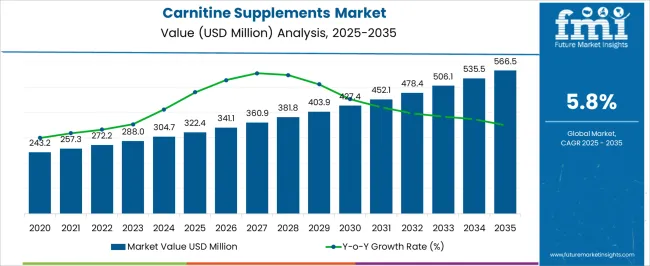

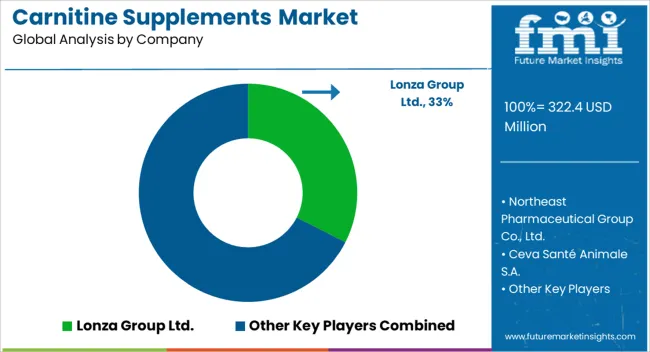

The Carnitine Supplements Market is estimated to be valued at USD 322.4 million in 2025 and is projected to reach USD 566.5 million by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

| Metric | Value |

|---|---|

| Carnitine Supplements Market Estimated Value in (2025 E) | USD 322.4 million |

| Carnitine Supplements Market Forecast Value in (2035 F) | USD 566.5 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

The Carnitine Supplements market is experiencing steady growth driven by the increasing adoption of sports nutrition and wellness products among health-conscious consumers. Rising awareness of fitness and weight management, combined with a growing interest in energy metabolism and muscle recovery, has elevated demand for carnitine supplements globally.

The market is influenced by trends in personalized nutrition and the expanding use of dietary supplements for performance enhancement and overall well-being. Investments in research and development of new formulations and flavors are enabling manufacturers to cater to diverse consumer preferences, thereby improving product accessibility and appeal.

Additionally, the aging population and increasing prevalence of lifestyle-related metabolic disorders are contributing to sustained market growth The continued focus on convenient dosage forms, innovative flavors, and scientifically validated efficacy is anticipated to drive adoption further, creating opportunities for new product launches and brand differentiation in both developed and emerging markets.

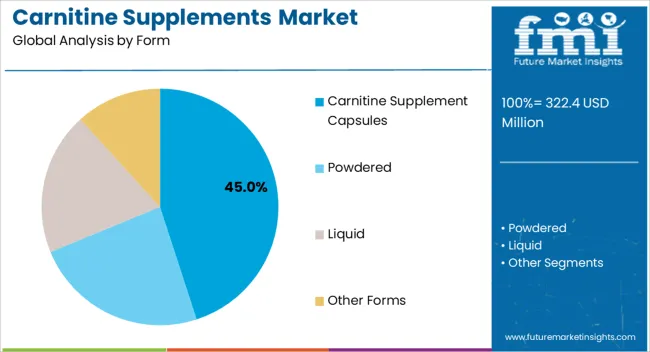

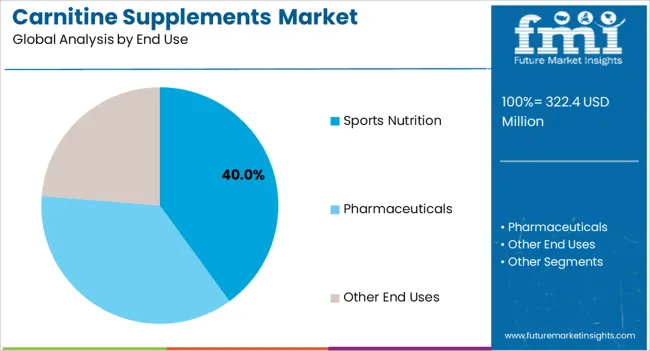

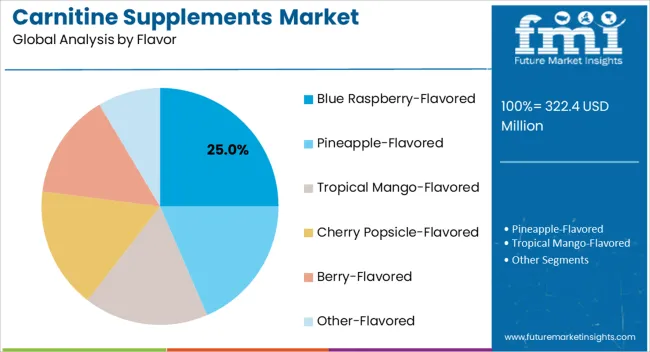

The carnitine supplements market is segmented by form, end use, flavor, distribution channel, and geographic regions. By form, carnitine supplements market is divided into Carnitine Supplement Capsules, Powdered, Liquid, and Other Forms. In terms of end use, carnitine supplements market is classified into Sports Nutrition, Pharmaceuticals, and Other End Uses. Based on flavor, carnitine supplements market is segmented into Blue Raspberry-Flavored, Pineapple-Flavored, Tropical Mango-Flavored, Cherry Popsicle-Flavored, Berry-Flavored, and Other-Flavored. By distribution channel, carnitine supplements market is segmented into Pharmacies And Drug Stores, Health & Beauty Stores, Hypermarkets/Supermarkets, Online Retailing, and Direct Selling. Regionally, the carnitine supplements industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Carnitine Supplement Capsules segment is projected to hold 45.00% of the market revenue share in 2025, making it the leading form in the market. This dominance is being attributed to the convenience, portability, and precise dosing offered by capsules, which support consumer adherence to daily supplementation regimens.

Capsules are preferred due to their ease of ingestion and compatibility with other health supplements, allowing integration into multi-supplement routines. Additionally, capsules provide enhanced stability and shelf life compared to other forms, ensuring consistent potency and efficacy.

The popularity of capsules has also been reinforced by consumer perception of higher quality and reliability in delivering targeted carnitine benefits for energy metabolism, fat oxidation, and muscle recovery As manufacturers continue to optimize formulations for enhanced absorption and bioavailability, the capsule segment is expected to maintain its leadership, benefiting from consumer preference for convenient and effective supplementation solutions.

The Sports Nutrition end-use segment is estimated to capture 40.00% of the Carnitine Supplements market revenue in 2025, positioning it as the dominant application. This segment has grown due to the increasing demand for performance-enhancing supplements among athletes, fitness enthusiasts, and active lifestyle consumers.

Carnitine supplementation is recognized for supporting energy production, improving exercise endurance, and aiding post-workout recovery, making it a critical component in sports nutrition formulations. The growth is also being driven by the rising adoption of structured training programs, gym memberships, and athletic performance tracking, which highlight the importance of nutritional supplementation for measurable outcomes.

Furthermore, convenient dosing options and targeted formulations have made carnitine supplements highly suitable for integration into sports nutrition regimens As consumer focus on health, fitness, and performance continues to rise, the Sports Nutrition segment is expected to remain the largest end-use category, providing consistent opportunities for innovation and market expansion.

The Blue Raspberry-Flavored segment is expected to account for 25.00% of the market revenue in 2025, making it the leading flavor preference among consumers. This preference is being driven by the growing demand for palatable and enjoyable supplement options that enhance adherence and user experience.

Flavor innovation in dietary supplements has become a key differentiator, with consumers seeking products that combine efficacy with pleasant taste. Blue Raspberry flavor has been favored for its refreshing and familiar taste profile, which appeals particularly to younger demographics and sports nutrition consumers.

The segment’s growth has also been supported by increasing product availability across retail, e-commerce, and specialty nutrition channels Continued focus on flavor enhancement, combined with functional benefits of carnitine, is expected to strengthen consumer preference for Blue Raspberry and similar appealing flavors, driving innovation in formulation and supporting market growth in the coming years.

Mammals use the amino acid carnitine to help turn fatty acids into energy. Carnitine-rich supplements are frequently used for weight loss since they boost metabolism, accelerate fat burning, and provide users energy. Customers are encouraged to use carnitine as an infant, anti-aging, and sports nutrition supplement because of the quality of the supplement.

The demand for carnitine supplements is dramatically rising as obesity and overweight excess weight gain are becoming more common in most established and emerging economies. "Obesity has reached epidemic proportions globally, with at least 2.8 million people dying each year as a result of being overweight or obese," said a World Health Organization (WHO) report published in June 2025. Obesity is currently more common in low- and middle-income countries than it used to be in high-income ones.

In our new study, ESOMAR-certified market research and consulting firm Future Market Insights (FMI) offers insights into key factors driving demand for Carnitine Supplements.

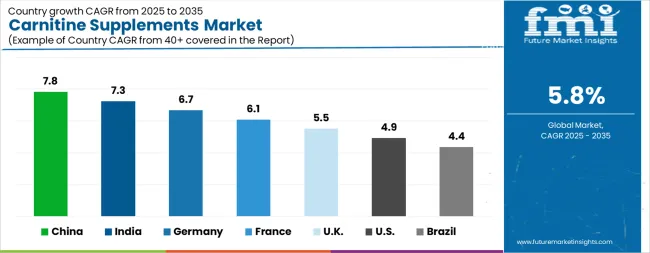

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The Carnitine Supplements Market is expected to register a CAGR of 5.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.8%, followed by India at 7.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.4%, yet still underscores a broadly positive trajectory for the global Carnitine Supplements Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.7%. The USA Carnitine Supplements Market is estimated to be valued at USD 118.1 million in 2025 and is anticipated to reach a valuation of USD 191.0 million by 2035. Sales are projected to rise at a CAGR of 4.9% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 17.4 million and USD 10.5 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 322.4 Million |

| Form | Carnitine Supplement Capsules, Powdered, Liquid, and Other Forms |

| End Use | Sports Nutrition, Pharmaceuticals, and Other End Uses |

| Flavor | Blue Raspberry-Flavored, Pineapple-Flavored, Tropical Mango-Flavored, Cherry Popsicle-Flavored, Berry-Flavored, and Other-Flavored |

| Distribution Channel | Pharmacies And Drug Stores, Health & Beauty Stores, Hypermarkets/Supermarkets, Online Retailing, and Direct Selling |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lonza Group Ltd., Northeast Pharmaceutical Group Co., Ltd., Ceva Santé Animale S.A., Kaiyuan Hengtai Chemical Co., Ltd., ChengDa Pharmaceuticals Co., Ltd., Merck KGaA, Biosint S.p.A, and Tokyo Chemical Industry Co., Ltd. |

The global carnitine supplements market is estimated to be valued at USD 322.4 million in 2025.

The market size for the carnitine supplements market is projected to reach USD 566.5 million by 2035.

The carnitine supplements market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in carnitine supplements market are carnitine supplement capsules, powdered, liquid and other forms.

In terms of end use, sports nutrition segment to command 40.0% share in the carnitine supplements market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

L-carnitine Supplements Market Size and Share Forecast Outlook 2025 to 2035

Supplements And Nutrition Packaging Market

L-Carnitine Market Size and Share Forecast Outlook 2025 to 2035

Levocarnitine Market Size and Share Forecast Outlook 2025 to 2035

ACF Supplements Market Size and Share Forecast Outlook 2025 to 2035

PDRN Supplements Market Size and Share Forecast Outlook 2025 to 2035

Feed Supplements Market Analysis - Size, Share & Forecast 2025 to 2035

Gummy Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fiber Supplements Market Size and Share Forecast Outlook 2025 to 2035

Vegan Supplements Market Analysis by Ingredient Type, Form, Customer Orientation , Sales Channel and Health Concer Through 2035

Andro Supplements Market

Beauty Supplements Packaging Market Size and Share Forecast Outlook 2025 to 2035

Urology Supplements Market Size and Share Forecast Outlook 2025 to 2035

Peptide Supplements Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Calcium Supplement Market Analysis - Size, Share & Forecast 2025 to 2035

Calorie Supplements Market Analysis by Form, Packaging, Flavor, Sales Channel and Region Through 2025 to 2035

Dietary Supplements Packaging Market Analysis – Trends & Forecast 2025-2035

D-Mannose Supplements Market Size and Share Forecast Outlook 2025 to 2035

Krill Oil Supplements Market Size and Share Forecast Outlook 2025 to 2035

Melatonin Supplements Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA