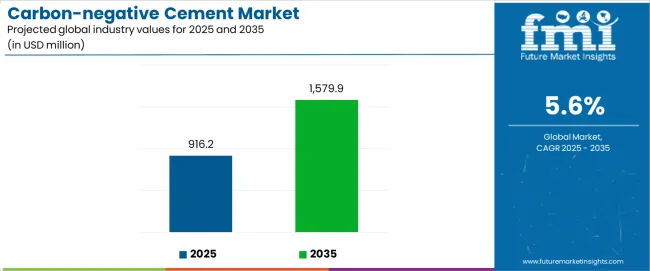

The global carbon-negative cement market is valued at USD 916.2 million in 2025 and is slated to reach USD 1,579.9 million by 2035, recording an absolute increase of USD 663.7 million over the forecast period. Total growth is expected to reach 72.4%, with the carbon-negative cement market forecast to expand at a compound annual growth rate (CAGR) of 5.6% between 2025 and 2035. Innovation and R&D define the trajectory of this market, as breakthroughs in material design and processing methods determine cost competitiveness, scalability, and durability.

Development of novel binders using bio-based or waste-derived materials forms the foundation of current innovation. Traditional Portland cement is highly carbon-intensive, while alternative binders derived from agricultural residues, industrial by-products, and bio-mineralization pathways reduce emissions and capture carbon dioxide during curing. Fly ash, blast furnace slag, rice husk ash, and biochar are integrated into new formulations to create cements with lower embodied carbon and higher long-term stability. Bio-based pathways using microbial-induced calcite precipitation are being scaled in laboratory environments, offering pathways for biological cementation. These innovations respond directly to regulatory frameworks and consumer demand for eco-efficient construction materials.

Integration of AI and digital twins into cement production accelerates formulation optimization. Artificial intelligence platforms are deployed to simulate binder compositions, predict compressive strength, and analyze hydration kinetics in real time. Digital twins replicate curing conditions and environmental exposure scenarios, enabling manufacturers to refine cement mixes before pilot production. Machine learning algorithms enhance predictive accuracy for performance under varying temperature, humidity, and loading conditions. This reduces research timelines and minimizes the need for extensive trial batches, cutting costs while enhancing product reliability. Predictive modeling supported by AI allows for tailored carbon-negative cement formulations adapted to specific infrastructure projects.

Research into long-term durability and performance in extreme climates remains critical. Carbon-negative cements must withstand saline environments, freeze-thaw cycles, seismic stresses, and high humidity without loss of structural integrity. R&D efforts focus on microstructural refinement, pore distribution, and resistance to chloride penetration. Durability studies conducted under accelerated aging conditions provide validation for large-scale infrastructure applications. Partnerships between universities, construction firms, and research laboratories extend testing protocols across geographies, ensuring regional suitability. Performance in marine construction, desert climates, and cold regions is studied to expand application viability.

Expansion of pilot projects into commercial-scale production lines signals market readiness. Demonstration plants evolve into operational facilities capable of producing thousands of tons annually. Scaling challenges are addressed through modular reactor systems, automated curing chambers, and integration with carbon capture utilization technologies. Pilot-to-commercial transitions points at pathways for cost reduction, supply chain integration, and standardization of product certification.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 916.2 million |

| Forecast Value in (2035F) | USD 1,579.9 million |

| Forecast CAGR (2025 to 2035) | 5.6% |

From 2030 to 2035, the carbon-negative cement market is forecast to grow from USD 1,203.2 million to USD 1,579.9 million, adding another USD 376.7 million, which constitutes 56.8% of the overall ten-year expansion. This period is expected to be characterized by the expansion of industrial-scale carbon utilization technologies, the integration of biogenic carbon sequestration systems, and the development of multi-functional cement platforms with enhanced carbon absorption capabilities. The growing adoption of climate-positive construction practices will drive demand for carbon-negative cement with superior environmental performance and compatibility with green building certification programs across construction operations.

Between 2020 and 2025, the carbon-negative cement market experienced robust growth, driven by increasing demand for climate-responsible construction materials and growing recognition of carbon capture technology as essential tools for achieving net-negative emissions across building construction, infrastructure development, and industrial construction applications. The carbon-negative cement market developed as construction companies recognized the potential for carbon-negative cement to reduce project carbon footprints while maintaining structural performance and enabling cost-effective climate mitigation protocols. Technological advancement in bio-mineralization processes and carbon utilization mechanisms began emphasizing the critical importance of maintaining construction quality and durability consistency in diverse building environments.

Market expansion is being supported by the increasing global demand for climate-positive construction solutions and the corresponding need for materials that can provide superior carbon sequestration capabilities while enabling reduced lifecycle emissions and positive environmental impact across various building and infrastructure development applications. Modern construction operations and green building specialists are increasingly focused on implementing cement technologies that can deliver carbon absorption benefits, prevent emissions increases, and provide consistent structural performance throughout complex projects and diverse construction conditions. Carbon-negative cement's proven ability to deliver exceptional carbon sequestration against atmospheric CO2, enable time-efficient construction, and support cost-effective climate mitigation protocols make them essential materials for contemporary building and construction operations.

The growing emphasis on construction decarbonization and climate impact reduction is driving demand for carbon-negative cement that can support large-scale building requirements, improve environmental outcomes, and enable automated carbon capture systems. Builders' preference for materials that combine effective structural performance with carbon absorption capabilities and resource efficiency is creating opportunities for innovative cement implementations. The rising influence of green construction and climate-positive building practices is also contributing to increased demand for carbon-negative cement that can provide biogenic carbon sequestration, real-time environmental monitoring capabilities, and reliable performance across extended operational periods.

The carbon-negative cement market is poised for rapid growth and transformation. As industries across construction, infrastructure, commercial building, and environmental remediation seek solutions that deliver exceptional carbon sequestration performance, structural reliability, and environmental compliance, carbon-negative cement is gaining prominence not just as specialized building material but as strategic enablers of climate-positive construction practices and emission reduction.

Rising green building adoption in Asia-Pacific and expanding climate-positive construction initiatives globally amplify demand, while manufacturers are leveraging innovations in bio-mineralization systems, carbon capture technologies, and integrated environmental monitoring technologies.

Pathways like high-performance bio-cement platforms, ai-powered carbon optimization systems, and specialized construction application solutions promise strong margin uplift, especially in large-scale infrastructure segments. Geographic expansion and technology integration will capture volume, particularly where local construction practices and green building adoption are critical. Regulatory support around construction decarbonization, emission reduction requirements, and building efficiency standards give structural support.

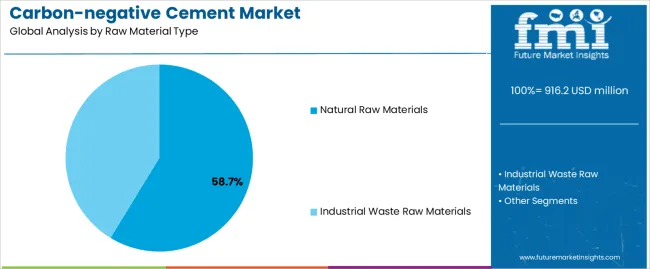

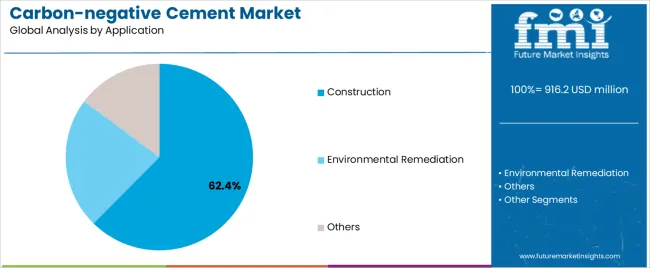

The carbon-negative cement market is segmented by raw material type, application, technology type, end-use sector, and region. By raw material type, the market is divided into natural raw materials and industrial waste raw materials categories. By application, it covers construction, environmental remediation, and others. By technology type, the market includes bio-mineralization systems, carbon capture platforms, and hybrid carbon sequestration systems. By end-use sector, it is categorized into commercial construction, infrastructure development, residential construction, and environmental services. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The natural raw materials segment is projected to account for 58.7% of the carbon-negative cement market in 2025, reaffirming its position as the leading raw material category. Large-scale construction operations and infrastructure developers increasingly utilize natural raw material-based carbon-negative cement for their superior bio-compatibility capabilities when operating across extensive construction projects, excellent environmental performance characteristics, and cost-effectiveness in applications ranging from building construction to large-area infrastructure development. Natural raw material cement technology's advanced carbon sequestration system capabilities and enhanced durability directly address the construction requirements for comprehensive environmental performance in large-scale building environments.

This raw material segment forms the foundation of modern green construction operations, as it represents the cement type with the greatest environmental compatibility and established market demand across multiple application categories and construction sectors. Manufacturer investments in enhanced bio-processing technologies and automated carbon optimization compatibility continue to strengthen adoption among construction contractors and large building enterprises. With companies prioritizing environmental performance and carbon absorption optimization, natural raw material carbon-negative cement align with both environmental requirements and economic efficiency objectives, making them the central component of comprehensive green construction strategies.

Construction applications are projected to represent 62.4% of carbon-negative cement demand in 2025, underscoring their critical role as the primary construction consumers of climate-positive cement technology for building construction, infrastructure development, and construction material applications. Construction operators prefer carbon-negative cement for their exceptional carbon absorption precision capabilities, environmental performance operational characteristics, and ability to reduce project emissions while ensuring effective structural performance throughout diverse construction programs. Positioned as essential materials for modern construction operations, carbon-negative cement offer both performance advantages and environmental compliance benefits.

The segment is supported by continuous innovation in bio-mineralization technologies and the growing availability of specialized construction systems that enable variable carbon absorption applications with enhanced structural uniformity and rapid construction capabilities. Additionally, construction operators are investing in environmental management systems to support large-scale cement utilization and construction planning. As green construction demand becomes more prevalent and building efficiency requirements increase, construction applications will continue to dominate the end-use market while supporting advanced environmental construction utilization and emission reduction strategies.

The carbon-negative cement market is advancing rapidly due to increasing demand for climate-positive construction technologies and growing adoption of carbon capture construction solutions that provide superior environmental performance and structural reliability while enabling reduced lifecycle emissions across diverse building and construction management applications. However, the carbon-negative cement market faces challenges, including high initial material costs, regulatory compliance requirements, and the need for specialized construction training and certification programs. Innovation in bio-mineralization capabilities and ai-powered carbon optimization systems continues to influence product development and market expansion patterns.

The growing adoption of bio-mineralization systems, ai-powered carbon absorption algorithms, and machine learning-based environmental optimization is enabling manufacturers to produce advanced carbon-negative cement with superior carbon sequestration capabilities, enhanced structural precision, and automated environmental management functionalities. Advanced bio-mineralization systems provide improved carbon absorption accuracy while allowing more efficient construction processes and consistent performance across various building types and environmental conditions. Manufacturers are increasingly recognizing the competitive advantages of bio-mineralization cement capabilities for environmental differentiation and premium market positioning.

Modern carbon-negative cement producers are incorporating IoT connectivity, cloud-based environmental management, and integrated construction monitoring systems to enhance operational intelligence, enable predictive carbon tracking capabilities, and deliver value-added solutions to construction customers. These technologies improve building efficiency while enabling new operational capabilities, including real-time carbon monitoring, environmental effectiveness tracking, and reduced construction overhead. Advanced environmental integration also allows manufacturers to support comprehensive construction management systems and building modernization beyond traditional conventional cement approaches.

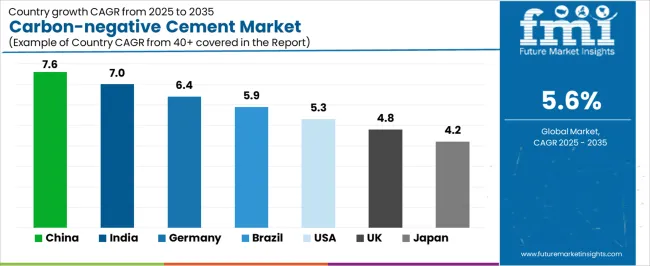

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.6% |

| India | 7% |

| Germany | 6.4% |

| Brazil | 5.9% |

| USA | 5.3% |

| UK | 4.8% |

| Japan | 4.2% |

The carbon-negative cement market is experiencing strong growth globally, with China leading at a 7.6% CAGR through 2035, driven by the expanding construction modernization programs, growing green building adoption, and significant investment in carbon capture technology development. India follows at 7%, supported by government initiatives promoting environmental construction technology, increasing infrastructure development demand, and growing emission reduction requirements. Germany shows growth at 6.4%, emphasizing green construction innovation and advanced building technology development. Brazil records 5.9%, focusing on large-scale infrastructure expansion and commercial construction modernization. The USA demonstrates 5.3% growth, prioritizing construction efficiency standards and building automation excellence. The UK exhibits 4.8% growth, emphasizing construction technology adoption and green building development. Japan shows 4.2% growth, supported by high-tech construction initiatives and climate-positive building concentration.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

Revenue from carbon-negative cement in China is projected to exhibit exceptional growth with a CAGR of 7.6% through 2035, driven by expanding construction modernization programs and rapidly growing green building adoption supported by government initiatives promoting environmental construction technology development. The country's strong position in cement manufacturing and increasing investment in carbon capture infrastructure are creating substantial demand for advanced carbon-negative cement solutions. Major construction companies and infrastructure enterprises are establishing comprehensive carbon management capabilities to serve both domestic building demand and environmental performance markets.

Revenue from carbon-negative cement in India is expanding at a CAGR of 7%, supported by the country's massive construction sector, expanding government support for building modernization, and increasing adoption of green construction solutions. The country's initiatives promoting construction technology and growing builder awareness are driving requirements for advanced emission reduction capabilities. International suppliers and domestic manufacturers are establishing extensive production and service capabilities to address the growing demand for carbon-negative cement products.

Revenue from carbon-negative cement in Germany is expanding at a CAGR of 6.4%, supported by the country's advanced green construction capabilities, strong emphasis on building technology innovation, and robust demand for high-performance environmental materials in construction and infrastructure management applications. The nation's mature construction sector and efficiency-focused operations are driving sophisticated carbon-negative cement systems throughout the building industry. Leading manufacturers and technology providers are investing extensively in bio-mineralization systems and carbon absorption technologies to serve both domestic and international markets.

Revenue from carbon-negative cement in Brazil is growing at a CAGR of 5.9%, driven by the country's expanding construction sector, growing commercial building operations, and increasing investment in construction technology development. Brazil's large infrastructure area and commitment to building modernization are supporting demand for efficient carbon-negative cement solutions across multiple construction segments. Manufacturers are establishing comprehensive service capabilities to serve the growing domestic market and construction export opportunities.

Revenue from carbon-negative cement in the USA is expanding at a CAGR of 5.3%, supported by the country's advanced construction technology sector, strategic focus on building efficiency, and established green construction capabilities. The USA's construction innovation leadership and technology integration are driving demand for carbon-negative cement in commercial building, specialty construction, and environmental construction applications. Manufacturers are investing in comprehensive technology development to serve both domestic construction markets and international specialty applications.

Revenue from carbon-negative cement in the UK is growing at a CAGR of 4.8%, driven by the country's focus on construction technology advancement, emphasis on building efficiency, and strong position in green construction development. The UK's established construction innovation capabilities and commitment to building modernization are supporting investment in advanced carbon-negative technologies throughout major construction regions. Industry leaders are establishing comprehensive technology integration systems to serve domestic building operations and specialty construction applications.

Revenue from carbon-negative cement in Japan is expanding at a CAGR of 4.2%, supported by the country's high-tech construction initiatives, growing green building sector, and strategic emphasis on construction automation development. Japan's prestige technology capabilities and integrated construction systems are driving demand for advanced carbon-negative cement in specialty building, environmental construction, and high-value construction applications. Leading manufacturers are investing in specialized capabilities to serve the stringent requirements of high-tech construction and climate-positive building industries.

The carbon-negative cement market in Europe is projected to grow from USD 183.2 million in 2025 to USD 315.9 million by 2035, registering a CAGR of 5.6% over the forecast period. Germany is expected to maintain its leadership position with a 31.8% market share in 2025, declining slightly to 31.2% by 2035, supported by its strong green construction sector, advanced building technology capabilities, and comprehensive construction environmental industry serving diverse carbon-negative cement applications across Europe.

France follows with a 21.7% share in 2025, projected to reach 22.3% by 2035, driven by robust demand for carbon-negative cement in infrastructure construction, building modernization programs, and green construction applications, combined with established construction technology infrastructure and specialty building expertise. The United Kingdom holds a 18.4% share in 2025, expected to reach 18.9% by 2035, supported by strong construction technology sector and growing green building activities. Italy commands a 13.2% share in 2025, projected to reach 13.6% by 2035, while Spain accounts for 8.7% in 2025, expected to reach 9.1% by 2035. The Netherlands maintains a 4.1% share in 2025, growing to 4.2% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Poland, and other nations, is anticipated to maintain momentum, with its collective share moving from 2.1% to 0.7% by 2035, attributed to increasing construction modernization in Eastern Europe and growing green building penetration in Nordic countries implementing advanced construction technology programs.

The carbon-negative cement market is characterized by competition among established cement manufacturers, specialized environmental technology producers, and integrated green construction solutions providers. Companies are investing in bio-mineralization technology research, carbon absorption optimization, environmental monitoring system development, and comprehensive product portfolios to deliver consistent, high-performance, and application-specific carbon-negative cement solutions. Innovation in ai-powered systems, environmental tracking integration, and operational efficiency enhancement is central to strengthening market position and competitive advantage.

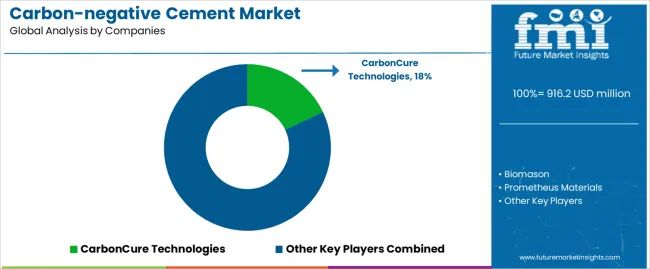

Biomason leads the carbon-negative cement market with a strong market share, offering comprehensive carbon-negative cement solutions including advanced bio-mineralization systems with a focus on construction and commercial applications. Prometheus Materials provides specialized environmental cement capabilities with an emphasis on carbon capture systems and automated environmental operations. Basilisk delivers innovative emission reduction products with a focus on high-performance platforms and commercial construction services.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 916.2 million |

| Raw Material Type | Natural Raw Materials, Industrial Waste Raw Materials |

| Application | Construction, Environmental Remediation, Others |

| Technology Type | Bio-mineralization Systems, Carbon Capture Platforms, Hybrid Carbon Sequestration Systems |

| End-Use Sector | Commercial Construction, Infrastructure Development, Residential Construction, Environmental Services |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan and 40+ countries |

| Key Companies Profiled | Biomason, Prometheus Materials, and Basilisk |

| Additional Attributes | Dollar sales by raw material type and application category, regional demand trends, competitive landscape, technological advancements in bio-mineralization systems, carbon capture development, AI integration innovation, and environmental construction integration |

The global carbon-negative cement market is estimated to be valued at USD 916.2 million in 2025.

The market size for the carbon-negative cement market is projected to reach USD 1,579.9 million by 2035.

The carbon-negative cement market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in carbon-negative cement market are natural raw materials and industrial waste raw materials.

In terms of application, construction segment to command 62.4% share in the carbon-negative cement market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cement Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cement Consistometer Market Size and Share Forecast Outlook 2025 to 2035

Cement Paints Market Size and Share Forecast Outlook 2025 to 2035

Cement Sacks Market Growth – Demand & Forecast 2025 to 2035

Cement Kiln Co-Processing Fuels Market Growth – Trends & Forecast 2024-2034

Europe Cement Packaging Market Analysis – Trends & Forecast 2024-2034

North America Cement Packaging Industry Analysis – Trends & Forecast 2024-2034

Cement Boards Market

Cement and Mortar Testing Equipment Market Growth – Trends & Forecast 2018-2027

Biocement Market Size and Share Forecast Outlook 2025 to 2035

GCC Cement Market Growth – Trends & Forecast 2025 to 2035

Replacement Sheets Market Analysis - Size, Share & Forecast 2025 to 2035

Bone Cement Delivery System Market Trends – Growth & Forecast 2024-2034

Bone Cement Mixers Market

Green Cement Market Size and Share Forecast Outlook 2025 to 2035

Resin Cement for Luting Market Size and Share Forecast Outlook 2025 to 2035

Fiber Cement Market Analysis by Raw Materials, End User, Application, and Region through 2025 to 2035

Fiber Cement Board Market Growth - Trends & Forecast 2025 to 2035

Qatar Cement Market Analysis by Product Type, End Use, and Region Forecast Through 2025 to 2035

Competitive Overview of White Cement Market Share

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA