incorporating plant-based proteins and functional ingredients that enhance nutritional profiles. This positioning has been amplified through marketing strategies focused on clean labels, high protein claims, and balanced fat compositions.

The involvement of established meat companies alongside plant-based pioneers has accelerated category legitimacy. Strategic collaborations, co-branding initiatives, and product innovations have expanded retail presence and normalized consumer trial. Parallel advances in protein processing, flavor enhancement, and binding technologies have improved texture, affordability, and scalability, creating a more competitive offering. As adoption broadens across mainstream retail, foodservice, and online channels, the hybrid meat products market is expected to solidify its position as a critical bridge in the transition toward sustainable protein consumption.

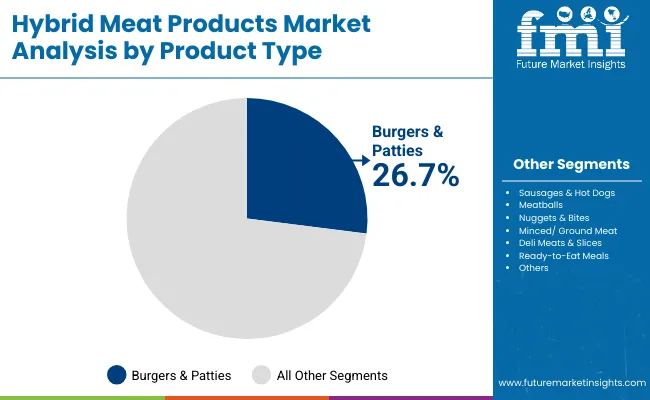

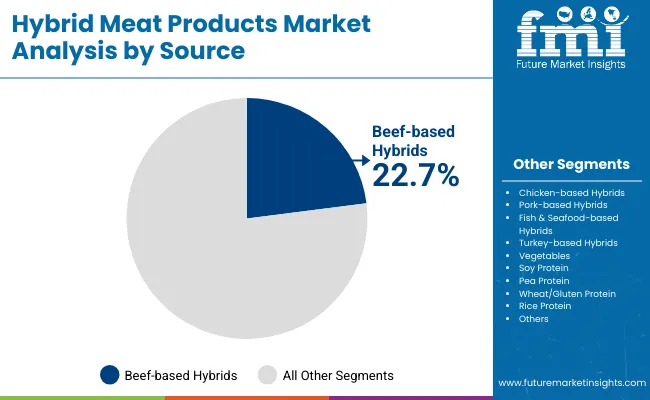

The Hybrid Meat Products Market has been segmented by product type, distribution channel, source, ingredient functionality, nutritional positioning, and region. Each segment reflects a distinct dimension of consumer demand, production innovation, and retail strategy shaping the trajectory of this emerging category. Product type segmentation highlights the formats through which hybrid proteins are most readily introduced to consumers, aligning with familiarity and convenience. Distribution channel segmentation emphasizes the critical role of retail touchpoints, ranging from mainstream supermarkets to online platforms, in expanding accessibility and awareness. Source segmentation underscores the evolving composition of hybrid formulations, with animal and plant-derived proteins combined to balance sensory expectations with sustainability imperatives. Together, these dimensions illustrate the multi-layered growth potential of hybrid meat products.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Burgers & Patties | 26.70% |

| Minced/ Ground Meat | 16.80% |

Burgers & Patties are projected to lead the product type segment with a 26.7% share in 2025, supported by their widespread consumer acceptance and ease of integration into fast food and retail formats. Growth has been sustained by their positioning as familiar entry points for hybrid proteins, allowing consumers to trial without altering established eating habits. Although the CAGR is moderate at 6.5%, their scale and visibility are expected to drive significant absolute gains over the decade. Minced and ground meat formats are forecasted to grow faster at 7.8%, reflecting demand for versatile cooking applications. Over time, product diversity and innovation in ready-to-eat hybrids are anticipated to strengthen the overall segment outlook.

| Source | 2025 Share% |

|---|---|

| Beef-based Hybrids | 22.70% |

| Chicken-based Hybrids | 18.40% |

| Soy Protein | 9.80% |

Beef-based hybrids are forecasted to hold the leading position with 22.7% share in 2025, reflecting consumer preference for beef flavor profiles in burgers and ground formats. However, their CAGR of 4.5% suggests slower growth due to environmental concerns and rising popularity of alternative sources. Chicken-based hybrids follow with 18.4% share and modest growth at 5.0%, favored for versatility in processed and ready-to-cook formats. Plant-based sources such as soy protein, accounting for 9.8% share, are anticipated to grow faster at 6.2%, supported by sustainability credentials and adaptability in diverse formulations. The gradual diversification into pea, rice, and mycoprotein is expected to further shift share toward plant-forward hybrids, strengthening long-term growth prospects.

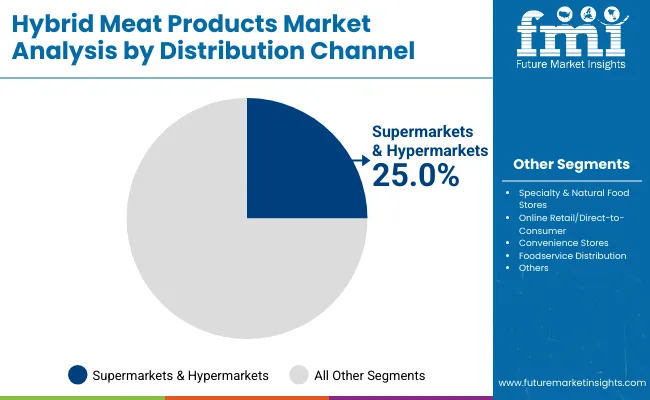

| Distribution Channel | 2025 Share% |

|---|---|

| Supermarkets & Hypermarkets | 25.0% |

| Convenience Stores | 22.0% |

| Specialty & Natural Food Stores | 20.0% |

Supermarkets & Hypermarkets are expected to command the largest share of distribution at 25% in 2025, reflecting their central role in consumer access and visibility of hybrid products. Shelf placement within mainstream grocery outlets has been leveraged as a key trust-building factor, enabling hybrid products to be positioned alongside conventional meat. Growth at 7.0% CAGR reflects steady penetration rather than rapid acceleration. Online retail, with a CAGR of 8.3%, is anticipated to be the fastest-growing channel as direct-to-consumer models expand through subscription services and digital-native brands. Convenience stores are also forecasted to contribute meaningfully, supported by ready-to-eat hybrid offerings suited to on-the-go consumption. Together, these channels are expected to strengthen hybrid product accessibility across consumer groups.

Adoption of hybrid meat products has been shaped by a balance of growth drivers, structural restraints, and emerging trends. While consumer health awareness and sustainability imperatives are strengthening demand, challenges related to cost competitiveness and consumer perception are moderating the pace of expansion. At the same time, evolving retail strategies and protein innovation are redefining the market’s long-term trajectory.

Sustainability and Environmental Impact

Market growth has been strongly influenced by rising concerns over the environmental footprint of livestock production. Hybrid meat products have been positioned as pragmatic solutions that combine familiar taste profiles with reduced reliance on animal proteins, thereby lowering greenhouse gas emissions and resource intensity. Growing alignment with corporate sustainability commitments and governmental climate policies has further reinforced adoption. Food companies have increasingly highlighted reduced carbon and water footprints in their branding, strengthening trust and driving consumer trial. Over the forecast period, environmental positioning is expected to act as a primary driver, solidifying hybrid meat products as a bridge to sustainable consumption.

Price Competitiveness and Cost Barriers

Despite strong momentum, hybrid meat products have faced challenges in achieving parity with conventional meat pricing. Higher production costs have been observed due to reliance on advanced processing technologies, premium plant-protein inputs, and specialized formulations to ensure texture and flavor alignment. These costs have limited affordability, particularly in price-sensitive markets where meat remains a staple protein. Retailers and foodservice operators have been cautious in scaling shelf presence when pricing premiums exceed consumer willingness to pay. Unless cost efficiencies are realized through economies of scale and technological optimization, affordability constraints are expected to act as a restraint on widespread adoption.

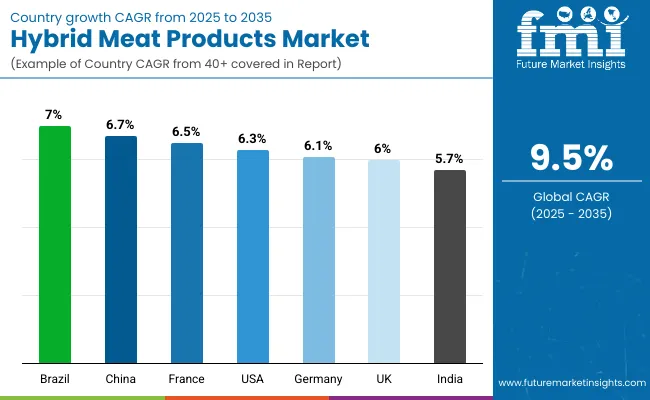

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 6.7% |

| India | 7.0% |

| Germany | 6.1% |

| France | 6.5% |

| UK | 6.0% |

| USA | 6.3% |

| Brazil | 5.7% |

The global Hybrid Meat Products Market is expected to show distinct country-level dynamics, with adoption influenced by consumer health trends, sustainability imperatives, and retail penetration strategies. China, projected at a 6.7% CAGR, is anticipated to lead Asia-Pacific growth, supported by strong government backing for sustainable food systems, rapid urbanization, and consumer receptiveness to protein diversification. India, with a 7.0% CAGR, is expected to expand steadily, as affordability concerns are balanced against increasing awareness of plant-forward diets and growing acceptance in metropolitan foodservice channels.

In Europe, Germany at 6.1% CAGR, France at 6.5%, and the UK at 6.0% are projected to maintain robust momentum, shaped by stringent sustainability regulations, strong retail infrastructure, and the high visibility of hybrid offerings in mainstream supermarkets. These markets are expected to benefit from cultural openness to food innovation and a rising focus on reducing meat consumption without compromising taste.

The USA, growing at 6.3% CAGR, is anticipated to remain a cornerstone of market expansion in North America, driven by strong retail and e-commerce penetration, alongside active participation of major food companies. Brazil, at 5.7% CAGR, is forecasted to outpace other Latin American markets, benefiting from a shift toward premium protein innovation and export-oriented opportunities.

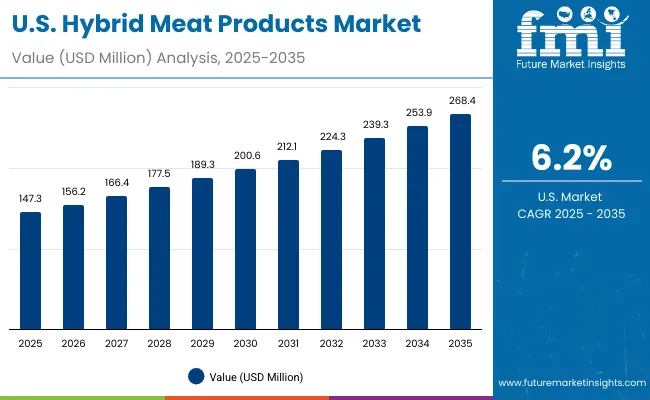

| Year | USA Hybrid Meat Products Market (USD Million) |

|---|---|

| 2025 | 147.3 |

| 2026 | 156.2 |

| 2027 | 166.4 |

| 2028 | 177.5 |

| 2029 | 189.3 |

| 2030 | 200.6 |

| 2031 | 212.1 |

| 2032 | 224.3 |

| 2033 | 239.3 |

| 2034 | 253.9 |

| 2035 | 268.4 |

The Hybrid Meat Products Market in the United States is projected to grow from USD 147.3 million in 2025 to USD 268.4 million in 2035, reflecting a strong CAGR of 6.3%. Expansion has been reinforced by increasing consumer interest in sustainable protein solutions that balance familiarity with nutritional innovation. Retail shelf presence in supermarkets and hypermarkets has been prioritized to normalize hybrid formats and stimulate mainstream adoption.

Demand growth has also been supported by rising interest from younger demographics seeking high-protein and clean-label food options. Strategic partnerships between established meat processors and plant-based companies have been observed, accelerating category legitimacy and improving product accessibility. Online retail channels are forecasted to expand at a faster pace, aligning with direct-to-consumer subscription trends.

The Hybrid Meat Products Market in the United Kingdom is projected to expand steadily at a 6.0% CAGR during 2025-2035, supported by strong consumer engagement with sustainable and healthier food choices. Growth has been reinforced by the country’s high retail penetration, where hybrid products are increasingly positioned alongside plant-based and conventional meat offerings in supermarkets. Regulatory alignment with sustainability targets is expected to further drive awareness and adoption.

The Hybrid Meat Products Market in India is forecasted to grow at a 7.0% CAGR between 2025 and 2035, reflecting the dual impact of rising health awareness and persistent price sensitivity. Expansion is expected to be anchored in metropolitan areas, where exposure to plant-forward diets and innovative foodservice offerings is higher. Affordability remains a critical factor shaping adoption rates, particularly outside Tier-1 cities.

The Hybrid Meat Products Market in China is projected to grow at a 6.7% CAGR through 2025-2035, making it the fastest-growing market in Asia-Pacific. Expansion is expected to be driven by strong government support for sustainable food systems, rapid urbanization, and consumer openness to protein diversification. Scaling opportunities are being reinforced by investments in retail integration and foodservice partnerships.

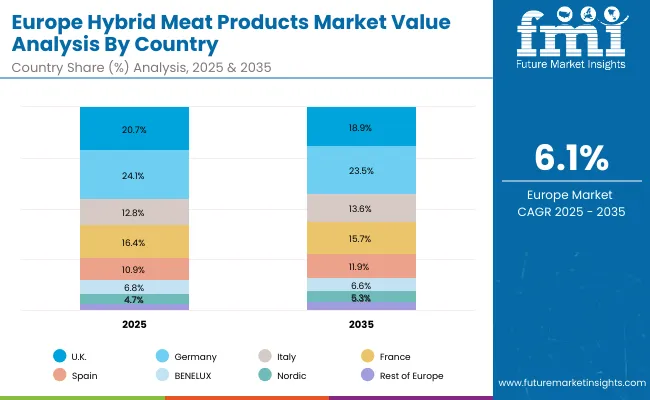

| Countries | 2025 |

|---|---|

| UK | 20.7% |

| Germany | 24.1% |

| Italy | 12.8% |

| France | 16.4% |

| Spain | 10.9% |

| BENELUX | 6.8% |

| Nordic | 4.7% |

| Rest of Europe | 3.6% |

| Countries | 2035 |

|---|---|

| UK | 18.9% |

| Germany | 23.5% |

| Italy | 13.6% |

| France | 15.7% |

| Spain | 11.9% |

| BENELUX | 6.6% |

| Nordic | 5.3% |

| Rest of Europe | 4.5% |

The Hybrid Meat Products Market in Germany is forecasted to record a 6.1% CAGR during 2025-2035, supported by high consumer openness to plant-forward diets and robust regulatory frameworks on sustainability. Supermarkets and hypermarkets are expected to drive early penetration, while online retail continues to gain momentum among younger consumers. Strong demand for fortified and clean-label hybrids is anticipated to define product differentiation.

| Product Type | Market Value Share, 2025 |

|---|---|

| Burgers & Patties | 26.7% |

| Sausages & Hot Dogs | 14.3% |

| Meatballs | 8.6% |

| Nuggets & Bites | 13.9% |

| Minced/ Ground Meat | 16.8% |

| Deli Meats & Slices | 7.4% |

| Ready-to-Eat Meals (curries, pasta, pizzas, etc.) | 8.7% |

| Others (jerky, strips, schnitzels, etc.) | 3.6% |

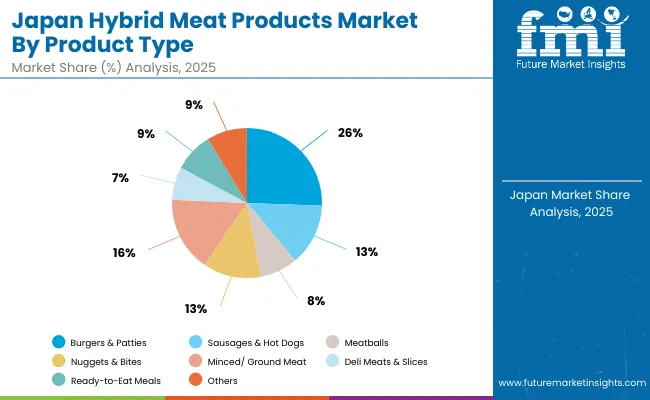

The Hybrid Meat Products Market in Japan is projected at USD 34.5 million in 2025, with burgers and patties contributing the largest share at 25.6%. Growth has been underpinned by strong demand for familiar formats, yet faster acceleration is being observed in ready-to-eat hybrids and “others” such as jerky and schnitzels, reflecting urban convenience preferences. Premiumization trends and health claims are shaping positioning, with hybrid products marketed as balanced choices that blend taste familiarity with nutritional and sustainability advantages. Over the decade, adoption is expected to broaden through foodservice collaborations and increased visibility in convenience retail formats, aligning with Japan’s evolving dietary patterns.

| Distribution Channel | Market Value Share, 2025 |

|---|---|

| Supermarkets & Hypermarkets | 25.0% |

| Specialty & Natural Food Stores | 20.0% |

| Online Retail/Direct-to-Consumer | 18.0% |

| Convenience Stores | 22.0% |

| Foodservice Distribution | 15.0% |

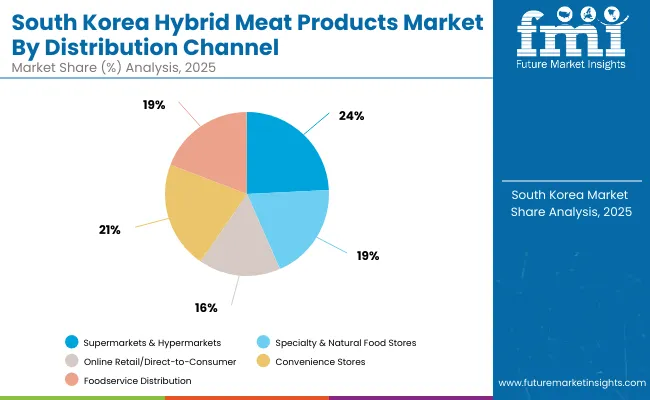

The Hybrid Meat Products Market in South Korea is projected at USD 19.7 million in 2025, with distribution dynamics strongly influenced by the country’s dense retail network and tech-driven consumer culture. Supermarkets and hypermarkets are expected to contribute the largest share at 24%, providing mainstream exposure and consumer trust. However, the fastest momentum is anticipated in foodservice distribution (8.0% CAGR), reflecting the rising role of hybrid proteins in quick-service restaurants and premium dining formats. Convenience stores, integral to South Korea’s food culture, are also forecasted to expand rapidly, supported by ready-to-eat hybrid meal solutions tailored for on-the-go consumption. Over the decade, digital-native retail and direct-to-consumer models are expected to deepen reach among younger demographics, driven by advanced e-commerce platforms and subscription models.

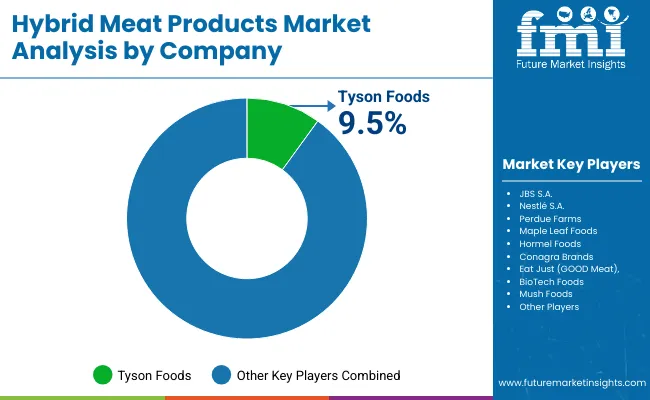

| Company | Global Value Share 2025 |

|---|---|

| Tyson Foods | 9.5% |

| Others | 90 .5% |

The Hybrid Meat Products Market is moderately fragmented, with global leaders, established mid-sized players, and innovation-driven specialists competing across product formats and distribution channels. Major global leaders such as Tyson Foods, JBS S.A., Nestlé S.A., and Perdue Farms have been leveraging scale, brand trust, and strong retail partnerships to dominate early adoption. Their strategies have emphasized diversification into hybrid categories to balance traditional meat portfolios with sustainable protein alternatives.

Established mid-sized innovators such as Maple Leaf Foods Inc., Hormel Foods Corporation, and Conagra Brands, Inc. have been focusing on product development agility, co-branding initiatives, and hybrid positioning strategies. These companies are accelerating adoption by aligning formulations with nutritional claims such as high-protein, fortified, and clean-label benefits. Their growing presence across supermarkets and foodservice has reinforced mainstream penetration.

Specialized pioneers such as Eat Just, Inc. (GOOD Meat), BioTech Foods, and Mush Foods are expected to reshape competition through advanced protein engineering, fermentation-driven innovations, and plant-based blends. Their strengths lie in customization, sustainability narratives, and appeal to younger consumer segments seeking ethical choices.

Competitive differentiation is shifting toward ecosystem building, with emphasis on taste innovation, cost efficiency, and scalable partnerships across retail and foodservice. Over time, hybrid meat players are anticipated to compete less on product novelty and more on supply chain resilience, affordability, and consumer trust.

Key Developments in Hybrid Meat Products Market

| Item | Value |

|---|---|

| Quantitative Units | USD 530.6 million |

| Product Type | Burgers & Patties, Sausages & Hot Dogs, Meatballs, Nuggets & Bites, Minced/Ground Meat, Deli Meats & Slices, Ready-to-Eat Meals, Others (jerky, schnitzels, strips) |

| Source | Beef-based Hybrids, Chicken-based Hybrids, Pork-based Hybrids, Fish & Seafood-based Hybrids, Turkey-based Hybrids, Vegetables, Soy Protein, Pea Protein, Wheat/Gluten Protein, Rice Protein, Faba Bean & Lentil Protein, Mycoprotein, Potato Protein, Chickpea, Hemp |

| Ingredient Functionality | Protein Enhancers, Fiber & Binders, Flavor Enhancers, Fat/Oil Blends, Additives for Texture & Juiciness |

| Nutritional Positioning | High-Protein Hybrids, Low-Fat/Reduced Calorie Hybrids, Fortified (vitamins, minerals, omega-3), Clean-Label, Conventional |

| Distribution Channel | Supermarkets & Hypermarkets, Specialty & Natural Food Stores, Online Retail/Direct-to-Consumer, Convenience Stores, Foodservice Distribution |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Tyson Foods, JBS S.A., Nestlé S.A., Perdue Farms, Maple Leaf Foods, Hormel Foods, Conagra Brands, Eat Just (GOOD Meat), BioTech Foods, Mush Foods |

| Additional Attributes | Dollar sales by product type, source, and channel; adoption trends in mainstream retail and foodservice; price competitiveness vs. conventional meat; health and sustainability positioning; influence of government sustainability targets; innovation in hybrid protein formulations; regional growth drivers shaped by consumer culture and regulatory environment |

The global Hybrid Meat Products is estimated to be valued at USD 530.6 million in 2025.

The market size for the Hybrid Meat Products is projected to reach USD 1,314.9 million by 2035.

The Hybrid Meat Products is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product types in the Hybrid Meat Products Market are burgers & patties, sausages & hot dogs, meatballs, nuggets & bites, minced/ground meat, deli meats & slices, ready-to-eat meals, and other formats such as jerky and schnitzels.

In terms of product type, burgers & patties are projected to command the largest share at 26.7% in the Hybrid Meat Products Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hybrid Reactive Power and Harmonic Compensation Device Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Vision Sensor Chips Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Printing Market Forecast Outlook 2025 to 2035

Hybrid Boat Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Metal-Paper Seamers Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Sealing-Cut Machines Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hybrid Powertrain Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Additive Manufacturing Machines Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Integration Platform Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Rice Seeds Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Memory Cube Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Solar Wind Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Cutters Market Analysis Size and Share Forecast Outlook 2025 to 2035

Hybrid Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Train Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hybrid Solar Wind Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA