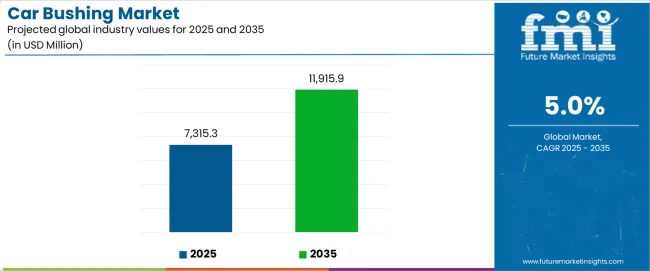

The car bushing market is projected to grow from USD 7,315.3 million in 2025 to USD 11,915.9 million in 2035, recording a CAGR of 5 percent. Bushings play a critical role in vibration isolation, suspension dynamics, and noise reduction in automotive engineering. Demand is strongly shaped by the increasing emphasis on ride comfort, handling precision, and vehicle durability. Passenger vehicles account for the largest consumption, with rising consumer expectations for smoother performance supporting growth. Commercial vehicles also remain a core application segment, as bushings reduce wear and extend service life in heavy-duty fleets.

Material trends influence demand patterns. Rubber bushings continue to dominate due to cost efficiency and flexibility. Polyurethane bushings are gaining share in performance-oriented vehicles because of greater stiffness and durability, creating a niche among sports cars and premium segments. Metal-backed composites are being studied for integration in electric vehicles to manage higher torque output and instantaneous acceleration. Such material diversification reflects the need for specialized bushings tailored to varied driving conditions and propulsion systems.

Electric vehicles introduce new demand dimensions. Silent drivetrains increase consumer sensitivity to minor vibrations and road noise, amplifying the importance of high-performance bushings. Manufacturers are investing in advanced designs for battery-electric platforms, with a focus on lighter weight, extended durability, and compatibility with regenerative braking systems. Hybrid vehicles present another growth driver, as dual propulsion dynamics require customized damping solutions. This shift opens opportunities for suppliers that can combine traditional mechanical engineering with advanced materials expertise.

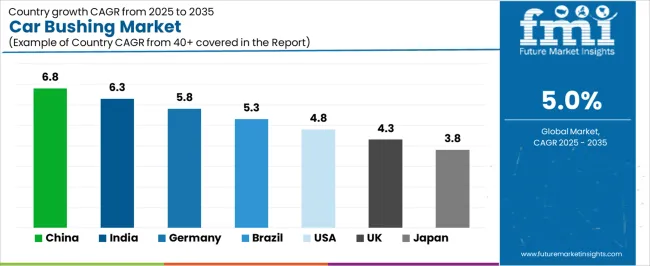

Regionally, Asia Pacific is expected to lead in absolute demand, supported by large-scale automobile production in China, India, Japan, and South Korea. Expanding middle-class vehicle ownership and rising EV manufacturing capacities reinforce the dominance of this region. Europe remains significant due to stringent noise and comfort regulations, pushing adoption of premium bushings in both passenger and commercial fleets. North America records consistent growth, with aftermarket replacement demand complementing OEM supply. Latin America and Middle East Africa show slower growth but represent emerging opportunities tied to expanding vehicle assembly operations and aging vehicle fleets requiring replacement parts.

The aftermarket represents a crucial revenue stream, as bushing replacement cycles typically occur after three to five years of usage. Vehicle aging trends in developed economies contribute to higher replacement rates, while developing economies see rapid OEM-driven adoption. This dual dynamic stabilizes demand patterns across time horizons.

The car bushing market growth reflects a balance between OEM adoption in new vehicle production and sustained aftermarket sales. Material diversification, EV-oriented innovation, and regional production clusters shape expansion. A CAGR of 5 percent between 2025 and 2035 confirms the market’s consistent demand base, supported by evolving mobility and vehicle ownership patterns.

| Item | Value / Description |

|---|---|

| Market Value (2025) | USD 7,315.3 million |

| Forecast Value (2035) | USD 11,915.9 million |

| Forecast CAGR (2025–2035) | 5% |

| Leading Material Type (2025) | Rubber — 68.0% share |

| Leading Application (2025) | Passenger Vehicle — 74.0% share |

| Leading Distribution Channel (2025) | OEM — 62% share |

| Key Growth Regions | Asia Pacific; North America; Europe |

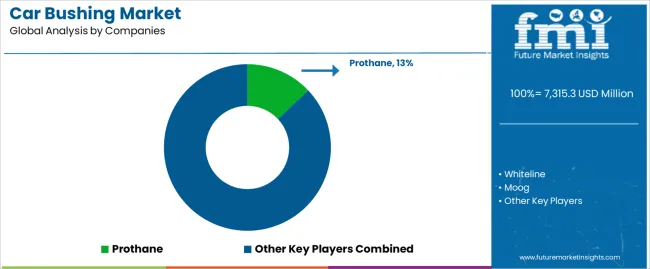

| Top Companies by Market Share | Prothane; Whiteline; Moog |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 7,315.3 million |

| Market Forecast Value (2035) | USD 11,915.9 million |

| Forecast CAGR (2025–2035) | 5.0% |

| AUTOMOTIVE PRODUCTION TRENDS | VEHICLE PErfORMANCE REQUIREMENTS | TECHNOLOGY & QUALITY STANDARDS |

|---|---|---|

| Global Vehicle Manufacturing Expansion — Continuous growth in automotive production across emerging and established markets driving demand for high-quality bushing components supporting vehicle assembly operations. | Suspension System Enhancement — Modern vehicle designs require precision bushings delivering improved handling, vibration isolation, and enhanced ride comfort for passenger and commercial applications. | Material Innovation Standards — Industry requirements establishing performance benchmarks favoring advanced polyurethane and rubber compound bushing solutions. |

| Commercial Fleet Modernization — Growing emphasis on fleet efficiency and vehicle longevity creating demand for premium bushing systems offering extended service life and operational reliability. | Noise Vibration Harshness (NVH) Control — Automotive manufacturers investing in premium bushings providing superior vibration dampening and noise reduction while maintaining system durability. | Load Distribution Optimization — Quality standards requiring optimal load bearing capacity and minimal component wear in automotive suspension applications. |

| Aftermarket Replacement Demand — Superior durability and performance capabilities making bushings essential for vehicle maintenance and performance upgrade applications across diverse automotive segments. | Dynamic Performance Requirements — Certified bushings with proven specifications required for high-performance and commercial vehicle applications demanding consistent operational excellence. | Advanced Manufacturing Requirements — Precision molding techniques and compound formulation driving need for specialized manufacturing capabilities and quality control systems. |

Category Segments Covered

| Category | Segments / Values |

|---|---|

| By Material Type | Rubber; Polyurethane; Metal; Composite; Others |

| By Application | Passenger Vehicle; Commercial Vehicle; Electric Vehicle; Off-Highway Vehicle; Others |

| By Vehicle Type | Sedan; SUV; Hatchback; Pickup Truck; Bus; Others |

| By Position | Front Suspension; Rear Suspension; Engine Mount; Transmission Mount; Anti-Roll Bar; Others |

| By Distribution Channel | OEM; Aftermarket Dealers; Online Retailers; Automotive Parts Stores; Direct Sales |

| By Region | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Segment | 2025–2035 Outlook |

|---|---|

| Rubber | Leader in 2025 with 68.0% market share; likely to maintain strong position through 2035. Broad compatibility with standard vehicle applications, cost-effective manufacturing, and proven durability. Momentum: steady growth. Watchouts: competition from polyurethane in performance segments. |

| Polyurethane | Premium segment with 24.5% share, benefiting from performance vehicle demand and aftermarket upgrade applications requiring enhanced durability and performance. Momentum: rising in high-performance markets. Watchouts: higher costs and specialized installation requirements. |

| Metal | Specialized applications primarily for heavy-duty commercial vehicles and industrial equipment, maintaining consistent performance under extreme loads. Momentum: stable growth in commercial segments. |

| Composite | Emerging technology offering weight reduction benefits and corrosion resistance for electric vehicle applications. Momentum: moderate growth in specialized applications. |

| Others (Hybrid Materials) | Includes advanced compound bushings for specialized automotive applications. High performance characteristics, niche market. Momentum: selective growth in premium and racing segments. |

| Segment | 2025–2035 Outlook |

|---|---|

| Passenger Vehicle | Largest application segment in 2025 at 74.0% share, supported by global automotive production growth and established consumer vehicle market. Driven by vehicle comfort requirements and replacement market demand. Momentum: strong growth from vehicle production increases and aftermarket activities. Watchouts: market saturation in mature regions and shift toward electric vehicles. |

| Commercial Vehicle | Key segment for fleet operators and transportation companies. Requires heavy-duty bushings for extended service life and operational reliability under demanding conditions. Momentum: steady growth through fleet expansion and modernization. Watchouts: economic cycles affecting commercial vehicle procurement. |

| Electric Vehicle | Rapidly expanding segment requiring specialized bushings adapted for electric drivetrains and battery weight distribution. Momentum: strong growth from EV adoption acceleration. Watchouts: evolving technical requirements and market standardization challenges. |

| Off-Highway Vehicle | Specialized segment for construction, agriculture, and mining equipment requiring extreme-duty bushings for harsh operating environments. Momentum: moderate growth from infrastructure development. Watchouts: cyclical demand patterns and specialized requirements. |

| Distribution Channel | Status & Outlook (2025–2035) |

|---|---|

| OEM | Dominant channel in 2025 with 62% share for new vehicle production. Direct relationships with automotive manufacturers ensuring quality specifications and volume contracts. Momentum: steady growth driven by vehicle production increases and quality standardization. Watchouts: margin pressure from manufacturers and competition intensity. |

| Aftermarket Dealers | Established channel serving vehicle maintenance and repair operations. Provides technical expertise and professional installation services for replacement bushings. Momentum: strong growth as vehicle parc ages and maintenance requirements increase. Watchouts: competition from online channels and inventory management challenges. |

| Online Retailers | Rapidly growing channel serving informed consumers and professional mechanics seeking competitive pricing and product variety. Momentum: strong growth as e-commerce adoption accelerates in automotive parts sector. Watchouts: quality control challenges and professional installation requirements. |

| Automotive Parts Stores | Traditional retail channel for aftermarket bushings and maintenance components. Broad consumer reach with local inventory and immediate availability. Momentum: stable growth in established markets, focus on value-added services. Watchouts: online competition and changing consumer purchasing patterns. |

| Direct Sales | Expanding channel for specialty manufacturers targeting performance enthusiasts and professional installers. Includes factory outlets and performance-oriented distribution. Momentum: rising as manufacturers develop direct relationships with professional market segments. |

| DRIVERS | RESTRaiNTS | KEY TRENDS |

|---|---|---|

| Continuing growth of global automotive production across emerging and established markets is driving demand for high-quality bushings supporting vehicle assembly and manufacturing operations. | Electric vehicle transition and changing powertrain configurations continue to impact traditional bushing specifications and replacement market demand patterns. | Development of advanced material compounds, precision molding techniques, and performance optimization are enabling superior durability and operational excellence. |

| Aftermarket Replacement Growth — Increasing vehicle age and maintenance requirements are creating demand for premium replacement bushings offering enhanced performance and extended service life. | Economic Sensitivity — Automotive industry cycles and consumer spending patterns limit aftermarket upgrade activities and premium product adoption rates. | Performance Enhancement Innovation — Advanced polyurethane formulations, hybrid materials, and specialized compounds are advancing load-bearing capabilities and vibration control. |

| Commercial Fleet Expansion — Rising demand for transportation services and logistics capabilities fuels steady bushing adoption across commercial vehicle and fleet operations. | Installation Complexity — Technical requirements and specialized tools affect consumer adoption and professional service market accessibility for advanced bushing systems. | Specialized Application Development — Emerging demand for bushings tailored to electric vehicles, autonomous systems, and commercial fleet optimization applications. |

| Vehicle Comfort Standards — Enhanced ride quality expectations and noise reduction requirements impact total cost of ownership and performance upgrade market development. | Material Cost Volatility — Integration of advanced compounds and quality control systems ensures consistent bushing performance while managing material expense fluctuations. | Ongoing R&D Focus — Continuous improvement in compound chemistry, manufacturing processes, and application-specific designs to meet evolving automotive and performance standards. |

| Country | CAGR (2025–2035) |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| Brazil | 5.3% |

| United States | 4.8% |

| United Kingdom | 4.3% |

| Japan | 3.8% |

Revenue from Car Bushings in China is projected to exhibit strong growth with a market value of USD 3,124.8 million by 2035, driven by expanding automotive manufacturing infrastructure and comprehensive vehicle production innovation creating substantial opportunities for component suppliers across passenger vehicle operations, commercial fleet sectors, and specialty automotive applications. The country's established automotive manufacturing tradition and expanding production capabilities are creating significant demand for both rubber and polyurethane bushing systems. Major automotive companies and parts manufacturers including Geely, BYD, and SaiC are establishing comprehensive local component production facilities to support large-scale manufacturing operations and meet growing demand for efficient bushing solutions.

Revenue from Car Bushings in India is expanding to reach USD 2,287.6 million by 2035, supported by extensive automotive sector expansion and comprehensive vehicle manufacturing development creating demand for reliable bushing solutions across diverse passenger vehicle categories and commercial transportation segments. The country's growing automotive production capacity and expanding vehicle ownership are driving demand for component solutions that provide consistent performance while supporting cost-effective manufacturing requirements. Component manufacturers and automotive suppliers are investing in local production facilities to support growing manufacturing operations and domestic market demand.

Demand for Car Bushings in Germany is projected to reach USD 1,895.4 million by 2035, supported by the country's leadership in precision automotive manufacturing and advanced bushing technologies requiring sophisticated material systems for premium vehicle and commercial applications. German automotive companies are implementing high-precision manufacturing systems that support advanced performance capabilities, operational reliability, and comprehensive quality protocols. The car bushing market is characterized by focus on engineering excellence, component precision, and compliance with stringent automotive quality and safety standards.

Revenue from Car Bushings in Brazil is growing to reach USD 1,623.7 million by 2035, driven by automotive production development programs and increasing vehicle manufacturing capacity creating opportunities for component suppliers serving both passenger vehicle operations and commercial transportation contractors. The country's expanding automotive manufacturing base and growing domestic vehicle demand are creating demand for bushing components that support diverse vehicle requirements while maintaining performance standards. Automotive manufacturers and component service providers are developing supply chain strategies to support operational efficiency and quality requirements.

Demand for Car Bushings in United States is projected to reach USD 1,434.2 million by 2035, expanding at a CAGR of 4.8%, driven by premium automotive equipment excellence and specialized aftermarket capabilities supporting advanced vehicle performance development and comprehensive high-performance applications. The country's established automotive manufacturing tradition and mature aftermarket segments are creating demand for high-quality bushing components that support operational performance and automotive standards. Component manufacturers and automotive equipment suppliers are maintaining comprehensive development capabilities to support diverse consumer and professional requirements.

Revenue from Car Bushings in United Kingdom is growing to reach USD 1,267.8 million by 2035, supported by automotive heritage appreciation and established manufacturing communities driving demand for premium bushing solutions across traditional automotive systems and specialized performance applications. The country's rich automotive heritage and established component manufacturing capabilities create demand for bushing components that support both classic vehicle restoration and modern high-performance applications.

Demand for Car Bushings in Japan is projected to reach USD 1,156.3 million by 2035, driven by precision automotive manufacturing tradition and established component technology leadership supporting both domestic vehicle markets and export-oriented production operations. Japanese companies maintain sophisticated bushing development capabilities, with established manufacturers continuing to lead in polyurethane technology and precision manufacturing standards.

European Car Bushing operations are increasingly concentrated between German precision engineering and established manufacturing centers across multiple countries. German facilities dominate premium polyurethane bushing production for luxury and performance vehicle applications, leveraging advanced material technologies and strict quality protocols that command price premiums in global markets. French and Italian manufacturers maintain leadership in traditional rubber bushing designs and commercial vehicle applications, with companies like Hutchinson and Pirelli driving technical specifications that smaller suppliers must meet to access major automotive contracts.

Eastern European operations in Czech Republic, Poland, and Hungary are capturing volume-oriented production contracts through skilled labor advantages and EU regulatory compliance, particularly in standard rubber bushings for mass-market vehicle applications. These facilities increasingly serve as manufacturing capacity for Western European automotive brands while developing their own engineering expertise and supply chain relationships.

The regulatory environment presents both opportunities and constraints. REACH compliance requirements create material standards that favor established European manufacturers over imports while ensuring consistent performance specifications. Brexit has created complexity for UK component sourcing from EU suppliers, driving opportunities for direct relationships between manufacturers and international distributors.

Supply chain consolidation accelerates as manufacturers seek economies of scale to absorb rising material costs and precision manufacturing expenses. Vertical integration increases, with major automotive manufacturers acquiring bushing production facilities to secure component supplies and quality control. Smaller manufacturers face pressure to specialize in performance applications or risk displacement by larger, more efficient operations serving mainstream automotive requirements.

South Korean Car Bushing operations reflect the country's advanced automotive manufacturing sector and export-oriented business model. Major conglomerates including Hyundai Motor Group and Kia drive component procurement strategies for their global vehicle platforms, establishing direct relationships with specialized bushing suppliers to secure consistent quality and pricing for their automotive operations targeting both domestic and international markets.

The Korean market demonstrates particular strength in integrating bushing technologies into electric vehicle platforms, with companies developing components that address the unique requirements of electric drivetrains and battery weight distribution. This integration approach creates demand for specific performance specifications that differ from traditional internal combustion engine applications, requiring suppliers to adapt load-bearing capabilities and vibration characteristics.

Regulatory frameworks emphasize automotive safety and environmental compliance, with Korean Ministry of Trade, Industry and Energy standards often exceeding international requirements. This creates barriers for smaller component suppliers but benefits established manufacturers who can demonstrate compliance capabilities. The regulatory environment particularly favors suppliers with KS certification and comprehensive quality management systems.

Supply chain efficiency remains critical given Korea's technological advancement focus and competitive automotive market dynamics. Companies increasingly pursue development contracts with suppliers in Japan, Germany, and specialized manufacturers to ensure access to advanced bushing technologies while managing cost pressures. Investment in research and development supports quality advancement during extended vehicle development cycles.

Profit pools are consolidating upstream in precision material compound development and downstream in application-specific bushing designs for performance, commercial, and electric vehicle markets where certification, durability, and consistent performance command premiums. Value is migrating from basic rubber bushing production to specification-driven, application-ready components where engineering expertise, material technology, and reliable performance create competitive advantages. Several archetypes define market leadership: established automotive suppliers defending share through manufacturing excellence and OEM relationships; specialty performance brands leveraging advanced polyurethane technology and aftermarket expertise; global component producers with material science intellectual property and manufacturing scale; and emerging manufacturers pursuing cost-competitive production while developing technical capabilities. Switching costs - vehicle compatibility, professional installation requirements, warranty considerations - provide stability for established suppliers, while performance requirements and material innovation create opportunities for specialized manufacturers. Consolidation continues as companies seek manufacturing scale; direct sales channels grow for performance products while OEM relationships remain critical for volume business. Focus areas: secure automotive OEM and aftermarket positions with application-specific performance specifications and technical support; develop advanced material technology and precision manufacturing capabilities; explore specialized applications including electric vehicle and performance aftermarket requirements.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Global Automotive Suppliers | Manufacturing scale; OEM relationships; comprehensive product portfolio | Volume production; quality systems; automotive certification |

| Performance Specialists | Advanced materials; aftermarket expertise; performance-focused engineering | Polyurethane technology; performance applications; enthusiast market relationships |

| Regional Manufacturers | Local market knowledge; competitive pricing; flexible production | Regional supply chains; cost optimization; market responsiveness |

| Material Technology Leaders | Advanced compounds; intellectual property; research capabilities | Material innovation; technical specifications; licensing opportunities |

| Aftermarket Distributors | Market access; technical support; installation expertise | Distribution networks; professional relationships; technical services |

| Item | Value |

|---|---|

| Quantitative Units | USD 7,315.3 Million |

| Material Types | Rubber; Polyurethane; Metal; Composite; Others |

| Applications | Passenger Vehicle; Commercial Vehicle; Electric Vehicle; Off-Highway Vehicle |

| Position | Front Suspension, Rear Suspension, Engine Mount, Transmission Mount, Anti-Roll Bar, Others |

| Distribution Channels Position | OEM; Aftermarket Dealers; Online Retailers; Automotive Parts Stores; Direct Sales |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa |

| Key Countries | China; India; Germany; Brazil; United States; United Kingdom; Japan (+35 additional countries) |

| Key Companies Profiled | Prothane; Whiteline; Moog; General Motors; Advanced Flow Engineering, Inc.; Crown Automotive; BOGE Rubber & Plastics; Tenneco Inc; Continental AG; ZF Friedrichshafen AG; Hutchinson; Bridgestone Corporation; NOK Corporation; Sumitomo Riko; Cooper Standard; Vibracoustic; Trelleborg AB |

| Additional Attributes | Dollar sales by material type and distribution channel; Regional demand trends (NA, EU, APAC); Competitive landscape; OEM vs. aftermarket adoption patterns; Manufacturing and assembly integration; Precision engineering innovations driving automotive enhancement, performance reliability, and technical excellence |

The global car bushing market is estimated to be valued at USD 7,315.3 million in 2025.

The market size for the car bushing market is projected to reach USD 11,915.9 million by 2035.

The car bushing market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in car bushing market are rubber, polyurethane, metal, composite and others.

In terms of application, passenger vehicle segment to command 0.0% share in the car bushing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cardiology Information System Market Size and Share Forecast Outlook 2025 to 2035

Cardiopulmonary Functional Testing Platform Market Size and Share Forecast Outlook 2025 to 2035

Carbon Enhanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Cement Market Size and Share Forecast Outlook 2025 to 2035

Card Printer Ribbon Market Size and Share Forecast Outlook 2025 to 2035

Caramel Malt Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tetrabromide Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Carpet Spot Remover Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular CT Systems Market Size and Share Forecast Outlook 2025 to 2035

Carbon Brush Market Size and Share Forecast Outlook 2025 to 2035

Carpet and Rug Market Size and Share Forecast Outlook 2025 to 2035

Carbon Offset Platform Market Size and Share Forecast Outlook 2025 to 2035

Carob Market Size and Share Forecast Outlook 2025 to 2035

Cargo Vans Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tapes Market Size and Share Forecast Outlook 2025 to 2035

Cars Market Size and Share Forecast Outlook 2025 to 2035

Carnitine Supplements Market Size and Share Forecast Outlook 2025 to 2035

Carboy Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Monitoring And Cardiac Rhythm Management Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA