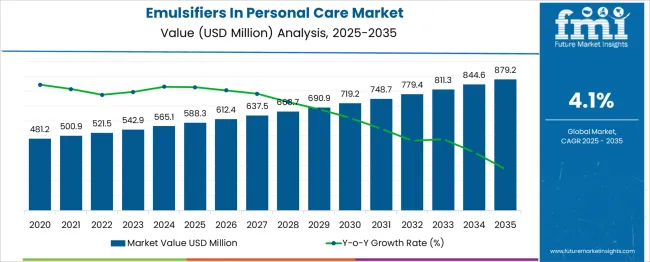

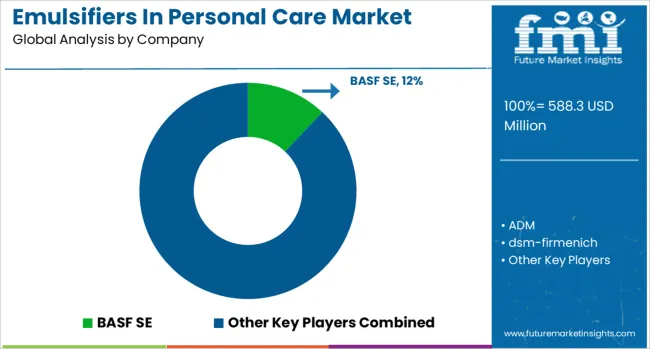

The global emulsifiers in personal care market is expected to expand from USD 588.3 million in 2025 to approximately USD 879.2 million by 2035, recording an absolute increase of USD 290.9 million over the forecast period. This translates into a total growth of 49.4%, with the market forecast to expand at a compound annual growth rate (CAGR) of 4.1% between 2025 and 2035.

The overall market size is expected to grow by nearly 1.49X during the same period, supported by increasing demand for natural and eco-efficient cosmetic ingredients, rising consumer awareness about clean beauty formulations, and growing emphasis on multifunctional emulsifying systems that enhance product stability and sensory attributes.

Between 2025 and 2030, the emulsifiers in the personal care market are projected to expand from USD 588.3 million to USD 710.5 million, resulting in a value increase of USD 122.2 million, which represents 42.0% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for clean-label cosmetic formulations, increasing adoption of plant-based emulsifiers, and growing consumer preference for products with minimal synthetic ingredients. Personal care manufacturers are expanding their portfolios of natural emulsifiers to meet the evolving demands for eco-efficient beauty solutions while maintaining product performance and stability.

From 2030 to 2035, the market is forecast to grow from USD 710.5 million to USD 879.2 million, adding another USD 168.7 million, which constitutes 58.0% of the overall ten-year expansion. This period is expected to be characterized by advanced formulation technologies, development of multifunctional emulsifying systems, and increased focus on biodegradable and eco-friendly ingredients. The growing integration of biotechnology in emulsifier production and rising demand for customized personal care solutions will drive innovation in specialty emulsifiers with enhanced performance characteristics.

Between 2020 and 2025, the emulsifiers in personal care market experienced steady expansion, driven by increasing consumer awareness about ingredient safety and growing demand for natural cosmetic formulations. The market developed as beauty brands recognized the critical role of emulsifiers in creating stable, effective, and aesthetically pleasing personal care products. Clean beauty movements and regulatory shifts toward safer cosmetic ingredients began emphasizing the importance of eco-efficient emulsifier solutions in formulation development.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 588.3 million |

| Forecast Value in (2035F) | USD 879.2 million |

| Forecast CAGR (2025 to 2035) | 4.1% |

Market expansion is being supported by the increasing consumer demand for natural and organic personal care products that require effective emulsifying systems to maintain stability and performance. Modern consumers are increasingly scrutinizing ingredient lists and preferring products formulated with plant-derived, biodegradable emulsifiers over synthetic alternatives. The shift toward clean beauty and transparency in cosmetic formulations is driving manufacturers to invest in innovative emulsifier technologies that meet both performance requirements and eco-efficiency goals.

The growing emphasis on multifunctional ingredients is driving demand for emulsifiers that provide additional benefits beyond stabilization, such as moisturizing properties, skin conditioning effects, and enhanced product texture. Consumer preference for lightweight, easily absorbed formulations is creating opportunities for advanced emulsifying systems that deliver superior sensory experiences. The rising influence of social media beauty trends and increasing awareness about skin microbiome health is also contributing to demand for gentle, non-irritating emulsifiers suitable for sensitive skin applications.

The market is segmented by product type and region. By product type, the market is divided into glyceryl esters, sucrose esters, sorbitan esters, alkyl polyglycosides, polyglyceryl-based emulsifiers, and amino acid-based emulsifiers (including stearoyl glutamate and cocoyl glutamate). Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

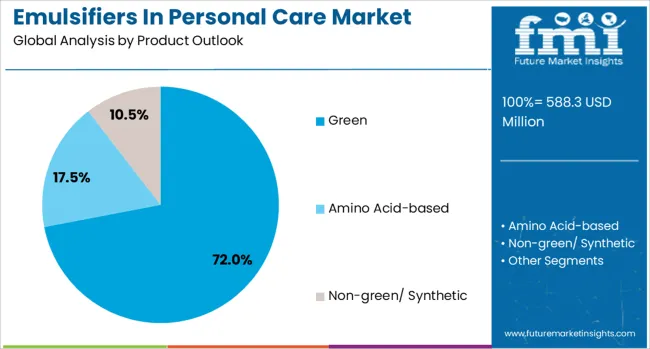

Green emulsifiers are projected to represent 72% of the emulsifiers in the personal care market in 2025, underscoring the industry's transformation toward eco-efficient and naturally-derived ingredients. This dominant share reflects consumer preference for eco-friendly personal care products and manufacturer commitments to reducing environmental impact through ingredient selection. Green emulsifiers, derived from renewable plant sources and produced through environmentally responsible processes, align perfectly with clean beauty standards and eco-efficiency goals.

The segment is supported by increasing regulatory pressure to phase out potentially harmful synthetic ingredients and growing consumer awareness about the environmental footprint of personal care products. Brands are leveraging green emulsifier credentials as key differentiators in competitive markets, justifying premium pricing through eco-efficiency narratives. As certification standards for natural and organic cosmetics become more stringent, the demand for verified green emulsifiers will continue to strengthen, reinforcing their market leadership position.

The emulsifiers in the personal care market are advancing steadily due to increasing demand for natural cosmetic ingredients and growing emphasis on product stability and performance. However, the market faces challenges, including raw material price volatility, formulation complexity with natural emulsifiers, and regulatory compliance requirements across different regions. Innovation in biotechnology-derived emulsifiers and eco-efficient sourcing practices continues to influence product development and market expansion patterns.

The growing clean beauty movement is driving demand for transparent, safe, and naturally-derived emulsifiers in personal care products. Consumers are increasingly educated about ingredient functions and seeking products with recognizable, plant-based components. This trend is pushing manufacturers to develop innovative emulsifying systems from eco-efficient sources while maintaining the performance standards expected in modern cosmetic formulations.

Modern emulsifier manufacturers are incorporating biotechnology and fermentation processes to create eco-efficient, high-performance emulsifying agents. These technologies enable the production of consistent, pure emulsifiers with reduced environmental impact compared to traditional chemical synthesis. Biotechnology-derived emulsifiers offer unique functional properties and can be tailored to specific formulation requirements, supporting innovation in personal care product development.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

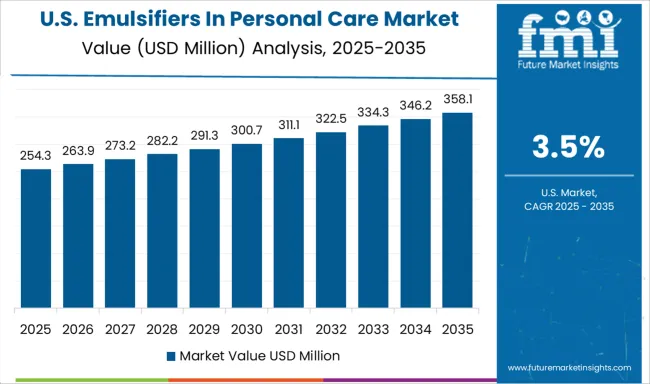

| USA | 3.5% |

| Brazil | 3.1% |

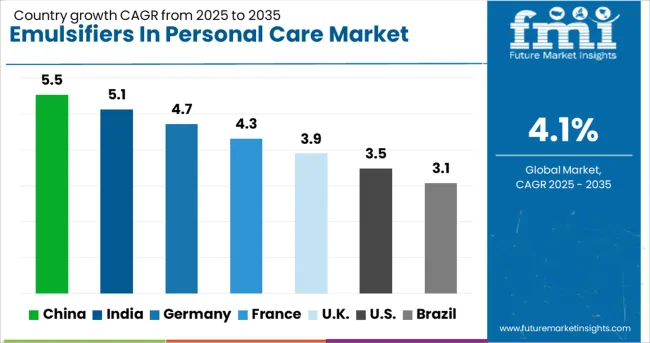

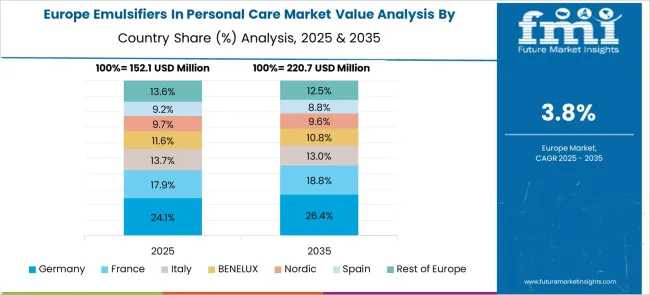

The emulsifiers in personal care market is experiencing varied growth globally, with China leading at a 5.5% CAGR through 2035, driven by rapid expansion of the domestic cosmetics industry and increasing demand for premium personal care products. India follows at 5.1%, supported by growing consumer awareness, rising disposable income, and expanding beauty and personal care sector. Germany shows steady growth at 4.7%, emphasizing innovation and eco-efficiency in cosmetic ingredients. France records 4.3%, focusing on luxury formulations and advanced emulsifier technologies. The UK demonstrates 3.9% growth, prioritizing clean beauty and natural ingredients. The USA shows 3.5% growth, driven by established market maturity and focus on innovation.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from emulsifiers in personal care in China is projected to exhibit strong growth with a CAGR of 5.5% through 2035, driven by rapid expansion of the domestic cosmetics industry and increasing consumer demand for premium personal care products. The country's growing middle class and rising beauty consciousness are creating significant opportunities for advanced emulsifier technologies. Both international chemical companies and domestic manufacturers are establishing production facilities to serve the expanding personal care manufacturing sector.

Revenue from emulsifiers in personal care in India is expanding at a CAGR of 5.1%, supported by the rapidly growing beauty and personal care industry and increasing consumer sophistication. The country's young demographic and rising disposable income are driving demand for diverse personal care products requiring advanced emulsifier systems. Both multinational and domestic cosmetic manufacturers are expanding production capabilities to meet growing market demands.

Revenue from emulsifiers in personal care in Germany is projected to grow at a CAGR of 4.7% through 2035, driven by the country's strong chemical industry foundation and commitment to eco-efficient innovation. German manufacturers like BASF SE and Evonik Industries AG continue to lead in developing advanced emulsifier technologies that meet evolving market requirements for performance and eco-efficiency.

Revenue from emulsifiers in personal care in France is projected to grow at a CAGR of 4.3%, supported by the country's prestigious cosmetics industry and emphasis on premium formulation quality. French beauty brands demand sophisticated emulsifier systems that deliver exceptional sensory properties while maintaining product stability and efficacy.

Revenue from emulsifiers in personal care in the UK is projected to grow at a CAGR of 3.9% through 2035, supported by strong consumer demand for clean beauty products and transparent formulations. British consumers increasingly prioritize natural ingredients and eco-efficient practices, driving demand for plant-based and biodegradable emulsifier solutions.

Demand for emulsifiers in personal care in the USA is projected to grow at a CAGR of 3.5%, supported by the mature cosmetics industry and continuous innovation in product formulations. American manufacturers focus on developing multifunctional emulsifiers that meet diverse formulation requirements while addressing consumer preferences for clean and eco-efficient beauty products.

Revenue from emulsifiers in personal care in Brazil is projected to grow at a CAGR of 3.1% through 2035, supported by the country's large beauty market and preference for natural ingredients. Brazilian consumers value products that incorporate local botanicals and eco-efficient ingredients, creating opportunities for naturally-derived emulsifier systems.

The emulsifiers in personal care market is characterized by competition among global chemical companies, specialty ingredient manufacturers, and regional suppliers. Companies are investing in eco-efficient production technologies, application development support, regulatory compliance capabilities, and technical service infrastructure to deliver innovative, effective, and environmentally responsible emulsifier solutions. Product innovation, eco-efficiency credentials, and formulation expertise are central to strengthening market positions and customer relationships.

BASF SE, Germany-based, leads the market with 12.0% global value share, offering comprehensive emulsifier portfolios with focus on eco-efficiency and performance optimization. ADM provides plant-based emulsifier solutions with emphasis on natural sourcing and clean label positioning. DSM-Firmenich delivers innovative emulsifying systems combining performance with eco-efficiency across personal care applications. Evonik Industries AG offers specialty emulsifiers with advanced functionality and customization capabilities.

Kerry Group Plc focuses on biotechnology-derived emulsifiers and natural solutions for clean beauty formulations. Palsgaard A/S specializes in plant-based emulsifiers with eco-efficient production practices and technical support. Puratos Group provides specialty emulsifiers for specific personal care applications with emphasis on sensory properties. Spartan Chemical Company Inc. offers cost-effective emulsifier solutions for mass market personal care products. Stepan Company delivers surfactant-based emulsifying systems with broad application versatility and regulatory compliance.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 588.3 million |

| Product Type | Glyceryl Esters, Sucrose Esters, Sorbitan Esters, Alkyl Polyglycosides, Polyglyceryl-Based, Amino Acid-based (Stearoyl Glutamate, Cocoyl Glutamate) |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | BASF SE, ADM, DSM-Firmenich, Evonik Industries AG, Kerry Group Plc, Palsgaard A/S, Puratos Group, Spartan Chemical Company Inc., and Stepan Company |

| Additional Attributes | Market share analysis by emulsifier type, regional demand patterns, competitive landscape assessment, buyer preferences for natural versus synthetic emulsifiers, integration with clean beauty positioning, innovations in biotechnology-derived emulsifiers, eco-efficient sourcing practices, and formulation compatibility studies |

The global emulsifiers in personal care market is estimated to be valued at USD 588.3 million in 2025.

The market size for the emulsifiers in personal care market is projected to reach USD 879.2 million by 2035.

The emulsifiers in personal care market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in emulsifiers in personal care market are green, _glyceryl esters, _sucrose esters, _sorbitan esters, _alkyl polyglycosides, _polyglyceryl-based, amino acid-based, _stearoyl glutamate, _cocoyl glutamate, _lauryl glutamate, _n-lauroyl glutamate, _others, non-green/ synthetic, _ethoxylated/ propoxylated emulsifiers, _silicone based, _others, lecithin and others.

In terms of , segment to command 0.0% share in the emulsifiers in personal care market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Emulsifiers, Stabilizers, and Thickeners Market Size and Share Forecast Outlook 2025 to 2035

Co-Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Food Emulsifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bitumen Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Squalane-Based Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Demand for Food Emulsifiers in EU Size and Share Forecast Outlook 2025 to 2035

Induction Brazing Services Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Integrated Trimming and Forming System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Incline Impact Tester Market Size and Share Forecast Outlook 2025 to 2035

In-line Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Internal Anthelmintics for Cats Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Cobalt Blue Pigments Market Size and Share Forecast Outlook 2025 to 2035

Injection Epoxy Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA