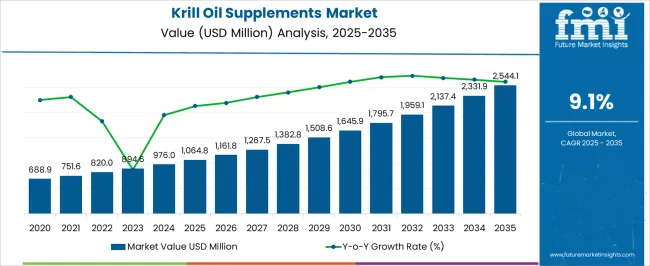

The krill oil supplements market is projected to grow from USD 1,064.8 million in 2025 to USD 2,544.1 million by 2035, reflecting a CAGR of 9.1%. During the early adoption phase (2020–2024), consumers gradually explored krill oil as an alternative to traditional omega-3 supplements due to its high bioavailability and functional benefits.

By 2025, growing awareness among health-conscious consumers and adoption by dietary supplement manufacturers will drive broader market growth. This phase represents the transition from niche usage to wider commercial adoption, as companies expand production capacity, diversify product offerings, and strengthen distribution networks, setting the stage for the scaling phase. From 2025 to 2030, the market enters a scaling phase, marked by accelerated uptake across retail, pharmaceutical, and online channels.

Market value rises from USD 1,064.8 million in 2025 as adoption increases in daily dietary supplements and fortified products. By 2030, krill oil supplements will become a recognized category within the omega-3 segment, preparing the market for consolidation. Between 2030 and 2035, the market reaches USD 2,544.1 million, with steady CAGR-driven growth. Consolidation occurs as leading suppliers optimize production, establish long-term distribution partnerships, and capture larger market shares, resulting in a mature and competitive market environment.

| Metric | Value |

|---|---|

| Krill Oil Supplements Market Estimated Value in (2025 E) | USD 1064.8 million |

| Krill Oil Supplements Market Forecast Value in (2035 F) | USD 2544.1 million |

| Forecast CAGR (2025 to 2035) | 9.1% |

The krill oil supplements market is a key segment of the broader omega-3 and dietary supplements market. In 2025, krill oil accounts for approximately 18% of the omega-3 supplements market, reflecting growing consumer preference for high-bioavailability sources of omega-3 fatty acids. The broader omega-3 and dietary supplements market is projected to grow at a CAGR of around 5–6% during 2025–2035, driven by increasing demand for heart health, cognitive support, and overall wellness products globally. Within the omega-3 segment, krill oil holds an estimated 12% share in 2025, while fish oil and plant-based omega-3 sources account for the remainder. By 2030, scaling adoption is expected to increase the krill oil share to nearly 15%, driven by its integration into functional foods, nutraceutical products, and direct-to-consumer supplements.

Between 2030 and 2035, market consolidation is anticipated as leading producers expand production, optimize supply chains, and establish strategic partnerships with retailers and health brands. By 2035, krill oil supplements are projected to account for approximately 17% of the omega-3 supplements market and around 8–9% of the overall dietary supplements market, solidifying their position as a key growth driver and significant revenue contributor within the parent market.

The krill oil supplements market is witnessing steady expansion, fueled by growing consumer awareness of the health benefits associated with omega-3 fatty acids and the bioavailability advantages of phospholipid-bound EPA and DHA found in krill oil. Demand is being supported by the rising prevalence of lifestyle-related health conditions, which has prompted increased incorporation of marine-based supplements into daily nutrition.

Market growth is further influenced by heightened interest in joint health, cardiovascular wellness, and cognitive support, driving consistent consumption across a diverse demographic base. Technological advancements in extraction and encapsulation methods have enhanced product stability and purity, increasing acceptance among both retail consumers and nutraceutical manufacturers.

While competition from fish oil supplements remains, krill oil continues to gain market share due to its differentiation in absorption efficiency and antioxidant content, particularly astaxanthin. Over the forecast period, demand is anticipated to rise steadily across global markets, supported by expanding distribution networks, premium positioning in health and wellness portfolios, and the continued endorsement of omega-3 supplementation by healthcare professionals.

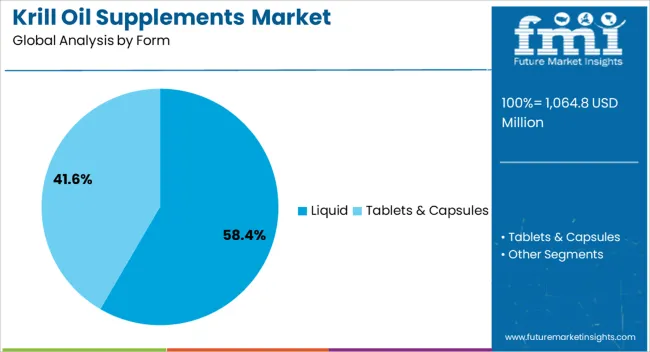

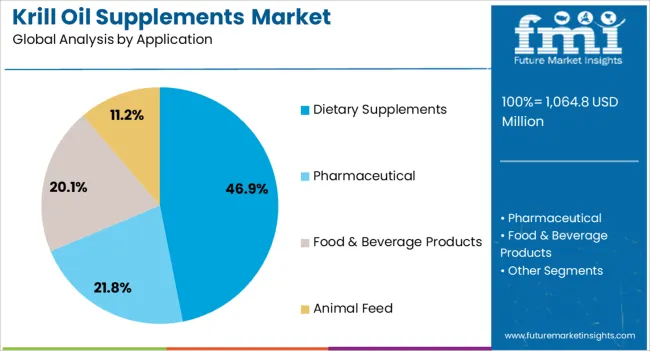

The krill oil supplements market is segmented by form, application, and geographic regions. By form, krill oil supplements market is divided into Liquid and Tablets & Capsules. In terms of application, krill oil supplements market is classified into Dietary Supplements, Pharmaceutical, Food & Beverage Products, and Animal Feed. Regionally, the krill oil supplements industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The liquid segment dominates the form category of the krill oil supplements market, holding approximately 58.4% of the total share. Its leadership is driven by consumer preference for easily absorbable formats and versatility in dosage customization. The segment has been further strengthened by the availability of liquid krill oil in both standalone supplement bottles and bulk formats for incorporation into functional foods and beverages.

Liquid formulations are perceived as offering higher purity levels and fresher taste profiles, appealing to health-conscious consumers seeking minimally processed products. Additionally, liquid krill oil allows for the preservation of naturally occurring antioxidants, such as astaxanthin, without undergoing extensive refinement.

The segment’s position is reinforced by its adaptability to a variety of consumption habits, from direct intake to blending with smoothies or health tonics. As manufacturing techniques continue to improve shelf life and stability, the liquid segment is expected to maintain its lead, benefiting from both retail and B2B nutraceutical applications.

The dietary supplements segment leads the application category in the krill oil supplements market, accounting for approximately 46.9% of total share. This segment’s strength is rooted in the increasing consumer adoption of daily omega-3 supplementation for cardiovascular, cognitive, and joint health. The growing shift towards preventive healthcare has elevated the role of krill oil capsules, softgels, and liquid droppers in routine wellness regimens.

The segment benefits from widespread retail penetration, including pharmacies, specialty nutrition stores, and online platforms, which has expanded accessibility to global consumers. Regulatory recognition of krill oil as a safe dietary ingredient has further boosted its credibility among health professionals and consumers alike.

Marketing campaigns highlighting the superior bioavailability of krill oil over conventional fish oil have amplified demand, particularly in premium supplement categories. Continued product diversification, including combination formulas with vitamins and herbal extracts, is expected to further strengthen the dietary supplements segment’s dominance over the forecast horizon.

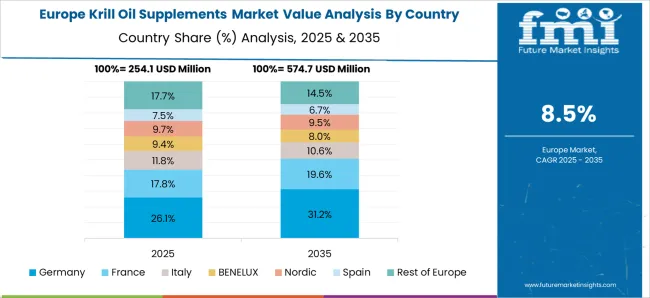

The krill oil supplements market is expanding due to increasing consumer interest in cardiovascular health, joint support, and cognitive wellness. North America and Europe lead adoption with high awareness of omega-3 benefits, aging populations, and well-established supplement retail channels. Asia-Pacific is growing rapidly due to rising disposable income, health awareness, and e-commerce penetration. Manufacturers differentiate through purity, phospholipid content, and sustainability certifications. Regional differences in dietary preferences, regulatory frameworks, and consumer trust strongly influence product formulation, adoption, and global competitiveness.

Increasing consumer focus on preventive healthcare is driving krill oil supplement adoption. North America and Europe emphasize cardiovascular and cognitive wellness products due to aging populations, widespread omega-3 knowledge, and functional food trends. Asia-Pacific markets are growing as health-conscious urban populations seek dietary supplements to support heart and joint health. Differences in awareness levels, supplement consumption habits, and medical recommendations influence product dosage, form (capsules or soft gels), and ingredient sourcing. Leading suppliers offer high-purity, phospholipid-rich krill oil with clinical validation, while regional manufacturers focus on affordable, mass-market formulations. Health awareness contrasts shape adoption, product positioning, and market competitiveness across global krill oil supplement markets.

Sustainability concerns and responsible sourcing are increasingly critical in the krill oil supplements market. North America and Europe prioritize certifications for sustainable harvesting, traceability, and environmental compliance. Asia-Pacific markets are gradually adopting sustainability-focused products, balancing cost and ecological impact. Differences in regulatory pressure, consumer perception, and marine conservation policies influence sourcing, extraction methods, and labeling. Leading suppliers provide certified krill oil with verified phospholipid and omega-3 content, while regional players focus on cost-effective, locally sourced alternatives. Sustainability and sourcing contrasts drive adoption, brand trust, and competitiveness in the global krill oil supplement market.

Regulatory frameworks and quality assurance significantly influence krill oil supplement adoption. North America and Europe require stringent labeling, purity verification, and clinical substantiation under FDA and EFSA guidelines. Asia-Pacific regulations vary; developed regions follow international standards, while emerging markets have flexible local regulations. Differences in testing protocols, dosage limits, and product registration impact production practices, market entry, and brand credibility. Leading suppliers invest in high-quality extraction, standardized phospholipid content, and batch testing, while regional manufacturers focus on affordable, compliant options. Regulatory contrasts shape adoption, consumer trust, and competitiveness globally.

Innovation in krill oil supplements, including enhanced bioavailability, combination formulations, and soft gel encapsulation, is driving market growth. North America and Europe prioritize clinically validated formulations with targeted benefits, including heart, joint, and brain health. Asia-Pacific markets adopt value-added, multi-nutrient supplements balancing affordability and efficacy. Differences in consumer expectations, health claims acceptance, and technological capabilities influence dosage, encapsulation, and delivery mechanisms. Leading suppliers develop high-potency, odor-controlled, and sustainably sourced products, while regional manufacturers focus on accessible, low-cost alternatives. Formulation and innovation contrasts drive adoption, product differentiation, and competitiveness across the global krill oil supplement market.

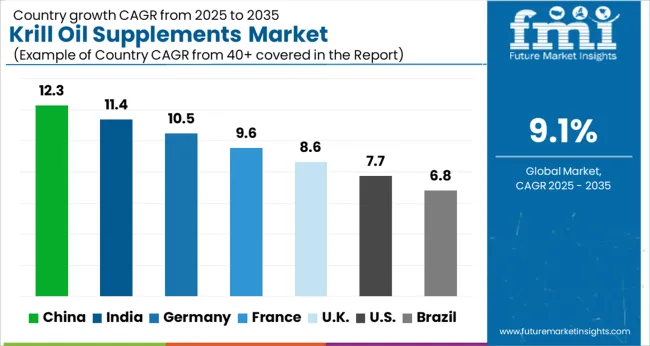

| Country | CAGR |

|---|---|

| China | 12.3% |

| India | 11.4% |

| Germany | 10.5% |

| France | 9.6% |

| UK | 8.6% |

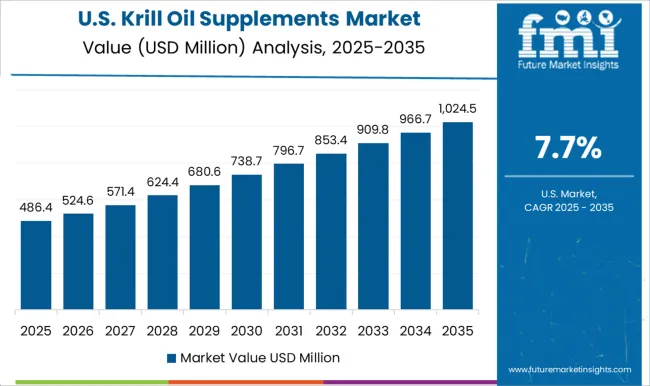

| USA | 7.7% |

| Brazil | 6.8% |

The global krill oil supplements market is projected to grow at a 9.1% CAGR through 2035, driven by demand in dietary supplements, functional foods, and nutraceutical applications. Among BRICS nations, China led with 12.3% growth as large-scale production and distribution networks were implemented, while India at 11.4% expanded manufacturing and supply to meet growing domestic and regional consumption. In the OECD region, Germany at 10.5% maintained steady utilization under strict quality and regulatory standards, while the United Kingdom at 8.6% supported moderate-scale deployment in commercial and retail sectors. The USA, growing at 7.7%, sustained adoption in nutraceutical and dietary supplement applications while complying with federal and state-level regulations. This report includes insights on 40+ countries; the top countries are shown here for reference.

The krill oil supplements market in China is growing at a 12.3% CAGR, driven by rising health awareness, increasing disposable incomes, and growing demand for omega-3 and antioxidant-rich products. Consumers are focusing on cardiovascular health, cognitive function, and joint support, which are key benefits associated with krill oil. E-commerce platforms and modern retail channels are expanding product availability across urban and semi-urban areas. Domestic manufacturers are investing in research and development to produce high-purity, sustainably sourced krill oil supplements. Marketing strategies emphasize clinical benefits, quality assurance, and certifications such as sustainability and purity standards. The rising popularity of preventive healthcare and nutraceutical products is supporting demand. Overall, China’s market reflects strong consumer interest in health supplements, growing online distribution channels, and increasing awareness of the benefits of marine-based omega-3 sources.

Krill oil supplements market in India is registering an 11.4% CAGR, supported by rising health consciousness and growing interest in dietary supplements for cardiovascular, cognitive, and joint health. Consumers in urban centers are increasingly turning to omega-3 supplements as preventive healthcare measures. Domestic and international manufacturers are introducing high-quality, sustainably sourced krill oil products with certifications for purity and safety. E-commerce and pharmacy retail channels are improving product accessibility, particularly in tier-one and tier-two cities. Marketing campaigns emphasize health benefits, natural sourcing, and clinical efficacy. The growth of health and wellness trends, combined with increasing disposable income, supports consistent market expansion. Overall, India’s market reflects increasing consumer adoption, expanding distribution channels, and rising awareness of nutraceutical benefits.

Germany’s krill oil supplements market is growing at a 10.5% CAGR, driven by strong health awareness and adoption of dietary supplements for heart, brain, and joint health. Consumers prefer high-purity, sustainably sourced krill oil products, supported by stringent quality and safety standards. Retailers, pharmacies, and online channels are expanding product availability, providing easy access for health-conscious buyers. Manufacturers focus on product innovation, including enhanced bioavailability, combined formulations, and environmentally responsible sourcing. Public awareness campaigns and nutraceutical marketing emphasize clinically validated benefits, supporting consumer adoption. Market growth is shaped by sustainability preferences, regulatory compliance, and increasing demand for preventive health supplements. Germany’s market reflects steady growth due to high consumer confidence in quality-assured products and consistent industrial innovation.

The United Kingdom market is expanding at an 8.6% CAGR, driven by consumer interest in cardiovascular, cognitive, and joint health supplements. Krill oil products are increasingly preferred for their bioavailability and antioxidant properties. Manufacturers focus on high-quality, sustainably sourced supplements with certifications to ensure consumer trust. E-commerce platforms, pharmacy chains, and specialty health stores enhance product accessibility. Marketing campaigns emphasize preventive healthcare, scientific backing, and environmental responsibility. Rising disposable incomes and health-conscious lifestyles among urban consumers further support growth. Overall, the UK market reflects moderate expansion supported by innovation, sustainable sourcing, and increasing consumer adoption of nutraceutical products.

The United States krill oil supplements market is growing at a 7.7% CAGR, supported by rising health awareness and demand for omega-3-rich nutraceuticals. Consumers focus on cardiovascular health, cognitive support, and joint wellness, increasing krill oil adoption. Manufacturers emphasize high-purity, sustainably sourced products with certifications to ensure safety and quality. Online retail, pharmacy chains, and health stores provide broad accessibility. Marketing campaigns highlight clinically proven benefits and environmental sustainability. The growth of preventive healthcare and wellness trends, combined with rising disposable income, drives market expansion. Overall, the USA market reflects steady growth supported by consumer health awareness, product quality assurance, and widespread distribution channels.

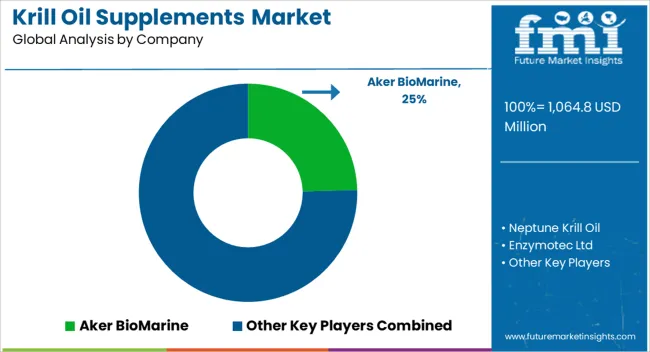

The krill oil supplements market is being shaped by prominent companies such as Aker BioMarine, Neptune Krill Oil, Enzymotec Ltd, RIMFROST AS, NutriGold Inc., Life Extension, and NOW Foods, who dominate the supply of high-quality krill oil products globally. These suppliers focus on sourcing Antarctic krill sustainably while maintaining strict quality standards to ensure high levels of omega-3 fatty acids and phospholipids. With increasing consumer awareness about the health benefits of krill oil, including cardiovascular support, cognitive enhancement, and anti-inflammatory effects, these companies are innovating to meet the rising demand for bioavailable and effective supplements. Leading players in the market are investing in advanced extraction and encapsulation technologies to improve absorption and minimize common drawbacks such as fishy aftertaste. Product differentiation has become a key strategy, with companies offering softgels, emulsified liquids, and functional blends targeting specific health needs. Additionally, there is a growing trend toward incorporating krill oil into nutraceuticals and functional foods, which broadens the reach of these products to a wider consumer base and enhances market penetration. Eco-efficiency and environmental responsibility remain core priorities for these suppliers, with many implementing eco-friendly harvesting practices to protect marine ecosystems. Strategic partnerships, mergers, and expanded distribution networks are also being pursued to strengthen global presence and ensure consistent supply. As interest in natural, marine-derived dietary supplements continues to grow, the krill oil market is expected to witness steady expansion, driven by both health-conscious consumers and the proactive initiatives of leading market suppliers.

| Item | Value |

|---|---|

| Quantitative Units | USD 1064.8 Million |

| Form | Liquid and Tablets & Capsules |

| Application | Dietary Supplements, Pharmaceutical, Food & Beverage Products, and Animal Feed |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aker BioMarine, Neptune Krill Oil, Enzymotec Ltd, RIMFROST AS, NutriGold Inc., Life Extension, and NOW Foods |

| Additional Attributes | Dollar sales vary by product form, including capsules, soft gels, and liquid oils; by application, such as cardiovascular health, joint support, cognitive health, and general wellness; by end-use, spanning nutraceutical companies, pharmacies, and direct-to-consumer channels; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising health awareness, omega-3 demand, and functional supplement trends. |

The global krill oil supplements market is estimated to be valued at USD 1,064.8 million in 2025.

The market size for the krill oil supplements market is projected to reach USD 2,544.1 million by 2035.

The krill oil supplements market is expected to grow at a 9.1% CAGR between 2025 and 2035.

The key product types in krill oil supplements market are liquid and tablets & capsules.

In terms of application, dietary supplements segment to command 46.9% share in the krill oil supplements market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Analysis and Growth Projections for Krill Oil Phospholipid Business

Krill Oil Market Outlook – Share, Growth & Forecast 2025 to 2035

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA