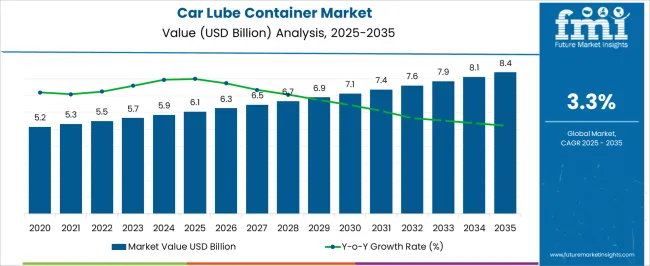

The Car Lube Container Market is estimated to be valued at USD 6.1 billion in 2025 and is projected to reach USD 8.4 billion by 2035, registering a compound annual growth rate (CAGR) of 3.3% over the forecast period.

| Metric | Value |

|---|---|

| Car Lube Container Market Estimated Value in (2025 E) | USD 6.1 billion |

| Car Lube Container Market Forecast Value in (2035 F) | USD 8.4 billion |

| Forecast CAGR (2025 to 2035) | 3.3% |

The car lube container market is currently advancing steadily, driven by increasing global demand for efficient lubricant packaging solutions across automotive service and aftermarket sectors. OEMs and lubricant manufacturers are emphasizing packaging that ensures product stability, spill resistance, and extended shelf life. Containers are being designed to withstand harsh storage conditions while maintaining compatibility with high-performance lubricant formulations.

Rising vehicle ownership and expansion of commercial fleet operations in emerging markets are contributing to sustained consumption of engine and process oils, thereby supporting container demand. Additionally, automation in lubricant filling lines and supply chain integration have prompted innovation in container design and material selection.

Sustainable packaging initiatives are encouraging the development of recyclable, lightweight formats that reduce transport emissions and waste. As players aim for cost-effective and regulatory-compliant solutions, the market is expected to witness growth opportunities in material innovation, custom branding, and functionality enhancements.

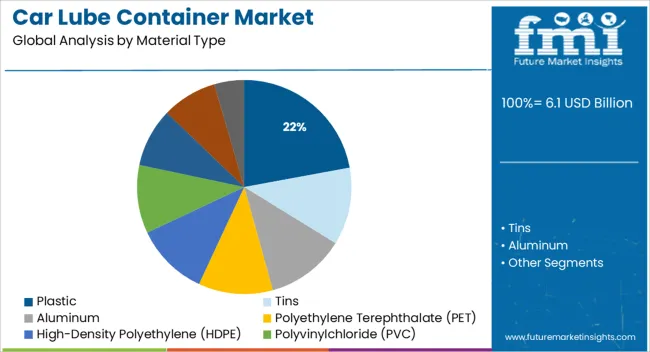

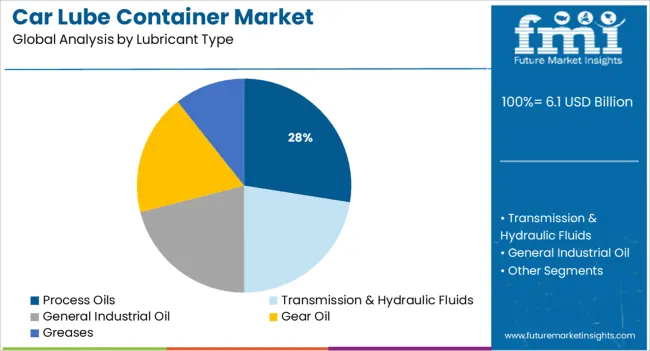

The market is segmented by Material Type and Lubricant Type and region. By Material Type, the market is divided into Plastic, Tins, Aluminum, Polyethylene Terephthalate (PET), High-Density Polyethylene (HDPE), Polyvinylchloride (PVC), Polypropylene (PP), Polystyrene (PS), and Metal. In terms of Lubricant Type, the market is classified into Process Oils, Transmission & Hydraulic Fluids, General Industrial Oil, Gear Oil, and Greases. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plastic segment is anticipated to hold 22.1% of the total market share by 2025 within the material type category, positioning it as the leading material choice. This dominance has been driven by plastic’s durability, chemical resistance, and adaptability to various container shapes and sizes.

High-density polyethylene and polypropylene are commonly used due to their stability when in contact with petroleum-based lubricants. Additionally, plastic offers significant advantages in terms of lightweight transport, ease of molding, and compatibility with high-speed filling systems, reducing overall production and logistics costs.

Its recyclability and growing alignment with circular economy principles are reinforcing its acceptance among environmentally conscious manufacturers. As container customization becomes more integral to brand differentiation in automotive retail, plastic’s versatility continues to support its leading position in the market.

Process oils are projected to contribute 27.5% of market revenue in 2025 under the lubricant type category, marking them as the most dominant lubricant application for containers. This leadership is explained by the broad usage of process oils across multiple automotive and industrial applications where consistent viscosity and thermal stability are critical.

The need for secure, contamination-resistant packaging for these oils has intensified, particularly in manufacturing hubs where operational efficiency depends on precise lubricant deployment. Car lube containers designed for process oils are often required to meet specific regulatory and technical handling criteria, which has driven the development of specialized closures and barrier technologies.

Furthermore, the rise in synthetic and high-performance lubricant variants has fueled container demand that supports long-term storage, ensuring the segment’s continued growth and relevance in high-volume lubricant markets.

The automobile industry plays a crucial role in the overall business cycle development of industrial growth. The automobile industry to some extent is highly correlated with the supply of lubricant. Of it, one such form of lubricant packaging which is predominantly used to suffice the demand of lubes are containers which are commonly known as cans.

Traditionally metal cans were mostly used as a form of packaging which over the last decade have been replaced by plastic, containers, pails, drums, totes, etc. As lubricant market is witnessing a steady year on year growth of more than 5%, the need for a smart and efficient form of packaging is warranted. Also, advancements which are technological in nature are related to development and innovation and have led to change in design to make it more cost effective for plastic packaging of car lube container.

HDPE and PET are primarily used for car lube containers owing to higher durability and cost- efficiency as compared to other plastic materials. With the rising purchasing power capacity of middle-income household, the number of new car purchased have increased which has directly pushed the demand of lubricant, subsequently the need for lubricant packaging.

In terms of consumption, the car lube container market in Asia- Pacific excluding Japan region is projected to register a comparatively higher volume than the other regions, while in terms of production North America and Western Europe market are expected to dominant the global car lube container market over the forecast period.

Companies such as RPC Promens, Industrial Plenmeller and other leading car lube manufacturers have enhanced the convenience of its lube container by adding a flexible spout that is used as a dispensing mechanism.

This has created a mass awareness among the car lube container manufacturer, who are able to provide ease to the user, driving product penetration into the untapped market.

Some of the factors expected to fuel the demand for car lube container markets include growing demand in the steel industry which is an important component for automobile industry. Secondly, technological advancement in production of automobile industry results in cost- efficiency, ultimately triggering a high demand for lubricant packaging products.

The emerging economies such as India, China, Saudi Arabia, Brazil, and Argentina are anticipated to be the key contributing region in car lube container packaging.Apart from this the factors which are expected to hamper the production of car lube container are stringent legislative regulation with regards to the use of plastic material for packaging.

Developing regions such as Asia Pacific and the Middle East are expected to witness a higher CAGR compared to other regions across the globe. Countries such as India, China, U.A.E., and Saudi Arabia are the key contributions for car lube container.

On the other hand region of North America are among the leading regions for consumption of car lube container. Moreover, the demand for car lube packaging are anticipated to witness a strong growth in all seven regions, over the forecast period.

Some of the players operating in the global car lube container market include Balmier Lawrie & Co. Ltd., Mold Tek Packaging, RPS Promens, Komal Packaging, and Bright Containers.

The report offers an accurate evaluation of the market through detailed qualitative insights and verifiable projections about market size. The projections presented in the report have been derived using proven research methodologies and assumptions.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments.

The report also maps the qualitative impact of various market factors on market segments and geographies

Global Car Lube Container market is segmented on the basis of material type and lubricant type.

The global car lube container market is estimated to be valued at USD 6.1 billion in 2025.

The market size for the car lube container market is projected to reach USD 8.4 billion by 2035.

The car lube container market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in car lube container market are plastic, tins, aluminum, polyethylene terephthalate (pet), high-density polyethylene (hdpe), polyvinylchloride (pvc), polypropylene (pp), polystyrene (ps) and metal.

In terms of lubricant type, process oils segment to command 27.5% share in the car lube container market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cartridge Heating Element Market Size and Share Forecast Outlook 2025 to 2035

Carboxymethyl Tamarind Kernel Powder Market Size and Share Forecast Outlook 2025 to 2035

Car Tail Light Mould Market Size and Share Forecast Outlook 2025 to 2035

Car OS Market Size and Share Forecast Outlook 2025 to 2035

Caramel Malt Market Size and Share Forecast Outlook 2025 to 2035

Carbon Capture and Sequestration Market Forecast Outlook 2025 to 2035

Cardiac Rehabilitation Market Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Incubators Market Size and Share Forecast Outlook 2025 to 2035

Carboxymethyl Tamarind Gum (CMT) Market Size and Share Forecast Outlook 2025 to 2035

Car Cover Market Size and Share Forecast Outlook 2025 to 2035

Cardiology Information System Market Size and Share Forecast Outlook 2025 to 2035

Cardiopulmonary Functional Testing Platform Market Size and Share Forecast Outlook 2025 to 2035

Carbon Enhanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Car Bushing Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Cement Market Size and Share Forecast Outlook 2025 to 2035

Card Printer Ribbon Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tetrabromide Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Carpet Spot Remover Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular CT Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA