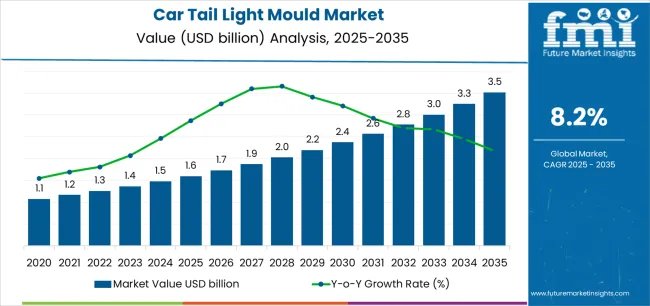

The global car tail light mould market, valued at USD 1.6 billion in 2025, is projected to reach approximately USD 3.5 billion by 2035, registering an absolute increase of USD 1.9 billion and expanding at a CAGR of 8.2% over the forecast period. The market is expected to grow by more than 2.2X, supported by the rising demand for precision moulding systems in automotive lighting production, increasing vehicle manufacturing output, and the rapid shift toward electrified and autonomous vehicle platforms. The accelerating adoption of advanced LED and adaptive lighting systems has intensified the need for high-precision car tail light moulds that can deliver enhanced accuracy, complex geometries, and premium visual finishes, meeting the evolving design and safety requirements of global automakers.

The automotive lighting sector is undergoing a fundamental transformation, with tail light assemblies emerging as a critical differentiator in vehicle aesthetics and brand identity. The demand for car tail light moulds is closely linked to this transition, as automakers invest heavily in new-generation lighting systems that combine functional performance with stylistic appeal. Tail light moulds are now designed to accommodate multi-material integration, combining transparent polycarbonate, PMMA, and ABS components within the same moulding sequence. The growing trend toward modular vehicle architectures has further amplified the need for flexible tooling solutions capable of supporting multiple design variants and production lines, ensuring faster tooling changeovers and consistent part replication across different vehicle models.

The growth of the electric vehicle (EV) segment represents a major driver for the car tail light mould market, as EV manufacturers emphasize aerodynamic lighting designs, compact housings, and dynamic illumination effects. These features require moulds with superior surface quality, precise cavity alignment, and integrated cooling channels to maintain dimensional stability during high-volume production. Tier-one suppliers are increasingly adopting CNC-machined, laser-textured, and coated mould surfaces to achieve advanced optical clarity and reduce defects in transparent lenses. Simultaneously, investments in 3D-printed inserts and conformal cooling technologies are improving cycle efficiency and thermal uniformity, lowering production downtime and operational costs.

Regional dynamics also play a crucial role in shaping the car tail light mould market. Asia-Pacific dominates global demand, driven by large-scale automotive production in China, Japan, and South Korea, coupled with strong investments in mould-making capabilities and tooling automation. Europe follows with strong adoption led by Germany, Italy, and France, where high-end vehicle manufacturers require ultra-precise mould systems for LED and OLED-based lighting modules. North America shows steady expansion, backed by the rising production of electric SUVs and trucks, alongside reshoring initiatives in automotive manufacturing.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.6 billion |

| Market Forecast Value (2035) | USD 3.5 billion |

| Forecast CAGR (2025-2035) | 8.2% |

| AUTOMOTIVE PRODUCTION TRENDS | LIGHTING TECHNOLOGY EVOLUTION | REGULATORY & QUALITY STANDARDS |

|---|---|---|

| Global Vehicle Manufacturing Expansion Continuous growth in global automotive production across established and emerging markets driving sustained demand for precision moulding solutions supporting tail light assembly manufacturing. Electrification Platform Development Rapid expansion of electric vehicle platforms requiring sophisticated lighting designs and advanced mould technologies to accommodate complex geometries and integrated sensor systems. Premium Segment Growth Increasing production of premium and luxury vehicles demanding high-precision moulding capabilities for distinctive lighting signatures and superior surface quality. |

LED Lighting Adoption Widespread transition to LED lighting technology requiring specialized mould designs supporting intricate heat sink geometries, precise lens formations, and complex optical element integration. Adaptive Lighting Systems Growing implementation of adaptive and intelligent lighting systems necessitating advanced mould solutions capable of producing sophisticated housing designs with integrated sensor mounting provisions. Design Complexity Increase Escalating tail light design sophistication driving demand for multi-cavity moulds, thin-wall capabilities, and precision surface finishing to achieve contemporary automotive aesthetics. |

Safety Regulation Compliance Stringent global vehicle safety standards mandating advanced lighting performance characteristics requiring precision-engineered mould solutions ensuring consistent part quality and regulatory compliance. Quality Assurance Requirements Automotive industry quality standards demanding superior dimensional accuracy, surface finish consistency, and production repeatability achievable through advanced moulding technologies. Durability Standards Increasing durability and longevity requirements for automotive lighting components driving investment in high-performance mould materials and surface treatment technologies. |

| Category | Segments Covered |

|---|---|

| By Cavity Type | Single-Cavity Moulds, Multi-Cavity Moulds |

| By Application | Passenger Vehicles, Commercial Vehicles |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

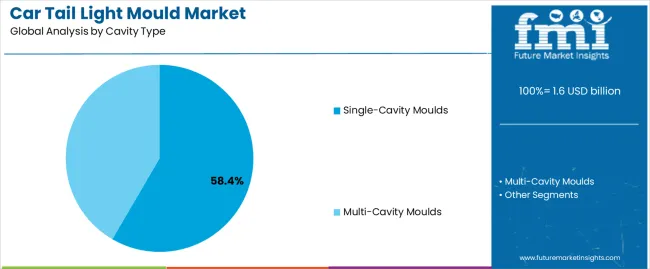

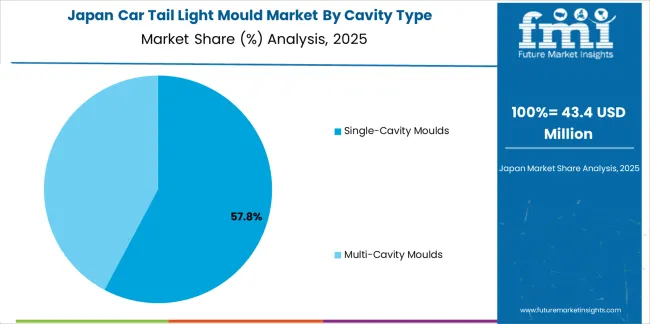

| Single-Cavity Moulds | Leader in 2025 with 58.4% market share, maintaining dominance through 2035. Preferred for complex, high-precision tail light assemblies requiring intricate geometries and superior surface quality. Widely adopted for premium vehicle segments and prototype development where design flexibility and part quality outweigh production volume considerations. Momentum: steady-to-strong growth driven by premium vehicle segment expansion and increasing design complexity. Single-cavity configurations offer superior control over part quality, simplified mould maintenance, and reduced initial tooling investment for lower-volume applications. Growing demand for customized lighting designs and rapid design iteration cycles supporting sustained adoption. Watchouts: pressure from efficiency-driven manufacturers seeking higher throughput, limited scalability for mass-market applications, longer cycle times affecting total cost of ownership in high-volume production scenarios. |

| Multi-Cavity Moulds | Strong presence with 41.6% share in 2025, gaining momentum through 2035. Essential for high-volume production environments serving mass-market vehicle segments where production efficiency and unit cost reduction drive tooling decisions. Enabling simultaneous production of multiple identical parts, significantly reducing per-unit manufacturing costs and improving overall equipment effectiveness. Momentum: rising adoption driven by global vehicle production volume growth and cost optimization imperatives in competitive automotive markets. Advanced multi-cavity designs incorporating hot runner systems and automated part handling enhancing productivity while maintaining acceptable quality standards. Increasing sophistication in cavity balancing and thermal management enabling quality parity with single-cavity solutions. Watchouts: higher initial tooling investment, increased maintenance complexity, greater sensitivity to process variations affecting part consistency, challenges in achieving uniform quality across all cavities for complex geometries. |

| Segment | 2025 to 2035 Outlook |

|---|---|

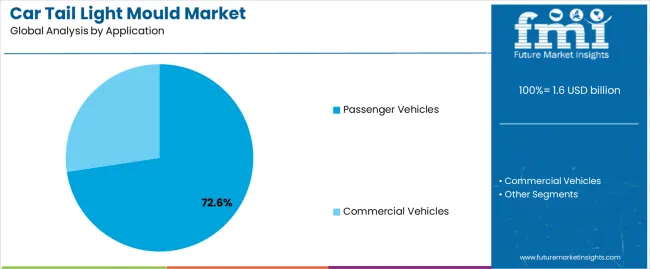

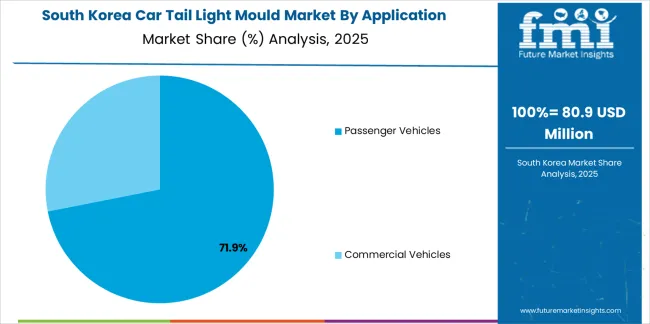

| Passenger Vehicles | Dominant segment with 72.6% market share in 2025, expected to maintain leadership through 2035. Encompasses diverse vehicle categories from compact cars to luxury sedans, each requiring tailored tail light moulding solutions. Largest volume contributor driven by global passenger car production exceeding 60 million units annually and continuous model refreshes necessitating new tooling investments. Momentum: steady growth supported by emerging market motorization, premium segment expansion, and design innovation cycles. Increasing adoption of sophisticated lighting designs incorporating 3D elements, sequential turn signals, and brand-distinctive signatures driving demand for advanced moulding capabilities. Electrification trend creating additional opportunities as EV platforms feature more aggressive aerodynamic designs with integrated lighting solutions. Watchouts: market saturation in developed regions, extended vehicle lifecycle reducing tooling replacement frequency, competitive pricing pressure from tier-two suppliers, potential demand fluctuations from economic cycles affecting consumer vehicle purchases. |

| Commercial Vehicles | Significant segment holding 27.4% share in 2025 with consistent growth trajectory through 2035. Covers light commercial vehicles, medium-duty trucks, heavy-duty trucks, and buses, each with distinct tail light design requirements and regulatory compliance standards. Growing logistics and e-commerce sectors driving commercial vehicle demand and corresponding tail light mould requirements. Momentum: moderate but stable growth driven by global freight transportation expansion, fleet modernization programs, and safety regulation updates mandating improved lighting systems. Commercial vehicle segment characterized by longer production runs per model, supporting investment in efficient multi-cavity mould solutions. Increasing adoption of LED technology in commercial applications creating retrofit and new vehicle opportunities. Watchouts: cyclical demand patterns tied to economic conditions, longer vehicle lifecycles reducing mould replacement frequency, cost sensitivity limiting adoption of premium moulding solutions, standardization trends potentially reducing design diversity and tooling variety requirements. |

| Region | Status & Outlook 2025-2035 |

|---|---|

| Asia Pacific | Dominant region commanding approximately 54.8% market share in 2025, driven by massive automotive production base concentrated in China, Japan, South Korea, India, and Southeast Asian manufacturing hubs. Region accounts for over 50 million passenger vehicle units annually, creating sustained demand for tail light moulding solutions across all vehicle segments. Momentum: robust growth trajectory supported by continued automotive production expansion, rising domestic consumption in emerging markets, and increasing localization of premium vehicle manufacturing. China leading regional growth with domestic OEM capability enhancement and transition toward premium segment production requiring sophisticated moulding technologies. India emerging as significant growth contributor with automotive manufacturing expansion and increasing quality standards. Watchouts: intense price competition from local mould manufacturers, varying quality standards across regional suppliers, potential supply chain disruptions, trade policy uncertainties affecting cross-border mould movements. |

| Europe | Critical market holding approximately 24.3% share in 2025, characterized by premium automotive production, stringent quality standards, and advanced lighting technology adoption. Region home to major luxury and premium automotive brands demanding highest-precision moulding solutions and innovative design capabilities. Momentum: moderate growth driven by electric vehicle transition, premium segment resilience, and continuous lighting technology innovation. German automotive industry maintaining leadership in advanced tail light design creating sustained demand for high-performance mould solutions. Increasing focus on sustainability driving adoption of eco-friendly mould materials and energy-efficient manufacturing processes. Watchouts: automotive production volume challenges in traditional markets, regulatory complexity, high labor and operational costs affecting mould manufacturing competitiveness, potential relocation of production capacity to lower-cost regions. |

| North America | Established market with approximately 15.7% share in 2025, featuring strong presence of domestic and international automotive manufacturers with sophisticated tail light design requirements. Market characterized by early adoption of advanced lighting technologies and premium design aesthetics. Momentum: steady growth supported by light truck and SUV segment dominance, electric vehicle production expansion, and continued investment in domestic automotive manufacturing capabilities. Nearshoring trends potentially benefiting North American mould suppliers as OEMs seek to reduce supply chain complexity and lead times. Watchouts: concentrated supplier base creating competitive intensity, sensitivity to automotive market cycles, labor cost considerations, potential shift toward imported mould solutions from lower-cost regions for high-volume applications. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Automotive Production Growth Continuous expansion of global automotive manufacturing creating sustained demand for tail light moulding solutions across diverse vehicle platforms and market segments. LED Technology Adoption Widespread transition to LED lighting systems requiring specialized mould designs supporting complex geometries and integrated thermal management features. Design Innovation Pressure Increasing emphasis on distinctive vehicle lighting signatures driving demand for advanced moulding capabilities supporting complex 3D designs and premium surface quality. |

High Tooling Investment Substantial capital requirements for precision mould development creating entry barriers and extending payback periods for mould manufacturers. Long Development Cycles Extended mould design and validation timelines affecting responsiveness to rapidly evolving automotive design trends and platform changes. Price Competition Intense competitive pressure particularly from Asian manufacturers creating margin constraints and limiting investment in advanced capabilities. |

Advanced Materials Integration Adoption of high-performance mould steels, advanced coatings, and thermal management technologies enabling superior part quality and extended tool life. Automation Enhancement Integration of automated mould monitoring systems, predictive maintenance capabilities, and smart manufacturing technologies improving operational efficiency. Lightweighting Emphasis Development of thin-wall moulding capabilities supporting automotive lightweighting initiatives while maintaining structural integrity and optical performance. Sustainability Focus Increasing emphasis on eco-friendly mould materials, energy-efficient manufacturing processes, and recyclable tail light components driving mould design evolution. |

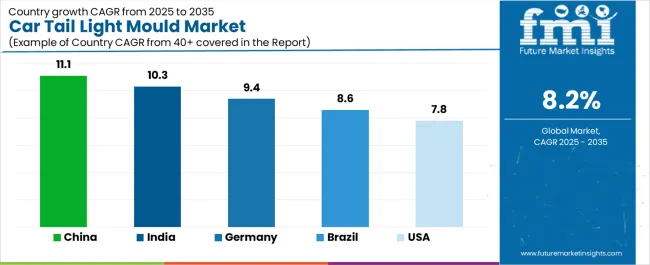

| Country | CAGR (2025-2035) |

|---|---|

| China | 11.1% |

| India | 10.3% |

| Germany | 9.4% |

| Brazil | 8.6% |

| USA | 7.8% |

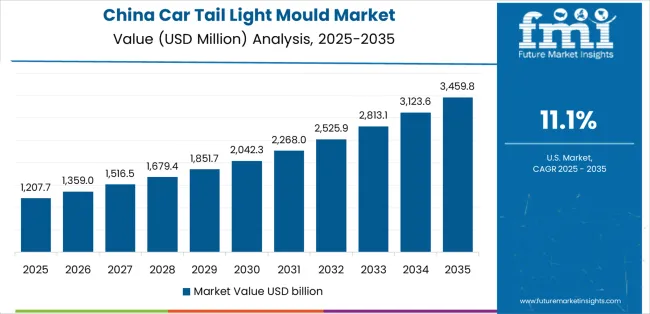

Revenue from car tail light moulds in China is projected to exhibit exceptional growth with a market value of USD 1.38 billion by 2035, driven by the country's position as the world's largest automotive producer manufacturing over 25 million vehicles annually and comprehensive domestic supply chain capabilities supporting both mass-market and premium vehicle segments. The country's rapid electric vehicle adoption with production exceeding 6 million units annually and government-supported automotive industry modernization programs are creating substantial opportunities for advanced moulding solutions. Major automotive manufacturers including BYD, Geely, Great Wall Motors, and joint ventures with international OEMs are establishing sophisticated tail light design capabilities requiring precision mould technologies.

Revenue from car tail light moulds in India is expanding to reach USD 0.92 billion by 2035, supported by rapidly growing automotive production base exceeding 4 million passenger vehicles annually and government initiatives promoting domestic manufacturing capabilities through production-linked incentive schemes and infrastructure investments. The country's emerging position as a global automotive manufacturing hub with increasing exports and growing domestic consumption creating sustained demand for cost-effective yet quality-focused moulding solutions. Major automotive manufacturers including Maruti Suzuki, Hyundai Motor India, Tata Motors, and Mahindra establishing comprehensive local supply chains.

Demand for car tail light moulds in Germany is projected to reach USD 0.76 billion by 2035, supported by the country's leadership in premium and luxury automotive manufacturing with brands including Mercedes-Benz, BMW, Audi, and Porsche driving continuous innovation in lighting design and requiring highest-precision moulding capabilities. German automotive suppliers maintaining competitive advantages through engineering excellence, advanced manufacturing technologies, and comprehensive quality management systems. The market characterized by focus on design innovation, operational precision, and compliance with stringent automotive industry standards.

Revenue from car tail light moulds in Brazil is growing to reach USD 0.67 billion by 2035, driven by the country's position as Latin America's largest automotive producer with production exceeding 2 million vehicles annually and comprehensive domestic supply chain supporting both local consumption and regional exports. Brazilian automotive industry benefiting from established manufacturing presence of global OEMs including Volkswagen, General Motors, Fiat, and Toyota alongside domestic manufacturer growth. Market characterized by focus on cost-effective solutions balanced with acceptable quality standards.

Demand for car tail light moulds in the USA is projected to reach USD 0.64 billion by 2035, driven by the country's leadership in light truck and SUV production with these segments representing over 75% of domestic vehicle sales and sophisticated lighting design requirements supporting premium positioning and distinctive brand identities. American automotive manufacturers including General Motors, Ford, and Stellantis alongside strong presence of international premium brands maintaining advanced design capabilities. Market characterized by early adoption of innovative lighting technologies and emphasis on safety performance.

Demand for car tail light moulds in the UK is projected to reach USD 0.48 billion by 2035, supported by continued presence of premium automotive manufacturing including Jaguar Land Rover, Bentley, Rolls-Royce, and McLaren alongside significant automotive component supply base serving European markets. British automotive sector navigating post-Brexit operational environment while maintaining engineering excellence and design leadership in premium segments. Market characterized by emphasis on high-value, low-volume applications requiring specialized moulding capabilities.

Demand for car tail light moulds in Japan is projected to reach USD 0.48 billion by 2035, driven by the country's reputation for automotive manufacturing excellence with major manufacturers including Toyota, Honda, Nissan, and Mazda maintaining stringent quality standards and continuous innovation in vehicle design and lighting technologies. Japanese automotive industry characterized by long-term supplier relationships, emphasis on continuous improvement methodologies, and leadership in hybrid and fuel-efficient vehicle development. Market features strong domestic mould manufacturing capabilities with companies like Misumi and local specialists serving both domestic and export markets.

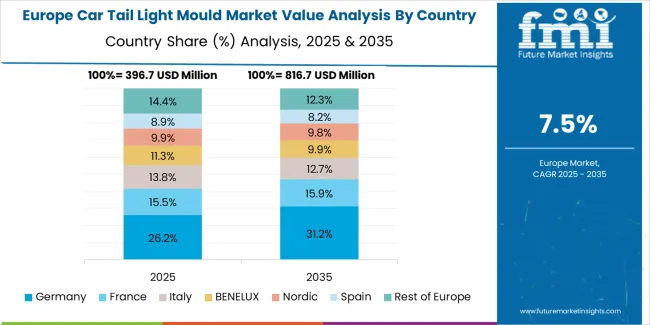

The car tail light mould market in Europe is projected to grow from USD 0.38 billion in 2025 to USD 0.84 billion by 2035, registering a CAGR of 8.2% over the forecast period. Germany is expected to maintain its leadership position with a 31.2% market share in 2025, reaching 30.8% by 2035, supported by its dominant premium automotive manufacturing base and continuous innovation in lighting technology from manufacturers including Mercedes-Benz, BMW, Audi, and Porsche headquartered in Stuttgart, Munich, Ingolstadt, and Stuttgart respectively.

France follows with a 16.4% share in 2025, projected to reach 16.7% by 2035, driven by established automotive production facilities operated by Stellantis brands including Peugeot, Citroën, and DS Automobiles, alongside Renault Group's comprehensive domestic manufacturing presence. The United Kingdom holds a 14.8% share in 2025, expected to stabilize at 14.5% by 2035 despite production volume challenges, supported by premium brand manufacturing including Jaguar Land Rover, Bentley, and specialist producers.

Italy commands a 13.6% share, while Spain accounts for 11.9% in 2025, both benefiting from significant automotive production volumes serving European markets. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 12.1% to 13.5% by 2035, attributed to growing automotive component manufacturing in Eastern European countries including Czech Republic, Poland, Hungary, and Slovakia where cost-competitive production capabilities are attracting increased investment from global automotive suppliers.

Japanese car tail light mould operations reflect the country's exacting quality standards and sophisticated manufacturing excellence. Major automotive manufacturers including Toyota, Honda, Nissan, and Mazda maintain rigorous supplier qualification processes that exceed international standards, requiring extensive dimensional accuracy verification, comprehensive material certification, and detailed process capability documentation that can require 18-24 months to complete. This creates substantial barriers for new suppliers but ensures consistent precision that supports premium vehicle positioning and zero-defect manufacturing philosophies.

The Japanese market demonstrates unique technical requirements, with significant emphasis on ultra-precise surface finishes, stringent dimensional tolerances often measured in microns, and comprehensive validation protocols that extend beyond typical automotive industry standards. Companies require specific mould steel specifications, advanced coating technologies, and sophisticated cooling system designs that differ from Western applications, driving demand for specialized engineering capabilities and continuous technical collaboration.

Regulatory oversight through the Ministry of Economy, Trade and Industry and automotive industry associations emphasizes comprehensive traceability and quality documentation requirements that surpass most international standards. The supplier qualification system requires extensive manufacturing process documentation, creating advantages for mould manufacturers with transparent production systems and comprehensive quality management capabilities.

Supply chain management focuses on long-term partnership relationships rather than purely transactional procurement approaches. Japanese automotive manufacturers typically maintain decade-long supplier relationships, with annual performance reviews emphasizing continuous improvement, quality consistency, and technical innovation over cost reduction. This stability supports investment in specialized mould manufacturing equipment and advanced process technologies tailored to Japanese specifications, while creating challenges for new market entrants seeking to establish customer relationships.

South Korean car tail light mould operations reflect the country's advanced automotive manufacturing sector and export-oriented business model. Major automotive manufacturers including Hyundai Motor Company, Kia Corporation, and Genesis luxury brand drive sophisticated mould procurement strategies, establishing direct relationships with domestic and international suppliers to secure consistent quality and competitive pricing for their global vehicle production spanning domestic facilities and international manufacturing operations in the United States, Europe, China, and India.

The Korean market demonstrates particular strength in high-volume production efficiency and rapid design iteration capabilities, with manufacturers like Hyundai-Kia Automotive Group producing over 7 million vehicles annually across global operations. This scale creates demand for robust mould solutions capable of supporting extended production runs while maintaining dimensional stability and part quality consistency. Korean automotive suppliers increasingly developing advanced capabilities in LED tail light production and complex optical component moulding.

Regulatory frameworks emphasize comprehensive safety compliance and quality assurance, with Korean Agency for Technology and Standards maintaining rigorous automotive component certification requirements. This creates preference for mould suppliers demonstrating proven track records and comprehensive quality management systems. The regulatory environment particularly favors suppliers with ISO/TS 16949 automotive quality certification and demonstrated capability in high-precision tooling applications.

Supply chain efficiency remains critical given Korea's concentrated automotive production and just-in-time manufacturing practices. Automotive manufacturers increasingly pursue long-term strategic partnerships with mould suppliers capable of supporting rapid product development cycles and flexible capacity allocation. Domestic mould manufacturing industry benefits from government support for precision manufacturing capability enhancement and advanced manufacturing technology adoption, while facing increasing competition from Chinese suppliers in cost-sensitive applications.

The car tail light mould market exhibits oligopolistic characteristics in precision tooling segments while remaining fragmented in standard applications, with value concentrating among established European and Asian suppliers commanding premium positions through engineering expertise, established OEM relationships, and proven quality track records. Profit pools are polarizing between ultra-precise single-cavity solutions for premium vehicles and cost-optimized multi-cavity systems for mass-market applications, with middle-tier suppliers facing margin compression from both directions.

Several distinct competitive archetypes dominate different market segments: established European precision tooling specialists commanding premiums through superior engineering and established luxury OEM relationships; comprehensive Asian manufacturers leveraging scale advantages and integrated capabilities serving high-volume producers; specialized mould component suppliers focusing on critical systems like hot runners and cooling channels; and emerging regional players capturing share in cost-sensitive segments through competitive pricing and improving capabilities.

Competitive dynamics increasingly favor suppliers demonstrating comprehensive capabilities spanning initial design collaboration, precision manufacturing, and ongoing technical support throughout mould lifecycle. Switching costs remain substantial due to extensive qualification processes, design-specific tooling investments, and production validation requirements, creating natural barriers protecting incumbent suppliers once established with major automotive manufacturers.

However, automotive industry consolidation, platform sharing strategies, and increasing quality expectations from emerging market manufacturers are creating opportunities for capable suppliers to expand their customer base. Price competition intensifies in standard applications while premium segments maintain value-based pricing supported by superior performance and established relationships.

Digital transformation initiatives including simulation-driven design optimization, automated quality monitoring, and predictive maintenance capabilities are becoming competitive differentiators, enabling faster development cycles and improved production efficiency. Sustainability considerations including recyclable mould materials, energy-efficient manufacturing processes, and extended tool life are increasingly influencing procurement decisions, particularly among European automotive manufacturers.

Strategic imperatives include securing design-phase engagement with automotive OEMs, developing flexible manufacturing capabilities supporting diverse cavity configurations, and building technical expertise in emerging lighting technologies including adaptive systems and integrated sensors. Consolidation continues as larger suppliers acquire specialized capabilities and expand geographic reach, while smaller players succeed through deep specialization or regional market focus.

| Items | Values |

|---|---|

| Quantitative Units | USD 1.6 billion |

| Cavity Type | Single-Cavity Moulds, Multi-Cavity Moulds |

| Application | Passenger Vehicles, Commercial Vehicles |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, South Korea, and other 35+ countries |

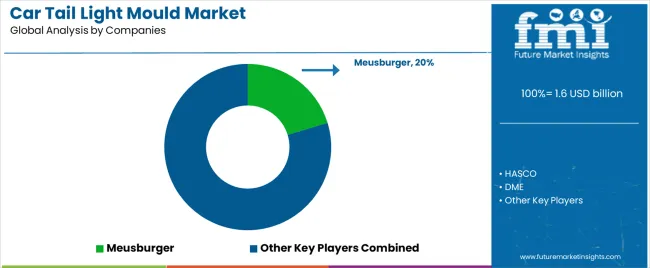

| Key Companies Profiled | Meusburger, HASCO, DME, CAD-IT Group, Zhejiang Saihao Industrial, JMT Mould, YAXIN Mould, Datamatic CNC Engineering, Zhejiang Yuya mould, Dianjing Mould, KaiHua, Polary |

| Additional Attributes | Dollar sales by cavity type and application, regional demand (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), competitive landscape, precision engineering capabilities, automotive OEM relationships, and advanced manufacturing technologies driving quality enhancement, production efficiency, and design innovation |

The global car tail light mould market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the car tail light mould market is projected to reach USD 3.5 billion by 2035.

The car tail light mould market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in car tail light mould market are single-cavity moulds and multi-cavity moulds.

In terms of application, passenger vehicles segment to command 72.6% share in the car tail light mould market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Car OS Market Size and Share Forecast Outlook 2025 to 2035

Caramel Malt Market Size and Share Forecast Outlook 2025 to 2035

Carbon Capture and Sequestration Market Forecast Outlook 2025 to 2035

Cardiac Rehabilitation Market Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Incubators Market Size and Share Forecast Outlook 2025 to 2035

Carboxymethyl Tamarind Gum (CMT) Market Size and Share Forecast Outlook 2025 to 2035

Car Cover Market Size and Share Forecast Outlook 2025 to 2035

Cardiology Information System Market Size and Share Forecast Outlook 2025 to 2035

Cardiopulmonary Functional Testing Platform Market Size and Share Forecast Outlook 2025 to 2035

Carbon Enhanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Car Bushing Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Cement Market Size and Share Forecast Outlook 2025 to 2035

Card Printer Ribbon Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tetrabromide Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Carpet Spot Remover Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular CT Systems Market Size and Share Forecast Outlook 2025 to 2035

Carbon Brush Market Size and Share Forecast Outlook 2025 to 2035

Carpet and Rug Market Size and Share Forecast Outlook 2025 to 2035

Carbon Offset Platform Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA