The global food emulsifier market is characterized by a moderately consolidated structure, with a few major multinational corporations commanding the largest market shares, followed by regional leaders and niche players. Top Multinational Corporations (55%) consists of international food ingredient developers that have a large-scale presence across industries, significant R&D spends and have a large international reach and network.

Leaders in this space include Cargill, ADM, DuPont, BASF, and Kerry Group. These companies serve big multinational food & beverage brands through multi-functional, high-performance emulsifiers suited for bakery, dairy, beverages, and convenience foods applications. Companies such as Palsgaard of Denmark, Fine Organics of India, Guangzhou Cardlo Biotech of China, and Riken Vitamin of Japan command a major share through their regional formulations.

The advantages of the local production and cost-effective ingredient sourcing coupled with expertise in region-specific food preferences have kept these companies alive. Niche & Small-Scale Players include the specialized emulsifier manufacturers, as well as emerging players in innovative, clean-label, and organic emulsifiers.

| Global Market Share, 2025 | Industry Share % |

|---|---|

| Top Multinationals (Cargill, ADM, DuPont, BASF, Kerry Group) | 55% |

| Regional Leaders (Palsgaard, Fine Organics, Guangzhou Cardlo Biotech) | 30% |

| Startups & Niche Brands (Lasenor Emul, Riken Vitamin, Stern-Wywiol Gruppe) | 15% |

Industry remains moderately consolidated with multinational giants leading the way while regional & niche players keep expanding into specific application areas.

There are several product types of food emulsifier. Lecithin remains the largest of them, representing 35% of the global market. The emulsifier lecithin is much in use, as it is derived from sources such as soybeans, sunflower oil, and egg yolk. It has improved texture, stability, and shelf life within various food applications. It represents 28% of the market share because mono- and di-glycerides are commonly used in baked goods, confectionery, and dairy products.

The 12% share in the market of Sorbitan Esters and, to equal, 10% share of both Polyglycerol Esters and Stearoyl Lactylates, are unique emulsifiers with specific functions that are applied only in specific application processes. The 5% remainder is called "Others," referring to less frequently used or more recently developed types of food emulsifier.

Under various application segments, the market for food emulsifier can be divided across the globe; the largest part is Bakeries, which capture 38%. Emulsifiers play a highly significant role in bakery products: they improve their texture, increase their volume and shelf life, and make them stay fresh for much longer. The Dairy Products segment captures 22% because emulsifiers stabilize and improve the properties of dairy-based items.

Confectionaries: The segment constitutes 20% of the market. In candies and chocolates, emulsifiers are used to give them a smooth, creamy texture and to avoid blooming fat. Functional Foods: The market accounts for 12%.

Emulsifiers are added to food products which contain different types of functional ingredients, along with their stabilization in health-focused foods. The remaining 8% of the market falls under the "Others" category, which could be specialized applications in the form of sauces, dressings, and other food categories.

In 2024, the global food emulsifier market underwent significant changes that were primarily influenced by sustainability, clean-label innovations, and new product launches. Several of the leading manufacturers concentrated on the expansion of their emulsifier portfolios, supply chain strength, and the use of novel ingredients to adapt to the evolving preferences of consumers.

Growing focus on palm-free and organic emulsifiers prompted it to engage in several high-profile mergers and acquisitions, while Asia-Pacific became a growth hub for functional emulsifiers.

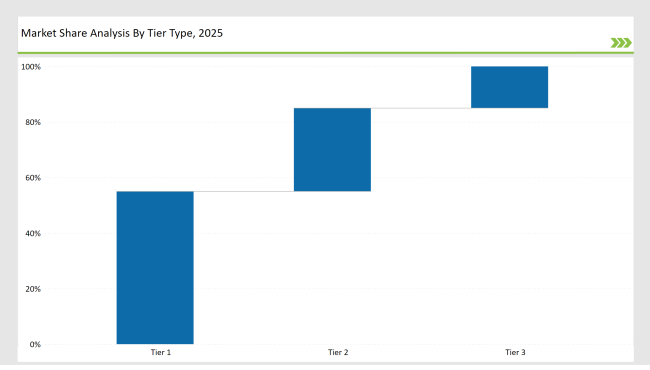

| Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 55% |

| Key Players | Cargill, ADM, DuPont, BASF, Kerry Group |

| Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 30% |

| Key Players | Palsgaard, Fine Organics, Guangzhou Cardlo Biotech |

| Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 15% |

| Key Players | Lasenor Emul, Riken Vitamin, Stepan Company |

| Brand | Key Focus |

|---|---|

| Cargill | Introduced sunflower-based lecithin as a non-GMO alternative to soy-derived emulsifiers. |

| ADM | Partnered with leading bakery manufacturers to co-develop clean-label emulsifiers. |

| Palsgaard | Launched sustainable, non-palm emulsifiers for margarine and plant-based dairy alternatives. |

| Fine Organics | Expanded emulsifier production to meet Asia’s rising demand for plant-based food additives. |

| Guangzhou Cardlo Biotech | Developed next-generation high-performance emulsifiers for low-fat bakery applications. |

| Stepan Company | Focused on organic-certified emulsifier production for European markets. |

| BASF | Invested in biodegradable emulsifier technologies to support sustainable packaging. |

| DuPont | Strengthened its emulsifier portfolio for sports nutrition and functional beverage brands. |

| Lasenor Emul | Developed cost-effective lecithins targeting Latin American manufacturers. |

| Riken Vitamin | Launched Japan’s first soy-free emulsifier blend for bakery and confectionery. |

The sustainable and ethically sourced emulsifiers represent the growing wave that will change the market. More and more food manufacturers are leaving synthetic and palm-based emulsifiers behind, choosing instead to opt for plant-based sources.

Sternchemie and Cargill brands are among the leaders in this initiative through their non-GMO sunflower and rapeseed lecithin. Companies investing in palm-free emulsifiers and carbon-neutral production will find a competitive advantage as retailers and consumers demand the most from sustainable sources.

The demand for high-protein, sports nutrition, and functional beverages is increasingly fueling innovation in emulsifiers. Emulsifiers can stabilize proteins, enhance nutrient absorption, and improve shelf life in health-oriented products. Thus, companies such as Stepan and BASF are already launching emulsifier blends specifically tailor-made for protein drinks and fortified foods. Medical nutrition and probiotic-based formulations are also opening new areas of application for emulsifiers.

The regions of Latin America and the Middle East are growing markets for emulsifiers because of increased demand for processed and packaged foods. The bakery, dairy, and meat processing industries in Brazil, Mexico, UAE, and Saudi Arabia are also increasing. Lasenor Emul is expanding its operations in these markets to satisfy the demand from these markets. Increasing demand for halal-certified emulsifiers also creates a potential market for brands offering compliant formulations.

As of 2025, the top five companies-Cargill, ADM, DuPont, BASF, and Kerry Group-collectively hold over 50% of the global market, with multinational players dominating supply to large food processors.

The industry is moderately consolidated, with 55% controlled by multinational corporations, 30% by regional leaders, and 15% by niche & small-scale players, such as Lasenor Emul and Riken Vitamin.

By 2035, over 80% of emulsifiers will be plant-based or derived from sustainable sources, with major brands phasing out synthetic and palm-derived emulsifiers.

AI-driven emulsifier formulations, palm-free alternatives, and fermented emulsifiers are Dupont and BASF developing key innovations to meet evolving industry demands.

Challenges include supply chain disruptions, fluctuating raw material costs, and increasing regulatory pressure on synthetic emulsifiers in markets like the EU and North America.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Basket Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Food Can Coatings Market Size and Share Forecast Outlook 2025 to 2035

Food Holding and Warming Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food Fortifying Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA