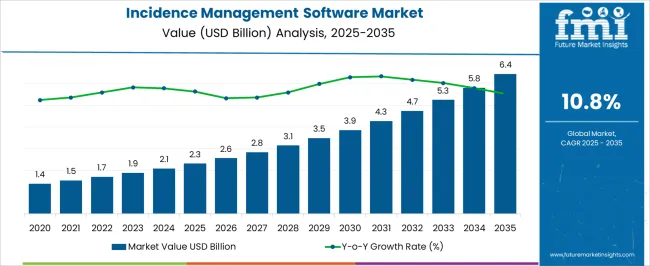

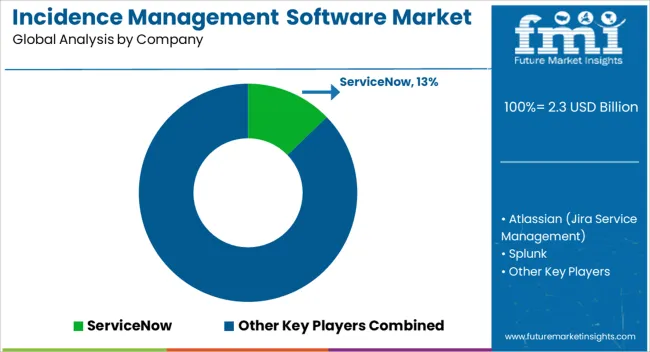

The Incidence Management Software Market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 6.4 billion by 2035, registering a compound annual growth rate (CAGR) of 10.8% over the forecast period.

| Metric | Value |

|---|---|

| Incidence Management Software Market Estimated Value in (2025 E) | USD 2.3 billion |

| Incidence Management Software Market Forecast Value in (2035 F) | USD 6.4 billion |

| Forecast CAGR (2025 to 2035) | 10.8% |

The incidence management software market is experiencing steady growth, supported by the rising complexity of IT infrastructures and the increasing importance of real-time response to operational disruptions. Organizations are adopting these solutions to improve resilience, ensure compliance, and protect business operations against a wide range of incidents, including cyberattacks, system failures, and natural disasters. Growth is being driven by heightened regulatory scrutiny, the surge in digital transformation initiatives, and the growing reliance on cloud-based platforms.

The ability of incidence management software to integrate with enterprise systems and automate workflows is strengthening adoption across multiple industries. A strong focus on risk mitigation and operational continuity is reshaping investment priorities, leading enterprises to implement platforms capable of predictive analytics, automated alerts, and collaborative response frameworks.

As global enterprises place greater emphasis on data-driven risk management and regulatory compliance, the market is positioned to expand further Continued advancements in AI-driven monitoring and incident forecasting are expected to create new opportunities and reinforce the long-term importance of these solutions.

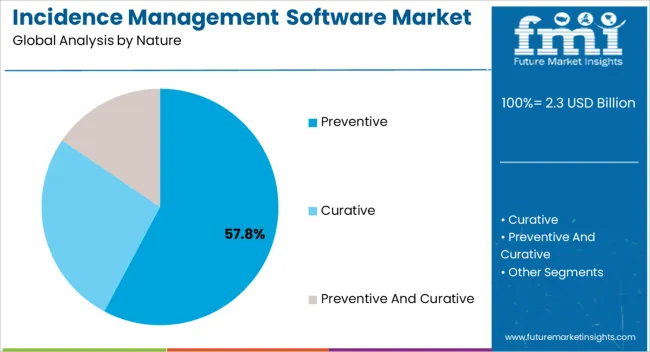

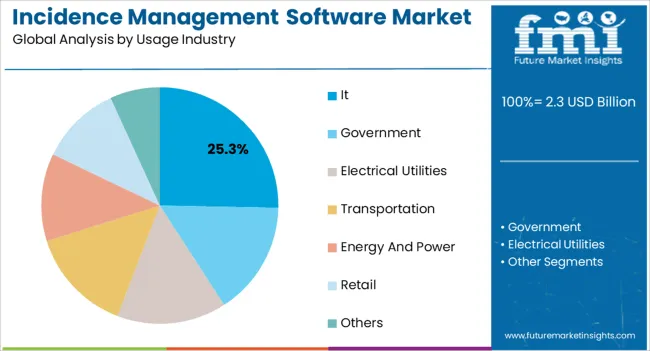

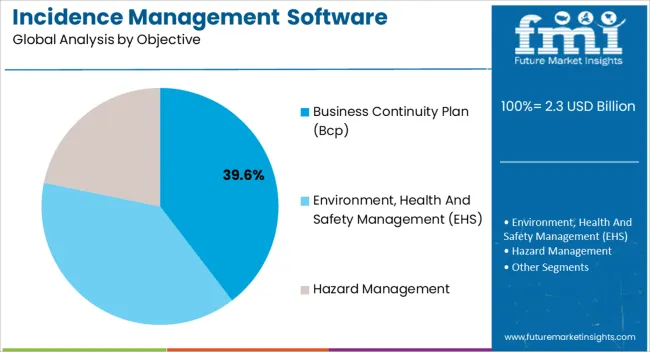

The incidence management software market is segmented by nature, usage industry, objective, and geographic regions. By nature, incidence management software market is divided into Preventive, Curative, and Preventive And Curative. In terms of usage industry, incidence management software market is classified into It, Government, Electrical Utilities, Transportation, Energy And Power, Retail, and Others. Based on objective, incidence management software market is segmented into Business Continuity Plan (Bcp), Environment, Health And Safety Management (EHS), and Hazard Management. Regionally, the incidence management software industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The preventive nature segment is projected to account for 57.8% of the incidence management software market revenue share in 2025, making it the leading category. This dominance is being reinforced by the increasing preference for proactive risk management over reactive incident response. Enterprises are prioritizing prevention-oriented solutions to minimize operational disruptions and reduce the financial and reputational costs of downtime.

The ability of preventive tools to leverage predictive analytics, early-warning alerts, and automated monitoring is significantly improving the resilience of IT and business operations. Growth is also being supported by regulatory requirements that mandate preventive risk frameworks, particularly in industries such as finance, healthcare, and critical infrastructure.

Preventive approaches are allowing enterprises to address vulnerabilities before they escalate into large-scale incidents, leading to higher adoption With the rising complexity of digital ecosystems and the growing exposure to cyber and operational risks, the preventive segment is expected to maintain its leadership as organizations increasingly invest in resilience-focused strategies.

The IT usage industry segment is anticipated to capture 25.3% of the incidence management software market revenue share in 2025, positioning it as the largest usage category. Its leadership is being driven by the dependence of IT organizations on continuous uptime, secure operations, and regulatory compliance. The segment is benefiting from rapid digitalization and the need to manage complex networks, cloud systems, and mission-critical applications.

Incidence management platforms in IT are being deployed to streamline event detection, automate escalation, and ensure rapid response to service disruptions or cyber incidents. The sector’s high vulnerability to security breaches, coupled with stringent compliance requirements, is further reinforcing adoption.

Increasing investment in IT infrastructure modernization and managed service delivery is amplifying demand for integrated software that can handle incident detection, prioritization, and remediation in real time As enterprises expand their reliance on IT to deliver digital services, the requirement for reliable and scalable incidence management solutions in this sector is expected to remain a primary growth driver.

The business continuity plan objective segment is expected to account for 39.6% of the incidence management software market revenue share in 2025, establishing itself as the dominant objective category. Its leadership is being supported by growing recognition of the financial, operational, and reputational risks posed by disruptions in business operations. Organizations are increasingly adopting incidence management platforms with integrated continuity planning features to ensure uninterrupted service delivery during crises.

This segment is benefiting from the rising importance of resilience strategies in sectors such as banking, telecommunications, manufacturing, and government. The ability to align continuity planning with incident detection and recovery workflows is enabling enterprises to respond more effectively to disruptions.

Regulatory pressures are also driving enterprises to prioritize continuity planning as part of their risk management frameworks With global supply chains becoming more complex and digital ecosystems more interdependent, the adoption of incidence management software to support continuity objectives is expected to remain a key growth driver, securing the segment’s leading market share.

An Incidence Management Software is used to manage the action of the existing system and workforce in response to a particular incident. Here an incident is defined as a disruption to an organizations operations, services or functions. An Incidence Management Software assures that a uniform and swift approach is being followed, so as to return to the normal at the earliest.

A standard Incidence Management Software allows simultaneous input from multiple locations, automate the information flow between response team members, logs and record the incident information, create a central repository for recovery information and simultaneously produce reports.

The primary goal of an Incidence Management Software is to warn and minimize the impact of any incident ranging from earthquake and power outages to product failures and market shifts. Incidence management software are nowadays commonly used in various industries like IT, Oil & Gas, Transportation, Retail, Government, Electrical utilities etc.

While prevention is always the first defense, still every organization also needs to be fully capable of responding efficiently to any kind of incidence, regardless how large or complex it is. Hence the Global Incidence Management Software market is anticipated to show a decent CAGR over the forecast period.

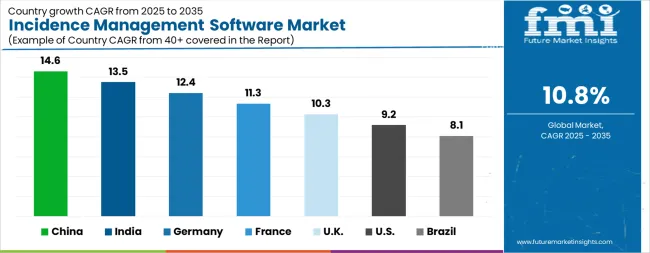

| Country | CAGR |

|---|---|

| China | 14.6% |

| India | 13.5% |

| Germany | 12.4% |

| France | 11.3% |

| UK | 10.3% |

| USA | 9.2% |

| Brazil | 8.1% |

The Incidence Management Software Market is expected to register a CAGR of 10.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 14.6%, followed by India at 13.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 8.1%, yet still underscores a broadly positive trajectory for the global Incidence Management Software Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 12.4%. The USA Incidence Management Software Market is estimated to be valued at USD 826.9 million in 2025 and is anticipated to reach a valuation of USD 2.0 billion by 2035. Sales are projected to rise at a CAGR of 9.2% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 115.6 million and USD 65.5 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.3 Billion |

| Nature | Preventive, Curative, and Preventive And Curative |

| Usage Industry | It, Government, Electrical Utilities, Transportation, Energy And Power, Retail, and Others |

| Objective | Business Continuity Plan (Bcp), Environment, Health And Safety Management (EHS), and Hazard Management |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ServiceNow, Atlassian (Jira Service Management), Splunk, PagerDuty, IBM (Resilient), BMC Software, Everbridge, SolarWinds, Freshworks (Freshservice), OpsGenie (now part of Atlassian), Cherwell Software, ManageEngine (ServiceDesk Plus), Datto (Autotask), LogicManager, AlertOps, and InvGate |

The global incidence management software market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the incidence management software market is projected to reach USD 6.4 billion by 2035.

The incidence management software market is expected to grow at a 10.8% CAGR between 2025 and 2035.

The key product types in incidence management software market are preventive, curative and preventive and curative.

In terms of usage industry, it segment to command 25.3% share in the incidence management software market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Risk Management Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Pain Management Devices Market Growth - Trends & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Cash Management Services Market – Trends & Forecast 2025 to 2035

CAPA Management (Corrective Action / Preventive Action) Market

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Exam Management Software Market

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Labor Management System In Retail Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Waste Management Market Size and Share Forecast Outlook 2025 to 2035

Stool Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Power Management System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fleet Management Market Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA