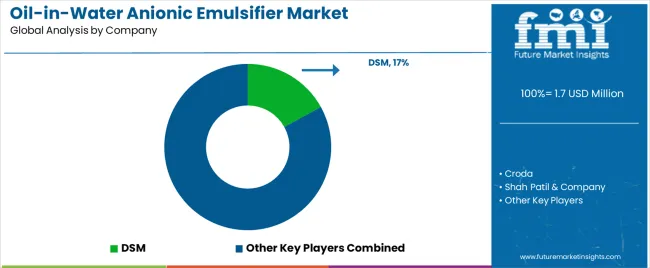

The oil-in-water anionic emulsifier market is projected to grow from USD 1.7 billion in 2025 to USD 2.5 billion by 2035, at a CAGR of 3.8%. Growth comes from a wide base of applications. Demand for emulsifiers are crucial as these stabilizing oil droplets within water-based systems, making them indispensable across food, cosmetics, pharmaceuticals, and industrial products. Each end-use sector carries distinct drivers, shaping both volume and value contributions over the forecast period.

In food and beverages, emulsifiers have long served as core ingredients in dressings, sauces, bakery creams, and dairy alternatives as these provide stability, improve texture, and extend shelf life. Demanf for oil-in-water anionic emulsifier is rising for processed and convenience food. Rising consumption of packaged foods across Europe, Asia, and North America has reinforced consistent usage. Specialty emulsifiers are also becoming important in plant-based food formulations, where taste, appearance, and texture demand greater innovation. Clean-label pressures push manufacturers to reformulate, making natural or high-purity emulsifiers more attractive.

Personal care and cosmetics are equally significant. Emulsifiers keep lotions smooth, creams consistent, and sunscreens effective. They help blend oils, fragrances, and active compounds into stable products. Consumers expect uniform texture and ease of application, and emulsifiers deliver on both fronts. Growth in skincare and haircare spending, especially in emerging markets, has created a stable pipeline of demand. Premium brands are moving toward multifunctional emulsifiers that add mildness, hydration, or conditioning benefits alongside stability.

Pharmaceuticals use these emulsifiers in oral suspensions, ointments, and injectables. The role shifts from texture alone to therapeutic reliability. Anionic emulsifiers improve solubility, enhance bioavailability, and ensure dosage uniformity. The segment is highly regulated, which favors suppliers with strict quality management and compliance certifications. As drug delivery systems evolve toward lipid-based and nano-emulsified forms, the demand for advanced emulsifiers is expected to increase.

Industrial uses add another layer of opportunity. In agrochemicals, emulsifiers stabilize active ingredients in pesticides and herbicides, ensuring performance under variable pH and environmental conditions. In coatings and paints, they support uniform film formation, improving durability and finish. Cleaning products also rely on them for effective dispersion of oils and active agents. Demand in these sectors is linked directly to agricultural cycles, construction activity, and manufacturing output, creating cyclical but steady growth.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | Sulfate ester formulations (food, cosmetic applications) | 45% | Traditional emulsification, stable formulations |

| Sulfonate solutions | 32% | Industrial applications, heavy-duty emulsification | |

| Lactate-based systems | 15% | Natural formulations, bio-compatible applications | |

| Specialty blended products | 8% | Custom formulations, niche applications | |

| Future (3-5 yrs) | Advanced sulfate ester systems | 42-44% | Multi-functional, targeted emulsification |

| Smart formulation & analytics | 20-24% | Real-time monitoring, quality optimization | |

| Specialized sulfonate solutions | 16-19% | Enhanced performance, application-specific | |

| Bio-based lactate formulations | 12-15% | Eco-friendly, regulatory compliant | |

| Digital process integration | 8-12% | Connected manufacturing, automation | |

| Research & development services | 5-8% | Custom development, regulatory support |

At-a-Glance Metrics

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.7 billion |

| Market Forecast (2035) | USD 2.5 billion |

| Growth Rate | 3.8% CAGR |

| Leading Technology | Sulfate Ester Systems |

| Primary Application | Food & Beverages Segment |

The market demonstrates strong fundamentals with sulfate ester systems capturing a dominant share through advanced emulsification capabilities and multi-industry application optimization. Food & beverages applications drive primary demand, supported by increasing formulation requirements and manufacturing facility capacity expansion. Geographic expansion remains concentrated in developed markets with established manufacturing infrastructure, while emerging economies show accelerating adoption rates driven by industrialization initiatives and rising quality standards.

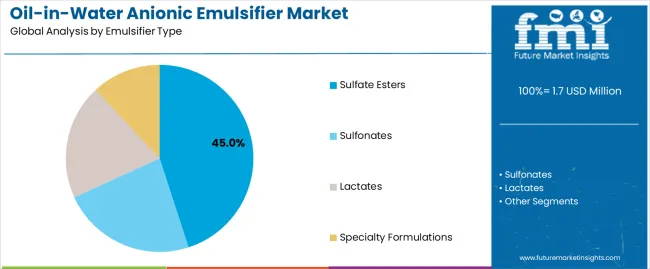

Primary Classification: The market segments by emulsifier type into sulfate esters, sulfonates, lactates, and specialty formulations, representing the evolution from basic emulsification materials to sophisticated chemical solutions for comprehensive manufacturing optimization.

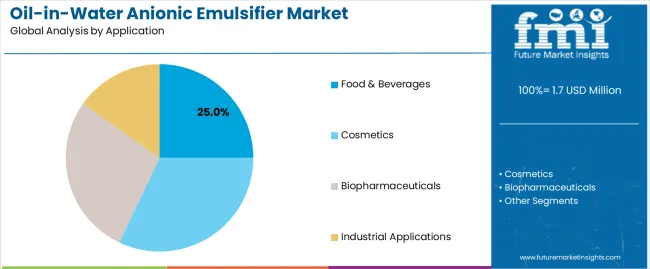

Secondary Classification: Application segmentation divides the market into food & beverages, cosmetics, biopharmaceuticals, and industrial applications, reflecting distinct requirements for formulation effectiveness, regulatory standards, and performance outcomes.

Tertiary Classification: End-use segmentation covers food manufacturers, cosmetic companies, pharmaceutical facilities, chemical processors, and research institutions, while distribution channels span direct sales, chemical distributors, and online platforms.

Regional Classification: Geographic distribution covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by industrial expansion programs.

The segmentation structure reveals technology progression from standard emulsifier materials toward sophisticated formulation systems with enhanced stability and performance capabilities, while application diversity spans from food processing to pharmaceutical operations requiring precise emulsification solutions.

Market Position: Sulfate Ester systems command the leading position in the oil-in-water anionic emulsifier market with 45% market share through advanced emulsification features, including superior stability characteristics, regulatory compliance, and multi-application optimization that enable manufacturing facilities to achieve optimal formulation outcomes across diverse industrial and consumer product environments.

Value Drivers: The segment benefits from manufacturing facility preference for reliable emulsification systems that provide consistent performance, reduced processing time, and operational efficiency optimization without requiring significant infrastructure modifications. Advanced formulation features enable automated mixing control systems, stability monitoring, and integration with existing production equipment, where emulsification performance and product quality represent critical facility requirements.

Competitive Advantages: Sulfate Ester systems differentiate through proven emulsification reliability, consistent performance characteristics, and integration with automated manufacturing systems that enhance facility effectiveness while maintaining optimal quality standards suitable for diverse industrial and consumer applications.

Key market characteristics:

Sulfonate systems maintain a 32% market position in the oil-in-water anionic emulsifier market due to their robust performance and heavy-duty emulsification advantages. These formulations appeal to facilities requiring industrial-grade emulsification solutions with competitive performance profiles for demanding manufacturing applications. Market growth is driven by industrial expansion, emphasizing high-performance emulsification solutions and operational effectiveness through optimized chemical designs.

Lactate systems capture 15% market share through specialized applications in natural product manufacturing, bio-compatible formulations, and eco-friendly production requirements. These facilities demand high-performance emulsifier systems capable of handling natural ingredient processing while providing effective emulsification capabilities and regulatory compliance.

Specialty formulations account for 8% market share through customized emulsification requirements in specialized manufacturing applications, research facilities, and development operations requiring tailored solutions for specific formulation outcomes.

Market Context: Food and beverages applications show the highest growth in the oil-in-water anionic emulsifier market with a 4.2% CAGR and a 25% industry share, driven by the widespread adoption of emulsification systems and an increasing focus on product formulation optimization, operational cost efficiency, and quality initiatives that maximize production effectiveness while maintaining food safety standards.

Appeal Factors: Food & beverage operators prioritize system reliability, formulation consistency, and integration with existing manufacturing infrastructure that enables coordinated production operations across multiple product lines. The segment benefits from substantial food industry investment and modernization programs that emphasize the acquisition of advanced emulsification systems for product optimization and quality applications.

Growth Drivers: Food industry expansion programs incorporate emulsification systems as standard equipment for production operations, while consumer demand growth increases need for formulation capabilities that comply with food safety standards and minimize processing complexity.

Market Challenges: Varying product requirements and formulation protocol complexity may limit system standardization across different facilities or production scenarios.

Application dynamics include:

Cosmetics applications capture 28% market share through specialized formulation requirements in beauty product manufacturing, personal care facilities, and cosmetic applications. These facilities demand effective emulsification systems capable of supporting product development while providing stable formulation access and operational reliability capabilities.

Biopharmaceutical applications account for 22% market share, including drug formulation operations, therapeutic treatments, and pharmaceutical manufacturing requiring specialized emulsification capabilities for product optimization and regulatory compliance.

Market Context: Food manufacturers dominate the market with 4.5% CAGR, reflecting the primary demand source for oil-in-water anionic emulsifier technology in food production applications and manufacturing operations.

Business Model Advantages: Food manufacturers provide direct market demand for advanced emulsification materials, driving product innovation and capacity expansion while maintaining quality control and regulatory compliance requirements.

Operational Benefits: Food manufacturing applications include product development, formulation optimization, and quality assurance that drive consistent demand for emulsifier products while providing access to latest food technology innovations.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Growing food processing industry & convenience food demand (ready-to-eat, packaged foods) | ★★★★★ | Expanding food manufacturing requires consistent emulsification solutions with proven stability and performance across production applications. |

| Driver | Cosmetic industry expansion & product innovation (anti-aging, natural formulations) | ★★★★★ | Turns advanced emulsification systems from "optional" to "mandatory"; providers that offer technical support and formulation documentation gain competitive advantage. |

| Driver | Pharmaceutical sector growth & drug formulation needs (bioavailability, stability) | ★★★★☆ | Pharmaceutical manufacturers need reliable, validated systems; demand for regulatory-compliant and stable emulsification solutions expanding addressable market. |

| Restraint | Raw material price volatility & supply chain challenges (petroleum-based ingredients) | ★★★★☆ | Smaller manufacturers defer purchases; increases price sensitivity and slows advanced material adoption in cost-conscious markets. |

| Restraint | Alternative emulsification technologies (non-ionic, cationic systems) | ★★★☆☆ | Modern emulsification alternatives offer specific advantages, potentially limiting anionic emulsifier adoption in specialized applications. |

| Trend | Smart manufacturing integration & process optimization (IoT, automated control) | ★★★★★ | Real-time viscosity monitoring, batch tracking, and quality analytics transform operations; connectivity and digital integration become core value propositions. |

| Trend | Bio-based & natural emulsifiers demand (eco-friendly, clean label) | ★★★★☆ | Natural emulsifier formulations for eco-conscious applications; specialized products and green chemistry capabilities drive competition toward natural solutions. |

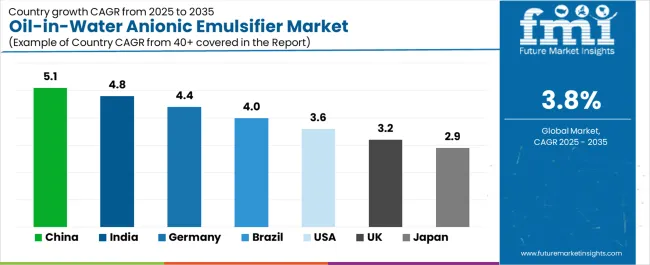

The oil-in-water anionic emulsifier market demonstrates varied regional dynamics with Growth Leaders including China (5.1% growth rate) and India (4.8% growth rate) driving expansion through industrial modernization initiatives and manufacturing capacity development.

Steady Performers encompass Germany (4.4% growth rate), Brazil (4.0% growth rate), and developed regions, benefiting from established chemical industries and advanced manufacturing adoption. Mature Markets feature United States (3.6% growth rate), United Kingdom (3.2% growth rate), and Japan (2.9% growth rate), where manufacturing technology advancement and regulatory standardization requirements support consistent growth patterns.

Regional synthesis reveals East Asian markets leading adoption through industrial expansion and infrastructure development, while North American countries maintain steady expansion supported by manufacturing technology advancement and quality standardization requirements. European markets show moderate growth driven by chemical applications and regulatory integration trends.

| Region/Country | 2025 to 2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 5.1% | Focus on manufacturing modernization solutions | Environmental regulations; local competition |

| India | 4.8% | Lead with cost-effective systems | Import restrictions; price sensitivity |

| Germany | 4.4% | Provide premium quality products | Over-regulation; lengthy approvals |

| Brazil | 4.0% | Offer value-oriented models | Currency fluctuations; import duties |

| United States | 3.6% | Push digital integration | EPA compliance costs; formulation restrictions |

| United Kingdom | 3.2% | Focus on innovation compatibility | Brexit impacts; supply chain issues |

| Japan | 2.9% | Emphasize precision systems | Aging infrastructure; slow adoption |

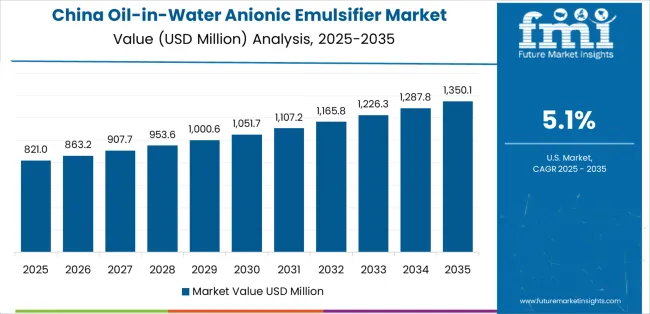

China establishes fastest market growth through aggressive industrial modernization programs and comprehensive manufacturing capacity development, integrating advanced oil-in-water anionic emulsifier systems as standard components in food processing facilities and chemical manufacturing installations. The country's 5.1% growth rate reflects government initiatives promoting industrial infrastructure and domestic chemical capabilities that mandate the use of advanced emulsifier systems in manufacturing and processing facilities.

Growth concentrates in major industrial hubs, including Beijing, Shanghai, and Guangzhou, where chemical technology development showcases integrated emulsification systems that appeal to manufacturers seeking advanced production optimization capabilities and quality applications.

Chinese manufacturers are developing cost-effective emulsifier solutions that combine domestic production advantages with advanced formulation features, including automated control systems and enhanced stability capabilities. Distribution channels through chemical suppliers and manufacturing service distributors expand market access, while government support for industrial modernization supports adoption across diverse manufacturing and processing segments.

Strategic Market Indicators:

In Delhi, Mumbai, and Bangalore, manufacturing facilities and processing centers are implementing advanced oil-in-water anionic emulsifier systems as standard equipment for production optimization and quality applications, driven by increasing government industrial investment and infrastructure modernization programs that emphasize the importance of chemical manufacturing capabilities. The market holds a 4.8% growth rate, supported by government industrial initiatives and infrastructure development programs that promote advanced emulsification systems for manufacturing and processing facilities. Indian operators are adopting emulsifier systems that provide consistent production performance and quality features, particularly appealing in urban regions where manufacturing effectiveness and product quality represent critical operational requirements.

Market expansion benefits from growing industrial capabilities and international technology partnerships that enable domestic production of advanced emulsification systems for manufacturing applications. Technology adoption follows patterns established in chemical equipment, where reliability and performance drive procurement decisions and operational deployment.

Market Intelligence Brief:

Germany's advanced chemical technology market demonstrates sophisticated oil-in-water anionic emulsifier deployment with documented production effectiveness in manufacturing applications and processing facilities through integration with existing quality systems and industrial infrastructure. The country leverages engineering expertise in chemical technology and quality systems integration to maintain a 4.4% growth rate. Manufacturing centers, including Baden-Württemberg, Bavaria, and North Rhine-Westphalia, showcase premium installations where emulsification systems integrate with comprehensive production platforms and facility management systems to optimize manufacturing operations and product effectiveness.

German manufacturers prioritize system precision and EU compliance in chemical equipment development, creating demand for premium systems with advanced features, including facility monitoring integration and automated quality systems. The market benefits from established chemical technology infrastructure and a willingness to invest in advanced emulsification technologies that provide long-term operational benefits and compliance with international chemical standards.

Market Intelligence Brief:

Brazil's market expansion benefits from diverse industrial demand, including infrastructure modernization in São Paulo and Rio de Janeiro, manufacturing facility upgrades, and government industrial programs that increasingly incorporate emulsification solutions for production applications. The country maintains a 4.0% growth rate, driven by rising manufacturing activity and increasing recognition of emulsification technology benefits, including precise formulation control and enhanced product effectiveness.

Market dynamics focus on cost-effective emulsification solutions that balance advanced production performance with affordability considerations important to Brazilian manufacturers. Growing industrial development creates continued demand for modern emulsification systems in new facility infrastructure and manufacturing modernization projects.

Strategic Market Considerations:

United States establishes market leadership through comprehensive industrial programs and advanced manufacturing infrastructure development, integrating oil-in-water anionic emulsifier systems across food processing and chemical manufacturing applications. The country's 3.6% growth rate reflects established chemical industry relationships and mature emulsification technology adoption that supports widespread use of precision emulsification systems in manufacturing and processing facilities. Growth concentrates in major industrial centers, including California, Texas, and New York, where chemical technology showcases mature emulsification deployment that appeals to manufacturers seeking proven formulation capabilities and operational efficiency applications.

American manufacturers leverage established distribution networks and comprehensive technical support capabilities, including validation programs and training support that create customer relationships and operational advantages. The market benefits from mature regulatory standards and industrial requirements that mandate emulsification system use while supporting technology advancement and operational optimization.

Market Intelligence Brief:

United Kingdom's industrial market demonstrates integrated oil-in-water anionic emulsifier deployment with documented production effectiveness in manufacturing applications and processing facilities through integration with existing quality systems and industrial infrastructure. The country maintains a 3.2% growth rate, supported by industrial modernization programs and production effectiveness requirements that promote advanced emulsification systems for manufacturing applications. Manufacturing facilities across England, Scotland, and Wales showcase systematic installations where emulsification systems integrate with comprehensive production platforms to optimize manufacturing operations and product outcomes.

UK manufacturers prioritize system reliability and regulatory compatibility in chemical equipment procurement, creating demand for validated systems with proven production features, including quality monitoring integration and automated control systems. The market benefits from established industrial infrastructure and regulatory validation requirements that support emulsification technology adoption and operational effectiveness.

Market Intelligence Brief:

Japan's market growth benefits from precision manufacturing demand, including advanced industrial facilities in Tokyo and Osaka, chemical technology integration, and quality programs that increasingly incorporate emulsification solutions for production applications. The country maintains a 2.9% growth rate, driven by manufacturing technology advancement and increasing recognition of precision emulsification benefits, including accurate formulation control and enhanced product outcomes.

Market dynamics focus on high-precision emulsification solutions that meet Japanese quality standards and production effectiveness requirements important to manufacturers. Advanced manufacturing technology adoption creates continued demand for sophisticated emulsification systems in industrial facility infrastructure and production modernization projects.

Strategic Market Considerations:

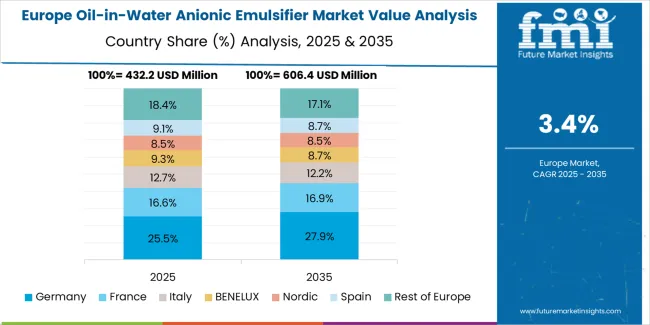

The European oil-in-water anionic emulsifier market is projected to grow from USD 478.6 million in 2025 to USD 695.2 million by 2035, registering a CAGR of 3.8% over the forecast period. Germany is expected to maintain its leadership position with a 41.2% market share in 2025, supported by its advanced chemical technology infrastructure and major manufacturing centers.

United Kingdom follows with a 22.8% share in 2025, driven by comprehensive industrial programs and chemical technology development initiatives. France holds a 15.6% share through specialized manufacturing applications and regulatory compliance requirements. Italy commands a 10.9% share, while Spain accounts for 8.1% in 2025. The rest of Europe region is anticipated to gain momentum, expanding its collective share from 1.4% to 1.8% by 2035, attributed to increasing industrial adoption in Nordic countries and emerging manufacturing facilities implementing industrial modernization programs.

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Global platforms | Distribution reach, broad product catalogs, technical support networks | Wide availability, proven performance, multi-region support | Product refresh cycles; customer dependency on technical validation |

| Formulation innovators | R&D capabilities; advanced chemical formulations; clean performance profiles | Latest formulations first; attractive ROI on application effectiveness | Service density outside core regions; customization complexity |

| Regional specialists | Local compliance, fast delivery, nearby technical support | "Close to site" support; pragmatic pricing; local regulations | Formulation gaps; talent retention in technical support |

| Application-focused ecosystems | Performance validation, technical training, regulatory support | Lowest application risk; comprehensive support | Service costs if overpromised; technology obsolescence |

| Niche specialists | Specialized applications, custom formulations, research support | Win research/development applications; flexible configurations | Scalability limitations; narrow market focus |

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 billion |

| Emulsifier Type | Sulfate Esters, Sulfonates, Lactates, Specialty Formulations |

| Application | Food & Beverages, Cosmetics, Biopharmaceuticals, Industrial Applications |

| End Use | Food Manufacturers, Cosmetic Companies, Pharmaceutical Facilities, Chemical Processors, Research Institutions |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, Canada, France, Australia, and 28+ additional countries |

| Key Companies Profiled | DSM, Croda, Shah Patil & Company, Clariant, Shree Vallabh Chemical, CIDOLS, Spectra Specialities, Hielscher Ultrasonics, Lansen, Lubrizol, BASF |

| Additional Attributes | Dollar sales by emulsifier type and application categories, regional adoption trends across East Asia, North America, and Western Europe, competitive landscape with chemical manufacturers and specialty suppliers, manufacturing operator preferences for formulation effectiveness and stability reliability, integration with manufacturing platforms and quality monitoring systems, innovations in emulsifier formulations and application enhancement, and development of advanced emulsification solutions with enhanced performance and chemical optimization capabilities. |

The global oil-in-water anionic emulsifier market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the oil-in-water anionic emulsifier market is projected to reach USD 2.5 billion by 2035.

The oil-in-water anionic emulsifier market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in oil-in-water anionic emulsifier market are sulfate esters , sulfonates, lactates and specialty formulations.

In terms of application, food & beverages segment to command 25.0% share in the oil-in-water anionic emulsifier market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anionic Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Emulsifier Blends / Self-Emulsifying Bases Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Emulsifiers in Personal Care Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Emulsifiers, Stabilizers, and Thickeners Market Size and Share Forecast Outlook 2025 to 2035

Emulsifier-Free Skincare Market Growth – Size, Trends & Forecast 2024-2034

Demulsifier Market

Co-Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Egg Emulsifier Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

AKD Emulsifier Market Growth - Trends & Forecast 2025 to 2035

Evaluating Egg Emulsifier Market Share & Provider Insights

Food Emulsifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Analyzing Food Emulsifier Market Share & Growth Trends

Bread Emulsifier Market Analysis by Source, Product Type and Application Through 2035

Bitumen Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

UK Food Emulsifier Market Analysis – Size, Share & Forecast 2025–2035

United States Food Emulsifier Market Trends – Growth, Demand & Forecast 2025–2035

Fragrance Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Food Emulsifier Market Report – Trends, Demand & Industry Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA