The car wax market is growing steadily, driven by an increasing consumer inclination towards vehicle maintenance and appearance enhancement. Car waxes protect a car from environmental elements like dirt, UV rays, and water which helps retain a beauty car. New synthetic and natural wax formulations, such as eco-friendly waxes, have been drawing a greater customer base.

Market demand is primarily driven by improving disposable incomes, expanding automotive sectors, and the growing do-it-yourself (DIY) car care trend. Globally, the growing inclination towards waterless car wash offerings and premium detailing solutions is expected to be another strong driver behind the adoption of next-gen car wax formulas in recent times.

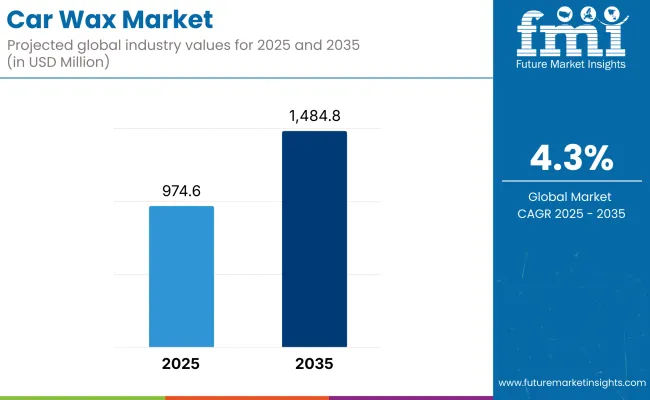

In 2025, the car wax market size is projected at approximately USD 974.63 million. By 2035, it is expected to reach USD 1,484.85 million, growing at a compound annual growth rate (CAGR) of 4.3%.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 974.63 million |

| Projected Market Size in 2035 | USD 1,484.85 million |

| CAGR (2025 to 2035) | 4.3% |

Key growth drivers include the rising popularity of electric vehicles (EVs), increased focus on vehicle longevity, and expanding urbanization trends. Product innovation, such as nanotechnology-based waxes and hybrid coatings that combine wax with sealants, is expected to shape future market dynamics, enhancing both protection and shine for vehicle exteriors.

Car wax products remain popular in North America, driven by high vehicle ownership rates and a strong preference among consumers for vehicle maintenance. Demand for premium and eco-friendly defense, which provides durable protection, is driving the region, led by the USA. New waxes, including those that use ceramic particles, have also become more common. Coupled with the increasing number of professional car detailing services in the region as well a thriving DIY car care culture made easy by automotive specialty shops and eCommerce websites.

The car wax market of Europe is growing, boosted by strict vehicle maintenance and the cultural value placed on having high-quality vehicle appearances in Europe. Germany, France and the UK are the third, fourth and fifth top-countries with natural carnauba waxes and synthetic hybrids applications.

An evolving market dynamic: the move towards eco-friendly goods and a growing emphasis on electric vehicle services. The number of sales channels available to consumers online is increasing exponentially, providing consumers easy access to the best car care products on the market.

With a wide middle-class population, booming automotive sales, and a robust aftermarket industry, the Asia-Pacific market, thus offers an impressive growth opportunity for the car wax manufacturers. While Chinese, Indian, and Japanese presence is strong in the region, it's becoming more conscious about both vehicle protection and aesthetic maintenance.

The growing use of western-based car care trends, along with the growing number of auto detailing centers, will drive the need for high class and high-performance car waxes. Budget-friendly options are also seeing more uptake from cost-conscious consumers.

Growing consumer inclination towards vehicle aesthetics and protection is anticipated to result in healthy growth of car wax market. Due to the innovations in formulations, environment friendly product developments and expanding e-commerce channels, the future has a lot in store.

With the increasing global vehicle ownership and the growing demand for DIY maintenance from the consumer's side, there are well-defined opportunities for premium and specialty wax products. Companies that focus on sustainability, easy application, and long-lasting performance will dominate the competitive environment in the decade ahead.

Challenges

Rising Popularity of Ceramic Coatings

Car wax products are beginning to face serious competition from ceramic coatings, which not only provide longer-lasting protection, but also offer superior hydrophobic properties. In premium segments, most consumers are leaning more towards ceramic alternatives than a traditional wax to deter them from the menace, thus affecting overall sales volumes.

Additionally, enhanced consumer education regarding the advantages of longer-lasting protection and reduced maintenance inherent in ceramic coatings necessitates a competitive landscape in which wax manufacturers must either reinvent approaches or explore variable product portfolios. And even more so that ceramic coatings are getting cheaper with the passing day, which is posing a threat to traditional wax sales.

Increasing Environmental Regulations on Chemical Ingredients

Internationally, stricter environmental regulations targeting volatile organic compounds (VOCs) and certain chemical solvents used in formulations of automotive waxes are anticipated to impact this market. The need to reformulate products to meet these changing standards requires companies to invest heavily, leading to increased R&D costs and increased time-to-market.

Eco-conscious consumers also are demanding biodegradable, non-toxic waxes, marking a hurdle for traditional formulations depending heavily on petroleum-based ingredients, notably in North America and Europe. Such regulatory shifts are forcing companies to look for certification labels, which adds more operational complexities.

Opportunities

Surge in DIY Car Care Trends

Consumer demand has dramatically increased for easy-to-apply car wax products developed for do it yourself (DIY) car detailing as the practice spreads through tutorials available online and social media influencers. Consumers are increasingly spending money on products that help them achieve a professional finish in the comfort of their own property, presenting huge opportunities for brands with spray waxes, liquid waxes and hybrid solutions.

Access has also improved thanks to e-commerce, enabling niche brands to target global DIY fans and find them actively, rather than passively, seeking out information. Expansion in the interest groups of hobbyist cars further extends the reach of DIY wax recipes.

Growing Demand for Premium and Natural Car Waxes

A rising trend towards premium, natural car waxes, such as those that use carnauba, has opened profitable avenues. Premium wax products are considered today not just protectants, but specific luxury items that enrich the vehicle aesthetic and resale value.

Companies focusing on natural or hybrid wax formulations can capture up to 90% market share given the proclivity towards improved quality, durability, and eco-friendliness. Strategic collaborations with premium automobile manufacturers are another major growth opportunity.

The car wax market saw robust growth from 2020 to 2024, particularly with sales through online channels and specialty retailers. COVID-19 halted professional detailing services in the earlier days, but DIY car care blossomed; the rise in at-home detailing led to a surge in consumer-level product sales.

Brands focused on user-friendly applications, waterless solutions and quick-buff products to address changing consumer behavior patterns. Suddenly, ecofriendly status waxes began to gain popularity, as they dovetailed the greater movement towards environmental sustainability and informed product development in other areas of the industry.

Hyper-premiumization, sustainability, and tech-infused solutions define the future racetrack (2025 to 2035). This will gain traction from smart waxes, self-healing surfaces, UV damage indicators, ultra-hydrophobic nano-formulas, etc. Subscription models for regular car care kits and tailored solutions will be common place (given vehicle type and usage) in urban and tech-savvy consumer segments. Through automotive tech company collaborations, next-gen smart wax products are anticipated to be developed.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Aspect | 2020 to 2024 Trends |

|---|---|

| Key Growth Driver | DIY car care boom, online retail growth |

| Product Innovations | Spray waxes, hybrid quick-application wax |

| Consumer Behavior | Affinity for convenience and affordability |

| Distribution Channels | E-commerce dominance, specialty retail |

| Regional Demand Hotspots | North America, Europe |

| Regulatory Environment | VOC compliance tightening in developed markets |

| Competitive Strategies | Pricing and promotions |

| Market Aspect | 2025 to 2035 Projections |

|---|---|

| Key Growth Driver | Tech-infused waxes, sustainability-focused formulations |

| Product Innovations | Nano-coatings, smart waxes with UV indicators |

| Consumer Behavior | Willingness to pay premium for performance and sustainability |

| Distribution Channels | Direct-to-consumer subscriptions, customized online offerings |

| Regional Demand Hotspots | Asia-Pacific, Middle East, emerging African markets |

| Regulatory Environment | Global eco-label requirements and carbon-neutral mandates |

| Competitive Strategies | Innovation, product sustainability, brand loyalty programs |

The United States car wax market is experiencing steady expansion due to rising vehicle ownership rates and a growing emphasis on vehicle maintenance and aesthetics among consumers. The premiumization trend, with consumers craving high-end products that offer stronger protection and longer-lasting shine, is well-established.

Additionally, the rising demand for retail products from American consumers, driven by the popularity of DIY (Do-It-Yourself) car care, is fueling the market. Additionally, a rise in professional car detailing services and eco-friendly wax formulations are further aiding the growth of the market across the country.

| Country | CAGR (2025 to 2035) |

|---|---|

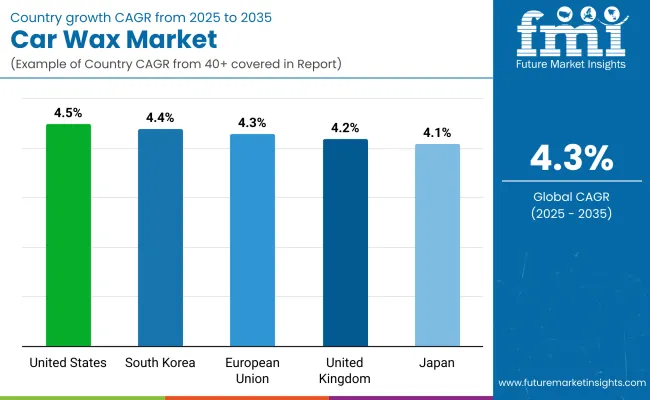

| USA | 4.5% |

The car wax market in the United Kingdom is gaining traction due to growing awareness of vehicle maintenance and the resulting increase in resale value. Consumers are increasingly favoring natural and ceramic-based waxes that provide optimal defense against the UK’s notoriously moist and changeable climate.

Sales are significantly supported by the surge in e-commerce platforms for automotive care products and an increasing demand for professional detailing services. Innovative materials targeting biodegradable waxes will drive further demand for easy-application waxes.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.2% |

The car wax market in the European Union is steadily expanding, which can be attributed to the rising automotive care culture in countries such as Germany, France, and Italy. This means that powerful waxes, waxes that use nanotechnology and hydrophobic particles, are in high demand.

This is partly due to stricter environmental regulations, but also due to the introduction of eco-friendly, water-based wax products. In addition, increasing disposable income and booming pre-owned car market is driving customers to spend more on retaining a vehicle's appearance.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.3% |

The car wax market in Japan is also healthy. Long-term preservation of a vehicle is an important factor in Japanese consumers' purchase decisions, fueling demand for premium waxes that offer superior protection solutions.

Emerging technologies, such as graphene-infused wax, hybrid polymer solutions, and ceramic sealants, are gaining popularity. Furthermore, the increasing prevalence of electric vehicles (EVs) and high-end car sales is driving the development of specialized car wax formulations designed to meet the requirements of modern automotive finishes.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

The market for car wax in South Korea is experiencing growth, driven by factors such as increasing car ownership, a thriving second-hand car market, and a culture that prioritizes vehicle aesthetics. Once consumers can save time on applying high-gloss, durable wax with UV protection, they are always searching for it.

It’s also a boon for a strong automotive manufacturing sector, driving innovation in car care products. The growth of online automotive retail platforms and the increasing demand for do-it-yourself (DIY) car detailing kits are propelling the adoption of different types of car wax products even further.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

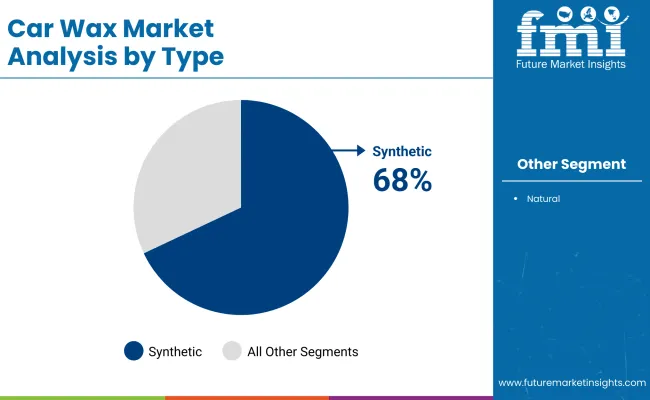

| Type | Market Share (2025) |

|---|---|

| Synthetic Car Wax | 68% |

However, synthetic car wax has taken the lead due to its smoother performance features, giving car owners the advantage most needed in today's era. Many synthetic waxes, which include polymers and resins, offer improved durability, a longer-lasting shine, and enhanced protection against environmental contaminants compared to natural waxes, such as carnauba.

Another major driver of consumer preference is the ease with which the product can be applied. Synthetic waxes, usually easier to apply and to remove, are a time-saver for both do-it-yourselfers and professional detailers. If combined with the months-long protection from UV rays, acid rain, road salt, and industrial fallout, they are becoming a more and more appealing option.

Additionally, with consumers increasingly expecting more value with less hassle, the durability of synthetic wax means it reduces the need for reapplication and is a great option for those with a busy lifestyle. At the same time, the rise of e-commerce and easy-to-use synthetic car care kits have made car care even more accessible and contributed to the growth of the segment as a whole.

Synthetic waxes are typically favored in professional detailing situations where high-volume work in a consistent, high-quality manner is desired, along with durability. They also excel under a diverse range of climatic conditions, allowing gloss and protection to be retained throughout each weather elements, thereby solidifying their stronghold in foreign terrains.

As product formulations evolve to include ceramic-infused synthetics and Hybrid Blends, performance keeps getting extended, making synthetic car wax the leading option for a wide range of users. The synthetic car wax segment is expected to maintain and expand its leading market position going forward, as automotive ownership and detailing culture continue to proliferate worldwide, particularly in emerging economies.

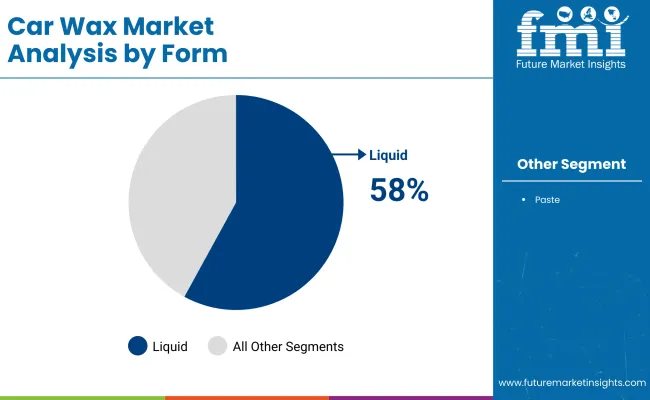

| Form | Market Share (2025) |

|---|---|

| Liquid Car Wax | 58% |

Liquid Car Wax is well ahead in terms of sales, and consumers, as well as auto detailers, are using liquid waxes because they are easy to use. Liquid formulations, unlike traditional paste waxes, offer a smoother, easier-to-apply spreading experience that lets consumers cover more square footage in a shorter amount of time.

Liquid car wax also offers a shorter buffing and removal process, appealing to both professionals and amateurs, resulting in a high-gloss finish with less effort. The ability to only require a small amount of product each use can save both professionals and individuals time spent maintaining each vehicle on the surface.

Moreover, liquid car wax has often advanced formulations with polymers, resins and even synthetic additives which offer better shine, better protection from the environmental elements and even longer-lasting. They feature terrific beading qualities, UV blockers, grime and light scratch resistance, making them a full 360-degree coat for the surfaces of your vehicle.

Liquid wax is versatile and suitable for users of all skill levels, as it can be applied with various tools, including applicator pads, polishing machines, or even simple microfiber cloths. Furthermore, advances in e-commerce connectivity and the DIY culture are further assisting in the global expansion of liquid car wax products.

The increasing demand for such products in at-home car care routines has also been a catalyst in the rising popularity of liquid car wax products worldwide. In the near future, the liquid car wax segment is expected to maintain its dominant position in the global car care market, as automotive maintenance awareness increases and consumers prioritize both convenience and performance.

The demand for car wax is expected to grow steadily, driven by consumer interest in vehicle aesthetics, maintenance, and protection. Trends will be replaced in the modern world through technology such as eco-friendly and nanotechnology-based car wax formulations. Growing vehicle ownership in emerging economies, as well as strong automotive aftermarket activity, is also boosting the growth of the market.

Moreover, as individuals increasingly opt to care for and detail their vehicles, demand for easy-to-use wax products is rising. The market is expected to grow at a sharp compound annual growth rate (CAGR) of 4.3% during the forecast period (2025-2035). As a means to gain customer loyalty and derive recurrent revenues, companies are also offering subscription models and wax products bundled with complete car care kits.

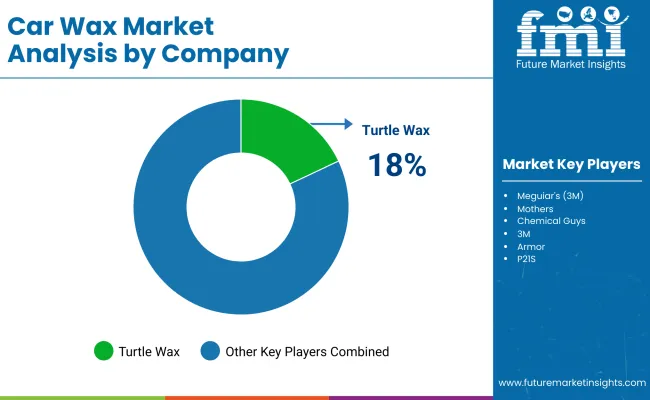

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Turtle Wax | 18-22% |

| Meguiar's (3M) | 15-18% |

| Mothers | 8-10% |

| Chemical Guys | 6-8% |

| 3M | 5-7% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Turtle Wax | In 2025, launched a new line of hybrid ceramic waxes with improved UV protection. Expanded e-commerce footprint globally through major online marketplaces and partnered with car detailing service chains. |

| Meguiar's (3M) | In 2024, introduced a biodegradable car wax range targeting eco-conscious consumers. Enhanced digital presence by offering online tutorials and virtual detailing classes. |

| Mothers | In 2025, expanded its professional-grade product line for automotive workshops. Invested in influencer marketing campaigns across North America and Europe to boost brand awareness. |

| Chemical Guys | In 2024, customizable car care kits were released, allowing users to personalize wax types and fragrances. Strengthened retail presence in Southeast Asia. |

| 3M | In 2025, integrated smart technology into wax applicators for more precise coating applications. Focused heavily on research and development in durable, weather-resistant wax solutions. |

Key Company Insights

Turtle Wax (18-22%)

Turtle Wax is still a major player in the market, capitalizing on its history as well as a wide array of product options and consumer loyalty. The emphasis on hybrid technology and the entry into worldwide eCommerce channels is great for the future. Recent partnerships with professional detailing chains are anticipated further to enhance brand visibility and credibility to new customer segments.

Meguiar's (3M) (15-18%)

Meguiar's Specialty Cleaner is continuing to strengthen its eco-friendly product line, serving a rapidly expanding group of environmentally aware consumers. Meguiar's fosters community engagement and even brand loyalty among DIY enthusiasts and professional detailers alike through virtual training programs.

Mothers (8-10%)

Mothers caters to high-performance wax products for marine and automotive professionals and enthusiasts. Notably, the firm's market-hitting investments, in particular via social networking influencers, are suave influential on the steady influx of newer car owners who are opting for premium solutions for car care.

Chemical Guys (6-8%)

Cost-conscious car owners, such as millennials and Gen Z, will find Chemical Guys' focus on customization and personalization particularly appealing. Whether it be their expansion into emerging markets like Southeast Asia, seizing opportunity from an urbanizing populace with an appetite for vehicle care.

3M (5-7%)

Drawing upon their core R&D strengths, 3M developed new wax formulations that resist wear and weathering. With the up-to-date smart applicator technology, 3M paves its way toward a user-friendly and relevant experience in comparison with conventional competitors.

Other Key Players (35-45% Combined)

The overall market size for car wax market was USD 974.63 million in 2025.

The car wax market expected to reach USD 1,484.85 million in 2035.

Rising automotive ownership, increasing demand for vehicle aesthetics, growing DIY car care trends, and advancements in eco-friendly wax formulations will drive demand for the car wax market during the forecast period.

The top 5 countries which drives the development of cargo bike tire marketare USA, UK, Europe Union, Japan and South Korea.

Synthetic car wax segment driving market growth to command significant share over the assessment period.

Table 1: Global Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Product Type, 2013 – 2028

Table 2: Global Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Form, 2013 – 2028

Table 3: Global Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Sales Channel, 2013 – 2028

Table 4: Global Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by End Use, 2013 – 2028

Table 5: Global Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Region, 2013 – 2028

Table 6: North America Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast By Country, 2013 – 2028

Table 7: North America Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Product Type, 2013 – 2028

Table 8: North America Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Form, 2013 – 2028

Table 9: North America Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Sales Channel, 2013 – 2028

Table 10: North America Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by End Use, 2013 – 2028

Table 11: Latin America Car Wax Market Size (US$ Mn) and Volume ( Tons) Forecast By Country, 2013 – 2028

Table 12: Latin America Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Product Type, 2013 – 2028

Table 13: Latin America Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Form, 2013 – 2028

Table 14: Latin America Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Sales Channel, 2013 – 2028

Table 15: Latin America Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by End Use, 2013 – 2028

Table 16: Western Europe Car Wax Market Size (US$ Mn) and Volume ( Tons) Forecast By Country, 2013 – 2028

Table 17: Western Europe Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Product Type, 2013 – 2028

Table 18: Western Europe Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Form, 2013 – 2028

Table 19: Western Europe Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Sales Channel, 2013 – 2028

Table 20: Western Europe Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by End Use, 2013 – 2028

Table 21: Eastern Europe Car Wax Market Size (US$ Mn) and Volume ( Tons) Forecast By Country, 2013 – 2028

Table 22: Eastern Europe Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Product Type, 2013 – 2028

Table 23: Eastern Europe Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Form, 2013 – 2028

Table 24: Eastern Europe Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Sales Channel, 2013 – 2028

Table 25: Eastern Europe Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by End Use, 2013 – 2028

Table 26: SEA Car Wax Market Size (US$ Mn) and Volume ( Tons) Forecast By Country, 2013 – 2028

Table 27: SEA Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Product Type, 2013 – 2028

Table 28: SEA Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Form, 2013 – 2028

Table 29: SEA Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Sales Channel, 2013 – 2028

Table 30: SEA Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by End Use, 2013 – 2028

Table 31: MEA Car Wax Market Size (US$ Mn) and Volume ( Tons) Forecast by Country, 2013 – 2028

Table 32: MEA Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Product Type, 2013 – 2028

Table 33: MEA Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Form, 2013 – 2028

Table 34: MEA Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Sales Channel, 2013 – 2028

Table 35: MEA Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by End Use, 2013 – 2028

Table 36: China Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Product Type, 2013 – 2028

Table 37: China Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Form, 2013 – 2028

Table 38: China Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Sales Channel, 2013 – 2028

Table 39: China Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by End Use, 2013 – 2028

Table 40: Japan Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Product Type, 2013 – 2028

Table 41: Japan Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Form, 2013 – 2028

Table 42: Japan Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Sales Channel, 2013 – 2028

Table 43: Japan Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by End Use, 2013 – 2028

Table 44: India Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Product Type, 2013 – 2028

Table 45: India Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Form, 2013 – 2028

Table 46: India Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by Sales Channel, 2013 – 2028

Table 47: India Car Wax Market Size (US$ Mn) and Volume (Tons) Forecast by End Use, 2013 – 2028

Figure 01: Global Car Wax Market Size (US$ Mn) and Volume (Tons) Analysis, 2013 – 2017

Figure 02: Global Car Wax Market Size (US$ Mn) and Volume (Tons) Analysis, 2022 – 2028

Figure 03: Global Car Wax Market Share and BPS Analysis by Product Type – 2022 & 2028

Figure 04: Global Car Wax Market Attractiveness Analysis by Product Type, 2022 – 2028

Figure 05: Global Car Wax Market Absolute $ Opportunity by Natural Segment, 2017 – 2028

Figure 06: Global Car Wax Market Absolute $ Opportunity by Synthetics Segment, 2017 – 2028

Figure 07: Global Car Wax Market Share and BPS Analysis by Form – 2022 & 2028

Figure 08: Global Car Wax Market Attractiveness Analysis by Form, 2022 – 2028

Figure 09: Global Car Wax Market Absolute $ Opportunity by Liquid Segment, 2017 – 2028

Figure 10: Global Car Wax Market Absolute $ Opportunity by Paste Segment, 2017 – 2028

Figure 11: Global Car Wax Market Share and BPS Analysis by Sales Channel – 2022 & 2028

Figure 12: Global Car Wax Market Attractiveness Analysis by Sales Channel, 2022 – 2028

Figure 13: Global Car Wax Market Absolute $ Opportunity by Manufacturer Segment, 2017 – 2028

Figure 14: Global Car Wax Market Absolute $ Opportunity by Distributor/Retailer Segment, 2017 – 2028

Figure 15: Global Car Wax Market Share and BPS Analysis by End Use – 2022 & 2028

Figure 16: Global Car Wax Market Attractiveness Analysis by End Use, 2022 – 2028

Figure 17: Global Car Wax Market Absolute $ Opportunity by OEM Segment, 2017 – 2028

Figure 18: Global Car Wax Market Absolute $ Opportunity by Aftermarket Segment, 2017 – 2028

Figure 19: Global Market Share and BPS Analysis by Region – 2022 & 2028

Figure 20: Global Car Wax Market Attractiveness Analysis by Region, 2022 – 2028

Figure 21: Global Car Wax Market Absolute $ Opportunity (US$ Mn), 2022 – 2028 by Region

Figure 22: North America Car Wax Market Share and BPS Analysis by Country – 2022 & 2028

Figure 23: North America Car Wax Market Attractiveness Analysis by Country, 2022 – 2028

Figure 24: North America Lime Market Volume Y-o-Y Growth Analysis by Country, 2017 – 2028

Figure 25: North America Market Absolute $ Opportunity (US$ Mn), 2017 – 2028 by Country

Figure 26: North America Car Wax Market Share and BPS Analysis by Product Type – 2022 & 2028

Figure 27: North America Car Wax Market Attractiveness Analysis by Product Type, 2022 – 2028

Figure 28: North America Car Wax Market Y-o-Y growth (%) Analysis by Product Type

Figure 29: North America Car Wax Market Share and BPS Analysis by Form – 2022 & 2028

Figure 30: North America Car Wax Market Attractiveness Analysis by Form, 2022 – 2028

Figure 31: North America Car Wax Market Y-o-Y growth (%) Analysis by Form

Figure 32: North America Car Wax Market Share and BPS Analysis by Sales Channel – 2022 & 2028

Figure 33: North America Car Wax Market Attractiveness Analysis by Sales Channel, 2022 – 2028

Figure 34: North America Car Wax Market Y-o-Y growth (%) Analysis by Sales Channel

Figure 35: North America Car Wax Market Share and BPS Analysis by End Use – 2022 & 2028

Figure 36: North America Car Wax Market Attractiveness Analysis by End Use, 2022 – 2028

Figure 37: North America Car Wax Market Attractiveness Analysis by End Use, 2022 – 2028

Figure 38: Latin America Car Wax Market Share and BPS Analysis by Country – 2022 & 2028

Figure 39: Latin America Car Wax Market Attractiveness Analysis by Country, 2022 – 2028

Figure 40: Latin America Lime Market Volume Y-o-Y Growth Analysis by Country, 2017 – 2026

Figure 41: Latin America Car Wax Market Absolute $ Opportunity (US$ Mn), 2022 – 2028 by Country

Figure 42: Latin America Car Wax Market Share and BPS Analysis by Product Type – 2022 & 2028

Figure 43: Latin America Car Wax Market Attractiveness Analysis by Product Type, 2022 – 2028

Figure 44: Latin America Car Wax Market Y-o-Y growth (%) Analysis by Product Type

Figure 45: Latin America Car Wax Market Share and BPS Analysis by Form – 2022 & 2028

Figure 46: Latin America Car Wax Market Attractiveness Analysis by Form, 2022 – 2028

Figure 47: Latin America Car Wax Market Y-o-Y growth (%) Analysis by Form

Figure 48: Latin America Car Wax Market Share and BPS Analysis by Sales Channel – 2022 & 2028

Figure 49: Latin America Car Wax Market Attractiveness Analysis by Sales Channel, 2022 – 2028

Figure 50: Latin America Car Wax Market Y-o-Y growth (%) Analysis by Sales Channel

Figure 51: Latin America Car Wax Market Share and BPS Analysis by End Use – 2022 & 2028

Figure 52: Latin America Car Wax Market Attractiveness Analysis by End Use, 2022 – 2028

Figure 53: Latin America Car Wax Market Attractiveness Analysis by End Use, 2022 – 2028

Figure 54: Western Europe Car Wax Market Share and BPS Analysis by Country – 2022 & 2028

Figure 55: Western Europe Car Wax Market Attractiveness Analysis by Country, 2022 – 2028

Figure 56: Western Europe Car Wax Market Volume Y-o-Y Growth Analysis by Country, 2017 – 2028

Figure 57: Western Europe Car Wax Market Absolute $ Opportunity (US$ Mn), 2022 – 2028 by Country

Figure 58: Western Europe Car Wax Market Share and BPS Analysis by Product Type – 2022 & 2028

Figure 59: Western Europe Car Wax Market Attractiveness Analysis by Product Type, 2022 – 2028

Figure 60: Western Europe Car Wax Market Y-o-Y growth (%) Analysis by Product Type

Figure 61: Western Europe Car Wax Market Share and BPS Analysis by Form – 2022 & 2028

Figure 62: Western Europe Car Wax Market Attractiveness Analysis by Form, 2022 – 2028

Figure 63: Western Europe Car Wax Market Y-o-Y growth (%) Analysis by Form

Figure 64: Western Europe Car Wax Market Share and BPS Analysis by Sales Channel – 2022 & 2028

Figure 65: Western Europe Car Wax Market Attractiveness Analysis by Sales Channel, 2022 – 2028

Figure 66: Western Europe Car Wax Market Y-o-Y growth (%) Analysis by Sales Channel

Figure 67: Western Europe Car Wax Market Share and BPS Analysis by End Use – 2022 & 2028

Figure 68: Western Europe Car Wax Market Attractiveness Analysis by End Use, 2022 – 2028

Figure 69: Western Europe Car Wax Market Attractiveness Analysis by End Use, 2022 – 2028

Figure 70: Eastern Europe Car Wax Market Share and BPS Analysis by Country – 2022 & 2028

Figure 71: Eastern Europe Car Wax Market Attractiveness Analysis by Country, 2022 – 2028

Figure 72: Eastern Europe Lime Market Volume Y-o-Y Growth Analysis by Country, 2017 – 2026

Figure 73: Eastern Europe Car Wax Market Absolute $ Opportunity (US$ Mn), 2022 – 2028 by Country

Figure 74: Eastern Europe Car Wax Market Share and BPS Analysis by Product Type – 2022 & 2028

Figure 75: Eastern Europe Car Wax Market Attractiveness Analysis by Product Type, 2022 – 2028

Figure 76: Eastern Europe Car Wax Market Y-o-Y growth (%) Analysis by Product Type

Figure 77: Eastern Europe Car Wax Market Share and BPS Analysis by Form – 2022 & 2028

Figure 78: Eastern Europe Car Wax Market Attractiveness Analysis by Form, 2022 – 2028

Figure 79: Eastern Europe Car Wax Market Y-o-Y growth (%) Analysis by Form

Figure 80: Eastern Europe Car Wax Market Share and BPS Analysis by Sales Channel – 2022 & 2028

Figure 81: Eastern Europe Car Wax Market Attractiveness Analysis by Sales Channel, 2022 – 2028

Figure 82: Eastern Europe Car Wax Market Y-o-Y growth (%) Analysis by Sales Channel

Figure 83: Eastern Europe Car Wax Market Share and BPS Analysis by End Use – 2022 & 2028

Figure 84: Eastern Europe Car Wax Market Attractiveness Analysis by End Use, 2022 – 2028

Figure 85: Eastern Europe Car Wax Market Attractiveness Analysis by End Use, 2022 – 2028

Figure 86: SEA Car Wax Market Share and BPS Analysis by Country – 2022 & 2028

Figure 87: SEA Car Wax Market Attractiveness Analysis by Country, 2022 – 2028

Figure 88: SEA Lime Market Volume Y-o-Y Growth Analysis by Country, 2017 – 2026

Figure 89: SEA Car Wax Market Absolute $ Opportunity (US$ Mn), 2022 – 2028 by Country

Figure 90: SEA Car Wax Market Share and BPS Analysis by Product Type – 2022 & 2028

Figure 91: SEA Car Wax Market Attractiveness Analysis by Product Type, 2022 – 2028

Figure 92: SEA Car Wax Market Y-o-Y growth (%) Analysis by Product Type

Figure 93: SEA Car Wax Market Share and BPS Analysis by Form – 2022 & 2028

Figure 94: SEA Car Wax Market Attractiveness Analysis by Form, 2022 – 2028

Figure 95: SEA Car Wax Market Y-o-Y growth (%) Analysis by Form

Figure 96: SEA Car Wax Market Share and BPS Analysis by Sales Channel – 2022 & 2028

Figure 97: SEA Car Wax Market Attractiveness Analysis by Sales Channel, 2022 – 2028

Figure 98: SEA Car Wax Market Y-o-Y growth (%) Analysis by Sales Channel

Figure 99: SEA Car Wax Market Share and BPS Analysis by End Use – 2022 & 2028

Figure 100: SEA Car Wax Market Attractiveness Analysis by End Use, 2022 – 2028

Figure 101: SEA Car Wax Market Attractiveness Analysis by End Use, 2022 – 2028

Figure 102: MEA Car Wax Market Share and BPS Analysis by Country – 2022 & 2028

Figure 103: MEA Car Wax Market Attractiveness Analysis by Country, 2022 – 2028

Figure 104: MEA Lime Market Volume Y-o-Y Growth Analysis by Country, 2017 – 2026

Figure 105: MEA Car Wax Market Absolute $ Opportunity (US$ Mn), 2022 – 2028 by Country

Figure 106: MEA Car Wax Market Share and BPS Analysis by Product Type – 2022 & 2028

Figure 107: MEA Car Wax Market Attractiveness Analysis by Product Type, 2022 – 2028

Figure 108: MEA Car Wax Market Y-o-Y growth (%) Analysis by Product Type

Figure 109: MEA Car Wax Market Share and BPS Analysis by Form – 2022 & 2028

Figure 110: MEA Car Wax Market Attractiveness Analysis by Form, 2022 – 2028

Figure 111: MEA Car Wax Market Y-o-Y growth (%) Analysis by Form

Figure 112: MEA Car Wax Market Share and BPS Analysis by Sales Channel – 2022 & 2028

Figure 113: MEA Car Wax Market Attractiveness Analysis by Sales Channel, 2022 – 2028

Figure 114: MEA Car Wax Market Y-o-Y growth (%) Analysis by Sales Channel

Figure 115: MEA Car Wax Market Share and BPS Analysis by End Use – 2022 & 2028

Figure 116: MEA Car Wax Market Attractiveness Analysis by End Use, 2022 – 2028

Figure 117: MEA Car Wax Market Attractiveness Analysis by End Use, 2022 – 2028

Figure 118: China Car Wax Market Share and BPS Analysis by Product Type – 2022 & 2028

Figure 119: China Car Wax Market Attractiveness Analysis by Product Type, 2022 – 2028

Figure 120: China Car Wax Market Y-o-Y growth (%) Analysis by Product Type

Figure 121: China Car Wax Market Share and BPS Analysis by Form – 2022 & 2028

Figure 122: China Car Wax Market Attractiveness Analysis by Form, 2022 – 2028

Figure 123: China Car Wax Market Y-o-Y growth (%) Analysis by Form

Figure 124: China Car Wax Market Share and BPS Analysis by Sales Channel – 2022 & 2028

Figure 125: China Car Wax Market Attractiveness Analysis by Sales Channel, 2022 – 2028

Figure 126: China Car Wax Market Y-o-Y growth (%) Analysis by Sales Channel

Figure 127: China Car Wax Market Share and BPS Analysis by End Use – 2022 & 2028

Figure 128: China Car Wax Market Attractiveness Analysis by End Use, 2022 – 2028

Figure 129: China Car Wax Market Attractiveness Analysis by End Use, 2022 – 2028

Figure 130: Japan Car Wax Market Share and BPS Analysis by Product Type – 2022 & 2028

Figure 131: Japan Car Wax Market Attractiveness Analysis by Product Type, 2022 – 2028

Figure 132: Japan Car Wax Market Y-o-Y growth (%) Analysis by Product Type

Figure 133: Japan Car Wax Market Share and BPS Analysis by Form – 2022 & 2028

Figure 134: Japan Car Wax Market Attractiveness Analysis by Form, 2022 – 2028

Figure 135: Japan Car Wax Market Y-o-Y growth (%) Analysis by Form

Figure 136: Japan Car Wax Market Share and BPS Analysis by Sales Channel – 2022 & 2028

Figure 137: Japan Car Wax Market Attractiveness Analysis by Sales Channel, 2022 – 2028

Figure 138: Japan Car Wax Market Y-o-Y growth (%) Analysis by Sales Channel

Figure 139: Japan Car Wax Market Share and BPS Analysis by End Use – 2022 & 2028

Figure 140: Japan Car Wax Market Attractiveness Analysis by End Use, 2022 – 2028

Figure 141: Japan Car Wax Market Attractiveness Analysis by End Use, 2022 – 2028

Figure 142: India Car Wax Market Share and BPS Analysis by Product Type – 2022 & 2028

Figure 143: India Car Wax Market Attractiveness Analysis by Product Type, 2022 – 2028

Figure 144: India Car Wax Market Y-o-Y growth (%) Analysis by Product Type

Figure 145: India Car Wax Market Share and BPS Analysis by Form – 2022 & 2028

Figure 146: India Car Wax Market Attractiveness Analysis by Form, 2022 – 2028

Figure 147: India Car Wax Market Y-o-Y growth (%) Analysis by Form

Figure 148: India Car Wax Market Share and BPS Analysis by Sales Channel – 2022 & 2028

Figure 149: India Car Wax Market Attractiveness Analysis by Sales Channel, 2022 – 2028

Figure 150: India Car Wax Market Y-o-Y growth (%) Analysis by Sales Channel

Figure 151: India Car Wax Market Share and BPS Analysis by End Use – 2022 & 2028

Figure 152: India Car Wax Market Attractiveness Analysis by End Use, 2022 – 2028

Figure 153: India Car Wax Market Attractiveness Analysis by End Use, 2022 – 2028

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carnauba Wax Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

UK Car Wax Market Analysis – Size, Share & Forecast 2025-2035

USA Car Wax Market Report – Trends, Demand & Industry Forecast 2025-2035

ASEAN Car Wax Market Analysis - Size, Share & Forecast 2025 to 2035

Japan Car Wax Market Report - Trends, Demand & Industry Forecast 2025 to 2035

Germany Car Wax Market Insights – Demand, Size & Industry Trends 2025-2035

Cardiology Information System Market Size and Share Forecast Outlook 2025 to 2035

Cardiopulmonary Functional Testing Platform Market Size and Share Forecast Outlook 2025 to 2035

Carbon Enhanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Car Bushing Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Cement Market Size and Share Forecast Outlook 2025 to 2035

Card Printer Ribbon Market Size and Share Forecast Outlook 2025 to 2035

Caramel Malt Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tetrabromide Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Carpet Spot Remover Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular CT Systems Market Size and Share Forecast Outlook 2025 to 2035

Carbon Brush Market Size and Share Forecast Outlook 2025 to 2035

Carpet and Rug Market Size and Share Forecast Outlook 2025 to 2035

Carbon Offset Platform Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA